Академический Документы

Профессиональный Документы

Культура Документы

AKUNTANSI KEUANGAN MENENGAH I - CH 11

Загружено:

ini viaОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

AKUNTANSI KEUANGAN MENENGAH I - CH 11

Загружено:

ini viaАвторское право:

Доступные форматы

AKUNTANSI KEUANGAN MENENGAH I

EXERCISE - CHAPTER 11

1. A truck was acquired on July 1, 2016, at a cost of £216,000. The truck had a six-year

useful life and an estimated residual value of £24,000. The straight-line method of depreciation

was used. On January 1, 2019, the truck was overhauled at a cost of £20,000, which extended

the useful life of the truck for an additional two years beyond that originally estimated (residual

value is still estimated at £24,000). In computing depreciation for annual adjustment purposes,

expense is calculated for each month the asset is owned.

Instructions

Prepare the appropriate entries for January 1, 2019 and December 31, 2019.

2. Merando Company acquired equipment on January 1, 2017, for €60,000. Merando

elects to value this class of equipment using revaluation accounting. This equipment is being

depreciated on a straight-line basis over its 6-year useful life. There is no residual value at the

end of the 6-year period. The appraised value of the equipment approximates the carrying

amount at December 31, 2017 and 2019. On December 31, 2018, the fair value of the

equipment is determined to be €35,000.

Instructions

(a) Prepare the journal entries for 2017 related to the equipment.

(b) Prepare the journal entries for 2018 related to the equipment.

(c) Determine the amount of depreciation expense that Merando will record on the

equipment in 2019.

3. Rojas Company purchased for €5,600,000 a mine estimated to contain 2 million tons

of ore. When the ore is completely extracted, it was expected that the land would be worth

€200,000. A building and equipment costing €2,800,000 were constructed on the mine site,

and they will be completely used up and have no residual value when the ore is exhausted.

During the first year, 750,000 tons of ore were mined, and €450,000 was spent for labor and

other operating costs.

Instructions

Compute the total cost per ton of ore mined in the first year. (Show computations by setting

up a schedule giving cost per ton.)

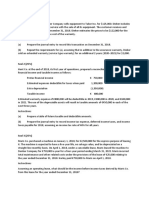

4. Presented below is information related to equipment owned by Marley Company at

December 31, 2018.

Cost €7,000,000

Accumulated depreciation to date 1,500,000

Value-in-use 5,000,000

Fair value less cost of disposal 4,400,000

Assume that Marley will continue to use this asset in the future. As of December 31, 2018, the

equipment has a remaining useful of 4 years.

Instructions

(a) Prepare the journal entry (if any) to record the impairment of the asset at

December 31, 2018.

(b) Prepare the journal entry to record depreciation expense for 2019.

(c) The recoverable amount of the equipment at December 31, 2019, is €5,250,000.

Prepare the journal entry (if any) necessary to record this increase.

Вам также может понравиться

- How To Value Stocks - by Value SpreadsheetДокумент19 страницHow To Value Stocks - by Value SpreadsheetNick Kraakman100% (2)

- Auditing Problems-Ppep1Документ4 страницыAuditing Problems-Ppep1Par CorОценок пока нет

- TB 03Документ65 страницTB 03chowchow123Оценок пока нет

- PPE QuizДокумент6 страницPPE QuizKristelle Mae Bautista100% (1)

- Project Report On SharekhanДокумент59 страницProject Report On Sharekhankumar shashank keshriОценок пока нет

- Steven Shreve. Lectures On Stochastic Calculus and FinanceДокумент365 страницSteven Shreve. Lectures On Stochastic Calculus and FinanceSee Keong LeeОценок пока нет

- Option Strategy Cheat Sheet: Condition Volatility Skew Time NotesДокумент1 страницаOption Strategy Cheat Sheet: Condition Volatility Skew Time Notesraj33% (3)

- College of Accountancy and Finance: 1st Semester, S.Y. 2018-2019 Page 1 of 4 Prof. GMДокумент4 страницыCollege of Accountancy and Finance: 1st Semester, S.Y. 2018-2019 Page 1 of 4 Prof. GMPpp BbbОценок пока нет

- On January 1Документ2 страницыOn January 1UNKNOWNNОценок пока нет

- Investment Property Other Non Current Financial Assets and Non Current Assests Held For SaleДокумент16 страницInvestment Property Other Non Current Financial Assets and Non Current Assests Held For SaleRizza Morada50% (2)

- Union Bank Stock Statement FormatДокумент2 страницыUnion Bank Stock Statement Formatberrysautolko83% (12)

- Capital Budgeting Techniques: ProblemsДокумент3 страницыCapital Budgeting Techniques: ProblemsripplerageОценок пока нет

- Risk Metrics Technical Doc 4ed PDFДокумент296 страницRisk Metrics Technical Doc 4ed PDFjamilkhannОценок пока нет

- Individual Assignment 1Документ2 страницыIndividual Assignment 1Getiye LibayОценок пока нет

- Soal Quiz Intermediate Accounting 1 - UASДокумент2 страницыSoal Quiz Intermediate Accounting 1 - UASLiamОценок пока нет

- Exercise Chap 11Документ7 страницExercise Chap 11JF FОценок пока нет

- PPE IllustrationsДокумент3 страницыPPE Illustrationsprlu1Оценок пока нет

- SOAL Kuis Materi UAS Inter 2Документ2 страницыSOAL Kuis Materi UAS Inter 2vania 322019087Оценок пока нет

- SOAL Kuis Materi UAS Inter 2Документ2 страницыSOAL Kuis Materi UAS Inter 2vania 322019087Оценок пока нет

- Recitation #9Документ5 страницRecitation #9wtfОценок пока нет

- Problem 1Документ3 страницыProblem 1Beverly MindoroОценок пока нет

- Module 5 - PpsДокумент4 страницыModule 5 - PpsMIGUEL JOSHUA VILLANUEVAОценок пока нет

- Practice QuestionsДокумент5 страницPractice QuestionsCheuk Ling SoОценок пока нет

- Assignment 1Документ8 страницAssignment 1Ivan SsebugwawoОценок пока нет

- 2023 Tutorials Capital Allow & RecoupmtДокумент10 страниц2023 Tutorials Capital Allow & RecoupmtNchafie AsemahleОценок пока нет

- Accounting II - Assignment 1Документ5 страницAccounting II - Assignment 1Hawultu AsresieОценок пока нет

- Depreciation MCQsДокумент5 страницDepreciation MCQsAsaduzzaman LimonОценок пока нет

- Financial Accounting II CTRL 202-Spring 2021 Tutorial 2 Plant Assets, Natural Resources and Intangible AssetsДокумент2 страницыFinancial Accounting II CTRL 202-Spring 2021 Tutorial 2 Plant Assets, Natural Resources and Intangible AssetsAbdelrahman AlaaОценок пока нет

- CTAA021 Tutorial 22 February 2024Документ4 страницыCTAA021 Tutorial 22 February 2024202200224Оценок пока нет

- 2.2. PPE IAS16 - Practice - EnglishДокумент12 страниц2.2. PPE IAS16 - Practice - EnglishBích TrâmОценок пока нет

- Accounting For Exploration and Evaluation Expenditures and DepletionДокумент1 страницаAccounting For Exploration and Evaluation Expenditures and DepletionMark Angelo BustosОценок пока нет

- CFR Paper 2020 PDFДокумент10 страницCFR Paper 2020 PDFharoon nasirОценок пока нет

- SQB - Chapter 4 QuestionsДокумент13 страницSQB - Chapter 4 QuestionsracsoОценок пока нет

- A192-Mc1 PpeДокумент4 страницыA192-Mc1 PpeTeo ShengОценок пока нет

- DEPRECIATIONДокумент5 страницDEPRECIATIONjdjdbОценок пока нет

- 2021 COAF 4201 GroupsДокумент16 страниц2021 COAF 4201 GroupsTawanda Tatenda HerbertОценок пока нет

- 147308Документ4 страницы147308Ahmed Raza TanveerОценок пока нет

- Dado BpsДокумент6 страницDado BpsmcannielОценок пока нет

- Assessment TasksДокумент5 страницAssessment TasksLDB Ashley Jeremiah Magsino - ABMОценок пока нет

- AbdulSamad 12 15796 1 DepreciationДокумент12 страницAbdulSamad 12 15796 1 DepreciationSyed SumamaОценок пока нет

- WileyPlus PPEДокумент9 страницWileyPlus PPEKaiWenNgОценок пока нет

- Pertemuan 9 - Soal (English)Документ2 страницыPertemuan 9 - Soal (English)Boby Kristanto ChandraОценок пока нет

- Depreciation ActivityДокумент4 страницыDepreciation ActivityAngelica PagaduanОценок пока нет

- Intermediate Accounting 1 Problems and SolutionДокумент26 страницIntermediate Accounting 1 Problems and SolutionRAFALLO, ABMYR ROSE R.Оценок пока нет

- EdexelДокумент12 страницEdexelManuthi HewawasamОценок пока нет

- Exercises - Wasting Assets, Borrowing Costs, and Government GrantsДокумент3 страницыExercises - Wasting Assets, Borrowing Costs, and Government GrantsMeeka CalimagОценок пока нет

- Lebanese Association of Certified Public Accountants - IFRS February Exam 2020 - Extra SessionДокумент8 страницLebanese Association of Certified Public Accountants - IFRS February Exam 2020 - Extra Sessionjad NasserОценок пока нет

- Poa T - 6Документ2 страницыPoa T - 6SHEVENA A/P VIJIANОценок пока нет

- Ppe&ia PDFДокумент19 страницPpe&ia PDFNicole BernardoОценок пока нет

- Chapter 10Документ11 страницChapter 10Saharin Islam ShakibОценок пока нет

- Non Current Assets 2019AДокумент4 страницыNon Current Assets 2019AKezy Mae GabatОценок пока нет

- Adjusting Entries ProblemsДокумент5 страницAdjusting Entries ProblemsDirck VerraОценок пока нет

- 3 - (Ppe)Документ3 страницы3 - (Ppe)fbaabgfgbfdОценок пока нет

- CE On PPE Acquisition and Depreciation CДокумент3 страницыCE On PPE Acquisition and Depreciation CRedОценок пока нет

- MUH - SYUKUR (A031191077) AKUNTANSI KEUANGAN Problem P11-9 (Buku Kieso Chapter 11)Документ2 страницыMUH - SYUKUR (A031191077) AKUNTANSI KEUANGAN Problem P11-9 (Buku Kieso Chapter 11)Rismayanti100% (1)

- Muh - Syukur (A031191077) Akuntansi Keuangan Problem p11-9 (Buku Kieso Chapter 11)Документ2 страницыMuh - Syukur (A031191077) Akuntansi Keuangan Problem p11-9 (Buku Kieso Chapter 11)RismayantiОценок пока нет

- Property, Plant, and EquipmentДокумент3 страницыProperty, Plant, and EquipmentIzza Mae Rivera KarimОценок пока нет

- Impairment of AssetsДокумент21 страницаImpairment of AssetsSteffanie Granada50% (2)

- Tutorial 4Документ3 страницыTutorial 4LIM WEI LIANGОценок пока нет

- Assgnt Acfn 3202 2020extДокумент2 страницыAssgnt Acfn 3202 2020extbethelhemОценок пока нет

- Pup-Ppe6-Src 2-1Документ7 страницPup-Ppe6-Src 2-1hellokittysaranghae0% (2)

- Classroom Exercises On Ncahs & Discontinued Operations 1st Term Sy2018-2019Документ3 страницыClassroom Exercises On Ncahs & Discontinued Operations 1st Term Sy2018-2019alyssaОценок пока нет

- Chapter 6 Noncurrent Asset Held For SaleДокумент6 страницChapter 6 Noncurrent Asset Held For SaleCarrie DangОценок пока нет

- Audit PpeДокумент4 страницыAudit Ppenicole bancoroОценок пока нет

- Provision For Depreciation & DisposalДокумент3 страницыProvision For Depreciation & DisposalKristen NallanОценок пока нет

- A. Record The Adjusting Entries To Take Up The Depreciation For The Year December 31, 2019Документ3 страницыA. Record The Adjusting Entries To Take Up The Depreciation For The Year December 31, 2019Imee Claire EdinoОценок пока нет

- Transforming the energy systemОт EverandTransforming the energy systemОценок пока нет

- Climate-Related Financial Disclosures 2021: Progress Report on Implementing the Recommendations of the Task Force on Climate-Related Financial DisclosuresОт EverandClimate-Related Financial Disclosures 2021: Progress Report on Implementing the Recommendations of the Task Force on Climate-Related Financial DisclosuresОценок пока нет

- Chapter-5: Statement of Cash FlowДокумент43 страницыChapter-5: Statement of Cash FlowBAM ZAHARDОценок пока нет

- Investment Scenario: Savings and Investment - Two Sides of A CoinДокумент37 страницInvestment Scenario: Savings and Investment - Two Sides of A CoinLokesh GowdaОценок пока нет

- B.A Laundry ShopДокумент6 страницB.A Laundry ShopMary Grace BituinОценок пока нет

- Jump Diffusion Models - PrimerДокумент3 страницыJump Diffusion Models - PrimerycchiranjeeviОценок пока нет

- Making AgreemenДокумент4 страницыMaking AgreemenEvan VarianОценок пока нет

- Chapter 3 Tutorial QuestionsДокумент3 страницыChapter 3 Tutorial QuestionsMilanОценок пока нет

- Financial Statements: College of Business Management and AccountancyДокумент6 страницFinancial Statements: College of Business Management and AccountancyJamie Rose AragonesОценок пока нет

- Capital Inv Appraisal Questions Notes PDFДокумент6 страницCapital Inv Appraisal Questions Notes PDFtaridanОценок пока нет

- Consolidated Rules of Bursa Malaysia Securities BHDДокумент323 страницыConsolidated Rules of Bursa Malaysia Securities BHDjerlson83Оценок пока нет

- C213 Study Guide - SolutionДокумент23 страницыC213 Study Guide - Solutiondesouzas.ldsОценок пока нет

- Intermediate Accounting I: Financial AssetsДокумент20 страницIntermediate Accounting I: Financial AssetsdeeznutsОценок пока нет

- Report PT Sri Rejeki Isman TBK 31 Dec 2020 1Документ175 страницReport PT Sri Rejeki Isman TBK 31 Dec 2020 1bullywilliamОценок пока нет

- Analisis Laporan Keuangan Pada PT Impack Pratama Industri TBKДокумент24 страницыAnalisis Laporan Keuangan Pada PT Impack Pratama Industri TBKzul zilaОценок пока нет

- 1-Accounting EquationДокумент4 страницы1-Accounting EquationNoraОценок пока нет

- TSE - What Is ArrowheadДокумент2 страницыTSE - What Is ArrowheadVel KumarОценок пока нет

- Goals of Corporate Finance: Profit MaximizationДокумент1 страницаGoals of Corporate Finance: Profit MaximizationReniva KhingОценок пока нет

- Operating LeverageДокумент4 страницыOperating Leveragetimothy454Оценок пока нет

- Initiating Coverage - Lupin - 31 Aug 2020Документ12 страницInitiating Coverage - Lupin - 31 Aug 2020Ayush KapoorОценок пока нет

- PDFДокумент364 страницыPDFSmita mohantyОценок пока нет

- 06 Task Performance 1Документ5 страниц06 Task Performance 1LunaОценок пока нет

- Project For Tally Prime - 013659 (1) (Mith)Документ39 страницProject For Tally Prime - 013659 (1) (Mith)Or IyerОценок пока нет

- Ch12in 1Документ44 страницыCh12in 1Smile LyОценок пока нет