Академический Документы

Профессиональный Документы

Культура Документы

Vat Quiz

Загружено:

Mark Joseph Olino0 оценок0% нашли этот документ полезным (0 голосов)

27 просмотров2 страницы1. The document provides financial information for X Corporation for 2004 including income, expenses, sales returns, discounts, and capital gains. It asks to compute the amount subject to VAT, output VAT, and VAT payable.

2. For business C, it provides cash sales, sales on account, installment sales, costs, purchases including VAT, input VAT credit, and owner's drawings. It also details the import of machines and asks to compute the net VAT payable.

3. For business X Corporation, it provides an income statement with sales, returns, discounts, costs, expenses, other revenues, losses, and net income. It also provides purchases including VAT, consigned goods, and inventory used to pay

Исходное описание:

Hwggw

Оригинальное название

VAT-QUIZ

Авторское право

© © All Rights Reserved

Доступные форматы

DOCX, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документ1. The document provides financial information for X Corporation for 2004 including income, expenses, sales returns, discounts, and capital gains. It asks to compute the amount subject to VAT, output VAT, and VAT payable.

2. For business C, it provides cash sales, sales on account, installment sales, costs, purchases including VAT, input VAT credit, and owner's drawings. It also details the import of machines and asks to compute the net VAT payable.

3. For business X Corporation, it provides an income statement with sales, returns, discounts, costs, expenses, other revenues, losses, and net income. It also provides purchases including VAT, consigned goods, and inventory used to pay

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

27 просмотров2 страницыVat Quiz

Загружено:

Mark Joseph Olino1. The document provides financial information for X Corporation for 2004 including income, expenses, sales returns, discounts, and capital gains. It asks to compute the amount subject to VAT, output VAT, and VAT payable.

2. For business C, it provides cash sales, sales on account, installment sales, costs, purchases including VAT, input VAT credit, and owner's drawings. It also details the import of machines and asks to compute the net VAT payable.

3. For business X Corporation, it provides an income statement with sales, returns, discounts, costs, expenses, other revenues, losses, and net income. It also provides purchases including VAT, consigned goods, and inventory used to pay

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 2

Problem 1 - 3

The following data are taken from the records of X Corporation, a VAT-registered business, for the

year 2004 the first year of operation:

Income tax expense P 570,000

Input VAT on purchases of goods sold 120,000

Sales returns 60,000

Sales discount due to prompt payments 150,000

Gain on sale of capital assets-subject to normal tax 50,000

Operating expense before taxes 990,000

Community tax 10,000

Required: Compute the following:

1. Amount subject to VAT

2. Output Vat

3. Amount of VAT payable

Problem 4

C, a VAT-registered business, reported total cash sales of P1,000,000,000 during the month.

Additional information is as follows:

Sales on account P 300,000

Installment sales (20% collected)- not included

In total cash sales 500,000

Cost of regular sales 600,000

Purchases of goods during the month, Including VAT 448,000

Input VAT credit from previous month 36,000

During the month, the owner had a drawing of goods for sale for personal use amounting to

P50,000, had consigned goods to outlet amounting to P100,000 were already more than 60 days.

Also, C imported machines as follows:

Machines: Purchase price Purposes

1 P100,000 Personal use

2 200,000 Business use

The importation was subject to a 50% excise tax.

Required: Compute the net VAT payable.

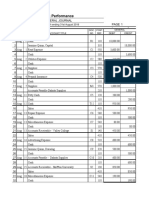

Problem 5

The income statement of X Corporation, a VAT-registed business, prepared under the GAAP rules is

as follows:

Sales P10,000,000

Less: Sales returns and allowances P300,000

Sales discounts (prompt payment) 200,000 500,000

Net sales P9,500,000

Less: Cost of sales 5,500,000

Gross profit P4,000,000

Less: Operating expenses:

Salaries P1,000,000

Depreciation 300,000

Supplies 200,000

Bad debts (% of accts rec'ble) 100,000

Interest expense 50,000 1,650,000

Operating income P2,350,000

Add: Other revenues:

Interest income, net of tax P32,000

Cash dividend(domestic) 68,000 100,000

Income before other expenses P2,450,000

Less: Losses on investment in securities 250,000

Net income before tax P2,200,000

In addition, the records of X Corporation show the following:

Total purchases during the year (inclusive of VAT) P4,480,000

Consigned goods for more than 60 days 560,000

Inventory used to pay 400,000

Required: Determine the correct amount of the following: Output VAT

Вам также может понравиться

- Reinforcement Activity 1 Financial Statement Amp WorksheetsДокумент12 страницReinforcement Activity 1 Financial Statement Amp Worksheetsapi-33442031249% (35)

- Activities No. 2Документ5 страницActivities No. 2Joshua Cabinas60% (5)

- Taxation - Corporation - Quizzer - 2018Документ4 страницыTaxation - Corporation - Quizzer - 2018Kenneth Bryan Tegerero Tegio100% (4)

- Group 1 American Greetings ReportДокумент13 страницGroup 1 American Greetings Reportshershah hassan100% (1)

- Afar - CVPДокумент3 страницыAfar - CVPJoanna Rose Deciar0% (1)

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionОт EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionОценок пока нет

- The Complete Guide To Investing The Schloss Way v1.2 1Документ22 страницыThe Complete Guide To Investing The Schloss Way v1.2 1siant stocksОценок пока нет

- Corporate Income TaxДокумент8 страницCorporate Income TaxClaire BarbaОценок пока нет

- Problem 1: CAT LEVEL 3 - SET 4 QuestionsДокумент4 страницыProblem 1: CAT LEVEL 3 - SET 4 QuestionsEliza BethОценок пока нет

- Vergara, Gian Bianca F. BSAT-4A Recitation: Compensation IncomeДокумент3 страницыVergara, Gian Bianca F. BSAT-4A Recitation: Compensation Incomelena cpa100% (2)

- Income Tax ExercisesДокумент3 страницыIncome Tax ExercisesLaguna HistoryОценок пока нет

- Percentage Tax KeyДокумент5 страницPercentage Tax KeyLeisleiRagoОценок пока нет

- Quiz - Solution - PAS - 1 - and - PAS - 2.pdf Filename - UTF-8''Quiz (Solution) % PDFДокумент3 страницыQuiz - Solution - PAS - 1 - and - PAS - 2.pdf Filename - UTF-8''Quiz (Solution) % PDFSamuel BandibasОценок пока нет

- Optional Standard Deductions ExampleДокумент7 страницOptional Standard Deductions ExampleSandia EspejoОценок пока нет

- Tax On Corporation: Presented By: Ms. Arlene F. SabadoДокумент34 страницыTax On Corporation: Presented By: Ms. Arlene F. SabadoVal PinedaОценок пока нет

- Module 4 IntaxДокумент14 страницModule 4 IntaxPark MinyoungОценок пока нет

- Vergara, Gian Bianca F. BSAT-4A Recitation: Compensation IncomeДокумент4 страницыVergara, Gian Bianca F. BSAT-4A Recitation: Compensation Incomelena cpaОценок пока нет

- Tax 1Документ2 страницыTax 1Che CheОценок пока нет

- Philhealth Contribution (Table) : Illustration: Mr. C Has The Following Monthly CompensationДокумент5 страницPhilhealth Contribution (Table) : Illustration: Mr. C Has The Following Monthly CompensationMaraiah InciongОценок пока нет

- Tax On Corporations (Additional Exercises)Документ2 страницыTax On Corporations (Additional Exercises)April PacanasОценок пока нет

- New Train Income Tax Table Year 2018 To 2022 and 2023 OnwardsДокумент8 страницNew Train Income Tax Table Year 2018 To 2022 and 2023 OnwardsSD AccountingОценок пока нет

- TaxationДокумент9 страницTaxationEnitsuj Eam EugarbalОценок пока нет

- TaxationДокумент2 страницыTaxationMesdame Jane TubalinalОценок пока нет

- Taxation On IndividualsДокумент10 страницTaxation On IndividualsHERNANDO REYESОценок пока нет

- Problems On TaxationДокумент3 страницыProblems On TaxationRandy ManzanoОценок пока нет

- Synthesis - Problem Solving QuizДокумент3 страницыSynthesis - Problem Solving QuizEren CuestaОценок пока нет

- ApplicationTAX - LecturePROBLEMДокумент2 страницыApplicationTAX - LecturePROBLEMAyessa ViajanteОценок пока нет

- TAx 1 - OSD and Itemized DeductionsДокумент16 страницTAx 1 - OSD and Itemized DeductionsKatrina Vianca DecapiaОценок пока нет

- Exercise CorporationДокумент3 страницыExercise CorporationJefferson MañaleОценок пока нет

- Module 6 - Income Tax On Corporations - Part 2Документ5 страницModule 6 - Income Tax On Corporations - Part 2Never Letting GoОценок пока нет

- Capital BudgetingДокумент12 страницCapital BudgetingNike ColeОценок пока нет

- IAET TaxationДокумент2 страницыIAET TaxationRandy Manzano100% (1)

- PRACTICEДокумент4 страницыPRACTICEGleeson Jay NiedoОценок пока нет

- Business Tax - Output VAT ActivityДокумент4 страницыBusiness Tax - Output VAT ActivityDrew BanlutaОценок пока нет

- Cash and AccrualДокумент3 страницыCash and Accrual夜晨曦Оценок пока нет

- MOD2 Statement of Cash FlowsДокумент2 страницыMOD2 Statement of Cash FlowsGemma DenolanОценок пока нет

- Vat Seatwork - NeДокумент3 страницыVat Seatwork - NeMarvin San JuanОценок пока нет

- Chapter 2 AssignmentДокумент8 страницChapter 2 AssignmentRoss John JimenezОценок пока нет

- Corporation Income Tax ProblemsДокумент3 страницыCorporation Income Tax ProblemsRandy Manzano50% (2)

- Mary Joy Asis QUIZ 1Документ6 страницMary Joy Asis QUIZ 1Joseph AsisОценок пока нет

- Illustration: The Following Data Were Reported For 200A Business Activities of Western UniversitiesДокумент3 страницыIllustration: The Following Data Were Reported For 200A Business Activities of Western UniversitiesCarlo QuiambaoОценок пока нет

- TAX ANSWER-R4Tanyag KeyДокумент5 страницTAX ANSWER-R4Tanyag KeyCheska JaplosОценок пока нет

- Tax On Corp. Sample ProblemsДокумент2 страницыTax On Corp. Sample ProblemsWenjunОценок пока нет

- How To Compute Individual Income TaxДокумент4 страницыHow To Compute Individual Income TaxberinguelajunahОценок пока нет

- 3.3 Exercise - Improperly Accumulated Earnings TaxДокумент2 страницы3.3 Exercise - Improperly Accumulated Earnings TaxRenzo KarununganОценок пока нет

- Exercises in Corporation SolutionsДокумент6 страницExercises in Corporation Solutionsdiane camansagОценок пока нет

- VAT-problems-key by Andrew Gil AmbrayДокумент10 страницVAT-problems-key by Andrew Gil AmbrayMark Gelo WinchesterОценок пока нет

- TAÑOTE Daisy AEC7 MEPIIДокумент9 страницTAÑOTE Daisy AEC7 MEPIIDaisy TañoteОценок пока нет

- Output and Input VAT1Документ21 страницаOutput and Input VAT1Eza MayandiaОценок пока нет

- Accounting 2Документ18 страницAccounting 2cherryannОценок пока нет

- TAX 1 SampleДокумент2 страницыTAX 1 SamplerhieelaaОценок пока нет

- Income Tax 2022 Part 2Документ6 страницIncome Tax 2022 Part 2Chezkie EmiaОценок пока нет

- Take Home Quiz 1Документ9 страницTake Home Quiz 1Akira Marantal Valdez100% (1)

- Taxation Material 4Документ36 страницTaxation Material 4Shaira BugayongОценок пока нет

- Mixed Income EarnersДокумент6 страницMixed Income EarnersEzi AngelesОценок пока нет

- Activity 13 May 2023 Key To CorrectionДокумент1 страницаActivity 13 May 2023 Key To CorrectionJohn Paul MagbitangОценок пока нет

- Capital BudgetingДокумент2 страницыCapital BudgetingAlexis KingОценок пока нет

- Information For Items 21 & 22Документ3 страницыInformation For Items 21 & 22Kurt Morin CantorОценок пока нет

- Golpo 10 Task Performance 1.taxationДокумент13 страницGolpo 10 Task Performance 1.taxationNin JahОценок пока нет

- Equity Valuation: Models from Leading Investment BanksОт EverandEquity Valuation: Models from Leading Investment BanksJan ViebigОценок пока нет

- Business Combination Stock AcquisitionДокумент2 страницыBusiness Combination Stock AcquisitionMark Joseph OlinoОценок пока нет

- CharДокумент5 страницCharMark Joseph OlinoОценок пока нет

- Compute The Taxable IncomeДокумент1 страницаCompute The Taxable IncomeMark Joseph OlinoОценок пока нет

- Booking Agreement: - WITNESSETHДокумент5 страницBooking Agreement: - WITNESSETHMark Joseph OlinoОценок пока нет

- Summary of Report (MacroEcon)Документ2 страницыSummary of Report (MacroEcon)Mark Joseph OlinoОценок пока нет

- How The Economic Machine WorksДокумент7 страницHow The Economic Machine WorksMark Joseph OlinoОценок пока нет

- Schedule 1 Depreciation Expense - Machineries and EquipmentДокумент4 страницыSchedule 1 Depreciation Expense - Machineries and EquipmentMark Joseph OlinoОценок пока нет

- Compre2 ReviewerДокумент6 страницCompre2 ReviewerMark Joseph OlinoОценок пока нет

- Financial Statements Income Statement Body Works Fitness Gym Projected Income StatementsДокумент4 страницыFinancial Statements Income Statement Body Works Fitness Gym Projected Income StatementsMark Joseph OlinoОценок пока нет

- NotesДокумент1 страницаNotesMark Joseph OlinoОценок пока нет

- 3int 2006 Dec QДокумент9 страниц3int 2006 Dec QlowchangsongОценок пока нет

- Tut 1 Group 5 Group Presentation Auditing 2023Документ21 страницаTut 1 Group 5 Group Presentation Auditing 2023mai linhОценок пока нет

- Accounting I December 2020Документ5 страницAccounting I December 2020faraz hassanОценок пока нет

- 8 Types of Companies in MalaysiaДокумент9 страниц8 Types of Companies in MalaysiaYingfang HuangОценок пока нет

- Credit and Credit Administration LatestДокумент297 страницCredit and Credit Administration LatestPravin GhimireОценок пока нет

- Fabm1 Grade-11 Qtr4 Module2 Week-2Документ6 страницFabm1 Grade-11 Qtr4 Module2 Week-2Crestina Chu BagsitОценок пока нет

- SBR Consolidation Mock QueДокумент7 страницSBR Consolidation Mock QuePratham BarotОценок пока нет

- Analysys of Financial StatementsДокумент78 страницAnalysys of Financial Statementsmaybelline111Оценок пока нет

- Unit 1 Setting Up PracticeДокумент19 страницUnit 1 Setting Up PracticeAditi100% (1)

- Arvino: Bse Limited National Stock Exchange of India LimitedДокумент263 страницыArvino: Bse Limited National Stock Exchange of India LimitedPrem TetambeОценок пока нет

- ACCT 302 - Assignment 01 - Questions PaperДокумент4 страницыACCT 302 - Assignment 01 - Questions Paperايهاب حسنىОценок пока нет

- New SMRДокумент2 страницыNew SMRFrancis ChrisОценок пока нет

- QUIZ 1: Interim Financial ReportingДокумент13 страницQUIZ 1: Interim Financial ReportingJusteen BalcortaОценок пока нет

- Elliott Presentation On HessДокумент161 страницаElliott Presentation On HessshortmycdsОценок пока нет

- Perpetual System, Problem #17Документ2 страницыPerpetual System, Problem #17Feiya LiuОценок пока нет

- BUKU - Blocher Et Al-Cost Management - A Strategic Emphasis, 5th Edition (2009) - 127-179 PDFДокумент53 страницыBUKU - Blocher Et Al-Cost Management - A Strategic Emphasis, 5th Edition (2009) - 127-179 PDFelis100% (1)

- Introduction To DerivativesДокумент6 страницIntroduction To DerivativesXiaoxi NiОценок пока нет

- Roco, Ryan Jermon R. Corporation Law Block BДокумент31 страницаRoco, Ryan Jermon R. Corporation Law Block BRyan RocoОценок пока нет

- FIN 458 Test 1 Flashcards - Chap 1Документ34 страницыFIN 458 Test 1 Flashcards - Chap 1An AnОценок пока нет

- Zomato Equity Research ReportДокумент12 страницZomato Equity Research ReportShubhamShekharSinhaОценок пока нет

- 11-1 Medieval Adventures CompanyДокумент5 страниц11-1 Medieval Adventures Companydhosmanyos100% (1)

- Illustration: Accounting For Non-Controlling InterestДокумент17 страницIllustration: Accounting For Non-Controlling Interestwarsidi100% (1)

- Balance Sheet Unilever ProjectionДокумент1 страницаBalance Sheet Unilever ProjectionGusti Angrumsari Mustikawati 1206285775Оценок пока нет

- MacroAsia CorporationДокумент62 страницыMacroAsia CorporationLea PolinarОценок пока нет

- Risk and ReturnДокумент40 страницRisk and ReturnKisan BhagatОценок пока нет

- IAS 40 Investment Properties - Out-Of-Class practice-EN NewДокумент5 страницIAS 40 Investment Properties - Out-Of-Class practice-EN NewDAN NGUYEN THEОценок пока нет

- Fundamentals of Financial Management Concise 8E: Eugene F. Brigham & Joel F. HoustonДокумент17 страницFundamentals of Financial Management Concise 8E: Eugene F. Brigham & Joel F. Houstondas413Оценок пока нет