Академический Документы

Профессиональный Документы

Культура Документы

FIN9770 Exam2

Загружено:

Vikas Sharma0 оценок0% нашли этот документ полезным (0 голосов)

20 просмотров1 страницаBond w / o sinkin fund always rate below BBB (junk) -Par value : bond sold at $1000. -Yield to Maturity(YTM): rate of return earned on a bond held to maturity.

Исходное описание:

Оригинальное название

FIN9770-Exam2

Авторское право

© Attribution Non-Commercial (BY-NC)

Доступные форматы

DOCX, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документBond w / o sinkin fund always rate below BBB (junk) -Par value : bond sold at $1000. -Yield to Maturity(YTM): rate of return earned on a bond held to maturity.

Авторское право:

Attribution Non-Commercial (BY-NC)

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

20 просмотров1 страницаFIN9770 Exam2

Загружено:

Vikas SharmaBond w / o sinkin fund always rate below BBB (junk) -Par value : bond sold at $1000. -Yield to Maturity(YTM): rate of return earned on a bond held to maturity.

Авторское право:

Attribution Non-Commercial (BY-NC)

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 1

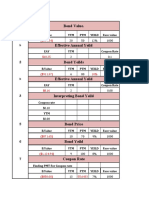

CHAP-5: BONDS

-Bond: T-Bond ; Corporate Bond; Municipal Bond; Foreign Bond.

-Sinking Fund: Provision to pay off a loan over its life rather all at maturity. Bond w/o sinkin fund always

rate below BBB (junk)

-Par value : Bond sold at $1000 . - If Rd < Coupon Rate: Bond sells at premium. When going rate>Coupon

Rate: Discount Bond

- Payment in Kind (PIK)Bond : don’t pay cash but coupons consisting of additional bonds. Company w/

cash flow problem. Risky

-Bond Valuation: A bond of 10 yr.,10%annuity of $100/yr.plus a lump sum at t=10:{n=10;I/yr.:10

;PMT:100;FV:1000;Ans.PV:(-1000)

-Coupon Rate : PMT/FV(normally $1000)

-Yield to Maturity(YTM): Rate of return earned on a bond held to maturity. YTM= Current Yield + Capital

Gains Yield.

- Current Yield : Annual Coupon Pmt. /Current price ; - Capital Gain Yield = Change in price/Beginning

Price.

-Semi Annual Bonds : N=2N ; I/YR = Rd /2 ; PV =Ok ; PMT = INT/2 ; FV=OK.

- YTC : N =when it can be called (say 5); PV :won’t change ; PMT: won’t change ; FV: change in question ;

I% =?

- YTC for semi-annual bonds : 2N ; PMT/2 ; whatever I% comes multiply that by 2 to get final interest

rate.

- Interest Rates go Up ; Bond prices fall. Expect YTC on premium bonds , YTC at par & discount bonds.

- (Rd = r* + IP + DRP + LP + MRP) ; Rd = Req. rate of return ; r*= Real risk free rate (0 inflation) ; IP =

Inflation Premium ;

DRP = Default Risk Premium ; LP = Liquidity Premium ; MRP = Maturity Risk Premium.

- Nominal Risk Free Rate (RRF) = r* + IP [Rate on Treasury Security] ;

- (TIPS) Treasury Inflation Protected Securities ; IP = Yield on Treasury Security – Yield on TIPS.

- Bond Spread [Corporate bond’s yield - T-Security yield of same maturity] = DRP+LP ; {Junk Bond

=greater spread , More risky}

- Yield(for US T-Bond) = Real Rate + IP + MRP as DRP = LP=0

- DRP for Corp. Bond =Corp. Bond Yield - T-Bond Yield – LP

- Interest Rate Risk : 1. Price & Interest rate are inversely related. 2. Longer term bond is riskier than

short term. 3. Lower coupon bond riskier than bonds with higher coupon.

-Zero coupon bonds. Don’t pay any coupon. PMT = 0

-Bankruptcy : Chap 11: Reorganization ; Chap -7 :Liquidation

CHAP-6:

-Investment Risk: the probability of earning a return less than expected.

- Expected Rate of Return (r) = ∑Pi ri , where Pi = Probability; ri = Rate of return.

- Standalone Risk : Measures the risk of a single asset. Std. Deviation (Sigma) = √ Variance = √ ∑ (ri –

r)2 Pi.

-Coefficient of Variation (CV) = Std. dev. / Expected Return.

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Corporate Finance 4th Edition Berk Solutions Manual 1Документ4 страницыCorporate Finance 4th Edition Berk Solutions Manual 1bradley100% (39)

- Exercises Topic 2 With AnswersДокумент2 страницыExercises Topic 2 With AnswersfatehahОценок пока нет

- Bond Equivalent Yield Financial MarketsДокумент5 страницBond Equivalent Yield Financial MarketsLianne PadillaОценок пока нет

- Heads Contact of CompaniesДокумент2 592 страницыHeads Contact of CompaniesAshutosh SharmaОценок пока нет

- Bonds and DepreciationДокумент12 страницBonds and DepreciationJayson Cuadra PagalaОценок пока нет

- Loma 357 C8Документ26 страницLoma 357 C8May ThirteenthОценок пока нет

- QuestionsДокумент4 страницыQuestionsSohad ElnagarОценок пока нет

- Principles of Corporate Finance QuizДокумент5 страницPrinciples of Corporate Finance QuizKalonОценок пока нет

- Assignment 6Документ3 страницыAssignment 6killerОценок пока нет

- JYSKE Bank AUG 03 Corporate Bond UniverseДокумент5 страницJYSKE Bank AUG 03 Corporate Bond UniverseMiir ViirОценок пока нет

- Fixed Income 6.1. Basic Features of A Fixed-Income Security 6.1.1. 6.1.1.1. Basic Features of A Fixed-Income SecurityДокумент80 страницFixed Income 6.1. Basic Features of A Fixed-Income Security 6.1.1. 6.1.1.1. Basic Features of A Fixed-Income SecurityEvelyn YangОценок пока нет

- EM Bond List Oct - 12Документ257 страницEM Bond List Oct - 12Nicolas Canales MironesОценок пока нет

- Lecture 10 BFДокумент19 страницLecture 10 BFHussnain AbbasОценок пока нет

- KKBS Week 6 - CH 7 Bond ValuationДокумент22 страницыKKBS Week 6 - CH 7 Bond ValuationLili YaniОценок пока нет

- Pricing Fixed Income SecuritiesДокумент3 страницыPricing Fixed Income SecuritiesIrfan Sadique IsmamОценок пока нет

- Lee HW2Документ7 страницLee HW2Cheska LeeОценок пока нет

- Bond Value.: B.Value YTM PTM Yeild Face ValueДокумент4 страницыBond Value.: B.Value YTM PTM Yeild Face ValueshabywarriachОценок пока нет

- Debt Redeemed-20.06.2016Документ830 страницDebt Redeemed-20.06.2016Reedos LucknowОценок пока нет

- Solution To Some Questions From Bodie Ch-14 Problem SetsДокумент14 страницSolution To Some Questions From Bodie Ch-14 Problem Setspitcher90100% (2)

- Security and Corporate Valuation: 1. Bond / Debenture 2.preferred StockДокумент7 страницSecurity and Corporate Valuation: 1. Bond / Debenture 2.preferred StockRajkumar TimalsinaОценок пока нет

- Vanguard High Yield Bond Fund BogleheadsДокумент12 страницVanguard High Yield Bond Fund Bogleheadsambasyapare1Оценок пока нет

- Debt J-LДокумент414 страницDebt J-LkenindiОценок пока нет

- Lecture 03 Bond Price VolatilityДокумент45 страницLecture 03 Bond Price Volatilityandrewchen336Оценок пока нет

- MBA 7427 Sample Questions CH 7: Multiple ChoiceДокумент5 страницMBA 7427 Sample Questions CH 7: Multiple ChoiceAlaye OgbeniОценок пока нет

- Chapter 4 - MinicaseДокумент4 страницыChapter 4 - MinicaseMuhammad Aditya TMОценок пока нет

- 1 - Week 3 Assignment Module 3 Bond Valuation WorksheetДокумент2 страницы1 - Week 3 Assignment Module 3 Bond Valuation WorksheetAhmad S YuddinОценок пока нет

- Issuer of Bonds: Illustration: On January 04, 20cy, Mcramos Food Products Borrowed P170,000,000 by Issuing P170,000,000Документ9 страницIssuer of Bonds: Illustration: On January 04, 20cy, Mcramos Food Products Borrowed P170,000,000 by Issuing P170,000,000Ruby Mae Ann RomualdoОценок пока нет

- Lecture Notes PDFДокумент17 страницLecture Notes PDFversОценок пока нет

- Chapp 8Документ13 страницChapp 8TRUC.NT1874 2151874Оценок пока нет

- 02 BondsДокумент2 страницы02 BondsblablaОценок пока нет