Академический Документы

Профессиональный Документы

Культура Документы

ACFrOgBcHli5V1CuP4kgwJ1Ddqkh3RlMjZroiE6kGOC6dOVO7ybySc 1F6uNlgIEu8HvlFLHapV98ureMPjKrEJGBmE1GntVYAOTzYIcW7LUwu9knEe4O1w41XxEQqrxFbWh5 Ui5 - vSYFpXc0D

Загружено:

Emmanual Cheeran0 оценок0% нашли этот документ полезным (0 голосов)

7 просмотров15 страницGg

Оригинальное название

ACFrOgBcHli5V1CuP4kgwJ1Ddqkh3RlMjZroiE6kGOC6dOVO7ybySc-1F6uNlgIEu8HvlFLHapV98ureMPjKrEJGBmE1GntVYAOTzYIcW7LUwu9knEe4O1w41XxEQqrxFbWh5-uI5_-vSYFpXc0D

Авторское право

© © All Rights Reserved

Доступные форматы

PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документGg

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

7 просмотров15 страницACFrOgBcHli5V1CuP4kgwJ1Ddqkh3RlMjZroiE6kGOC6dOVO7ybySc 1F6uNlgIEu8HvlFLHapV98ureMPjKrEJGBmE1GntVYAOTzYIcW7LUwu9knEe4O1w41XxEQqrxFbWh5 Ui5 - vSYFpXc0D

Загружено:

Emmanual CheeranGg

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 15

SRI KRISHNA ARTS AND SCIENCE

COLLEGE

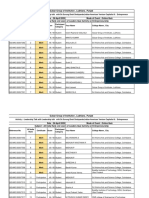

Course: Applied Cost Accounting

DEPARTMENT OF COMMERCE

Sub Code: 19COP09

Programme: I M.Com

Unit: I

Google classroom : bre115s Map

Code : G

Term: Academic Year 2018-19 ; Even Semester

Faculty: Dr. K.R. Sivabagyam

APPLIED COST ACCOUNTING

ATTENDANCE

APPLIED COST ACCOUNTING

SNAP TALK

APPLIED COST ACCOUTNING

Production Statement

❖ It is a statement which gives detailed information

regarding the costs incurred, total cost, selling price of

the goods and profit or loss during a particular period.

❖ It also gives information regarding cost per unit, selling

price per unit and profit or loss made per unit or output

and contains the corresponding data for the previous year.

❖ It is prepared for a month, quarter etc.,

Production Account

❖ If the production statement and the cost sheet are drawn in

the form of a ledger account, then it is known as

production account.

Production Account

Particulars Units Rs. Particulars Units Rs.

To D. Materials *** By Cost of production c/d ***

To D. Wages ***

To D. Expenses ***

To Prime cost ***

To Factory cost ***

Works cost ***

To administrative cost ***

To opening stock of finished goods *** By cost of goods sold ***

Cost of production b/d *** By closing stock of finished goods ***

By Cost of goods sold *** By sales ***

To selling & distribution overheads ***

To Profit ***

Total *** Total ***

Tender or Quotations

❖ The price quoted for future production is called Quotations price or Tender

price.

❖ This price is ascertained on the basis of previous Cost Sheet or Production

Account.

❖ In drawing tenders or quotations, the estimation of the cost of production is an

essential point.

❖ The price to be quoted in tender includes a reasonable percentage of profit.

Tender Price

Tender is an offer inviting quotations to do a certain work.

Cost sheet is useful for determining tender/bid price by providing information

element wise and component wise.

In preparing tender price probable changes in the input prices should be taken

into account.

Fixed costs should be ignored if the tender output can be met out of the existing

plant capacity of the firm.

Treatment of Scrap or Wastage

❖ Materials obtained during the course of production or the

residue in the course of manufacture, which are useless for

production are called scrap or wastage.

❖ The scrap materials are sold out and this will reduce the

cost of materials consumed.

❖ This scrap value will be deducted from factory overheads

or from factory costs.

Treatment of Defective Products

❖ Defective product can be rectified at an extra expenses.

❖ If it is caused by normal reasons, it can be included in

factory costs.

❖ If it is caused by abnormal reasons, it can be transferred to

costing profit and loss account or to a separate Defective

Account.

Meaning and characteristics of cost accounting

Types, advantages and disadvantages of cost accounting

Difference between financial and cost accounting

Meaning and features of unit costing.

APPLIED COST ACCOUNTING

1. Total of direct costs is termed as ________ cost.( Prime )

2. Woks cost is the total of prime cost and ______ overhead.

( factory or works or production)

3.Work-in-progress is adjusted before ascertaining ____________

cost.(works or factory)

4. Finished goods stocks are adjusted after finding cost of _____________.

(Production)

5. Overheads is the total of all ________costs.( indirect)

APPLIED COST ACCOUNTING

6.Depreciation of plant & machinery is a part of _____________ overhead.(

factory)

7. Audit fees is a part of __________overhead. (Administration)

8. Bad debts written off is a part of __________ overhead.( Selling)

9. Warehouse rent is a part of _________ overhead.

( Distribution)

10. Tenders is an (estimation of selling price)

APPLIED COST ACCOUNTING

Able to understand the meaning of production account,

Tender and the treatment of scrap and defective

APPLIED COST ACCOUNTING

⚫Problems in cost sheet

APPLIED COST ACCOUNTING

Вам также может понравиться

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Letter KitДокумент9 страницLetter KitHandy Elpa100% (1)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- FPT Software Company Financial Statement and Management Report 1Документ39 страницFPT Software Company Financial Statement and Management Report 1Huy Nguyễn NgọcОценок пока нет

- Quiz 1 2Документ4 страницыQuiz 1 2UndebaynОценок пока нет

- Swaps PresentationДокумент34 страницыSwaps PresentationSherman WaltonОценок пока нет

- Management SOPДокумент12 страницManagement SOPsparkle shresthaОценок пока нет

- Puschmann2017 FintechДокумент8 страницPuschmann2017 FintecharushichananaОценок пока нет

- Thế Giới Di Động 2022Документ14 страницThế Giới Di Động 2022Phạm Thu HằngОценок пока нет

- Gulzar Group of Institution, Ludhiana, PunjabДокумент23 страницыGulzar Group of Institution, Ludhiana, PunjabEmmanual CheeranОценок пока нет

- Febin Francis C PDFДокумент3 страницыFebin Francis C PDFEmmanual CheeranОценок пока нет

- C. Cost Ascertainment B. Each Unit of Output A. All Indirect CostsДокумент11 страницC. Cost Ascertainment B. Each Unit of Output A. All Indirect CostsEmmanual CheeranОценок пока нет

- Sri Krishna Arts and Science College Coimbatore - 641 008 UG - V Semester - Arrear Examinations - Time Table (FEB / MAR 2020) (Autonomous) CE 04Документ3 страницыSri Krishna Arts and Science College Coimbatore - 641 008 UG - V Semester - Arrear Examinations - Time Table (FEB / MAR 2020) (Autonomous) CE 04Emmanual CheeranОценок пока нет

- Kebs 111Документ52 страницыKebs 111Emmanual CheeranОценок пока нет

- Managerial Economics: Prepared By: Mrs.P.Chandradevi Academic Year: 2019-2020 Odd Sem Unit 1 - Hour 1 ProgrammeДокумент19 страницManagerial Economics: Prepared By: Mrs.P.Chandradevi Academic Year: 2019-2020 Odd Sem Unit 1 - Hour 1 ProgrammeEmmanual CheeranОценок пока нет

- Technical Analysis: Dow TheoryДокумент11 страницTechnical Analysis: Dow TheorySiwat Thongsuk100% (1)

- Fundamentals of Financial Management - Preetha ChandranДокумент7 страницFundamentals of Financial Management - Preetha ChandranAditya KumarОценок пока нет

- Fundamental Analysis of ACCДокумент10 страницFundamental Analysis of ACCmandeep_hs7698100% (2)

- Bankin and Fin Law Relationship Between Bank and Its CustomersДокумент6 страницBankin and Fin Law Relationship Between Bank and Its CustomersPersephone WestОценок пока нет

- BOLT Graham Formula ValuationДокумент1 страницаBOLT Graham Formula ValuationOld School ValueОценок пока нет

- Taxation, Types of Taxation, Main Objectives of TaxationДокумент4 страницыTaxation, Types of Taxation, Main Objectives of TaxationKc Cassandra RosalОценок пока нет

- Appendix I Specimen of Advice of Maturity Date To Term Deposit Account HoldersДокумент11 страницAppendix I Specimen of Advice of Maturity Date To Term Deposit Account HoldersRuchi SharmaОценок пока нет

- Contemporary Economic Issues Facing The Filipino EntrepreneurДокумент16 страницContemporary Economic Issues Facing The Filipino EntrepreneurNicole EnriquezОценок пока нет

- Assumptions:: Financial FeasibilityДокумент3 страницыAssumptions:: Financial FeasibilityHassanRanaОценок пока нет

- Bance Cash HoldingsДокумент37 страницBance Cash HoldingsrameОценок пока нет

- Student Name: Luu Gia Bao Student ID: 1567033: HW Assignment For Week 3Документ5 страницStudent Name: Luu Gia Bao Student ID: 1567033: HW Assignment For Week 3Lưu Gia BảoОценок пока нет

- Tcs Report On Ratio AnalysisДокумент40 страницTcs Report On Ratio Analysisami100% (1)

- Step 1 Analsis of Source DocumentsДокумент5 страницStep 1 Analsis of Source DocumentsSittie Hafsah100% (1)

- White County Lilly Endowment Scholarship ApplicationДокумент11 страницWhite County Lilly Endowment Scholarship ApplicationVoodooPandasОценок пока нет

- Mba 410: Commercial Banking Credit Units: 03 Course ObjectivesДокумент6 страницMba 410: Commercial Banking Credit Units: 03 Course ObjectivesakmohideenОценок пока нет

- Lehman Examiner's Report, Vol. 4Документ493 страницыLehman Examiner's Report, Vol. 4DealBookОценок пока нет

- Analysis On Financial Health of HDFC Bank and Icici BankДокумент11 страницAnalysis On Financial Health of HDFC Bank and Icici Banksaket agarwalОценок пока нет

- Wachemo University School of Computing and Informatics Department of Computer Science Entrepreneurship Business PlanДокумент9 страницWachemo University School of Computing and Informatics Department of Computer Science Entrepreneurship Business PlanAbe BerhieОценок пока нет

- ISA-400-Audit Risk, ISA-550-Related Parties ISA-600-Groups Audit, and ISA-620-Using The Work of An Auditor's ExpertДокумент18 страницISA-400-Audit Risk, ISA-550-Related Parties ISA-600-Groups Audit, and ISA-620-Using The Work of An Auditor's ExpertSohaib BilalОценок пока нет

- ExchangeReferenceCourseList T2Документ8 страницExchangeReferenceCourseList T2Javier MartínОценок пока нет

- Symmetry Hedge Fund Survey 2010-11 FinalДокумент7 страницSymmetry Hedge Fund Survey 2010-11 FinalhlbeckleyОценок пока нет

- Bala Raksha Bhavan Rent Not File DT 07.02.2020Документ2 страницыBala Raksha Bhavan Rent Not File DT 07.02.2020District Child Protection Officer VikarabadОценок пока нет

- Difference Between IMF and World BankДокумент4 страницыDifference Between IMF and World BankSourabh ShuklaОценок пока нет