Академический Документы

Профессиональный Документы

Культура Документы

Sample DCF Valuation Template

Загружено:

Tharun RaoОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Sample DCF Valuation Template

Загружено:

Tharun RaoАвторское право:

Доступные форматы

Sample DCF Valuation Template

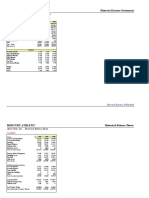

Note: Items in RED are calculated automatically

(In $ Billions)

Base year 1 2

Assumptions:

Revenue growth rate 5.0% 6.0%

EBIT (Operating) margin 8.0% 8.0% 8.0%

Tax rate 35.0% 35.0% 35.0%

Depreciation as % of Sales 3.0% 3.0% 3.0%

CAPEX as % of sales 4.0% 4.0% 4.0%

Working Capital ($) 10.0 10.5 11.1

WC as % of Sales 1.0% 1.0% 1.0%

Cost of capital 6.3% 6.3%

Free cash flow to firm ($ millions):

Revenues 1,000 1,050 1,113

EBIT 80 84 89

EBIT(1-tax) 52 55 58

Add: Depreciation 31.5 33.4

Less: CAPEX 42 45

Less: Increase in Working Capital 1 1

FCFF 44 46

Terminal value

Present value:

Cumulative discount factor 0.9409 0.8852

PV of FCFF and TV 41 41

Enterprise value of firm 1,520.0

- Debt 600.0

+ Excess Cash 0.0

+Value of other holdings not included in EV 0.0

Value of equity 920.0

- Misc non-interest paying liabilities not included in Debt 0.0

Value of common equity 920.0

Number of shares outstanding 16.00

Estimated value /share $ 57.50

Market Price today $ 50.00

WACC Equity Debt Preferred

Market values $ 800.0 $ 600.0 $ -

Weights in WACC 57.1% 42.9% 0.0%

Cost of Component (after-tax cost for debt) 8.0% 4.0% 6.0%

Terminal

3 4 5 year

7.0% 7.0% 7.0% 3.0%

8.0% 8.0% 8.0% 8.0%

35.0% 35.0% 35.0% 35.0%

3.0% 3.0% 3.0% 3.0%

4.0% 4.0% 4.0% 4.0%

11.9 12.7 13.6 14.0

1.0% 1.0% 1.0% 1.0%

6.3% 6.3% 6.3% 6.3%

1,191 1,274 1,363 1,404

95 102 109 112

62 66 71 73

35.7 38.2 40.9 42.1

48 51 55 56

1 1 1 0

49 53 56 59

1,783

0.8329 0.7836 0.7373 0.7373

41 41 42 1,314

Capital

$ 1,400.0

100.0%

6.29%

Вам также может понравиться

- 107 10 DCF Sanity Check AfterДокумент6 страниц107 10 DCF Sanity Check AfterDavid ChikhladzeОценок пока нет

- Creative Sports Solution-RevisedДокумент4 страницыCreative Sports Solution-RevisedRohit KumarОценок пока нет

- Worldwide Paper DCFДокумент16 страницWorldwide Paper DCFLaila SchaferОценок пока нет

- WACC Calculator: WACC Calculation Comparable Companies Unlevered BetaДокумент1 страницаWACC Calculator: WACC Calculation Comparable Companies Unlevered Betahassan1993Оценок пока нет

- 06 06 Football Field Walmart Model Valuation BeforeДокумент47 страниц06 06 Football Field Walmart Model Valuation BeforeIndrama Purba0% (1)

- Hynix Semiconductor: Initiate With A 1-OW: Re-Armed and ReadyДокумент45 страницHynix Semiconductor: Initiate With A 1-OW: Re-Armed and Readymanastir_2000Оценок пока нет

- Valuation Final ProjectДокумент31 страницаValuation Final ProjectsidchorariaОценок пока нет

- Valuation - CocacolaДокумент14 страницValuation - CocacolaLegends MomentsОценок пока нет

- Distress PDFДокумент65 страницDistress PDFKhushal UpraityОценок пока нет

- Chapter 6 Review in ClassДокумент32 страницыChapter 6 Review in Classjimmy_chou1314Оценок пока нет

- Box IPO Financial ModelДокумент42 страницыBox IPO Financial ModelVinОценок пока нет

- In-Class Project 2: Due 4/13/2019 Your Name: Valuation of The Leveraged Buyout (LBO) of RJR Nabisco 1. Cash Flow EstimatesДокумент5 страницIn-Class Project 2: Due 4/13/2019 Your Name: Valuation of The Leveraged Buyout (LBO) of RJR Nabisco 1. Cash Flow EstimatesDinhkhanh NguyenОценок пока нет

- FCFE CalculationДокумент23 страницыFCFE CalculationIqbal YusufОценок пока нет

- Practice Casestudy SolutionsДокумент6 страницPractice Casestudy SolutionsnurОценок пока нет

- DCFTemplateДокумент5 страницDCFTemplateRob Keith100% (1)

- ProformaДокумент1 страницаProformaapi-401204785Оценок пока нет

- WACC AnalysisДокумент9 страницWACC AnalysisFadhilОценок пока нет

- Michael McClintock Case1Документ2 страницыMichael McClintock Case1Mike MCОценок пока нет

- Vcel PDFДокумент30 страницVcel PDFAnonymous XGz2JEОценок пока нет

- Partners Healthcare (Tables and Exhibits)Документ9 страницPartners Healthcare (Tables and Exhibits)sahilkuОценок пока нет

- 2022.07.24 - DCF Tutorial Answer KeyДокумент18 страниц2022.07.24 - DCF Tutorial Answer KeySrikanth ReddyОценок пока нет

- BTIG PEN InitiationДокумент58 страницBTIG PEN InitiationNickОценок пока нет

- Wyeth ValuationДокумент54 страницыWyeth ValuationSaurav GoyalОценок пока нет

- Valuation - NVIDIAДокумент27 страницValuation - NVIDIALegends MomentsОценок пока нет

- Ducati Case ExhibitsДокумент10 страницDucati Case Exhibitslucien_lu0% (1)

- Finance Simulation - Capital BudgetingДокумент1 страницаFinance Simulation - Capital BudgetingKarthi KeyanОценок пока нет

- Mercury Athletic Historical Income StatementsДокумент18 страницMercury Athletic Historical Income StatementskarthikawarrierОценок пока нет

- Myriad Genetics Coverage ReportДокумент8 страницMyriad Genetics Coverage ReportChazz262Оценок пока нет

- Godrej AgrovetДокумент37 страницGodrej AgrovetBandaru NarendrababuОценок пока нет

- Sun Brewing Case ExhibitsДокумент26 страницSun Brewing Case ExhibitsShshankОценок пока нет

- Kellogg: Balance SheetДокумент14 страницKellogg: Balance SheetSubhajit KarmakarОценок пока нет

- Discounted Cash Flow (DCF) Valuation: This Model Is For Illustrative Purposes Only and Contains No FormulasДокумент2 страницыDiscounted Cash Flow (DCF) Valuation: This Model Is For Illustrative Purposes Only and Contains No Formulasrito2005Оценок пока нет

- Sneaker Excel Sheet For Risk AnalysisДокумент11 страницSneaker Excel Sheet For Risk AnalysisSuperGuyОценок пока нет

- ZomatoДокумент56 страницZomatopreethishОценок пока нет

- Titanium Dioxide and Super Project Prof. Joshy JacobДокумент3 страницыTitanium Dioxide and Super Project Prof. Joshy JacobSIDDHARTH SINGHОценок пока нет

- Date of Valuation: Default AssumptionsДокумент61 страницаDate of Valuation: Default AssumptionsАнна КуличОценок пока нет

- Helius Medical Technologies Mackie Initiation June 2016Документ49 страницHelius Medical Technologies Mackie Initiation June 2016Martin TsankovОценок пока нет

- CRS Monte Carlo Simulation WorkpapersДокумент388 страницCRS Monte Carlo Simulation WorkpapersShaunak ChitnisОценок пока нет

- General Mills PillsburyДокумент8 страницGeneral Mills PillsburyteenabansalОценок пока нет

- Midland Energy CaseДокумент2 страницыMidland Energy CaseRonak SinghalОценок пока нет

- DCF ModellДокумент7 страницDCF ModellziuziОценок пока нет

- Seagate NewДокумент22 страницыSeagate NewKaran VasheeОценок пока нет

- 2022 - Chapter02 To 05 - ValueDrivers - UpdatedДокумент38 страниц2022 - Chapter02 To 05 - ValueDrivers - UpdatedElias MacherОценок пока нет

- L&T 4Q Fy 2013Документ15 страницL&T 4Q Fy 2013Angel BrokingОценок пока нет

- Qatar National Bank April 2011Документ6 страницQatar National Bank April 2011Michael KiddОценок пока нет

- Cfroi HoltДокумент7 страницCfroi Holtamro_baryОценок пока нет

- Facebook IPO caseHBRДокумент29 страницFacebook IPO caseHBRCrazy Imaginations100% (1)

- WrigleyДокумент28 страницWrigleyKaran Rana100% (1)

- Beta Management QuestionsДокумент1 страницаBeta Management QuestionsbjhhjОценок пока нет

- Zip Co Ltd. - Acquisition of QuadPay and Capital Raise (Z1P-AU)Документ12 страницZip Co Ltd. - Acquisition of QuadPay and Capital Raise (Z1P-AU)JacksonОценок пока нет

- Super Project AnalysisДокумент6 страницSuper Project AnalysisDHRUV SONAGARAОценок пока нет

- Final AssignmentДокумент15 страницFinal AssignmentUttam DwaОценок пока нет

- Mercury Athletic FootwearДокумент4 страницыMercury Athletic FootwearAbhishek KumarОценок пока нет

- Bed Bath Beyond (BBBY) Stock ReportДокумент14 страницBed Bath Beyond (BBBY) Stock Reportcollegeanalysts100% (2)

- Quiz 1 The Body Shop International PLCДокумент13 страницQuiz 1 The Body Shop International PLCNaman Nepal100% (1)

- Sterling Student ManikДокумент23 страницыSterling Student ManikManik BajajОценок пока нет

- XLS EngДокумент26 страницXLS EngcellgadizОценок пока нет

- Sample DCF Valuation TemplateДокумент2 страницыSample DCF Valuation TemplateTharun RaoОценок пока нет

- Sample DCF Valuation TemplateДокумент2 страницыSample DCF Valuation TemplateTharun RaoОценок пока нет

- Task 1 AnswerДокумент9 страницTask 1 AnswerSiddhant Aggarwal0% (4)

- Assessing The Risk Management ProcessДокумент32 страницыAssessing The Risk Management ProcessIslam Monged100% (2)

- Muhammad Zeeshan: Personal SummaryДокумент3 страницыMuhammad Zeeshan: Personal SummaryMuhammad ZeeshanОценок пока нет

- Certificate in Management Accounting Level 3/series 3-2009Документ15 страницCertificate in Management Accounting Level 3/series 3-2009Hein Linn Kyaw100% (2)

- Annual ReportДокумент155 страницAnnual ReportHarsimranSinghОценок пока нет

- Naqdown Clincher QuestionДокумент13 страницNaqdown Clincher QuestionsarahbeeОценок пока нет

- Indus 2018 PDFДокумент157 страницIndus 2018 PDFFatu AquariusОценок пока нет

- IFRS 16 - Gripping18 Extract PDFДокумент116 страницIFRS 16 - Gripping18 Extract PDFFaizan AbbasiОценок пока нет

- The Effect of International Public Sector Accounting Standard (IPSAS) Implementation and Public Financial Management in NigeriaДокумент10 страницThe Effect of International Public Sector Accounting Standard (IPSAS) Implementation and Public Financial Management in NigeriaaijbmОценок пока нет

- Dougall Letter To Tax CommissionДокумент10 страницDougall Letter To Tax CommissionRobert GehrkeОценок пока нет

- Deped ChecklistДокумент18 страницDeped ChecklistJohnson Sunga100% (1)

- What Are The Benefits of Performance Measurement?Документ12 страницWhat Are The Benefits of Performance Measurement?Faan Waliporn CheawchanОценок пока нет

- Is Whistleblowing An Ethical PracticeДокумент15 страницIs Whistleblowing An Ethical Practicey11k4Оценок пока нет

- Coa Dof DBM - JC4 86 AДокумент15 страницCoa Dof DBM - JC4 86 AZyki Zamora LacdaoОценок пока нет

- Investigating Effects of Accounting Ethics On Quality of Financial Reporting of An Organization: Case of Selected Commercial Banks in South SudanДокумент15 страницInvestigating Effects of Accounting Ethics On Quality of Financial Reporting of An Organization: Case of Selected Commercial Banks in South SudanXhaОценок пока нет

- Aml ObjectivesДокумент15 страницAml ObjectivesaliyasbradОценок пока нет

- Techniques of AuditingДокумент35 страницTechniques of AuditingyuvashankarОценок пока нет

- Request For An Official USMLE Transcript Form 172: Request Form. Include A Payment of US$65.00 For Each Form You SubmitДокумент3 страницыRequest For An Official USMLE Transcript Form 172: Request Form. Include A Payment of US$65.00 For Each Form You SubmitAmiroh AllabibahОценок пока нет

- BNM Organisation Structure 20200901 - ENwebДокумент1 страницаBNM Organisation Structure 20200901 - ENwebNorman LucasОценок пока нет

- Goveva Description PDFДокумент11 страницGoveva Description PDFViswanathan RajagopalanОценок пока нет

- Monitoring and Continuous AuditingДокумент0 страницMonitoring and Continuous AuditingWarnherОценок пока нет

- Thesis Topics For AccountingДокумент7 страницThesis Topics For Accountingerikanelsonwashington100% (2)

- Financial and Managerial AccountingДокумент1 страницаFinancial and Managerial Accountingcons theОценок пока нет

- Jamiestentaford CVДокумент3 страницыJamiestentaford CVJamie StentafordОценок пока нет

- CORPORATE GovernanceДокумент62 страницыCORPORATE Governanceaurorashiva1Оценок пока нет

- CTC Annual Report 2020Документ164 страницыCTC Annual Report 2020thugnatureОценок пока нет

- f8 IIIДокумент366 страницf8 IIIThanh PhạmОценок пока нет

- BfinДокумент3 страницыBfinjonisugandaОценок пока нет

- PICPA QAR Peer Review ChecklistДокумент45 страницPICPA QAR Peer Review ChecklistErlene CompraОценок пока нет

- 6 Rectification of ErrorsДокумент33 страницы6 Rectification of Errorsniraj jainОценок пока нет

- The Code of Professional EthicsДокумент33 страницыThe Code of Professional EthicsPrima FacieОценок пока нет