Академический Документы

Профессиональный Документы

Культура Документы

3rd Sem MCom Direct Taxes Dec 2015

Загружено:

ravi nИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

3rd Sem MCom Direct Taxes Dec 2015

Загружено:

ravi nАвторское право:

Доступные форматы

For More Question Papers Visit - www.pediawikiblog.

com

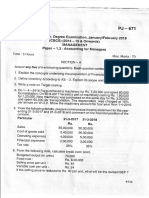

Illillllililil]lllilililtililil] PG - 528

lll semester M.com. Degree Examination, Decernber 2015

(CBCS Scheme)

COMMERCE

Paper - 3.5 AT : Direct Taxes and planning

m

Time : 3 Hours Max. Marks : 70

co

SECTION _ A

1.

g.

Answer anyT sub-questions of the following. Each sub-question carries

2 marks. (Tx2=14)

a) What do you mean by colourable devises ?

lo

b) State the treatment of expenditure incurred on promotion of family planning

among employees.

ib

c) Differentiate between'Tax Planning' and'Tax Management'.

d) State the general principles governing assessment of business income

ik

e) What are appeals under tncome Tax Act, 1961 ?

f) Define Block of assets uls 2(11).

aw

g) what is MAT u/s 1 l sJB ? what's the reason for its introduction ?

h) Define Net Wealth u/s 2(m).

i) State the provisions u/s 35D for amortization of preliminary expenditure.

di

j) What is return of income ? Mention the types of return.

e

SECTION - B

marks.

.p

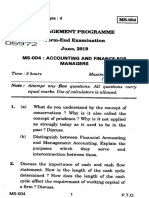

Answer any 4 of the following. Each question carries S _. (4x5=20)

2. Briefly explain the Exempted assets under Section S of the Wealth Tax Act, 1g57.

w

3. State the tax provisions for,the following :

w

a) Advance Payment of Tax

b) Typesofassessment

w

c) Due date forfiling return of income.

4. Enumerate the tax holidays entitled to business undertaking established in north

eastern states u/s 80 lE.

P.T.O.

For More Question Papers Visit - www.pediawikiblog.com

For More Question Papers Visit - www.pediawikiblog.com

PG - 528 Illllilllilfltililffifliltiltllll

5. The following details are furnished by Ram Pottu Company Limited forthe previous

year 2014-15. Gross Total lncome is Rs. 8,10,000 which includes the following :

m

a) Capital gain on sale of long term capitalasset Fls. 1,50,000.

' b) Short term capital gain liabile for STT u/s 111A is Rs. 75,000.

c) The company is eligible for deduction u/s 80lB at 30% of its income from

co

business Rs.3,50,000.

Sl. No. Donation given to the following Amount in Rs.

01 Zila Saksharta Samiti 15,000

g.

02 Prime Minister's Drought Relief Fund 45,000

03 An institution engaged in promotion,of family planning 15,000

04

lo

lndian Olympic Association 25,000

05 An institution which is recognized u/s BOG 10,000

06 lndira Gandhi MemorialTrust 40,000

07

08

09

ib

National Foundation for Communal Harmony 25,000

National Defense Fund set up by the central Government 45,000

A notified Temple (Rs. 15,000 given in cash)

ik

30,000

10 Prime Minister's National Relief Fund 35;000

Compute allowable amount of deduction u/s 80G for the Assessment Year

w

2015-16.

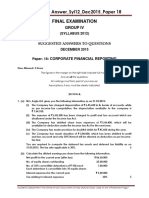

6. An industrial undertaking which commences the manufacturing activity w.e.f.

ia

1510612014 has acquired the following assets during the previous year ZOlqlS:

Assets Date of Acquisition/ Date when put Cost of

ed

construction into use acquisition/

construction

(in Rs.)

Factory building 14lSlZO14 augpa14

.p

50,00,000

Building

Residential 16/Ogt2O14 a7fi112014 3,70,000

Plant and Machinery

w

i) Air pollution control

equipment a91612014 4il9l2014 4,00,000

ii) Machinery A

w

2518t2014 0410Do14 16,50,000

iii) Machinery B 291912014 3111012014 7,50,000

iv) Machinery C

w

(Second hand) 04101t2015 13|AV2A15 3,00,000

v) Motor car 01fiu2014 ufia2u4 4,50,000

vi) Airconditioner

office)

(installed in 10B12A1F, 15/03/201s 1,00,000

Compute the allowable depreciation u/s 32 for the A.Y. 201 5-1 6 and WDV as on

01104t2015.

For More Question Papers Visit - www.pediawikiblog.com

For More Question Papers Visit - www.pediawikiblog.com

ililrffilillil[fllilrilllilllll PG - 528

7, From the following information of Mohith Private Limited, compute tax liability

and showthe utilization of tax creditforthe various assessmentyears assuming

tax rates applicable are same as of current assessment year for various

assessment years given.

Assessment Years

Total income computed Book profit calculated as

m

as per normal provisions per Section 115J8

of lncomeTaxAct, 1961 Rs.

Rs.

co

2A14-15 25,00,000 40,00,000

2015-16 15,00,000 50,00,000

2016-17 75,00,000

g.

40,00,000

2017-18 1,10,00,000 85,00,000

2018-19 95,00,000 1,15,00,000

lo

2019-20 65,00,000 60,00,000

SECTION

ib

-C

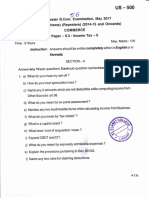

Answerany 3 questions of the following. Each question carries 12 marks. (3x12=36)

ik

8. Discuss the tax holidays in respect of profits and gains from certain undertakings

involved in infrastructure development undertakings u/s 80 lA.

w

9. Enumerate the tax provisions regarding set-off and carry fonruard of losses under

the lncome Tax Act, 1961.

ia

10. Discuss the valuation rules under Part B of Schedule lll relating to lmmovable

property under Wealth Tax Act, 1957. lllustrate with an example.

ed

11. From the following in{ormation determine whether assessee should "purchase

the asset or take on lease".

.p

a) Cost of asset Rs. 5,00,000

b) Rate of depreciation 15%

c) Rate of interest 10%

w

d) Repayment of loan bythe assessee Rs. 80,000 p.a.

e) Rate of tax 30.9%

f) Residualvalue of Rs. 80,000 after 5 years

w

g) Profit of ihe ssseusee Rs, 5,C0,C00 before depreeiation, interest and tax or

before lease rent and tax.

w

h) Lease rent Rs. 1,20,000 p.a.

i) Present value factor @ 10% is :

Year 1 2 3 4 5

P. V. Factor 0.909 0.826 0.751 0.683 0.621

For More Question Papers Visit - www.pediawikiblog.com

For More Question Papers Visit - www.pediawikiblog.com

PG - s28 Iililllltiltilillliltilililfll|lt

12. The following particulars are furnished by sunrise company Limited.

Trading and Profit and Loss Accountforthe yearending

Particulars particulars - sliosleots

Amount Amount

(in Rs.)

m

(in Rs.)

To Opening stock A,g9,000 By Sales 25,00,000

To Purchases 10,0b,000 By Dividend from

To Advertisement expenses gS,0O0 Domestic Company 10,000

co

To Travelling expenses 60,000 By Long term capitalgain

2,40,000

To Capital expenditure on By Bad debts recovered

promotion of family planning 25,000 disallowed earlier 15,000

g.

To Depreciation 6,25,000 By Amount withdrawn

To lncome tax 2,15,000 from contingency

tax

To Wealth

lo

40,500 reserves 2,30,000

expenses

To Entertainment 96,500 By Closing stock 4,65,000

due

To VAT 04,000

To Provision for unascertained

Iiability

To Salaries and wages

ib30,000

2,7A,000

ik

To Auditor's fees 30,000

To Provision for loss of

subsidiary company 67,500

w

To Proposed dividend 1,75,000

To Sundry expenses 2,25,000

To Net profit 1,47,500

ia

34,60,000 34,60,000

Additional information :

i) opening

ed

stock was overvalued by Rs. 2g,000 and crosing stock was

overvalued by Fls. 97,000.

ii) Customs duty of 2012-13 paid during the year Rs. 75,000 was not considered

in the above account.

.p

iii) sundry expenses include an item of Rs. 4z,ooapaid in cash.

iv) Out of the O/s amount of VAT tax Rs. 25,0d0 was paid before due

date of

filing of return of income.

w

v) Brought forward business ross Rs. 4,00,000 for income tax purpose and

Rs. 3,50,000 for accounting purposes.

vi) Brought forward unabsoroeo ciepreciation is Rs. 2,00,000 for

w

purposes accounting

vii) Depreciation as per Section 32 is Rs. 5,75,000.

w

Compute:

a) Total income

b) Book profit u/s 115J8 and

c) Total tax liabitity for the A.y. 2015-16.

For More Question Papers Visit - www.pediawikiblog.com

Вам также может понравиться

- Marks.: (Semester & LncomeДокумент8 страницMarks.: (Semester & LncomeChetan MОценок пока нет

- Accountancy Sample Question PaperДокумент8 страницAccountancy Sample Question PaperSoNam ZaNgmoОценок пока нет

- Finance QP 2017Документ3 страницыFinance QP 2017Yeswanth rajaОценок пока нет

- MBA 1654 Question PaperДокумент49 страницMBA 1654 Question PaperkedrabeydoОценок пока нет

- Question Paper Code: 3528: Commerce (Direct Tax Laws & Accounts)Документ7 страницQuestion Paper Code: 3528: Commerce (Direct Tax Laws & Accounts)Shyam ji DubeyОценок пока нет

- ECO-2 - ENG-J18 - CompressedДокумент6 страницECO-2 - ENG-J18 - CompressedAmit AdhikariОценок пока нет

- 134 Accounting Managers FreshersДокумент4 страницы134 Accounting Managers Freshersdchandru271Оценок пока нет

- Financial Reporting & Financial Statement Analysis: Time - 3 Hours Group - AДокумент6 страницFinancial Reporting & Financial Statement Analysis: Time - 3 Hours Group - Atanmoy sardarОценок пока нет

- 15A52301 Managerial Economics & Financial AnalysisДокумент2 страницы15A52301 Managerial Economics & Financial AnalysisGeorgekutty FrancisОценок пока нет

- CH18601 FM - II Model PaperДокумент5 страницCH18601 FM - II Model PaperKarthikОценок пока нет

- Paper 16Документ5 страницPaper 16VijayaОценок пока нет

- Reg. No.: Q.P. Code: (17 BBA 31/ 17 BBACA 31/17 BBARM 44/ 17 BBAIB 49/17 BBABPM 15)Документ10 страницReg. No.: Q.P. Code: (17 BBA 31/ 17 BBACA 31/17 BBARM 44/ 17 BBAIB 49/17 BBABPM 15)AK GAMINGОценок пока нет

- Paper 33Документ6 страницPaper 33AVS InfraОценок пока нет

- 6th Semester Paper 2022Документ5 страниц6th Semester Paper 2022Chandrarup BanerjeeОценок пока нет

- CBCS Accounting For Managers (2019)Документ4 страницыCBCS Accounting For Managers (2019)ROYAL COLLEGEОценок пока нет

- Llrilriltilillilillliltilililllil: Sernester Examination, January/February (CBCS) & Onwards) Faper 1.3 ManagersДокумент4 страницыLlrilriltilillilillliltilililllil: Sernester Examination, January/February (CBCS) & Onwards) Faper 1.3 ManagersKavithri ponnappaОценок пока нет

- Financial Accounting-Iii - HonoursДокумент7 страницFinancial Accounting-Iii - HonoursAlankrita TripathiОценок пока нет

- New Syllabus: NOTE: 1. Answer ALL QuestionsДокумент8 страницNew Syllabus: NOTE: 1. Answer ALL QuestionsAnkur GuptaОценок пока нет

- 13 Financial Accounting - April May 2021 (Freshers CBCS 2020-21 and Onwards)Документ15 страниц13 Financial Accounting - April May 2021 (Freshers CBCS 2020-21 and Onwards)Rakesh MaliОценок пока нет

- KL Taxtaion I May June 2012Документ2 страницыKL Taxtaion I May June 2012asdfghjkl007Оценок пока нет

- For Good Marks in IGNOU Exams Always Read Gullybaba BooksДокумент4 страницыFor Good Marks in IGNOU Exams Always Read Gullybaba Booksansar shaikОценок пока нет

- Management Programme Term-End Examination June, 2019: Ms-004: Accounting and Finance For ManagersДокумент4 страницыManagement Programme Term-End Examination June, 2019: Ms-004: Accounting and Finance For ManagersreliableplacementОценок пока нет

- CSEC Principles of Accounts June 2015 Paper 1Документ14 страницCSEC Principles of Accounts June 2015 Paper 1Aria PersaudОценок пока нет

- 63 Question PaperДокумент4 страницы63 Question PaperSam NayakОценок пока нет

- Mock Questions ICAiДокумент7 страницMock Questions ICAiPooja GalaОценок пока нет

- Paper18 Solution PDFДокумент24 страницыPaper18 Solution PDFI'm Just FunnyОценок пока нет

- Test Series: October, 2020 Mock Test Paper Final (Old) Course: Group - Ii Paper - 7: Direct Tax LawsДокумент11 страницTest Series: October, 2020 Mock Test Paper Final (Old) Course: Group - Ii Paper - 7: Direct Tax LawsAnshul JainОценок пока нет

- CAPE Accounting 2018 U1 P2Документ9 страницCAPE Accounting 2018 U1 P2Kimberly MОценок пока нет

- (CBCS) Commerce Paper: 4.5 A - Innovations in Accounting: Note: Answer As Per Internal ChoiceДокумент4 страницы(CBCS) Commerce Paper: 4.5 A - Innovations in Accounting: Note: Answer As Per Internal ChoiceSanaullah M SultanpurОценок пока нет

- 325Документ12 страниц325Ganesh AgarwalОценок пока нет

- Bba 705Документ2 страницыBba 705api-3782519Оценок пока нет

- Accounts Mock Test May 2019Документ18 страницAccounts Mock Test May 2019poojitha reddyОценок пока нет

- MTP - Final - Syllabus 2016 - Dec 2019 - Set2: Paper 17-Corporate Financial ReportingДокумент6 страницMTP - Final - Syllabus 2016 - Dec 2019 - Set2: Paper 17-Corporate Financial ReportingBhupen SharmaОценок пока нет

- P18 Syl2012 Set1Документ22 страницыP18 Syl2012 Set1Aswin KumarОценок пока нет

- Cib GH 04-23 Financial Reporting, Planning & Analysis Level Iii Page 1Документ8 страницCib GH 04-23 Financial Reporting, Planning & Analysis Level Iii Page 1lilliananne5051Оценок пока нет

- Direct Tax Laws Detail Test 1 May 2024 Test Paper 1702105507Документ9 страницDirect Tax Laws Detail Test 1 May 2024 Test Paper 1702105507shauryagupta20013007Оценок пока нет

- OSMS/M-20 Taxation Laws IMS-601: Roll No. .......................... Total Pages: 05Документ5 страницOSMS/M-20 Taxation Laws IMS-601: Roll No. .......................... Total Pages: 05mehaik patwa , 20Оценок пока нет

- Commerce (Regular) Accounting For Specialised Institutions (Group A: Accounting and Finance) Paper - 3.5 (A)Документ4 страницыCommerce (Regular) Accounting For Specialised Institutions (Group A: Accounting and Finance) Paper - 3.5 (A)Sanaullah M SultanpurОценок пока нет

- Corporate ACДокумент4 страницыCorporate ACElavarasan NОценок пока нет

- Advanced AccountsДокумент3 страницыAdvanced AccountsArun SankarОценок пока нет

- 5th Sem Accounts Previous Year PapersДокумент25 страниц5th Sem Accounts Previous Year PapersViratОценок пока нет

- Income Tax IISep Oct 2022Документ15 страницIncome Tax IISep Oct 2022supritha724Оценок пока нет

- Ca Inter, Group I Class Test 5. Test - DT Topic - . PGBP Date-TIME: 1:30 Hours MARKS:40 Total No - of Questions: 7 Total No - of Pages: 00Документ5 страницCa Inter, Group I Class Test 5. Test - DT Topic - . PGBP Date-TIME: 1:30 Hours MARKS:40 Total No - of Questions: 7 Total No - of Pages: 00Shrestha GuptaОценок пока нет

- Suggested Answers For Ca Final Financial ReportingДокумент17 страницSuggested Answers For Ca Final Financial ReportingSamuel AnthrayoseОценок пока нет

- Alpa Bravo 123Документ16 страницAlpa Bravo 123adnan khanОценок пока нет

- Bcom 6Документ15 страницBcom 6Chetan MОценок пока нет

- AC5021 2015-16 Resit Exam Questions ASPДокумент8 страницAC5021 2015-16 Resit Exam Questions ASPyinlengОценок пока нет

- Bangalore University Previous Year Question Paper AFM 2020Документ3 страницыBangalore University Previous Year Question Paper AFM 2020Ramakrishna NagarajaОценок пока нет

- © The Institute of Chartered Accountants of IndiaДокумент7 страниц© The Institute of Chartered Accountants of IndiaRahul AgrawalОценок пока нет

- IMP 2225 Advance Accounts Prelims QUESTION PAPERДокумент8 страницIMP 2225 Advance Accounts Prelims QUESTION PAPERArnik AgarwalОценок пока нет

- Adobe Scan Jan 30, 2023Документ6 страницAdobe Scan Jan 30, 2023Karan RajakОценок пока нет

- Psaf Revision Day 4Документ7 страницPsaf Revision Day 4Esther AkpanОценок пока нет

- CO3CRT07 - Corporate Accounting I (T)Документ5 страницCO3CRT07 - Corporate Accounting I (T)shemymuhammad289Оценок пока нет

- Question CMA April 2019 SP Exam.Документ4 страницыQuestion CMA April 2019 SP Exam.F A Saffat RahmanОценок пока нет

- Financial Management 5th Sem. NotesДокумент4 страницыFinancial Management 5th Sem. NotesAmit Mondal0% (1)

- IncomeTax-IIДокумент7 страницIncomeTax-IIAditya .cОценок пока нет

- Particulars Debit Credit: © The Institute of Chartered Accountants of IndiaДокумент46 страницParticulars Debit Credit: © The Institute of Chartered Accountants of IndiaOveyaaОценок пока нет

- Bcom 6 Sem Business Finance 2 Foundation Group 2 5511 Summer 2019Документ5 страницBcom 6 Sem Business Finance 2 Foundation Group 2 5511 Summer 2019Shrikant AvzekarОценок пока нет

- One Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020От EverandOne Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020Оценок пока нет

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisОт EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisОценок пока нет

- GAJ Mod 18 Ace Your InterviewДокумент12 страницGAJ Mod 18 Ace Your InterviewAnjela SantiagoОценок пока нет

- Why Do Firms Do Basic Research With Their Own Money - 1989 - StudentsДокумент10 страницWhy Do Firms Do Basic Research With Their Own Money - 1989 - StudentsAlvaro Rodríguez RojasОценок пока нет

- Re CrystallizationДокумент25 страницRe CrystallizationMarol CerdaОценок пока нет

- Viva QuestionsДокумент3 страницыViva QuestionssanjayshekarncОценок пока нет

- Musculoskeletan Problems in Soccer PlayersДокумент5 страницMusculoskeletan Problems in Soccer PlayersAlexandru ChivaranОценок пока нет

- A Guide To Effective Project ManagementДокумент102 страницыA Guide To Effective Project ManagementThanveerОценок пока нет

- Lista Verbelor Regulate - EnglezaДокумент5 страницLista Verbelor Regulate - Englezaflopalan100% (1)

- Case Study 1 (Pneumonia)Документ13 страницCase Study 1 (Pneumonia)Kate EscotonОценок пока нет

- Yukot,+houkelin 2505 11892735 Final+Paper+Group+41Документ17 страницYukot,+houkelin 2505 11892735 Final+Paper+Group+410191720003 ELIAS ANTONIO BELLO LEON ESTUDIANTE ACTIVOОценок пока нет

- Algebra. Equations. Solving Quadratic Equations B PDFДокумент1 страницаAlgebra. Equations. Solving Quadratic Equations B PDFRoberto CastroОценок пока нет

- Conrail Case QuestionsДокумент1 страницаConrail Case QuestionsPiraterija100% (1)

- AIM Mag Issue 22 April 2010Документ98 страницAIM Mag Issue 22 April 2010Artisans in Miniature95% (19)

- 28Документ12 страниц28physicsdocsОценок пока нет

- Chpater 2 PDFДокумент44 страницыChpater 2 PDFBilalОценок пока нет

- How To Export: 1) Establishing An OrganisationДокумент5 страницHow To Export: 1) Establishing An Organisationarpit85Оценок пока нет

- Biology - Solved ExamДокумент27 страницBiology - Solved ExamlyliasahiliОценок пока нет

- FJ&GJ SMДокумент30 страницFJ&GJ SMSAJAHAN MOLLAОценок пока нет

- Creative Nonfiction 2 For Humss 12 Creative Nonfiction 2 For Humss 12Документ55 страницCreative Nonfiction 2 For Humss 12 Creative Nonfiction 2 For Humss 12QUINTOS, JOVINCE U. G-12 HUMSS A GROUP 8Оценок пока нет

- Writing - Hidden Curriculum v2 EditedДокумент6 страницWriting - Hidden Curriculum v2 EditedwhighfilОценок пока нет

- City/ The Countryside: VocabularyДокумент2 страницыCity/ The Countryside: VocabularyHương Phạm QuỳnhОценок пока нет

- Article 1156 Gives The Civil Code Definition of Obligation, in Its Passive Aspect. Our Law MerelyДокумент11 страницArticle 1156 Gives The Civil Code Definition of Obligation, in Its Passive Aspect. Our Law MerelyFeir, Alexa Mae C.Оценок пока нет

- 576 1 1179 1 10 20181220Документ15 страниц576 1 1179 1 10 20181220Sana MuzaffarОценок пока нет

- Motion To Strike BasedДокумент16 страницMotion To Strike BasedForeclosure Fraud100% (1)

- Practice Test 4 For Grade 12Документ5 страницPractice Test 4 For Grade 12MAx IMp BayuОценок пока нет

- 38 Bayan Muna Vs MendozaДокумент3 страницы38 Bayan Muna Vs MendozaDavid Antonio A. EscuetaОценок пока нет

- 1stQ Week5Документ3 страницы1stQ Week5Jesse QuingaОценок пока нет

- Final Report - Solving Traveling Salesman Problem by Dynamic Programming Approach in Java Program Aditya Nugroho Ht083276eДокумент15 страницFinal Report - Solving Traveling Salesman Problem by Dynamic Programming Approach in Java Program Aditya Nugroho Ht083276eAytida Ohorgun100% (5)

- Anindya Anticipatory BailДокумент9 страницAnindya Anticipatory BailYedlaОценок пока нет

- Annexure 8: Medical Certificate (To Be Issued by A Registered Medical Practitioner) General ExpectationsДокумент1 страницаAnnexure 8: Medical Certificate (To Be Issued by A Registered Medical Practitioner) General ExpectationsMannepalli RamakrishnaОценок пока нет

- Thermal Systems: Introduction To Heat TransferДокумент33 страницыThermal Systems: Introduction To Heat TransferParas SharmaОценок пока нет