Академический Документы

Профессиональный Документы

Культура Документы

Investment Recommendations For DAcharya RG 09052009

Загружено:

Dinesh AcharyaИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Investment Recommendations For DAcharya RG 09052009

Загружено:

Dinesh AcharyaАвторское право:

Доступные форматы

My Financial Advisor

3-40, Dheeraj Heritage, S. V. Road,

Milan Subway Junction,

Santacruz (W),

Mumbai – 400 054

Email: info@myfinad.com www.myfinad.com

Tel: +91-22-2660 5075 / +91-22-2660 1302

09/05/2009

Dear Mr. Acharya,

As discussed with you we are planning to adopt the following strategy

1. Use the rally to exit dud stocks & mutual funds or rather be very selective about the stocks & mutual

funds in the portfolio. The idea is to have a portfolio of around 12-14 stocks , 8-10 mutual funds and

prune the portfolio to manageable levels and exit the aggressive ones.

2. Invest the proceeds in liquid plus fund for some times.

3. Post the election results; invest the funds in the stocks and mutual funds that we have short listed.

Your stock portfolio consist of 24 stocks valued Rs.4.12 Lakhs. We have recommended you to sell around

12 stocks valued Rs.60,000 approximately. The proceeds as mentioned above can go in a liquid plus

fund….You can then look at picking up the following

BHEL, Bharti, Rcom (add to existing)

Axis / Bank of India

ICICI Bank, Tata Steel, (add to existing)

Tata Motors

Sterlite (add to existing), Suzlon

Larsen & Toubro (add to existing)

Reliance Infrastructure,

We will take a call post election results.

Dinesh Acharya

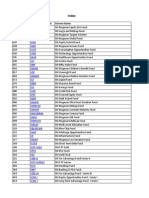

Stocks to be Kept

Stocks to be sold

Stock Qty Mkt. Val Stock Qty Mkt. Val

1 3i Infotech 20 1,017 1 BHEL 16 26,360

2 Aban Offshore 6 2,730 2 Bharti Airtel 37 28,393

3 Adlabs 50 11,657 3 HDFC 8 13,919

4 DLF Ltd. 90 21,636 4 ICICI Bank 40 20,824

5 Future Capital Holdings 18 2,742 5 Larsen & Toubro 618 104,034

6 GMDC. 4 282 6 Punj Lloyd 81 17,077

7 IFCI 100 2,660 7 Reliance Capital 312 14,368

8 Jupiter Biosciences 20 1,002 8 RCOM 158 26,404

9 TCS 10 6,302 9 Reliance Industries 1,326 55,013

10 Unitech 14 739 10 SBI 965 10,601

11 Usha Martin 65 2,704 11 Sesa goa 86 20,936

12 Sterlite 315 7,379 12 Tata Steel 50 14,125

Total 60,850 Total 352,054

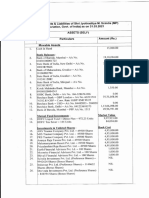

Your mutual fund portfolio consists of total 12 mutual funds valued at Rs.3.30 Lakhs approximately. We

have recommended you to redeem around 7 Funds valued Rs.1.12 Lakhs immediately. Funds will be parked

in liquid plus funds and over a period of time we can move into less aggressive excellent diversified equity

fund such as HDFC Top 200 Fund, HSBC Equity Fund, DSP BR Top 100 Fund.

There is one close ended fund that has not done well at all but we cannot exit it at this point of time. During

our next review we can decide on what needs to be done there.

Mutual Funds to be Redeemed Mutual Funds to be Kept

Market Market

Scheme Scheme

Value Value

1 Reliance Vision Fund 6,702 1 BSL Frontline Equity Fund 17,853

2 UTI Infrastructure Fund 50,295 2 Reliance Growth Fund 44,777

3 UTI Master Share 11,639 3 HDFC Top 200 G Fund 6,807

4 Kotak Opportunities Fund 1,910 4 SBIMF MSFU Contra Fund 49,216

5 ICICI Prudential Power Fund 9,669 5 DSP BR Balanced Fund 100,000

6 Tata Equity Opportunities Fund 10,000

(3 years closed ended post that it

7 Tata Tax Advantage Fund -1 21,844

is open ended)

Total 112,059 Total 218,653

As explained to you, the idea is not to exit equity as an asset class permanently but take advantage of the

rally, book out of not so great investments and move into better investments. We do not intend to book a

loss but want to ensure that the losses can be covered over a period of time by going into meaningful

investments.

Let us know if you have any questions.

Best Regards

Milin Shah.

Вам также может понравиться

- Murder in Baldurs Gate Events SupplementДокумент8 страницMurder in Baldurs Gate Events SupplementDavid L Kriegel100% (3)

- Ngo Burca Vs RP DigestДокумент1 страницаNgo Burca Vs RP DigestIvy Paz100% (1)

- Square Pharma Valuation ExcelДокумент43 страницыSquare Pharma Valuation ExcelFaraz SjОценок пока нет

- AWS D14.1 - 1997 Specification For Welding of Industrial and Mill Crane and Material Handling EqДокумент141 страницаAWS D14.1 - 1997 Specification For Welding of Industrial and Mill Crane and Material Handling EqRicardo Contzen Rigo-Righi50% (2)

- Fabric Test ReportДокумент4 страницыFabric Test ReportHasan MustafaОценок пока нет

- Architecture FirmДокумент23 страницыArchitecture Firmdolar buhaОценок пока нет

- All Financial Tasks Compiled Research Report.Документ44 страницыAll Financial Tasks Compiled Research Report.Abhishek PatilОценок пока нет

- SIP 10-15-20 Years Performance July 2021Документ2 страницыSIP 10-15-20 Years Performance July 2021ABCОценок пока нет

- Jyoti-CNC Automation Limited Anchor Intimation ReportДокумент4 страницыJyoti-CNC Automation Limited Anchor Intimation Reportbodema2660Оценок пока нет

- All Schemes Monthly Portfolio - As On 31 August 2018Документ759 страницAll Schemes Monthly Portfolio - As On 31 August 2018brijsingОценок пока нет

- Changing Trends in MF Industry Post Entry Load WaiverДокумент82 страницыChanging Trends in MF Industry Post Entry Load WaiverDeepak JashnaniОценок пока нет

- Day 3 Master Class CS Rakesh Puri Securities Laws 29.06.2020 PDFДокумент119 страницDay 3 Master Class CS Rakesh Puri Securities Laws 29.06.2020 PDFsmchmpОценок пока нет

- Indian Stock Market GuideДокумент12 страницIndian Stock Market GuideParidhi VarshneyОценок пока нет

- Prime Series 4Документ3 страницыPrime Series 4peeyushbcihmctОценок пока нет

- Mutual Fund Holdings InsightsДокумент292 страницыMutual Fund Holdings InsightsRudra GoudОценок пока нет

- MF Report April 2010Документ6 страницMF Report April 2010Jitin MehtaОценок пока нет

- CompanyДокумент4 страницыCompanyPrembala SharmaОценок пока нет

- Alcoholic Beverages-CH1Документ5 страницAlcoholic Beverages-CH1Prateek KhardОценок пока нет

- Infrastructure Leasing and Financial Services (Il & FS) Revival CaseДокумент5 страницInfrastructure Leasing and Financial Services (Il & FS) Revival CaseGokul GokulОценок пока нет

- TrueДокумент1 063 страницыTruegarvitaneja477Оценок пока нет

- Gopal Namkeen Anchor AllocationReportДокумент3 страницыGopal Namkeen Anchor AllocationReportxepikej426Оценок пока нет

- Rategain Travel IPO anchors allot equity sharesДокумент4 страницыRategain Travel IPO anchors allot equity sharesTejesh GoudОценок пока нет

- Mutual Fund Investment Study In IndiaДокумент69 страницMutual Fund Investment Study In IndiaSv KhanОценок пока нет

- BCG Aditya BirlaДокумент6 страницBCG Aditya BirlaDhruvil PuraniОценок пока нет

- KBC Knowledge Series - Top Ten SchemesДокумент2 страницыKBC Knowledge Series - Top Ten SchemesktiindiaОценок пока нет

- Group 6 - FRMДокумент7 страницGroup 6 - FRMAkshita SkОценок пока нет

- Average Market Capitalization of Listed Companies During Jul - Dec - 2020 - FinalДокумент44 страницыAverage Market Capitalization of Listed Companies During Jul - Dec - 2020 - FinalPankaj SankholiaОценок пока нет

- SREI OrderДокумент26 страницSREI OrderdevarshОценок пока нет

- Kotak Harsha Upadhyaya PortfolioДокумент8 страницKotak Harsha Upadhyaya PortfoliomiddlecricketwarriorsОценок пока нет

- Unrealised Profit and Loss RM - 3060655 - 30 08 21 10 17 37Документ1 страницаUnrealised Profit and Loss RM - 3060655 - 30 08 21 10 17 37san RayОценок пока нет

- IL&FS Group cash generating SPVs stop debt paymentsДокумент6 страницIL&FS Group cash generating SPVs stop debt paymentsAnuj SaxenaОценок пока нет

- MedPlus Health Services Limited Anchor Intimation To Stock ExchangeДокумент3 страницыMedPlus Health Services Limited Anchor Intimation To Stock ExchangeRubiks TejОценок пока нет

- CyientDLMAnchor Allocation IntimationДокумент3 страницыCyientDLMAnchor Allocation IntimationSaurav Kumar SinghОценок пока нет

- Exchange Trade of FundДокумент4 страницыExchange Trade of Fundnidhi thakurОценок пока нет

- Mutual Fund Booklet (May)Документ20 страницMutual Fund Booklet (May)pkkothariОценок пока нет

- saad shaikh aditiya sir assignmentДокумент4 страницыsaad shaikh aditiya sir assignment2224019.khan.miranОценок пока нет

- Investors Strategy in Global SlumpДокумент7 страницInvestors Strategy in Global Slumpanjali1981Оценок пока нет

- RISHI21 - Alpha Bluechip - LUMPSUMДокумент4 страницыRISHI21 - Alpha Bluechip - LUMPSUMPower of Stock MarketОценок пока нет

- Nainshee Sadrani - Ma AssignmentДокумент10 страницNainshee Sadrani - Ma Assignmentjay77sadraniОценок пока нет

- GPT Healthcare Limited - Anchor Intimation LetterДокумент2 страницыGPT Healthcare Limited - Anchor Intimation Letterxepikej426Оценок пока нет

- Industrial Profile: Mutual FundsДокумент14 страницIndustrial Profile: Mutual Fundsmanogna432Оценок пока нет

- DSP BlackrockДокумент82 страницыDSP BlackrockParulGuptaОценок пока нет

- Intimation Letter-Anchor AllocationДокумент3 страницыIntimation Letter-Anchor AllocationThe KevinОценок пока нет

- Project Report - Group 1 - Section CДокумент20 страницProject Report - Group 1 - Section CNaveen K. JindalОценок пока нет

- Annual Report 2020-21 - TIICДокумент98 страницAnnual Report 2020-21 - TIICMrs.D.Mythili Computer TechnologyОценок пока нет

- MF CurrДокумент2 страницыMF Curraparna tiwariОценок пока нет

- Cartrade Tech Limited: (Formerly Known As MXC Solutions India Private Limited)Документ4 страницыCartrade Tech Limited: (Formerly Known As MXC Solutions India Private Limited)Prashant barodiyaОценок пока нет

- Average Market Capitalizationoflistedcompaniesduringthesixmonthsended 30 Jun 2023Документ47 страницAverage Market Capitalizationoflistedcompaniesduringthesixmonthsended 30 Jun 2023Rajeev Kumar PandeyОценок пока нет

- Top Indian companies by net profit in 2022Документ49 страницTop Indian companies by net profit in 2022George Khris DebbarmaОценок пока нет

- MF Icici FormДокумент2 страницыMF Icici FormTradeep PunjabiОценок пока нет

- Sahrudaya HealthcareДокумент6 страницSahrudaya HealthcareAakash Singh BJ22162Оценок пока нет

- I .KVB) Karurvysya Bank: Institutional Equities' Scheduled To Be Held On February 23, 2023 at Mumbai. The List ofДокумент1 страницаI .KVB) Karurvysya Bank: Institutional Equities' Scheduled To Be Held On February 23, 2023 at Mumbai. The List ofmahakarthicОценок пока нет

- Abbott Laboratories Pakistan LimitedДокумент15 страницAbbott Laboratories Pakistan LimitedHibaОценок пока нет

- Financial Education and Investor AwarenessДокумент9 страницFinancial Education and Investor Awarenessgethu.akiОценок пока нет

- Friday June 15, 2012Документ61 страницаFriday June 15, 2012colomboanalystОценок пока нет

- Types of Depositories: NSDL (National Securities Depository LTD.)Документ6 страницTypes of Depositories: NSDL (National Securities Depository LTD.)Vivek DixitОценок пока нет

- MF ProjectДокумент8 страницMF Projectdhiraj singhОценок пока нет

- सार - Last Note by Mr. Prashant JainДокумент12 страницसार - Last Note by Mr. Prashant JaindhavalОценок пока нет

- Shri_Jyotiraditya_Scindia_1Документ7 страницShri_Jyotiraditya_Scindia_1mariusaroneОценок пока нет

- An Insight Into Stocks Markets in India: Veena AnandДокумент71 страницаAn Insight Into Stocks Markets in India: Veena AnandAbith PremnathОценок пока нет

- Latent View - Intimation of Anchor AllocationДокумент6 страницLatent View - Intimation of Anchor AllocationTejesh GoudОценок пока нет

- Wipro: Company Profile Financial Detail'S of WiproДокумент19 страницWipro: Company Profile Financial Detail'S of WiproAmanpreet RandhawaОценок пока нет

- Afa Cia - 1Документ13 страницAfa Cia - 1George UkkenОценок пока нет

- A1655911537 23823 29 2022 OnlineCA3Документ4 страницыA1655911537 23823 29 2022 OnlineCA3DEEWAKAR KUMARОценок пока нет

- United States v. Hernandez-Maldonado, 1st Cir. (2015)Документ9 страницUnited States v. Hernandez-Maldonado, 1st Cir. (2015)Scribd Government DocsОценок пока нет

- Con PhilДокумент48 страницCon PhilConica BurgosОценок пока нет

- SIBUR - 1H 2020 - Results - PresentationДокумент22 страницыSIBUR - 1H 2020 - Results - Presentation757rustamОценок пока нет

- International HR Management at Buro HappoldДокумент10 страницInternational HR Management at Buro HappoldNishan ShettyОценок пока нет

- Understanding Culture, Society and PoliticsДокумент3 страницыUnderstanding Culture, Society and PoliticsแซคОценок пока нет

- Effecting Organizational Change PresentationДокумент23 страницыEffecting Organizational Change PresentationSvitlanaОценок пока нет

- IEC 60050-151-2001 Amd2-2014Документ8 страницIEC 60050-151-2001 Amd2-2014mameri malekОценок пока нет

- New Funding Pushes Convoy Valuation To $3.8 BillionДокумент3 страницыNew Funding Pushes Convoy Valuation To $3.8 BillionTrang BùiОценок пока нет

- SimpleДокумент3 страницыSimpleSinghTarunОценок пока нет

- 2016-2017 Course CatalogДокумент128 страниц2016-2017 Course CatalogFernando Igor AlvarezОценок пока нет

- Micro - Welfare EconomicsДокумент14 страницMicro - Welfare EconomicsTanvi ShahОценок пока нет

- Working While Studying in Higher Education: The Impact of The Economic Crisis On Academic and Labour Market Success (Preprint Version)Документ22 страницыWorking While Studying in Higher Education: The Impact of The Economic Crisis On Academic and Labour Market Success (Preprint Version)Vexie Monique GabolОценок пока нет

- ACC WagesДокумент4 страницыACC WagesAshish NandaОценок пока нет

- Charity Extends Help To Seniors: Donating Is Made EasierДокумент16 страницCharity Extends Help To Seniors: Donating Is Made EasierelauwitОценок пока нет

- HB Nutrition FinalДокумент14 страницHB Nutrition FinalJaoОценок пока нет

- Surface Chemistry Literature List: Literature On The SubjectДокумент5 страницSurface Chemistry Literature List: Literature On The SubjectMasih SuryanaОценок пока нет

- Civil Litigation MCQ FeedbackДокумент17 страницCivil Litigation MCQ Feedbackbennyv1990Оценок пока нет

- Six Sigma and Total Quality Management (TQM) : Similarities, Differences and RelationshipДокумент15 страницSix Sigma and Total Quality Management (TQM) : Similarities, Differences and RelationshipSAKTHIVELОценок пока нет

- Online Applicaiton Regulations Under CQ (MBBS&BDS) ChangedДокумент23 страницыOnline Applicaiton Regulations Under CQ (MBBS&BDS) Changedyamini susmitha PОценок пока нет

- Sweetlines v. TevesДокумент6 страницSweetlines v. TevesSar FifthОценок пока нет

- Place of Provision of Services RulesДокумент4 страницыPlace of Provision of Services RulesParth UpadhyayОценок пока нет

- List of Presidents of Pakistan Since 1947 (With Photos)Документ4 страницыList of Presidents of Pakistan Since 1947 (With Photos)Humsafer ALiОценок пока нет

- Journalism of Courage: Wednesday, January 11, 2023, New Delhi, Late City, 24 PagesДокумент24 страницыJournalism of Courage: Wednesday, January 11, 2023, New Delhi, Late City, 24 PagesVarsha YenareОценок пока нет

- Customer Engagement & Commerce: Because The Journey & The Outcome MattersДокумент23 страницыCustomer Engagement & Commerce: Because The Journey & The Outcome MattersZhamrooОценок пока нет