Академический Документы

Профессиональный Документы

Культура Документы

Tax Rates KPT

Загружено:

Hitheswar ReddyОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Tax Rates KPT

Загружено:

Hitheswar ReddyАвторское право:

Доступные форматы

The Karnataka Tax on Professions, Trades, Callings

and Employments Act, 1976

Applicable with w.e.f. 1-04-2003 as per Karnataka act no. 7 of 2003

Schedules See Section 3(2)

Sl. Class of persons Rate of tax

No.

1 2 3

1 Salary or wage earners whose salary

or wage or both, as the case may be,

for a month is,-

[Omitted] [(a)not less than Rs. 3,000

but less than Rs. 5,000 Rs. 30

per month ]Sl. No. 1 omitted

by Act No. 6 of 2008 w.e.f.

1.8.2008

[Omitted] [(b) not less than Rs. 5,000

but less than Rs. 8,000 Rs. 60

per month]Sl. No. 1 column

(b) omitted by Act No. 7 of

2009 w.e.f. 1.4.2009

[Omitted] [(c) not less than Rs. 8,000

but less than Rs. 10,000 Rs.

100 per month] Sl. No. 1

column (c) omitted by Act No.

7 of 2009 w.e.f. 1.4.2009

(d) Omitted Omitted Omitted with effect from 1-

4-2015

(e) Rs. 15,000 and above Rs. 200 per

month

Legal practitioners including Solicitors

and Notaries Public:-

2

(a) in the Bangalore Urban

Agglomeration where standing

in the profession is-

Nil

(i)less than 10 years

(ii) 10 years or more but less

than 20 years Rs.1500/- per annum

(iii) 20 years or more Rs.2500/- per annum

(b) in any other area in the State is-

(i)less than 10 years Nil

(ii) 10 years or more but less Rs.1000 per annum

than 20 years

(iii) 20 years or more Rs.1500 per annum

1. Substituted Act by 11 or 2005 w.e.f 1.4.2005

Technical and Professional Consultants

Other than those mentioned elsewhere in

3 the Schedule but including plumbing and

Tax consultant:-

(a) in the Bangalore Urban Agglomeration

1976: KAR. ACT 35] Tax on Professions, Trades Callings 211

and Employments

Sl. Class of persons Rate of tax

No.

where standing in the profession is-

(i) less than 2 years Nil

(ii) 2 years or more but less than 5 years Rs.1000 per annum

(iii) 5 years or more but less than 10 years Rs.1500 per annum

Rs.2500 per annum

(iv) 10 years or more

(b) in any other area in the State is-

Nil

(i) less than 2 years

(ii) 2 years or more but less than 10 years Rs.1000 per annum

(iii) 10 years or more Rs.1500 per annum

4

(i) Chief Agents, Principal Agents, Special

Rs.1500 per annum

Agents, Insurance Agents and Surveyors or

Loss Assessors registered or licensed under

the Insurance Act, 1938 (Central Act IV of

1938) whose annual income is not less than

Rs.36,000.

(ii) Pigmy Agents or UTI Agents whose

Rs. 1000 per annum

annual income is not less than Rs.36,000.

Explanation: For the purpose of this item

income shall be deemed to be the

commission or any other remuneration by

whatever name called, earned by the person

as such Chief Agent, Principal Agent,

Special Agent, Insurance Agent, Survey or

Loss Assessor or Pigmy Agents or UTI

Agents.

5

Chartered Accountants and Actuaries where

the standing in the profession is,-

(i) Less than 2 years Nil

(ii) Not less than 2 years but less than 5

years Rs.1000 per annum

(iii) 5 years or more

Rs.2500 per annum

6 Medical Practitioners, including Medical

Consultants (other than practitioners of

Ayurvedic, Homeopathic and Unani Systems

212 Tax on Professions, Trades Callings 1976: KAR. ACT 35]

and Employments

Sl. Class of persons Rate of tax

No.

of medicines), Dentists, Radiologists,

Pathologists and persons engaged in other

similar professions or callings of a para-

medical nature:-

(a) in the Bangalore Urban Agglomeration

where standing in the profession is-

(i) Less than 2 years Nil

(ii) 2 years or more but less than 5 years Rs.1000 per annum

(iii) 5 years or more Rs.2500 per annum

(b) in any other area in the State-

(i) Less than 2 years Nil

(ii) 2 years or more but less than 5 years Rs.1000 per annum

(iii) 5 years or more but less than 10 years Rs.1500 per annum

(iv) 10 years or more Rs.2500 per annum

7 Engineers, RCC Consultants, Architects and

Management Consultants-

(a) in the Bangalore Urban Agglomeration

where standing in the profession is-

(i) Less than 2 years Nil

(ii) 2 years or more but less than 5 years Rs.1000 per annum

(iii) 5 years or more Rs.2500 per annum

(b) in any other area in the State-

(i) Less than 2 years Nil

(ii) 2 years or more but less than 10 years Rs.1000 per annum

(iii) 10 years or more Rs.1500 per annum

8 Members of Stock-Exchanges recognized Rs.2500 per annum

under the Security Contracts (Regulation)

Act, 1956

9 Estate agents or brokers,

(i) in Bangalore Urban Agglomeration, Rs.2500 per annum

(ii) in any other area in the State

(a) Income tax payees

Rs.1500 per annum

1976: KAR. ACT 35] Tax on Professions, Trades Callings 213

and Employments

Sl. Class of persons Rate of tax

No.

(b) Other than (a) above Rs.1000 per annum

10 Contractors executing works contract (as

defined under the Karnataka Sales Tax Act,

1957 or the Karnataka Value Added Tax Act,

2003) where total consideration of all the

contracts in a year is:-

Nil

(i) less than Rs.2 lakhs

(ii) more than Rs. 2 lakhs but less than Rs.1000 per annum

Rs.10 lakhs

(iii) more than Rs.10 lakhs but less than Rs.1500 per annum

Rs.25 lakhs

(iv) more than Rs.25 lakhs Rs.2500 per annum

11 (i) Race horse owners and trainers licensed Rs.2500 per annum

by the turf clubs.

(ii) Jockeys licensed by the turf clubs / race

clubs-

(a) in case of Apprentice Jockeys Rs.1000 per annum

(b) other than (a) above Rs.2500 per annum

(iii) Bookmakers licensed by turf clubs Rs.2500 per annum

12 Self-employed persons in the motion picture

industries as follows:

(a) Directors, Actors and Actresses

(excluding Junior Artists), Playback Singers,

recordists, editors

(i) Income tax payees Rs.2500 per annum

(ii) other than (i) above Rs.1500 per annum

(b) Cameramen and still photographers Rs.900 per annum

13 Dealers registered or liable to be registered

under the Karnataka Sales Tax Act, 1957 or

the Karnataka Value Added Tax Act, 2003

214 Tax on Professions, Trades Callings 1976: KAR. ACT 35]

and Employments

Sl. Class of persons Rate of tax

No.

whose total turnover in any year is-

(a) Upto Rs.2 lakhs Nil

(b) not less than Rs.2 lakhs but less than Rs.1000 per annum

Rs.10 lakhs

(c) not less than Rs.10 lakhs but less than

Rs.25 lakhs Rs.1500 per annum

(d) Rs.25 lakhs or more Rs.2500 per annum

14 Occupiers of factories as defined under the

Factories Act, 1948

15 Employers of establishments defined under

the Karnataka Shops and Commercial

Establishments Act, 1961,-

(i) Where there are no employees

Nil.

(ii) Where not more than 5 employees are Rs.1000 per annum

employed

(iii) Where more than 5, but not more than

10 employees are employed Rs.1500 per annum

(iv) Where more than 10 employees are

employed Rs.2500 per annum

16 Owners of Oil Pumps and Service stations

Rs.2500 per annum

17 (i) Licensed wholesale dealers of liquors

other than toddy and arrack Rs.2500 per annum

(ii) Licensed imported foreign liquor vendors

other than those specified in (i) above. Rs.2500 per annum

18 (i) Owners of residential hotels or lodging Rs.1500 per annum

houses having less than 20 rooms

(ii) Owners of residential hotels or lodging

Rs.2500 per annum

houses having 20 rooms or more

(i) Owners of cinema theatres but excluding

19 touring talkies. Rs.2500 per annum

(ii) Owners of touring talkies Rs.1500 per annum

(iii) Owners of video parlours

Rs.2500 per annum

1976: KAR. ACT 35] Tax on Professions, Trades Callings 215

and Employments

Sl. Class of persons Rate of tax

No.

20 1[Owners of transport vehicles(other than

auto rickshaws) run on their own or through

others under permits granted]1 under the

Motor Vehicles Act, 1988.-

(a) owning only one vehicle Rs.1000 per annum

(b) owning more than one vehicle Rs.2500 per annum

1. Substituted by Act 5 of 2006 w.e.f. 1.4.2006

21 Money lenders licensed under the Karnataka

Money Lenders’ Act, 1961 Rs.2500 per annum

22 Individuals or institutions conducting chit

funds Rs.2500 per annum

23 Cooperative Societies registered under the

Karnataka Cooperative Societies Act and

engaged in any profession, trade or calling.-

(i) State level societies Rs.2500 per annum

(ii) Cooperative sugar factories, spinning

mills and banks Rs.2500 per annum

(iii) District level societies Rs.1500 per annum

(iv) Below district level but not below taluk Rs.1000 per annum

level societies

24 Banking companies as defined in the

Banking Regulations Act, 1949 Rs.2500 per annum

1[Explanation.- For the purpose of this

entry, ‘banking companies’ shall include any

bank whose operations are governed by the

provisions of the Banking Regulation

Act,1949 (Central Act 10 of 1949).]1

1. Shall be deemed to have been inserted by Act 6 of 2008

w.e.f. 1.4.2003.

Companies registered under the Companies

25 Act, 1956 and engaged in any profession, Rs.2500 per annum

trade or calling.

26 Each partner of a firm engaged in any Rs.1000 per annum

profession, trade or calling.

216 Tax on Professions, Trades Callings 1976: KAR. ACT 35]

and Employments

Sl. Class of persons Rate of tax

No.

27 Agriculturists growing plantation crops as

defined in the Karnataka Agricultural Income

Tax Act, 1957

(Karnataka Act 22 of 1957)

(a) in extents of land exceeding 15 acres Rs.1500 per annum

and less than 50 acres

(b) in extents of land exceeding 50 acres Rs.2500 per annum

28 Photo laboratories, film processing

laboratories and photo studios.-

(i) in the Bangalore Urban Agglomeration or Rs.1500 per annum

within the Municipal limits of District

Headquarters/Town

(ii) in any other area in the State Rs.500 per annum

29 (a) Nursing home and hospital other than

those run by the State or Central Rs.2500 per annum

Government.

(b) Pathological testing laboratories and X-

ray clinics.-

(i) in the Bangalore Urban Agglomeration or

within the Municipal limits of District Rs.2500 per annum

Headquarters / town

(ii) in any other area in the State. Rs.1000 per annum

30 Beauty parlours, dry cleaners and interior

decorators-

(i) in the Bangalore Urban Agglomeration or

within the Municipal limits of District Rs.1500 per annum

Headquarters / town

(ii) in any other area in the State. Rs.1000 per annum

31

Film distributors Rs.2500 per annum

(a) Travel agents not falling under sub-item

32 (b) below.-

(i) in the Bangalore Urban Agglomeration or

Rs.1500 per annum

within the Municipal limits of District

1976: KAR. ACT 35] Tax on Professions, Trades Callings 217

and Employments

Sl. Class of persons Rate of tax

No.

Headquarters/Town

(ii) in any other area in the State. Rs.1000 per annum

(b) Air travel agents Rs.2500 per annum

33 Journalists Rs.1000 per annum

34 Rs.2500 per annum

Advertising firms / agencies

35 Persons using photocopying machines for Rs.1000 per annum

job works

36 Video cassette libraries Rs.1000 per annum

37 Educational Institutions and Tutorial Rs.2500 per annum

Colleges or Institutes (other than those

owned by the State or Central Government

or Institutions teaching Kannada or English

shorthand or typewriting).

38 Persons owning / running STD/ISD/FAX

Booths other than those owned / run by

Government or physically handicapped

persons.-

(i) In the Bangalore Urban Agglomeration or Rs.600 per annum

within the Municipal limits of District

Headquarters/Town

(ii) In any other area in the State. Rs.300 per annum

39

Persons providing entertainment using Dish

Antennae and Cable TV-

(i) In the Bangalore Urban Agglomeration or Rs.1500 per annum

within the Municipal limits of District

Headquarters/Town

(ii) In any other area in the State. Rs.1000 per annum

Property Developers including Land

40

Developers and Building / Flat Developers

Rs.2500 per annum

41 Persons owning / running,

(a) Computer Institutes selling time, Rs.2500 per annum

(b) Computer Training Institutes / Driving

218 Tax on Professions, Trades Callings 1976: KAR. ACT 35]

and Employments

Sl. Class of persons Rate of tax

No.

Institutes / Technical Training Institutes Rs.1500 per annum

42 Persons owning Marriage Halls / Kalyana Rs.2500 per annum

Mantaps.

43 Owners of bars and restaurants within the Rs.2500 per annum

limits of City Municipal Corporation.

44 Licence Holders of distilleries, bottling units Rs.2500 per annum

and vending of arrack (other than sub

lessees)

45 (a) Cinematograph film processors. Rs.2500 per annum

(b) Owners of outdoor film shooting units Rs.2500 per annum

Persons licensed or approved as contractors

46 by the Railways, State or Central

Government, Corporations, Local Authorities

or any other person or agency, namely,

Contractors constructing roads, dams,

canals, bridges, culverts including civil or

masonry work, railways sleeper contractors,

forest contractors and electrical contractors;

where the total consideration of all the

contract in a year is.-

(a) Upto Rs. 2 lakhs Nil

(b) Rs.2 lakhs and above but less than Rs.1000 per annum

Rs.10 lakhs

(c) Rs. 10 lakhs and above but less than Rs.1500 per annum

Rs.25 lakhs

(d) Rs. 25 lakhs and above Rs.2500 per annum

Transport contractors including forwarding Rs.2500 per annum

47 and clearing agents

Bankers who are financing the trade against Rs.1500 per annum

48 hundies or other securities by way of short

term advance on interest.

49 (a) Authorised Assistant recognized by Rs.1000 per annum

Stock Exchange

(b) Stock brokers, sub-brokers recognized Rs.2500 per annum

by the Stock Exchange Board of India

1976: KAR. ACT 35] Tax on Professions, Trades Callings 219

and Employments

Sl. Class of persons Rate of tax

No.

50 Persons running weigh bridges Rs.1000 per annum

51 (a) Persons operating courier service Rs.2500 per annum

(b) Agents of courier service.-

(i) in Bangalore Urban Agglomeration Rs.600 per annum

(ii) in any other area in the State. Rs.300 per annum

Persons operating wireless services

52

including pagers service. Rs.2500 per annum

(a) Persons operating mobile telephone

53 service Rs.2500 per annum

(b) Persons providing internet service

running internet cafes, information kiosks. Rs.2500 per annum

(c) Persons operating e-commerce business

Persons operating Air taxi and helicopter Rs.2500 per annum

54

services

(a) Persons running clubs including Rs.2500 per annum

55 recreation clubs

(b) Persons operating gymnasium Rs.2500 per annum

Persons organizing events, pageants,

56 fashion shows and the like. Rs.2500 per annum

Persons operating city-taxi services

57 (i) in the Bangalore Urban Agglomeration Rs.1500 per annum

(ii) in any other area in the State Rs.1000 per annum

58 Persons providing bill boards Rs.1000 per annum

Designers and landscaping consultants,

59 Vaastu, Fengshui and other similar

consultants

(i) in the Bangalore Urban Agglomeration Rs.1500 per annum

(ii) in any other area in the State Rs.1000 per annum

60 Persons engaged in placement services Rs.2500 per annum

61 Persons running IT call centres Rs.2500 per annum

62 Multi-system operators (TV signal providers) Rs.2500 per annum

220 Tax on Professions, Trades Callings 1976: KAR. ACT 35]

and Employments

Sl. Class of persons Rate of tax

No.

63 Yoga and Reiki Training Centres

(i) in the Bangalore Urban Agglomeration Rs.1500 per annum

(ii) in any other area in the State Rs.1000 per annum

64 Persons trading in REP licences and Exim Rs.2500 per annum

scrips

65 1[xxx]

1

1. Omitted by Act 5 of 2006 w.e.f. 1.4.2006

66 Persons running security services Rs.2500 per annum

67 Private radio broadcasters and operators Rs.1500 per annum

68 Astrologers, Astropalmists, Numerologists

and Faith healers Rs. 1500 per annum

(i) in the Bangalore Urban

Agglomeration

(ii) in any other area in the State Rs. 1000 per annum

69 Persons engaged in maintenance or running

of vehicle including bicycle parking places or

areas

(i) in the Bangalore Urban Agglomeration Rs.2,500 per annum

(ii) in any other area in the State Rs.1,500 per annum

70. Persons owning or running places providing

massage, sauna and other health and

beauty improvement services,

Rs.2,500 per annum

(i) in the Bangalore Urban Agglomeration

(ii) in any other area in the State Rs.1,500 per annum

Persons acting as brokers, commission

71.

agents and the like for purchase and sale

of old or used motor vehicles,

Rs.2,500 per annum

(i) in the Bangalore Urban Agglomeration

(ii) in any other area in the State Rs.1,500 per annum

72 Persons acting as agents, consultants and

the like for any company or firm engaged in

any business,

(i) in the Bangalore Urban Agglomeration Rs.2,500 per annum

(ii) in any other area in the State

Rs.1,500 per annum

73 Persons other than those mentioned in any

of the preceding entries who are engaged in Rs.2,500 per annum

any profession, trade, calling or employment

and who are paying tax under the Income Tax

Act, 1961 (Central Act 43 of 1961)

Persons other than those mentioned in any

74 of the preceding entries who are engaged in Rs.1,000 per annum]1

profession, trade, calling or employments as

the State Government from time to time by

notification specify

1. Substituted by Act 5 of 2007 w.e.f. 1.4.2007.

1976: KAR. ACT 35] Tax on Professions, Trades Callings 221

and Employments

Explanation I. - Notwithstanding anything in this Schedule, where a

person is covered by more than one entry in the Schedule the highest rate

of tax specified under any of those entries shall be applicable in his case.

Explanation II.- For purposes of determining the liability and the rate

of tax in terms of Serial Number 15 in this Schedule, the higher number of

workers and / or employees and / or employees at any time during the year

shall be reckoned as the basis.

Explanation III.- For the purposes of Serial No. 16 of this Schedule

where the oil pump or service station is held on lease by a lessee, such

lessee shall be deemed to be the person liable under the Act.

Explanation IV.- No tax shall be levied under this Act on any firm

except when it is engaged in any profession, trade or calling specified in

Serial Numbers 2(a)(iii), 3(a)(iv), 5(iii), 6(a)(iii), 6(b)(iv), 7(a)(iii), 8, 8(i),

10(iv), 11(i), 11(ii)(b), 11(iii), 13(d), 15(iv), 16, 17, 18(ii), 19(i), 20(b), 21, 22,

27(b), 29(a), 29(b)(i), 31, 32(b), 34, 37, 40, 41(a), 42, 43, 44, 45, 46(d), 47,

49(b), 51(a), 52, 53, 54, 55, 56, 60, 61, 62,1[64, 66, 69(i), 70(i), 71(i), 72(i)

and 73]1 of the Schedule.

1. Substituted by Act 5 of 2007 w.e.f. 1.4.2007.

Explanation V. - No tax shall be levied under this Act on any partner

of a firm, which is engaged in any profession, trade or calling specified in

Explanation IV above.

222 Tax on Professions, Trades Callings 1976: KAR. ACT 35]

and Employments

Explanation VI.- Notwithstanding anything contained in the Schedule,

every branch of any self-employed assessee enumerated in any item of the

Schedule shall be deemed to be a separate assessee for the purpose of

levy of profession tax specified in the Schedule]1.

***

Вам также может понравиться

- Tax Rates KPT PDFДокумент16 страницTax Rates KPT PDFAbhishek KumarОценок пока нет

- RateДокумент13 страницRatejustndn4u6307Оценок пока нет

- PT ScheduleДокумент14 страницPT ScheduleRaghavendra karekarОценок пока нет

- Rates On Profession TaxДокумент7 страницRates On Profession Taxknikesh58Оценок пока нет

- Changes Made in Income Tax Act 2058Документ10 страницChanges Made in Income Tax Act 2058shankarОценок пока нет

- Punjab Finance Act 2019Документ14 страницPunjab Finance Act 2019DETDGKHANОценок пока нет

- The West Bengal State Tax On ProfessionsДокумент7 страницThe West Bengal State Tax On ProfessionsNiladri SenОценок пока нет

- Maharashtra State Tax On Professions, Trades, Callings and Employments ActДокумент8 страницMaharashtra State Tax On Professions, Trades, Callings and Employments ActswapnilswayamОценок пока нет

- The West Bengal State Tax On ProfessionsДокумент7 страницThe West Bengal State Tax On ProfessionsRAJESH SAHAОценок пока нет

- New Profession Tax Rates in W.BДокумент5 страницNew Profession Tax Rates in W.BUdayan GautamОценок пока нет

- Tender Procedures 20.06.2023Документ34 страницыTender Procedures 20.06.2023Pavina MОценок пока нет

- Profession Tax-Schedule 1Документ3 страницыProfession Tax-Schedule 1SAYAN BHATTAОценок пока нет

- Various CalculatorsДокумент24 страницыVarious Calculatorsshagun khandelwalОценок пока нет

- Finance Management Specialisation - Ii 304 - B: Direct TaxationДокумент3 страницыFinance Management Specialisation - Ii 304 - B: Direct TaxationRohit ParmarОценок пока нет

- It 1Документ18 страницIt 1naheensyeda20Оценок пока нет

- Consumer ProtectionДокумент1 страницаConsumer ProtectionDeepak DasОценок пока нет

- Revision of Rates IGRS 01-Sep-2021Документ8 страницRevision of Rates IGRS 01-Sep-2021venu4u498Оценок пока нет

- Tests - CAF 02 Tax Practices Sir Adnan Rauf (SPR24)Документ87 страницTests - CAF 02 Tax Practices Sir Adnan Rauf (SPR24)Umar HasanОценок пока нет

- Maud MS 218Документ16 страницMaud MS 218Avinash SarwanОценок пока нет

- KP Finance Act 2021Документ19 страницKP Finance Act 2021Arshad MahmoodОценок пока нет

- PT Rate Schedule Updated - 0 (01.04.2023) - 0Документ10 страницPT Rate Schedule Updated - 0 (01.04.2023) - 0rohitgawande2010Оценок пока нет

- Incoem Tax Final PDFДокумент138 страницIncoem Tax Final PDFRam IyerОценок пока нет

- Css Accountancy2 2018 PDFДокумент2 страницыCss Accountancy2 2018 PDFMaria NazОценок пока нет

- Income Tax - DEA-1Документ83 страницыIncome Tax - DEA-1Crick CompactОценок пока нет

- A Consent To Establish (Noc) : Industries Having Capital InvestmentДокумент8 страницA Consent To Establish (Noc) : Industries Having Capital InvestmentAnkit GuptaОценок пока нет

- Reg. No.: Q.P. Code: (17 BBA 31/ 17 BBACA 31/17 BBARM 44/ 17 BBAIB 49/17 BBABPM 15)Документ10 страницReg. No.: Q.P. Code: (17 BBA 31/ 17 BBACA 31/17 BBARM 44/ 17 BBAIB 49/17 BBABPM 15)AK GAMINGОценок пока нет

- Proforma For Calculation of Income Tax For Tax DeductionДокумент1 страницаProforma For Calculation of Income Tax For Tax DeductionManchala Devika100% (1)

- The Institute of Chartered Accountants of India (Icai)Документ4 страницыThe Institute of Chartered Accountants of India (Icai)Lolitambika NeumannОценок пока нет

- Sr. No. Capital Investment Cost of Industries/project Fee Amount (RS.)Документ12 страницSr. No. Capital Investment Cost of Industries/project Fee Amount (RS.)deepali_nih9585Оценок пока нет

- Government of Pakistan Federal Board of Revenue (Revenue Division) No.C.4 (1) ITP/2008-ECДокумент19 страницGovernment of Pakistan Federal Board of Revenue (Revenue Division) No.C.4 (1) ITP/2008-ECAhsan RazaОценок пока нет

- Direct Tax-IДокумент21 страницаDirect Tax-Ivivek rajakОценок пока нет

- 07 EngДокумент1 страница07 EngYours YoursОценок пока нет

- Changes in Income-Tax - 2020-21 PDFДокумент32 страницыChanges in Income-Tax - 2020-21 PDFmir makarim ahsanОценок пока нет

- Sec. 6Документ15 страницSec. 6Akanksha BohraОценок пока нет

- CS Professional DT IDT Most Expected Questions For DECEMBER 2023Документ285 страницCS Professional DT IDT Most Expected Questions For DECEMBER 2023Dhanush GunisettyОценок пока нет

- General Financial RulesДокумент9 страницGeneral Financial RulesmskОценок пока нет

- Most Expected GST Questions Part 1 by Ca Vivek GabaДокумент25 страницMost Expected GST Questions Part 1 by Ca Vivek GabaLakshman MurthyОценок пока нет

- Time Allowed: 3 Hours Maximum Marks: 100: Advanced Tax Laws and PracticeДокумент19 страницTime Allowed: 3 Hours Maximum Marks: 100: Advanced Tax Laws and PracticeMurugesh Kasivel EnjoyОценок пока нет

- Table "A"Документ5 страницTable "A"hemantasharma123Оценок пока нет

- Economic Legislation II 0405Документ24 страницыEconomic Legislation II 0405api-26541915Оценок пока нет

- MBA183F3: RamaiahДокумент5 страницMBA183F3: Ramaiahvijay shetОценок пока нет

- Sa 3 DT NovДокумент9 страницSa 3 DT NovRishabh GargОценок пока нет

- Income Tax ChangesДокумент30 страницIncome Tax ChangesColors of LifeОценок пока нет

- Rera ProjectДокумент26 страницRera ProjectNidhi PiousОценок пока нет

- Summary of Important Changes Introduced by The Finance Bill, 2022 of BangladeshДокумент26 страницSummary of Important Changes Introduced by The Finance Bill, 2022 of BangladeshNura PaglaОценок пока нет

- PTP SolutionsДокумент5 страницPTP SolutionsSanah SahniОценок пока нет

- TP Documentation & Certification - NIRC-07.10Документ34 страницыTP Documentation & Certification - NIRC-07.10preetishahОценок пока нет

- Itcst Nov06Документ27 страницItcst Nov06api-3825774Оценок пока нет

- Professional Tax Act KPKДокумент6 страницProfessional Tax Act KPKHumayunОценок пока нет

- Test 2Документ3 страницыTest 2Awais ShahidОценок пока нет

- Tds 16 NДокумент3 страницыTds 16 Nssanju_bhatОценок пока нет

- Indirect Tax Laws Detail Test 1 May 2024 Solution 1702459521Документ13 страницIndirect Tax Laws Detail Test 1 May 2024 Solution 1702459521SAKSHI SINGHОценок пока нет

- DefinitionsДокумент86 страницDefinitionsAkanksha BohraОценок пока нет

- Solution of CS PROFESSIONAL Income Tax Test by CA Vivek GabaДокумент13 страницSolution of CS PROFESSIONAL Income Tax Test by CA Vivek Gabaarohi guptaОценок пока нет

- Sections:All Subject: CAF-06 Teacher: Sir Adnan/Salman Total Marks: 36 Time Allowed: 1 Hour 10 Minutes Assessment-1 Date: 17 May, 2021Документ6 страницSections:All Subject: CAF-06 Teacher: Sir Adnan/Salman Total Marks: 36 Time Allowed: 1 Hour 10 Minutes Assessment-1 Date: 17 May, 2021BablooОценок пока нет

- 2016 - Final Income Tax Ordinance, 2001 - 19.09.16 First & Second ScheduleДокумент148 страниц2016 - Final Income Tax Ordinance, 2001 - 19.09.16 First & Second ScheduletalalhaiderОценок пока нет

- The Punjab Urban Immovable Property Tax ActДокумент12 страницThe Punjab Urban Immovable Property Tax ActHumayoun Ahmad FarooqiОценок пока нет

- 2004 MMS Exam and KeyДокумент35 страниц2004 MMS Exam and KeyAnni ZhouОценок пока нет

- 2012 Syllabus 11 AccountancyДокумент4 страницы2012 Syllabus 11 AccountancyYadira TerryОценок пока нет

- 3.3 Exercise - Improperly Accumulated Earnings TaxДокумент2 страницы3.3 Exercise - Improperly Accumulated Earnings TaxRenzo KarununganОценок пока нет

- Factors Influencing The Advertising Budget AllocationДокумент10 страницFactors Influencing The Advertising Budget AllocationAnkush Kumar Rana0% (1)

- The Institute of Certified General Accountants of Bangladesh Formation Level 2 F7 - Business FinanceДокумент3 страницыThe Institute of Certified General Accountants of Bangladesh Formation Level 2 F7 - Business FinanceAbdullah Tousif MajumderОценок пока нет

- The Impact of Financial Management System On Human Resource Utilization (A Case in Gondar Municipality)Документ67 страницThe Impact of Financial Management System On Human Resource Utilization (A Case in Gondar Municipality)meseret sisayОценок пока нет

- Analysis of Walmart Case With Tableu GraphicsДокумент5 страницAnalysis of Walmart Case With Tableu GraphicsEdgar BuitragoОценок пока нет

- Term Structure of Interest RatesДокумент48 страницTerm Structure of Interest Ratesakshays123Оценок пока нет

- Gpro From HTfedДокумент19 страницGpro From HTfedMunteanu Bogdan BlackHelmets100% (1)

- A Study On Dividend Policy FinalДокумент111 страницA Study On Dividend Policy FinalrahulОценок пока нет

- Postgraduate PG Mba Semester 1 2019 November Managerial Accounting 2019 PatternДокумент7 страницPostgraduate PG Mba Semester 1 2019 November Managerial Accounting 2019 PatternHarshad BangarОценок пока нет

- College Savings Plan ComparisonДокумент2 страницыCollege Savings Plan Comparisoncharanmann9165Оценок пока нет

- Chapter 6 Discussion QuestionsДокумент3 страницыChapter 6 Discussion QuestionsS1NL3SS PA1NОценок пока нет

- Decision Making .PPT 4th Sem McomДокумент16 страницDecision Making .PPT 4th Sem Mcomnousheen rehmanОценок пока нет

- FI MM OBYC ScenariosДокумент29 страницFI MM OBYC ScenariosPawanDubeyОценок пока нет

- Psm1 (New - Deg) - 0910 - v1.3 Nhs Bursary Application FormДокумент26 страницPsm1 (New - Deg) - 0910 - v1.3 Nhs Bursary Application FormAZZIEAKHTAR100% (1)

- Ellcot Spinning Mills PresentationДокумент22 страницыEllcot Spinning Mills PresentationAhsan ShahidОценок пока нет

- PM7e PindyckRubinfeld Microeconomics Ch12ab - Az.ch12Документ35 страницPM7e PindyckRubinfeld Microeconomics Ch12ab - Az.ch12Wisnu Fajar Baskoro100% (1)

- JobsOhio Bond Offering CircularДокумент253 страницыJobsOhio Bond Offering CircularJosephОценок пока нет

- Working Capital Tools and TechniquesДокумент60 страницWorking Capital Tools and TechniquesMaria Bernadita RiveraОценок пока нет

- Nike Case Study VrindaДокумент4 страницыNike Case Study VrindaAnchal ChokhaniОценок пока нет

- Introduction To Hospitality Fifth Edition John R. Walker: Chapter 3: The Hotel BusinessДокумент24 страницыIntroduction To Hospitality Fifth Edition John R. Walker: Chapter 3: The Hotel BusinessScotch PelosoОценок пока нет

- Special Transact - Almario Quiz 1Документ4 страницыSpecial Transact - Almario Quiz 1Es ToryahieeОценок пока нет

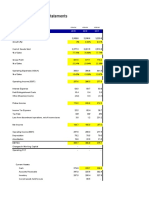

- Financial Statements-Kingsley AkinolaДокумент4 страницыFinancial Statements-Kingsley AkinolaKingsley AkinolaОценок пока нет

- CASE PresentationДокумент29 страницCASE PresentationErro Jaya RosadyОценок пока нет

- Fundamentals of Export Business Plan Major PointsДокумент84 страницыFundamentals of Export Business Plan Major PointsRahim JAbbar67% (3)

- Final Term Project: Report On MCB PakistanДокумент6 страницFinal Term Project: Report On MCB PakistanBHATTIОценок пока нет

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageДокумент1 страницаIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageRAMBABU KURUVAОценок пока нет

- CIR v. Hantex Trading Co., Inc.Документ3 страницыCIR v. Hantex Trading Co., Inc.Junmer OrtizОценок пока нет

- A Mutual Fund is a Common Pool of Money in to Which Investors With Common Investment Objective Place Their Contributions That Are to Be Invested in Accordance With the Stated Investment Objective of the SchemeДокумент6 страницA Mutual Fund is a Common Pool of Money in to Which Investors With Common Investment Objective Place Their Contributions That Are to Be Invested in Accordance With the Stated Investment Objective of the SchemeKumaran MohanОценок пока нет