Академический Документы

Профессиональный Документы

Культура Документы

Domestic Transfer Pricing Analysing The Impact On Tax Holiday Undertakings

Загружено:

SamRathoreОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Domestic Transfer Pricing Analysing The Impact On Tax Holiday Undertakings

Загружено:

SamRathoreАвторское право:

Доступные форматы

Domestic Transfer Pricing-

Analysing the impact on Tax

Holiday undertakings

T

he Finance Act, 2012 ushered in significant Transfer pricing amendments

- APAs and extension of Transfer Pricing provisions to specified

domestic transactions (‘SDTs’), being the most significant ones. In this

article, the Authors discuss the application of transfer pricing provisions to

tax holiday undertakings, as under:

1. Introduction

2. Scope and Coverage:

Q1: Which undertakings are covered?

Q2: What are the typical transactions covered?

3. Key Issues and Challenges

Issue 1: Ordinary profits vs arm’s length

Issue 2: Loss making tax holiday undertakings

Issue 3: Impact on Cost allocations

Issue 4: Close connection?

Issue 5: Impact of recent judicial precedents

4. Way forward

The Supreme Court in the case of Glaxo Smithkline 1 opined on the need to

extend the existing Transfer Pricing provisions to domestic transactions, with

a view to counter tax evasion between domestic related parties, as illustrated

below:

ö Ü¿®°¿² Ó»¸¬¿ ·- ¿ Ì®¿²-º»® Ю·½·²¹ ß--±½·¿¬» Ü·®»½¬±® ¾¿-»¼ ·² ЩÝù- Ó«³¾¿· ±ºº·½»ò

öö Ö¿§ Ó¿²µ¿¼ ·- ¿ Ì®¿²-º»® Ю·½·²¹ Ó¿²¿¹»® ¾¿-»¼ ·² ЩÝù- Ó«³¾¿· ±ºº·½»ò

ööö Í«¶¿§ ̸¿µµ¿® · ¿ Ì®¿²º»® Ю·½·²¹ ß·¬¿²¬ Ó¿²¿¹»® ·² Ð©Ý Ó«³¾¿· ±ºº·½»ò

ó ̸»§ ³¿§ ¾» ½±²¬¿½¬»¼ ¾§ »³¿·´ ¿¬æ ¼¿®°¿²ò³»¸¬¿à·²ò°©½ò½±³ô ¶¿§ò³¿²µ¿¼à·²ò°©½ò½±³ô -«¶¿§ò¬¸¿µµ¿®à·²ò°©½ò½±³

INTERNATIONAL TAXATION n VOL. 8 n MAY 2013 n 25 517

ÜÑÓÛÍÌ×Ý ÌÎßÒÍÚÛÎ ÐÎ×Ý×ÒÙ ó ßÒßÔÇÍ×ÒÙ ÌØÛ ×ÓÐßÝÌ ÑÒ ÌßÈ ØÑÔ×ÜßÇ ËÒÜÛÎÌßÕ×ÒÙÍ

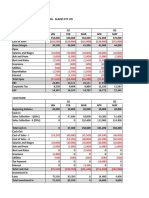

Scenario Particulars Impact

Expenditure to Group Co. A (loss making) could Reduction in current year’s tax

Domestic related party charge an excessive amount liability

to Group Co. B (profit making)

Transactions by Tax Tax Holiday Undertaking could Claiming higher tax holiday

Holiday undertakings charge an excessive amount for

sales to related parties

Consequent to the above, section 92BA of the u any other transaction as notified by CBDT.

Income-tax Act, 1961 has been introduced w.e.f. In relation to tax holiday undertakings, the

Assessment Year (‘AY’) 2013-14 i.e. April 1, 2012, provisions essentially extend to the following

to cover the following domestic related party transactions:

transactions:

u ‘transfer of goods and services’ with other

u any expenditure in respect of which pay- undertakings of the same taxpayer; and

ment is made/to be made to related parties

as enlisted under section 40(A)(2)(b); u business transacted with other entities having

‘close connection’ with the taxpayer.

u inter-unit transactions of tax holiday units

eligible to claim profit linked deduction The Act prescribes a safe harbour i.e. minimum

under sections 80(A)(6) and 80-IA(8); threshold of À 5 crore (i.e. À 50 millions) on an

aggregate basis in order to apply the provisions.

u any business transacted between the tax

holiday unit and other person as referred îò ͽ±°» ¿²¼ ݱª»®¿¹»

in section 80-IA(10);

Q1. Which tax holiday undertakings are cov-

u any transaction referred to in Chapter ered?

VI-A or section 10AA to which provisions

The provisions cover the following undertakings:

of section 80-IA(8)/80-IA(10) apply; and

Particulars Coverage

Undertakings claiming industry • Undertakings engaged in generation/transmission/

based tax holidays distribution of power or developing/operating/

maintaining infrastructure facilities

• Companies engaged in refining oil, undertakings

engaged in developing and building housing projects,

etc

Undertakings claiming • Undertakings located in Special Economic Zone

geographical location based tax

holidays • Undertakings located in backward industrial areas

(Rajasthan, Bihar etc.)

• Undertakings located in Himachal Pradesh, Uttaranchal

or notified areas in North Eastern States

• Undertakings engaged in business of hotels/

convention centre in specified area/district

Q2: What typical transactions are covered? (a) Transfer of goods and services from one

In respect of tax holiday undertakings, the tax holiday undertaking to another under-

following transactions are likely to be covered: taking of the same taxpayer or vice versa.

To illustrate:

518 INTERNATIONAL TAXATION n VOL. 8 n MAY 2013 n 26

ÜÑÓÛÍÌ×Ý ÌÎßÒÍÚÛÎ ÐÎ×Ý×ÒÙ ó ßÒßÔÇÍ×ÒÙ ÌØÛ ×ÓÐßÝÌ ÑÒ ÌßÈ ØÑÔ×ÜßÇ ËÒÜÛÎÌßÕ×ÒÙÍ

u Purchase or sale of goods need to be determined having regard to the arm’s

length principle and the transfer pricing methods.

u Receipt or provision of services;

The challenges likely to be faced by taxpayers in

u Purchase or sale of capital assets; and this regard, have been illustrated below:

u Further, any other income and ex- u A taxpayer (say ABC Ltd., a tax holiday

pense transactions that impact the tax unit) has earned a margin of 30% while

holiday profits of the undertaking, arithmetic mean of the margins earned by

where they qualify as transfer of goods comparables is 15%. OP/TC of 30% is

and services should also be covered. considered to be at arm’s length by the

transfer pricing officer, since it is in excess

(b) Any business transacted with entities hav-

of the comparables.

ing close connection with the taxpayer. To

illustrate:

Particulars Profit level indicator

u Each of the transactions listed under Total Income 150

(a) above would ordinarily be cov-

ered. Cost (TC) 105

Profits (OP) 45

u The term ‘business transacted’ has a

wider connotation than ‘transfer of OP/TC 30%

goods and services’ and specific facts

of any transaction which could have Comparable Operating profits/

an impact on tax holiday would need Companies Total cost (OP/TC)

to be examined. Company A 35%

Some additional situations which are likely to Company B 10%

need detailed examination are:

Company C 25%

u Purchase of a tax holiday undertak- Company D 14%

ing by a taxpayer from a closely

connected person (whether at ‘book Company E -8%

value’ or ‘market value’). Arithmetic Mean 15%

u Allocation of common expenses – i.e.

u In the above case, if price based method

strategy, marketing, design & engi-

(say, the Comparable Uncontrolled Price

neering, human resources, accounting,

method) has been applied to benchmark

finance etc. as to whether the same

the transaction between ABC Ltd. and a

qualifies as a ‘service’ and needs to

person closely connected with it, the de-

be at a mark-up to be at fair value.

rived profits should be considered as or-

u Guarantees and loans for the purpose dinary profits.

of the business of the tax holiday

u However, where ABC Ltd.’s arm’s length

undertaking.

price was benchmarked using profit based

íò Õ»§ ×--«»- ¿²¼ ݸ¿´´»²¹»- methods (such as net margins of compa-

rable companies), a question arises as to

Issue 1: Ordinary profits v. arm’s length

whether tax holiday benefits will be denied

Section 80-IA(10) provides that where the Revenue when the ABC Ltd. has earned profits (30%)

authorities believe that the tax holiday undertaking in excess of the arithmetic mean of

produces more than ordinary profits due to a comparables (15%).

close connection with any person, only a reasonable

In this regard, the Authors are of the view that

level of profits will be eligible for the tax holiday

taxpayers can seek to rely on Tribunal rulings2

benefit. With introduction of domestic transfer

in the context of section 80-IA(10) [even though

pricing, ordinary profits for tax holiday units would

INTERNATIONAL TAXATION n VOL. 8 n MAY 2013 n 27 519

ÜÑÓÛÍÌ×Ý ÌÎßÒÍÚÛÎ ÐÎ×Ý×ÒÙ ó ßÒßÔÇÍ×ÒÙ ÌØÛ ×ÓÐßÝÌ ÑÒ ÌßÈ ØÑÔ×ÜßÇ ËÒÜÛÎÌßÕ×ÒÙÍ

in respect of years before transfer pricing provisions has been a debated issue in various Tribunals

were extended to section 80-IA(10)], which have and High Courts.

held the following principles:

Accordingly, the Authors are of the view that

u The tax authorities was not justified to invoke non-applicability of provisions to loss making

the provisions of section 80-IA(10) read with tax holiday undertakings is not free from doubt

section 10B(7) so as to reduce the eligible and it is advisable for the taxpayers to disclose

profits on the basis of the arm’s length the position sought to be adopted in the Form

price computed by the transfer pricing officer 3CEB.

without showing how he determined that

Issue 3: Impact on Cost allocations

the taxpayer had shown more than “ordi-

nary profits”. Determination of allocable costs

u The provisions of section 80-IA(10) do not Under the provisions of the Act, the Tax holiday

given an arbitrary power to the tax au- undertakings are required to maintain separate

thorities to fix the profits of the taxpayer3. audited accounts. The costs directly relatable to

In cases where the transfer pricing officer the individual undertakings are assigned/charged

has confirmed that no adjustment on ac- to such undertakings. However, some common

count of transfer pricing is required to be Head Office expenditures (‘common HO expenses’)

made, then any reduction of eligible profits benefit all the undertakings of the taxpayer/

by the AO is not sustainable unless the tax Group in general. These expenses could be in

authorities can show that the taxpayer has the nature of general administrative expenses

earned more than ordinary profits. like research, travelling, conveyance, communi-

cation, marketing, legal and professional expenses,

The Authors acknowledge that a question may

accounting and finance expenses etc. In order

arise as to whether the ratio of the above rulings

to arrive at the correct amount of profits eligible

will continue to be applicable in the future

for tax holidays, it is important to consider

given that transfer pricing provisions now apply

whether such HO expenses are allocable to the

to section 80-IA(10) and which require ordinary

tax holiday undertakings or otherwise.

profits to be referenced to the arm’s length

price. The Authors suggest taxpayers focus on The issue of allocation of common Head Office

establishing through robust transfer pricing expenditures between entities claiming tax holiday

documentation how the profits of the tax holiday undertakings and other undertakings of the

units are ‘ordinary’ to support their case before taxpayer/Group has been a debated issue in

the tax authorities to support their case where various Tribunals and High Courts. There are

unintended controversies and litigations arise. a number of rulings4 available on the subject,

in favour of cost allocation of common HO

Issue 2: Loss making tax holiday undertakings?

expenditures, encompassing the following

Where a tax holiday undertaking incurs losses, guidelines:

tax holiday provisions continue to be applicable

u All common expenses ought to be allocated

to such undertakings though tax holiday claimed

on a reasonable and scientific basis (say

is ‘NIL’.

turnover, head-count, etc.);

Taxpayers may argue that in the event of losses,

u Even if the expenses are in the nature of

the ‘motive’ of shifting tax holiday profits is

finance department, human resources etc.,

absent and accordingly, the provisions ought

which do not directly relate to qualifying

not to apply. However, this would depend upon

undertakings, they ought to be reasonably

the treatment accorded by the taxpayer as well

allocated to the undertakings on the premise

as tax authorities to such losses i.e. whether the

that the HO does not exist for its own sake,

losses are set-off against profits of other businesses

but its existence is relevant for all activities

or carried forward to be set-off against future

undertaken by various undertakings/divi-

profits of the tax holiday undertaking, which

sions/profit centres; and

520 INTERNATIONAL TAXATION n VOL. 8 n MAY 2013 n 28

ÜÑÓÛÍÌ×Ý ÌÎßÒÍÚÛÎ ÐÎ×Ý×ÒÙ ó ßÒßÔÇÍ×ÒÙ ÌØÛ ×ÓÐßÝÌ ÑÒ ÌßÈ ØÑÔ×ÜßÇ ËÒÜÛÎÌßÕ×ÒÙÍ

u Non-allocation of common HO expenses dividual undertakings, on the footing that

might lead to inflation of profits of tax the funds so borrowed were not diverted

holiday undertakings and consequent de- towards the qualifying undertakings.

flation of income in the hands of the HO,

u The determination of ‘pure and simple’ ad-

leading to erosion of domestic tax base.

ministrative expenses is subjective and prone

As opposed to the above, in the case of Wipro to several litigative challenges. Further, the

Information Technology v. Dy. CIT [2004 88 TTJ determination of expenses having ‘direct

(Bang) 778], it was held by the Income-tax nexus’ with the individual undertakings is

Appellate Tribunal that the corporate group does subjective and prone to several litigative

not carry on any business activity by itself, and challenges.

hence, cannot be called to be the business of

In view of the above judicial precedents as well

the taxpayer. The taxpayer is required to maintain

as the ambiguity surrounding the precedents in

its corporate image, set up corporate house and

favour of taxpayers, taxpayers would be advised

employ various persons for such purposes. The

to weigh their options carefully and make adequate

funds used for such purposes cannot be related

disclosures in their filings.

to any of the individual undertakings, and

accordingly interest on such funds is not required Whether a cost allocation is a ‘service’ and is re-

to be apportioned to any of the tax holiday quired to be at a ‘mark-up’?

undertakings, for the purpose of deduction under

Chapter VI-A. Circular No. 14 of 2001 explains the perspective

of the CBDT behind the introduction of the

Further, in the case of Ponds India Limited (now, word ‘services’ in section 80-IA(8):

Hindustan Lever Limited) [ITA No. 2047/Mad/

88], the Madras High Court has upheld the “...As in certain cases, the transfer may relate

order of the Tribunal and accepted the contention to services, the provision has been accordingly

that pure and simple common administrative amended to clarify that this would include

HO expenses need not be allocated to individual services. Such services may include marketable

undertakings, if not directly relatable to such services of operations and maintenance in

undertakings and if used in the day to day case of infrastructure facilities, marketable

monitoring requirements of finance and other services for distribution of electricity and

actions. specified marketable services in telecom...”

A similar view has also been taken by the Bombay From the above, an inference could be drawn

High Court in the case of Zandu Pharmaceuticals that the introduction of the arm’s length principle

Works Ltd. v. CIT [2013] 31 taxmann.com 191/ by section 92BA would require computation of

213 Taxman 207. The Bombay High Court has fair market value as per the specified transfer

held that there must be a direct nexus between pricing methods where the undertakings provide

an industrial undertaking and the expenses which ‘marketable services’ to other undertakings. Whether

are sought to be apportioned/attributable to it. or not the activities of the HO or corporate

Expenses which do not relate to an industrial office qualify as a ‘business activity’ or marketable

undertaking/unit under consideration and they service is a fact driven issue. In the Authors’

relate to other units or to the head office cannot view, ordinarily, common HO functions should

be taken into consideration while computing not constitute marketable services requiring more

the deduction. than a pure allocation to the tax holiday

undertakings i.e. no markup ought to be charged.

In relation to the abovementioned precedents,

the following aspects draw key consideration Reliance for the above can be also drawn from

and attention: commentaries on Article 7 of the OECD/UN

Model which state that in respect of dealings

u The common interest expenses incurred by between HO/other undertakings, which are in

the HO could not be allocated to the in- the nature of ‘general management’, nothing

INTERNATIONAL TAXATION n VOL. 8 n MAY 2013 n 29 521

ÜÑÓÛÍÌ×Ý ÌÎßÒÍÚÛÎ ÐÎ×Ý×ÒÙ ó ßÒßÔÇÍ×ÒÙ ÌØÛ ×ÓÐßÝÌ ÑÒ ÌßÈ ØÑÔ×ÜßÇ ËÒÜÛÎÌßÕ×ÒÙÍ

beyond third party costs should be allocated would be required to be charged in the event

and no mark-up can be charged by one of characterisation of such services as ‘marketable’

undertakings to another. Accordingly, common from HO perspective.

HO expenses could be allocated by taxpayers

The Authors have summarized their

on a reasonable basis. An appropriate mark-up

recommendations on common costs below:

Issue Approach

Whether allocation of costs is a trans- • Arguably, no, based on judicial precedent5.

action covered under section 92BA • However, reference can also be placed on Revised

ICAI Guidance Note6 which opines that allocation

of costs constitutes a SDT

• In the Authors’ view, treating allocation of common

costs as a transaction covered under section 92BA

and requiring reporting, seems a more prudent

view

Determination of allocable costs • An ideal cost allocation policy would entail allocation

of ‘all’ common costs based on rational allocation

keys

• Based on a recent judicial precedent7, a view could

be taken that pure and simple common administrative

costs incurred for the purpose of monitoring day

to day requirements of finance and other actions

may not be allocated. However the determination

of ‘pure and simple’ administrative expenses is

subjective and prone to several litigative challenges

Determining reasonable allocation keys • All common expenses ought to be allocated on a

reasonable and scientific basis (say on the basis

of ratio of turnover, head-count, Cost of sales, FTE

etc.) depending upon the nature of business of the

entities/undertakings to which such costs are

allocated.

Allocation of costs – whether at actual • The relevant costs could be charged at a mark-up

or at mark-up if the services provided by the HO partake the

character of marketable services; otherwise, a pure

allocation should suffice.

Issue 4: Meaning of ‘close connection’ provisions of the Act to define ‘close connection’

as under:

Section 80-IA(8) covers business transactions

undertaken by a taxpayer claiming tax holiday u Substantial interest [Section 40A(2)(b)];

with other entities having ‘close connection’ with

u Associated Enterprise [Section 92A(2)]; and

the taxpayer. The term ‘close connection’ has

not been expressly defined in the Act. In this u Related party as per Accounting Standard

regard, reference could be drawn from other – 18 issued by ICAI.

522 INTERNATIONAL TAXATION n VOL. 8 n MAY 2013 n 30

ÜÑÓÛÍÌ×Ý ÌÎßÒÍÚÛÎ ÐÎ×Ý×ÒÙ ó ßÒßÔÇÍ×ÒÙ ÌØÛ ×ÓÐßÝÌ ÑÒ ÌßÈ ØÑÔ×ÜßÇ ËÒÜÛÎÌßÕ×ÒÙÍ

Particulars Substantial Associated Related Party as

interest Enterprise per AS-18

Voting Power >= 20% >= 26% >50%

Directors covered? Directors Not covered Key Managerial

Personnel

Key suppliers covered? Not covered More than 90% Specifically

supplies excluded

The Authors are of the view that since DTP as a reference point, for the purposes of

provisions have been introduced on similar lines determining/defining ‘close connection’ between

as the normal transfer pricing provisions, taxpayers tax holiday undertakings and other entities.

may consider the definition of ‘Substantial Interest’

Issue 5: Impact of recent judicial precedents

Case law Summary & Impact analysis

Cadilla Healthcare Ltd. (Supra) • The assessee was claiming deduction under sections 80-IB and 80-

IC of the Act.

• The Assessing Officer contended that the Baddi unit of the assessee

was earning abnormally high profits. The profits from manufacturing

activity ought to be separated from profits for marketing activity

and on account of brand value (which were not attributable to the

Baddi unit) and only the manufacturing profits are eligible for

deduction.

• The assessee contended that the Assessing Officer should not disturb

computation of deduction of the eligible unit on the ground that

profit earned by other units is lower than profits earned by the

eligible unit. There are no provisions in the Act that provide for

segregation of profits of eligible unit with regards to various operations

of the units.

• The Tribunal, upholding the assessee’s contentions, observed that

the profits of Baddi unit have been computed based on valid accounting

principles and based on separately maintained books of account,

after appropriate allocation of HO expenses. The Tribunal held that

the Assessing Officer has not pointed out any defect in the working

of the profit of the Baddi unit. There is no concept of imaginary

sale price to the HO and segregation of profits based on such

imaginary sales price under section 80-IA.

With the introduction of domestic transfer pricing provisions based on

arm’s length principle, the above principles laid down by the Tribunal

would need to be followed in consonance with the transfer pricing

regulations.

Nahar Spinning Mills Ltd. v. JCIT [TS- • The Assessing Officer contended that the assessee did not allocate

622-ITAT-2012 (Chandi)] MD remuneration to tax holiday units and overstated profits of the

undertaking, claiming higher deduction.

• The assessee contended that the allocation was unwarranted since

it was never questioned in the past and the assessee maintained

proper books of account.

INTERNATIONAL TAXATION n VOL. 8 n MAY 2013 n 31 523

ÜÑÓÛÍÌ×Ý ÌÎßÒÍÚÛÎ ÐÎ×Ý×ÒÙ ó ßÒßÔÇÍ×ÒÙ ÌØÛ ×ÓÐßÝÌ ÑÒ ÌßÈ ØÑÔ×ÜßÇ ËÒÜÛÎÌßÕ×ÒÙÍ

• The Tribunal observed that the provisions of section 80-IA(8) applies

where goods and services are transferred by the eligible undertaking

to any other business of the assessee. In the instant case, there is

no transfer of goods and services, hence the provisions of section

80-IA(8) do not apply to cost allocations. Further, provisions of

section 80-IA(10) are also not applicable as the transaction only

involves re-allocation of MD’s remuneration from one unit of the

assessee to another.

• However, for the purposes of section 10B, all expenses relating to

eligible unit should be deducted, accordingly, managerial remuneration

ought to be allocated to eligible units as well. The above ruling

suggests that allocation of common expenditures to tax holiday

units, to the extent this does not qualify as ‘provision of services’

is not covered. However, the revised ICAI Guidelines state that cost

allocations are to be considered as specified domestic transactions.

In such cases, taxpayers are recommended to develop and maintain

the following documents which would help them in defending the

allocation:–

- An appropriate cost allocation policy;

- A description of the nature of costs and an explanation as to

why these do not qualify as “provision of services”.

The above approach will help taxpayers address the implications of

the onerous compliance requirements enforced through the domestic

transfer pricing provisions.

ìò É¿§ º±®©¿®¼ compliance requirements. However, this

expectation is unmet and the provisions are

Domestic transfer pricing provisions have created here to stay. Further, Advance Pricing Agreements

unique challenges for taxpayers given onerous are also not available for DTPs.

documentation requirements and challenges in

applying the provisions to tax holiday undertakings Taxpayers now need to focus on preparing for

in areas such as ‘ordinary profits’, ‘close connection’ the first year of compliance due by 30 November

and cost allocations, as discussed in the earlier 2013, taking into consideration the suggestion

sections. of the Authors and cognizance of the likely

issues and potential solutions.

Taxpayers expected Finance Act, 2013 to address

some of these challenges and rationalize the

ïò Ý×Ì ªò Ù´¿¨± ͳ·¬¸µ´·²» ß-·¿ øÐò÷ Ô¬¼ò Åîðïðà ïçë Ì¿¨³¿² íë øÍÝ÷

îò Ê·-«¿´ Ù®¿°¸·½- ݱ³°«¬·²¹ Í»®ª·½»- øײ¼·¿÷ øÐò÷ Ô¬¼ò ªò ß--¬¬ò Ý×Ì Åîðïîà ëî ÍÑÌ ïéî øËÎÑ÷ñîï ¬¿¨³¿²²ò½±³ ïìë øݸ»²²¿·÷ô É»-¬±²

Õ²±©´»¼¹» ͧ-¬»³- ú ͱ´«¬·±²- øײ¼·¿÷øÐò÷ Ô¬¼ò ª ×ÌÑ Åîðïîà îí ¬¿¨³¿²²ò½±³ îïëñëî ÍÑÌ ïîð øا¼ò÷ øËÎÑ÷

íò λº»®»²½» ³¿¼» ¬± ¬¸» ½¿-» ±º Ì©»»¦»®³¿² øײ¼·¿÷ øÐ÷ Ô¬¼ò ªò ß¼¼´ò Ý×Ì Åîðïðà ïíí ÌÌÖ øݸ»²²¿·÷ íðè÷ ¿²¼ Ü·¹·¬¿´ Û¯«·°³»²¬ ײ¼·¿

Ô¬¼ò ªò ܧò Ý×Ì Åîððêà ïðí ÌÌÖ øÞ¿²¹ò÷ íîçò

ìò Ý×Ì ªò ÍòÌò Ó·½®± Û´»½¬®±²·½- øÐò÷ Ô¬¼ò Å×Ì ß°°»¿´ Ò±ò çîè ±º îðïðô ¼¿¬»¼ îëóëóîðïïÃô ܧò Ý×Ì ªò Ù±¼®»¶ ݱ²-«³»® Ю±¼«½¬- Ô¬¼ò

Å×Ì ß°°»¿´ Ò±ò ìéëí øÓ«³ò÷ ±º îððéÃô ܧò Ý×Ì ªò ײº±®³¿¬·½- øײ¼·¿÷ Ô¬¼ò Å×Ì ß°°»¿´ Ò±ò çèî øÞ¿²¹ò÷ ±º îððçÃô ܧò Ý×Ì ªò Õ»©¿´

Õ·®¿² Ý´±¬¸·²¹ Ъ¬ Ô¬¼ Å×Ì ß°°»¿´ Ò±ò ìì øÓ«³ò÷ ±º îððçÃô Ê¿®¼¸¿³¿² ر´¼·²¹- Ô¬¼ò ªò ß--¬¬ò Ý×Ì Å×Ì ß°°»¿´ Ò±ò éèê øݸ¿²¼·ò÷

±º îððèÃô É·°®± Ô¬¼ò ªò ܧò Ý×Ì Åøîððë÷ çê ÌÌÖ îïï øÞ¿²¹ò÷Ãô Ò¿¸¿® Í°·²²·²¹ Ó·´´- Ô¬¼ò ªò Ö¬ò Ý×Ì Åîðïîà ëì ÍÑÌ ïíì øËÎÑ÷ñ

îë ¬¿¨³¿²²ò½±³ íìî øݸ¼ò÷ô Ý¿¼·´´¿ Ø»¿´¬¸½¿®» Ô¬¼ò ªò ß¼¼´ò Ý×Ì Åîðïîà îï ¬¿¨³¿²²ò½±³ ìèí ø߸¼ò÷ô ɱ½µ¸¿®¼¬ Ô¬¼ò ªò ßÝ×Ì Å×Ìß

Ò±ò íççïñÓ«³ñîððêÃô ݱ²-±´·¼¿¬»¼ ݱºº»» Ô¬¼ò ªò ͬ¿¬» ±º Õ¿®²¿¬¿µ¿ Åîððïà îìè ×ÌÎ ìíî øÍÝ÷ô Ю»-¬·¹» Ú±±¼- Ô¬¼ò ªò Ý×Ì Åèï

ÝÝØ ðíï øîðïî÷øÓÐ÷Ã

ëò Ò¿¸¿® Í°·²²·²¹ Ó·´´- Ô¬¼ò øÍ«°®¿÷

êò ݸ¿°¬»® ìßæ Í°»½·º·»¼ ܱ³»¬·½ Ì®¿²¿½¬·±² °¿®¿ ïîòïî °¿¹» Ò±ò íç

éò б²¼- ײ¼·¿ Ô·³·¬»¼ ø²±© Ø·²¼«-¬¿² Ô»ª»® Ô·³·¬»¼÷ øÍ«°®¿÷

524 INTERNATIONAL TAXATION n VOL. 8 n MAY 2013 n 32

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- CMA Case Study Blades PTY LTDДокумент6 страницCMA Case Study Blades PTY LTDMuhamad ArdiansyahОценок пока нет

- Bill details and charges for May 2018Документ3 страницыBill details and charges for May 2018Mah Jabeen0% (1)

- Swiggy Order 43333379786Документ2 страницыSwiggy Order 43333379786Bhargav VekariaОценок пока нет

- Refining Corporation v. Court of Appeals, Et Al, 246 SCRA 667)Документ35 страницRefining Corporation v. Court of Appeals, Et Al, 246 SCRA 667)UsixhzkaBОценок пока нет

- Epaycard - Terms Conditions - 2017 NewДокумент1 страницаEpaycard - Terms Conditions - 2017 NewDrw ArcyОценок пока нет

- NominationДокумент2 страницыNominationvarun shahОценок пока нет

- Property Tax PresentationДокумент8 страницProperty Tax PresentationOloruntobaОценок пока нет

- CE Luzon Geothermal Power Company vs. BIR on unutilized input VAT refundДокумент11 страницCE Luzon Geothermal Power Company vs. BIR on unutilized input VAT refundJaysonОценок пока нет

- Scorpio N (FBD)Документ1 страницаScorpio N (FBD)Rishabh MahajanОценок пока нет

- Taxation of Individuals QuizzerДокумент37 страницTaxation of Individuals QuizzerJc QuismundoОценок пока нет

- PROFORMA INVOICE TITLEДокумент1 страницаPROFORMA INVOICE TITLESimran DhamoonОценок пока нет

- Detailed StatementДокумент5 страницDetailed StatementSantosh Kumar GuptaОценок пока нет

- Guest Checkout GuideДокумент7 страницGuest Checkout GuideechxОценок пока нет

- Statement 1669899891666Документ6 страницStatement 1669899891666Vetsa VivekОценок пока нет

- SeafarersДокумент2 страницыSeafarersJEZRELL E. ENRICOSOОценок пока нет

- Payment Instruments ExplainedДокумент40 страницPayment Instruments ExplainedThanh HuyenОценок пока нет

- Payment Advice DetailsДокумент2 страницыPayment Advice DetailsVishal KambleОценок пока нет

- Assignment CTP Dr. Shipra JindalДокумент6 страницAssignment CTP Dr. Shipra JindalAbhishek AroraОценок пока нет

- Munch Catering LTD Whose Financial Year Runs From 1 DecemberДокумент1 страницаMunch Catering LTD Whose Financial Year Runs From 1 DecemberMiroslav GegoskiОценок пока нет

- Ola BillДокумент3 страницыOla BillMohit TanwarОценок пока нет

- Account StatementДокумент4 страницыAccount StatementdatadocsbdОценок пока нет

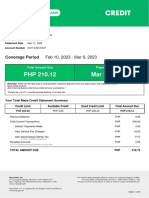

- MayaCredit SoA 2023MARДокумент2 страницыMayaCredit SoA 2023MARJan SaysonОценок пока нет

- TRIDHARMA MARKETING CORPORATION Vs COURT OF TAX APPEALSДокумент2 страницыTRIDHARMA MARKETING CORPORATION Vs COURT OF TAX APPEALSNFNLОценок пока нет

- M PassbookДокумент4 страницыM Passbookirfan shaikhОценок пока нет

- SSGC Duplicate Bill20210123 090016Документ1 страницаSSGC Duplicate Bill20210123 090016Ghulam Baqir MazariОценок пока нет

- Sbi Account Jan 2021Документ2 страницыSbi Account Jan 2021Manoj GaurОценок пока нет

- I 1040Документ214 страницI 1040Brian GohackiОценок пока нет

- Interco Transactions Problem 4 To 6 SolutionДокумент5 страницInterco Transactions Problem 4 To 6 SolutionViky Rose EballeОценок пока нет

- Regional Evaluation Board (Reb) Resolution On The Application For Compromise Settlement or For Abatement/ Cancellation of AssessmentДокумент3 страницыRegional Evaluation Board (Reb) Resolution On The Application For Compromise Settlement or For Abatement/ Cancellation of AssessmentHanabishi RekkaОценок пока нет

- Mahi Account StatementДокумент97 страницMahi Account StatementchinnaОценок пока нет