Академический Документы

Профессиональный Документы

Культура Документы

R17AMR ReleaseHighlights

Загружено:

tayutaОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

R17AMR ReleaseHighlights

Загружено:

tayutaАвторское право:

Доступные форматы

What's New in R17 AMR!

©2017 Temenos Headquarters SA - All rights reserved.

Warning: This document is protected by copyright law and international treaties. Unauthorised reproduction of this document, or any portion of it, may result in severe

and criminal penalties, and will be prosecuted to the maximum extent possible under law.

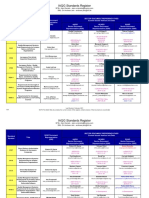

Table of Contents

Release Information 4

Overview 4

New Products 5

Application Framework 8

Core 8

Security 8

Banking Framework 9

Accounts 9

Loan Loss Provisioning 10

Payment Order 10

Interest and Charges 11

Delivery 11

ISO20022 XML Account Statement 12

Collateral 12

FATCA 12

System Tables 12

Multi-GAAP 12

IFRS 13

Customer Reporting Standards 13

Business Intelligence 14

DW.EXPORT 14

Market Risk 14

Credit Risk 14

Asset Liability Management 15

Channels 16

Digital Engagement Platform 16

Internet Banking 16

Image Management 17

UXP Browser 17

Corporate 18

Factoring and Forfaiting 18

Letters of Credit 18

Miscellaneous Deals 18

Syndicated Lending 19

Internet Banking - Corporate 20

Country / Regional Solutions 22

Canada Model Bank 22

US Model Bank 22

Generic Regional Solutions 27

Enterprise Frameworks 28

Data Framework 28

Enterprise Monitoring 28

Integration Framework 28

T24 External BPM 30

Islamic Banking 31

Islamic Banking AA 31

Payments 32

Funds Transfer 32

Payments Hub 32

SEPA 37

Local Clearing 39

Private Wealth 40

Derivatives 40

Fiduciaries 40

What's New in R17 AMR! - Page 2 of 48

Securities Trading 40

Structured Products 42

Retail 43

Arrangement Architecture - Core 43

Retail Accounts 45

Retail Deposits 45

Safe Deposit Box 45

Campaign Management 46

Treasury 47

Forex 47

Interest Rate Swaps 47

Money Market 47

Treasury Trader 48

Deal Manager 48

Risk Management 48

What's New in R17 AMR! - Page 3 of 48

Release Information

Version Release Date

1.0 R17 AMR 2017 - 05 - 18

Overview

The Release Highlights list the new functionality that has been introduced into Temenos Core Banking product and other

Temenos products. It is broken down by Product Stream.

The enhancements listed in this document are also present in the R17 AMR documentation pack (which is available with

Distribution Team). Readers can access the 'What's New in R17 AMR' section of the documentation pack to read the

detailed release highlights.

For documentation support, contact the Distribution Team.

What's New in R17 AMR! - Page 4 of 48

New Products

Product Code Product Name Description

AX External Product Allows creation of new AA Product lines and property

classes by the user so that other products(not belonging

to own bank) may be created and used for bundling and

distribution with bank’s own products.

CALEND Canadian Lending (Feature) This product offers a list of widely used Canadian func-

tionalities like Provincial tax & fee calculation, Cal-

culation of discharge fee at the time of collateral

discharge / loan payout.

CE CRS Reporting This product enables Reporting/ Automatic Exchange of

Information based on the rules of Common Reporting

Standards (CRS)

CP Digital Engagement - Customer Real-time marketing campaign definitions (configured

Programmes via role-based user agents)

CS Digital Engagement - Social Chan- Real-time integration with social media platforms (e.g.

nels Facebook)

ESCROW Escrow Escrow is a common facility in North America, where by

the bank and customer agree to make tax / insurance

payments on behalf of the collateral / property that is

mortgaged.

EV Evidence Management Allows definition of user defined evidences, rules based

requirements for an origination application, evaluation

and management of rules and verification of data

against evidence.

ID Islamic Deposits Facilitates Islamic Deposits in AA and Profit Distribution

System processing

NACUST NACUST (Feature) This product enables the user to define conditions that

serve as a base to designate which accounts are “trans-

action” accounts and are therefore covered by the Regu-

lation. It also enables the user to define the “Business

days” that funds must be available for withdrawal when

deposited the same day.

NA Needs Analysis Match a prospect’s/client’s requirements together with

their financial capabilities and preferences to the

products offered by the bank. Closely integrates with

T24 Marketing Catalog to offer best fit products.

What's New in R17 AMR! - Page 5 of 48

OA Origination Architecture Framework which allows origination components to be

built and managed. These components are rules and

defaults based, could be catalogued and allows reusab-

ility.

PH Payments Hub Payments hub is a flexible solution with a universal pay-

ments process, which enables centralization of all pay-

ment operations to support multiple payment formats

and global payment mechanisms. It provides banks with

a single solution to configure their payment processing

for all customers, specifying different processing for

high and low care customers by parameterization

without requiring any software changes.

PPACHC NACHA (US-ACH) Enables support for US Automated Clearing House

(ACH), which is an electronic network for financial trans-

actions in the United States, used to process large

volumes of credit and debit transactions in batches.

PPBACS BACS (UK ACH) Enables support for BACS, which is an electronic net-

work for financial transactions in the United Kingdom,

used to process large volumes of credit and debit trans-

actions in batches

PPCHAT CHATS (Hong Kong RTGS) CHATS clearing module allows banks to process and

send clearing payments to CHATS system and receive

the clearing payments. The message types supported

for receiving and sending payments include MT103 and

MT202.

PPFATF FATF Enables banks to comply with FATF regulation Recom-

mendation 16 on wire transfers.

PPHKGC HKCLG (Hong Kong ACH) Enables support for HKCLG, which is an electronic net-

work for financial transactions in Hong Kong, used to pro-

cess large volumes of credit and debit transactions in

batches.

PPISOX ISO 20022 Customer-to- Bank / The module supports receiving and sending Bank to

Bank- to- Customer (inward/out- Bank ISO20022 clearing (Bank to Bank -B2B) messages

ward pain) and Customer to Bank (C2B). Incoming and Outgoing

ISO messages are transformed to the target format of

the Payment System or Clearing using the transforms

and ISO adaptor supplied along with the module

PPPSDC PSD Regulation Provides banks (PSPs) with the ability to comply with

PSD regulations in Europe (which came into force on 1st

Nov 2009) for Payments processed . Rules relate to

charges and value dating of payments within the SEPA

region.

What's New in R17 AMR! - Page 6 of 48

PPSPCT SEPA CT (EU ACH) SEPA CT clearing module allows banks to initiate, pro-

cess and reconcile SEPA credit transfers STP. The mod-

ule supports 2 clearings in the SEPA Region (EBA and

BundesBank). The module validates SEPA outgoing pay-

ments against the Scheme rules.

PPSPDD SEPA DD (EU ACH) SEPA DD clearing module allows banks to initiate, pro-

cess and reconcile SEPA direct debits STP. The module

supports 2 clearings in the SEPA Region (EBA and Bun-

desBank). The module validates SEPA outgoing pay-

ments against the Scheme rules.

PPTGTC TARGET2 (MT based) (EU RTGS) TARGET2 clearing module allows banks to process and

send clearing payments to TARGET2 system and

receive the clearing payments. The message types sup-

ported for receiving and sending payments include

MT103, MT202 and MT202COV. The module also sup-

ports handling of MT019 abort notification from

TARGET2, for exceptions.

UXP Browser Temenos' ground breaking Channels solutions enable

you to deliver products and services for any business

line, across all self-service and assisted channels, for

both bank staff and customers, in any language and

optimized for any device from a single user experience

platform (UXP).

UXP Browser is the new user interface for clients retain-

ing the familiar usability of Temenos Browser but offer-

ing a better user experience and richer set of features

by leveraging the Temenos Channels Solutions.

What's New in R17 AMR! - Page 7 of 48

Application Framework

Core

Mass Changes

Available from: Release 201701

Mass Changes is a new feature that allows to effect a user driven change in a number of data records based on a user

defined Selection criteria. The nature of the change is same across all these records that are updated. This is limited to

making any changes to Core Banking customer Static information and changing Interest, Officers and Settlement

Instructions on AA Arrangements.

Dynamic Applications

Available from: Release 201704

EDGE enhancement to Dynamic Applications

Dynamic Applications can now be defined with enhanced features for UX Browser and other EDGE-based user inter-

faces. These features includes the ability to hide or display fields dynamically.

Processing on hold API for Dynamic Applications

An API to allow user-defined processing when a deal is put on or deleted from hold status.

Security

Non repudiation and Digital Signature

Available from: Release 201608

Core Banking product Transaction Digital Signing is handled by

l Validating the Digital Signature with transaction representation extracted from original data, to ensure it is not

tampered when it traverse from front end to Core Banking product through IRIS.

l Storing the Digital Signature in Core Banking product EB.DIGITAL.SIGNATURE table with the ID referencing to

the main transaction record. The new details are received from IRIS through Resource Provider component and

this storage facility is made available only for the authorised transactions. The same details are routed to TAF log

for history maintenance.

Local SMS API

Available from: Release 201609

A local API is added to the Security Management System (SMS) which allows local definition of complex data access

rules; that could not be implemented using the standard SMS application alone.

What's New in R17 AMR! - Page 8 of 48

Banking Framework

Accounts

Account Closure and Nostro Account Creation

Available from: Release 201605

Account closure and Nostro account creation have been redesigned to

l provide a reason for account closure in different languages.

l provide an enquiry that lists accounts closed within a specific period with specific reason codes.

l define the account name in different languages.

Customer Mass Block Selection Criteria for Customer and Account

Available from: Release 201701

Customer Mass Block application now supports the selection criteria from both the customer and account tables which

allows you to :

l Specify Multiple Selection Values in the Customer Mass Block application

l Define a restriction through the customer mass block application at the account level that points the overrides to

the corresponding account only

l Define a restriction through the customer mass block application that may or may not be implied to the legacy AC

Accounts which includes the Nostro Accounts.

Customer Mass Block of Accounts

Available from: Release 201701

Customer Mass Blocking allows you to

l Create an Account Block record where the User can input the ID(s) of the specific customer number(s) or Cus-

tomer Groups subject to the account block.

l Block accounts of all customers registered in a specific country, nationality or sector

l Block accounts created with specific currency and category

l Exclude/unblock customers or accounts from the mass blocking action.

Account Blocking Alert Processing

Available from: Release 201701

The system can now produce notification events based on the various dates set by the user in the CUSTOMER MASS

BLOCK application to the IF.EVENTS.TABLE.INTERFACE.

Addition of 'Industry' to the Selection Criteria

Available from: Release 201702

What's New in R17 AMR! - Page 9 of 48

This is an improvement to the existing CUSTOMER.MASS.BLOCK functionality, where the Field ‘INDUSTRY’ from the cus-

tomer file is made available as a selection criteria in addition to the existing fields from customer and account.

SSI - Effective Dated Instructions

Available from: Release 201608

Standard Settlement Instructions now support Effective Dated Instructions which capture future dated standard set-

tlement instructions and Nostro Correspondent changes.

HVT - Balance Checking

Available from: Release 201611

A mechanism is now in place to check balances in the corebanking account processing for accounts with high volumes

while achieving high volumes of transaction processing.

Interest Rate Changes in Statements and Reports

Available from: Release 201703

Changes in interest rates for statements and reports are handled by enabling the generation of accounts statement for

AA accounts using AA functioanality.

Addition of Local Reference Fields in Entries

Available from: Release 201611

The enhancement is related to the Inclusion of local reference field in entries. To update a value date field in the core-

banking special entry and profit and loss entry tables that correspond to the value date of the accounting entries for the

interest and charges accruals and capitalisation.

Loan Loss Provisioning

Provision for Different PL Categories for Profit and Loss

Available from: Release 201605

The enhancement facilitates the availability of different profit and loss categories for decrease and increase in provision

amounts respectively.

As a part of this enhancement, the customer can also view the loss amount specifically, in addition to the provision

amount.

Payment Order

Improvements to Payment Order Warehousing Functionality

Available from: Release 201606

Amendments and improvements have been made to the functionality related to Warehousing of payments in the Pay-

ment Order Framework.

Support of Debit Collection Requests

Available from: Release 201701

What's New in R17 AMR! - Page 10 of 48

The Payment Order (PO) module now supports the debit collection request creation when instructions are given on

product arrangement. This applies both internally and externally in Core Banking , but still within debit collection

request.

Execute Internal Payment Orders

Available from: Release 201702

Temenos Core Banking has a feature enabled to execute and settle internal Payment Orders within Core banking itself ,

rather than routing them to an external system

Additional Information on Payment Status

Available from: Release 201702

Status of payment orders sent to external systems are tracked and monitored by means of Payments acknowledgement

information sent back to Core Banking to notify the status of the payment execution .

Interest and Charges

Provision for Waiving of Negative Interest

Available from: Release 201607

The enhancement is an amendment to the existing Negative interest and charges functionality and allows additional

options to control the waiving of Negative Interest and charges.

Processing of Liquidation Accounts

Available from: Release 201608

This enhancement is to process liquidation accounts after normal accounts where Liquidation accounts are processed as

High Volume Accounts (HVT) when posted to, but normal accounts when processed themselves

Delivery

SWIFT 2016 Rulebook Changes

Available from: Release 201608

The SWIFT MT Rule Book is revised every year, and a new version is implemented in November each year. SWIFT MT

2016 Rule Book is now supported .

Generation of MT942 Messages

Available from: Release 201608

Delivery mechanism is enhanced to handle the additional requirement of MT942 messages

Generation of MX Messages

Available from: Release 201608

The ISO20022 Messages Framework introduces an industry standard transformation capability that transforms the raw

delivery application handoff data into MX messages.

What's New in R17 AMR! - Page 11 of 48

ISO20022 XML Account Statement

Generation of the CAMT 053 and CAMT 054 Statement Summary

Available from: Release 201611

Banks that participate in SEPA, C2B and other payments, substituting for the ordering party or the beneficiary, are

required to generate the CAMT.054/053/052 electronic statements if requested by the account holding customer or

bank.

Collateral

LTCV and LTMV Calculation

Available from: Release 201612

This enhancement deals with the calculation and storing of key collateral ratios.

Changes to the Collateral Advance Ratio

Available from: Release 201612

Changes have been made in the existing calculation logic of the Advance ratio and concentration cap functionalities.

LTV Calculation

Available from: Release 201704

Calculation of Loan to Value Ratio which defines the portion of collateral covered with the limit it is attached.

FATCA

XML Schema Version 2.0

Available from: Release 201702

FATCA Schema version 2.0 changes are now supported.

System Tables

Position of Amount Field Length

Available from: Release 201702

A mechanism is now in place to increase the size of all the amount fields in the corebanking product.

Customer - Digital ID

Available from: Release 201704

This system table stores the data for Campaign Engine which communicates with the targeted social medias.

Multi-GAAP

Memo Accounting for Transaction Accounts

Available from: Release 201703

What's New in R17 AMR! - Page 12 of 48

This enhancement provides an additional functionality for the funds diversion process in order to facilitate the account-

ing for Balance Netting Cash pools. It allows funds posted against accounts with the reporting type INTERNAL (MEMO

accounts) to be diverted to an on-balance sheet or contingent accounts and vice versa.

IFRS

Additional Fairvalue Changes

Available from: Release 201704

IFRS module now provides the faciltity of an additional Fair value measurement at Market rates, where the contracts

are measured at Fair value on initial recognition and Amortised Cost for the subsequent measurements

Customer Reporting Standards

Automatic Exchange of Information

Available from: Release 201704

CRS contains the detailed rules and procedures that financial institutions follow to ensure that relevant information is col-

lected and reported. The CE module extends the available Module CD - T24 CRS functionality within corebanking to pro-

tect the exchange of information to the tax authority by the financial institution.

What's New in R17 AMR! - Page 13 of 48

Business Intelligence

DW.EXPORT

DW.Export is now Optimised

Available from: Release 201606

DW Export tool is now optimized and several functions are automated for better performance.

DW Lite - the slim version of DW.Export

Available from: Release 201606

DW.Lite, the slim version of the existing DW.Export tool, is now available.

Market Risk

Derivatives Product Pricing - FX Forward

Available from: Release 201608

Market Risk module is now enhanced to accept and price the FX-Forward instruments from T24 and other source sys-

tems.

Derivatives Product Pricing – Option

Available from: Release 201609

Derivatives pricing of Option is now available in Insight Risk.

Derivatives Product Pricing - Swaps

Available from: Release 201701

The derivatives pricing functionality now supports both Currency swaps and Interest Rate swaps.

Credit Risk

Risk Weight Calculation with Multi-Supervisor and Multi-Company Setup

Available from: Release 201701

The Risk module now supports both multi-supervisor and multi-company setup to help banks in calculating Risk Weight

in various global regulatory environments to meet the local regulation.

What's New in R17 AMR! - Page 14 of 48

Asset Liability Management

Cash-flows Simulation / Scenario Engine

Available from: Release 201702

ALM module now features cash-flows generation engine coupled with Bonds / Securities pricing.

What's New in R17 AMR! - Page 15 of 48

Channels

Digital Engagement Platform

Digital Engagement Platform

Digital Engagement Platform (DEP) is a new Front Office module for managing real time communication with customers

and prospects through digital channels.

Internet Banking

Internet Banking Solution Now Componentized

Available from: Release 201610

TCIB 2.0 offers an all-new componentized structure which allows a bank to pick only the required component and integ-

rate it into their solution.

Deposits Functionality Improvements

Available from: Release 201611

Deposit functionality is now improved to view complete details of any deposits.

Account Overview Improvements

Available from: Release 201612

Account overview functionality is now enhanced with additional details from AA and Limit modules.

Loans Functionality Improvements

Available from: Release 201611

Loans functionality in Internet Banking is now enhanced with new fields for a better user experience.

Customer Profile Feature Now Enhanced

Available from: Release 201702

The newly improved Customer Profile function is now displayed on the Internet Banking home screen.

Transactions Functionality Now Enhanced

Available from: Release 201612

Transactions list section in Internet Banking solution is now enhanced with new fields for a better user experience.

POA now Integrated with Retail Internet Banking

Available from: Release 201703

What's New in R17 AMR! - Page 16 of 48

POA application is now integrated with Retail Internet banking to initiate transfers and payments.

TCIB 2.0

Available from: Release 201703

TCIB 2.0 now offers a fully revamped RetailSuite Channels application.

Image Management

Add a Note

Available from: Release 201703

Users can now add a note to their transactions.

UXP Browser

UXP Browser

UXP Browser is the new user interface for clients retaining the familiar usability of Temenos Browser, but offering a bet-

ter user experience and richer set of features by leveraging the Temenos Channels Solutions.

What's New in R17 AMR! - Page 17 of 48

Corporate

Factoring and Forfaiting

Suspension of Unamortised Interest in Bills

Available from: Release 201605

For a discounted bill, the unamortised discount interest portion can be suspended instead of being credited to P and L.

The interest can then be revoked in due course and capitalised.

Letters of Credit

Amendment Commission

Available from: Release 201605

Banks can collect commission for an amendment and the commission period (monthly, quarterly, and semester) can be

defined for the calculation of commission under LC and amendment.

Acceptance Commission for Import and Export LC

Available from: Release 201605

Banks can collect commission under Export LC's for advising, confirmation and acceptance. Also, default conditions and

special pricing can be defined with regards to periodic commissions under Export LCs. Acceptance commission can be

calculated and collected based on the tenor of the LC. Commission period (monthly, quarterly, semester) can be defined

for the calculation of commission under both Import and Export LCs.

Export LC Assignment of Proceeds

Available from: Release 201605

Assignment reference and assignment details are defaulted in the drawings record and can be modified at the time of

drawing. MT756 is sent to the presenting bank and other payment messages are generated, appropriately.

Outward / Inward Collection Avalisation

Available from: Release 201605

Outward / Inward Collection bills with an avalisation request can be handled in Core Banking under LETTER.OF.CREDIT

application.

Miscellaneous Deals

Guarantee Commission

Available from: Release 201605

What's New in R17 AMR! - Page 18 of 48

Commission period (monthly, quarterly and semester) can be defined for the calculation of commission on a guarantee.

Banks can collect commission for any delay in returning the original guarantee. Special pricing can be defined and

applied for a specific customer or a group of customers.

Invocation Claim under Inward Guarantees

Available from: Release 201607

User can initiate a claim, settle the claim after receipt of funds from the Guarantor / Issuing Party, and Cancel / With-

draw a claim under an Inward guarantee received in favour of the beneficiary.

Syndicated Lending

Rate Fixing Date based on Holidays

Available from: Release 201607

Interest rate reset date defined in SL.REPAYMENT.SCHEDULES can be cycled considering the holidays of the countries

exclusively defined.

Forward Backward Key and Base Date in SL.CHARGE and FACILITY

Available from: Release 201607

The base date and forward/backward options can be defined in SL.CHARGE and FACILITY applications.

Daily Accrual of Charges

Available from: Release 201611

Charges can be collected in arrears and accrued under a Syndicated lending. Also, option available for charges to be

amortised or accrued on a daily or monthly basis.

Automatic Update to SL.CHARGE

Available from: Release 201611

Whenever the level of participation changes amongst the existing or new participants on trading, the details of the same

are updated in SL.CHARGE record when charges are accrued. Also, SL.CHARGE records are created automatically for

the new SL.LOANS when a rollover, merger or split takes place.

Back Dated Early Maturity

Available from: Release 201611

When a syndicated loan is pre-closed the maturity date can be backdated. The accruals are recalculated and accounting

entries are generated with the back valued date.

Accounting Entries in INAU

Available from: Release 201611

When a loan under SL.LOANS is matured online, accounting entries are generated when the contract is in unauthorised

status (INAU).

What's New in R17 AMR! - Page 19 of 48

New Enquiries in Syndicated Lending

Available from: Release 201704

Five new enquiries are added to Syndicated Lending module.

Standalone Facility Creation

Available from: Release 201704

A standalone facility record can be created by user without a pre-syndication record in place.

Internet Banking - Corporate

Collections

Inward Collections - TCIB

Available from: Release 201612

Corporate is now able to handle the Inward collections lodged by the bank and provide online instructions to the bank on

payment/acceptance/queries.

Outward/Export collection in TCIB

Available from: Release 201702

Corporate customer can initiate export collection request through TCIB. The corporate can receive details and status of

Export collection transactions through TCIB until the transaction is settled.

Letters of Credit

Export LC Amendment Advising

Available from: Release 201703

Export LC amendment advised by the bank is available in the queue of the Corporate customer and the Corporate cus-

tomer can respond to the amendment online.

Import Drawings

Available from: Release 201704

Applicant can choose to 'Waive' or 'Reject' against each discrepancy under Import LC drawing and delivery messages

are generated based on the pre-defined events.

Miscellaneous Deals

Internet Initiated Claim Requests

Available from: Release 201703

Beneficiary can initiate a claim under a guarantee and place the request online to the bank through TCIB to further send

it to the advising party/Guarantor. The beneficiary can view the claim and settlement details online.

What's New in R17 AMR! - Page 20 of 48

Advising Amendment to Inward Guarantees

Available from: Release 201703

An amendment under a Guarantee received can be advised online to the beneficiary and also it is possible to view the

transaction/inward messages.

What's New in R17 AMR! - Page 21 of 48

Country / Regional Solutions

Canada Model Bank

CALEND-DISCHARGE FEE

Discharge Fees and Loan Validations

This feature is used to setup charge fees based on a customer's province. It is also used to install and validate instal-

ment amounts and setup and validate loan repayment amounts for the calendar year.

CALEND-RESERVE

Reserve Accounts

This feature is used to collect borrower's funds to be escrowed into a reserve account for the future for such items as

maintenance of machinery or property.

CALEND

Non-Performing Loan

This feature is used to track loans past due, as well as suspend interest at a predefined status. Additionally, it includes a

list of NPL reasons. The bank user can also manually mark/unmark NPL and/or NAB flag at the loan level..

Taxes

This feature is used to address Canadian tax requirement for federal tax based on a standard flat tax rate. It also

provides for province tax based on the province of the property (used as loan collateral) and/or customer.

US Model Bank

Account Analysis

New source balances and Adhoc charges are available to be collected at the transaction level or at the new activity

level. A new account analysis statement is available as per different analysis flag methods.

GL Average Balance

Banks are required to generate a series of reports, on a monthly/quarterly basis, which provides the average balance

and rolling average balances for selected GL lines (balance sheet).

l Monthly/Quarterly at the branch level

l Monthly/Quarterly at a consolidated level

B Notice

While creating a customer record, it is mandatory to capture the TIN details. If a customer fails to provide the appro-

priate Tax Identifier Number (TIN) number (W8/W9 forms) the result is:

What's New in R17 AMR! - Page 22 of 48

l Forms certifying TIN are requested and returned to the bank.

l B-Notices are generated and handed/delivered to customers.

If the requested TIN information is not delivered to the bank within a specified time frame, tax withholding will occur.

B-Notice development allows for the generation of first and second B-Notice letters. It also provides two reports, which

display upcoming or already expired customer documents. These documents (W9, W8) are expected after sending the

first B-Notice and the B2 letter, which in turn is expected after sending the second B-Notice.

Currency Transaction Report

Introduced new screens in the customer and teller applications, which offers the following:

l Tracks the customers who are exempted from CTR with an appropriate exception reason.

l Identifies if the cash transactions are initiated by the customer or a third-party.

l Facilitates to store and monitor all cash transactions pertaining to CTR and to collect additional information for

customer exceeding the CTR threshold limit.

l Allows new inquiries to view the CTR exempted/non-exempted customer details and cash transactions exceed-

ing the threshold limit.

Customer Input Screen

The core customer statement layout is redesigned and new components are added to suit the requirement format as

per the US regulatory and market requirements.

Coupon Books

Created new fields to select the billing method and number of coupons for the coupon books on the payment schedule.

Additionally, provided a new table to store coupon book related arrangement payment details.

Credit Bureau Reporting

This enhancement provides for a periodic file created during Close of Business (COB) processing to be sent to a bank’s

clients loan details to one or more of the credit bureau agencies as required by law.

FR2900 Report of Transaction Accounts, Other Deposits, and Vault Cash

FR2900 reports on the daily balances, per week, of transaction accounts, other deposits and vault cash, which are

required by the Federal Reserve to monitor banks liquidity.

Individual Retirement Account (IRA)

There are new Individual Retirement Account (IRA) products, funds transfer and teller screens that are used to make

IRA contributions/distributions. The new screens are also used for queries to display plan information, required min-

imum distribution (RMD) system calculations, display a RMD calculator, as well as RMD and withholding notice inform-

ation.

KYC CEDD

Within the Know Your Customer functionality, there are several new screens available to the bank user, which allows

them:

What's New in R17 AMR! - Page 23 of 48

l To identify the customer exempt from the customer identification verification.

l To record anticipated account activity, additional information for high risk customer details and political details.

Legal Status

A Status field is introduced in AA loans to identify the status of a loan (such as bankruptcy, deceased, litigation and so

forth) in order to post a restriction and also not generate messages/alerts to the customer.

Seasonal Address (Name/Address Changes)

The Seasonal Address option is used if a customer resides at a different location during various seasons. It is now pos-

sible to define the period spent by the customer at a different address and all the correspondence is sent to the correct

address of the customer, valid for that particular period. Also, the ADDCHN functionality is introduced, which sends the

change of communication address notification letter to the old and new address of the customer. If there is a change of

an e-mail address, then the notification is sent to the current address of the customer.

Loan Overdue Inquiry

A new inquiry is created to display additional information related to loans.

Overdue Notices

Different types of overdue notices are generated for 10, 30, 45, 60 and 90 days delinquent loans. Precise overdue loan

details with specific standard verbiage for the United States Department of Housing and Urban Development (HUD)

/Fair Credit Reporting Act (FCRA)/HUD and Servicemembers Civil Relief Act (SCRA) must be displayed on the overdue

notices as per regulatory requirements.

Payment Processing

Three new inquiries were created to view the bill details in the Arrangement Overview screen.

l Unpaid view – The unpaid view inquiry displays entire bills that are outstanding.

l Settled view – The settled view inquiry displays all the bills that are settled.

l Full view – The full view inquiry displays both unpaid and settled bills.

Regulation BB - CRA Reporting

A new table to parameterize the loan types and a few fields in the collateral application are introduced in order to cap-

ture the additional loan information, which is required for CRA reporting.

Regulation CC

New screens are available to establish and govern the maximum permissible hold periods for various check deposits

(deposited by the customer) and the collection and return of checks.

Regulation D - Transaction Monitoring

New screens and inquiries are provided to limit a non-transactional account to a certain threshold limit. The accounts,

which violate the threshold limit are recorded and provided for review on a daily basis. Provisions to send customer

advices after the review and to update the status of the record are available.

What's New in R17 AMR! - Page 24 of 48

Regulation C – HMDA Reporting

This release introduces a table to capture additional loan information, which is required for Reg C HMDA data collection.

A few fields were added to the collateral and customer applications, which are also used for Regulation C reporting pur-

poses.

Rate Change Set in Advance

Added a provision to generate a new advice, which displays the change in the interest rates and enhanced the screen to

display the details of the interest rate and payment amount changes along with the change in date and value.

Regulation Z – Treatment of Credit Balances

Added the functionality to generate an end of day report to display all the loan accounts, which have a negative balance

reflected as a positive balance. This report displays the following details:

l Customer ID

l Customer Name

l Loan Number

l Loan Currency

l Loan status

l Loan Outstanding

l Unspecified Credit

l Escrow Balance

l Rebate Amount

l Total Loan Outstanding

l Last Activity Date

Restricted Backdating

Restricted backdating refers to the generation of periodic statement for open ended credits, which includes revolving

line of credit and HELOC products.

Secondary Market Mortgages

Added a provision to indicate, which mortgage loans are participating in pooling (secondary market) and also identify

the secondary investor to which the loan is tagged.

Static Data Change Report

The Static Data Change Report is a Close of Business (COB) report, generated on a daily basis.

It shows:

l Authorized changes to static system data (monetary changes/transactions are not included in the report)

l Newly opened records

l Failed system sign-on attempts

What's New in R17 AMR! - Page 25 of 48

History Migration

A template has been created to move the historical transaction data into the product and provide inquiries to view the

pre-migrated and post-migrated data details of the following:

l Accounts

l Loans

l Deposits

l GL

USGAAP – Early Withdrawal Penalties

Introduced a new Product Condition and Source Calculation Types to collect the penalty fees based on the number of

days apart from Fixed and Variable charge types.

Regulation DD

The calculation of Annual Percentage Yield (APY) and Annual Percentage Yield Earned (APYE) for the different con-

sumer products is supported in the product, AA Deposit, and AA account modules. The APY value is displayed on the

Arrangement screen and in the advices generated for the deposits. The value of APYE is disclosed in the periodic

account statements.

NSF Management

To accommodate the management of NSF (Non-Sufficient Fund) functionality, eight queries and two templates have

been designed for the user to pay or return certain items that are presented against insufficient funds in the account or

items rejected due to certain criteria (ex. Invalid account number, positing restriction, etc.) The user makes a manual

decision on the item, and if no decision is made, certain action is taken to either pay or return the items, based on the

NSF parameter set up.

Regulation P - Privacy Status & Notice

The US Platform provides an inquiry to display the list of customer’s to whom the "Annual Privacy Notice" is to be sent.

Provision is given at the customer level to mark the "Privacy status/Date" and "Publically available information".

Interest Paid Inquiry for Accounts and Deposits

Two enquiries to display the additional information related to accounts and deposits have been added.

Customer Input Screen

New fields, validations, and customer input screen design as per US requirement are available.

Single Customer View (SCV)

Single Customer View (SCV) built to provide new fields and validations to conform to the US banking practice.

Positive Pay

A table to store all the check information issued by the customer has been introduced. This information is checked

against the check received from the clearing house at the time of clearing. Decisions on the checks which do not match

are made on whether to pay or return.

What's New in R17 AMR! - Page 26 of 48

Regulation E Statements

When an Electronic Fund Transfer (EFT) is processed to/from the account, and the frequency is greater than monthly,

the system automatically generates a Regulation E statement at the end of the month, during which the transaction

occurred.

The Regulation E statement format is compliant with the US regulatory requirements.

Account Masking

A new parameter screen is available to mask certain field values for the user. Only authorized special users can have

access to view these masked values. Masked values can appear in three different ways to the user.

Year End Tax Reporting

It is now possible to complete the following tasks:

l Configure IRS form types and static information with the new introduced table.

l Capture tax transaction details manually and to correct customer TIN details.

l Generate an IRS report file through an inquiry and service.

Generic Regional Solutions

NACUST

Customer Based Holds

This is an enhancement to existing Customer Based Holds Process. The development is done to hold a certain amount

for a specified number of days for cheque type of transaction deposited in the branch or ATM based on the type of cus-

tomer, currency and Transaction type.

Customer Messages and Notes

This is an enhancement to existing Customer Online Messages and Positing Restrict Process. The development is done

to raise override messages to alert the user while doing financial and non-financial transactions which can be configured

by the administrator.

What's New in R17 AMR! - Page 27 of 48

Enterprise Frameworks

Data Framework

Balance Reporting Model

Available from: Release 201609

Balancing Reporting model is now enhanced to:

l Provide support for multi-values and associate multi-values by providing support for an unlimited number of ele-

ments.

l Provide support for multi-language attributes by providing support for a dynamic list.

l Add VALID_IND metadata column in all fact tables.

Financial Reporting Model

Available from: Release 201610

Financial Reporting model is now enhanced to

l Implement the model, mapping and views to support the Financial Data Model

l Support for Data-Driven target loading in ETL

l Support for substring function in ETL

DFMapping Service

Available from: Release 201701

The 'df.mapper.create.live.data’ parameter is now introduced in the mapper config file to enhance the DfMap-

pingService component which allows/restricts the Core Banking artefact generation such as ETD, SS, FILE.CONTROL,

PGM.FILE, DICT and TAFJ_VOC.

Enterprise Monitoring

tOP Stabilization

Available from: Release 201701

tOP application is now Operating System and Application Server independent.

Integration Framework

Integration Event Table per Company

Available from: Release 201610

The IF.EVENTS.INTERFACE.TABLE is now changed to FIN type of application

What's New in R17 AMR! - Page 28 of 48

Event Designer – Publish Per Exit Point

Available from: Release 201610

The Integration Event Designer is enhanced to publish per Exit Point.

Integration Framework – Event Packager

Available from: Release 201605

The Integration Event Designer is now enhanced to Create Packages of flows and exit points.

Selectivity for Integration Service

Available from: Release 201606

Integration Service is now modified to deliver events to different queues and allow to co-exist with adapters.

Selectivity Condition

Available from: Release 201610

T24 Inbound Custom Adapter for IIB now allows a functionality that can selectively pull messages from T24.

Company Specific polling in IIB Adapter Condition

Available from: Release 201610

T24 Inbound Custom Adapter for IIB now allows a functionality that can pull messages from T24 based on the con-

figured companies.

Bulk Event Delivery in IIB Adapter

Available from: Release 201608

T24 Inbound Custom Adapter for IIB now allows the events to be bulked when polling

Polling for multiple Event Types in IIB Adapter

Available from: Release 201610

T24 Inbound Custom Adapter for IIB now allows multiple type of events to be polled using an instance of inbound

adapter.

Editable bar file properties

Available from: Release 201702

The T24 Custom Adapter properties is made editable in the deployable artefact .bar file to suit the deployment envir-

onment.

Catch Terminal in IIB Adapter

Available from: Release 201702

T24 Inbound Custom Adapter for IIB has catch terminal in par with IBM Custom Node Design Standards.

IF Generic Archival Solution now a part of Integration Framework

Available from: Release 201704

What's New in R17 AMR! - Page 29 of 48

Archival solution for Integration Framework based on T24 Archival process is now a part of Integration Framework

Product

Event Delivery for selected companies in Integration Service

Available from: Release 201704

Integration Service can be configured to deliver events from multiple companies.

Configurable Retry Mechanism in Integration Service

Available from: Release 201704

Integration Service can be configured to stop automatically in the case of continued non delivery of events.

Custom Common Section in Integration Event

Available from: Release 201704

Integration Events can include a custom section in event common to allow users to define implementation specific data

to be added to the Integration Event.

Message Transformation using custom style sheets

Available from: Release 201606

Integration Framework allows custom style sheet to be applied to generate a event XML in a custom format when using

Integration Service.

T24 External BPM

Business Data based Search

Available from: Release 201702

An enquiry, to view all the pending processes based on the business variables, is now introduced along with a drill-down

enquiry to get all the tasks of the process.

Records are Process Aware

Available from: Release 201702

PW can now be used across Core Banking product without restriction to 'to do' lists.

PW and BPM Co-existence

Available from: Release 201702

Both PW and BPM are now co-existing so that some processes can run from PW while others from BPM while there is a

switch to reverse if needed.

What's New in R17 AMR! - Page 30 of 48

Islamic Banking

Islamic Banking AA

AA Islamic Retail

Available from: Release 201607

The work flow process is now redesigned and developed to cater to the functionality of various Islamic products aligned

under Arrangement Architecture (AA).

What's New in R17 AMR! - Page 31 of 48

Payments

Funds Transfer

FT Commission

Available from: Release 201605

This feature allocates certain types of profit and losses to be booked in the company of the customer account, irre-

spective of where the transaction is booked. This is applicable to the Funds Transfer, Securities and Derivatives mod-

ules.

FT Pricing at Portfolio level

Available from: Release 201608

As part of the existing FT module, this new feature focuses on the pricing setup and execution of Payment related fees

at the Portfolio level.

Payments Hub

USMB-ACH

Available from: Release 201605

TPS can process payment orders from US ACH clearing received via USMB. These orders are processed as per the

Clearing rules and the processing rules chosen by the bank (via configuration). The status of the transactions is sent

back to USMB for tracking and reconciliation.

Restructuring of Static Tables

Available from: Release 201606

Static data tables are updated using standard Core Banking application.

Enquire about Received Files (Bulks and Transactions) from a Clearing

Available from: Release 201606

The payments system can use the existing generic GUI to enquire about any type of received files, including files

received from the SEPA network/area. Only the bank officer use this GUI to view/enquiry the details of the payment.

Outward Mapping Framework

Available from: Release 201606

Outward Mapping Framework, a new feature that triggers the generation of clearing file for outgoing transactions and

performs NOSTRO settlement, is now available.

Credit Transfer Initiations

Available from: Release 201608

What's New in R17 AMR! - Page 32 of 48

Payments system can receive and accept a Credit Transfer Initiation based on pain.001 file or other type of files. After

the pain.001 file is accepted, it is de-bulked and mapped. During mapping, the pain.001 is split into bulks/batches and

individual CTIs. Then, the payments system processes these CTIs.

IBAN Mandatory Country

Available from: Release 201610

Payments can be moved to repair for which IBAN is not provided for beneficiary’s account when the beneficiary’s bank

is in an IBAN mandatory country.

Clearing Payments Status Report

Available from: Release 201610

Clearing Payment Status Report can be received/accepted and mapped. Also, pending clearing status reports can be pro-

cessed from a GUI.

Inward Mapping Framework

Available from: Release 201610

Inward Mapping Framework is a new TPS functionality that aims to replace Message Acceptance in TPS and simplify

Message Mapping, such that any new payment type is easily integrated, without changing the core functionality, or even

Inward Mapping Framework component itself. The aim is to map to TPS neutral format (POR tables and others) all

involved levels such as file level, bulk level and transaction level into the system.

Repair an Inward DD

Available from: Release 201610

The Repair GUI now contains all the extended information (including mandate information) of a SEPA direct debit.

Cancellation Requests

Available from: Release 201611

TPS can now process the inward and outward cancellation requests, and process the resolution of investigation

(camt.056 and camt.029) for a Credit transfer transaction.

Restructuring of Static Tables

Available from: Release 201611

The previous versions and enquiries are amended from PPT to PP for the static tables.

Credit Transfer Initiation - Batch Processing

Available from: Release 201611

TPS can now process Batch Messages which comes as part of SEPA pain.001 and Batch Payments can be processed in

Multiple Bulks.

XML Outward Mapping Framework

Available from: Release 201611

What's New in R17 AMR! - Page 33 of 48

XML Outward Mapping Framework, a new feature that triggers clearing file generation for outgoing transactions and

perform the NOSTRO settlement, is now available.

Direct Debit from SEPA Clearing

Available from: Release 201611

Payment system can now process Inward Direct Debits from a SEPA Clearing under CORE/COR1 SDD Scheme.

Return Credit Transfer

Available from: Release 201611

Return messages can now be sent within certain time frame if they represent a reject.

XML Inward Framework for SCT Types

Available from: Release 201611

Inward Framework is a TPS functionality that replaces Message Acceptance in TPS and simplify Message Mapping, such

that any new format can be easily integrated, without changing the core functionality, or even Inward Framework com-

ponent itself.

XML Outward Framework for Cancellation Request, Credit Transfer and Returns

Generic Type

Available from: Release 201611

The individual messages can be batched based on the file reference.

XML Outward Framework for Customer Status Report

Available from: Release 201611

The pain.002 messages can now be mapped into the corresponding generic tables that is used to generate an outgoing

pain.002 messages from TPS.

AA Restriction

Available from: Release 201612

Restrictions can now be checked for AA accounts before the payment is finalised for booking.

SWIFT ACK NAK

Available from: Release 201612

TPS can process ACK NAK Message with one service for all the companies.

Receive Clearing Status Reports - SDD

Available from: Release 201701

Any outward direct debit messages (pacs.003, pacs.004, pacs.007, pacs.002 (Refusal/Reject) or camt.056) can be

rejected by the clearing (SDD) against technical (DVF) or functional (RSF) validations. A pacs.002 (clearing status report

– SDD) will be received after those validations (technical or functional) are made.

What's New in R17 AMR! - Page 34 of 48

Multi Character Set Handling on EPC, PE-ACH, Country/Bank Level

Available from: Release 201701

For SEPA processing flow, the country specific characters are replaced/converted to valid XML characters described by

the EPC.

STP Reject, Return, Refund an Inward DD

Available from: Release 201701

Payment system can now process outgoing Return messages and outgoing Reject Messages, based on an incoming Dir-

ect Debit message.

Receive Reversals of Inward DD

Available from: Release 201701

Payment system can process Direct Debits Reversal incoming messages (pacs.007), when such messages are received

from the SEPA clearing.

Receive Rejects of Outward DD

Available from: Release 201701

The debtor bank can reject a direct debit received from creditor bank, before clearing settlement due to functional reas-

ons: invalid mandate or account. It might be the case when the debtor (customer) initiates a refusal (approved by

debtor bank) to the bank (debtor bank) to reject the direct debit (received from creditor bank).

Direct Debit from SEPA Clearing

Available from: Release 201701

System can receive, in dedicated queue, incoming DNF (Debit Notification File) from the Clearing containing pacs.003

bulk with direct debit instructions. The DNF file is validated against the XSD scheme provided by the Clearing itself and

then is translated into the system generic XML format with an “Accepted” status. With this status, the generic XML is

passed to the next step which is de-bulking and mapping of individual direct debit transactions. In case of validation fail-

ure, the status of the file is set to ‘REJECTED’.

SEPA DD Cancellation

Available from: Release 201704

Cancellation requests can be processed for Direct Debit payments in TPS.

Balance Reservation with Charges

Available from: Release 201704

TPS now allows transaction amount to be reserved on the debit account when a payment is processed.

Payments Hub Licensing

Available from: Release 201704

New modules PH, PPACHC, PPBACS, PPCHAT, PPFATF, PPHKGC, PPISOX, PPSDC, PPSPDD, PPSPCT and PPTGTC are

introduced so user needs to have these products (or License) installed to achieve the respective functionality.

What's New in R17 AMR! - Page 35 of 48

DDI Manual Processes

Available from: Release 201704

TPS is now enabled to process for SEPA Direct Debit Payments from the order entry Direct debit screen..

33B Instructed Amount

Available from: Release 201704

Payments Hub supports 33B payment processing for the credit transfer initiations with Instructed amount and currency.

Non Stop Support

Available from: Release 201704

Payments Hub is able to run continuously like other Core Banking modules. To accomplish, the SOD/EOD needs to be

changed as currently at EOD TPH jobs stop the TPH services and are only started again at SOD after all EOD jobs ran.

Drilldown to TPS from a Statement Enquiry

Available from: Release 201704

It is now possible to drilldown to TPS from any Statement enquiry/statement.

Reversal of Processed Direct Debits

Available from: Release 201704

Payment system can receive a Customer Payment Reversal (pain.007) message sent by the customer.

SEPA Directory Upload

Available from: Release 201704

The upload directory files can be received from the two clearings STEP2 and RPSSCL, and the records can be mapped

from the received files into the tables PP.STEP2.CLEARING.DIRECTORY and PP.RPSSCL.CLEARING.DIRECTORY.

SEPA Payments to Screening Application

Available from: Release 201704

Payments Hub now supports to send SEPA payments to the Screening application.

Charge Debtors for Insufficient Funds

Available from: Release 201704

Banks can now charge debtors for insufficient funds.

Validate Transaction Amount in R&S

Available from: Release 201704

A new R&S channel validation is now available in TPS for the SEPA outgoing messages that are sent to the clearing

house.

Reversal GUI Restrictions

Available from: Release 201704

What's New in R17 AMR! - Page 36 of 48

User is now restricted when deciding to reverse the SEPA messages.

Validation for CTI and DDI Messages

Available from: Release 201704

Payment system is able to perform the validation for a Credit Transfer Initiation or Direct Debit Initiation message.

When receiving a CTI or DDI message that is a batch (Batch Booking Indicator is True), then the currency of all the

transactions in the batch should be the same (same currency).

Handle Reversal Posting Failures

Available from: Release 201704

Reversal of posting failures can be performed when receiving a pacs.002 (Clearing Payment Status Report) or a Reject

from the debtor bank.

Automate STP Rejection of Inward Cancellation Request

Available from: Release 201704

Payment system can automatically send/generate a Resolution of Investigation message (camt.029) when receiving an

incoming Cancellation Request message (camt.056).

Inward Single/Multiple MT101 Message

Available from: Release 201704

TPS is now enabled to process inward single or multiple MT101 or Chained or unchained MT101 message.

Insight Extract

Available from: Release 201704

The time taken for insight extracts is now reduced, which in turn reduces the overall TPS SODEOD time.

Restructuring of Order Entry and Repair GUI's

Available from: Release 201704

A uniform user experience is provided in TPS for Core Banking users and warnings can now be generated as overrides

to support SMS based approval.

SEPA

Mandate and Limit ID check

Available from: Release 201607

This is an amendment to the existing functionality, Mandate Management, which is part of the SEPA SDD process.

Pacs.008 SCT Validation Changes

Available from: Release 201607

This is an amendment to the existing functionality to check file duplication.

What's New in R17 AMR! - Page 37 of 48

SEPA 2016 Rulebook Changes

Available from: Release 201608

Changes are made to the format of SEPA messages or to the processing workflow to ensure that the SEPA module

remains compliant with the mandatory aspects of the rule book.

Global Cancellation

Available from: Release 201612

Banks facilitate the need to display multiple Pacs.003 transactions which have an ‘SND’ status and the Pain.008 trans-

actions which have a ‘PRC’ status where multiple transactions can be selected and bulk cancellations are performed.

Net Accounting

Available from: Release 201612

A feature named 'Net accounting' is added for future dated settlements.

Return, Refund and Cancellation of In-House Transactions

Available from: Release 201612

A process to return, refund or cancel transactions is developed to enable the process to Return, Refund or Cancel trans-

actions for In-House transactions generated by the pain.008 file.

Pain008 Control Validations

Available from: Release 201701

This enhancement is part of the EP module and covers the primary validation on the Customer initiated Pain files.

Multiple Payment Block on Pain008

Available from: Release 201701

The pain008 xml files are sent by the customer for direct debit. These files have more than one payment information

block that is required to be supported by the system.

Monitoring Lifecycle of an SDD Transaction

Available from: Release 201702

An enquiry is developed to monitor the process of a pain.008 file.

Processing of Non - EUR Accounts

Available from: Release 201702

A feature is developed for Debit and Credit Accounts that are not in EUR currency when processing a pain.008 file.

Pain002 File Controls and Generation

Available from: Release 201703

The functionality now supports the Generation of Pain.002 on file rejection and Accepted transactions.

What's New in R17 AMR! - Page 38 of 48

Local Clearing

OFS Clearing Duplicate Check

Available from: Release 201704

The mechanism is now introduced in Core Banking to check for duplicity and ensure the booking requests are handled

appropriately in case of technical problems in legacies and payment systems.

What's New in R17 AMR! - Page 39 of 48

Private Wealth

Derivatives

Percentage Commission in DX Trade/Order

Available from: Release 201605

It is now possible to specify the commission as a percentage of contract value in DX Trade/Order.

Consolidation of Partial fills

Available from: Release 201605

It is now possible to consolidate Partial executions within the exchange cut-off time into a single trade for the aggreg-

ated lot, at an average execution price.

Order Workflow

Available from: Release 201605

The DX module is enhanced to support the complete workflow of an ETD Order.

Support for SWIFT MT306 and MT601

Available from: Release 201607

The Derivatives module now supports generation of SWIFT messages MT306 (Exotic foreign currency option con-

firmation) and MT601 (Precious Metal Option confirmation).

Fiduciaries

Commission Accrual Deferral on Last-Day basis

Available from: Release 201608

The Fiduciaries commission Accrual/Amortization processing is enhanced. Core Banking product now provides more

flexibility on Accounting for Fiduciaries commissions.

Securities Trading

Pricing of fees at Portfolio level

Available from: Release 201605

Securities is now enhanced to support the set up and execution of Periodic fees, Trading fees and Contract fees at Port-

folio level.

Processing of Amount based Corporate Actions

Available from: Release 201605

What's New in R17 AMR! - Page 40 of 48

There are several corporate actions such as redemption, fractional cash for conversion and so on, where the custodian

notifies the cash amount rather than providing a rate. The cash amount needs to be pro-rated based on client qualifying

holdings.

The system calculated entitlement amount can be modified by the user.

Bulk Order allocation

Available from: Release 201606

Temenos Core Banking is now enhanced to support different allocation methods for bulk orders involving multiple cli-

ents, through use of an API where the allocation logic can be built in.

Online Valuation Queue Prioritization

Available from: Release 201606

The Online Valuation (OV) module provides a real-time valuation engine for automatic intra-day revaluation of port-

folios. The enhancement allows prioritisation of transaction events over bulk events, while performing near real-time

valuation.

Corporate Action events for Restricted Currencies

Available from: Release 201606

Temenos Core Banking now facilitates Corporate Action events for Restricted Currencies.

Client Segregated Accounts

Available from: Release 201608

Securities product is now enhanced to handle Segregated Accounts and the related processing.

Swift Message - Omnibus Account to client Segregated account

Available from: Release 201608

Temenos Core Banking now has the capability to generate instructions (Swift MT 54n) to transfer the positions from pro-

prietary books to Client Accounts (Omnibus/Segregated).

Cash Dividend with choice of currency

Available from: Release 201612

Temenos Core Banking is now enhanced to handle Cash Dividends with choice of currency.

MT 565 generation

Available from: Release 201612

In Temenos Core Banking , the Corporate Actions processing (using STP) is covered by standard functionality.

This is now enhanced to change the processing flow for Optional events to allow:

l MT565 to be generated prior to the authorisation of Entitlement; and

l Generate MT565 per option

What's New in R17 AMR! - Page 41 of 48

Capital Increase – Oversubscription of Rights

Available from: Release 201612

Temenos Core Banking now handles oversubscription of the Rights directly with the custodian if the option is available.

ISO20022 - Settlement and Corporate Action(Event) Messages

Available from: Release 201704

Temenos Core Banking now supports ISO20022 MX Messages relevant to Securities Settlement and Corporate Actions.

Structured Products

Digital Investment

Available from: Release 201606

Structured Products module now supports transacting in Digital/Tower Investment Contracts and handles the complete

lifecycle of these products from inception to maturity.

What's New in R17 AMR! - Page 42 of 48

Retail

Arrangement Architecture - Core

Charge Accruals

Available from: Release 201605

A new option named Accrue is added to the Accounting property class to facilitate accrual of a Charge property (or all

properties of the Charge property class).

Linked Interest Rate

Available from: Release 201605

A new loan product named Linked Rate Products is introduced to link interest conditions with deposit interest prop-

erty.

AA Dormancy Processing

Available from: Release 201605

A new Property class named Dormancy is added to AA to allow definition and better control of dormancy.

Tier for Negative Interest Rates

Available from: Release 201607

The Interest Property class is now enhanced to allow the control of negative rates to be defined per tier level.

Posting Restriction

Available from: Release 201610

The Posting Restriction functionality is now enhanced to give the ability to control the duration of each restriction with a

start and end date. Additionally, the ability to choose some predefined restriction reasons or add any text when applying

or removing the restriction is also available.

External Products in AA

Available from: Release 201610

External Products can be defined in T24 central product catalogue. Temenos Core Banking product users can now cre-

ate their own Product Lines and their own Property Classes.

Restriction Availability per Product

Available from: Release 201611

A new property class named Facility is introduced to specify which account facilities are available/not available for a

product.

Multiple Accounts

Available from: Release 201612

What's New in R17 AMR! - Page 43 of 48

The Settlement property class is enhanced to allow the definition of multiple accounts with a percentage or fixed amount

being defined. The DD field has been repositioned so now allows multiple DD mandates to be configured.

Proportional Tax Calculation

Available from: Release 201701

Tax Engine and AA is enhanced to support Proportional Tax Calculation. If, on the Interest Payment date, the system

detects that the Tax Rate has changed during the current Interest period, it is now possible to calculate the Tax pro-

portional to the interest accrued for each of those sub-periods of Tax Rate Change. Interest Payment Date here could be

Capitalisation / Make Due/ Pay.

Calculate End date of Term

Available from: Release 201701

Calculation of Maturity date (or end date) of a deposit or loan contract can be managed when it falls on a holiday.

Product Eligibility

Available from: Release 201701

Banks can now manage the list of countries in which a product to be made available for a sale. A new attribute at the

level of both Products and Conditions is created to specify which company (country) owns the record.

Quotation Engine

Available from: Release 201701

Quotation Engine is introduced to provide the xml data required for the generation of quotations and other doc-

umentation necessary during the application form process, through the coordination of multiple simulations.

Commission Amortization Period

Available from: Release 201702

Agent commission can now be amortized until the renewal date of the financial contract.

Multiple Brokers

Available from: Release 201703

AA now supports multiple brokers in a financial contract.

Commission Amortization Period

Available from: Release 201703

AA now supports Choice of Commission Accounting Company (Branch) i.e., choice of P&L to which the commissions can

be booked. It can be Agent Branch, Customer Branch or the Branch where the sale was booked.

Commission Offsetting

Available from: Release 201704

System allows offsetting of due balance of commission whenever a pay commission is calculated.

What's New in R17 AMR! - Page 44 of 48

Notice of Base Rate Change

Available from: Release 201704

System can be configured to notify a customer ‘X’ number of days or weeks in advance about the change in base rate

for floating rate linked contracts.

High Volume Transaction

Available from: Release 201704

Banks process high volumes of transactions on certain types of accounts, including accounts opened with AA-Retail

Accounts (AR).

Interest Rate Changes in Statement

Available from: Release 201703

A new property class named STATEMENT is introduced to allow Interest Rates and Interest rate changes on Statement

in addition to regular statement information.

AA Link to Beneficiary

Available from: Release 201703

AA module now has a link to the BENEFICIARY record and can produce the required PAYMENT.ORDER on a given set-

tlement activity.

Retail Accounts

Interest for Accounts Opened / Closed mid-period

Available from: Release 201605

Interest can now be waived for the Opening and / or the Closing months.

Retail Deposits

Partial Withdrawal Simulation

Available from: Release 201701

During a partial withdrawal of a customers fixed term deposit product, user can now inform the customer and advise

them on information regarding any costs and charges connected with this particular transaction. Also, user has the abil-

ity at hand to notify the customer if required the recalculated interest amount that will be paid based on the new balance

amount.

Safe Deposit Box

Safe Deposit Box

Available from: Release 201605

What's New in R17 AMR! - Page 45 of 48

A new product line named Safe Deposit Box is now available as part of AA product suite. The new ‘BX’ module

enables the customers to maintain and lease safe deposit boxes.

Campaign Management

Campaign Management

Available from: Release 201609

A new product named Campaign Management (CP) is available as part of Core Banking. Campaigns define the tar-

get opportunity, rules for how that opportunity should be delivered to the customer, the rules by which customers are

selected for an opportunity, and campaign Meta data (such as schedule date, costing etc).

Contact History Tracking

Available from: Release 201609

CR.OPPORTUNITY can now hold the campaign-specific data.

What's New in R17 AMR! - Page 46 of 48

Treasury

Forex

FX Forward-Forward Swap

Available from: Release 201607

Forex module is enriched to support another variant of FX Swaps called “Forward to Forward”.

FX Margin Trading

Available from: Release 201612

Existing Limit, Collateral and FX functionality are configured in Model Bank to show case the FX Margin trading facility

which a bank can offer to its clients.

Interest Rate Swaps

SWIFT 2016 CHANGES

Available from: Release 201609

Tag 37 U is now renamed as 37 M.

Swap Revaluation

Available from: Release 201704

Swap revaluation is enhanced to consider alternative PI key for deriving implicit future rate and transparency around

zero rate calculations is built.

Money Market

SWIFT 2016 CHANGES

Available from: Release 201609

Tag 37 J, in MT 350, is renamed as 37 M.

What's New in R17 AMR! - Page 47 of 48

Treasury Trader

Deal Manager

Rate Fixing

Available from: Release 201609

An interface is now introduced in TT to read IRS rate fixing event from Core Banking.

Risk Management

Value at Risk (VaR)

Available from: Release 201609

Risk Management module is now enhanced to provide the user the flexibility to configure the horizon and confidence

level in calculating VaR. Also, FX Volatility is now included to conduct scenario analysis as part of stress testing the VaR

of a portfolio.

What's New in R17 AMR! - Page 48 of 48

Вам также может понравиться

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)