Академический Документы

Профессиональный Документы

Культура Документы

Npo

Загружено:

Saurabh AdakИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Npo

Загружено:

Saurabh AdakАвторское право:

Доступные форматы

Navnit Agrawal

26

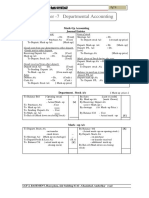

Chapter

[NPO] Financial Statement of

Not for Profit Organisation

INTRODUCTION

The charitable organizations like trust, clubs, schools, etc. which are non-trading/non-profit

motive organizations, prepares their final accounts in the following form:

(1) Income & Expenditure A/c

(2) Balance sheet

Generally, such organizations also prepare a Receipt & payment A/c

Income and Expenditure account (I & E A/c):

It is nominal account prepared to ascertained “Surplus” (Excess of Income over

Expenditure) or “Deficiency” (Excess of Expenditure over Income).

All the Expenses for that year will be debited to it & all the incomes related to that year

will be credited to it on mercantile system/ Accrual concept.

If the credit side is more, the balance is known as “surplus” & if the debit side is more

the balance is known as “Deficit” which is transferred to the capital account of the

Association/Trust which is Known as Trust Fund/General fund/capital Fund etc.

Receipt and Payment Account (R&P A/c)

Receipt & Payment Account is a summary of cash book.

All receipts (irrespective of its nature whether revenue or capital) in a year Debited to

Receipt & payment a/c.

Similarly, all payments made in this year (irrespective of its nature whether revenue or

capital) should be created to Receipt & Payment a/c.

Balance of this Account is the closing cash and bank balance and will appear in the

balance sheet.

Treatment of Special Item

Entrance fees

The Associations collect entrance fees/admission fees from the new members at the time of

their admission.

Treatment:

If the amount is just sufficient to recover the

a) Treated as Revenue Income

expenditure incurred while admitting any member

It should be capitalized &

b) In any other case transferred to the Trust fund

Account

Membership Fees and Subscription

These are usually charged on monthly/quarterly/ half yearly/ annual basis form the

members. hence are traded as revenue income and credited to Income and expenditure

Account on accrual basis.

CA/Foundation/Principle and Practices of Accounting 1

Navnit Agrawal

Membership

Fund for Specific Purpose

The Trust/Association Generally creates funds for various purposes. The funds are created

by crediting the donations and fees etc. received for the purpose of that fund or by transfer

from income & Expenditure Account. If the amount equivalent to the fund account is

invested in Government securities/Bank Deposits etc. then the income earned on such

investments will be credited to that fund account and not to Income and Expenditure

Account. The purpose is to keep proper control and utilize the money for the purpose for

which it is intended.

Classification of funds

The funds can be broadly divided in to two types:

A. Funds for some capital Expenditure.

B. Funds for meeting some Revenue expenditure.

Accounting of funds for capital expenditure

In case of Funds for the purpose of some capital expenditure, when any amount is spent for

that purpose, the same will be Debited to a separate Assets Account/capital Expenditure

Account. When such funds are utilized it results into an asset for the organization.

Funds for Revenue Expenditure

The incomes, donations etc. received for specific purpose are credited to separate fund

account and all expenditure incurred for that purpose are debited to that fund account. The

Balance if credit is shown in balance sheet and carried forwarded to next year, but if it is

Debit (that means expenditure is more) that it will be transferred to income & Expenditure

a/c. (The funds/Reserve Account should never show Debit balance) When such funds are

utilized, it does not create any asset for the organization. E.g. price fund Tournament Fund

etc.

Accounting for investment

When organization has surplus funds, it can invest in securities or bank Deposits etc. This

investment apart from keeping money safe and liquid, also gives incomes in the form of

interest/dividend.

When investments are not related to any specific fund then its income is credited to Income

and Expenditure account.

When funds for specific purpose are not immediately usable, then the same may be

invested. As and when need of fund arises for that purpose, investments are sold and

proceeds used for that purpose.

Income and profit/loss on such investments will be credited to related fund account and not

to Income and Expenditure Account.

Accounting of Grants/subsidies

Grants/subsidies received form Govt. or other local authorities may be for:

(1) Capital expenditure (i.e. for acquiring fixed assets) or

(2) Revenue expenditure (i.e. for maintenance etc.)

In the 1st case it will be created to separate account & shown in the Balance Sheet on the

liability side. It can be deferred and credited to Income and Expenditure Account in

CA/Foundation/Principle and Practices of Accounting 2

Navnit Agrawal

proportion of depreciation charged on that asset alternatively grant can be credited to the

asset account itself consequently reducing depreciation.

In the 2nd case, it will be credited as income in Income & Expenditure Account.

Treatment for donation

If donations are received for Specific purpose, then it will be credited to that particular fund

a/c. Otherwise general donations will be credited to Income & Expenditure a/c.

Note: If question requires capitalization, but does not specify the fund to which it should be

credited, then credit such donation to trust fund a/c.

Treatment of Scholarship

In case of schools/colleges, there may be credit balance in scholarship account which

represents scholars. Hip received from Govt. etc. but yet to be distributed to the students.

This should be shown as liability in the balance sheet. Debit balance in scholarship account

may represent paid to student and recoverable from the concerned authority. But if college

has its own scholarship then that debit balance will transfer to Income and Expenditure A/c.

Income and expenditure of special activities/functions/programmes

Trust may organize various functions/activities like charity show, sports functions etc.

Income & expenses on this account are generally netted & net balance is shown in the

Income & Expenditure a/c.

Q 16: What Type of questions are asked in the exam?

Answer: Generally, there may be three types of question.

Information Given Requirement of Question

Receipt and Payment account, and Income & Expenditure Account, and

a) Opening Balance sheet, and/or Balance sheet

Other Information

Balance Sheet and Receipt & Payment Account

b)

Income and Expenditure Account

Trial balances and Income & expenditure Account and

c)

Other Information Balance sheet

CA/Foundation/Principle and Practices of Accounting 3

Navnit Agrawal

Account (Format) of frequently used Item

1. Income account

Particular Rs. Particular Rs.

To, Opening Outstanding B/d xxx By Opening Advance b/d Xxx

(Receivable)

To, Income & Expenditure a/c xxx By, Cash/Bank A/c Xxx

(Income earned during the year) (Received during the year)

To, Closing Advance C/d xxx By, Closing Outstanding C/d Xxx

(Receivable)

Total xxx Total xxx

2. Expense Account

Particular Rs. Particular Rs.

To, Opening Advance B/d (Prepaid) xxx By, Opening Outstanding B/d (Payable) Xxx

To, Cash/Bank a/c xxx By, Income & Expenditure A/c Xxx

(paid during the year) (Expense for the year)

To, Closing outstanding c/f (payable) xxx By, Closing Advance c/d (prepaid) Xxx

Total xxx Total Xxx

CA/Foundation/Principle and Practices of Accounting 4

Navnit Agrawal

PRACTICAL QUESTIONS

Questions related to preparation of Receipt and Payment Account

Q-1 The receipts and payments for the Saran club for the year ended December 31, 2017

were: Entrance Fees Rs. 300; Membership Fees Rs. 3,000; Donation for Club Pavilion Rs.

10,000; Foodstuff Sales Rs. 1,200; Salaries and Wages Rs. 1,200; Purchase of Foodstuff Rs.

800; Construction of Club Pavilion Rs. 11,000; General Expenses Rs. 600; Rent and Taxes

Rs. 400; Bank Charges Rs. 250;

Cash in hand-Jan 1st Rs. 200; Dec. 31st Rs. 350

Cash in Bank-Jan 1st Rs. 400; Dec. 31st Rs. 500

Prepare Receipt and Payment Account for the year ended December 21, 2017.

Miscellaneous Questions

Q 2: During 2017 subscription received in cash is Rs. 42,000. It includes Rs. 1,600 for 2016

and Rs. 600 for 2018 also Rs. 3,000 has still to be received for 2017. Calculate the amount

to be credited to Income and Expenditure Account in respect of subscription.

Q-3 Salaries paid during 2017 were Rs. 23,000. The following further information is

available:

Salaries unpaid on 31st December, 2016 1,400

Salaries Prepaid On 31 December,2016

st

400

Salaries unpaid On 31st December,2017 1,800

Salaries prepaid On 31st December,2017 600

Calculate the amount to be debited to Income and Expenditure account in respect of salaries

and also show necessary Journal entry and Ledger Accounts.

Questions Related to Preparation of Income and Expenditure Account and Balance

Sheet

Q 4: The following was the Receipts and payments Account of Exe Club for the year ended

Dec. 31, 2017

Receipts Rs. Payments Rs.

Cash in hand 100 Grounds man’s Fee 750

Balance at bank Moving Machine 1,500

Deposit Account 2,230 Rent of Ground 250

Current Account 600 Cost of teas 250

Bank interest 30 Fares 400

Donations and subscriptions 2,600 Printing & office Expenses 280

Receipts from teas 300 Repairs to Equipment 500

Net proceeds of variety 780 Honoraria to Secretary and Treasurer 400

Entertainment of 2016

Sale of Equipment 80 Balance at bank

CA/Foundation/Principle and Practices of Accounting 5

Navnit Agrawal

Contribution to fares 100 Deposit Account 3,090

Donation for forth Coming 1,000 Current Account 150

Tournament

Cash in hand 250

7,820 7,820

You are given the following additional information:

Jan. 1, 2017 Dec. 31, 2017

Subscription due 150 100

Amount due for printing etc. 100 80

Estimated value of Machinery and Equipment 800 1750

Bonus to Grounds man --- 300

For the year ended Dec. 31, 2012 the honoraria to the secretary and treasurer are to be

increased by a total of Rs. 200.

Prepare the Income and Expenditure Account for 2017 and the relevant Balance Sheet.

Q 5: The following is the Receipts and Payments Account of star club for the year ended 31st

March, 2017:

Receipts Rs.

To, cash in hand (1.4.2016) 15,000

To, Subscriptions:

2015-16 3,000

2016-17 1,62,000

2017-18 1,500 1,66,500

To, Income from Entertainment 2,900

To, Entrance Fees 6,700

To, Interest on Securities 4,800

To, Sale Proceeds of Old Chairs (Book Value-Nil) 1,200

Total 1,97,100

Payments Rs.

By Bank Overdraft (1.4.2016) 31,000

By Investment in Securities 30,000

By Furniture Purchased on 1.4.2016 14,500

By Salaries 62,000

By Stationary and Printing 8,900

By Miscellaneous Expenses 14,200

By Balance on 31.03.2017

Cash in Hand 5,500

Cash at Bank 31,000

CA/Foundation/Principle and Practices of Accounting 6

Navnit Agrawal

Total 1,97,100

Prepare the Income and Expenditure Accounts the star club for the year ended 31 st March,

2002, and the Balance Sheet as at that date having due regard to the following additional

information:

The club has 1,800 members each paying an annual subscription of Rs. 100, subscriptions

amounting to Rs. 900 is in arrears in respect of the year 2015-16.

Stock of stationary on 31st March, 2016 was Rs. 1,250 and on 31st March, 2017 was Rs. 870

Entrance fees are to be capitalized.

Salary of Rs. 5,500 for March, 2017 is outstanding.

Miscellaneous expenses outstanding on 31st March, 2016 amounted to Rs. 1,320.

The star club paid Rs. 5,500 in the year 2015-2016 towards telephone charges of which Rs.

1,250 relate to the year 2016-17.

As on 31st March, 2016 premise stood in the books at Rs. 2,45,000; furniture at Rs. 10,000

and investment at Rs. 65,000; depreciate premises and furniture @ 5% per annum.

Q 6: The following is the Receipts and Payments account of Jota charitable hospital for the

year ended 31st March, 2018;

Receipts Rs. Payments Rs.

To Balance B/D 1,40,000 By Payment For Medicine 6,00,000

To Subscriptions 10,00,000 By Honorarium to Doctor 2,00,000

To Donations 2,90,000 By Salaries 5,50,000

To Interest on Investments 1,40,000 By Sundry Expenses 10,000

@ 7% per annum for the Year

To, Charity Show Collections 2,00,000 By Equipment Purchased 3,00,000

By Charity Show Expenses 20,000

By Blanch c/d 90,000

17,70,000 17,70,000

Additional information:

On 1.4.2017 On 31.03.2018

Subscriptions due 10,000 20,000

Subscriptions received in advance 20,000 10,000

Stock of medicines 2,00,000 3,00,000

Creditors for medicines 1,60,000 2,40,000

Equipment’s 4,20,000 6,00,000

Buildings 8,00,000 7,60,000

You are required to prepare income and expenditure account for the year ended 31 st March,

2018 and Balance Sheet as at that date.

CA/Foundation/Principle and Practices of Accounting 7

Navnit Agrawal

Questions related to preparation of Receipt and Payment Account and Balance

Sheet

Q-7: The Income and Expenditure account of the Youth Club for the year 2017 is as follows:

Particular Rs. Particular Rs.

To Salaries 4,750 By Subscription 7,500

To General Expenses 500 By Entrance Fees 250

To Audit Fee 250 By Contribution for Annual Dinner 1,000

To Secretary’s Honorarium 1,000 By Profit on Annual Sport Meet 750

To Stationery & Printing 450

To Annual Dinner Expenses 1,500

To Interest & Bank Charges 150

To Depreciation 300

To Surplus 600

9,500 9,500

This account had been prepared after the following adjustments.

Rs.

Subscription outstanding at the end of 2016 600

Subscription received in Advance on 31 December, 2016

st

450

Subscription received in Advance on 31st December, 2017 270

Subscription outstanding on 31st Dec., 2017 750

Salaries Outstanding at the beginning and the end of 2017 were respectively Rs. 400 and

Rs. 450.

General Expenses include insurance prepaid to the extent of Rs. 60.

Audit fee for 2017 is as yet unpaid.

During 2017 audit fee for 2016 was paid amounting to Rs. 200.

The club owned a freehold lease of ground valued at Rs. 10,000.

The club had sports equipment on 1st January, 2017 valued at Rs. 2,600. At the end of the

year, after depreciation, this equipment amounted to Rs. 2,700.

In 2016, the club has raised a bank loan of Rs. 2,000. This was outstanding throughout

2017.

On 31st December, 2017 cash in hand amounting to Rs. 1,600.

Prepare the Receipts and payments Account for 2017 and Balance sheet as at the end of the

year.

Q 8: From the following Income and Expenditure Account and the Balance sheet of a club,

prepare its Receipts and payments Account and subscription Account for the year ended 31 st

March, 2013:

Income & Expenditure Account for the year 2012-13

Particular Rs. Particular Rs.

To Upkeep of Ground 10,000 By Subscriptions 17,320

To Printing 1,000 By Sale of Newspapers (Old) 260

CA/Foundation/Principle and Practices of Accounting 8

Navnit Agrawal

To Salaries 11,000 By Lectures 1,500

To Depreciation on Furniture 1,000 By Entrance Fee 1,300

To Rent 600 By Miscellaneous Income 400

By Deficit 2,820

23,600 23,600

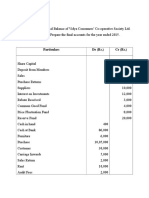

Balance sheet as at 31st March, 2013

Liabilities Rs. Assets Rs.

Subscription in Advance (2013-14) 100 Furniture 9,000

Prize fund: opening Balance 25,000 Ground and Building 47,000

Add: interest 1,000 Prize Fund Investment 20,000

26,000 Cash in hand 2,300

Less: Prizes (2,000) 24,000 Subscription (2012-13) 700

General Fund:

Opening balance 56,420

Less: Deficit (2,820)

53,600

Add: Entrance Fee 1,300 54,900

79,000 79,000

The following adjustments have been made in the above accounts:

(1) Upkeep of ground Rs. 600 and printing Rs. 240 relating to 2011-2012 were paid in

2012-13.

(2) One-half of entrance fees had been capitalized by transfer to General Fund.

(3) Subscription outstanding in 2011-12 was Rs. 800 and for 2012-13 Rs. 700.

(4) Subscription received in advance in 2011-12 was Rs. 200 and in 2012-13 for 2013-14

Rs. 100.

Q 9: Following is the Income and Expenditure Account of the United Club for the year ended

on 30.06.2018

Expenditure Rs. Income Rs.

To Salaries 15,750 By Subscriptions 45,0000

To Stationery 1,250 By Donations 7,500

To Postage 800 By Sale of Furniture (Profit) 1,000

To Sundry Expenses 4,700 By Govt. Grant 4,000

To Repairs & Maintenance 3,600 By Interest on Fixed Deposit 800

To Sports Expenses 1,800

To Swimming Pool Expenses 2,000

To Affiliation Fee 500

To Electricity 3,250

CA/Foundation/Principle and Practices of Accounting 9

Navnit Agrawal

To Billiard Room Expenses 1,250

To Periodicals 1,200

To Audit Fees 250

To Depreciation on Sports Equip 1,000

To Depreciation on Building 2,500

To Depreciation on Furniture 450

To Surplus 18,000

58,300 58,300

The above account is prepared after considering the information mentioned below:

01.07.17 30.06.18

Building 1,00,000 97,500

Sports ground 1,00,000 1,00,000

Sports equipment 6,000 9,000

Furniture 5,000 ---

Fixed deposits in bank 8,000 8,000

Bank A/c – saving deposit --- 25,000

Subscriptions outstanding 5,000 2,000

Subscriptions received in advance 3,000 1,000

Stock of stationery 250 500

Suit fees outstanding 200 250

Salaries outstanding 500 1,000

Affiliation fee paid in advance --- 250

Cash in hand on 1.7.2017 was Rs. 1,250 new furniture of Rs. 9,000 has been purchased on

credit but not entered in books. Depreciation has been charged on this furniture at 5%.

You are required to prepare:

(a) Receipts and payment account for the year ended on 30.6.2018

(b) Balance sheet as on 30.6.2018

Q 10: The Sport Writers’ Club gives the following Receipts and payments Account for the

year ended March, 31, 2013:

Receipts and payments Account

Receipts Rs. Payments Rs.

To Balance b/d 4,820 By Salaries 12,000

To subscriptions 28,600 By Rent and Electricity 7,220

To Miscellaneous income 700 By Library Books 1,000

To interest on fixed deposit 2,000 By Magazines and Newspapers 2,172

By Sundry Expenses 10,278

By Sports Equipment 1,000

By Balance c/d 2,450

CA/Foundation/Principle and Practices of Accounting 10

Navnit Agrawal

36,120 36,120

Figures of other assets and liabilities are furnished as follows:

31/03/2012 31/03/2013

Salaries Outstanding 710 170

Outstanding Rent & Electricity 864 973

Outstanding for Magazines and Newspapers. 226 340

Fixed Deposit (10%) with Bank 20,000 20,000

Interest Accrued thereon 500 500

Subscription Receivable 1,263 1,575

Prepaid Expenses 417 620

Furniture 9,600

Sports Equipment 7,200

Library Books 5,000

The closing values of furniture and sports equipments are to be determined after charging

depreciation at 10% and 20% p.a. respectively inclusive of the additions, if any, during the

year. The club’s library books are revalued at the end of every year and the value at the end

of March, 31, 2013 was Rs. 5,250.

From the above information you are required to prepare:

(a) The Club’s Balance sheet as at March, 31, 2012;

(b) The Club’s income and Expenditure Account for the year ended March, 31, 2013.

(c) The club’s closing balance sheet as at March, 31, 2013.

Q 11: From the following data, prepare an income and Expenditure Account for the year

ended 31st December, 2012, and a statement of affaiRs. as at that data of the Mayura

Hospital:

Receipts and payments Account for the year ended 31 December, 2012

Particular Rs. Rs. Particular Rs. Rs.

By Salaries:

To Balances 15,600

(Rs. 3,600 For 2011)

Cash 400 By Hospital Equipment 8,500

Bank 2,600 3,000 By Furniture Purchased 3,000

To Subscriptions: By Additions to Building 25,000

By Printing and

For 2011 2,550 1,200

Stationery

For 2012 12,250 By Diet Expenses 7,800

By Rent and Rates

For 2013 1,200 16,000 1,000

(Rs. 150 For 2013)

By Electricity and Water

To Government Grant: 1,200

Charges

For Building 40,000 By office Expenses 1,000

For Maintenance 10,000 By Investments 10,000

CA/Foundation/Principle and Practices of Accounting 11

Navnit Agrawal

Fees From Sundry Patients 2,400 52,400 By Balances:

To Donations (Not to be

4,000 Cash 700

Capitalized )

To Net Collections from

3,000 Bank 3,400 4,100

Benefit Shows

78,400 78,400

Additional Information:

Value of Building under Construction as On 31.12.2012 - 70,000

Value of Hospital Equipment on 31.12.2012 - 25,500

Building Fund as On 1.1.2012- 40,000

Subscriptions in Arrears as On 31.12.2011 - 3,250

Investments in 8% Govt. Securities were made on 1st July, 2012.

Q 12: The Receipts and Payments Account and the Income and Expenditure account of a

club for the year ended 30st December, 2012 were as follows:

Receipts and payments Account

Receipts Rs. Payments Rs.

To balance c/d 2,500 By, Books Purchased 1,000

To Subscriptions: By, Printing And Stationery 200

2011 600 By, Salary 1,500

2012 4,300 4,900 By, Advertisement 200

To Interest 500 By, Electric Charge 400

To Donation for special fund 300 By, Balance c/d 7,350

To Rent:

2011 150

2012 300 450

To Government Grants 2,000

10,650 10,650

Income and Expenditure Account

Expenditure Rs. Income Rs.

To Salary 2,800 By Interest 400

To Tent Hire 200 By Subscription 4,800

To Electric Charges 400 By Rent 2,300

To Depreciation on Building 750 By Government Grant 2,000

To Printing and Stationery 200

To Advertisement 150

To Surplus 5,000

9,500 9,500

The club’s assets as on 1 January 2012 were:

st

Building Rs. 15,000; books Rs. 10,000

CA/Foundation/Principle and Practices of Accounting 12

Navnit Agrawal

Furniture Rs. 4,000; investments Rs. 10,000

Liabilities as on that date were Rs. 50 for advertisement and Rs. 100 for salary.

You are required to prepare the balance sheet of the club on 31 st December, 2011 and 31st

December, 2012.

Q 13: The following is the Receipts and payments Account of Lion Club for the year ended

31st March, 2012.

Receipts Rs. Payments Rs.

Opening balance Salaries 1,20,000

Cash 10,000 Creditors 15,20,000

Bank 3,850 Printing and stationary 70,000

Subscription received 2,02,750 Postage 40,000

Entrance donation 1,00,000 Telephones and telex 52,000

Interest received 58,000 Repairs and maintenance 48,000

Sale of assets 8,000 Glass and table linen 12,000

Miscellaneous income 9,000 Crockery and cutlery 14,000

Receipts at Garden upkeep 8,000

Coffee room 10,70,000 Membership fees 4,000

Wines and spirits 5,10,000 Insurance 5,000

Swimming pool 80,000 Electricity 28,000

Tennis court 1,02,000 Closing balance

Cash 8,000

Bank 2,24,600

21,53,600 21,53,600

The assets and liabilities as on 1.4.2011 were as follows:

Rs.

Fixed assets (net) 5,00,000

Stock 3,80,000

Investment in 12% Government securities 5,00,000

Outstanding subscription 12,000

Prepaid insurance 1,000

Sundry creditors 1,12,000

Subscription received in advance 15,000

Entrance donation received pending membership 1,00,000

Gratuity fund 1,50,000

The following adjustments are to be made while drawing up the accounts:

(i) Subscription received in advance as on 31st March, 2012 was Rs. 18,000.

(ii) Outstanding subscription as on 31st March, 2012 was Rs. 7,000.

(iii) Outstanding expenses are salaries Rs. 8,000 and electricity Rs. 15,000.

CA/Foundation/Principle and Practices of Accounting 13

Navnit Agrawal

(iv) 50% of the entrance donation was to be capitalized. There was no pending membership

as on 31st March, 2012.

(v) The cost of assets sold net as on 1.4.2011 was Rs. 10,000.

(vi) Depreciation is to be provided at the rate of 10% on assets.

(vii) A sum of Rs. 20,000 received in October 2011 as entrance donation from an applicant

was to be refunded as he has not fulfilled the requisite membership qualifications. The

refund was made on 3.6.2012.

(viii) Purchases made during the year amounted Rs. 15,00,000.

(ix) The value of closing stock was Rs. 2,10,000.

(x) The club as a matter of policy, charges off to income and expenditure account all

purchases made on account of crockery, cutlery, glass and linen in the year of purchase.

You are required to prepare an Income and Expenditure Account for the year ended 31 st

March, 2012 and the Balance Sheet as on 31st March, 2012 along with necessary workings.

Q 14: Noida school maintains separate building fund. As on 31.3.2012, balance of building

fund was Rs. 10,00,000 and it was represented by fixed deposit (15% per annum) of Rs.

6,00,000 and current account balance of Rs. 4,00,000. During the year 2012-13, the school

collected as donations towards the building fund Rs. 5,60,000 and transferred 40% of

developmental fees collected Rs. 22,56,500 to building fund. Capital work progress as on

31st March, 2012 was Rs. 8,25,000 for which contractors’ bill up to 75% was paid on

14.4.2012. The extension of building was finished on 31.12.2012 costing Rs. 7,25,000 for

which contractors.’ bill was fully met. It was decided to transfer the cost of completed

building (Rs. 15,50,000) to the corresponding asset account.

You are required to pass journal entries to incorporate the above transactions in the books

of Noida school for the year 2012-13 and show the trial balance of building fund ledger.

Q 15: (IPC M 16/8Marks): Following information’s has been given for Bharat Sports Club,

Delhi for the year ending 31.12.2014 and 31.12.2015.

31.12.201 31.12.2015

Building (Subject to 10% Depreciation for the current year) 60,000 ?

Furniture (Subject to 10% Depreciation for the current year) - 20,000

Stock of Sports materials 5,000 2,000

Prepaid Insurance 3,000 6,000

Outstanding Subscription 12,000 8,000

Advance Subscription 6,000 4,000

Outstanding Locker Rent - 6,000

Advance Locker Rent Received - 2,000

Outstanding Rent for Godown 6,000 3,000

12% General Fund Investment 2,00,000 2,00,000

Accrued interest on above - 4,000

Cash balance 1,000 64,000

Bank Balance 2,000 -

Bank Overdraft - 2,000

Additional Information:

CA/Foundation/Principle and Practices of Accounting 14

Navnit Agrawal

(i) Entrance fees received Rs. 20,000. Life membership fees received Rs. 20,000 during the

year.

(ii) Surplus from income and Expenditure Account Rs. 60,000.

(iii) It is policy of the club to treat 60% of entrance fees and 40% of life membership fees

as revenue nature.

(iv) The furniture was purchased on 01.01.2015.

Prepare Opening and Closing Balance Sheet of Bharat Sports Club as on 31 st Dec., 2014 and

31st Dec., 2015 respectively.

State with Reason whether the following statements are True of False

Statements T/F

1. Scholarships granted to students out of funds provided by Government will be

debited to Income and Expenditure Account.

2. Receipts and payments Account is a summary of all-capital receipts and payment.

3. The Receipts and Payments Account records receipts and payments of revenue

nature only.

4. If there appeaRs. a sports fund, the expenses incurred on spots activities will be

taken to income and expenditure account.

5. Receipts and payments account highlights total income and expenditure.

6. Income and expenditure a/c highlights total income and expenditure of revenue

nature.

CA/Foundation/Principle and Practices of Accounting 15

Navnit Agrawal

7. Expenditure on building is debited to building fund a/c.

8. Income on investment related to a particular fund should be credited to that fund

a/c.

9. Entrance fees must be credited to income and expenditure a/c.

10. Donation received for a particular purpose should be credited to that fund a/c

only.

CA/Foundation/Principle and Practices of Accounting 16

Navnit Agrawal

DIY

Q 1: (M 08) following is The Receipts and Payments Account of Mayur Club for the year

ended 31st March, 2008

Receipts Rs. Payments Rs.

Opening balance (1.4.2007) Payments:

Cash on hand 39,100 Sports materials 3,04,500

Cash at bank 50,000 Salaries 3,15,000

Receipts: Equipment purchased on 60,000

1.10.2007

Subscriptions Bank fixed deposit on 1,50,000

31.03.2008

For the year 2006-07 18,000 Rent 1,48,500

For the year 2007-08 9,63,000 Ground maintenance 22,120

For the year 2008-09 4,500 Insurance 38,400

Interest on bank Fixed deposits 45,000 Stationery 3,450

@ 10%

Sundry expenses 5,880

Closing balance as on

31.03.2008

Cash on hand 31,750

Cash at bank 40,000

11,19,600 11,19,600

Following additional information is provided to you

(i) The club has 220 membeRs. The annual subscription is Rs. 4,500 per member

(ii) Depreciation to be provided on furniture at 10% p.a. and on sports equipment at 15%

p.a.

(iii) On 31st March, 2008 stock of sports material in hand (after membeRs. use during the

year) is valued at Rs. 78,000 and stock of stationery at Rs. 3,150 Rent for 1 month is

outstanding. Unexpired insurance amounts to Rs. 9,600.

(iv) On 31st March, 2007 the club had the following assets:

Furniture Rs. 2,70,000 Stock of sports material Rs. 73,500

Sports equipment Rs. 1,80,000 Unexpired insurance Rs. 8,400

Bank fixed deposit Rs. 4,50,000 Subscription in arrear Rs. 22,500

Stock of stationery Rs. 1,500

Note: there was no liability on 31.03.2007

You are required to prepare:

(i) Income and expenditure account: and

(ii) Balance sheet as at 31st March, 2008

Q 2: (D 97) The following is the income and expenditure account of a club for the year 31 st

March, 1997

CA/Foundation/Principle and Practices of Accounting 17

Navnit Agrawal

Expenditure Rs.

To Provision used:

Opening stock 10,000

Add: Purchases 1,40,000

1,50,000

Less: Closing stock (5,000) 1,45,000

To Salaries 18,000

To General Expenses 5,000

To Depreciation on Equipment’s 1,000

To Surplus (Excess of Income Over Expenditure) 28,000

1,97,000

Income: Rs.

By Subscriptions 34,000

By Sale of Provisions 1,63,000

1,97,000

The following Balance Sheet is also given to you:

Liabilities On 31.03.1996 On 31.03.1997

Creditors for provisions 8,000 10,000

Capital fund 47,000 75,000

55,000 85,000

Assets On 31.03.1996 On 31.03.1997

Equipment’s (cost less depreciation ) 10,000 25,000

Stock of provisions 10,00 5,000

Subscriptions receiveable 5,000 10,000

Cash at bank and in hand 30,000 45,000

55,000 85,000

Prepare the Receipts and payments account of the club for the year ended 31st March, 1997

Q 3: (D 96): from the following particulaRs. relating to Deena Nath charitable Hospital

prepare

(i) Receipts and Payments Account for the year ended on 31st March, 1996 and

(ii) Balance Sheet as on 31st March, 1996

Income and expenditure account

For the year ended 31st March, 1996

Expenditure Rs. Income Rs.

To Medicines Used 29,980 By, Subscriptions 56,000

To Honorarium to DoctoRs. 12,000 By, Donations 9,500

To Salaries 27,500 By, Interest on investments 11,000

@ 11% per annum

CA/Foundation/Principle and Practices of Accounting 18

Navnit Agrawal

To Printing and stationery 1,100 By Income from film show

To Electricity 475 Proceeds 11,450

To Rent 6,000 Less: expenses (780) 10,670

To Depreciation on Furniture 2,100

To Depreciation on Equipment 3,250

To surplus i.e. excess of income 4,765

over Expenditure

87,170 87,170

Additional Information

On 1.4.1995 On 31.03.1996

Subscription due 120 160

Subscriptions received in advance 64 100

Electricity bills unpaid 92 115

Stock of medicine 7,820 9,750

Estimated value of equipments 11,600 13,900

Furniture and fixture 21,000 18,900

Land 10,000

Interest accrued on investments in 11% 3,750 3,750

debentures costing Rs. 1,02,500 (face value: Rs.

1,00,000)

Cash in hand 340 160

Cash at bank 9,000 ?

Q 4 (N 09): the Income and expenditure account of City Sports Club for the year ended

31st March, 2009 was as follows:

Expenditure Rs. Income Rs.

To Salaries 1,20,000 By Subscriptions 1,60,000

To Printing And Stationery 6,000 By Entrance Fees 10,000

By Contribution For Annual

To Rent 12,000 20,000

Dinner

By Profit On Annual Sports

To Repairs 10,000 20,000

Meet

To Sundry Expenses 8,000

To Annual Dinner Expenses 30,000

To Interest To Bank 6,000

To Depreciation On Sports

6,000

Equipment

To excess of income over

12,000

expenditure

2,10,000 2,10,000

CA/Foundation/Principle and Practices of Accounting 19

Navnit Agrawal

The above account had been prepared after the following adjustments:

Rs.

Subscriptions outstanding on 31.03.2008 12,000

Subscriptions received in advance on 31.03.2008 9,000

Subscriptions received in advance on 31.03.2009 5,400

Subscriptions outstanding on 31.03.2009 15,000

Salaries outstanding at the beginning and at the end of the financial year were Rs. 8,000

and Rs. 10,000 respectively.

Sundry expenses included prepaid insurance expenses of Rs. 1,200.

The club owned a freehold ground valued Rs. 2,00,000.

The club has sports equipment on 01.04.2008 valued at Rs. 52,000 at the end of the

year after depreciation the sports equipments amounted to Rs. 54,000

The club raised a loan of Rs. 40,000 from a bank on 01.01.2008 which was unpaid till

31.03.2009

On 31.03.2009 cash in hand was Rs. 32,000

Prepare Receipts and Payments Account of the club for the year ended 31 st March 2009 and

Balance Sheet as on that date.

Prepare Income and Expenditure A/c

Q 5: from the following particulaRs. prepare income and expenditure account.

(i) Fees collected including Rs. 80,000 on account of the previous year 3,80,000

(II) Fees for the year outstanding 10,000

(iii) Salary paid including Rs. 3,000 on account of the previous year 28,000

(iv) Salary outstanding at the end of year 1,000

(v) Entertainment expenses 3,000

(vi) Tournament expenses 12,000

(vii) Meeting expenses 18,000

(viii) Travelling expenses 6,000

(ix) Purchase of books and periodicals including Rs. 19,000 for purchases of 29,000

books

(x) Rent 10,000

(xi) Postage telegrams and telephones 15,000

(xii) Printing and stationary 4,000

(xiii) Donations received 20,000

Prepare Balance Sheet

Q 6 From the following details prepare Balance Sheet of Green club as at 31st March, 1998

(Dec. 1998)

Rs. Rs.

Furniture (before depreciation ) 8,000 PrinteRs. bill outstanding 1,000

CA/Foundation/Principle and Practices of Accounting 20

Navnit Agrawal

Depreciation on furniture written of 800 Allowances outstanding 800

Buildings fund 30,000 Capital grants 10,000

Income of building fund 2,000 Entrance fees (50% to be funded ) 4,000

Fixed deposits 20,000 Legacies received (to be funded ) 8,000

Openi8ng balance of general fund 10,000 Prize fund 10,000

Exposes of income over expenditure 20,000 Income of prose fund 1,000

Capital fund (opening balance) 60,000 Expenses of prize find 800

Cost of swimming pool 40,000 Investment of prize fund 10,000

Equipment’s 20,000 Balance in current account 10,000

Investment of general fund 36,000 Cash in hand 800

Subscription outstanding 10,000

Q 7: From the following particulaRs. calculate the amount of subscription to be credited to

the income and expenditure account for the year ended 31st March, 1998

31.03.1997 31.03.1998

Outstanding subscription 1,500 1,200

Subscriptions received in advance 900 540

A sum of Rs. 14,670 was received as subscriptions during the year ended 31 st March, 1998

Q 8: (Dec. 1999) for the following find out the amount of subscription to be included in the

income and expenditure account for the year emended 31st March, 1999

Subscription was received during the year 1998-99 as follows:

Rs.

For the year 1997-98 2,000

For the year 1998-99 30,000

For the year 1999-2000 3,000

Subscriptions outstanding as on 31st March, 1998 were Rs. 3,500 out of which Rs. 500 were

considered to be irrecoverable. On the same date subscription received in advance for 1998-

99 were Rs. 2,000. Subscription still outstanding as on 31st March, 1999 amounted to Rs.

6,000.

Q 9: (Dec. 2000) There are 450 membeRs. of a club each paying an annual subscription of

Rs. 500. On 31st March, 2000, subscriptions in arreaRs. totaled Rs. 5,000; subscriptions

received during the year ended 31st March, 2001, amounted to Rs. 2,23,000 including Rs.

4,500 for the year 1999-200 and Rs. 7,500 for the year 2001-2002.

Calculate the amount of subscriptions in arreaRs. as on 31st March, 2001 by preparing

subscriptions a/c.

Q 10 (J 03): On the basis of the following information calculate the amount that will appear

against the item stationery used in the income and expenditure account for the year ended

31st March, 2003

CA/Foundation/Principle and Practices of Accounting 21

Navnit Agrawal

Rs.

Stock of stationary as on 1st April, 2002 12,000

Creditors for stationary on 1 April, 2002

st

25,600

Amount paid for stationary during the year ended 31st March, 2003 1,40,000

Stock of stationary as on 31st March, 2003 23,200

Creditors for stationary as on 31 March, 2003

st

24,000

Q 11 (N 01): Summary of receipts and payment of Bombay Medical Aid Society for the

year ended 31.12.2000 is as follows:

Opening Cash Balance in Hand Rs. 8,000; Subscription Rs. 50,000; Donation Rs. 15,000;

Interest on Investment @ 9% P.A. Rs. 9,000; Payments For Medicine Supply Rs. 30,000;

Honorarium to DoctoRs. Rs. 10,000; Salaries Rs. 28,000; Sundry Expenses Rs. 1,000;

Equipment Purchase Rs. 15,000; Charity Show Expenses Rs. 1,500; Charity Show

Collections Rs. 12,500

Additional information:

1.1.2000 31.12.2000

Subscription due 1,500 2,200

Subscription received in advance 1,200 700

Stock of medicine 10,000 15,000

Amount due for medicine supply 9,000 13,000

Value of equipment 21,000 30,000

Value of building 50,000 48,000

You are required to prepare Receipts and Payments Account and Income and Expenditure

Account for the year ended 31.12.2000 and Balance Sheet as on 31.12.2000.

Q 12 (N 98): The following information’s were obtained from the books of Delhi club as on

31.03.1998 at the end of the fiRs.t year of the club. You are required to prepare Receipts

and Payments Account, Income and Expenditure Account for the year ended 31.03.1998 and

a Balance Sheet as at 31.03.1998 on mercantile basis;

(i) Donations received for building and library room Rs. 2,00,000

(ii) Other revenue income and actual receipts:

Revenue income Rs. Actual receipts Rs.

Entrance fees 17,000 17,000

Subscription 20,000 19,000

Locker rents 600 600

Sundry income 1,600 1,060

Refreshment account 16,000

(iii) Other revenue expenditure and actual payments:

Revenue expenditure Rs. Actual payments Rs.

Land (cost Rs. 10,000) 10,000

Furniture (cost Rs. 1,46,000) 1,30,000

CA/Foundation/Principle and Practices of Accounting 22

Navnit Agrawal

Salaries 5,000 4,800

Maintenance of playgrounds 2,000 1,000

Rent 8,000 8,000

Refreshment account 8,000

Donations to the extent of Rs. 25,000 were utilized for the purchase of library books balance

was still unutilized. In order to keep it safe, 9% Govt. bonds of Rs. 1,60,000 were purchased

on 31.03.1998.

Remaining amount was put in the bank on 31.03.1998 under the term deposit. Depreciation

at 10% p.a. was to be provided for the year on furniture and library books.

Solutions of DIY

Solution 1: Mayur Club

(i) Income and Expenditure Account for the year ended 31.03.2008

Expenditure Rs. Income Rs.

To, Sports Material used By, Subscription 9,90,000

[WN2]

Opening Stock 73,500 By, interest on F.D. 45,000

Add Purchases 3,04,500

3,78,000

Less: Closing Stock 78,000 3,00,000

To, Salaries 3,15,000

To, Rent 1,48,500

Add: Outstanding Rent [WN6] 13,500 1,62,000

To, insurance 38,400

Less: Unexpired on 01.04.08 9,600

Add: Unexpired on 01.04.07 8,400 37,200

To, Stationary used

Opening stock 1,500

Add: Purchase 3,450

4,950

Less: Closing Stock 3,150 1,800

To, Sundry Expenses 5,880

To, Depreciation on

Furniture 27,000

Sports Equipment 31,500 58,500

To, Excess of Income Over 1,32,500

expenditure

10,35,000 10,35,000

Balance Sheet as at 31st March, 2008

Liabilities Rs. Assets Rs.

Capital fund Equipment

Opening balance [WN1] 10,95,000 Opening bal. 1,80,000

Add: Surplus 1,32,500 12,27,500 Add: Addition 60,000

Rent outstanding [WN6] 13,500 2,40,000

Subscription Recd. In Advance 4,500 Less: Depreciation (31,500) 2,08,500

Furniture 2,70,000

Less: Depreciation 27,000 2,43,000

Sports Material 78,000

CA/Foundation/Principle and Practices of Accounting 23

Navnit Agrawal

Stock of stationary 3,150

Fixed Deposited in bank 6,00,000

[4,50,000 + 1,50,000]

Subscription in Arrear

For 06-07 4,500

For 07-08 27,000 31,500

Prepaid Insurance 9,600

Cash on hand 31,750

Cash at bank 40,000

12,45,500 12,45,500

Working Note:

1. Balance Sheet as at 31.03.2007

Liabilities Rs. Assets Rs.

Capital fund [bal. Fig.] 10,95,000 Sports Equipment 1,80,000

Furniture 2,70,000

Sports material 73,500

Stock of Stationary 1,500

Fixed Deposit in bank 4,50,000

Subscription in Arrear 22,500

Prepaid insurance 8,400

Cash on hand 39,100

Cash at bank 50,000

10,95,000 10,95,000

2. Income on account of subscription

220 member @ Rs. 4,500 each 9,90,00

3. Subscription still in arrear for 2006-07

Opening balance of subscription in arrear [as on 01.04.07] 22,500

Less: Arrears subscription of 2006-07 received during the year 07-08 18,000

Subscription of 2006-07 still in arrear as on 31.03.08 4,500

4. Subscription in arreaRs. on 31.03.08

Subscription for the year 07-08 9,90,000

Less: Subscription received for the year 9,63,000

Subscription in arreaRs. for 2007-08 27,000

5. Depreciation on sports equipment

On Rs. 1,80,000 @ 15% for full year 27,000

On Rs. 60,000 @ 15% for 6 months 4,500

Total 31,500

6. Outstanding rent for 2007-08

= 1,48,500 x 1 month / 11 months 13,500

Solution 2:

Receipt and payment Account

Receipt Rs. Payment Rs.

To, opening balance 30,000 By, salary 18,000

To, Sale of Provision A/c 1,63,000 By, General Expenses 5,000

To, Subscription A/c 29,000 By, Creditors 1,38,000

By, Equipment A/c 16,000

By, Closing Balance 45,000

2,22,000 2,22,000

Working Note:

CA/Foundation/Principle and Practices of Accounting 24

Navnit Agrawal

1. Creditors’ A/c

Particular Rs. Particular Rs.

To, Cash/bank [bal. Fig] 1,38,000 By, Op. bal 8,000

To, Closing Bal. 10,000 By, purchase 1,40,000

2,20,000 2,20,000

2. Equipment A/c

Particular Rs. Particular Rs.

To, op. bal 10,000 By, depreciation 1,000

To, Cash/ bank [bal. fig] 16,000 By, Cl. Bal. 25,000

26,000 26,000

3. Subscription A/c

To, Accrued Subs. b/d 5,000 By, Cash/ bank A/c [Bal. Fig.] 29,000

To, Income and Expenditure A/c 34,000 By, Accrued Subs. c/d 10,000

39,000 39,000

Solution 3: Deena Nath Cheritable Hospital

Receipt and payment Account

Receipt Rs. Payment Rs.

To, Opening balance By, Honorarium to doctor 12,000

Cash 340 By, Salary 27,500

Bank 9,000 9,340 By, Printing and Stationary 1,100

To, Donation 9,500 By, rent 6,000

To, Charity Show Collection 11,450 By, Charity show Expenses 780

To, Interest 11,000 By, land [Purchase] 10,000

To, Subscription 55,996 By, Electric Expenses 452

By, Medicine 31,910

By, Equipment 5,550

By, Closing bal. c/d

Cash -160

Bank – 1,834 [bal. Fig] 1,994

97,286 97,286

Balance Sheet as at 31.03.1996

Liabilities Rs. Assets Rs.

Trust fund – 1,55,974 Equipment 13,900

Add: Surplus – 4,765 1,60,739 Furniture 18,900

Advance Subscription 100 Land 10,000

Electricity Bill Outstanding 115 Stock of Medicine 9,750

Investment in 11% Debenture 1,02,500

Subscription in Arrear 160

Accrued interest 3,750

Cash on hand 160

Cash at bank 1,834

1,60,954 1,60,954

Working Note:

1. Memorandum balance Sheet as on 01.04.1995

Liabilities Rs. Assets Rs.

CA/Foundation/Principle and Practices of Accounting 25

Navnit Agrawal

Trust fund [Bal. Fig.] 1,55,974 Equipment 11,600

Advance Subscription 64 Furniture 21,000

Electricity Bill Outstanding 92 Land

Stock of Medicine 7,820

Investment in 11% Debenture 1,02,500

Subscription in Arrear 120

Accrued interest 3,750

Cash on hand 340

Cash at bank 9,000

2,56,130 2,56,130

2. Subscription A/c 3. Electricity A/c

Particular Rs. Particular Rs.

Particular Rs. Particular Rs.

Op. O/s b/d 120 Op. Adv. B/d 64

To, Cash/ bank [ bal. 452 By, op. O/s 92

Fig] b/d

Income and Exp. 56,000 Cash/ bank [bal 55,996 To, Cl. O/s c/d 115 By, I & Exp. 475

A/c fig] A/c

Cl. Adv. c/d 100 Cl. O/s c/d 160

56,220 56,220 567 567

4. Medicine A/c 5. Equipment A/c

Particular Rs. Particular Rs. Particular Rs. Particular Rs.

To, op. Stock 7820 By, I & Exp. 29,980 To, Op. bal 11,600 By, Dep. 3,250

A/c

To, Cash/ bank[bal. 31,910 By, Cl. Stock 9750 To, Cash/ bank[Bal. 5,550 By, Cl. 13,900

Fig] Fig] Bal.

39,730 39,730 17,150 17,150

6. Furniture A/c 7. Interest A/c

Particular Rs. Particular Rs. Particular Rs. Particular Rs.

To, Op. bal 21,000 By, Dep. 2100 To, Op. 3,750 By, Cash/ bank 11,000

Outstanding

To, Cash/ bank[Bal. Nil By, Cl. 18,900 To, I & Exp. A/c 11,000 By, Cl. 3,750

Fig] Bal. Outstanding

21,000 21,000 14,750 14,750

Solution 5:

Income and Expenditure A/c [For the year ended…….]

Expenditure Rs. Rs. Income Rs. Rs.

To, Salary By, Fees

Paid 28,000 Received 3,80,000

Less: Op. O/s (3,000) Less: Op. O/s (80,000)

Add: Cl. O/s 1,000 26,000 Add: Cl. O/s 10,000 3,10,000

To, Entertainment Exp. 3,000 By, Donation Received 20,000

To, Tournament Exp. 12,000

To, Meeting Exp. 18,000

To, Travelling Exp. 6,000

To, Periodicals

Purchase 29,000

Less: Books (19,000) 10,000

To, Rent 10,000

To, Postage 15,000

To, Printing and Stationary 4,000

CA/Foundation/Principle and Practices of Accounting 26

Navnit Agrawal

To, Surplus 2,26,000

3,30,000 3,30,000

Solution 6: Green Club

Balance Sheet as at 31st March, 2008

Liabilities Rs. Assets Rs.

General fund Equipment 20,000

Opening balance 10,000 Furniture 8,000

Add: Surplus 20,000 Less: Depreciation (800) 7,200

Add: Entrance fees 2,000 Swimming Pool 40,000

Add: Legacy 8,000 40,000 Investment of General fund 36,000

Building Fund 30,000 Investment in Prize Fund 10,000

Add: income of Fund 2,000 32,000 Fixed Deposited in bank 20,000

Capital Fund 60,000 Subscription in Arrear 10,000

Add: capital Grant 10,000 70,000 Cash on hand 800

Prize Fund 10,000 Cash at bank 10,000

Add: Fund Income 1,000

Less: Prize fund exp (800) 10,200

Printing Bill outstanding 1,000

Allowances O/s 800

1,54,000 1,54,000

Note: Investment should not be more than fund. If amount of expense is more than income of

particular fund then that excess amount should be debited to Income and Expenditure A/c.

Solution 7:

Subscription A/c

Particular Rs. Particular Rs.

To, opening O/s Subscription A/c 1,500 By, Op. Adv. Subs. A/c 900

To, I & Exp. A/c [Bal. Fig.] 14,730 By, Cash/ bank A/c 14,670

To, Cl. Adv. Subs. A/c 540 By, Cl. O/s Subs. A/c 1,200

16,770 16,770

Solution 8:

Subscription A/c

Particular Rs. Particular Rs.

To, opening O/s Subscription A/c 3,500 By, Op. Adv. Subs. A/c 2,000

To, I & Exp. A/c [Bal. Fig.] 37,000 By, I & Exp. A/c [Irrecoverable] 500

By, Cash/ bank A/c

1997-98 2,000

1997-99 30,000

1999-00 3,000 35,000

To, Cl. Adv. Subs. A/c 3,000 By, Cl. O/s Subs. A/c 6,000

43,500 43,500

Solution 9:

Subscription A/c

Particular Rs. Particular Rs.

To, opening O/s Subscription A/c 5,000 By, Op. Adv. Subs. A/c Nil

To, I & Exp. A/c [450 x 500] 2,25,000 By, Cash/ bank A/c 2,23,000

To, Cl. Adv. Subs. A/c 7,500 By, Cl. O/s Subs. A/c [Bal. Fig.] 14,500

CA/Foundation/Principle and Practices of Accounting 27

Navnit Agrawal

2,37,500 2,37,500

Solution 10:

Stationary A/c

Particular Rs. Particular Rs.

To, opening stock of stationary A/c 12,000 By, Op. Bal of creditors for stationary 25,600

To, Cash/ bank 1,40,000 By, I & Exp. A/c [Bal. Fig.] 1,27,200

To, Closing creditors for stationary 24,000 By, Closing stock of stationary 23,200

1,76,000 1,76,000

Note: Alternatively students can prepare two accounts.

Creditors for Stationary A/c

Particular Rs. Particular Rs.

By, Op. Bal of creditors for stationary 25,600

To, Cash/ bank 1,40,000 By, Stationary stock A/c [Bal. Fig.] 1,38,400

To, Closing creditors for stationary 24,000

1,64,000 1,64,000

Stationary Stock A/c

Particular Rs. Particular Rs.

To, opening stock of stationary A/c 12,000 By, I & Exp. A/c [Bal. Fig.] 1,27,200

To, Creditors for Stationary A/c 1,38,400 By, Closing stock of stationary 23,200

1,50,400 1,50,400

Solution 11: Bombay Medical Aid Society

Income and Expenditure A/c [For the year ended 31.12.2000]

Expenditure Rs. Income Rs. Rs.

To, Hon. To Doctor 10,000 By, Donation 15,000

To, Salary 28,000 By, Interest on investment 9,000

To, Expenses 1,000 By charity show income 12,500

To, Medicine Consumed 29,000 Less: Expenses (1500) 11,000

To, Depreciation[6,000 + 2,000] 8,000

To, Surplus 10,200

86,200 86,200

Balance Sheet as at 31.12.2000

Liabilities Rs. Assets Rs.

General fund Equipment

Opening balance 1,80,300 Opening Bal 21,000

Add: Surplus 10,200 1,90,500 Add: Addition 15,000

Advance Subscription 700 36,000

Creditors for medicine 13,000 Less: Depreciation[bal fig] (6,000) 30,000

Building 48,000

Opening Bal 50,000

Less: Depreciation[bal fig] 2,000 48,000

Investment 1,00,000

Stock 15,000

Subscription in Arrear 2,200

Cash on hand 9,000

2,04,200 2,04,200

CA/Foundation/Principle and Practices of Accounting 28

Navnit Agrawal

Receipt and payment Account

Receipt Rs. Payment Rs.

To, Opening balance By, Honorarium to doctor 10,000

Cash 8,000 By, Salary 28,000

To, Donation 15,000 By, Sundry Expenses 1,000

To, Charity Show Collection 12,500 By, Creditors 30,000

To, Interest on investment 9,000 By, Charity show Expenses 1500

To, Subscription 50,000 By, Equipment 15,000

By, Closing bal. c/d 9,000

94,500 94,500

Working notes:

Subscription A/c

Particular Rs. Particular Rs.

To, opening O/s Subscription A/c 1,500 By, Op. Adv. Subs. A/c 1,200

To, I & Exp. A/c [450 x 500] 51,200 By, Cash/ bank A/c 50,000

To, Cl. Adv. Subs. A/c 700 By, Cl. O/s Subs. A/c 2,200

53,400 53,400

Creditors A/c

Particular Rs. Particular Rs.

To, Cash/ bank 30,000 By, Op. Bal of creditors 9,000

To, Closing balance 13,000 By, Purchase A/c [Bal. Fig.] 34,000

43,000 43,000

Medicine Expenses A/c

Particular Rs. Particular Rs.

To, opening stock A/c 10,000 By, I & Exp. A/c [Bal. Fig.] 29,000

To, Creditors [Purchase] A/c 34,000 By, Closing stock 15,000

44,000 44,000

Amount of Investment = Interest/ Rate = 9,000/9% = Rs. 1,00,000

Solution 12: Delhi Club

Income and Expenditure A/c [For the year ended 31.03.1998]

Expenditure Rs. Income Rs. Rs.

To, maintenance [1,000 + 1,000] 2,000 By, Entrance fees 17,000

To, Salary [4,800 + 200] 5,000 By, Subscription [19,000 + 1,000] 20,000

To, Rent 8,000 By, Locker rent 600

To, Depreciation[14,600 + 2,500] 17,100 By, Sundry Income [ 1,060 + 540] 1,600

To, Surplus 15,100 By Refreshment income 16,000

Less: Expenses (8,000) 8,000

47,200 47,200

Balance Sheet as at 31st March, 1998

Liabilities Rs. Assets Rs.

Capital Fund Land 10,000

Opening balance Nil Furniture 1,46,000

Add: Surplus 15,100 15,100 Less: Depreciation (14,600) 1,31,400

Building and Liability Fund 2,00,000 Library books 25,000

Creditors for furniture 16,000 Less: Depreciation (2,500) 22,500

Salary outstanding 200 Subscription in Arrear 1,000

maintenance O/s 1,000 Sundry income O/s 540

CA/Foundation/Principle and Practices of Accounting 29

Navnit Agrawal

Bank O.D. 1,08,140 Investment of Building Fund

Govt. Bond 1,60,000

F.D. 15,000 1,75,000

3,40,440 3,40,440

CA/Foundation/Principle and Practices of Accounting 30

Вам также может понравиться

- Study Note 3, Page 114-142Документ29 страницStudy Note 3, Page 114-142s4sahithОценок пока нет

- Chapter 9 Accounting For Branches Including Foreign Branches PDFДокумент61 страницаChapter 9 Accounting For Branches Including Foreign Branches PDFAkshansh MahajanОценок пока нет

- Bos 28432 CP 14Документ53 страницыBos 28432 CP 14Basant Ojha100% (1)

- Study Note 4.3, Page 198-263Документ66 страницStudy Note 4.3, Page 198-263s4sahithОценок пока нет

- Partnership NotesДокумент68 страницPartnership NotesSandeepОценок пока нет

- Ca Inter - Nov 2018 - Advanced Accounts - Suggested Answers PDFДокумент28 страницCa Inter - Nov 2018 - Advanced Accounts - Suggested Answers PDFHIMANSHU NОценок пока нет

- Paper - 3: Cost and Management Accounting Questions Material CostДокумент31 страницаPaper - 3: Cost and Management Accounting Questions Material CostMohammed Mustafa KampuОценок пока нет

- Chapter - 7 Departmental Accounting: Mark-Up Accounting Journal EntriesДокумент17 страницChapter - 7 Departmental Accounting: Mark-Up Accounting Journal EntriesAyush AcharyaОценок пока нет

- Fin Account-Sole Trading AnswersДокумент10 страницFin Account-Sole Trading AnswersAR Ananth Rohith BhatОценок пока нет

- Chap 6Документ27 страницChap 6Basant OjhaОценок пока нет

- 7948final Adv Acc Nov05Документ16 страниц7948final Adv Acc Nov05Kushan MistryОценок пока нет

- As-2 Inventory Valuation: 1) IntroductionДокумент17 страницAs-2 Inventory Valuation: 1) IntroductionDipen AdhikariОценок пока нет

- Partnership PDFДокумент28 страницPartnership PDFBasant OjhaОценок пока нет

- Account Past Questions Compilation (2009june - 2020 Dec.)Документ246 страницAccount Past Questions Compilation (2009june - 2020 Dec.)Prashant Sagar Gautam100% (2)

- PartnershipДокумент28 страницPartnershipAdi Murthy100% (2)

- Notes On Average Due Date PDFДокумент15 страницNotes On Average Due Date PDFManjunath Manju100% (1)

- 5 6168179598107345065Документ14 страниц5 6168179598107345065Madhan Aadhvick0% (1)

- Amalgamation SummaryДокумент26 страницAmalgamation SummaryPrashant SharmaОценок пока нет

- CA Foundation Accounts Suggested Answer May 2022Документ23 страницыCA Foundation Accounts Suggested Answer May 2022Himanshu RayОценок пока нет

- FR ConsolidationДокумент31 страницаFR Consolidationvignesh_vikiОценок пока нет

- Compiler CAP II Cost AccountingДокумент187 страницCompiler CAP II Cost AccountingEdtech NepalОценок пока нет

- RTP Dec2023 p1Документ32 страницыRTP Dec2023 p1Vaibhav M S100% (1)

- Accounting For Branches Including Foreign Branch Accounts: © The Institute of Chartered Accountants of IndiaДокумент53 страницыAccounting For Branches Including Foreign Branch Accounts: © The Institute of Chartered Accountants of IndiaHarikrishna100% (1)

- PT 06 (Partnership) (5 Dec)Документ8 страницPT 06 (Partnership) (5 Dec)Rajesh Kumar100% (2)

- Bos 28432 CP 10Документ45 страницBos 28432 CP 10hiral dattaniОценок пока нет

- Coc Departmental Accounting Ca/Cma Santosh KumarДокумент11 страницCoc Departmental Accounting Ca/Cma Santosh KumarAyush AcharyaОценок пока нет

- Final AccountДокумент7 страницFinal Accountswati100% (3)

- DepartmentalДокумент17 страницDepartmentalPapiya DeyОценок пока нет

- Practice Accounts Prime PDFДокумент56 страницPractice Accounts Prime PDFShraddha NepalОценок пока нет

- CA IPCC Branch AccountsДокумент19 страницCA IPCC Branch AccountsAkash Gupta75% (4)

- Pe2 Acc Nov05Документ19 страницPe2 Acc Nov05api-3825774Оценок пока нет

- Hire Purchase Notes 10 YrДокумент80 страницHire Purchase Notes 10 YrLalitKukreja100% (2)

- Worksheet On Accounting For Partnership - Admission of A Partner Board QuestionsДокумент16 страницWorksheet On Accounting For Partnership - Admission of A Partner Board QuestionsCfa Deepti Bindal100% (1)

- 5 6084915055709651012Документ8 страниц5 6084915055709651012Ajit Yadav100% (1)

- 5 Debenture Material3619080524732228932Документ14 страниц5 Debenture Material3619080524732228932Prabin stha100% (1)

- BCom Financial Accounting Study Material Notes Branch Accounts PDFДокумент45 страницBCom Financial Accounting Study Material Notes Branch Accounts PDFsimran32366Оценок пока нет

- CA Notes Sale of Goods On Approval or Return Basis PDFДокумент14 страницCA Notes Sale of Goods On Approval or Return Basis PDFBijay Aryan Dhakal100% (1)

- Purchase ConsiderationДокумент5 страницPurchase ConsiderationAR Ananth Rohith BhatОценок пока нет

- 15-Mca-Nr-Accounting and Financial ManagementДокумент4 страницы15-Mca-Nr-Accounting and Financial ManagementSRINIVASA RAO GANTA0% (2)

- CBSE Class 11 Accounting-Vouchers and Their Preparation PDFДокумент13 страницCBSE Class 11 Accounting-Vouchers and Their Preparation PDFDiksha60% (5)

- Internal Reconstruction NotesДокумент16 страницInternal Reconstruction NotesAkash Mehta100% (1)

- Sectional and Self Balancing SystemДокумент7 страницSectional and Self Balancing SystemBhupender Singh Kaushal78% (9)

- CA Foundation Account Scanner by Nahta CoachingДокумент521 страницаCA Foundation Account Scanner by Nahta CoachingSuneeta Srivastava50% (8)

- 19732ipcc CA Vol2 Cp3Документ43 страницы19732ipcc CA Vol2 Cp3PALADUGU MOUNIKAОценок пока нет

- © The Institute of Chartered Accountants of IndiaДокумент39 страниц© The Institute of Chartered Accountants of IndiaGowriОценок пока нет

- PCC 2008 NPO QuestionДокумент10 страницPCC 2008 NPO QuestionVaibhav MaheshwariОценок пока нет

- Decemeber 2020 Examinations: Suggested Answers ToДокумент41 страницаDecemeber 2020 Examinations: Suggested Answers ToDipen AdhikariОценок пока нет

- Paper 1 Advanced AccountingДокумент576 страницPaper 1 Advanced AccountingExcel Champ60% (5)

- Finanal Accounts - Solved ExamplesДокумент11 страницFinanal Accounts - Solved ExamplesDesmond Suting100% (2)

- Chapter 4: Redemption of Pref Share & Debentures Topic: Redemption of Debentures. Practice QuestionsДокумент53 страницыChapter 4: Redemption of Pref Share & Debentures Topic: Redemption of Debentures. Practice QuestionsMercy GamingОценок пока нет

- Non Profit OrganisationsДокумент28 страницNon Profit OrganisationsSubham Jaiswal0% (1)

- Not For Profit Organisation: Basic ConceptsДокумент48 страницNot For Profit Organisation: Basic Conceptsmonudeep aggarwalОценок пока нет

- Chapter 2 Hire Purchase & Installment SystemДокумент26 страницChapter 2 Hire Purchase & Installment SystemSuku Thomas Samuel100% (1)

- Suggested Answer CAP II June 2017rДокумент104 страницыSuggested Answer CAP II June 2017rBAZINGAОценок пока нет

- Unit - 4: Amalgamation and ReconstructionДокумент54 страницыUnit - 4: Amalgamation and ReconstructionAzad AboobackerОценок пока нет

- Accounting For Non-Profit OrganisationДокумент6 страницAccounting For Non-Profit OrganisationSGEОценок пока нет

- Clubs and SocietyДокумент7 страницClubs and SocietyJAPHET NKUNIKAОценок пока нет

- Study Note 3, Page 148-196Документ49 страницStudy Note 3, Page 148-196samstarmoonОценок пока нет

- 19674ipcc Acc Vol1 Chapter-9Документ44 страницы19674ipcc Acc Vol1 Chapter-9Sonu KamalОценок пока нет

- Chapter-14 Accounting For Not For Profit Organization PDFДокумент6 страницChapter-14 Accounting For Not For Profit Organization PDFTarushi Yadav , 51BОценок пока нет

- English Paper 3 PDFДокумент4 страницыEnglish Paper 3 PDFSaurabh AdakОценок пока нет

- SKP MathsДокумент11 страницSKP MathsSaurabh AdakОценок пока нет

- 25 - 02!19!22!41!07 - Daily Practice Problem BookДокумент66 страниц25 - 02!19!22!41!07 - Daily Practice Problem BookSaurabh AdakОценок пока нет

- 405d - Business StatisticsДокумент21 страница405d - Business StatisticsSaurabh AdakОценок пока нет

- NPO Master ProblemДокумент3 страницыNPO Master ProblemSaurabh AdakОценок пока нет

- Additional English Sharp NotesДокумент30 страницAdditional English Sharp NotesSaurabh Adak75% (36)

- Guaranteed Gains MuscularStrength FREE PROGRAMДокумент11 страницGuaranteed Gains MuscularStrength FREE PROGRAMSaurabh AdakОценок пока нет

- Shred Bible by Sadik HadzovicДокумент76 страницShred Bible by Sadik HadzovicSaurabh Adak100% (7)

- 2b Blockchain PDFДокумент15 страниц2b Blockchain PDFjshen5Оценок пока нет

- HRM Incentive PlansДокумент10 страницHRM Incentive PlansYashu ReddyОценок пока нет

- Project Report Metlife InsuranceДокумент82 страницыProject Report Metlife InsuranceYaadrahulkumar Moharana100% (1)

- Sale of Goods ActДокумент52 страницыSale of Goods Actrishabh jainОценок пока нет

- Unsecured Loan AgreementДокумент2 страницыUnsecured Loan AgreementSavoir Pen100% (1)

- Irr Waterfall TechniqueДокумент16 страницIrr Waterfall TechniquehichambhОценок пока нет

- Higher Education Loans Board: Tvet-Loan/Bursary Application Form - First Time ApplicantДокумент8 страницHigher Education Loans Board: Tvet-Loan/Bursary Application Form - First Time ApplicantPaulineОценок пока нет

- DGM Annexure B Know Your Pay ComponentsДокумент3 страницыDGM Annexure B Know Your Pay ComponentsaakritishellОценок пока нет

- Gerova Financial GroupДокумент20 страницGerova Financial GroupDavid DorrОценок пока нет

- Simple Interest PDF For Bank Exams IBPS SBI PO Clerk RRBДокумент26 страницSimple Interest PDF For Bank Exams IBPS SBI PO Clerk RRBSrini VasuluОценок пока нет

- Civil Law Review CasesДокумент14 страницCivil Law Review CasesElreen Pearl AgustinОценок пока нет

- Insurance NotesДокумент61 страницаInsurance NotesIvyGwynn214Оценок пока нет

- Rent-to-Own FlyerДокумент1 страницаRent-to-Own FlyerCj AlfieОценок пока нет

- TPA - Introduction and Important DefinitionsДокумент41 страницаTPA - Introduction and Important DefinitionsakhilОценок пока нет

- Afw 3331 2008 S1 Questions PDFДокумент7 страницAfw 3331 2008 S1 Questions PDFYan YingОценок пока нет

- 3rd Hand OutДокумент3 страницы3rd Hand Outsonny arcenalОценок пока нет

- Allied Bank Vs ORDOÑEZДокумент2 страницыAllied Bank Vs ORDOÑEZida_chua8023Оценок пока нет

- Pros Vs Cons MP Vs FPДокумент2 страницыPros Vs Cons MP Vs FPShoaib PatelОценок пока нет

- Loan Agreement Paperwork of $5000.00Документ8 страницLoan Agreement Paperwork of $5000.00Alex SpecimenОценок пока нет

- Res # 1388 - SHAHEEN AIR INTERNATIONAL TicketДокумент1 страницаRes # 1388 - SHAHEEN AIR INTERNATIONAL TicketHabib AhmedОценок пока нет

- LAWTFДокумент3 страницыLAWTFHashaira AlimОценок пока нет

- Altman Z-ScoreДокумент30 страницAltman Z-Scoreshikhakalani_19100% (1)

- Tax Distinguished From Other FeesДокумент1 страницаTax Distinguished From Other FeesAndro Louis Malabarbas RulonaОценок пока нет

- DMS Report ListДокумент11 страницDMS Report ListDilan Maduranga Fransisku ArachchiОценок пока нет

- Letter of Intent: Model Stock Purchase Agreement, Second EditionДокумент18 страницLetter of Intent: Model Stock Purchase Agreement, Second EditionMuhammad Noor Murthadha100% (1)

- 105 BPI v. BPI Employees Union - Metro ManilaДокумент2 страницы105 BPI v. BPI Employees Union - Metro ManilaLiliosaEscober100% (1)

- Leung Yee V Strong Machinery GR No. L-11658Документ2 страницыLeung Yee V Strong Machinery GR No. L-11658Armand Jerome CaradaОценок пока нет

- Cma With Cra For Bank ProjectionДокумент31 страницаCma With Cra For Bank ProjectionMuthu SundarОценок пока нет

- Poultry FarmДокумент22 страницыPoultry Farmrisingprince89Оценок пока нет

- CA Agro-Industrial Development Corp V CA 219 SCRA 426Документ4 страницыCA Agro-Industrial Development Corp V CA 219 SCRA 426Jay CruzОценок пока нет