Академический Документы

Профессиональный Документы

Культура Документы

2.6 Session 08

Загружено:

smfi4490Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

2.6 Session 08

Загружено:

smfi4490Авторское право:

Доступные форматы

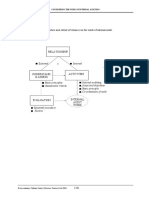

AUDIT MATERIALITY

OVERVIEW

Objective

To describe the concept of materiality and its relationship with audit risk.

MATERIALITY

IASC definition

Basic principles

Economic decisions of users

CONSIDERATIONS Amount

Nature

AUDIT

Planning materiality

PROCEDURES

Effect of audit work

Relationship with risk

EVALUATING

Essential procedure

MISSTATEMENTS

Accountancy Tuition Centre (Overseas Courses) Ltd 2001 0801

AUDIT MATERIALITY

1 MATERIALITY

1.1 IASC1 “Framework” definition

Information is material if its omission or misstatement could influence the economic

decisions of users taken on the basis of the financial statements …

… Materiality depends on the size of the item or error judged in the particular

circumstances of its omission or misstatement. It provides a threshold or cutoff point

rather than being a primary qualitative characteristic which information must have if it

is to be useful.

1.2 Basic principles

Materiality should be considered when:

carrying out an audit (and its relationship with audit risk);

determining audit procedures (their nature, timing and extent);

evaluating misstatements.

ISA 320 also repeats, as a standard, the objective of an audit (see Session 1).

2 CONSIDERATIONS

The ISA refers to “professional judgement” and “amount” and “nature” of

misstatements as considerations. However, given the importance of the

concept of materiality to the objective of an audit (as defined), the users of

financial statements must not be overlooked.

Example 1

Identify FOUR users of financial statements and state their information needs.

Solution

1

The International Accounting Standards Committee’s Framework for the Preparation and

Presentation of Financial Statements

Accountancy Tuition Centre (Overseas Courses) Ltd 2001 0802

AUDIT MATERIALITY

2.1 Economic decisions of users

The auditor ordinarily reports to the shareholders who are of primary

importance when setting materiality levels.

Different users base their assessment of materiality on different criteria.

Illustration 1

A bank considering a loan application will consider matters to be material if

they affect the company’s:

− profit before interest (affects interest cover)

− net assets (affects solvency).

2.2 Amount

In designing the audit plan, the auditor sets an acceptable materiality level so

as to detect quantitatively material misstatements.

In a particular context In a general context

Comparing an item to a Look at item in relation to

category as a whole. Eg an financial statements as a whole.

inventory error of $50,000 Eg comparison to

compared to total inventory

– revenue

value of $650,000.

– profit before taxation

– total assets

– capital and reserves.

As a “yardstick”, materiality must be relevant to the user rather than the

preparer of financial statements.

“Critical points” include those at which:

profit → loss

net current assets → net current liabilities.

Misstatements of relatively small amounts could, cumulatively, have a

material effect on financial statements.

Accountancy Tuition Centre (Overseas Courses) Ltd 2001 0803

AUDIT MATERIALITY

Some balances are capable of “precise determination” – others are not.

Capable of Not capable of

Eg directors’ emoluments and share Eg inventory provisions and contingent

capital liabilities

Any error (however small) may be Some degree of latitude is acceptable.

considered material and adjusted.

2.3 Nature

Examples of qualitative misstatements

inadequate or improper description of an accounting policy

failure to disclose the breach of regulatory requirements.

3 AUDIT PROCEDURES

3.1 Planning materiality

Assessment based on latest available reliable financial information related to

specific account balances and classes of transactions.

% guides

5 – 10% profit

½ – 1% net assets

1 – 2% total assets

½ – 1 % revenue.

Example 2

Turnover $5,000,000

Total assets $6,250,000

Profit before tax $417,000

Required:

(a) Commenting on the suitability of setting a materiality level for planning

purposes at:

(i) $20,000

(ii) $40,000

(iii) $100,000.

(b) Justify a materiality level which you consider to be more suitable (if any).

Accountancy Tuition Centre (Overseas Courses) Ltd 2001 0804

AUDIT MATERIALITY

Solution

(a)

(i)

(ii)

(iii)

(b)

Materiality assists in determining an effective audit approach eg

− what items to examine

− whether to use sampling (see Session 16) and/or analytical

procedures (see Session 15).

3.2 Effect on audit work

Example 3

Trade receivables total approximately $210,000 made up as follows:

Value range Number of Total

$000 balances $000

10 – 15 2 22.3

5 – 10 6 41.5

1 – 5 40 87.0

0 – 1 89 59.6

___ _____

137 210.4

___ _____

Prepayments amount to $16,450.

Required:

Suggest how a materiality level of $25,000 may affect audit procedures on trade

receivables and prepayments.

Solution

Accountancy Tuition Centre (Overseas Courses) Ltd 2001 0805

AUDIT MATERIALITY

3.3 Relationship with audit risk

The relationship between materiality and the level of audit risk is described as

“inverse” (ie the higher the materiality level, the lower the audit risk and vice

versa).

For example, if acceptable materiality level is lower (↓), audit risk is

increased (↑). The auditor compensates for this by either:

reducing CR (if possible) and carrying out extended or additional

tests of control, or

reducing DR by modifying the nature, timing and extent of planned

substantive procedures.

4 EVALUATING MISSTATEMENTS

4.1 Essential procedures

The aggregate of uncorrected misstatements must be assessed (as material or not

material) in evaluating fair presentation of the financial statements.

Uncorrected misstatements =

specific misstatements (including previous periods)

+ best estimate of other misstatements (ie projected errors).

Further considerations, if aggregate may be material:

any further adjustments which management propose or are prepared

to make;

the impact (if any) on critical points;

whether projected errors can be reduced (to bring the aggregate

below an acceptable threshold) by extending audit procedures.

Accountancy Tuition Centre (Overseas Courses) Ltd 2001 0806

AUDIT MATERIALITY

Example 4

During the course of an audit, the following errors are discovered.

(1) Trade accounts receivable overstated by $40,000

(2) Inventories overstated by $58,000

(3) Trade payables understated by $80,000

$100,000 is considered to be material.

Required:

Determine the minimum adjustment (if any) that must be made for the presentation of

the financial statement to be evaluated as fair if:

(i) all three errors affect profit;

(ii) only error (2) affects profit.

If any remaining (unadjusted) aggregate may be material the auditor’s report should be

modified in accordance with ISA 700 (see Session 17).

FOCUS

You should now be able to

define and illustrate the concepts of materiality”

assess planning materiality

explain the significance of unadjusted differences and evaluate the effect of

misstatements.

Accountancy Tuition Centre (Overseas Courses) Ltd 2001 0807

AUDIT MATERIALITY

EXAMPLE SOLUTIONS

Solution 1 – Users and their information needs

Users Information needs

Investors (owners) and their Providers of capital are concerned with the risk and

advisers return of their investment. They need information

− for decision-making (buy, hold or sell?)

− to assess the enterprise’s ability to pay

dividends

Employees and their Stability and profitability of employers

representatives

Ability to provide remuneration, retirement

benefits and employment opportunities

Lenders (eg banks) Whether loans and interest will be paid when due

Suppliers and other trade Whether amounts owing will be paid when due

creditors

Customers Continuance – important for long-term

involvement with, or dependence on, the enterprise

Governments and their Allocation of resources and, therefore, activities of

agencies (eg tax authorities) enterprises

Information to regulate activities, determine

taxation policies and as the basis for national

income and similar statistics

Public Contribution to local economy including number of

employees and patronage of local suppliers

Trends and recent developments in prosperity and

range of activities

Management To plan, make decisions and control operational

activities.

Accountancy Tuition Centre (Overseas Courses) Ltd 2001 0808

AUDIT MATERIALITY

Solution 2 – Planning materiality

(a) Suitability of levels

(i) $20,000 – this is likely to too low as it falls below the lower limits

for turnover, total assets and profit before tax.

(ii) $40,000 – this is more suitable in that it lies within the % ranges for

turnover and profit before tax. However, it may still be regarded as

too low in relation to the balance sheet.

(iii) $100,000 – although suitable for the audit of the balance sheet, this is

likely to be considered too high for classes of transactions and material

error in the income statement may not be detected by audit procedures.

(b) Recommendation

This is clearly a matter of judgement, however, as profit before tax is a

function of the make-up of balances and transactions (and at this stage in the

audit only draft), it is more likely that preliminary materiality will be

determined in relation to turnover and/or total assets. As there is no overlap

of these ranges – no one range will satisfy both. Therefore, an amount could

be set to satisfy just one judged on the needs of users. (For example, if users

are more interested in revenues and the income statement than the balance

sheet, $50,000 may be appropriate.) Alternatively, an amount could be set

between ranges as a compromise, say $60,000.

WORKING

% $000

Turnover ½–1 25 – 50

Total assets 1–2 62.5 – 125

Profit before tax 5 – 10 20.8 – 41.7

Solution 3 – Effect on audit work

Trade receivables

Although there is no one trade account receivable balance greater than

$25,000 the 8 largest balances total $63,800 and have the greatest potential

for containing material error (of overstatement). These individual balances

are likely to be tested in detail (see Session 23).

The average balance in the range $1,000 – $5,000 is $2,100 and the average

balance less than $1,000 is $670. If the profile of these balances is similar to

the previous year audit tests may not be detailed, but take the form of

analytical procedures (see Session 15).

Prepayments

If $16,450 is in line with the prior period then it is unlikely to be materiality

incorrectly stated and audit tests may be limited to an analytical comparison

with the prior year.

Accountancy Tuition Centre (Overseas Courses) Ltd 2001 0809

AUDIT MATERIALITY

Solution 4 – Evaluation of aggregate misstatement

(i) All three items affect profit

In aggregate, net profit and net current assets are overstated by $178,000 – which is

material. A minimum adjustment of $78,000 is therefore needed. For example, if the

understatement of trade payables is due to liabilities for purchases having been omitted,

then if management are prepared to adjust the trade payables to correct the $80,000

understatement, the remaining unadjusted aggregate, $98,000 is less that the materiality

limit.

(ii) Only (2) affects profit

The misstatements on receivables and payables must be reflected elsewhere in the

balance sheet. For example, cash at bank may be overstated (or bank overdraft

understated) if the errors are due to incorrect cut-off on cash receipts and payments.

The effect on net assets and profit is therefore only $58,000 which is not material.

However, if the incorrect cut-off (say) was in error, management should be prepared to

adjust for it. (If not, this might raise doubts about whether the “error” was by accident

or design.)

Accountancy Tuition Centre (Overseas Courses) Ltd 2001 0810

Вам также может понравиться

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- 2.6 Session 15Документ14 страниц2.6 Session 15smfi4490Оценок пока нет

- 2.6 Session 13Документ12 страниц2.6 Session 13smfi4490Оценок пока нет

- 2.6 Session 11Документ6 страниц2.6 Session 11smfi4490Оценок пока нет

- 2.6 Session 12Документ6 страниц2.6 Session 12smfi4490Оценок пока нет

- 2.6 Session 14Документ14 страниц2.6 Session 14smfi4490Оценок пока нет

- 2.6 Session 09Документ12 страниц2.6 Session 09smfi4490Оценок пока нет

- 2.6 Session 11Документ6 страниц2.6 Session 11smfi4490Оценок пока нет

- 2.6 Session 07Документ22 страницы2.6 Session 07smfi4490Оценок пока нет

- ATC Review NotedДокумент6 страницATC Review Notedsmfi4490Оценок пока нет

- 2.6 Session 04Документ18 страниц2.6 Session 04smfi4490Оценок пока нет

- 2.6 Session 06Документ12 страниц2.6 Session 06smfi4490Оценок пока нет

- 2.6 Session 12Документ6 страниц2.6 Session 12smfi4490Оценок пока нет

- 2.6 Session 18Документ6 страниц2.6 Session 18smfi4490Оценок пока нет

- 2.6 Session 07Документ22 страницы2.6 Session 07smfi4490Оценок пока нет

- 2011 CalendarДокумент13 страниц2011 CalendarMicrosoftTemplatesОценок пока нет

- 2.6 Monitoring Test 1 - AnswersДокумент12 страниц2.6 Monitoring Test 1 - Answerssmfi4490Оценок пока нет

- ATC Review NotedДокумент6 страницATC Review Notedsmfi4490Оценок пока нет

- Excel Formula For CAДокумент61 страницаExcel Formula For CArameshritikaОценок пока нет

- ThursdayДокумент1 страницаThursdaysmfi4490Оценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- DSДокумент57 страницDSDelishaОценок пока нет

- IdaДокумент23 страницыIdaarun_choudhary_9Оценок пока нет

- Propectus, Share Capital and Shares, Buyback of Shares, DebenturesДокумент40 страницPropectus, Share Capital and Shares, Buyback of Shares, DebenturesZayed KhanОценок пока нет

- Accounting For Business Decision PDFДокумент29 страницAccounting For Business Decision PDFfirdaus indrajayaОценок пока нет

- Piercing The Veil of Corporate FictionДокумент3 страницыPiercing The Veil of Corporate FictionjamesОценок пока нет

- The Role of MNCs in The National Economy in BangladeshДокумент2 страницыThe Role of MNCs in The National Economy in Bangladeshsopner jalanaОценок пока нет

- Horse Racing Winning FormulaДокумент23 страницыHorse Racing Winning Formulaifandoot100% (2)

- Finance Quiz On M&AДокумент6 страницFinance Quiz On M&AAman SinghОценок пока нет

- The Target The Decimation of Jignesh Shahs Global EmpireДокумент240 страницThe Target The Decimation of Jignesh Shahs Global Empirevishal sharma0% (1)

- DocxДокумент16 страницDocxJustin NoladaОценок пока нет

- RES Essay Competition 2014 Judges Report & Winning EssaysДокумент38 страницRES Essay Competition 2014 Judges Report & Winning EssaysAxelОценок пока нет

- Business CycleДокумент12 страницBusiness CycleAnonymous xfUYb0MPnPОценок пока нет

- Accounting CH 8Документ29 страницAccounting CH 8Nguyen Dac ThichОценок пока нет

- Economic Analysis of Production of Essential Oil Using Steam Distillation TechnologyДокумент5 страницEconomic Analysis of Production of Essential Oil Using Steam Distillation TechnologygoutamsasmitaОценок пока нет

- Clip Art, Elements, and Firm GraphicsДокумент45 страницClip Art, Elements, and Firm GraphicsSHОценок пока нет

- Plaintiffs:: Court Use Only - Case NumberДокумент39 страницPlaintiffs:: Court Use Only - Case NumberCircuit MediaОценок пока нет

- Research Scientist IBM Research Africa DR - Charity Wayua EaseofDoingBusinessReport ConnectedEA2015 1-04-15Документ28 страницResearch Scientist IBM Research Africa DR - Charity Wayua EaseofDoingBusinessReport ConnectedEA2015 1-04-15ICT AUTHORITYОценок пока нет

- Lecture 5312312Документ55 страницLecture 5312312Tam Chun LamОценок пока нет

- Indian Unicorns With Chinese InvestorsДокумент1 страницаIndian Unicorns With Chinese InvestorsThe WireОценок пока нет

- How To Import Share Price Data Into Excel - Market IndexДокумент6 страницHow To Import Share Price Data Into Excel - Market IndexgeologerОценок пока нет

- Comparative Analysis of Stock Exchanges ReturnsДокумент40 страницComparative Analysis of Stock Exchanges ReturnsRanjeet RajputОценок пока нет

- Purchasing Power ParityДокумент9 страницPurchasing Power Paritymahantesh123Оценок пока нет

- Carter Favorite Set UpsДокумент56 страницCarter Favorite Set UpsAndreas100% (2)

- The Market Whisperer - Part One PDFДокумент159 страницThe Market Whisperer - Part One PDFfeliceanu75% (8)

- Dtaa 2Документ18 страницDtaa 2dj_han85Оценок пока нет

- JournalДокумент5 страницJournalvdreams24Оценок пока нет

- 05 Asset AccountingДокумент80 страниц05 Asset AccountingParman Manullang ManullangОценок пока нет

- Harley Davidson Strategic PlanДокумент28 страницHarley Davidson Strategic PlanRasydi Rashid67% (3)

- Carlsberg Brewery BHDДокумент9 страницCarlsberg Brewery BHDGunawathy ArumugamОценок пока нет

- Fa Mod1 Ont 0910Документ511 страницFa Mod1 Ont 0910subash1111@gmail.comОценок пока нет