Академический Документы

Профессиональный Документы

Культура Документы

Guidance On Loan

Загружено:

banglauser0 оценок0% нашли этот документ полезным (0 голосов)

8 просмотров2 страницыloan

Оригинальное название

Guidance on loan

Авторское право

© © All Rights Reserved

Доступные форматы

DOCX, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документloan

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

8 просмотров2 страницыGuidance On Loan

Загружено:

banglauserloan

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 2

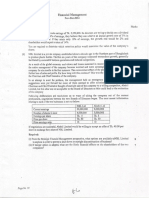

There are 4 types of Loan as per BRPD Circular-14 dated 23/09/2012.

They are:

(a) Continuous Loan

(b) Demand Loan

(c) Fixed Term Loan

(d) Short Term Agriculture & Micro Loan (STAG&MI)

a. Continuous Loan

The Loan Accounts in which transactions may be allowed frequently within certain limit and have an

expiry date for full adjustment will be treated as Continuous Loan. Examples are: CC, OD etc.

Two key indicators:

1. Transactions may be allowed frequently within certain limit.

2. Have an expiry date for full adjustment.

b. Demand Loan:

The Loan that becomes repayable on demand by the bank will be treated as Demand Loan. Such loan

has no specific repayment schedule. So if any contingent or any other liabilities are turned to forced

Loans (i.e. without any prior approval as regular Loan) those too will be treated as Demand Loans. Such

as: Forced PAD (Forced Loan against imported merchandise), Foreign Bill Purchased and Inland Bill

Purchased etc.

C. Fixed Term Loan:

The Loans which are repayable within a specific time period under a specific repayment schedule will

be treated as Fixed Term Loan. Classification rule for Fixed Term Loan is different depending on its

limit ( upto 10 lac and beyond 10 lac).

d. Short Term Agriculture & Micro Credit:

Short-term Agricultural Loan will include the short-term Loans as listed under the Annual Credit

Programe issued by the Agricultural Credit Department (ACD) of Bangladesh Bank. Loan in the

agricultural sector repayable within 12 (twelve) months will also be included herein. Short-term Micro-

Loan will include any micro-Loan not exceeding an amount determined by Bangladesh Bank from time

to time and repayable within 12 (twelve) months.

However, loans and advances can be classified in other ways also as follows:

Short term Loan- If the tenure of the loan is not more than one year

Long term Loan- If the tenure of the loan is more than one year

Funded- If loan is provided through fund

Non-Funded – If the loan is not provided through fund

Secured- If the loan is backed by security

Un-secured- If the loan is not backed by any security

Domestic currency loan-If the loan is obtained in domestic currency

Foreign currency loan-If the loan is obtained in foreign currency

Local loan- If the loan is obtained in local currency

External Loan or foreign loan-If the loan is obtained from abroad.

Bill Purchase- Advance against bill prior to the realization of value from the ultimate importer

or buyer or purchaser. Here interest is charged for the period of financing. Usually sight bills are

purchased.

Bill discounting- Advance against usance bill after deducting a portion which is called discount.

Here discount represents the interest on the advance from the date of purchase of the bill until it

is due for payment.

Export Finance (suppose packing credit- working capital loan to manufacture/procure goods

before execution of shipment or delivery).

Import Finance ( PAD, LTR, LIM, EDF)

Pre-shipment Credit- Credit provided before shipment

Post Shipment- Credit provided after shipment

Operating lease- Short term lease wherein the lessee gets the right to use the property for short

period against rent and the ownership remains with the lessor.

Financing Lease-The lessee gets the right to use the property for a long time and the end of the

lease term becomes the owner of the property.

SME- Loan: Loan provided to small and medium enterprises. In small industries maximum

grantable loan amount is Tk 20 cr for manufacturing and 5 cr for service sector. In case of medium

scale enterprise grantable loan amount is Tk. 75 cr for manufacturing sector while 50 cr is for

service sector.

Consumer finance or personal loan-Basically loan to individuals like credit card, education loan,

car loan, home loan, loan for purchase of home appliances, etc.

Floating rate loan- Interest rate is variable or linked to any other bench mark rate like LIBOR

Fixed rate loan- Interest rate is fixed.

Вам также может понравиться

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Dealer Manual Chapter 3 186042 7Документ23 страницыDealer Manual Chapter 3 186042 7Swaggonathousand Truckdahustlnazz QuarterboiОценок пока нет

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Fred C. Trump 1954 Senate Banking Committee Interview Transcript.Документ67 страницFred C. Trump 1954 Senate Banking Committee Interview Transcript.Woke-AF.comОценок пока нет

- Travel Meeting and Entertainment PolicyДокумент18 страницTravel Meeting and Entertainment PolicyAbhinav Singh Solanki100% (1)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Law On Obligations and Contracts BSA I PrelimsДокумент7 страницLaw On Obligations and Contracts BSA I PrelimsRojohn ValenzuelaОценок пока нет

- CUP VI - Financial Accounting and ReportingДокумент17 страницCUP VI - Financial Accounting and ReportingRonieOlarte0% (1)

- Freehold ConversionДокумент7 страницFreehold ConversionRazali ZlyОценок пока нет

- ქირავნობა - EngДокумент4 страницыქირავნობა - Engluka daneliaОценок пока нет

- Weber Meadowview Corporation Bylaws May 31, 2014 Approved FinalДокумент18 страницWeber Meadowview Corporation Bylaws May 31, 2014 Approved FinalMattGordonОценок пока нет

- 60 CA Agro-Industrial Development Corp. vs. Court of Appeals, G.R. No. 9002, 3 March 1993Документ2 страницы60 CA Agro-Industrial Development Corp. vs. Court of Appeals, G.R. No. 9002, 3 March 1993Bibi JumpolОценок пока нет

- Transfer by Ostensible OwnerДокумент7 страницTransfer by Ostensible OwnerMOHIT100% (2)

- Withholding VAT Guideline (2017-18)Документ29 страницWithholding VAT Guideline (2017-18)banglauserОценок пока нет

- Withholding VAT Guideline 2015-2016Документ20 страницWithholding VAT Guideline 2015-2016banglauserОценок пока нет

- Vat Sro 220 SDДокумент2 страницыVat Sro 220 SDbanglauserОценок пока нет

- Fm-May-June 2015Документ18 страницFm-May-June 2015banglauserОценок пока нет

- STRATEGIC BUSINESS MANAGEMENT - JA-23 - Suggested - AnswersДокумент15 страницSTRATEGIC BUSINESS MANAGEMENT - JA-23 - Suggested - AnswersbanglauserОценок пока нет

- Suggested Answers: Financial ManagementДокумент14 страницSuggested Answers: Financial ManagementbanglauserОценок пока нет

- CR-Nov-Dec-2021Документ7 страницCR-Nov-Dec-2021banglauserОценок пока нет

- May-June 2012 Answer To The Ques. No.l: Financial ManagementДокумент11 страницMay-June 2012 Answer To The Ques. No.l: Financial ManagementbanglauserОценок пока нет

- Fm-Nov-Dec 2012Документ14 страницFm-Nov-Dec 2012banglauserОценок пока нет

- Fm-Nov-Dec 2014Документ14 страницFm-Nov-Dec 2014banglauserОценок пока нет

- Fm-May-June 2013Документ16 страницFm-May-June 2013banglauserОценок пока нет

- Fm-May-June 2011Документ10 страницFm-May-June 2011banglauserОценок пока нет

- Income ChecklistДокумент17 страницIncome ChecklistbanglauserОценок пока нет

- Questions On IAS 19Документ5 страницQuestions On IAS 19banglauserОценок пока нет

- Rules Regardign Firm enlistment-FRCДокумент36 страницRules Regardign Firm enlistment-FRCbanglauserОценок пока нет

- Questions On IFRS 9Документ3 страницыQuestions On IFRS 9banglauserОценок пока нет

- Logitech Surround Sound Speaker System Z906 User's Guide: Model: S-00102 (110V ) S-00103 (220V )Документ36 страницLogitech Surround Sound Speaker System Z906 User's Guide: Model: S-00102 (110V ) S-00103 (220V )banglauserОценок пока нет

- Ias 12 Recognition and Measurement of Deferred Tax Assets When An Entity Is Loss Making May 2014Документ1 страницаIas 12 Recognition and Measurement of Deferred Tax Assets When An Entity Is Loss Making May 2014banglauserОценок пока нет

- Evsjv 'K Evsjv 'K M Ru: Iwr÷Vw© Bs WW G-1Документ32 страницыEvsjv 'K Evsjv 'K M Ru: Iwr÷Vw© Bs WW G-1banglauserОценок пока нет

- VAT SummaryДокумент1 страницаVAT SummarybanglauserОценок пока нет

- CAPE - Masterclass On VAT - Dr. Abdul Mannan Shikder Sir - Member (VAT Implementation & IT) NBRДокумент115 страницCAPE - Masterclass On VAT - Dr. Abdul Mannan Shikder Sir - Member (VAT Implementation & IT) NBRbanglauserОценок пока нет

- Ahluwalia Planning For Urban DevelopmentДокумент20 страницAhluwalia Planning For Urban DevelopmentRatnil ShrivastavaОценок пока нет

- Knowing PPP BodyДокумент248 страницKnowing PPP BodyambonulanОценок пока нет

- Standard RentДокумент2 страницыStandard RentShayan ZafarОценок пока нет

- Student Life: How Much It Costs in Chişin ĂU?Документ14 страницStudent Life: How Much It Costs in Chişin ĂU?Kristina ArhipОценок пока нет

- Sales Cases (52 To 70)Документ62 страницыSales Cases (52 To 70)Arlando G. ArlandoОценок пока нет

- Jaipur Premises Atm 10012014Документ5 страницJaipur Premises Atm 10012014sur011Оценок пока нет

- Lease Practice QuestionsДокумент4 страницыLease Practice QuestionsAbdul SamiОценок пока нет

- Infra Abstract of Bid As ReadДокумент2 страницыInfra Abstract of Bid As ReadRico TinacoОценок пока нет

- Section 1 30 Minutes (20 Questions) : Gmat Math Problem SolvingДокумент23 страницыSection 1 30 Minutes (20 Questions) : Gmat Math Problem Solvingajju1378Оценок пока нет

- The Tenancy Agreement: The Second Schedule Hereto (Hereinafter Referred To As "The Security Deposit")Документ12 страницThe Tenancy Agreement: The Second Schedule Hereto (Hereinafter Referred To As "The Security Deposit")Siti AsyuuraОценок пока нет

- Taxguru - In-Reverse Charge Mechanism in GST Regime With ChartДокумент20 страницTaxguru - In-Reverse Charge Mechanism in GST Regime With Chartvikrant.chutke12Оценок пока нет

- Invoice ListДокумент2 страницыInvoice Listapi-3744361Оценок пока нет

- Fido Terms and Conditions-EnДокумент6 страницFido Terms and Conditions-EnahdhanafyОценок пока нет

- 156713023030082019-Kurnool Airport - EOI-Aerosports and FTCДокумент34 страницы156713023030082019-Kurnool Airport - EOI-Aerosports and FTCSamОценок пока нет

- Plaintiff-Appellant Vs Vs Defendant-Appellee Claro M. Recto Damasceno Santos Ross, Selph, Carrascoso & JandaДокумент10 страницPlaintiff-Appellant Vs Vs Defendant-Appellee Claro M. Recto Damasceno Santos Ross, Selph, Carrascoso & Jandamarites ongtengcoОценок пока нет

- PS#2 2015Документ12 страницPS#2 2015Eegii EgОценок пока нет

- Ch3 Revenue Management Saves National Car RentalДокумент5 страницCh3 Revenue Management Saves National Car RentalAnirban DubeyОценок пока нет

- Executive Order No. 648 Reorganizing The Human Settlements Regulatory CommissionДокумент7 страницExecutive Order No. 648 Reorganizing The Human Settlements Regulatory CommissionJom MariaОценок пока нет

- Exam QuizДокумент27 страницExam QuizPat Gohh0% (1)

- Mines and Minerals Development & Regulation Act 1957Документ38 страницMines and Minerals Development & Regulation Act 1957Cherukuru S RaoОценок пока нет