Академический Документы

Профессиональный Документы

Культура Документы

Asad Psid

Загружено:

عمر عمیИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Asad Psid

Загружено:

عمر عمیАвторское право:

Доступные форматы

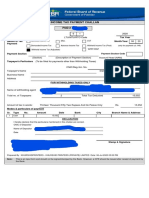

INCOME TAX PAYMENT CHALLAN

PSID # : 36540438

RTO PESHAWAR 6 3 2019

Name of LTU/MTU/RTO LTU/MTU/RTO Code Tax Year

Nature of Tax Admitted Income Tax Misc. CVT Month/Year

Payment

Demanded Income Tax Advance Income Tax Withheld Income Tax (Final) (only for payment u/s 149)

Withheld Income Tax (Adjustible) WPPF/WWF

Payment Section 137 Admitted Income Tax Payment Section Code 9203

(Section) (Description of Payment Section) Account Head (NAM) B01105

Taxpayer's Particulars (To be filled for payments other than Withholding Taxes) (To be filled in by the bank)

NTN 6635482-7 CNIC/Reg./Inc. No.

Taxpayer's Name MUSKAN TRADING COMPANY (SMC-PRIVATE) LIMITED Status COMPANY

Business Name MUSKAN TRADING COMPANY (SMC-PRIVATE) LIMITED

Address Khalil Plaza, Shop No. 9 - 10, 1st Floor, New Adda, Mardan Mardan , MARDAN

FOR WITHHOLDING TAXES ONLY

NTN/FTN of Withholding agent CNIC/Reg./Inc. No.

Name of withholding agent

Total no. of Taxpayers Total Tax Deducted

Amount of tax in words: Five Thousand Five Hundred Ninety Rupees And No Paisas Only Rs. 5,590

Modes & particulars of payment

Sr. Type No. Amount Date Bank City Branch Name & Address

1 Cash 5,590

DECLARATION

I hereby declare that the particulars mentioned in this challan are correct.

CNIC of Depositor

Name of Depositor MUSKAN TRADING COMPANY (SMC-PRIVATE) LIMITED

Date

Stamp & Signature

PSID-IT-000090026581-002019

Prepared By : guest_user - Guest_User Date: 14-Dec-2019 10:32 AM

Note: This is an input form and should not be signed/stamped by the Bank. However, a CPR should be issued after receipt of payment by

the Bank.

Вам также может понравиться

- Goods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesОт EverandGoods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesОценок пока нет

- Wide Band Communication PVT LTD - Psid# 37347217 (2015)Документ1 страницаWide Band Communication PVT LTD - Psid# 37347217 (2015)Asif JavidОценок пока нет

- Income Tax Payment Challan: PSID #: 43239093Документ1 страницаIncome Tax Payment Challan: PSID #: 43239093Rizwan Akram RizwanОценок пока нет

- Income Tax Payment Challan: PSID #: 50454183Документ1 страницаIncome Tax Payment Challan: PSID #: 50454183Shehla FarooqОценок пока нет

- Income Tax Payment Challan: PSID #: 34336315Документ1 страницаIncome Tax Payment Challan: PSID #: 34336315kashif shahzadОценок пока нет

- Muhammad Afan Malik-IIДокумент1 страницаMuhammad Afan Malik-IIBabu AnsariОценок пока нет

- It 000095921232 2020 06Документ1 страницаIt 000095921232 2020 06Haroon ButtОценок пока нет

- It 000095921212 2020 05Документ1 страницаIt 000095921212 2020 05Haroon ButtОценок пока нет

- Income Tax Payment Challan: PSID #: 148473028Документ1 страницаIncome Tax Payment Challan: PSID #: 148473028Haseeb RazaОценок пока нет

- It 000095883329 2019 00Документ1 страницаIt 000095883329 2019 00Haroon ButtОценок пока нет

- It 000095721007 2019 00Документ1 страницаIt 000095721007 2019 00Haroon ButtОценок пока нет

- It 000096024377 2017 00Документ1 страницаIt 000096024377 2017 00Haroon ButtОценок пока нет

- It 000135879998 2023 00Документ1 страницаIt 000135879998 2023 00Qavi UddinОценок пока нет

- Income Tax Payment Challan: PSID #: 43568625Документ1 страницаIncome Tax Payment Challan: PSID #: 43568625GM B&GОценок пока нет

- Income Tax Payment Challan: PSID #: 35390320Документ1 страницаIncome Tax Payment Challan: PSID #: 35390320zeshanОценок пока нет

- PSID# 36803358 (Junaid Paracha) PDFДокумент1 страницаPSID# 36803358 (Junaid Paracha) PDFAsif JavidОценок пока нет

- It 000126794858 2023 08Документ1 страницаIt 000126794858 2023 08Anas KhanОценок пока нет

- Income Tax Payment Challan: PSID #: 152672806Документ1 страницаIncome Tax Payment Challan: PSID #: 152672806JosephОценок пока нет

- Income Tax Payment Challan: PSID #: 164638694Документ1 страницаIncome Tax Payment Challan: PSID #: 164638694Syed Tahir ImamОценок пока нет

- It 000111825668 2020 00Документ1 страницаIt 000111825668 2020 00Muhammad IrfanОценок пока нет

- Abdul Ghaffar 14-10-19 PDFДокумент1 страницаAbdul Ghaffar 14-10-19 PDFAyan BОценок пока нет

- Musthtaq Azeem Atl Challan PDFДокумент1 страницаMusthtaq Azeem Atl Challan PDFFarhan AliОценок пока нет

- Income Tax Payment Challan: PSID #: 42719670Документ1 страницаIncome Tax Payment Challan: PSID #: 42719670Muhammad Qaisar LatifОценок пока нет

- Income Tax Payment Challan: PSID #: 21114984Документ1 страницаIncome Tax Payment Challan: PSID #: 21114984Zia Sultan AwanОценок пока нет

- It 000145577881 2023 00Документ1 страницаIt 000145577881 2023 00Hazrat BilalОценок пока нет

- Umair + Shahid PDFДокумент1 страницаUmair + Shahid PDFAyan BОценок пока нет

- DirectTaxesPaymentPSID UpdateNatureДокумент1 страницаDirectTaxesPaymentPSID UpdateNatureSkjhkjhkjhОценок пока нет

- It 000129964508 2022 11Документ1 страницаIt 000129964508 2022 11SkjhkjhkjhОценок пока нет

- Income Tax Payment Challan: PSID #: 48471182Документ1 страницаIncome Tax Payment Challan: PSID #: 48471182Haseeb RazaОценок пока нет

- Income Tax Payment Challan: PSID #: 145879823Документ1 страницаIncome Tax Payment Challan: PSID #: 145879823farhan aliОценок пока нет

- Income Tax Payment Challan: PSID #: 144740076Документ1 страницаIncome Tax Payment Challan: PSID #: 144740076usama ameenОценок пока нет

- Income Tax Payment Challan: PSID #: 35235957Документ1 страницаIncome Tax Payment Challan: PSID #: 35235957Ayan BОценок пока нет

- Income Tax Payment Challan: PSID #: 143186538Документ1 страницаIncome Tax Payment Challan: PSID #: 143186538talhaОценок пока нет

- Income Tax Payment Challan: PSID #: 165120097Документ1 страницаIncome Tax Payment Challan: PSID #: 165120097FBR GujranwalaОценок пока нет

- Income Tax Payment Challan: PSID #: 146916470Документ1 страницаIncome Tax Payment Challan: PSID #: 146916470Madiah abcОценок пока нет

- Income Tax Payment Challan: PSID #: 175921882Документ1 страницаIncome Tax Payment Challan: PSID #: 175921882taxhouse.kasur786Оценок пока нет

- It 000130702686 2021 00Документ1 страницаIt 000130702686 2021 00Qazi zubairОценок пока нет

- It 000146384671 2022 00Документ1 страницаIt 000146384671 2022 00zohaib hassan ShahОценок пока нет

- Income Tax Payment Challan: PSID #: 165866345Документ1 страницаIncome Tax Payment Challan: PSID #: 165866345Ashok KumarОценок пока нет

- It 000095777126 2020 06Документ1 страницаIt 000095777126 2020 06Haroon ButtОценок пока нет

- Saeed KhanДокумент1 страницаSaeed Khanattock jadeedОценок пока нет

- Income Tax Payment Challan: PSID #: 30308134Документ1 страницаIncome Tax Payment Challan: PSID #: 30308134Azam mughalОценок пока нет

- Income Tax Payment Challan: PSID #: 32849321Документ1 страницаIncome Tax Payment Challan: PSID #: 32849321hanzalah aminОценок пока нет

- Mushtaq & IshfaqДокумент1 страницаMushtaq & IshfaqAʌĸʌsʜ AƴʌŋОценок пока нет

- Income Tax Payment Challan: PSID #: 161602500Документ1 страницаIncome Tax Payment Challan: PSID #: 161602500Muhammad Asif BashirОценок пока нет

- Income Tax Payment Challan: PSID #: 171610056Документ1 страницаIncome Tax Payment Challan: PSID #: 171610056nadeemuzairОценок пока нет

- ReturnДокумент1 страницаReturnFaisal Islam ButtОценок пока нет

- Income Tax Payment Challan: PSID #: 139758233Документ1 страницаIncome Tax Payment Challan: PSID #: 139758233umaar99Оценок пока нет

- It 000130629196 2021 00Документ1 страницаIt 000130629196 2021 00muhammad faiqОценок пока нет

- Income Tax Payment Challan: PSID #: 42751407Документ1 страницаIncome Tax Payment Challan: PSID #: 42751407Muhammad Qaisar LatifОценок пока нет

- Income Tax Payment Challan: PSID #: 37536860Документ1 страницаIncome Tax Payment Challan: PSID #: 37536860Mohsin Ali Shaikh vlogsОценок пока нет

- It 000136741219 2023 05Документ1 страницаIt 000136741219 2023 05wali khelОценок пока нет

- Adjustable Tax-PSIDДокумент1 страницаAdjustable Tax-PSIDWaris Corp.Оценок пока нет

- Income Tax Payment Challan: PSID #: 47684385Документ1 страницаIncome Tax Payment Challan: PSID #: 47684385gandapur khanОценок пока нет

- It 000130389542 2023 11Документ1 страницаIt 000130389542 2023 11Muneeb ChaudhryОценок пока нет

- It 000016485106 2011 00Документ1 страницаIt 000016485106 2011 00AMMAR REHMANIОценок пока нет

- FBR FerozabadДокумент1 страницаFBR Ferozabadferozabad schoolОценок пока нет

- It 000126799893 2023 08Документ1 страницаIt 000126799893 2023 08Anas KhanОценок пока нет

- It 000136721186 2022 00Документ1 страницаIt 000136721186 2022 00wali khelОценок пока нет

- FBR ITO Assing Contractor 22feb2024Документ1 страницаFBR ITO Assing Contractor 22feb2024Syed TabishОценок пока нет

- 2021 10 18 Triangle MastercardДокумент2 страницы2021 10 18 Triangle MastercardAngela R Brittain0% (1)

- Ms - Kakani Sai Priyanka Chowdari: Page 1 of 1 M-8515039Документ1 страницаMs - Kakani Sai Priyanka Chowdari: Page 1 of 1 M-8515039Sai Raavan Chowdary KakaniОценок пока нет

- SCM Exam 3 ReviewДокумент3 страницыSCM Exam 3 Reviewadegroot130% (1)

- E-Receipt For State Bank Collect PaymentДокумент1 страницаE-Receipt For State Bank Collect PaymentAkashdeepGaneshОценок пока нет

- Thesis Accounts PayableДокумент2 страницыThesis Accounts PayableMarife Arellano AlcobendasОценок пока нет

- Total Tax Payable - 15142.4: Health Checkup (Max 5000), House Loan Interest Etc.Документ1 страницаTotal Tax Payable - 15142.4: Health Checkup (Max 5000), House Loan Interest Etc.Kumar RajadhyakshОценок пока нет

- Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceДокумент25 страницDate Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceVicky GunaОценок пока нет

- Lab Posttest 3 - Posting and Trial BalanceДокумент1 страницаLab Posttest 3 - Posting and Trial BalanceRaymond Pacaldo100% (4)

- Laporan Transaksi: No. Rekening Nama Produk Mata Uang Nomor CIFДокумент2 страницыLaporan Transaksi: No. Rekening Nama Produk Mata Uang Nomor CIFCasmitoPanjiОценок пока нет

- Statement of Axis Account No:912010049541859 For The Period (From: 30-04-2022 To: 29-05-2022)Документ5 страницStatement of Axis Account No:912010049541859 For The Period (From: 30-04-2022 To: 29-05-2022)Rahul BansalОценок пока нет

- Mrunal Banking - Bharat Bill Payment System (BBPS) ExplainedДокумент10 страницMrunal Banking - Bharat Bill Payment System (BBPS) ExplainedRahul KumarОценок пока нет

- Growth of The Use of Plastic Money in IndiaДокумент46 страницGrowth of The Use of Plastic Money in IndiaHarshitGupta81% (21)

- Filharmony Shipmanagement, Inc QuotationДокумент3 страницыFilharmony Shipmanagement, Inc QuotationJoel Albert FantoneОценок пока нет

- Business Plan Template ErasmusДокумент14 страницBusiness Plan Template ErasmusTajudin MMОценок пока нет

- Onebill Invoice FormatДокумент3 страницыOnebill Invoice FormatiCloud GuruОценок пока нет

- Incoterms ® 2010 Rules Chart of ResponsibilityДокумент1 страницаIncoterms ® 2010 Rules Chart of Responsibilityvinoth rotemОценок пока нет

- Account StatementДокумент6 страницAccount StatementHussainОценок пока нет

- Mpesa Data KenyaДокумент18 страницMpesa Data KenyaagweyoОценок пока нет

- ITX 240.01.B - VAT Monthly ReturnДокумент2 страницыITX 240.01.B - VAT Monthly ReturnFredben BenardОценок пока нет

- Accounting Adjusting EntriesДокумент12 страницAccounting Adjusting EntriesChin-Chin SantiagoОценок пока нет

- Forex Service Charges: Exports Bills Purchased /Discounted/NegotiatedДокумент9 страницForex Service Charges: Exports Bills Purchased /Discounted/NegotiatedSameer GhogaleОценок пока нет

- 1MT#4 Daily Activity - Store Operation (To Send)Документ8 страниц1MT#4 Daily Activity - Store Operation (To Send)Jarwo KuatОценок пока нет

- R CodesДокумент5 страницR CodesFermikeОценок пока нет

- Gmail - Your Sunday Evening Trip With Uber PDFДокумент4 страницыGmail - Your Sunday Evening Trip With Uber PDFAnonymous 0Rc3aqQОценок пока нет

- Uttarakhand Transport Corporation E-Ticket: Fare DetailДокумент1 страницаUttarakhand Transport Corporation E-Ticket: Fare DetailAnindya SharmaОценок пока нет

- Account Summary: Statement Date:20/12/2021 Loan No: 0036 1150 XXXX 9510 Payment Due Date Total Dues Loan AmountДокумент1 страницаAccount Summary: Statement Date:20/12/2021 Loan No: 0036 1150 XXXX 9510 Payment Due Date Total Dues Loan AmountbimexetОценок пока нет

- What Are The Agency Services Rendered by Bank?: Funds Transfer ServiceДокумент2 страницыWhat Are The Agency Services Rendered by Bank?: Funds Transfer ServiceAnkitha TheresОценок пока нет

- Customer Credit CardInfo High Sev EDMДокумент4 страницыCustomer Credit CardInfo High Sev EDMFabian Valero Duque100% (7)

- Exercises of Bank Reconciliation Statement: Exercise No. IДокумент9 страницExercises of Bank Reconciliation Statement: Exercise No. ITayyab AliОценок пока нет

- Passbookstmt 1682942556469Документ4 страницыPassbookstmt 1682942556469DeeptiОценок пока нет