Академический Документы

Профессиональный Документы

Культура Документы

Salient Features of GST PDF

Загружено:

Rajeev Kumar0 оценок0% нашли этот документ полезным (0 голосов)

44 просмотров2 страницыОригинальное название

Salient Features of GST.pdf

Авторское право

© © All Rights Reserved

Доступные форматы

PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

44 просмотров2 страницыSalient Features of GST PDF

Загружено:

Rajeev KumarАвторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 2

(a)

GST-CONCEPT & STATUS

The The introduction of Goods and Services Tax (GST) would be a very significant step in

the field of indirect tax reforms in India. By amalgamating a large number of Central and State taxes

into a single tax, the aim was to mitigate cascading or double taxation in a major way and pave the

way for a common national market. From the consumer point of view, the biggest advantage would

be in terms of a reduction in the overall tax burden on goods, which was estimated to be around 25%-

30%. Introduction of GST would also make Indian products competitive in the domestic and

international markets. Studies show that this would have a positive impact on economic growth.

Last but not the least, this tax, because of its transparent and self-policing character, would be easier

to administer.

Genesis

I. The idea of moving towards the GST was first mooted by the then Union Finance Minister in

his Budget for 2006-07. Initially, it was proposed that GST would

be introduced from 1st April, 2010. The Empowered Committee of State Finance Ministers (EC)

which had formulated the design of State VAT was requested to come up with a roadmap and

structure for the GST. Joint Working Groups of officials having representatives of the States as well

as the Centre were set up to examine various aspects of the GST and draw up reports specifically on

exemptions and thresholds, taxation of services and taxation of inter-State supplies. Based on

discussions within and between it and the Central Government, the EC released its First Discussion

Paper (FDP) on the GST in November, 2009. This spells out the features of the proposed GST and

has formed the basis for discussion between the Centre and the States so far.

Salient Features of GST

II. The salient features of GST are as under:

GST would be applicable on “supply” of goods or services as against the present concept of

tax on manufacture of goods or on sale of goods or on provision of services.

GST would be based on the principle of destination based consumption taxation as against

the present principle of origin based taxation.

A. It would be a dual GST with the Centre and the States simultaneously levying it on a common

base. The GST to be levied by the Centre would be called Central GST (central tax- CGST)

and that to be levied by the States would be called State GST (SGST).

B. An Integrated GST (IGST) would be levied on inter-State supply (including stock transfers)

of goods or services. This would be collected by the Centre so that the credit chain is not

disrupted.

Ramdayalu Singh College, Muzaffarpur Page 4

Вам также может понравиться

- Gst-Concept & StatusДокумент2 страницыGst-Concept & StatusRajeev KumarОценок пока нет

- The Meaning and Scope of SupplyДокумент3 страницыThe Meaning and Scope of SupplyRajeev KumarОценок пока нет

- Gst-Concept & StatusДокумент2 страницыGst-Concept & StatusRajeev KumarОценок пока нет

- Gst-Concept & StatusДокумент2 страницыGst-Concept & StatusRajeev KumarОценок пока нет

- AbstractДокумент1 страницаAbstractRajeev KumarОценок пока нет

- Gst-Concept & StatusДокумент2 страницыGst-Concept & StatusRajeev KumarОценок пока нет

- Modern Poetic DramaДокумент1 страницаModern Poetic DramaRajeev KumarОценок пока нет

- SurrealismДокумент1 страницаSurrealismRajeev KumarОценок пока нет

- Modern Poetic DramaДокумент1 страницаModern Poetic DramaRajeev KumarОценок пока нет

- Modern Poetic DramaДокумент1 страницаModern Poetic DramaRajeev KumarОценок пока нет

- Modern Poetic DramaДокумент1 страницаModern Poetic DramaRajeev KumarОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (120)

- IFM CH 3 Monetary SystemДокумент50 страницIFM CH 3 Monetary SystemDhrumi PatelОценок пока нет

- IB Economics SL15 - Economic IntegrationДокумент2 страницыIB Economics SL15 - Economic IntegrationTerran100% (3)

- SAARCДокумент14 страницSAARCgrooveit_adiОценок пока нет

- Harmonized System 2017Документ55 страницHarmonized System 2017Abdul Ghaffar100% (1)

- Anne Osborn Krueger - Wikipedia, The Free EncyclopediaДокумент3 страницыAnne Osborn Krueger - Wikipedia, The Free EncyclopediabmxengineeringОценок пока нет

- Republic of The Philippines Supreme Court ManilaДокумент21 страницаRepublic of The Philippines Supreme Court ManilaJopan SJОценок пока нет

- Introduction To Macroeconomics (Lecture 1)Документ21 страницаIntroduction To Macroeconomics (Lecture 1)Salman HaiderОценок пока нет

- Government Sector PolicyДокумент39 страницGovernment Sector Policyrak999Оценок пока нет

- Homework Assignment - 6 AnswersДокумент7 страницHomework Assignment - 6 AnswersSyed Hassan Raza Jafry0% (1)

- Impact of Globalisation On Developing Countries and IndiaДокумент19 страницImpact of Globalisation On Developing Countries and Indiatinkoo22Оценок пока нет

- Icai Bikaner - Business EnvironmentДокумент20 страницIcai Bikaner - Business EnvironmentKNOWLEDGE CREATORSОценок пока нет

- Is There A Future For The EU After The Crisis?: Olaf CrammeДокумент14 страницIs There A Future For The EU After The Crisis?: Olaf CrammeVishal JainОценок пока нет

- 3.6 - PLANILHA Celesc INPC Distribuicao Transmissao Encargos 01Документ8 страниц3.6 - PLANILHA Celesc INPC Distribuicao Transmissao Encargos 01AugustoAdvОценок пока нет

- Baumol-Tobin Model of Demand For MoneyДокумент1 страницаBaumol-Tobin Model of Demand For Moneyshruti100% (2)

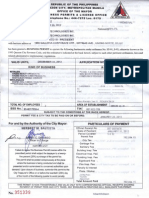

- City Business Permit 2012Документ1 страницаCity Business Permit 2012Claire BarnesОценок пока нет

- The Budget Process & The Philippine CongressДокумент5 страницThe Budget Process & The Philippine CongressSimon WolfОценок пока нет

- July Advance Bord 2013 PDFДокумент28 страницJuly Advance Bord 2013 PDFhenrydeeОценок пока нет

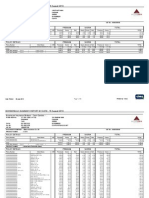

- Financial and Physical Performance Report FORMATДокумент9 страницFinancial and Physical Performance Report FORMATJeremiah TrinidadОценок пока нет

- Contoh Report TextДокумент1 страницаContoh Report TextRandi naufОценок пока нет

- Ventures Environment AssessmentДокумент10 страницVentures Environment AssessmentOloka George Okwir100% (2)

- Direct & Indirect TaxesДокумент33 страницыDirect & Indirect Taxesdinanikarim50% (2)

- Political Economy - by CSD in SrilankaДокумент35 страницPolitical Economy - by CSD in SrilankaSampath SamarakoonОценок пока нет

- Public Provident FundДокумент10 страницPublic Provident FundJubin JainОценок пока нет

- PCДокумент1 страницаPCtpsroxОценок пока нет

- Chapter 2Документ44 страницыChapter 2Shafiq HafizullahОценок пока нет

- System Dynamics of Interest Rate Effects On Aggregate Demand PDFДокумент24 страницыSystem Dynamics of Interest Rate Effects On Aggregate Demand PDFUmkc Economists100% (2)

- Proof of Your No Claims Bonus: Call Customer Services OnДокумент2 страницыProof of Your No Claims Bonus: Call Customer Services OnstephjazzerciseОценок пока нет

- BOJ - Functions and Operations of The BOJДокумент344 страницыBOJ - Functions and Operations of The BOJ007featherОценок пока нет

- City of Brookhaven Press Release Explaining GA Power Franchise Fees.Документ6 страницCity of Brookhaven Press Release Explaining GA Power Franchise Fees.The Brookhaven PostОценок пока нет

- Bir 1600Документ13 страницBir 1600Adelaida TuazonОценок пока нет