Академический Документы

Профессиональный Документы

Культура Документы

7th Practice Qs 99.2

Загружено:

Bromanine0 оценок0% нашли этот документ полезным (0 голосов)

10 просмотров2 страницыs

Авторское право

© © All Rights Reserved

Доступные форматы

DOCX, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документs

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

10 просмотров2 страницы7th Practice Qs 99.2

Загружено:

Bromanines

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 2

1.

Short-term creditors are usually most interested in assessing

a. marketability.

b. profitability.

c. solvency.

d. operating results.

2. Horizontal analysis of comparative financial statements includes the

a. evaluation of financial statement data

b. development of common size statements

c. calculation of liquidity ratios.

d. calculation of dollar amount changes and percentage changes from the previous to the current year.

3. One reason that a common-size statement is a useful tool in financial analysis is that it enables the user to

a. determine which companies in a single industry are of the same size.

b. determine which companies in a single industry are of the same value.

c. make a better comparison of two companies of different sizes in the same industry.

d. judge the relative potential of two companies of similar size in different industries.

4. Which of the following ratios provides a solvency measure that shows the margin of safety of noteholders or

bondholders and also gives an indication of the potential ability of the business to borrow additional funds on

a long-term basis?

a. rate earned on stockholders' equity

b. ratio of net sales to assets

c. ratio of fixed assets to long-term liabilities

d. number of days' sales in receivables

5. The ability of a business to pay its debts as they come due and to earn a reasonable amount of income is

referred to as

a. solvency and equity

b. solvency and liquidity

c. solvency and profitability

d. solvency and leverage

6. Which of the following is not an analysis used in assessing solvency?

a. current position analysis

b. inventory analysis

c. number of times interest charges are earned

d. ratio of net sales to assets

7. Vertical analysis is also known as

a. perpendicular analysis.

b. trend analysis.

c. straight-line analysis.

d. common size analysis

8. A balance sheet that displays only component percentages is called

a. trend balance sheet

b. common-sized balance sheet

c. comparative balance sheet

d. condensed balance sheet

9. Which of the following is an appropriate computation for return on investment?

a. Sales divided by stockholders' equity

b. Net income divided by total assets

c. Sales divided by total assets

d. Net income divided by sales

10. An acceleration in the collection of receivables will tend to cause the accounts receivable turnover to

a. remain the same

b. either increase or decrease

c. increase

d. decrease

11. A common measure of liquidity is

a. receivable turnover.

b. dividends per share of common stock.

c. profit margin.

d. ratio of net sales to assets.

12. Which of the following is included in the calculation of the acid-test (quick) ratio?

a. Accounts receivable (Yes); Inventories (Yes)

b. Accounts receivable (No); Inventories (Yes)

c. Accounts receivable (Yes); Inventories (No)

d. Accounts receivable (No); Inventories (No)

13. Once inventory is excessive which item below is not true?

a. increase storage costs

b. reduce solvency

c. increase taxes

d. increase ordering costs

14. Which of the following is true about a pro forma earnings number?

a. Reporting pro forma earnings by companies subject to SEC regulation is illegal.

b. A pro forma earnings number is regular GAAP earnings with certain exclusions.

c. A pro forma earnings number is in total conformity with GAAP.

d. A pro forma earnings number is a forecast of earnings in future periods.

15. A firm’s financial risk is a function of how it manages and maintains its debt. Which one of the following sets

of ratios characterizes the firm with the greatest amount of financial risk?

a. High debt-to-equity ratio, low interest coverage ratio, volatile return on equity

b. High debt-to-equity ratio, high interest coverage ratio, stable return on equity

c. High debt-to-equity ratio, high interest coverage ratio, volatile return on equity

d. Low debt-to-equity ratio, low interest coverage ratio, volatile return on equity

Вам также может понравиться

- AK Mock BA 118.1 2nd LEДокумент6 страницAK Mock BA 118.1 2nd LEBromanineОценок пока нет

- AK Mock BA 141 1st LEДокумент2 страницыAK Mock BA 141 1st LEBromanineОценок пока нет

- AK Mock BA 99.2 1st LEДокумент4 страницыAK Mock BA 99.2 1st LEBromanineОценок пока нет

- Mock Board Answer KeyДокумент2 страницыMock Board Answer KeyBromanineОценок пока нет

- Partners (Because TAC TCC PAC (New)Документ5 страницPartners (Because TAC TCC PAC (New)BromanineОценок пока нет

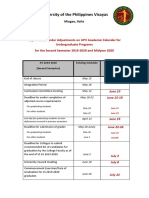

- University of The Philippines VisayasДокумент2 страницыUniversity of The Philippines VisayasBromanineОценок пока нет

- 5ea7fb0c57f53 SEC Form 17A Dec2019Документ222 страницы5ea7fb0c57f53 SEC Form 17A Dec2019BromanineОценок пока нет

- Agamata Answer KeyДокумент5 страницAgamata Answer KeyBromanineОценок пока нет

- (Pfrs/Ifrs 16) LeasesДокумент11 страниц(Pfrs/Ifrs 16) LeasesBromanineОценок пока нет

- Revised CPALE Syllabus - EditableДокумент19 страницRevised CPALE Syllabus - EditableBromanineОценок пока нет

- Abatement: "A Reduction in The Assessment of Tax, Penalty or Interest When It Is Determined The Assessment Is Incorrect"Документ1 страницаAbatement: "A Reduction in The Assessment of Tax, Penalty or Interest When It Is Determined The Assessment Is Incorrect"BromanineОценок пока нет

- Technical AnalysisДокумент34 страницыTechnical AnalysisBromanine100% (1)

- Opening BalancesДокумент37 страницOpening BalancesBromanineОценок пока нет

- Single Entry and Error CorrectionДокумент2 страницыSingle Entry and Error CorrectionBromanine0% (1)

- 6th Practice Qs 99.2Документ3 страницы6th Practice Qs 99.2BromanineОценок пока нет

- Audit of CashДокумент4 страницыAudit of CashBromanineОценок пока нет

- PRTC Oct2019 1st PB Answer Key PDFДокумент2 страницыPRTC Oct2019 1st PB Answer Key PDFBromanineОценок пока нет

- AP 8603 - Audit of Property, Plant and EquipmentДокумент6 страницAP 8603 - Audit of Property, Plant and EquipmentBromanineОценок пока нет

- Hyperinflation and Current CostДокумент3 страницыHyperinflation and Current CostBromanineОценок пока нет

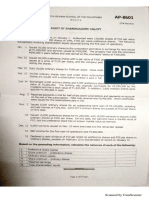

- AP 8601 - Audit of Shareholders' EquityДокумент8 страницAP 8601 - Audit of Shareholders' EquityBromanineОценок пока нет

- Sec Reportorial RequirementsДокумент2 страницыSec Reportorial RequirementsBromanineОценок пока нет

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- How To Choose The Best Funding Path For Your Startup - Lighter CapitalДокумент17 страницHow To Choose The Best Funding Path For Your Startup - Lighter Capitalyousef0% (1)

- Fundamentals of Corporate Finance 8th Edition by Brealey Myers Marcus ISBN Solution ManualДокумент6 страницFundamentals of Corporate Finance 8th Edition by Brealey Myers Marcus ISBN Solution Manualmary100% (24)

- A Synopsis On Stock Trading ProjectДокумент14 страницA Synopsis On Stock Trading ProjectDuke CyraxОценок пока нет

- 107 23 Uber ValuationДокумент34 страницы107 23 Uber Valuationram persadОценок пока нет

- PCAB Application FormДокумент26 страницPCAB Application Formmarvinceledio0% (1)

- Restoring Safety and Soundness To The GSEsДокумент51 страницаRestoring Safety and Soundness To The GSEsGSE Safety and Soundness100% (5)

- India's Sectoral Valuation Study: Historical Absolute Levels Vs Normalized Levels January 25, 2018Документ27 страницIndia's Sectoral Valuation Study: Historical Absolute Levels Vs Normalized Levels January 25, 2018brijsingОценок пока нет

- Audit Fot Liability Problem #10Документ2 страницыAudit Fot Liability Problem #10Ma Teresa B. CerezoОценок пока нет

- Ambrian Gold Book - 2011Документ56 страницAmbrian Gold Book - 2011gpperkОценок пока нет

- ACCT 575quiz 1 PDFДокумент16 страницACCT 575quiz 1 PDFMelОценок пока нет

- 08 Capital StructureДокумент6 страниц08 Capital Structurenotes.mcpuОценок пока нет

- 2011 Global Ideas SavoneДокумент51 страница2011 Global Ideas SavoneFaris RahmanОценок пока нет

- Raising Capitals: Fundamentals of Corporate Finance Ross, Westerfield & Jordan 8 EditionДокумент21 страницаRaising Capitals: Fundamentals of Corporate Finance Ross, Westerfield & Jordan 8 EditionSheikh RakinОценок пока нет

- Assignment 142Документ4 страницыAssignment 142vcarilloОценок пока нет

- Capital MarketsДокумент29 страницCapital MarketsShivangiОценок пока нет

- Jewellers Block Proposal FormДокумент4 страницыJewellers Block Proposal Formm_dattaias100% (1)

- Economics Notes PDFДокумент15 страницEconomics Notes PDFEstherОценок пока нет

- Shooting Stocks v5Документ21 страницаShooting Stocks v5saipavan999Оценок пока нет

- Ra 11223 PDFДокумент34 страницыRa 11223 PDFNica SalazarОценок пока нет

- Astra Microwave Products LTD PDFДокумент4 страницыAstra Microwave Products LTD PDFAwakash DixitОценок пока нет

- MilindMDeshpande Padma Award Docs1Документ46 страницMilindMDeshpande Padma Award Docs1Milind DeshpandeОценок пока нет

- Vairamani Mini ProjectДокумент45 страницVairamani Mini Projecttn63 villanОценок пока нет

- Chapter 1Документ12 страницChapter 1Sanaullah M SultanpurОценок пока нет

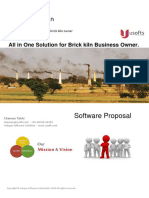

- Accounting Software For BrickkilnДокумент6 страницAccounting Software For BrickkilneBrickkiln - Brick kiln Management Software29% (7)

- 1.1 Multiple Choice Questions: Chapter 1 Fundamentals of Financial Accounting TheoryДокумент10 страниц1.1 Multiple Choice Questions: Chapter 1 Fundamentals of Financial Accounting TheorynowcuremanОценок пока нет

- Physical Asset Markets Vs Financial Asset MarketsДокумент2 страницыPhysical Asset Markets Vs Financial Asset MarketsDame Polinio33% (3)

- Case 2 Eskimo Pie Corporation (Abridged)Документ7 страницCase 2 Eskimo Pie Corporation (Abridged)Irakli Salia100% (1)

- Project On Futures and OptionsДокумент19 страницProject On Futures and Optionsaanu1234Оценок пока нет

- Introduction To Corporate Finance: MeaningДокумент6 страницIntroduction To Corporate Finance: Meaningkunal makyОценок пока нет

- Executive Edition March 2014Документ12 страницExecutive Edition March 2014franksimmons00Оценок пока нет