Академический Документы

Профессиональный Документы

Культура Документы

Omkar Gaikwad Project..Suk

Загружено:

Rutuja BhujbalОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Omkar Gaikwad Project..Suk

Загружено:

Rutuja BhujbalАвторское право:

Доступные форматы

Predicting Loan Default

“Predicting Loan Default”

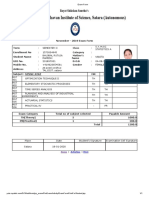

A PROJECT REPORT SUBMITTED TO

DEPARTMENT OF STATISTICS, SHIVAJI UNIVERSITY,

KOLHAPUR

FOR THE PARTIAL FULFILMENT OF THE DEGREE OF

MASTER OF SCIENCE

IN

STATISTICS

SUBMITED BY

Mr. GAIKWAD OMKAR SHAMRAO

DEPARTMENT OF STATISTICS, SHIVAJI UNIVERSITY,

KOLHAPUR.

Department of Statistics, Shivaji University, Kolhapur. Page 1

Predicting Loan Default

CERTIFICATE

This is to certify that the project entitled “Predicting Loan

Default”, being submitted by Mr. Gaikwad Omkar Shamrao, as a

partial fulfillment for the award of degree of M.Sc. in statistics of

Shivaji University, Kolhapur, is a record of bonafide work carried out

by him under my supervision and guidance. To the best my

knowledge the matter presented in the project has not been submitted

earlier.

Place : Kolhapur Mr. S. D. Pawar Dr. D.T. Shirke

Date : Project Guide Head of Department,

Department of Statistics,

Shivaji University,

Kolhapur.

Department of Statistics, Shivaji University, Kolhapur. Page 2

Predicting Loan Default

Acknowledgement

We wish to thank Department of Statistics (Shivaji University,

Kolhapur) for giving us an opportunity to do a project.

This report has been prepared under the guidance of Mr.

S.D.Pawar. We would like to express our profound gratitude towards

him for his guidance we constructive throughout this project.

Also we would like to thank head of department Dr. D. T.

Shirke and all faculty members. Also we would like thank to Mr.

Bhushan Kambale (Business Analyst, American Express India Pvt Ltd

Gurgaon) and Mr. A. A. Redekar (Statistical officer, statistical cell,

Shivaji University Kolhapur) for their support, suggestions and

guidance for this project.

Finally we would like to thank Research Students non-teaching

staff and of our Department for their valuable co-operation in this

project.

Department of Statistics, Shivaji University, Kolhapur. Page 3

Predicting Loan Default

Contents

Summary

Introduction

About data

Objectives

Statistical tools and software’s

Understanding variables, it’s distribution and relation with

default status

Model Building

Scope and Limitations

Major findings

References

Department of Statistics, Shivaji University, Kolhapur. Page 4

Predicting Loan Default

Summary:

Objective: Now a day’s the prediction of defaulting the borrower in future is a

challenging task for credit card companies. Therefore the main objective of this

project is to develop prediction models for defaulting the borrower in the future

by taking advantage of available technological advancement.

Methods and material: We used three popular data mining algorithms

(artificial neural network, decision tree and Naïve Bayesian classifier) along with

a most commonly used statistical method (logistic regression) to develop the

prediction models using a large dataset (150000 instances). Also we use two

sampling methods to develop models (undersampling and oversampling).

Results: The results indicated that the Naïve Bayesian classifier is the best

predictor with accuracy 92.4% and sensitivity 31.6% on the holdout dataset and

with accuracy 79.1% and specificity 81.4% on the undersampling dataset and

decision tree (J48) is the best predictor with accuracy 94.9% and specificity 99.7%

on oversampling dataset. Performance of logistic regression for given dataset is

not well.

Department of Statistics, Shivaji University, Kolhapur. Page 5

Predicting Loan Default

1. Introduction:-

We know that now a day’s bank play a crucial role in market economy.

Before giving a credit loan to borrowers, bank decides who is bad (defaulter) or

good (non defaulter) borrower. The prediction of borrower status i.e. in future

borrower will be defaulter or non defaulter is a challenging task for bank. The

loan defaulter prediction is a binary classification problem. For market and

society to function, individuals and companies need access to credit. Credit

scoring algorithm, which make a guess of probability of default, are the methods

bank use to determine whether or not a loan should be granted. In this project,

historical data on 150000 borrowers is analyzed. I implement various

classification algorithms namely artificial neural network, logistic regression,

decision tree and Naïve Bayesian to predict the probability of borrower will fail

in next two year. Also data is imbalanced so I use various sampling technique

like undersampling and oversampling (Maciej A. Mazurowski, 2008) and

compare the results with regular technique of building the model.

The problem is to classify borrower as defaulter or non defaulter. It is

commonly desired for banks to classify borrower accurately so as to manage their

loan risk better and increase business. However developing such a model is a

very challenging due to growing demand for loans. Data size is very huge and

some question arises about relevancy of data. Some banks are using data

warehouse technologies to support development and update the models. Mostly

banks use the logistic regression to evaluate customer risk. This project will

attempt to use some traditional classification models like Artificial Neural

Network, Logistic regression, Decision tree and Naïve Bayesian classifier and

attempt to create superior model using Sample Explore Modify Model and

Assess (SEMMA) methodology to better predict customer default.

Department of Statistics, Shivaji University, Kolhapur. Page 6

Predicting Loan Default

2. About data:-

2.1. Data source:

The data set used for this project is obtained from the competition titled

“Give Me Some Credit” in kaggle.com. The file contains various parameters such

as Monthly Income, Number of Dependents, age, number of open credit lines and

loans etc. It is stored in csv format.

2.2. Data description:

In this data there are 150000 instances and ten continuous variables and

one binary variable coded as 0 or 1 and which is our response variable. Means we

classify the new borrowers either a 0 or 1. The list of variable is as follows,

Sr. No. Variable Name Type

1 Serious Delinquent in 2 years Binary

2 Revolving Utilization Of Unsecured Lines percentage

3 Borrowers Age Integer

4 Debit Ratio percentage

Real

5 Monthly Income Number

6 Number Of Open Credit Lines And Loans Integer

7 Number of Real Estate Loans Or Lines Integer

8 Number Of Time 30-59 Days Past Due Not Worse Integer

9 Number Of Time60-89 Days Past Due Not Worse Integer

10 Number Of Times 90 Days Late Integer

11 Number Of Dependents Integer

2.3. Terminology:-

I describe some term related with this project like credit card, delinquency,

credit score, utilization etc.

i) Credit Card:-

Credit card is a type of financial account. By using credit cards,

customers can offers a bank’s money instead of their own to pay for a product

or service today, and over time, they repay the bank. For the benefit of using

someone else’s money, customers will often need to pay interest, as expected

with other types of loans.

ii) Default:-

When payments are not made in time and according to the agreement

signed by the card holder, the account is said to be in default.

iii) Delinquency:-

The term delinquent commonly refers to a situation where a borrower is

late or overdue on a credit payment. If borrower is in default, the bank that has

issued card is entitled to charge borrower a higher interest rate for that

particular billing period as a penalty.

Department of Statistics, Shivaji University, Kolhapur. Page 7

Predicting Loan Default

iv) Credit Score:-

Credit score is numerical expression based on a level of analysis of a

person’s credit files. Simply it is representation of creditworthiness of a

borrower.

v) Utilization:-

Utilization is a percentage of consumer’s available credit that borrower

has used. The credit utilization ratio is key component of borrower credit card.

3. Objectives:-

Keeping in view the above discussion, the following objectives has

been laid down;

1) To study the relationship between available variables and status of

default.

2) To model the relationship between available variables and status of

default.

4. Statistical tools:-

i) Frequency Table

ii) Logistic Regression

iii) Data mining classifiers: Artificial Neural Network, Decision Tree and

Naïve Bayesian classifier

5. Statistical and data mining software:-

i) SAS

ii) WEKA

6. Understanding variables and relation with default status:-

In this section we give description of each variable. First we check

relation of all variables with default status by using frequency table. The

frequency distribution of each variable is as follows.

Department of Statistics, Shivaji University, Kolhapur. Page 8

Predicting Loan Default

6.1. Frequency Table:-

i) Serious Delinquent in 2 years:-

Description:

This is of binary type. Our algorithm is used to predict this. This depicts

whether a person experienced 90 days past due delinquency or worse.

The number of defaulter instances in this variable is 10026 i.e. 6.68%

among the all instances.

ii) Number of revolving utilization of unsecured lines:-

Description:

Total balance on credit cards and personal lines of credit except real estate

and no installment debt like car loans divided by the sum of credit limits. This is in

percentage.

This variables contain some outliers. Most of the value of this variable lies

between 0 and 1 but sometimes it exceed to 1 because some borrowers use more

credit than credit limit.

Total Defaulter

Revolving % of

utilization Number cases Number % of cases

less than 0.25 87657 58.44 1873 2.14

0.25-0.5 21055 14.04 1114 5.29

0.5-0.75 13764 9.18 1394 10.13

0.75-1.0 24203 16.14 4408 18.21

1.0-2.0 2950 1.97 1183 40.1

above 2 371 0.25 54 14.56

From above table it is clear that as a revolving utilization of unsecured

lines increases the percentage of defaulters is increase. If revolving utilization of

unsecured lines is between 1 to 2 then chances of borrowers will be default is

high.

Department of Statistics, Shivaji University, Kolhapur. Page 9

Predicting Loan Default

iii) Borrowers Age:-

Description:

This variable contains the age of the borrower in years. It is of integer

type. This column didn’t contain any missing data. The frequency table and

percentage of defaulter of this variable is,

Total Defaulter

Borrower Age Number % of cases Number % of cases

less than 25 3028 2.02 338 11.16

26-35 18458 12.31 2053 11.12

36-45 29819 19.88 2628 8.81

46-55 36690 24.46 2786 7.59

56-65 33406 22.27 1531 4.58

above 65 28599 19.07 690 2.41

From above table we can say that the elder borrowers are most likely to

defaulter than older borrowers. Near about 85% borrowers have age greater than 35.

iv) Debit Ratio:-

Description:

This variable contains data in percentage form. It is obtained by

dividing the sum of monthly debt payments, alimony, living costs with monthly

gross income.

Debit ratio is the ratio of total debit and total asset. Most of the time

it is lies between 0 and 1 but sometime it is exceed to 1 because sometime total

asset is much less than total debit.

Total Defaulter

% of

Debit ratio Number cases Number % of cases

less than 0.25 52361 34.91 3126 5.97

0.25-0.5 41347 27.56 2529 6.12

0.5-0.75 15728 10.49 1484 9.44

0.75-1.0 5427 3.62 596 10.98

1.0-2.0 4092 2.73 539 13.17

above 2 31045 20.7 1752 5.64

As like revolving utilization of unsecured lines if debit ratio is increases the

proportion of borrower will be defaults is increase. The percentage of defaulters is

high when debit ratio is in between 1 to 2.

Department of Statistics, Shivaji University, Kolhapur. Page 10

Predicting Loan Default

v) Monthly Income:-

Description:

This column contained the information about the monthly income of an

individual.

The unit of income is unknown i.e. we don’t know the given income of

borrowers is in rupees or in dollars. Also this column contains some missing value.

We don’t know the exact value of those observations. Near about 29731(20%)

observations are missing.

Total Defaulter

% of

Monthly income Number cases Number % of cases

below 5000 55859 46.45 4813 8.62

5001-10000 46091 38.32 2752 5.97

10001-15000 13035 10.84 547 4.2

above 15000 5284 4.39 245 4.64

From the above table we can say that nearly 85% borrowers have monthly

income less than 10000 Unit. Proportion of defaulters are much high when income

of borrower is below than 5000 Unit.

vi) Number of open credit lines and loans:-

Description:

This column contained information about the number of open loans

such as car loans, house loans and lines of credit (ex. Credit card).

Number of open Total Defaulter

credit lines and % of

loans Number cases Number % of cases

below 5 46590 31.06 3922 8.42

6 to 10 60400 40.06 3345 5.54

11 to 15 29184 19.46 1804 6.18

16 to 20 9846 6.56 676 6.87

21 to 25 2841 1.89 191 6.72

26 to 30 785 0.52 62 7.9

above 30 354 0.24 26 7.34

Above table shows that nearly 70% borrowers use less than 10 open credit

lines and loans. The proportion of defaulters is overall equal.

Department of Statistics, Shivaji University, Kolhapur. Page 11

Predicting Loan Default

vii) Number of real estate and loans:-

Description:

This variable contained information about number of mortgage and

real estate loans including home equity lines of credit an individual have taken.

Total Defaulter

Number of real % of

estate loans & lines Number cases Number % of cases

below 5 149207 99.47 9884 6.62

6 to 10 699 0.47 121 17.31

11 to 15 70 0.05 16 22.86

16 to 20 14 0.01 3 21.43

above 20 10 0.01 2 20

From above table we can say that almost 99% borrowers have a

number of real estate loans is less than five. But proportion of defaulter borrowers

is high when number of real estate loans is greater than 5.

viii) Number of times 30-59 days past due but not worse:-

Description:

This variable contains number of times borrower has been 30-59 days

past due but no worse in the last 2 years.

Number of times Total Defaulter

30-59 days late Number % of cases Number % of cases

0 126018 84.01 5041 4

1 16033 10.69 2409 15.03

2 4598 3.07 1219 26.51

3 1754 1.17 618 35.23

4 747 0.5 318 42.57

5 342 0.23 154 45.03

6 140 0.09 74 52.86

7 54 0.04 28 51.85

above 7 314 0.21 165 52.54

From the above table it is clear that the percentage of defaulter borrowers is

high if they are more times late to pay their credit (30-59 days late).

Department of Statistics, Shivaji University, Kolhapur. Page 12

Predicting Loan Default

ix) Number of times 60-89 days past due but not worse:-

Description:

This variable contains the information about the number of times borrower

has been 60-89 days past due but no worse in the last 2 years.

Number of times Total Defaulter

60-89 days late Number % of cases Number % of cases

0 142396 94.93 7256 5.1

1 5731 3.82 1777 31.01

2 1118 0.75 561 50.18

3 318 0.21 180 56.6

4 105 0.07 65 61.9

5 34 0.02 21 61.76

Above 6 298 0.2 166 55.7

As like previous table this table also shows that defaulting rate is increases

as number of times delinquency of borrowers in 60-89 days increases.

x) Number of times 90 days late:-

Description:

This variable had information about the number of times an individual

was late by 90 days or more in paying their bills.

Number of times Total Defaulter

90 days late Number % of cases Number % of cases

0 141662 94.44 6554 4.63

1 5243 3.5 1765 33.66

2 1555 1.04 776 49.9

3 667 0.44 385 57.72

4 291 0.19 195 67.01

5 131 0.09 83 63.36

6 80 0.05 48 60

above 6 371 0.25 220 59.3

The proportion of defaulters is high when the more times borrower

has late to pay their credit bill.

Department of Statistics, Shivaji University, Kolhapur. Page 13

Predicting Loan Default

xi) Number of dependent:-

Description:

This variable contained information about the number of dependents

in the family excluding themselves. Near about 3924 values of this variable are

missing. We replace all missing values of this column by mode of that attribute and

mode is ‘0’.

Total Defaulter

Dependent Number % of cases Number % of cases

0 90826 60.55 5095 5.61

1 26316 17.54 1935 7.35

2 19522 13.01 1584 8.11

3 9483 6.32 837 8.83

4 2862 1.91 297 10.38

5 and above 991 0.66 99 9.98

From above table we can say that most of the individuals i.e. 61% are

single or no anyone is dependent on his. But the distribution of defaulting

borrowers is same for all values except for those individuals are single.

6.2. Descriptive Analysis:-

Following table shows descriptive statistic of all variables.

Variable

Mean SD Q1 median Q3

Name

utilization 6.05 249.76 0.0299 0.1542 0.5590

age 52.30 14.77 41 52 63

debitratio 353.01 2037.82 0.1751 0.3665 0.8683

income 6670.22 14384.67 3400 5400 8249

credit_lines 8.45 5.15 5 8 11

real_estate 1.02 1.13 0 1 2

del_30_59 0.42 4.19 0 0 0

del_60_89 0.24 4.16 0 0 0

del_90 0.27 4.17 0 0 0

dependent 0.76 1.12 0 0 1

* SD: Standard Deviation Q1: First quartile Q3:Third quartile

Department of Statistics, Shivaji University, Kolhapur. Page 14

Predicting Loan Default

Conclusion:-

i) Average of revolving utilization of unsecured lines of all borrowers is 6.05

with standard deviation 249.76. But 75% borrowers have a revolving utilization is

less than 0.56.

ii) On a average age of borrowers is nearly equal to 52 and also 50%

borrowers have a age below 52 or above.

iii) Mean of debit ratio is 353.01 and 75% borrowers have debit ratio less

than 0.87 means very few observations have debit ratio is high and which is

affected on average of debit ratio.

iv) On a average borrowers have income is 6670.22 unit.

6.3.T-Test of each variable with response variable:-

Now I check the relationship between defaulter variable and all other

variables. This will be checking by using test of equality of means i.e. T test

with unequal variance. Here we take two groups as defaulter (1) and non

defaulter (0). Here we use Welch’s t-test for testing equality of two means. By

using SAS command PROC TTEST following tables are obtained,

Mean of each variable

Serious Delinquent

Variables 0 (mean) 1(mean) P-value

Revolving utilization of unsecured lines 6.1689 4.3673 0.2248

Borrowers Age 52.7514 45.9266 0.0001

Number of times 30-59 days past due 0.2801 2.3885 0.0001

Debit ratio 357.2 295.1 0.0001

monthly income 6747.8 5630.8 0.0001

number of open credit lines and loans 8.4936 7.8823 0.0001

number of times 90 days late 0.1352 2.0914 0.0001

number real estate loans or lines 1.0204 0.9885 0.0001

number of time 60-89 days past due not worse 0.1267 1.828 0.0001

number of dependent 0.7434 0.9482 0.0001

* 0 : Non Defaulter 1 : Defaulter

Department of Statistics, Shivaji University, Kolhapur. Page 15

Predicting Loan Default

7. Model Building:-

First I delete those observations that contain at least one missing observation.

After deleting missing observations our data contains 120269 observations and 11

variables. Among these observations defaulting customers are 8357 (i.e. 6.95%).

As we seen in above section some variables contains unlikely values like age

variable has value ‘0’. So the following changes made in data,

i) ‘0’ value replaced by median of corresponding variable in age variable.

ii) ‘98’ and ‘96’ value replaced by 13 in number of delinquent in 30-59 days

variable.

iii) ‘98’ and ‘96’ value replaced by 11 in number of delinquent in 60-89 days

variable.

iv) ‘98’ and ‘96’ value replaced by 17 in 90 days late for paying credit bill.

Where 96 represent non response and 98 represent other.

After changes in data we use artificial neural network, logistic regression,

decision trees and naïve Bayesian classifier algorithms. This models have been

selected for this study because of their popularity in the recent literature. I first give

a short description of these classification models.

7.1.1. Artificial Neural Network:-

Artificial neural network(ANN) are commonly known as biological

inspired, sophisticated analytical technique, capable of modeling extremely

complex non-linear function. We used a popular ANN architecture called

multilayer perceptron (MLP) with back-propagation. The MLP is known to be a

powerful function approximator for prediction and classification problems. It is the

most commonly used and well studied ANN architecture. The MLP is essentially

the collection of nonlinear neurons organized and connected to each other in a

feedforward multilayer structure.

7.1.2. Logistic Regression model:-

Logistic regression is the generalization of linear regression. It is used

primarily for predicting binary or multiclass dependent variables. Because the

response variable is discrete, it cannot be modeled directly by linear regression.

Therefore, rather than predicting point estimate of the event itself, it builds the

model to predict the odds of its occurrence. In two class problem odds greater than

50% would mean that the case is assigned to the class designed as “1” and “0”

otherwise. While logistic regression is a powerful modeling tool, it assumes that

the response variable is linear in the coefficients of the predictor variable.

Department of Statistics, Shivaji University, Kolhapur. Page 16

Predicting Loan Default

7.1.3. Decision Tree:-

Decision tree are powerful classification algorithm that are becoming

increasing more popular with the growth of data mining in the field of information

systems. In the literature there are so many popular decision tree algorithms like

ID3, C4.5, C5 etc. As the name implies, this technique recursively separates

observations in branches to construct a tree for the purpose of improving the

prediction accuracy. In doing so, they use mathematical algorithms like information

gain, Gini index to identify a variable and corresponding threshold for the variable

that splits the input observation into two or more subgroups. This step is repeated

at each leaf node until the complete tree is conducted. The objective of the splitting

pair that maximizes the homogeneity of the resulting two or more subgroup

samples. The most commonly used mathematical algorithm for splitting includes

Entropy based information gain used in ID3, C4.5 and C5. Gini index used in

CART. In this study I choose to use J48 algorithm as our decision tree method

which is a simple C4.5 decision tree for classification.

7.1.4. Naïve Bayesian Classifier:-

The Naïve Bayes algorithm is a simple probabilistic classifier that

calculates a set of probabilities by counting the frequency and combinations of

values in a given dataset. The algorithm uses Bayes theorem and assumes all

attributes to be independent given the value of class variable. This conditional

independence assumption rarely holds true in real world applications, hence the

characterization as Naïve yet the algorithm tends to perform well and learn rapidly

in various supervised classification problems. Naïve Bayes classifier is based on

Bayes theorem and the theorem of total probability.

In this classifier we compute the conditional probability P(Cj/X) and

assign X to those class Ci having large probability i.e. Xϵ Cj if P(Cj/X)>P(Ci/X) for

all i≠j=1,2,….,m.

7.2. Measures for performance evaluation:-

In this study I used three performance measures: accuracy, sensitivity,

specificity.

i) Accuracy = It is a rate of true classified instances.

ii) Sensitivity= It is a rate of true positive classified instances.

iii) Specificity=It is a ratio of true negative instances and total observed negative

instances.

Department of Statistics, Shivaji University, Kolhapur. Page 17

Predicting Loan Default

To develop a model we partition the data into two part training dataset and

testing dataset. First I build the model on training dataset and then check the

performance of model on testing dataset. The methodology and performance of

every model is as follows,

a) Artificial Neural Network:-

I used sigmoid activation function and six hidden unites in hidden

layers. By using WEKA software I build the model and corresponding result are as

follows,

Weight matrix:

Input layer to hidden layer

variable node 1 node 2 node 3 node 4 node 5 node 6

Threshold -21.03 -11.01 -11.69 -7.48 -9.77 -10.55

utilization 18.78 8.84 10.08 6.84 9.64 9.09

Age 0.53 -2.15 1.84 4.49 0.61 5.26

del_30_59 -20.63 -20.04 -2.10 -1.50 -14.76 0.42

debitratio 20.36 11.21 8.99 6.93 7.83 10.68

income 29.45 16.67 19.14 12.62 12.43 16.24

credit_lines 4.63 17.51 -2.05 -1.62 21.07 -15.80

del_90 -38.25 -32.67 -28.83 -24.41 -24.28 -23.29

real_estate -10.25 5.11 -3.04 -0.04 -7.67 -15.18

del_60_89 -22.72 -12.46 -13.49 -11.23 -8.35 -10.05

dependent -2.13 -4.53 -2.87 4.95 -10.50 6.98

hidden layer to output layer

Hidden node Intercept node 1 node 2 node 3 node 4 node 5

defaulter 1.40 1.63 0.93 0.46 1.02 0.25

non defaulter -1.40 -1.63 -0.93 -0.46 -1.02 -0.25

The cutoff point is 0.5 used for the above model and the confusion matrix of

testing data is,

obs.\pred. Non def. Defaulter Total

Non def. 33330 264 33594

Defaulter 2091 396 2487

Total 35421 660 36081

Department of Statistics, Shivaji University, Kolhapur. Page 18

Predicting Loan Default

b) Logistic Regression model:-

I develop a model on training dataset by using SAS software. Stepwise

variable selection procedure is used for variable selection and result is as follows,

Summary of Stepwise Selection

Step Effect DF ScoreChi-Square WaldChi-Square Pr > ChiSq

1 del_30_59 1 5764.7015 1407.508 <.0001

2 del_90 1 1794.1215 756.6357 <.0001

3 age 1 580.5198 448.2811 <.0001

4 del_60_89 1 230.6534 207.9419 <.0001

5 dependent 1 22.8346 34.2155 <.0001

6 income 1 15.4233 83.9022 <.0001

7 real_estate 1 44.5306 44.5684 <.0001

8 debitratio 1 4.6635 4.9928 0.0308

Utilization and number of credit lines variables removed in stepwise procedure.

Estimates of coefficients is,

coefficients intercept age del_30_90 debitratio income del_90 real_estate del_60_89 dependent

estimate -1.76 -0.0241 0.5165 -0.00012 -0.00004 0.5488 0.0833 0.4193 0.0706

ROC Curve of logistic model:-

ROC curve for logistic regression is as follows,

Department of Statistics, Shivaji University, Kolhapur. Page 19

Predicting Loan Default

Since area under the curve is 0.7947, hence our model is appropriate model for

given data. From above ROC curve cut off point is 0.5. The confusion matrix of

testing data is,

obs.\pred. Non def. Defaulter Total

Non def. 33372 152 33524

Defaulter 2303 254 2557

Total 35675 406 36081

c) Naïve Bayesian Classifier:-

I use WEKA software to build Naïve Bayesian classifier. The confusion

matrix by using testing data is,

obs.\pred. Non def. Defaulter Total

Non def. 32579 1015 33594

Defaulter 1700 787 2487

Total 34279 1802 36081

d) Decision Tree:-

I use WEKA software to build tree. In WEKA software Gini index is

used to determine splitting variable.

Splitting variable = 90 days late for paying credit bill.

The confusion matrix by using testing data is as follows,

obs.\pred. Non def. Defaulter Total

Non def. 33284 310 33594

Defaulter 2079 408 2487

Total 35363 718 36081

The performance of above all classifiers is compared in following table,

Performance Area Under

Accuracy Sensitivity Specificity

measure / Classifiers Curve

ANN 0.934 0.159 0.992 0.815

Logistic regression 0.934 0.095 0.995 0.794

Naive Bayesian 0.924 0.316 0.969 0.795

Decision Tree 0.933 0.164 0.991 0.685

Department of Statistics, Shivaji University, Kolhapur. Page 20

Predicting Loan Default

From above table it is clear that accuracy of all classifier is nearly same but

sensitivity of Naïve Bayesian classifier is greater than all other classifiers. Naïve

Bayesian classifier achieves accuracy 92.475 with sensitivity 31.6 and specificity

96.97

To account for the class imbalance, two standard methods were evaluated,

namely undersampling and oversampling (Maciej A. Mazurowski, 2008). In

undersampling, instances from the overrepresented class are removed and make a

data balance. This method is useful for classification but drawback is that potentially

useful instances are discarded from training. In oversampling, instances from the

underrepresented class are copied several times such that make a balanced dataset.

Undersampling Method:-

In previous section we build the model on imbalance data i.e 93/7 data.

In this section I removed the non defaulter instances randomly to make dataset

balanced. We know that 8357 borrowers are defaulters and remaining are non

defaulters, so we take 7% sample without replacement from non defaulters and

combine data. Again we partition the data into training set and testing set. Develop

the model on training dataset and calculate performance measures. Repeat this

procedure into 10 times and take average of performance measures. The

performance of each model is shown in following table,

Performance Measure

Statistical Models Accuracy Sensitivity Specificity AUC

ANN Mean 0.736 0.659 0.818 0.815

SD 0.008 0.083 0.085 0.005

Logistic regression Mean 0.735 0.626 0.855 0.808

SD 0.006 0.016 0.011 0.007

Naïve Bayesian Mean 0.791 0.814 0.766 0.86

SD 0.01 0.016 0.025 0.011

Decision Tree Mean 0.713 0.551 0.888 0.796

SD 0.018 0.071 0.045 0.007

Hence Naïve Bayesian classifier achieves 79.1% accuracy with 81.4%

sensitivity and 76.6% specificity. Also area under curve (AUC) is 0.86.

Department of Statistics, Shivaji University, Kolhapur. Page 21

Predicting Loan Default

Oversampling Results:-

In this section I copied the defaulter instances several times such that data

make balance. We know that among 120269 instances 8357 instances are defaulters

and remaining are non defaulters. So I copied defaulter instances 13 times and make

dataset balance. Now our data contains 220553 instances. The performance of various

classifiers is given in following table,

Accuracy Sensitivity Specificity AUC

ANN 0.754 0.681 0.826 0.82

Logistic regression 0.738 0.601 0.871 0.808

Naïve Bayesian 0.712 0.493 0.922 0.799

Decision Tree 0.949 0.997 0.901 0.956

From above table it is clear that accuracy of decision tree is larger than all

other classifiers. Accuracy achieved by decision tree is 94.96% with sensitivity 99.7%

and specificity 90.1% and AUC is 0.956.

8. Scope and Limitations:-

Scope:

As studied, analysis of this project is concerned with credit risk or bank

loan defaults. Also our analysis gives better results. Similarly this analysis is useful

for other problems related with medical studies like predicting cancer survivability.

Also this project is useful for dealing with imbalance dataset.

Limitation:

For this project we have data on 10 variables listed as above. Some variable

like occupation, education, living status etc of borrowers are not consider in these

study. We develop model only with available variables but if add other important

variables then we expect that our models gives better results.

Department of Statistics, Shivaji University, Kolhapur. Page 22

Predicting Loan Default

9. Major Findings:-

In accordance with the SEEMA methodology, after obtaining the sample

data we started by understanding variables and relation with defaulting status. Also

skewness of the data has significant effect on analysis. Also dealing with missing

values is an important step of the data cleaning. We further modeled our data using

various classification techniques artificial neural network, logistic regression,

decision tree and Naïve Bayesian classifier. Then when assessing the various

techniques, we used ROC curve, Accuracy, Sensitivity, Specificity etc. to compare

the results. ROC values were most similar for most of the techniques but results

were not great in terms of the sensitivity. This was because of the 93:7 Proportion

of the events. So by changing the sampling method ( undersampling and

oversampling) we get better results of about 79% sensitivity using undersampling

method and 99.7% sensitivity using oversampling method.

10. Conclusion:-

In conclusion, we can show that it is possible to use a superior analytics

algorithm through the use of different sampling method to correctly classify

customers according to their probability of default. We believe that Naïve

Bayesian classifier classifies customer as close to true model when data is

imbalance but decision tree give better results when we make data balance by

using oversampling method.

11. Reference:-

i) Mazurowski M.A., Habas P.A., Zurada J.M., Lo J.Y., Baker J.A., Tourassi G.D.

(2008). Training neural network classifiers for medical decision making: The

effects of imbalanced dataset on classification performance. Neural Network,

21, 427-436.

ii) Dursun Delen, Glenn Walker, Amit Kadam (2004). Predicting breast cancer

survivability: a comparison of thee data mining methods. Artificial

Intelligence in Medicine, 34, 113-127.

iii) Jiawei Han, Micheline Kamber, Jian Pei (2011). Data Mining: Concepts and

Techniques, Third Edition.

Department of Statistics, Shivaji University, Kolhapur. Page 23

Вам также может понравиться

- AnujArora (7 0)Документ2 страницыAnujArora (7 0)Sourabh SharmaОценок пока нет

- Counter Design For Monitoring Shopping Mall Entrances During Covid-19Документ3 страницыCounter Design For Monitoring Shopping Mall Entrances During Covid-19International Journal of Innovative Science and Research Technology100% (1)

- IOT Based Accident Prevention and Detection System Using GSM-GPS, Eye Blink, and Alcohol SensorДокумент8 страницIOT Based Accident Prevention and Detection System Using GSM-GPS, Eye Blink, and Alcohol SensorIJRASETPublicationsОценок пока нет

- Detection and Diagnosis of COVID-19 Via SVMbased Analyses of X-Ray Images and Their EmbeddingsДокумент5 страницDetection and Diagnosis of COVID-19 Via SVMbased Analyses of X-Ray Images and Their EmbeddingsInternational Journal of Innovative Science and Research TechnologyОценок пока нет

- Final ReportДокумент8 страницFinal Reportapi-543198516Оценок пока нет

- Cargo Booking SystemДокумент3 страницыCargo Booking Systemchoudharydivesh9210Оценок пока нет

- Research Study On Loan Default by SHGДокумент101 страницаResearch Study On Loan Default by SHGramaknta100% (1)

- Erp For Manufacturing IndustryДокумент3 страницыErp For Manufacturing IndustrylighthouseindiaОценок пока нет

- Digital Vaccination Passport Using Blockchain TechnologyДокумент5 страницDigital Vaccination Passport Using Blockchain TechnologyInternational Journal of Innovative Science and Research TechnologyОценок пока нет

- Emprasa Startup CityДокумент20 страницEmprasa Startup CityEmprasa Startup CityОценок пока нет

- Blood Finder ApplicationДокумент96 страницBlood Finder ApplicationROHITОценок пока нет

- All Project IdeasДокумент38 страницAll Project IdeasRed SageОценок пока нет

- Art. 2, 3R ChinaДокумент9 страницArt. 2, 3R ChinaAurio CevallosОценок пока нет

- Location Based Information App For Ambulance and PoliceДокумент1 страницаLocation Based Information App For Ambulance and PoliceshitalОценок пока нет

- Online Blood-Bank-System Project Synopsis in PHPДокумент38 страницOnline Blood-Bank-System Project Synopsis in PHPAryan SinghОценок пока нет

- Location Based AlarmДокумент5 страницLocation Based Alarmhappy2009y100% (2)

- Design and Implementation of Computerized Child Abuse Database Management SystemДокумент71 страницаDesign and Implementation of Computerized Child Abuse Database Management SystemEmmanuel NnamОценок пока нет

- Medicine Reminder Project MAINДокумент9 страницMedicine Reminder Project MAINReal Ghost100% (1)

- Bus Pass Management System Documentation 2Документ82 страницыBus Pass Management System Documentation 2Nilesh KumarОценок пока нет

- Test CasesДокумент27 страницTest Casesbhagyanath100% (1)

- cs42 PROJECT REPORTДокумент17 страницcs42 PROJECT REPORTWaqar AHMADОценок пока нет

- Garage Booking System-Chapter1Документ5 страницGarage Booking System-Chapter1Jbee TrendsОценок пока нет

- Project Report - Part 3 - Full Report Conclusion Repaired)Документ49 страницProject Report - Part 3 - Full Report Conclusion Repaired)dinesh_kumar_32567% (6)

- Online Bus Ticket Reservation SystemДокумент15 страницOnline Bus Ticket Reservation SystemMonalisa M GowdaОценок пока нет

- Synopsis MultiLevel MarketingДокумент17 страницSynopsis MultiLevel MarketingRaj Bangalore100% (2)

- Arpan - Food Donation Android ApplicationДокумент28 страницArpan - Food Donation Android ApplicationTUSHAR SHARMA100% (1)

- Loan Data Analysis and Approval Prediction System ForДокумент17 страницLoan Data Analysis and Approval Prediction System Forabhay vaishОценок пока нет

- In The Fulfillment of Bachlor Degree in The Computer Management of North Maharashtra University JalgaonДокумент37 страницIn The Fulfillment of Bachlor Degree in The Computer Management of North Maharashtra University JalgaonsychaitanyaОценок пока нет

- Calendar ApplicationДокумент5 страницCalendar ApplicationAjewole Eben TopeОценок пока нет

- P4 Project ReportДокумент28 страницP4 Project ReportBrij MaheshwariОценок пока нет

- Blood Bank Android Application Collection Centre PDFДокумент52 страницыBlood Bank Android Application Collection Centre PDFAbir MahmudОценок пока нет

- Synopsis Animal Information Collection and Sharing System For Zoological DepartmentДокумент19 страницSynopsis Animal Information Collection and Sharing System For Zoological DepartmentRaj BangaloreОценок пока нет

- Crypto Currency Prediction Using Deep Learning in BitcoinДокумент66 страницCrypto Currency Prediction Using Deep Learning in BitcoinHarikrishnan ShunmugamОценок пока нет

- Lung Cancer Detection Using Digital Image Processing On CT Scan ImagesДокумент7 страницLung Cancer Detection Using Digital Image Processing On CT Scan ImagesShaka TechnologiesОценок пока нет

- Healthcare System DocumentationДокумент37 страницHealthcare System Documentationjaved9890Оценок пока нет

- Transport Company ComputerizationДокумент1 страницаTransport Company ComputerizationRohan SinghОценок пока нет

- Project - Farmers BuddyДокумент34 страницыProject - Farmers BuddyGunjit MakhijaОценок пока нет

- Food Wastage Management SystemДокумент4 страницыFood Wastage Management SystemSushma CHОценок пока нет

- Movie Recomendation: A Project Report oДокумент15 страницMovie Recomendation: A Project Report oVed PrakashОценок пока нет

- Significance of Value in Individual Development - Docx FcIIДокумент24 страницыSignificance of Value in Individual Development - Docx FcIISebastin RajОценок пока нет

- Fianl Report Mcsp-044Документ121 страницаFianl Report Mcsp-044Rajbir KaurОценок пока нет

- PROJECT REPORT 1 - SellingДокумент6 страницPROJECT REPORT 1 - SellingAnuОценок пока нет

- Dermatological Disorder Detection Using Machine LearningДокумент4 страницыDermatological Disorder Detection Using Machine LearningInternational Journal of Innovative Science and Research TechnologyОценок пока нет

- Finally ReportДокумент56 страницFinally ReportAnishSahniОценок пока нет

- Internship Program at Mangalore Institute of Technology (Mite) - MoodabidriДокумент8 страницInternship Program at Mangalore Institute of Technology (Mite) - MoodabidriUdupiSri groupОценок пока нет

- Child Safety Wearble DeviceДокумент6 страницChild Safety Wearble DeviceKorrapati Nagaraju Sri RamakrishnaОценок пока нет

- An Interactive RFID-Based Bracelet For Airport Luggage Tracking SystemДокумент5 страницAn Interactive RFID-Based Bracelet For Airport Luggage Tracking SystemNaveed BeighОценок пока нет

- Online Grocery Retailing: What Do Consumers Think?Документ18 страницOnline Grocery Retailing: What Do Consumers Think?novijoenОценок пока нет

- Internship ReportДокумент26 страницInternship ReportSatyajeet RoutОценок пока нет

- Impact of Auto CRM Solutions in The Telecom IndustryДокумент15 страницImpact of Auto CRM Solutions in The Telecom IndustryBhavin V RaykaОценок пока нет

- Hotel Room Booking ScenarioДокумент2 страницыHotel Room Booking ScenarioRodza WahabОценок пока нет

- Share and Care: A Food Donation Web ApplicationДокумент9 страницShare and Care: A Food Donation Web ApplicationInternational Journal of Innovative Science and Research TechnologyОценок пока нет

- Synopsis On Online Blood BankДокумент7 страницSynopsis On Online Blood BankJitendra Singh JeetОценок пока нет

- MCA Project Report Format - MU - UpdatedДокумент20 страницMCA Project Report Format - MU - Updatedromi Kushwaha100% (1)

- Animal Specie Detection Using Deep Convolution Neural NetworkДокумент6 страницAnimal Specie Detection Using Deep Convolution Neural NetworkIJRASETPublicationsОценок пока нет

- Seminar Topics For Mca StudentsДокумент3 страницыSeminar Topics For Mca StudentsnanisanjuОценок пока нет

- Project Report of Laser Security Alarm System 2.3Документ25 страницProject Report of Laser Security Alarm System 2.3B LIKHITH KUMAR100% (1)

- Online Crime Management System: Sri Ramakrishna College of Arts and ScienceДокумент34 страницыOnline Crime Management System: Sri Ramakrishna College of Arts and ScienceSanseedha NОценок пока нет

- Doe & SamplingДокумент4 страницыDoe & SamplingRutuja Bhujbal100% (1)

- 67 Sy C1 Chap-5 MCQДокумент6 страниц67 Sy C1 Chap-5 MCQRutuja Bhujbal86% (7)

- 67 Sy C1 Chap-5 MCQДокумент6 страниц67 Sy C1 Chap-5 MCQRutuja Bhujbal86% (7)

- Stochastic Markov ChainsДокумент61 страницаStochastic Markov ChainsKashif KhalidОценок пока нет

- 7 - Chapter 1 PDFДокумент42 страницы7 - Chapter 1 PDFTharinduОценок пока нет

- Content PDF 1Документ14 страницContent PDF 1Rutuja BhujbalОценок пока нет

- Bib 0fc432348a97.p001Документ81 страницаBib 0fc432348a97.p001Rutuja BhujbalОценок пока нет

- 67 Sy C1 Chap-5 MCQДокумент6 страниц67 Sy C1 Chap-5 MCQRutuja Bhujbal86% (7)

- 7 - Chapter 1 PDFДокумент42 страницы7 - Chapter 1 PDFTharinduОценок пока нет

- Actuarial Varying Benefit-1 1Документ16 страницActuarial Varying Benefit-1 1Rutuja BhujbalОценок пока нет

- Content PDF 1Документ14 страницContent PDF 1Rutuja BhujbalОценок пока нет

- Chapter-4: M/M/1/K Queue With Non-Preemptive PriorityДокумент9 страницChapter-4: M/M/1/K Queue With Non-Preemptive PriorityRutuja BhujbalОценок пока нет

- StochasticДокумент17 страницStochasticRutuja BhujbalОценок пока нет

- DocScanner-DO NOT DELETEДокумент1 страницаDocScanner-DO NOT DELETERutuja BhujbalОценок пока нет

- Exam Form PDFДокумент1 страницаExam Form PDFRutuja BhujbalОценок пока нет

- Content PDF 1Документ14 страницContent PDF 1Rutuja BhujbalОценок пока нет

- Productivity, Efficiency, and Data Envelopment AnalysisДокумент35 страницProductivity, Efficiency, and Data Envelopment Analysisra2002ma2002931Оценок пока нет

- Aadhaar Steps To Follow PDFДокумент1 страницаAadhaar Steps To Follow PDFRutuja BhujbalОценок пока нет

- Drug Bioavailability - Clinical Pharmacology - MSD Manual Professional Edition PDFДокумент2 страницыDrug Bioavailability - Clinical Pharmacology - MSD Manual Professional Edition PDFRutuja BhujbalОценок пока нет

- Exam FormДокумент1 страницаExam FormRutuja BhujbalОценок пока нет

- 53 - Final PaperДокумент5 страниц53 - Final PaperRutuja BhujbalОценок пока нет

- Unit 8 Inventory Models: StructureДокумент19 страницUnit 8 Inventory Models: StructureShah UzmaОценок пока нет

- 53 - Final Paper PDFДокумент5 страниц53 - Final Paper PDFRutuja BhujbalОценок пока нет

- Set PDFДокумент24 страницыSet PDFRutuja BhujbalОценок пока нет

- Rohit ResumeДокумент2 страницыRohit ResumeRutuja BhujbalОценок пока нет

- Lecture6prev PDFДокумент75 страницLecture6prev PDFRutuja BhujbalОценок пока нет

- CV Doc Roll No 201Документ2 страницыCV Doc Roll No 201Rutuja BhujbalОценок пока нет

- Cert 1073 14670632Документ1 страницаCert 1073 14670632Rutuja BhujbalОценок пока нет

- Cert 1073 14670632Документ1 страницаCert 1073 14670632Rutuja BhujbalОценок пока нет

- HCF and LCM PixiPPtДокумент16 страницHCF and LCM PixiPPtAnonymous OlT7WTОценок пока нет

- Monetary Policy Problem Set #1 Long-Run Correlations. NotesДокумент8 страницMonetary Policy Problem Set #1 Long-Run Correlations. NotesYuliya KulikovaОценок пока нет

- N-Bit Colour FrameДокумент30 страницN-Bit Colour Framevikram vikramОценок пока нет

- GR 4 Unit 7 Part 1 Measuring Angles Form AДокумент4 страницыGR 4 Unit 7 Part 1 Measuring Angles Form Aapi-280863641Оценок пока нет

- Mid Term 1b F16Документ1 страницаMid Term 1b F16Kartik PatelОценок пока нет

- Earthquake-Induced Pressures On A Rigid Wall Structurestructure - WoodДокумент327 страницEarthquake-Induced Pressures On A Rigid Wall Structurestructure - WoodAA_BB_HHОценок пока нет

- Comp312 Chapter3 - BordonДокумент14 страницComp312 Chapter3 - BordonJULIUS BORDON100% (1)

- Unit-2 Principles of Mathematical InductionДокумент7 страницUnit-2 Principles of Mathematical Inductionritul singhОценок пока нет

- 11 TextTechДокумент107 страниц11 TextTechSiva Raman RОценок пока нет

- 4024 w11 QP 11Документ20 страниц4024 w11 QP 11Muhammad Azhar HayatОценок пока нет

- Cambridge University Chemistry DataBookДокумент18 страницCambridge University Chemistry DataBookiantocОценок пока нет

- Permutations and CombinationsДокумент6 страницPermutations and Combinationsnandank44373Оценок пока нет

- BME ScheduleДокумент1 страницаBME ScheduleStephen SloanОценок пока нет

- Superelevation Calculator: Superelevation Data Dialog BoxДокумент2 страницыSuperelevation Calculator: Superelevation Data Dialog Boxhussnainali aliОценок пока нет

- Numerical Integration MethodsДокумент6 страницNumerical Integration MethodsOsama HassanОценок пока нет

- 24 03 2024 SR Super60 Elite, Target & LIIT BTs Jee Adv20Документ21 страница24 03 2024 SR Super60 Elite, Target & LIIT BTs Jee Adv20randomwork013Оценок пока нет

- APSDS 5.0. Wardle, Rodway 2010Документ11 страницAPSDS 5.0. Wardle, Rodway 2010Tim LinОценок пока нет

- Delta Encoding in Data CompressionДокумент18 страницDelta Encoding in Data CompressionNisha MenonОценок пока нет

- Database Programming With PL/SQL 2-3: Practice Activities: Recognizing Data TypesДокумент3 страницыDatabase Programming With PL/SQL 2-3: Practice Activities: Recognizing Data TypesMUHAMAD MAULANA IKSANОценок пока нет

- Ap Ipe 2020 4Документ12 страницAp Ipe 2020 4crazybossyt7Оценок пока нет

- Confirmatory Factor Analysis: IntroДокумент14 страницConfirmatory Factor Analysis: IntroHarshit AnandОценок пока нет

- Jacques Heyman (Auth.), C. R. Calladine (Eds.) - Masonry Construction - Structural Mechanics and Other Aspects-Springer Netherlands (1992) PDFДокумент102 страницыJacques Heyman (Auth.), C. R. Calladine (Eds.) - Masonry Construction - Structural Mechanics and Other Aspects-Springer Netherlands (1992) PDFamino222Оценок пока нет

- Specific Gravity CalculationДокумент3 страницыSpecific Gravity CalculationVenkateswaran venkateswaranОценок пока нет

- MATH 1281 Statistical Inference Unit 4 Written Assignment:: A Paired DesignДокумент4 страницыMATH 1281 Statistical Inference Unit 4 Written Assignment:: A Paired DesignPrakhar Pratap Singh100% (3)

- Math9 Q1 Mod3 QuadraticEquation Version3Документ40 страницMath9 Q1 Mod3 QuadraticEquation Version3Annelyn NavarroОценок пока нет

- Discrete StructuresДокумент165 страницDiscrete StructuresBramhesh AptekarОценок пока нет

- Presentation of Artificial Intelligence: Fuzzy Logic SystemДокумент17 страницPresentation of Artificial Intelligence: Fuzzy Logic SystemSahar PervezОценок пока нет

- Intervention Grade 7 - Second Quarter 3Документ1 страницаIntervention Grade 7 - Second Quarter 3Monsanto JomarОценок пока нет

- GED102-1 - MMW ScoreДокумент1 страницаGED102-1 - MMW ScoreNap LobrinОценок пока нет

- Plotting Graphs - MATLAB DocumentationДокумент10 страницPlotting Graphs - MATLAB DocumentationEr Rachit ShahОценок пока нет