Академический Документы

Профессиональный Документы

Культура Документы

Sbi's Minimum Balance Penalty

Загружено:

S K MahapatraОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Sbi's Minimum Balance Penalty

Загружено:

S K MahapatraАвторское право:

Доступные форматы

Pros and Cons of SBI's Minimum

Balance Penalty

Published on Saturday, March 11, 2017

By Admin

INTRODUCTION:-

I must admit, Indian Banks are very clever. Banks always find out the way around to

protect their territory. Non-Maintenance of Minimum Balance is a major issue for the

banks to handle. Banks incur the cost for keeping and servicing the Savings Account.

Banks recover this cost by imposing minimum balance criterion i.e. an amount which

should be reserved in the savings account on a regular basis to recover such cost.

Charges imposed for Non-Maintenance of Minimum Balance generate substantial

revenue for any bank. It is one of the most widely levied penalty by any bank.

regular basis to recover such cost. Charges imposed for Non-Maintenance of Minimum

Balance generate substantial revenue for any bank. It is one of the most widely levied

penalty by any bank.

SBI’s New Rule:-

o Making it necessary for account-holders to keep a minimum balance, the State

Bank of India (SBI) on Thursday said it will be charging nonpayers a penalty from

1st April onwards.

o Making maintenance of Rs. 5,000 compulsory for accounts in metropolitan areas,

Rs. 3,000 in urban areas, Rs. 2,000 in semi-urban areas and Rs. 1,000 in rural

areas, the SBI listed out the charges to be effective from April 1.

o The charges will be based on the difference between the minimum balance

required and the shortfall. For city areas, if the shortfall is greater than 75 percent,

then the charges would be Rs. 100 plus service tax. If the shortfall is between 50-

75%, the bank would charge Rs. 75 plus service tax and for below 50% shortfall,

a fee of Rs. 50 plus service tax would be levied. Likewise, for rural areas, the

penalty for non-maintenance of minimum balance ranges from Rs. 20-50 plus

service tax.

How Minimum Balance Condition Can Cost You

Assume, if you get a new bank account with your new job. Your old bank account is left

unobserved without minimum account balance as it used to be salary account. After

some period, you may realize that your account is useless. The bank has converted

your salary account to normal saving account. Now it is charging for non-maintenance

of minimum account balance. If it has been one year (time passes swiftly) then you

have to pay more. You can forget your unused account for more than a year.

Disadvantages :-

o The major disadvantage is that regardless of shortfall, charges levied are fixed. In

short, the normal penalty fixed, even if the shortfall is Rs 1 or it is Rs 5000.

o Second drawback is that banks are allowed to make negative balance i.e. banks

keep on levying the charges and customers bank balance becomes Negative. In

most of the cases, account holders are unaware and when they deposit money,

the money will be deducted automatically. To avoid the sudden deduction of

money, RBI issued some guidelines.

Summary of Guidelines on Non-Maintenance of Minimum

Balance issued by RBI w.e.f 1st April-2015

o Penalty for Minimum Balance necessity will be in proportion to the shortfall in the

Minimum Balance. Charges will be according to slab structure which will be fixed

with wide criterion of fixed percent of the difference between the actual balance

maintained in the account and the minimum balance required.

o It will be the duty of a bank to inform the customer through SMS/Email/Letter

regarding charges when minimum balance requirement is broken.

o Banks will not be able to create the negative balance. Account will be declared

inoperative. Bank may limit the services available to such accounts. For example,

bank may limit no of branch transactions or restrict usage of debit card if the

minimum balance is not kept.

o Customer will have 1 month grace period to restore the Minimum Balance in

account from the date of receipt of notice from the bank.

o Penal Charges can be levied only after 1 month’s grace period.

o Any Penal Charges levied in this regard will be informed to the customer.

o Charges cannot exceed the actual cost of providing the service and must be

reasonable.

Вам также может понравиться

- Types of ChequesДокумент5 страницTypes of ChequesS K MahapatraОценок пока нет

- Profit and GainДокумент3 страницыProfit and GainS K MahapatraОценок пока нет

- Twin Balance Sheet Problems in IndiaДокумент2 страницыTwin Balance Sheet Problems in IndiaS K MahapatraОценок пока нет

- Credit Card VS Debit CardДокумент3 страницыCredit Card VS Debit CardS K MahapatraОценок пока нет

- Certified Cheque and Cashier ChequeДокумент2 страницыCertified Cheque and Cashier ChequeS K MahapatraОценок пока нет

- Cheque Truncation SystemДокумент5 страницCheque Truncation SystemS K MahapatraОценок пока нет

- Money LaunderingДокумент3 страницыMoney LaunderingS K MahapatraОценок пока нет

- Types of Bank AccountДокумент5 страницTypes of Bank AccountS K MahapatraОценок пока нет

- Bill of ExchangeДокумент4 страницыBill of ExchangeS K MahapatraОценок пока нет

- Crossing of ChequesДокумент3 страницыCrossing of ChequesS K MahapatraОценок пока нет

- Atm VS Debit CardДокумент3 страницыAtm VS Debit CardS K MahapatraОценок пока нет

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5795)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- WTO Agreement On Customs ValuationДокумент2 страницыWTO Agreement On Customs ValuationAoi NagisaОценок пока нет

- Certificate of Transfer of ChargeДокумент2 страницыCertificate of Transfer of ChargeHemam PrasantaОценок пока нет

- Solution Manual World Trade and Payments: An IntroductionДокумент8 страницSolution Manual World Trade and Payments: An Introductionsylvester100% (1)

- Questions To Ask AboutДокумент3 страницыQuestions To Ask AboutSeif AbdelghanyОценок пока нет

- Porto Rico Telephone Company v. Sol Luis Descartes, Secretary of The Treasury of Puerto Rico, 255 F.2d 169, 1st Cir. (1958)Документ9 страницPorto Rico Telephone Company v. Sol Luis Descartes, Secretary of The Treasury of Puerto Rico, 255 F.2d 169, 1st Cir. (1958)Scribd Government DocsОценок пока нет

- Taxation Principles and Remedies Finals ReviewerДокумент39 страницTaxation Principles and Remedies Finals ReviewerRamilОценок пока нет

- Invoice 62060270Документ1 страницаInvoice 62060270Chandru PrasathОценок пока нет

- Bus 306 Exam 2 - Fall 2012 (A) - SolutionДокумент15 страницBus 306 Exam 2 - Fall 2012 (A) - SolutionCyn SyjucoОценок пока нет

- List of Important Articles of The Constitution of India - GK Notes PDF!Документ12 страницList of Important Articles of The Constitution of India - GK Notes PDF!Akash BhowalОценок пока нет

- The Price Revolution of The Sixteenth Century - BarkanДокумент27 страницThe Price Revolution of The Sixteenth Century - BarkanhalobinОценок пока нет

- Research ProposalДокумент4 страницыResearch Proposalsalman100% (2)

- Consolidated Mines, Inc Vs Cta and CirДокумент3 страницыConsolidated Mines, Inc Vs Cta and CirKirs Tie100% (3)

- Accounting Principle Kieso 8e - Ch09Документ47 страницAccounting Principle Kieso 8e - Ch09Sania M. JayantiОценок пока нет

- Sub ContractingДокумент19 страницSub ContractingPRABESH GAJUREL0% (1)

- Procedure On Financing of Two-Wheeler Loan at Centurian Bank by Sneha SalgaonkarДокумент57 страницProcedure On Financing of Two-Wheeler Loan at Centurian Bank by Sneha SalgaonkarAarti Kulkarni0% (2)

- Ray, K - Crises, Crashes and Speculation. Hegemonic Cycles of Capitalist World-EconomyДокумент20 страницRay, K - Crises, Crashes and Speculation. Hegemonic Cycles of Capitalist World-EconomyEEMОценок пока нет

- Auxesia BrochureДокумент7 страницAuxesia Brochurenirbhaya24Оценок пока нет

- UntitledДокумент3 страницыUntitledTINOTENDA MUCHEMWAОценок пока нет

- Transmission Corporation of Andhra Pradesh LimitedДокумент35 страницTransmission Corporation of Andhra Pradesh LimitedTender 247Оценок пока нет

- 2009 Taxation Law ReviewerДокумент203 страницы2009 Taxation Law ReviewerDoctorGreyОценок пока нет

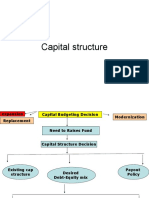

- Capital StructureДокумент41 страницаCapital StructuremobinsaiОценок пока нет

- Internship Report On ZTBL by Aneeka NiazДокумент54 страницыInternship Report On ZTBL by Aneeka NiazAneeka Niaz33% (3)

- Xin ChaoДокумент10 страницXin ChaoQuế Hoàng Hoài ThươngОценок пока нет

- Barbara Underwood's Law Suit Against Donald Trump and The Trump FoundationДокумент41 страницаBarbara Underwood's Law Suit Against Donald Trump and The Trump FoundationMichael SmithОценок пока нет

- Bylaws 2011 Amended 8-1-11Документ9 страницBylaws 2011 Amended 8-1-11cadmorОценок пока нет

- Libta - Technical Analysis Library - Free Books & Trading Courses On Cryptos, Forex and InvestingДокумент21 страницаLibta - Technical Analysis Library - Free Books & Trading Courses On Cryptos, Forex and InvestingAlexandru BogdanОценок пока нет

- Advocacy Strategy ManualДокумент53 страницыAdvocacy Strategy ManualINFID JAKARTA100% (1)

- Aci Training Companies v20140926Документ17 страницAci Training Companies v20140926RoninKiОценок пока нет

- Go.22 Da Arrears of CPS Account in CashДокумент4 страницыGo.22 Da Arrears of CPS Account in CashVenkatadurgaprasad GopamОценок пока нет

- 5201 - 21 AIS 008 Rashed Assignment - 095526Документ20 страниц5201 - 21 AIS 008 Rashed Assignment - 095526RashedОценок пока нет