Академический Документы

Профессиональный Документы

Культура Документы

Chapter 18 Final Account Without Adjuestments

Загружено:

Musical ChoirsОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Chapter 18 Final Account Without Adjuestments

Загружено:

Musical ChoirsАвторское право:

Доступные форматы

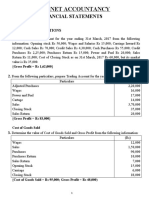

Final Account

Final Accounts

1. From the following information, Prepare the trading account for the year ended 31st

March,2010:

Adjusted purchases Rs15,00,000; sales Rs21,40,000; Returns inwards Rs40,000; Freight and

packing Rs15,000; Packing Expenses on Sales Rs20,000; Depreciation Rs36,000;Factory

Expenses Rs60,000; Closing Stock Rs1,20,000.

Ans.:- Gross Profit Rs 5,25,000.

2. Ascertain cost of Goods Sold and Gross Profit from the following: Rs.

Opening stock 32,000

Purchases 2,80,000

Direct expenses 20,000

Indirect expenses 45,000

Closing stock 50,000

Sales 4,00,000

Sales returns 8,000

Ans.:- Cost of goods sold Rs 2,82,000; Gross profit Rs 1,10,000.

3. Calculate gross profit on the basis of the following information:

Rs.

Purchases 6,80,000

Return outwards 30,000

Carriage Inwards 20,000

Carriage outwards 15,000

Wages 50,000

¾ of the goods sold for Rs6,00,000.

Ans.:- Gross profit Rs60,000.

4. Calculate closing stock and cost of goods sold:

Opening stock Rs5,000; Sales Rs16,000; Carriage inwards Rs1,000; Sales returns Rs1,000;

Gross profit Rs6,000; Purchase Rs10,000; Purchase returns Rs900.

Ans.:- Cost of Goods Sold Rs9,000; Closing Stock Rs6,100.

5. Calculate closing stock from the following:

Particulars Rs. Particulars Rs.

Opening stock 38,000 Sales 3,60,000

Purchases 3,40,000 Return inwards 5,000

Return outwards 4,000 Gross loss 20,000

Freight inwards 26,000

Ans.:- Cost of goods sold Rs3,75,000; Closing stock Rs25,000.

6. From the following information, prepare the trading account for the year ended 31 st

March,2010: Rs.

Cost of goods sold 12,10,000

Opening stock 50,000

Closing stock 80,000

Carriage inwards 15,000

Sales 15,00,000

Ans.:- Gross profit Rs2,90,000.

Presented by Raman Sachdeva

1 B.Com (H), M.Com, MBA, M.Phil, AMT, NET

17/2 (LGF) Jangpura Road, Bhogal

01124377255, 9811957255, 9210461650

www.solutionsacademy.co.in

Final Account

7. Calculate gross profit and cost of goods sold from the following information:

Net sales Rs12,00,000

Gross profit 33 1/3% on sales

Ans.:- Gross profit Rs.4,00,000; Cost of goods sold Rs.8,00,000.

8. Calculate the gross profit and cost of goods sold from the following information:

Net sales Rs9,00,000

Gross profit is 20% on cost.

Ans.:- Gross Profit : Rs1,50,000; Cost of goods sold ; Rs7,50,000.

9. Ascertain the value of closing stock from the following: Rs.

Opening stock 1,20,000

Purchases during the year 9,30,000

Sales during the year 15,60,000

Rate of Gross profit 40% on sales

Ans.:- Closing stock Rs1,14,000.

10. Calculate closing stock from the following details: Rs.

Opening stock 4,80,000

Purchases 13,60,000

Sales 19,50,000

G.P. is 30% on cost.

Ans.:- Closing Stock Rs3,40,000.

11. Calculate net sales and G.P. from the following:

Cost of goods sold Rs4,50,000

G.P. 25% on sales

Ans.:- Net sales Rs6,00,000; G.p. Rs1,50,000.

12. Calculate Gross profit and cost of goods sold from the following information :

Net Sales Rs. 1,00,000.

Gross profit is 25% on cost.

Ans. Gross profit = Rs. 20,000; Cost of goods sold = Rs. 80,000)

13. Opening stock Rs. 5,000; sales Rs. 16,000; carriage inward Rs. 1,000; Sales return Rs.

1,000; Gross profit Rs. 6,000; purchases Rs. 10,000; and purchases return Rs. 900.

Calculate the closing stock and the cost of goods sold.

Ans. Closing stock = Rs. 6,100; Cost of goods sold = Rs .9,000)

14. Calculate Gross profit from the following information :

Rs.

Capital as on Jan. 1,2012 10,500

Drawings made during the year 3,000

Fresh capital introduced during the year 1,000

Purchased a transistor for proprietor’s son 500

Capital as on December 31, 2012 22,500

Ans. Gross profit = Rs. 14,500

Presented by Raman Sachdeva

2 B.Com (H), M.Com, MBA, M.Phil, AMT, NET

17/2 (LGF) Jangpura Road, Bhogal

01124377255, 9811957255, 9210461650

www.solutionsacademy.co.in

Final Account

15. From the following balances taken from the books of Simmi and Vimmi Ltd. for the

year ending March 31, 2003, calculate the gross profit.

Rs.

Closing stock 2,50,000

Net sales during the year 40,00,000

Net purchases during the year 15,00,000

Financial Statements - I

Opening stock 15,00,000

Direct expenses 80,000

Ans. Gross profit Rs.11,70,000.

16. From the following balances extracted from the books of M/s Ahuja and Nanda.

Calculate the amount of:

(a) Cost of goods available for sale

(b) Cost of goods sold during the year

(c) Gross Profit

Opening stock 25,000

Credit purchases 7,50,000

Cash purchases 3,00,000

Credit sales 12,00,000

Cash sales 4,00,000

Wages 1,00,000

Salaries 1,40,000

Closing stock 30,000

Sales return 50,000

Purchases return 10,000

Ans. (a) Rs. 11,65,000 ; (b) Rs.11,35,000 ; (c) Rs.4,15,000

17. Cash sales of a business in a year were Rs. 29,000 and credit sales Rs. 31,000. The

cost of goods sold (Including Direct expenses) works out at Rs. 52,000. Find out the

gross profit.

Ans. Gross profit = Rs. 8,000

18. Calculate the Closing Stock from the following:

Rs. Rs.

Sales 20,000 Purchases 12,300

Return Inwards 500 Carriage Inwards 400

Return Outwards 1,000 Gross Profit 8,000

Ans. Closing Stock Rs. 1,200.

19. S. Kumar & Sons close their financial books on 31st December. Stock taking takes

about two weeks. In 2012, the value of closing stock thus arrived at was Rs. 25,000.

During the two weeks in which stock taking took place purchases made were Rs.

1,000 and sales totaled Rs. 4,000. The firm makes a gross profit of 30% on sales.

Ascertain the value of closing stock on 31st December, 2012.

Ans. The value of closing stock = Rs. 26,800

Presented by Raman Sachdeva

3 B.Com (H), M.Com, MBA, M.Phil, AMT, NET

17/2 (LGF) Jangpura Road, Bhogal

01124377255, 9811957255, 9210461650

www.solutionsacademy.co.in

Final Account

20. Capital of X at the beginning of the year was Rs. 70,000. During the year his business

earned a profit of Rs. 20,000, he withdrew Rs. 7,000 for his personal use. He sold

ornaments of his wife for Rs. 20,000 and invested that amount into the business. Find

out his capital at the end of the year.

Ans. Capital at the end = Rs. 1,03,000

21. Calculate closing stock from the following information :

Name of Accounts Rs.

Sales 20,000

Purchases 12,300

Returns Inward 500

Carriage Inward 400

Returns Outward 1,000

Gross Profit 8,000

Ans. Closing stock = Rs. 200

22. Calculate closing stock from the following information :

Name of Accounts Rs.

Opening Stock 36,000

Net purchases 45,000

Salaries and Wages 7,000

Sales 60,000

Gross loss 4,000

Freight Inward 6,000

Ans. Closing stock = Rs. 23,000

23. Calculate the amount of gross profit and operating profit on the basis of the following

balances extracted from the books of M/s Rajiv & Sons for the year ended March 31,

2005.

Rs.

Opening stock 50,000

Net sales 11,00,000

Net purchases 6,00,000

Direct expenses 60,000

Administration expenses 45,000

Selling and distribution expenses 65,000

Loss due to fire 20,000

Closing stock 70,000

Ans. Gross profit Rs.4,60,000. Operating profit Rs.3,50,000

24. Operating profit earned by M/s Arora & Sachdeva in 2005-06 was Rs.17,00,000. Its

non-operating incomes were Rs.1,50,000 and non-operating expenses were

Rs.3,75,000. Calculate the amount of net profit earned by the firm.

Ans. Net profit Rs.14,75,000

Presented by Raman Sachdeva

4 B.Com (H), M.Com, MBA, M.Phil, AMT, NET

17/2 (LGF) Jangpura Road, Bhogal

01124377255, 9811957255, 9210461650

www.solutionsacademy.co.in

Final Account

25. From the following figures ascertain the gross profit:

Rs. Rs.

Opening stock (1.1.2011) 25,000 Goods purchased during 2011 1,40,000

Freight and Packing 10,000 Closing Stock (31.12.2011) 30,000

Sales 1,90,000 Packing Expenses on Sales 6,000

Ans. Gross Profit Rs. 45,000

Preparation of a Trading Account

26. Prepare the trading account of Anil Kumar from the following particulars for the year

ending 31st March, 2012. Rs.

Opening Stock 12,200

Purchases 9,000

Wages 4,500

Carriage 140

Sales 15,800

Closing Stock 11,390

Ans. Gross Profit = Rs. 1,350

27. Prepare a Trading account from the following information :

Name of Account Debit Credit

Rs. Rs.

Opening Stock 28,000

Purchases and Sales 42,000 58,000

Return Inward and Outward 2,000 3,000

Import duty 7,000

Export duty 2,000

Stores consumed 5,000

Closing stock was valued at Rs. 8,000

Ans. Gross loss = Rs. 15,000

28. Prepare the Trading account of Rajeev Sharma from the following balances for the

year ending 31st March, 2012. Rs.

Opening Stock 60,255

Purchases 1,99,080

Sales 2,81,505

Returns Outward 1,455

Returns Inward 1,875

Manufacturing Wages 46,875

Carriage Inward 15,175

Coal. Gas and Water 1,100

Factory Fuel & Power 1,305

Closing Stock 63,705

Ans. Gross Profit = Rs. 21,000

Presented by Raman Sachdeva

5 B.Com (H), M.Com, MBA, M.Phil, AMT, NET

17/2 (LGF) Jangpura Road, Bhogal

01124377255, 9811957255, 9210461650

www.solutionsacademy.co.in

Final Account

29. From the following information extracted from the books of Rustamji. Prepare the

Trading Account for the year ending March 31, 2012. Rs.

Sales 50,000

Sales return 150

Salaries and Wages 4,000

Carriage Inward 2,000

Returns Outward 250

Freight Inward 2,500

Office expenses 2,000

Octroi 5,000

Fuel 1,000

Insurance 3,721

Cash 1,500

Purchases 40,000

Rent 750

Ans. Gross profit = Rs. 2,600

30. Following balances were extracted from the books of Shri Rajesh on 30th June, 2012.

Name of Accounts Rs.

Capital 24,500

Drawings 2,000

General expenses 2,500

Building 11,000

Stock 16,200

Power 2,240

Insurance 1,315

Wages 7,200

Debtors 6,280

Charity 105

Bad debts 550

Sales 63,360

Purchases 47,000

Scooter 2,000

Bad debts provision 900

Bills payable 3,850

Cash 80

Bank Overdraft 3,300.

th

Prepare Trading A/c for year ended 30 June, 2012. Closing Stock Rs. 23,500

Ans. Gross Profit = Rs. 16,220

31. Prepare the Trading Account from the transactions given below:

Rs. Rs.

Opening stock 2,300 Purchases Return 240

Purchases 2,900 Closing Stock 4,770

Sales Return 50 Carriage Inwards 10

Sales 2,540 Depreciation 200

Ans. Gross Profit Rs.2,290

Presented by Raman Sachdeva

6 B.Com (H), M.Com, MBA, M.Phil, AMT, NET

17/2 (LGF) Jangpura Road, Bhogal

01124377255, 9811957255, 9210461650

www.solutionsacademy.co.in

Final Account

32. Ascertain the Gross Profit from the following:

Rs. Rs.

Opening stock 20,000 Carriage on Sales 3,000

Closing Stock 18,000 Office Rent 5,800

Purchases 85,000 Sales 1,40,700

Carriage on Purchases 2,300

Ans. Gross Profit Rs. 51,400.

33. From the following information, Prepare the Trading Account for the year ended 31st

March, 2011:

Rs. Rs.

Stock (As on 1.4.2010) 40,000 Return Outwards 80,000

Purchases 4,00,000 Wages and Salaries 50,000

Sales 3,80,000 Return Inwards 20,000

Carriage Inwards 20,000 Stock (31.3.2011) 1,30,000

Ans. Gross Profit Rs. 60,000.

34. From the following information, prepare the Trading Account for the year ended 31 st

March, 2011:

Adjusted Purchases Rs 6,60,000; Sales Rs 7,44,000; Closing Stock Rs 50,400; Freight

and Carriage Inwards Rs 3,600; Wages Rs 6,000; Freight and Cartage Outwards Rs

2,000.

Ans. Gross Profit Rs.1,24,800.

Preparation of Profit and Loss Account

35. From the following figures, Prepare the Profit and Loss Account of Sohan Lal as it

would appear in the 1st year that ended 31st March, 2011.

Rs. Rs.

Salaries and Wages 3,000 Advertising 1,000

Commission Paid 200 Discount Allowed 1,800

Postage and Telegrams 150 Rent Received 1,700

Insurance 300 Interest on Investment 1,500

Interest Paid 400 Bad Debts 900

Carriage Outwards 500 Brokerage Paid 95

The Gross Profit was 45% of sales, which amounted to Rs 65,000.

Ans. Net Profit Rs. 24,105.

36. From the following information, prepare the Profit and Loss Account for the year

ended 31st March, 2011:

Rs Rs.

Gross profit 1,20,000 Discount Received 6,000

Rent 5,000 Printing and Stationery 4,000

Salary 35,000 Legal Charges 10,000

Commission paid 19,000 Bad Debts 2,000

Interest on loan 5,000 Loss by Fire 6,000

Advertisement 8,000 Depreciation 4,000

Interest received 8,000

Ans. Net Profit Rs. 36,000.

Presented by Raman Sachdeva

7 B.Com (H), M.Com, MBA, M.Phil, AMT, NET

17/2 (LGF) Jangpura Road, Bhogal

01124377255, 9811957255, 9210461650

www.solutionsacademy.co.in

Final Account

Preparation of Balance Sheet

37. From the following information, prepare the Balance Sheet of a trader as at 31st

March, 2011 arranging the assets and liabilities:

(i) In order of permanence

(ii) In order of liquidity

Rs. Rs.

Goodwill 20,000 Bank 20,000

Capital 1,80,000 Sundry Creditors 63,000

Liabilities for Expenses 1,200 Bills Receivable 13,000

Cash in Hand 1,000 Plant and Machinery 40,000

Investment 20,000 Provision for Doubtful Debts 2,500

Bills Payable 10,700 Closing Stock 80,000

Net Profit 92,600 Furniture 16,000

Sundry Debtors 50,000 Drawing 30,000

Land and Buildings 60,000

Ans. Balance Sheet Rs.2,10,000

38. Prepare the Trading and Profit and Loss Account and Balance Sheet of Jagat Shah as

at 31st March, 2011 from the following balances:

Rs. Rs.

Capital (Cr.) 3,600 Salaries 600

Machinery 700 General Expenses 200

Sales 8,200 Rent 500

Purchases 4,000 Purchases Return 50

Sales Return 100 Debtors 3,000

st

Stock on 1 April, 2010 1,000 Cash 400

Drawing 400 Carriage Outwards 200

Wages 1,000 Advertising 200

Carriage Inwards 50 Creditors 500

The Closing Stock was valued at Rs 2,000.

Ans. Gross Profit Rs. 4,100; Net Profit Rs. 2,400; Balance Sheet Rs. 6,100.

39. From the following balances, prepare the Final Accounts of M/s. Raja & Sons for the

year ended 31st March, 2011:

Salary Rs 5,400; Insurance Rs 2,500; Cash Rs 400; Purchases Rs 84,170; Rent

Received Rs 3,150; Drawings Rs 2,100; bill Payable Rs 3,900; Debtors Rs 38,080;

Stock (1.4.2010) Rs 29,500; Bank Overdraft Rs 9,700; Carriage Rs 2,200; Creditors

Rs 4,200; Trade Expenses Rs 4,900; Sales Return Rs 4,700; Machinery Rs 12,000;

Wages Rs 45,000; Sales Rs 1,47,200; Purchases Return Rs 3,900; Capital Rs 58,900;

Closing Stock (31st March, 2011) Rs 36,200.

Ans. Gross Profit Rs. 21,730; Net Profit Rs.12,080; Balance Sheet Rs.82,780.

40. From the following balances, Prepare the Trading and Profit and Loss Account and

the Balance Sheet:

Debit Balances: Rs. Debit Balances (Contd.): Rs.

Machinery 35,000 Rent 4,500

Debtors 27,000 Sundry Expenses 2,000

Drawings 9,000 Carriage 1,500

Presented by Raman Sachdeva

8 B.Com (H), M.Com, MBA, M.Phil, AMT, NET

17/2 (LGF) Jangpura Road, Bhogal

01124377255, 9811957255, 9210461650

www.solutionsacademy.co.in

Final Account

Purchases 95,000 Credit Balances:

Wages 50,000 Capital A/c 1,00,000

Bank 15,000 Creditors 14,000

Stock 20,000 Sales 1,45,000

Closing Stock was Rs 6,000.

Ans. Gross Loss Rs.15,500; Net Loss Rs.22,000; Balance Sheet Rs.83,000.

41. From the following balances taken from the books of Hari & Co., prepare the Trading

and Profit and Loss Account for the year ended 31st March, 2011 and the Balance

Sheet as at that date:

Rs. Rs.

Capital 3,50,000 Salaries 11,100

Building 1,87,500 Discount Allowed 2,000

st

Machinery 92,500 Stock (1 April, 2010) 1,65,000

Debtors 70,000 Bills Payable 50,000

General Expenses 8,000 Sales 6,35,000

Rent Paid 37,100 Purchases 4,68,500

Proprietor’s Drawings 6,500 Wages 25,000

Electricity Changes 1,900 Cash in Hand 18,000

Carriage Inwards 8,500 Sundry Creditors 1,00,000

Cash at Bank 30,000 Return Inwards 4,500

Return Outwards 1,100

Closing Stock was Rs 1,82,100.

Ans. Gross Profit Rs. 1,46,700; Net Profit Rs.86,600; Balance Sheet Rs. 5,80,100.

42. Prepare trading and profit and loss account and balance sheet as on March 31, 2005 :

Account Title Debit Account Title Credit

Machinery 27,000 Capital 60,000

Sundry debtors 21,600 Bills payable 2,800

Drawings 2,700 Sundry creditors 1,400

Purchases 58,500 Sales 73,500

Wages 15,000

Sundry expenses 600

Rent & taxes 1,350

Carriage inwards 450

Bank 4,500

Openings stock 6000

Closing stock as on March 31, 2005 Rs.22,400

Ans. Gross Profit Rs. 15,950; Net Profit Rs.14,000; Balance Sheet Rs. 75,500.

43. From the following balances, prepare the Trading and Profit and Loss Account and

the Balance Sheet:

Rs. Rs.

Capital Account 10,000 Return Outwards 500

Plant and Machinery 4,000 Rent 400

Sundry Debtors 2,400 Sales 16,400

Sundry Creditors 1,200 Manufacturing Expenses 800

Drawings 1,200 Trade Expenses 700

Presented by Raman Sachdeva

9 B.Com (H), M.Com, MBA, M.Phil, AMT, NET

17/2 (LGF) Jangpura Road, Bhogal

01124377255, 9811957255, 9210461650

www.solutionsacademy.co.in

Final Account

Purchases 10,500 Bad Debts 200

Wages 5,000 Carriage 150

Bank 1,000 Bills Payable 700

Repairs 50 Returns Inwards 400

Stock (1st April, 2010) 2,000

The Closing Stock (31st March, 2011) was valued at Rs 1,450.

Ans. Gross Loss Rs. 500; Net Loss Rs. 1,850; Balance Sheet Rs. 8,850.

44. The Trial Balance of Chatter Sen on 31st March, 2011 revealed the following

balances:

Debit Balances: Rs. Debit Balance (Contd.): Rs.

Plant and Machinery 90,000 Freight Out 1,200

Purchases 58,000 Rent, Rates and Taxes 2,000

Sales Return 1,000 Advertisement 2,000

Opening Stock 40,000 Cash at Bank 6,900

Discount Allowed 350 Credit Balances:

Bank Charges 75 Capital A/c 1,10,000

Sundry Debtors 45,000 Sales 1,27,000

Salaries 6,800 Purchases Return 1,275

Wages 10,000 Discount Received 800

Freight In 750 Sundry Creditors 25,000

The stock on 31st March, 2011 was valued at Rs 35,000.

Prepare the Trading and Profit and Loss Account for the year ended 31st March, 2011

and the Balance Sheet as at that date.

Ans. Gross Profit Rs. 53,525; Net Profit Rs.41,900; Balance Sheet Rs. 1,76,900.

45. John Smith carries on business as a copy manufacturer. Prepare his Profit and Loss

Account and Balance Sheet from the following balances as at 31st March, 2011:

Rs. Rs.

Capital 6,000 Boxes, Labels, etc. 500

Withdrawals (Drawings) 1,000 Rates and Taxes 40

Sales 10,000 Bills Receivable 300

Paper (bought) 2,000 Insurance 150

Loan or Mortgage (Cr.) 1,000 Carriage 10

Machinery and Plant 1,500 Incidental Expenses 200

Land and Building 2,000 Stock on 1st April, 2010 2,000

Creditors 500 Cash at Bank 1,250

Wages 5,000 Cash in Hand 50

Debtors 1,500

Stock on 31st March, 2011 was Rs 1,500.

Ans. Gross Profit Rs. 1,990; Net Profit Rs.1,600; Balance Sheet Rs. 8,100.

46. The Trial balance of Bihari Lal on 31st March, 2012 revealed the following balances :

Rs.

Debit Balance:

Plant and Machinery 90,000

Purchases 58,000

Sales Returns 1,000

Opening Stock 40,000

Presented by Raman Sachdeva

10 B.Com (H), M.Com, MBA, M.Phil, AMT, NET

17/2 (LGF) Jangpura Road, Bhogal

01124377255, 9811957255, 9210461650

www.solutionsacademy.co.in

Final Account

Discount Allowed 350

Bank charges 75

Sundry Debtors 45,000

Salaries 6,800

Wages 10,000

Freight Inward 750

Freight Outward 1,200

Rent, Rates and Taxes 2,000

Advertisement 2,000

Cash at Bank 6,900

Credit Balances:

Capital Account 1,10,000

Sales 1,27,000

Purchase Return 1,275

Discount Received 800

Sundry Creditors 25,000

st

The stock on 31 March, 2012 was valued at Rs. 13,262. Prepare Trading and profit and loss

account for the year ended 31st March, 2012 and Balance sheet as on that date.

Ans. Gross profit = Rs. 31,787; Net profit = Rs. 20,162; Total of Balance Sheet = Rs.

1,55,162

47. From the following Trial Balance of Pardip, prepare Trading and Profit and Loss

account and Balance sheet on 31st December, 2012 :

Rs.

Debit Balances:

Furniture and Fittings 7,700

Bills receivable 10,000

Sundry Debtors 76,720

Cash in hand 5,250

Interest 3,400

Wages 27,890

Goodwill 25,000

Carriage 1,720

Salaries 5,000

Insurance 600

Opening Stock 38,500

Audit Fee 1,000

Law Costs 710

Drawings 13,200

Purchases 61,900

Repairs 3,300

Credit Balance:

Capital 1,05,000

Commission 9,000

Sales 1,30,000

Returns Outward 2,570

Presented by Raman Sachdeva

11 B.Com (H), M.Com, MBA, M.Phil, AMT, NET

17/2 (LGF) Jangpura Road, Bhogal

01124377255, 9811957255, 9210461650

www.solutionsacademy.co.in

Final Account

Bank Overdraft 10,000

Creditors 25,320

Closing stock was valued at Rs. 12,560.

Ans. G.P. = Rs. 15,120; N.P. = Rs. 10,110; B.S. = Rs. 1,37,230

48. From the following balances of Seth Tent House, prepare Trading and Profit and loss

account and Balance sheet as on 31st Dec., 2012.

Name of Account Dr. (Rs.) Cr. (Rs.)

Capital 10,000

Plant and Machinery 14,000

Furniture and Fixtures 200

Debtors and Creditors 2,400 1,700

Drawings A/c 1,000

Purchases 10,500

Wages 5,000

Cash in hand 200

Cash at Bank 800

st

Stock on 1 January, 2012 2,000

Returns Outward 500

Rent and Taxes 400

Depreciation 420

Sales 26,800

Manufacturing Expenses 800

Travelling expenses 100

Sundry expenses 400

Bad Debts 150

Printing and Stationery 50

Carriage 130

Returns Inward 400

Repairs 50

Total 39,000 39,000

The values of stock on that date was Rs. 11,355.

Ans. Gross Profit = Rs. 19,825; Net Profit = Rs. 18,255; Total of balance sheet = 28,955

49. From the following balances prepare final accounts of M/s Mangal & Sons for the

year ending 31st December, 2012:

Salary Rs. 5,400; Insurance Rs. 2,500; Cash Rs. 400; Purchases Rs. 84,170; Rent received Rs.

3,150; Drawings Rs. 2,100; Bills payable Rs. 3,900; Debtors Rs. 38,080; Stock (1-1-2012) Rs.

29,500; Bank overdraft Rs. 9,700; Carriage Rs. 2,200; Creditors Rs. 4,200; Trade expensese

Rs. 4,900; Sales return Rs. 4,700; Machinery Rs. 12,000; Wages Rs. 45,000; Sales Rs.

1,47,200; Purchases Return Rs. 3,900; Capital Rs. 58,900; Closing Stock (31-12-2012) Rs.

36,200.

Ans. Gross Profit = Rs. 21,730; Net Profit = Rs. 12,080; Balance Sheet Total = 86,680

Presented by Raman Sachdeva

12 B.Com (H), M.Com, MBA, M.Phil, AMT, NET

17/2 (LGF) Jangpura Road, Bhogal

01124377255, 9811957255, 9210461650

www.solutionsacademy.co.in

Final Account

50. Prepare a Balance Sheet with the following items :

Rs.

Net profit 15,000

Drawings 4,000

Debtors 25,000

Capital 70,000

Outstanding Wages 3,000

Creditors 18,000

Stock 22,000

Building 42,000

Loan (Cr.) 5,000

Bank Overdraft 7,000

Furniture 5,000

Cash 20,000

Ans. Total of Balances sheet Rs. 1,14,000

51. Prepare Final Accounts from the following balances of a firm at the end of December

2012.

Name of Accounts Debit (Rs.) Credit (Rs.)

Capital - 10,000

Cash in hand 1,500 -

Bank Overdraft - 2,000

Purchases and Sales 12,000 15,000

Returns 1,000 2,000

Office expenses 2,500 -

Taxes and Insurance 500 -

Discount 500 1,000

Debtors and Creditors 5,000 2,000

Commission - 500

Investments 4,000 -

Stock ( Opening) 3,000 -

Drawings 1,400 -

Furniture 600 -

Bill Receivable 3,000 2,500

Ans. Gross Profit Rs. 20,000; Net Profit Rs. 18,000; Balance Sheet Rs. 33,100

52. From the following information extracted from the books of M/s Pragati printers. Pass

the necessary closing entries and prepare a Profit & Loss Account and Balance sheet.

Dr. Cr.

Particulars Amount (Rs) Particulars Amount (Rs.)

Opening Stock 12,500 Sales 1,89,000

Depreciation 7,000 Commission Received 2,000

Carriage Inward 700 Capital 1,71,300

Furniture 8,000 Creditors 17,500

Carriage Outward 500 Bills Payable 5,000

Plant & Machinery 2,00,000 Returns Outward 13,800

Presented by Raman Sachdeva

13 B.Com (H), M.Com, MBA, M.Phil, AMT, NET

17/2 (LGF) Jangpura Road, Bhogal

01124377255, 9811957255, 9210461650

www.solutionsacademy.co.in

Final Account

Cash 8,900

Salaries 7,500

Debtors 19,000

Discount 1,500

Bills Receivable 17,000

Wages 16,000

Sales Return 14,000

Purchases 86,00

Total 3,98,600 Total 3,98,600

Closing stock on 31-3-2012 was Rs. 45,000.

Ans. Gross Profit Rs. 1,18,600; Net Profit Rs. 1,04,000; Balance Sheet Rs. 2,97,900

53. The following trial balance is extracted from the books of M/s Ram on March 31,

2005. You are required to prepare trading and profit and loss account and the balance

sheet as on date:

Account Title Debit Account Title Credit

Debtors 12,000 Apprenticeship premium 5,000

Purchases 50,000 Loan 10,000

Coal, gas and water 6,000 Bank overdraft 1,000

Factory wages 11,000 Sales 80,000

Salaries 9,000 Creditors 13,000

Rent 4,000 Capital 20,000

Discount 3,000

Advertisement 500

Drawings 1,000

Loan 6,000

Petty cash 500

Sales return 1,000

Machinery 5,000

Land and building 10,000

Income tax 100

Furniture 9,900

Ans. Gross Profit: Rs. 12,000, Net Profit: Rs. 500, Total Balance sheet: Rs. 43,400

54. The following is the trial balance of Manju Chawla on March 31, 2005. You are

required to prepare trading and profit and loss account and a balance sheet as on date :

Account title Debit Credit

Opening stock 10,000

Purchases and sales 40,000 80,000

Returns 200 600

Productive wages 6,000

Dock and Clearing charges 4,000

Donation and charity 600

Delivery van expenses 6,000

Lighting 500

Sales tax collected 1,000

Presented by Raman Sachdeva

14 B.Com (H), M.Com, MBA, M.Phil, AMT, NET

17/2 (LGF) Jangpura Road, Bhogal

01124377255, 9811957255, 9210461650

www.solutionsacademy.co.in

Final Account

Bad debts 600

Misc. incomes 6,000

Rent from tenants 2,000

Royalty 4,000

Capital 40,000

Drawings 2,000

Debtors and Creditors 6,000 7,000

Cash 3,000

Investment 6,000

Patents 4,000

Land and Machinery 43,000

Closing stock Rs.2,000.

Ans. Gross Profit: Rs. 18,400, Net profit: Rs. 18,700, Total balance sheet: Rs. 64,700

55. The following is the trial balance of Mr. Deepak as on March 31, 2005. You are

required to prepare trading account, profit and loss account and a balance sheet as on

date:

Account Title Debit Account Title Credit

Drawings 36,000 Capital 2,50000

Insurance 3,000 Bills payable 3,600

General expenses 29,000 Creditors 50,000

Rent and taxes 14,400 Discount received 10,400

Lighting (factory) 2,800 Purchases return 8,000

Travelling expenses 7,400 Sales 4,40,000

Cash in hand 12,600

Bills receivable 5,000

Sundry debtors 1,04,000

Furniture 16,000

Plant and Machinery 1,80,000

Opening stock 40,000

Purchases 1,60,000

Sales return 6,000

Carriage inwards 7,200

Carriage outwards 1,600

Wages 84,000

Salaries 53,000

Closing stock Rs. 35,000.

Ans. Gross profit: Rs.1,83,000, Net profit : Rs. 85,000, Total balance sheet: Rs. 3,52,600

56. Prepare trading and profit and loss account and balance sheet from the following

particulars as on March 31, 2005.

Account title Dedbit Credit

Purchases and Sales 3,52,000 5,60,000

Return inwards and Return outwards 9,600 12,000

Carriage inwards 7,000

Carriage outwards 3,360

Presented by Raman Sachdeva

15 B.Com (H), M.Com, MBA, M.Phil, AMT, NET

17/2 (LGF) Jangpura Road, Bhogal

01124377255, 9811957255, 9210461650

www.solutionsacademy.co.in

Final Account

Fuel and power 24,800

Opening stock 57,600

Bad debts 9,950

Debtors and Creditors 1,31,200 48,000

Capital 3,48,000

Investment 32,000

Interest on investment 3,200

Loan 16,000

Repairs 2,400

General expenses 17,000

Wages and salaries 28,800

Land and buildings 2,88,000

Cash in hand 32,000

Miscellaneous receipts 160

Sales tax collected 8,350

Closing stock Rs. 30,000.

Ans. Gross profit: Rs. 1,22,200, Net profit : Rs.92,850, Total balance sheet: Rs.5,13,200

57. From the following trial balance of Mr. A. Lal, prepare trading, profit and loss

account and balance sheet as on March 31, 2005

Account title Dedbit Credit

Stock as on April 01, 2005 16,000

Purchases and Sales 67,600 1,12,000

Returns inwards and outwards 4,600 3,200

Carriage inwards 1,400

General expenses 2,400

Bad debts 600

Discount received 1,400

Bank over draft 10,000

Interest on bank overdraft 600

Commission received 1,800

Insurance and taxes 4,000

Scooter expenses 200

Salaries 8,800

Cash in hand 4,000

Scooter 8,000

Furniture 5,200

Building 65,000

Debtors and Creditors 6,000 16,000

Capital 50,000

Closing stock Rs. 15,000.

Ans. Gross Profit: Rs. 40,600, Net profit: Rs. 27,200, Total balance sheet: Rs. 1,03,200

58. Prepare trading and profit and loss account and balance sheet of M/s Royal Traders

from the following balances as on March 31, 2005.

Account Title Debit Account Title Credit

Presented by Raman Sachdeva

16 B.Com (H), M.Com, MBA, M.Phil, AMT, NET

17/2 (LGF) Jangpura Road, Bhogal

01124377255, 9811957255, 9210461650

www.solutionsacademy.co.in

Final Account

Stock 20,000 Sales 2,45,000

Cash 5,000 Creditors 10,000

Bank 10,000 Bills payable 4,000

Carriage on purchases 1,500 Capital 2,00,000

Purchases 1,90,000

Drawings 9,000

Wages 55,000

Machinery 1,00,000

Debtors 27,000

Postage 300

Sundry expenses 1,700

Rent 4,500

Furniture 35,000

Closing stock Rs.8,000

Ans. Gross loss Rs. 13,500, Net loss Rs. 20,000, Total balance sheet Rs. 1,85,000

59. Prepare trading and profit and loss account from the following particulars of M/s

Neema Traders as on March 31, 2005.

Account Title Debit Account Title Credit

Buildings 23,000 Sales 1,80,000

Plant 16,930 Loan 8,000

Carriage inwards 1,000 Bills payable 2,520

Wages 3,300 Bank overdraft 4,720

Purchases 1,64,000 Creditors 8,000

Sales return 1,820 Capital 2,36,000

Opening stock 9,000 Purchases return 1,910

Machinery 2,10,940

Insurance 1,610

Interest 1,100

Bad debts 250

Postage 300

Discount 1,000

Salaries 3,000

Debtors 3,900

Stock on March 31, 2005 Rs.16,000.

Ans. Gross profit Rs.17,850, Net profit Rs. 10,590, Total of balance sheet Rs.2,69,830

60. From the following balances of M/s Nilu Sarees as on March 31, 2005. Prepare

trading and profit and loss account and balance sheet as on date.

Account Title Debit Account Title Credit

Opening stock 10,000 Sales 2,28,000

Purchases 78,000 Capital 70,000

Carriage inwards 2,500 Interest 7,000

Salaries 30,000 Commission 8,000

Commission 10,000 Creditors 28,000

Wages 11,000 Bills payable 2,370

Presented by Raman Sachdeva

17 B.Com (H), M.Com, MBA, M.Phil, AMT, NET

17/2 (LGF) Jangpura Road, Bhogal

01124377255, 9811957255, 9210461650

www.solutionsacademy.co.in

Final Account

Rent & taxes 2,800

Repairs 5,000

Telephone expenses 1,400

Legal charges 1,500

Sundry expenses 2,500

Cash in hand 12,000

Debtors 30,000

Machinery 60,000

Investments 90,000

Drawings 18,000

Closing stock as on March 31, 2005 Rs.22,000.

Ans. Gross profit Rs. 1,56,500, Net profit Rs. 1,10,300, Total balance sheet Rs.2,14,000

61. Prepare trading and profit and loss account of M/s Sports Equipments for the year

ended March 31, 2006 and balance sheet as on that date:

Account title Debit Credit

Opening stock 50,000

Purchases and sales 3,50,000 4,21,000

Sales returns 5,000

Capital 3,00,000

Commission 4,000

Creditors 1,00,000

Bank overdraft 28,000

Cash in hand 32,000

Furniture 1,28,000

Debtors 1,40,000

Plants 60,000

Carriage on purchases 12,000

Wages 8,000

Rent 15,000

Bad debts 7,000

Drawings 24,000

Stationery 6,000

Travelling expenses 2,000

Insurance 7,000

Discount 5,000

Office expenses 2,000

Closing stock as on March 31, 2006 Rs.2,500.

Ans. Gross loss Rs. 1,500, Net loss Rs. 41,500 , Total balance sheet Rs.3,62,500

Presented by Raman Sachdeva

18 B.Com (H), M.Com, MBA, M.Phil, AMT, NET

17/2 (LGF) Jangpura Road, Bhogal

01124377255, 9811957255, 9210461650

www.solutionsacademy.co.in

Вам также может понравиться

- Chapter 8Документ14 страницChapter 8Kanton FernandezОценок пока нет

- Financial Planning and Pro Forma Statements Simplistic Approach Part 2Документ17 страницFinancial Planning and Pro Forma Statements Simplistic Approach Part 2ishaОценок пока нет

- Departmental Accounts BreakdownДокумент41 страницаDepartmental Accounts BreakdownAryan ChoudharyОценок пока нет

- WIP Configuration SettingsДокумент6 страницWIP Configuration SettingsSantosh Vaishya75% (4)

- Ratio Formula Calculation Industry Average CommentДокумент2 страницыRatio Formula Calculation Industry Average Commentjay balmesОценок пока нет

- AUDP ROB REV-Correction of Errors Wit Ans KeyДокумент12 страницAUDP ROB REV-Correction of Errors Wit Ans KeyJohn Emerson PatricioОценок пока нет

- Accounting For Property Plant and EquipmentДокумент6 страницAccounting For Property Plant and EquipmentmostafaОценок пока нет

- SOP Arshdeep Singh, UelДокумент3 страницыSOP Arshdeep Singh, Uelcosmo worldОценок пока нет

- TKP Thingkah Unit Local Sub RuleДокумент7 страницTKP Thingkah Unit Local Sub RuleLalmuanawma MualchinОценок пока нет

- Branch/bial Report Form - CKTPДокумент4 страницыBranch/bial Report Form - CKTPsamuelapaОценок пока нет

- BMA Who's WhoДокумент22 страницыBMA Who's WhobangaloremizoОценок пока нет

- Yrc ReportДокумент2 страницыYrc ReportsamuelapaОценок пока нет

- Bial KTP ReportДокумент2 страницыBial KTP ReportLd ArfОценок пока нет

- KTP Rorel Inkhawm Prog & Agenda, 2013Документ41 страницаKTP Rorel Inkhawm Prog & Agenda, 2013Mizoram Presbyterian Church SynodОценок пока нет

- Dawrpui Kohhran Centenary SouvenirДокумент222 страницыDawrpui Kohhran Centenary SouvenirLalrinsanga100% (1)

- Missionary Dilna FormДокумент4 страницыMissionary Dilna FormHlima RalteОценок пока нет

- YRC ChanchinДокумент2 страницыYRC ChanchinachungaОценок пока нет

- MV Act Penalties Increased Under New Amendment ActДокумент3 страницыMV Act Penalties Increased Under New Amendment ActJTONIB AIZAWLОценок пока нет

- Hmeichhe Inkhawmpui Lian 2013 Bulletin 2 (March 10)Документ2 страницыHmeichhe Inkhawmpui Lian 2013 Bulletin 2 (March 10)Mizoram Presbyterian Church SynodОценок пока нет

- GZRSC 13th Annual Magazine 2014-15Документ234 страницыGZRSC 13th Annual Magazine 2014-15CK LalropuiaОценок пока нет

- INTHLANNA THIANGHLIM LEH RAM RORELNA DIK - Dr. Robert S. HallidayДокумент55 страницINTHLANNA THIANGHLIM LEH RAM RORELNA DIK - Dr. Robert S. HallidayMizoram Presbyterian Church Synod100% (1)

- Sermon On October 10, 2021 Pathianni ChawhmaДокумент2 страницыSermon On October 10, 2021 Pathianni ChawhmaWilliam LgguiteОценок пока нет

- Chhiatni Thatni KaihhruainaДокумент4 страницыChhiatni Thatni KaihhruainaMizoram Presbyterian Church Synod100% (1)

- Souvenir: Mizoram Presbyterian Kohhran Synod Inkhawmpui Vawi 87-NaДокумент67 страницSouvenir: Mizoram Presbyterian Kohhran Synod Inkhawmpui Vawi 87-NaMizoram Presbyterian Church SynodОценок пока нет

- YRC Chungchang PDFДокумент6 страницYRC Chungchang PDFVanlal Ruata100% (1)

- Ratio Analysis-1Документ4 страницыRatio Analysis-1Aakash RamakrishnanОценок пока нет

- Answer ALL The Questions (10 2 20) Answer ALL The Questions (10 2 20) Answer ALL The Questions (10 2 20)Документ4 страницыAnswer ALL The Questions (10 2 20) Answer ALL The Questions (10 2 20) Answer ALL The Questions (10 2 20)Harish KapoorОценок пока нет

- Practical Questions (Sandeep Garg 2018-19)Документ10 страницPractical Questions (Sandeep Garg 2018-19)Kanishk SinglaОценок пока нет

- Worksheet Final AccountsДокумент9 страницWorksheet Final AccountsAa BbОценок пока нет

- Worksheet Final AccountДокумент9 страницWorksheet Final Accountstraightforwardly851Оценок пока нет

- Model Exam Work Out FAДокумент5 страницModel Exam Work Out FAnewaybeyene5Оценок пока нет

- Question Compilation - 230316 - 072454Документ9 страницQuestion Compilation - 230316 - 072454Ranjan DhakalОценок пока нет

- CH 2 Ratio ProblemsДокумент21 страницаCH 2 Ratio ProblemsRohith100% (1)

- Questions - Financial AccountingДокумент9 страницQuestions - Financial AccountingMariamОценок пока нет

- Financial Statement - Without AdjustmentДокумент29 страницFinancial Statement - Without AdjustmentAnmol SinghОценок пока нет

- Ratio Analysis-1Документ3 страницыRatio Analysis-1Ramakrishna J RОценок пока нет

- TS Grewal Solutions for Class 11 Accountancy Chapter 14 - Capital and Revenue ExpenditureДокумент39 страницTS Grewal Solutions for Class 11 Accountancy Chapter 14 - Capital and Revenue ExpenditureShivant GuptaОценок пока нет

- AssignmentДокумент11 страницAssignmentKBA AMIRОценок пока нет

- ACCOUNTANCYДокумент2 страницыACCOUNTANCYIshika GautamОценок пока нет

- AIOU Financial Reporting Checklist and AssignmentsДокумент9 страницAIOU Financial Reporting Checklist and AssignmentsSyedОценок пока нет

- Quiz - Solution - PAS - 1 - and - PAS - 2.pdf Filename - UTF-8''Quiz (Solution) % PDFДокумент3 страницыQuiz - Solution - PAS - 1 - and - PAS - 2.pdf Filename - UTF-8''Quiz (Solution) % PDFSamuel BandibasОценок пока нет

- Acctg4a 02042017 Exam Quiz1aДокумент5 страницAcctg4a 02042017 Exam Quiz1aPatOcampoОценок пока нет

- Accounting For Managers - QBДокумент6 страницAccounting For Managers - QBIm CandlestickОценок пока нет

- AccountancyДокумент16 страницAccountancyevangiebalunsat9Оценок пока нет

- Henri Emanuel Reforba - Learning Task #2Документ6 страницHenri Emanuel Reforba - Learning Task #2Rhea BernabeОценок пока нет

- Ratio AnalysisДокумент14 страницRatio AnalysisVijay KumarОценок пока нет

- Ratio Problems 1Документ6 страницRatio Problems 1Vivek MathiОценок пока нет

- 2016 AFR PaperДокумент6 страниц2016 AFR Paperrwl s.r.lОценок пока нет

- 13. INCOMPLETE RECORDSДокумент32 страницы13. INCOMPLETE RECORDSSunil KumarОценок пока нет

- FABM 2 3.ACT SCIdocxДокумент10 страницFABM 2 3.ACT SCIdocxMaryPher CadioganОценок пока нет

- Worksheet Financial StatementsДокумент11 страницWorksheet Financial StatementsTanishkОценок пока нет

- F.Y Test SeriesДокумент16 страницF.Y Test SeriesAkki GalaОценок пока нет

- NCERT Solutions For Class 11 Accountancy Financial Accounting Part-2 Chapter 1Документ41 страницаNCERT Solutions For Class 11 Accountancy Financial Accounting Part-2 Chapter 1Asiya GhaznaviОценок пока нет

- Financial StatementДокумент15 страницFinancial StatementPankaj SharmaОценок пока нет

- Accounts Receivable CalculationДокумент5 страницAccounts Receivable CalculationCarmina SanchezОценок пока нет

- Cash Flow StatementДокумент19 страницCash Flow StatementROHIT SHAОценок пока нет

- Merchandise Business Class PerformanceДокумент5 страницMerchandise Business Class PerformanceGrace GamillaОценок пока нет

- Loyola College (Autonomous), Chennai - 600 034: Degree Examination - CommerceДокумент4 страницыLoyola College (Autonomous), Chennai - 600 034: Degree Examination - CommerceHarish KapoorОценок пока нет

- Home Office and Branch Accounting - Special ProceduresДокумент17 страницHome Office and Branch Accounting - Special Procedureseulhiemae arongОценок пока нет

- Xii Acc Worksheetss-30-55Документ26 страницXii Acc Worksheetss-30-55Unknown patelОценок пока нет

- Financial StatementДокумент33 страницыFinancial StatementĎêěpãķ Šhăŕmå100% (1)

- Strategic Cost Management Take Home Quiz - Budgeting and Financial Projections for Dalagang Pilipina CompanyДокумент2 страницыStrategic Cost Management Take Home Quiz - Budgeting and Financial Projections for Dalagang Pilipina CompanyseviОценок пока нет

- Indian Institute of Management RanchiДокумент3 страницыIndian Institute of Management RanchiAtul YadavОценок пока нет

- 11 A) Discuss About The Objectives of Management Accounting. (OR) B) Explain The Nature and Scope of Management AccountingДокумент4 страницы11 A) Discuss About The Objectives of Management Accounting. (OR) B) Explain The Nature and Scope of Management AccountingSwathi SwathiОценок пока нет

- Nfjpiancr Ncrcup6 AFAR EliminationRound QuestionsДокумент19 страницNfjpiancr Ncrcup6 AFAR EliminationRound QuestionsIvan DorosanОценок пока нет

- Principle of Double Entry & Trial Balance: Prepared By: Nurul Hassanah HamzahДокумент35 страницPrinciple of Double Entry & Trial Balance: Prepared By: Nurul Hassanah HamzahNur Amira NadiaОценок пока нет

- A. TheoryДокумент10 страницA. TheoryROMULO CUBID100% (1)

- Review risks related to asset lives, depreciation, inventory counts and insurance claimsДокумент2 страницыReview risks related to asset lives, depreciation, inventory counts and insurance claimsTashfeenОценок пока нет

- Excel Model The Body Shop International PLC 2001: An Introduction To Financial ModelingДокумент29 страницExcel Model The Body Shop International PLC 2001: An Introduction To Financial Modelingalka murarka33% (6)

- Ph.D in Banking Technology RegulationsДокумент13 страницPh.D in Banking Technology RegulationsShuvajoyyyОценок пока нет

- 3 New GLДокумент8 страниц3 New GLChirag SolankiОценок пока нет

- Finance ManagerДокумент4 страницыFinance Managerknowledge musendekwaОценок пока нет

- Green Accounting - A Proposition For EA/ER Conceptual Implementation MethodologyДокумент22 страницыGreen Accounting - A Proposition For EA/ER Conceptual Implementation Methodologyaisyah nabilaОценок пока нет

- Fabm2 6a1 Books of AccountsДокумент3 страницыFabm2 6a1 Books of AccountsRenz AbadОценок пока нет

- IAASB Strategy and Work Program 2012-2014-FinalДокумент28 страницIAASB Strategy and Work Program 2012-2014-FinalSwapnil ChoudhariОценок пока нет

- LaporanKeuanganWIKA30September2018Документ164 страницыLaporanKeuanganWIKA30September2018arrizal firdausОценок пока нет

- BHEL Org ChartДокумент19 страницBHEL Org ChartAbhishek AnandОценок пока нет

- Journal List For AccountingДокумент5 страницJournal List For AccountingNikhil Chandra ShilОценок пока нет

- Summar Training Project Report (MBA-035)Документ99 страницSummar Training Project Report (MBA-035)arunОценок пока нет

- CH 2 - Job Costing SystemДокумент19 страницCH 2 - Job Costing SystemDeeb. DeebОценок пока нет

- Homework T1. Fin Account - IntroductionДокумент4 страницыHomework T1. Fin Account - IntroductionCrayZeeAlexОценок пока нет

- (Finance Clerk) Job AdvertДокумент2 страницы(Finance Clerk) Job Adverttutorfelix777Оценок пока нет

- Navin Packaging LTD: Share Capital A/cДокумент4 страницыNavin Packaging LTD: Share Capital A/cMaryОценок пока нет

- Ledger Accounting and Double Entry Bookkeeping: Chapter Learning ObjectivesДокумент46 страницLedger Accounting and Double Entry Bookkeeping: Chapter Learning Objectiveskoti kebele100% (1)

- CH 06Документ40 страницCH 06lalala010899Оценок пока нет

- SFM Case 4 Strategic ValuationДокумент3 страницыSFM Case 4 Strategic ValuationPatrick RomeroОценок пока нет

- Act 701 Assignment 2Документ3 страницыAct 701 Assignment 2Nahid HawkОценок пока нет

- 07 JUNE QuestionДокумент11 страниц07 JUNE Questionkhengmai67% (3)

- Accounting Information Systems OverviewДокумент9 страницAccounting Information Systems OverviewKesiah FortunaОценок пока нет