Академический Документы

Профессиональный Документы

Культура Документы

Corporate Finance Case Analysis Submission

Загружено:

Malavika UmeshОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Corporate Finance Case Analysis Submission

Загружено:

Malavika UmeshАвторское право:

Доступные форматы

CORPORATE FINANCE CASE ANALYSIS SUBMISSION

“Valuation of Wal-Mart”

A PROJECT SUBMITTED IN PARTIAL FULFILLMENT OF

THE REQUIREMENTS OF THE CORPORATE FINANCE COURSE (FNA002) OF

Term 2 (PGP 2019-21)

Submitted By

ARZOO JAISWAL (1910071)

BARNISHA LEPCHA (1910072)

JAYETA MATREJA (1910081)

KANCHAN KRISHAN (1910084)

LINGALA VAMSI (1910085)

MALAVIKA UMESH (1910086)

Under the guidance

Of

Prof. Kaveri Krishnan

INDIAN INSTITUTE OF MANAGEMENT, VISAKHAPATNAM

Valuation of Wal Mart

1. DIVIDEND DISCOUNT MODELS: Dividends in Perpetuity

Under the dividend discount model (DDM), the present value of a stock is calculated as shown by the

formula given below: -

P0=D1/(Ke-g)……[Equation 1]

Where, P0 = Current value of a firm’s stock price

D1 = Next year’s expected dividend

Ke = It is the investor’s required rate of return

g = expected perpetual dividend growth rate

As per the case, the discount rate is 7% and the analyst estimated a constant dividend growth of 5%.

Also, D1 = $1.21 per share

Ke = 7% (as per the case)

Therefore, P0 = 1.21/ (0.07-0.05) = 1.21/0.02 = 60.5

P0 = 60.5

Therefore, the present value of the firm’s stock using the dividends in perpetuity method is $60.5.

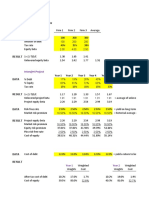

2. FORECASTED DIVIDENDS FOR THE NEXT SEVERAL YEARS PLUS SALE

OF STOCK IN THE FUTURE

The terminal value approach is used to calculate the value of a project or a business beyond a given

forecast period wherein future cash flows can be estimated. In this method, the dividends are estimated

for a set number of years (in the case of Wal-Mart it is estimated for 5 years), at which point a future

stock price value is calculated and this value is known as the terminal value. In the forecasted dividend

approach, the future stock price represents the present value at that point of all the future dividends

beyond the terminal value.

The formula for computing the present value of stock using the forecasted dividends approach is given

below: -

P0 = D1/(1+Ke)1 + D2/(1+Ke)2 + ……… + Dn/(1+Ke)n + Pn/(1+Ke)n…… [Equation 2]

Also, as per the case it is given that: -

n = 5, we are taking the estimated dividend values for a period of 5 years.

Assumption: -The growth rate of earnings is expected to 10.40% for the next five years and hence the

dividends are also expected to grow at the same rate (assuming a constant payout ratio).

Discount rate (as per the case) = 7%

The current and future values of dividends are calculated as shown below: -

Indian Institute of Management Visakhapatnam 2

Valuation of Wal Mart

Year Dividend in $

2010 1.090

2011 1.203

2012 1.328

2013 1.466

2014 1.619

2015 1.787

2016 1.876 (grows at a constant

rate of 5% hereon)

Calculation of the terminal value: -

Dividend obtained for the 6th year = 1.876

Hence, terminal value (future stock price) = 1.876/ (0.07-0.05)

Terminal Value (future stock price) = $93.8

Therefore, the current price of stock (obtained by substituting the calculated values in equation 2) =

1.203/(1.07)1 + 1.328/(1.07)2 + 1.466/(1.07)3 + 1.619/(1.07)4 + (1.787)/(1.07)5 +

(93.8)/(1.07)4 = 77.547

Current Price of Stock = $77.547

Therefore, the present value of the firm’s stock using the forecasted dividends method is $77.547.

3. USING THE THREE STAGE APPROACH

As per the guidelines given in the case, this approach can be modelled as given below: -

Discount Rate: r = 7%

For the growth period (g1):

Growth Years: 5

Initial growth rate of EPS: 10.40%

For the maturity period (g2):

Payout at maturity:45%

Retention rate at maturity (retent): 1- (payout ratio): 1-0.45 = 0.55 = 55%

Growth rate at maturity: r x retent: 0.07 *55 = 3.85%

For the transition period:

Transition years: 12

Growth rate of EPS (incremental): The growth rate during the transition period is assumed to be such

that it tends towards the growth rate at the time of maturity. Thus, the growth rate during the transition

period can be calculated as given below:

Indian Institute of Management Visakhapatnam 3

Valuation of Wal Mart

Growth rate during the transition period = (10.4-3.85)/13 = 0.5

This implies that there is a 0.5% drop in the growth rate during the transition period.

Other information:

Current fiscal year EPS (incremental): $3.72

Current calendar year dividend: $1.09

Current payout (p1): 29.3%

Growth years payout = Current year’s payout: 29.3%

Maturity Payout (p2): 45%

Transition years payout = 1.21% = (45-29.3)/13 (Assumption is that payout ratio during the transition

period increases to reach the payout rate at maturity)

Growth + Transition years = 17

Terminal Value (TV) = div1/(r-g)

Year Assumption EPS Growth Dividend payout Present

Number Value

PV(div+TV)

1 Growth 4.11 10.40% 1.20 29.30% 1.12459424

2 Growth 4.53 10.40% 1.33 29.30% 1.16032901

3 Growth 5.01 10.40% 1.47 29.30% 1.19719928

4 Growth 5.53 10.40% 1.62 29.30% 1.23524113

5 Growth 6.10 10.40% 1.79 29.30% 1.27449178

6 Transition 6.70 9.90% 2.05 30.51% 1.36294237

7 Transition 7.33 9.39% 2.33 31.72% 1.44857546

8 Transition 7.99 8.89% 2.63 32.92% 1.53027556

9 Transition 8.66 8.38% 2.95 34.13% 1.60693816

10 Transition 9.34 7.88% 3.30 35.34% 1.67749403

11 Transition 10.03 7.38% 3.66 36.55% 1.74093357

12 Transition 10.72 6.87% 4.05 37.75% 1.79633056

13 Transition 11.40 6.37% 4.44 38.96% 1.84286446

14 Transition 12.07 5.87% 4.85 40.17% 1.87984056

15 Transition 12.71 5.36% 5.26 41.38% 1.90670725

16 Transition 13.33 4.86% 5.68 42.58% 1.92306991

17 Transition 13.91 4.35% 6.09 43.79% 67.2681527

18 Maturity 14.45 3.85% 6.50 45%

Assumptions and Calculations: For maturity period, there is perpetual growth rate of 3.85% and on

the 18th year dividend is 6.5,

Thus P17 = 6.5/ (0.07-0.0385)

= 206.40

Thus, Present value of 17th year dividend and stock price = (6.09+206.4)/1.0717 = 67.268

Indian Institute of Management Visakhapatnam 4

Valuation of Wal Mart

Current price of stock, P0 = Sum of all the present values in the table = 91.98

Therefore, the present value of the firm’s stock using the three-step approach method is $91.98.

4. THE PRICE/EARNINGS MULTIPLE APPROACH

In the method, the intrinsic value of the stock is estimated as the projected EPS (earnings per share)

multiplied by an appropriate forward-looking P/E multiple.

As per the case facts: -

Current value of EPS (as of 2010) = $3.72

EPS growth rate (anticipated earnings growth over the next five years) = 10.40%

Therefore, Projected EPS value = $3.72*1.1040 = $4.10688

P/E multiple (as given in exhibit 7 of the case) = 13.40

Therefore, Present Value of Stock, PV = 4.10688*13.40

PV = $55.032192

Therefore, the present value of the firm’s stock using the price/earnings multiple approach method is

$55.032192.

Indian Institute of Management Visakhapatnam 5

Вам также может понравиться

- Sales Volume, Revenue, Cost & Profit Analysis by ProductДокумент5 страницSales Volume, Revenue, Cost & Profit Analysis by Productrahulchohan2108Оценок пока нет

- Fixed VS Variable CostsДокумент5 страницFixed VS Variable Costssonia100% (1)

- Accounting AnalysisДокумент15 страницAccounting AnalysisMonoarul IslamОценок пока нет

- Financial Statement Analysis PDFДокумент16 страницFinancial Statement Analysis PDFLara CelestialОценок пока нет

- Breakeven PointsДокумент8 страницBreakeven PointsAdrimar AquinoОценок пока нет

- Management and Cost Accounting Chapter 3Документ28 страницManagement and Cost Accounting Chapter 3Muhammad SohailОценок пока нет

- MALec Batch 4Документ125 страницMALec Batch 4Dương DươngОценок пока нет

- Debt RatioДокумент7 страницDebt RatioAamir BilalОценок пока нет

- ACCT BUS COM ADVДокумент12 страницACCT BUS COM ADVDaveKwokОценок пока нет

- Difference Between Financial and Managerial AccountingДокумент10 страницDifference Between Financial and Managerial AccountingRahman Sankai KaharuddinОценок пока нет

- Strategic Capacity PlanningДокумент22 страницыStrategic Capacity PlanningguhelenaОценок пока нет

- Chapter 1Документ28 страницChapter 1Adhi WirayanaОценок пока нет

- Strategic Cost ManagementДокумент12 страницStrategic Cost Managementapi-3709659Оценок пока нет

- Companies' Financial Reporting RequirementsДокумент27 страницCompanies' Financial Reporting RequirementsprashnilОценок пока нет

- Ifrs 3Документ4 страницыIfrs 3Ken ZafraОценок пока нет

- Applying IFRS Revenue From Contracts With CustomersДокумент76 страницApplying IFRS Revenue From Contracts With CustomersDhe SagalaОценок пока нет

- Practice Problems Ch12Документ57 страницPractice Problems Ch12Kevin Baconga100% (2)

- Accounting & Control: Cost ManagementДокумент22 страницыAccounting & Control: Cost ManagementdewyОценок пока нет

- Intrinsic Stock Value FCFF On JNJ StockДокумент6 страницIntrinsic Stock Value FCFF On JNJ Stockviettuan91Оценок пока нет

- Management Accounting Course OverviewДокумент7 страницManagement Accounting Course OverviewsaminacheemaОценок пока нет

- Estimatingthe Optimal Capital StructureДокумент22 страницыEstimatingthe Optimal Capital StructureKashif KhurshidОценок пока нет

- PRELEC 1 Updates in Managerial Accounting Notes PDFДокумент6 страницPRELEC 1 Updates in Managerial Accounting Notes PDFRaichele FranciscoОценок пока нет

- Current Asset ManagementДокумент17 страницCurrent Asset ManagementKurt HendiveОценок пока нет

- Cost of CapitalДокумент23 страницыCost of CapitalnigemahamatiОценок пока нет

- New Castle Case Study SolutionДокумент5 страницNew Castle Case Study Solutionsani0250% (2)

- FS ModelДокумент13 страницFS Modelalfx216Оценок пока нет

- Chapter 7 CPA FAR NotesДокумент5 страницChapter 7 CPA FAR Notesjklein2588Оценок пока нет

- Breakeven Analysis PDFДокумент16 страницBreakeven Analysis PDFTeja VenkatОценок пока нет

- Comparable Companies: Inter@rt ProjectДокумент9 страницComparable Companies: Inter@rt ProjectVincenzo AlterioОценок пока нет

- Management Accounting ConceptsДокумент19 страницManagement Accounting ConceptsPlatonicОценок пока нет

- Blocher8e EOC SM Ch04 FinalДокумент46 страницBlocher8e EOC SM Ch04 FinalDiah ArmelizaОценок пока нет

- Accounting 303Документ13 страницAccounting 303survivalofthepolyОценок пока нет

- Trend AnalysisДокумент1 страницаTrend Analysisapi-385117572Оценок пока нет

- Chapter 6 Discounted Cash Flow ValuationДокумент27 страницChapter 6 Discounted Cash Flow ValuationAhmed Fathelbab100% (1)

- Inflation Module: Real vs. Actual DollarsДокумент6 страницInflation Module: Real vs. Actual DollarsImsupaОценок пока нет

- © 2010 Financial Management Prepared By: Amyn WahidДокумент66 страниц© 2010 Financial Management Prepared By: Amyn Wahidfatimasal33m100% (1)

- IFRS Functional Currency CaseДокумент23 страницыIFRS Functional Currency CaseDan SimpsonОценок пока нет

- Financial Statement AnalysisДокумент50 страницFinancial Statement AnalysisRishin Suresh S100% (1)

- Chapter 4 Analysis of Financial StatementsДокумент2 страницыChapter 4 Analysis of Financial StatementsSamantha Siau100% (1)

- Managing PerformanceДокумент39 страницManaging PerformanceIvani KatalОценок пока нет

- Section 1.8 Equation of ValuesДокумент13 страницSection 1.8 Equation of ValuesMary Dianneil MandinОценок пока нет

- Financial and Managerial AccountingДокумент1 страницаFinancial and Managerial Accountingcons theОценок пока нет

- CMA Text SampleДокумент35 страницCMA Text SampleVinoth SairamОценок пока нет

- Forward Rate AgreementДокумент8 страницForward Rate AgreementNaveen BhatiaОценок пока нет

- Cost Volume Profit-Analysis Day2Документ50 страницCost Volume Profit-Analysis Day2Martin LojoyaОценок пока нет

- 6 Externalities Price Quantity Regulation3Документ29 страниц6 Externalities Price Quantity Regulation3Arlene DaroОценок пока нет

- IFRS 3 Business Combinations GuideDeferred tax assets or liabilities arising from the initial recognition of anДокумент9 страницIFRS 3 Business Combinations GuideDeferred tax assets or liabilities arising from the initial recognition of anKath SantosОценок пока нет

- AFM Notes by - Taha Popatia - Volume 1Документ68 страницAFM Notes by - Taha Popatia - Volume 1Ashfaq Ul Haq OniОценок пока нет

- Working Capital Adjustments Under Transfer PricingДокумент9 страницWorking Capital Adjustments Under Transfer PricingTaxpert Professionals Private LimitedОценок пока нет

- Chapter-17-LBO MergerДокумент69 страницChapter-17-LBO MergerSami Jatt0% (1)

- Mergers & Acquisitions: Aldovino, Hansley Eud, Rizza Mae Magana, Geselle Rodil, Via NicoleДокумент27 страницMergers & Acquisitions: Aldovino, Hansley Eud, Rizza Mae Magana, Geselle Rodil, Via NicoleRizza Mae EudОценок пока нет

- Cost and Management Accounting - Course OutlineДокумент9 страницCost and Management Accounting - Course OutlineJajJay100% (1)

- Ratio AnalysisДокумент33 страницыRatio AnalysisJhagantini PalaniveluОценок пока нет

- Definition and Objectives of BookkeepingДокумент6 страницDefinition and Objectives of BookkeepingmlumeОценок пока нет

- Chapter 3 Problems AnswersДокумент11 страницChapter 3 Problems AnswersOyunboldEnkhzayaОценок пока нет

- Management AccountingДокумент236 страницManagement AccountingDixie CheeloОценок пока нет

- Construction Contracts-IAS 11 & Rev Rec & Journals-EY-PG22Документ22 страницыConstruction Contracts-IAS 11 & Rev Rec & Journals-EY-PG22varadu1963Оценок пока нет

- Critical Financial Review: Understanding Corporate Financial InformationОт EverandCritical Financial Review: Understanding Corporate Financial InformationОценок пока нет

- Business Finance Assignment 2Документ8 страницBusiness Finance Assignment 2Akshat100% (1)

- Fundamentals of Investments Valuation and Management 7Th Edition Jordan Solutions Manual Full Chapter PDFДокумент28 страницFundamentals of Investments Valuation and Management 7Th Edition Jordan Solutions Manual Full Chapter PDFmary.galvez312100% (14)

- Mahindra SCOДокумент4 страницыMahindra SCOMalavika UmeshОценок пока нет

- MSP430 REPORT - OdtДокумент19 страницMSP430 REPORT - OdtMalavika UmeshОценок пока нет

- Ar 2015Документ194 страницыAr 2015Mayank TripathiОценок пока нет

- 12EC24 Tutorial-1 Jan16Документ1 страница12EC24 Tutorial-1 Jan16Malavika UmeshОценок пока нет

- Pmos PDFДокумент13 страницPmos PDF윤진수Оценок пока нет

- PH Meter Sku Sen0161 - Robot WikiДокумент6 страницPH Meter Sku Sen0161 - Robot WikiPanji SiregarОценок пока нет

- Registrar Status and Details ReportДокумент1 105 страницRegistrar Status and Details ReportJedhungОценок пока нет

- Bkash Project Report PDFДокумент61 страницаBkash Project Report PDFostak khanОценок пока нет

- PayslipДокумент3 страницыPayslipDurga raniОценок пока нет

- Luca Nogler, Udo Reifner Life Time ContractsДокумент871 страницаLuca Nogler, Udo Reifner Life Time ContractsMohamad mahdiОценок пока нет

- Banking DigestsДокумент42 страницыBanking DigestsRenz Aimeriza AlonzoОценок пока нет

- Setup Credit Card Payments in Oracle ReceivablesДокумент21 страницаSetup Credit Card Payments in Oracle ReceivablesMag Marina50% (2)

- June 2023Документ6 страницJune 2023DadaОценок пока нет

- HookupДокумент3 страницыHookupThelostboi86% (7)

- StarlingStatement 01 2023-04-2023Документ2 страницыStarlingStatement 01 2023-04-2023MasoomaIjazОценок пока нет

- 2022 07 14 - StatementДокумент4 страницы2022 07 14 - StatementGuoXuanChanОценок пока нет

- Auditing PracticeДокумент217 страницAuditing PracticeAlip100% (4)

- Internship Report Bank IslamicДокумент53 страницыInternship Report Bank Islamicnizihunzai80% (5)

- International Capital Market.Документ18 страницInternational Capital Market.sereneanu100% (11)

- Relevance of Customer ServiceДокумент22 страницыRelevance of Customer ServiceSiddharth KhuranaОценок пока нет

- Super Star Tax ChallanДокумент2 страницыSuper Star Tax ChallanSaghirОценок пока нет

- Refund Request: Home Page General Enquiry LineДокумент6 страницRefund Request: Home Page General Enquiry LineJamal BukhariОценок пока нет

- Banking SectorДокумент7 страницBanking SectorPreyas GursalОценок пока нет

- Financial Inclusion and Women Empowerment A StudyДокумент16 страницFinancial Inclusion and Women Empowerment A Studychisanga chilesheОценок пока нет

- Euforia Emas PDFДокумент170 страницEuforia Emas PDFAbrang DoangОценок пока нет

- BIR Ruling 456-2011 PDFДокумент5 страницBIR Ruling 456-2011 PDFLianne Carmeli B. FronterasОценок пока нет

- CA Caspule For SBI Clerk Mains Part 1Документ129 страницCA Caspule For SBI Clerk Mains Part 1RAV 888Оценок пока нет

- Here Are The Steps To Take in Order To Retrieve Monies of A Deceased RelationДокумент2 страницыHere Are The Steps To Take in Order To Retrieve Monies of A Deceased RelationRalkan KantonОценок пока нет

- International BanksДокумент21 страницаInternational BanksPrince KaliaОценок пока нет

- Jatf - Seed: S E E DДокумент6 страницJatf - Seed: S E E DDivyam ShahОценок пока нет

- Assignment CashДокумент4 страницыAssignment Cashrj batiyeg100% (1)

- UBLДокумент55 страницUBLarrssiiОценок пока нет

- Moore, T., & Mirzaei, A. (2014) - The Impact of The Global Financial Crisis On Industry Growth. The Manchester School, 84 (2), 159-180. Doi10.1111manc.12090Документ22 страницыMoore, T., & Mirzaei, A. (2014) - The Impact of The Global Financial Crisis On Industry Growth. The Manchester School, 84 (2), 159-180. Doi10.1111manc.12090Chan Hui Yan YanОценок пока нет

- CXC CSEC Economics 2009 May Past PapersДокумент4 страницыCXC CSEC Economics 2009 May Past PapersBarbi Doll nafi100% (1)

- Nego Bar Qs 2010-2012Документ16 страницNego Bar Qs 2010-2012kuheDS100% (1)

- CSS Regional Workshop 18 19 April 2012 ParticipantsДокумент7 страницCSS Regional Workshop 18 19 April 2012 ParticipantsAsian Development Bank ConferencesОценок пока нет