Академический Документы

Профессиональный Документы

Культура Документы

Form DVAT 16: Online Return Id #1565786 Department of Trade and Taxes

Загружено:

sanjkumb242000Исходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Form DVAT 16: Online Return Id #1565786 Department of Trade and Taxes

Загружено:

sanjkumb242000Авторское право:

Доступные форматы

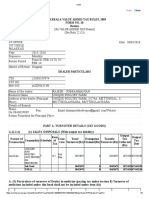

Online Return Id #1565786

Date:25-11-2010

Ward:96

Department of Trade and Taxes

Government of NCT of Delhi

Form DVAT 16

Refund Claimed? No (see Rule 28 and 29 of Delhi Value Added Tax Rules,2005) Orignal

Delhi Value Added Tax Return

R1. Tax Period From 1-10-2010 To 31-10-2010

R2.1 Registration No./TIN 07120291503

R2.2 Full Name of Dealer PICCADELHI (A Unit of ARA Hospitality Pvt. Ltd.)

R2.3 Address

R3 Description of top 3 items you deals in 1. COOKED FOOD

(in order of volume of sales for the tax period. 2. INDIAN MADE FOREIGN LIQUOR

1- Highest Volume to 3-lowest Volume) 3.

R4 Turnover Details TurnOver(Central) 0

TurnOver(Local) 3845906

Gross TurnOver 3845906

R5.Computation of Output tax Turnover (Rs.) Output tax(Rs.)

R5.1 Goods taxable at 1% 0 0

R5.2 Goods taxable at 4% 0 0

R5.2 Goods taxable at 5% 0 0

R5.3 Goods taxable at 12.5% 2539050 317381

R5.4 Goods taxable at 20% 1306856 261371

R5.5 Work contract taxable at 4% 0 0

R5.6 Work contract taxable at 12.5% 0 0

R5.7 Exempt sales (other deduction claimed) 0 N.A.

R5.8 Output Tax before adjustment Sub Total (A) 578752

R5.9 Adjustment to output tax 0

(Complete Annexure and enter Total A2 here (B)

R5.10 Total Output Tax (A + B) 578752

R6. Turnover of Purchases in Delhi(including tax) & tax credits Purchases (Rs.) Tax Credits (Rs.)

R6.1 Capital goods 0 0

R6.2 Other goods 2460191 220873

R6.2(1) Goods taxable at 1% 0 0

R6.2(2) Goods taxable at 4% 0 0

R6.2(3) Goods taxable at 5% 126236 6011

R6.2(4) Goods taxable at 12.5% 1579455 175495

R6.2(5) Goods taxable at 20% 236201 39367

R6.2(6) Works contract taxable at 4% 0 0

R6.2(8) Works contract taxable at 12.5% 0 0

R6.2(9) Exempted purchase 518299 N.A.

R6.3 Tax credit before adjustment Sub Total (A) 220873

R6.4 Adjustment of tax credits 0

(Complete Annexure and enter Total A4 here (B)

R6.5 Total Tax Credits (A + B) 220873

R7.1 Net Tax (R5.10) - (R6.5) 357879

R7.2 Add : Interest, if payable 0

R7.3 Add : Penalty, if payable 0

R7.4 Less : Tax deducted at source/n (attach 0 No. of TDS 0

certificates in original)

R7.5 Balance Payable (R7.1 + R7.2+ R7.3-R7.4) 357879

R7.6 Less: Amount deposited by the dealer (attach proof of 357879

payment)

Challan No. Name of Bank and Branch Date of Deposit Amount

DD-MM-YYYY

0006 ICICI BANK CANNOUGHT PLACE, NEW DELHI 25-11-2010 357879.00

-- 0.00

-- 0.00

-- 0.00

-- 0.00

-- 0.00

- - 357879.00

R8. Net Balance* (R7.5-R7.6) - - 0

* The net balance should not be positive as amount due has to be deposited before filing the return.

IF REFUND IS CLAIMED,PROVIDE DETAILS IN THIS BOX

R10. Details of Bank Account

R10.1 Account No.

R10.2 Account Type(Saving/Current etc)

R10.3 MICR No.

R10.4 Name of Bank and Branch

R11 Inter - State Trade and exports/imports Inter-State Sales / Exports Inter -State Purchases/Imports

R11.1 Against C/D Forms 0 0

R11.2 Against C+E1/E2 Forms 0 0

R11.3 Inward/Outward Stock Transfer Against F Forms 0 0

R11.4 Against H Forms 0 0

R11.5 Against I Forms 0 0

R11.6 Against J Forms 0 0

R11.7 Exports to / Import from outside india 0 0

R11.7(1) Exempted sales/purchase including High sea sales etc. 0 0

R11.8 Other (Not Supported By any Form) 0 0

R11.9 Capital goods 0 0

R11.10 Total 0 0

R11 Verification

I /We hereby solemny affirm and declare that the information given hereinabove is true and correct to the best of my/our knowledge and belief and nothing has been concealed thereform.

Signature of Authorized Signatory ....................:

Full Name (First name, Middle,surname): 0

Designation 0

Place :

Date : 25-11-2010

ANNEXURE

(To be attached with the return where adjustment in output or tax credits are made)

1 Adustment of Output Tax

Nature of Adjustment Increase in Output Decreses in Output Tax

Tax (B)

(A)

A1.1 Sale cancelled [Section 8(1) (a)] XXXXXXXXXXXXXXXXXXXX 0

A1.2 Nature of sale changed [Section 8(1) (b)] 0 0

A1.3 Change in agreed consideration [Section 8(1) (c )] 0 0

A1.4 Goods sold returned [Section 8(1)(d)] XXXXXXXXXXXXXXXXXXXX 0

A1.5 Bad debts written off [Section 8(1) (e) and Rule 7A] XXXXXXXXXXXXXXXXXXXX 0

A1.6 Bad debts recovered [Rule 7A(3)] 0 XXXXXXXXXXXXXXXXXXXX

A1.7 Tax payable on goods held on the date of cancellation of registration 0 XXXXXXXXXXXXXXXXXXXX

(Section 23)

A1.8 Other adjustments , if any (specify)

0 0

0 0

0 0

Total 0 0

A2 Total net increase / (decrease) in Output Tax (A-B) 0

A3 Adjustment of Tax Credits

Nature of Adustment Increase in Tax Decrease in Tax Credit

Credit (D)

(C)

A3.1 Tax credit carried forward from previous tax period 0 XXXXXXXXXXXXXXXXXXXX

A3.2 Receipt of debit notes from the seller [Section 10(1)] 0 XXXXXXXXXXXXXXXXXXXX

A3.3 Receipt of credit notes from seller [Section 10(1)] XXXXXXXXXXXXXXXXXXXX 0

A3.4 Goods purchased returned or rejected [Section 10(1)] XXXXXXXXXXXXXXXXXXXX 0

A3.5 Change in use of goods, for purposes other than for which credit is XXXXXXXXXXXXXXXXXXXX 0

allowed [Section 10(2)(a)]

A3.6 Change in use of goods for purposes for which credit is allowed [Section 0 XXXXXXXXXXXXXXXXXXXX

10(2)(b)

A3.7 Tax credit disallowed in respect of stock transfer out of Delhi [Section XXXXXXXXXXXXXXXXXXXX 0

10(3)]

A3.8 Tax credit for Transitional stock held on 1st April 2005 (Section 14) 0 XXXXXXXXXXXXXXXXXXXX

A3.9 Tax credit for purchase of Second-hand goods (Section 15) 0 XXXXXXXXXXXXXXXXXXXX

A3.10 Tax credit for goods held on the date of withdrawal from Composition 0 XXXXXXXXXXXXXXXXXXXX

Scheme [Section 16(2)]

A3.11 Tax credit for trading stock and raw materials held at the time of 0 XXXXXXXXXXXXXXXXXXXX

registration (Section 20)

A3.12 Tax credit disallowed for goods lost or destroyed (Rule 7) XXXXXXXXXXXXXXXXXXXX 0

A3.13 tax credit adjustment or Stock Transfer of capital goods [Section 9(9)(a)] 0 0

A3.15 Reduction in input tax credit due to sale of goods at price lower than the XXXXXXXXXXXXXXXXXXXX 0

purchase price[section 10(5)]

A3.16 Second/Third instalment of balance tax credit goods [Section 9(9)(a)] 0 XXXXXXXXXXXXXXXXXXXX

A3.17 Opening Stock 0 XXXXXXXXXXXXXXXXXXXX

A3.18 Closing Stock XXXXXXXXXXXXXXXXXXXX 0

A3.14 Other adjustments if any (specify)

0 0

0 0

0 0

0 0

Total 0 0

A4 Total net increase / (decrease) in Output Tax(C-D) 0

Вам также может понравиться

- Quarterly Income Tax Return For Corporations, Partnerships and Other Non-Individual TaxpayersДокумент2 страницыQuarterly Income Tax Return For Corporations, Partnerships and Other Non-Individual TaxpayersRegs AccountingTaxОценок пока нет

- Quarterly Income Tax Return For Corporations, Partnerships and Other Non-Individual TaxpayersДокумент2 страницыQuarterly Income Tax Return For Corporations, Partnerships and Other Non-Individual TaxpayersRegs AccountingTaxОценок пока нет

- VAT Form202Документ2 страницыVAT Form202ncgohil78Оценок пока нет

- FeburaryДокумент8 страницFeburaryRohama TullaОценок пока нет

- Submitted Status:: Sales Tax Credit Gross Value Taxable Value Sales TaxДокумент4 страницыSubmitted Status:: Sales Tax Credit Gross Value Taxable Value Sales TaxaizazbarkiОценок пока нет

- Quarterly Income Tax Return For Corporations, Partnerships and Other Non-Individual TaxpayersДокумент2 страницыQuarterly Income Tax Return For Corporations, Partnerships and Other Non-Individual TaxpayersRegs AccountingTaxОценок пока нет

- VAT RET 201 Monthly New (Oct-10)Документ22 страницыVAT RET 201 Monthly New (Oct-10)Raju ShahОценок пока нет

- MarchДокумент7 страницMarchRohama TullaОценок пока нет

- Sherrod, Inc., Reported Pretax Accounting Income of $88 Million For 2018Документ15 страницSherrod, Inc., Reported Pretax Accounting Income of $88 Million For 2018laale dijaanОценок пока нет

- JanuaryДокумент8 страницJanuaryRohama TullaОценок пока нет

- Quarterly Income Tax Return: 12 - December 056Документ2 страницыQuarterly Income Tax Return: 12 - December 056Cha GomezОценок пока нет

- 1702 QДокумент3 страницы1702 Qappipinnim50% (2)

- TEST 3 SolutionДокумент3 страницыTEST 3 SolutionlusandasithembeloОценок пока нет

- PDF 332384320310321 PDFДокумент1 страницаPDF 332384320310321 PDFSekharОценок пока нет

- Test PDFДокумент2 страницыTest PDFLulu Adaro VillanuevaОценок пока нет

- TAXC371+-+Second+Opportunity+2019+Solution+ UpdatedДокумент18 страницTAXC371+-+Second+Opportunity+2019+Solution+ UpdatedakeeraОценок пока нет

- Monthly Value-Added Tax DeclarationДокумент2 страницыMonthly Value-Added Tax DeclarationJa'maine ManguerraОценок пока нет

- Quarterly Income Tax Return: Schedule 1Документ3 страницыQuarterly Income Tax Return: Schedule 1Ja'maine ManguerraОценок пока нет

- PDF 928543220281220Документ1 страницаPDF 928543220281220Rajendra Prasad sahaОценок пока нет

- US Internal Revenue Service: f1120h - 2001Документ4 страницыUS Internal Revenue Service: f1120h - 2001IRSОценок пока нет

- 1702-RT Annual Income Tax ReturnДокумент1 страница1702-RT Annual Income Tax ReturnTricia GBОценок пока нет

- Rajesh Bora Itr PLBS 2022Документ5 страницRajesh Bora Itr PLBS 2022ABDUL KHALIKОценок пока нет

- Ack Aflph9386l 2022-23 634868880121022Документ1 страницаAck Aflph9386l 2022-23 634868880121022Ritu RajОценок пока нет

- 1701 Doc FabianДокумент2 страницы1701 Doc FabianCristopher NacinoОценок пока нет

- Additional ExcelSpreadsheetsДокумент35 страницAdditional ExcelSpreadsheetsbipin kumarОценок пока нет

- BIR Form No. 2551MДокумент1 страницаBIR Form No. 2551MLorraine Steffany BanguisОценок пока нет

- 1702 July 08Документ7 страниц1702 July 08Jchelle Lustre DeligeroОценок пока нет

- 1701 Annual Income Tax Return: (From Part VI Item 5) (From Part VII Item 10)Документ4 страницы1701 Annual Income Tax Return: (From Part VI Item 5) (From Part VII Item 10)Rhomel HemorОценок пока нет

- Bir 1701Документ2 страницыBir 1701RAYNAN MARCELO100% (1)

- Yashodeep RULI 58 (1) 09-10 MonthlyДокумент52 страницыYashodeep RULI 58 (1) 09-10 MonthlyharilabdeОценок пока нет

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruДокумент1 страницаIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruMohammad WaseemОценок пока нет

- Ambot Ani Oy Gusto Rko Mag Basa Sa PDFДокумент4 страницыAmbot Ani Oy Gusto Rko Mag Basa Sa PDFJahziel Rosh V. AroaОценок пока нет

- ContentДокумент11 страницContentpriyadarshiusha9Оценок пока нет

- 1701 - ITR For 2022 SampleДокумент1 страница1701 - ITR For 2022 SampleKaixeR 0125Оценок пока нет

- Easterbloom 2550M - 082022Документ2 страницыEasterbloom 2550M - 082022Reyes Accounting Law OfficeОценок пока нет

- 2551Q Jan 2018 ENCS Final Rev 3Документ2 страницы2551Q Jan 2018 ENCS Final Rev 3MIS MijerssОценок пока нет

- Return Ali Raza 2022Документ5 страницReturn Ali Raza 2022hikamuddin38Оценок пока нет

- Tax Card 2021 2022Документ26 страницTax Card 2021 2022AqeelAhmadОценок пока нет

- 1pg Itr SMIIДокумент2 страницы1pg Itr SMIIRic Dela CruzОценок пока нет

- Tax ReturnДокумент4 страницыTax ReturncykablyatОценок пока нет

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruДокумент1 страницаIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruHarjot SinghОценок пока нет

- 1702Q SGC - 2nd QTR 2019 FOR EMAILДокумент31 страница1702Q SGC - 2nd QTR 2019 FOR EMAILJaylou BobisОценок пока нет

- Particulars: Report FinalДокумент12 страницParticulars: Report FinaldananjОценок пока нет

- Monthly Percentage Tax Return: Fill in All Applicable Spaces. Mark All Appropriate Boxes With An "X". X X 12Документ2 страницыMonthly Percentage Tax Return: Fill in All Applicable Spaces. Mark All Appropriate Boxes With An "X". X X 12PingLomaadEdulanОценок пока нет

- Form IR2 4Документ3 страницыForm IR2 4khaingshwe wutyiОценок пока нет

- UYLC Income Tax Return For 2022 (1702RT 2018C) - DraftДокумент4 страницыUYLC Income Tax Return For 2022 (1702RT 2018C) - DraftVirgelio AbarquezОценок пока нет

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearДокумент1 страницаIndian Income Tax Return Acknowledgement 2021-22: Assessment YearAmit DuttaОценок пока нет

- Sales Tax Return Sept 10Документ6 страницSales Tax Return Sept 10Raheel BaigОценок пока нет

- 1701A Annual Income Tax ReturnДокумент3 страницы1701A Annual Income Tax ReturnWa37354Оценок пока нет

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruДокумент1 страницаIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruChinmay BhattОценок пока нет

- Mail To LornaДокумент27 страницMail To Lornaapi-3740993Оценок пока нет

- Sample Bir Form - CorporationsДокумент4 страницыSample Bir Form - CorporationsChristine ViernesОценок пока нет

- ZVI - ITR 2022 DraftДокумент4 страницыZVI - ITR 2022 DraftMike SyОценок пока нет

- 2020 07 07 09 18 12 832 - 1594093692832 - XXXPC2200X - Acknowledgement PDFДокумент1 страница2020 07 07 09 18 12 832 - 1594093692832 - XXXPC2200X - Acknowledgement PDFLokeshОценок пока нет

- Ack Bqgpa0377p 2022-23 794790900120722Документ1 страницаAck Bqgpa0377p 2022-23 794790900120722inspiremetonewworldОценок пока нет

- 2020 10 17 15 39 31 472 - 1602929371472 - XXXPP3112X - Acknowledgement PDFДокумент1 страница2020 10 17 15 39 31 472 - 1602929371472 - XXXPP3112X - Acknowledgement PDFParmeshwar PrasadОценок пока нет

- Common Size Analysis: Hul Profit and Loss StatementДокумент7 страницCommon Size Analysis: Hul Profit and Loss Statementamlan dasОценок пока нет

- Form REV 1 - Application For New Registration FormДокумент18 страницForm REV 1 - Application For New Registration FormMajaya JonasiОценок пока нет

- 1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and TrustsДокумент1 страница1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and Trustsjoel razОценок пока нет

- E Comm - Unit 3Документ8 страницE Comm - Unit 3prashanttendolkarОценок пока нет

- Order Form: Learning: The Treasure WithinДокумент1 страницаOrder Form: Learning: The Treasure Withininbox9999Оценок пока нет

- FPD 6 Icr G9 RSLT 2 ABДокумент8 страницFPD 6 Icr G9 RSLT 2 ABKrishna muthyalaОценок пока нет

- Handling Unit Management in SAP - Packing During Outbound ProcessДокумент48 страницHandling Unit Management in SAP - Packing During Outbound ProcessBabu Pon Immanuel Gnanadhas86% (7)

- Uttarakhand Transport Corporation E-Ticket: Fare DetailДокумент1 страницаUttarakhand Transport Corporation E-Ticket: Fare DetailAnindya SharmaОценок пока нет

- Adobe Scan Nov 02, 2022Документ1 страницаAdobe Scan Nov 02, 2022Soma HazraОценок пока нет

- Draf T: Form GSTR-4Документ6 страницDraf T: Form GSTR-4padminiОценок пока нет

- Appendix 32 - DISBURSEMENT VOUCHERДокумент1 страницаAppendix 32 - DISBURSEMENT VOUCHERPau PerezОценок пока нет

- Mapping V4Документ670 страницMapping V4kasun madushanОценок пока нет

- Tren de Flam TarifasДокумент2 страницыTren de Flam TarifasJoaquin Cantero GuerreroОценок пока нет

- Monthly Review FormatДокумент69 страницMonthly Review FormatvamshivarkutiОценок пока нет

- PWC Incoterms and IFRSДокумент1 страницаPWC Incoterms and IFRSEumell Alexis Pale0% (1)

- Rwms CommonДокумент154 страницыRwms Commonjishan82Оценок пока нет

- Nordea BankДокумент6 страницNordea Bankeureka.net24Оценок пока нет

- Taxation 2 Prelim NotesДокумент11 страницTaxation 2 Prelim NotesMae TrabajoОценок пока нет

- Payment Acknowledgement 0311151431193119Документ1 страницаPayment Acknowledgement 0311151431193119Rishabh goswamiОценок пока нет

- Western Union Pickup Notification PDFДокумент1 страницаWestern Union Pickup Notification PDFကိုသန္း ေဌးОценок пока нет

- It 000144418085 2024 10Документ1 страницаIt 000144418085 2024 10Sheeraz AhmedОценок пока нет

- Tutorial Chapter 3Документ3 страницыTutorial Chapter 3ASMA HANANI BINTI ANUARОценок пока нет

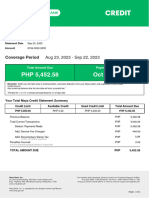

- MayaCredit SoA 2023SEPДокумент3 страницыMayaCredit SoA 2023SEPNancy DiplomaОценок пока нет

- Federal Registery For 1040 and W-2 ScanДокумент3 страницыFederal Registery For 1040 and W-2 ScanPhilОценок пока нет

- Donald 2022Документ8 страницDonald 2022Kgalalelo DonaldОценок пока нет

- Babu Banarsi Das Universty: Assigned by AssignorДокумент15 страницBabu Banarsi Das Universty: Assigned by AssignoramanОценок пока нет

- Southern University BangladeshДокумент1 страницаSouthern University BangladeshRaihanОценок пока нет

- Tag Life Science Corporation: Purok Uno, Minante II, Cauayan City, IsabelaДокумент3 страницыTag Life Science Corporation: Purok Uno, Minante II, Cauayan City, IsabelaBrandon Jorjs HolgadoОценок пока нет

- Chapter 1Документ13 страницChapter 1vinh88Оценок пока нет

- Status 2019 06 12-13 41 05 PDFДокумент2 страницыStatus 2019 06 12-13 41 05 PDFRoberta Alexandra CosteaОценок пока нет

- Invoice #5315 From Darcan Engineering Pty LTD PDFДокумент1 страницаInvoice #5315 From Darcan Engineering Pty LTD PDFWantakОценок пока нет

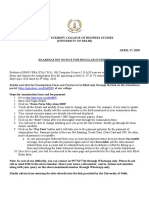

- Examination Notice For Regular Students PDFДокумент2 страницыExamination Notice For Regular Students PDFAbdal LalitОценок пока нет

- Onebill Invoice FormatДокумент3 страницыOnebill Invoice FormatiCloud GuruОценок пока нет