Академический Документы

Профессиональный Документы

Культура Документы

Security Bank & Trust Company v. RTC Magtanggol Eusbio & Leila Ventura

Загружено:

Pretzel TsangАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Security Bank & Trust Company v. RTC Magtanggol Eusbio & Leila Ventura

Загружено:

Pretzel TsangАвторское право:

Доступные форматы

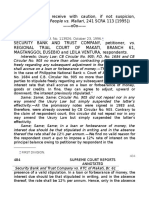

Case 26: Security Bank & Trust Company v. RTC Magtanggol Eusbio & Leila Ventura.

3 PNs balance - collection - rtc 12% - SBTC dapat 23 agreed sa PN, Only in absence of stipulation can RTC impose 12% interest rate, stipulated interest prevails.

● 4/27/83, Magtanggol executed P100K PN#1 in favor of SBTC payable in 6 monthly installments with 23% stipulated interest/annum up to the fifth installment.

○ 7/28 Executed P100K PN#2 in favor of SBTC 6mos installment + 23% interest/annum.

■ 8/31/83 P65K PN#3 in 6mos. installments + 23% interest/annum.

○ Leila signed as co-maker on the 3 PNs

● Upon maturity the principal balance remaining on the notes stood at:

○ PN#1 P16,665 as of 9/83 | PN#2 P83,333 as of 8/83 | PN#3 65,000 as of 8/83.

● Upon failure & refusal of Magtanggol to pay the balance, SBTC filed a collection case.

○ 3/30/93 RTC: Magtanggol to bay balances + 12%/annum from due date

● 8/6/93 SBTC MR: interest rate agreed during the signing of PNs was 23% per annum;

○ interest should be compounded quarterly from due date as provided in PNs

ISSUE: Stipulated interest rate in a contract of loan or forbearance of money, goods, or credit, in excess of the Usury Law prescribed ceiling, prevails over Sec 2 CBC905.

● CB Monetary board issued CBC905: "SEC. 1-a. Monetary Board authorized to prescribe max interest rate for loan or renewal thereof or the forbearance of any money, goods or credits, & to change such

rate whenever warranted by prevailing economic & social conditions:

○ changes may be effected gradually on scheduled dates announced in advance.

■ "In exercise of authority granted, Monetary Board may prescribe higher max rates for low priority loans, such as consumer loans/renewals thereof & such loans made by pawnshops, finance

companies & other similar credit institutions although the rates prescribed for these institutions need not necessarily be uniform.

○ Monetary Board is authorized to prescribed different max rate/s for different types of borrowings, including deposits & deposit substitutes, or loans of financial intermediaries

● All the PNs were signed in 1983 &, therefore, were already covered by CB905.

○ Contrary to the claim of RTC, this circular didn’t repeal nor in anyway amend the Usury Law but simply suspended the latter’s effectivity.

● When the law is clear & unambiguous, the court is left with no alternative but to apply the same according to its clear language.

○ The rate of interest was agreed upon by the parties freely.

■ Significantly, Magtanggol did not question that rate.

● It is not for RTC to change the stipulations in the contract where it is not illegal.

○ Article 1306: contracting parties may establish such stipulations, clauses, terms & conditions as they may deem convenient, provided they are not contrary to law, morals, good customs,

public order, or public policy.

● No valid reason for RTC to impose a 12% interest rate on the principal balance owing to petitioner by Magtanggol in the presence of a valid stipulation.

○ In a loan or forbearance of money, the interest due should be that stipulated in writing, & in the absence thereof, the rate shall be 12%/annum.

■ Only in absence of stipulation can the court impose 12% interest rate

● The PNs were signed by both parties voluntarily.

○ stipulations therein are binding between them.

● Magtanggol, likewise, did not question any of the stipulations therein.

○ he chose not to question the decision & instead expressed his desire to negotiate with the petitioner bank for "terms within which to settle his obligation."

DISPOSITION: Modified interest at 23%

Вам также может понравиться

- Usurious Transactions Case DigestsДокумент2 страницыUsurious Transactions Case DigestsMarinelle Aycee Moleta PerralОценок пока нет

- Security Bank v. RTC MakatiДокумент1 страницаSecurity Bank v. RTC MakatiEmir MendozaОценок пока нет

- G.R. No. 113926. October 23, 1996.: - First DivisionДокумент8 страницG.R. No. 113926. October 23, 1996.: - First DivisionMalolosFire BulacanОценок пока нет

- Security Bank and Trust Company vs. RTC of Makati Branch 61Документ2 страницыSecurity Bank and Trust Company vs. RTC of Makati Branch 61Arianne AstilleroОценок пока нет

- Security Bank v. MercadoДокумент3 страницыSecurity Bank v. Mercadodelayinggratification100% (1)

- Security Bank Vs RTC MakatiДокумент1 страницаSecurity Bank Vs RTC MakatiJames Evan I. ObnamiaОценок пока нет

- PNB Vs CAДокумент3 страницыPNB Vs CAAllen Jeil GeronaОценок пока нет

- Security Bank and Trust Company v. Regional Trial Court of MakatiДокумент2 страницыSecurity Bank and Trust Company v. Regional Trial Court of MakatiMarionnie SabadoОценок пока нет

- 1308 - Mutuality of ContractsДокумент3 страницы1308 - Mutuality of ContractsSarah Jane UsopОценок пока нет

- Security Bank and Trust CompanyДокумент2 страницыSecurity Bank and Trust CompanyCistron ExonОценок пока нет

- Credit Transaction CasesДокумент30 страницCredit Transaction CasesLei Bataller BautistaОценок пока нет

- 22 Advocates For Truth in Lending V BSPДокумент3 страницы22 Advocates For Truth in Lending V BSProbby100% (1)

- 8 Security Bank and Trust Co. vs. RTC of ManilaДокумент5 страниц8 Security Bank and Trust Co. vs. RTC of Manilarho wanalОценок пока нет

- Spouses Silos v. PNBДокумент2 страницыSpouses Silos v. PNBFrancisco Ashley AcedilloОценок пока нет

- Security Bank and Trust Co vs. RTC MakatiДокумент3 страницыSecurity Bank and Trust Co vs. RTC Makaticmv mendozaОценок пока нет

- Almeda Vs CA 256 Scra 292Документ14 страницAlmeda Vs CA 256 Scra 292Rommel Mancenido LagumenОценок пока нет

- Security Bank Vs RTC MakatiДокумент1 страницаSecurity Bank Vs RTC MakatiJerome C obusan100% (1)

- 1308 - Mutuality of ContractsДокумент1 страница1308 - Mutuality of ContractsSarah Jane UsopОценок пока нет

- Banco Filipino Vs YbanezДокумент3 страницыBanco Filipino Vs YbanezAllen Jeil GeronaОценок пока нет

- Spouses Ponciano Almeda and Eufemia P. Almeda The Court of Appeals and Philippine National Bank G.R. No. 113412 April 17, 1996 FactsДокумент2 страницыSpouses Ponciano Almeda and Eufemia P. Almeda The Court of Appeals and Philippine National Bank G.R. No. 113412 April 17, 1996 FactsJovz BumohyaОценок пока нет

- SECURITY BANK v. RTC OF MAKATIДокумент2 страницыSECURITY BANK v. RTC OF MAKATIsiyaonОценок пока нет

- CIVREV - Security Bank Vs Sps MercadoДокумент3 страницыCIVREV - Security Bank Vs Sps MercadoJimenez LorenzОценок пока нет

- Security Bank Vs RTC MakatiДокумент4 страницыSecurity Bank Vs RTC MakatiUnknown userОценок пока нет

- New Sampaguita Builders Construction, Inc Vs Philippine National BankДокумент2 страницыNew Sampaguita Builders Construction, Inc Vs Philippine National BankLoОценок пока нет

- LAW 107 - Advocates For Truth in Lending, Inc. & Olaguer v. Bangko Sentral Monetary BoardДокумент3 страницыLAW 107 - Advocates For Truth in Lending, Inc. & Olaguer v. Bangko Sentral Monetary BoardDanielle AbuelОценок пока нет

- Floirendo, Jr. v. Metropolitan BankДокумент2 страницыFloirendo, Jr. v. Metropolitan BankYvonne MallariОценок пока нет

- Case Digests - CreditTransДокумент14 страницCase Digests - CreditTransMaria Fiona Duran MerquitaОценок пока нет

- Equitable CaseДокумент2 страницыEquitable CaseLe Obm SizzlingОценок пока нет

- Almeda v. CAДокумент2 страницыAlmeda v. CAEmir Mendoza100% (1)

- Banco Filipino v. YbañezДокумент2 страницыBanco Filipino v. YbañezAlexis Von TeОценок пока нет

- Case Digest - Credit Transaction No. 9 13Документ5 страницCase Digest - Credit Transaction No. 9 13anon_746511540Оценок пока нет

- Almeda V CaДокумент2 страницыAlmeda V CaLiv PerezОценок пока нет

- Spec Com CasesДокумент12 страницSpec Com CasesRexan E VillaverОценок пока нет

- Credit Transactions Reviewer Draft 1Документ15 страницCredit Transactions Reviewer Draft 1sei1davidОценок пока нет

- Security Bank and Trust CoДокумент2 страницыSecurity Bank and Trust CoTin AngusОценок пока нет

- Locator: G.R No. 138677 Title: Tolomeo Ligutan & Leonidas de La Llana vs. Hon. Court of Appeals & Date Promulgated: February 12, 2016 Statement of FactsДокумент3 страницыLocator: G.R No. 138677 Title: Tolomeo Ligutan & Leonidas de La Llana vs. Hon. Court of Appeals & Date Promulgated: February 12, 2016 Statement of FactsRay Adrian P. DitonaОценок пока нет

- Digest-Sbc V SPS MercadoДокумент8 страницDigest-Sbc V SPS MercadoPhilip UlepОценок пока нет

- 21 UCPB v. BelusoДокумент3 страницы21 UCPB v. BelusoNico de la PazОценок пока нет

- Century Bankers Insurance Corp. vs. LagmanДокумент3 страницыCentury Bankers Insurance Corp. vs. LagmanMay Lann LamisОценок пока нет

- Security Bank vs. RTC of MakatiДокумент3 страницыSecurity Bank vs. RTC of MakatiMark TeaОценок пока нет

- United Coconut Planters Bank v. Sps BelusoДокумент2 страницыUnited Coconut Planters Bank v. Sps Belusod2015member100% (1)

- Security Bank vs. Sps. MercadoДокумент23 страницыSecurity Bank vs. Sps. MercadohlcameroОценок пока нет

- Reynaldo P. Floirendo Jr. vs. Metropolitan Bank G.R. No. 148325, Sept 3, 2007 - Escalation Clause in A Loan AgreementДокумент3 страницыReynaldo P. Floirendo Jr. vs. Metropolitan Bank G.R. No. 148325, Sept 3, 2007 - Escalation Clause in A Loan AgreementThoughts and More ThoughtsОценок пока нет

- Credit Case Analysis 13 (Basilisco, Jalefaye)Документ1 страницаCredit Case Analysis 13 (Basilisco, Jalefaye)jalefaye abapoОценок пока нет

- UsuryДокумент1 страницаUsuryjalefaye abapoОценок пока нет

- Banking ReviwerДокумент38 страницBanking ReviwerGela Bea BarriosОценок пока нет

- Almeda v. Court of Appeals, G.R 113412, April 17, 1996, 256 SCRA 292, 302Документ12 страницAlmeda v. Court of Appeals, G.R 113412, April 17, 1996, 256 SCRA 292, 302f678486Оценок пока нет

- NOV17 (1) SryjshsДокумент15 страницNOV17 (1) SryjshsDustine MarleeОценок пока нет

- UCPB v. BelusoДокумент4 страницыUCPB v. BelusotemporiariОценок пока нет

- Miranda v. Imperial (Decision of Court of Appeals)Документ49 страницMiranda v. Imperial (Decision of Court of Appeals)Alyssa DupanОценок пока нет

- 31 Addtl Case DigestsДокумент64 страницы31 Addtl Case DigestsMaan LucsОценок пока нет

- Macalinao Vs BPI Case SummaryДокумент2 страницыMacalinao Vs BPI Case SummaryEmelie Marie Diez100% (2)

- Security Bank and Trust Vs Etc MakatiДокумент5 страницSecurity Bank and Trust Vs Etc MakatiJerome C obusanОценок пока нет

- Almeda V CA - GR 113412Документ9 страницAlmeda V CA - GR 113412jovelyn davoОценок пока нет

- NSB Vs PNB Case DigestДокумент3 страницыNSB Vs PNB Case DigestLily M.Оценок пока нет

- Sps. Silos v. PNB (Digest)Документ3 страницыSps. Silos v. PNB (Digest)Tini GuanioОценок пока нет

- Supreme Court Reports Annotated Volume 435Документ57 страницSupreme Court Reports Annotated Volume 435Janice LivingstoneОценок пока нет

- PNB Vs IAC and MaglasangДокумент5 страницPNB Vs IAC and MaglasangSyElfredGОценок пока нет

- Susan Reyes vs. Judge Manuel DuqueДокумент2 страницыSusan Reyes vs. Judge Manuel DuquePretzel TsangОценок пока нет

- General Indemnity Co., Inc. (GICI) v. Estanislao AlvarezДокумент1 страницаGeneral Indemnity Co., Inc. (GICI) v. Estanislao AlvarezPretzel TsangОценок пока нет

- Bank of America Vs CAДокумент2 страницыBank of America Vs CAPretzel TsangОценок пока нет

- Pampampararampampam ParararamДокумент3 страницыPampampararampampam ParararamTooter KantuterОценок пока нет

- Annex A: Compensation Self-Employed / Professionals P3MДокумент7 страницAnnex A: Compensation Self-Employed / Professionals P3MPretzel TsangОценок пока нет

- Gross IncomeДокумент1 страницаGross IncomePretzel TsangОценок пока нет

- CIR vs. Efren CastanedaДокумент1 страницаCIR vs. Efren CastanedaPretzel TsangОценок пока нет

- Khan Vs SimbilloДокумент1 страницаKhan Vs SimbilloPretzel TsangОценок пока нет

- Old Colony Trust Co vs. CommissionerДокумент1 страницаOld Colony Trust Co vs. CommissionerPretzel TsangОценок пока нет

- Old Colony Trust Co vs. CommissionerДокумент1 страницаOld Colony Trust Co vs. CommissionerPretzel TsangОценок пока нет

- The Law Library: Revisiting Traditional Legal Research Methods by M.S. FelicianoДокумент23 страницыThe Law Library: Revisiting Traditional Legal Research Methods by M.S. FelicianoPretzel Tsang0% (1)

- Hacienda Bino v. CuencaДокумент3 страницыHacienda Bino v. CuencaPretzel TsangОценок пока нет

- An Ordinary Striking Worker May Not Be Declared To Have Lost His Employment Status by Mere Participation in An Illegal StrikeДокумент1 страницаAn Ordinary Striking Worker May Not Be Declared To Have Lost His Employment Status by Mere Participation in An Illegal StrikePretzel TsangОценок пока нет

- Chapter Ii: Emancipation of Tenants ART. 7. Statement of ObjectivesДокумент1 страницаChapter Ii: Emancipation of Tenants ART. 7. Statement of ObjectivesPretzel TsangОценок пока нет

- A.M. No. 17-03-09-SCC Rules On Community Legal Aid Service - Includes Those Who Will Pass The 2017 Bar Exams & Are Admitted To The Bar in 2018Документ3 страницыA.M. No. 17-03-09-SCC Rules On Community Legal Aid Service - Includes Those Who Will Pass The 2017 Bar Exams & Are Admitted To The Bar in 2018Pretzel TsangОценок пока нет

- IBP Membership CaseДокумент1 страницаIBP Membership CasePretzel TsangОценок пока нет

- Star Paper Corporation v. SimbolДокумент1 страницаStar Paper Corporation v. SimbolPretzel TsangОценок пока нет

- Lagunzad Vs SotoДокумент9 страницLagunzad Vs SotoGladys BantilanОценок пока нет

- Deed of Sale of Motor VehicleДокумент2 страницыDeed of Sale of Motor Vehiclejoonee09Оценок пока нет

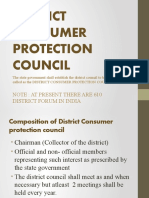

- District Consumer Protection CouncilДокумент11 страницDistrict Consumer Protection CouncilKIARAОценок пока нет

- 1867 Statutes at Large 750-828Документ80 страниц1867 Statutes at Large 750-828ncwazzyОценок пока нет

- Legal Aspects of Business (LAB) : Post Graduate Programme in Management (PGPM)Документ19 страницLegal Aspects of Business (LAB) : Post Graduate Programme in Management (PGPM)AshiОценок пока нет

- John McLearn v. James Wallace, 35 U.S. 625 (1836)Документ21 страницаJohn McLearn v. James Wallace, 35 U.S. 625 (1836)Scribd Government DocsОценок пока нет

- Leycano V COAДокумент2 страницыLeycano V COALiz LorenzoОценок пока нет

- Abellana Bocayo Vs Ferraris BorromeoДокумент3 страницыAbellana Bocayo Vs Ferraris BorromeoNina CastilloОценок пока нет

- Stankunas v. Statkus Et Al - Document No. 5Документ3 страницыStankunas v. Statkus Et Al - Document No. 5Justia.comОценок пока нет

- Digests Reyes and GuintoДокумент4 страницыDigests Reyes and Guintorcciocon08Оценок пока нет

- Yui Combo 002Документ7 страницYui Combo 002Jason MendozaОценок пока нет

- Corporate FormДокумент4 страницыCorporate Formudupiganesh3069Оценок пока нет

- Lutz Vs Araneta, G.R. No. L-7859, December 22, 1955Документ1 страницаLutz Vs Araneta, G.R. No. L-7859, December 22, 1955Celinka Chun100% (2)

- Manual On Position Classification and CompensationДокумент14 страницManual On Position Classification and Compensationedwin6656Оценок пока нет

- 3chassi PDFДокумент2 страницы3chassi PDFUS BatteryОценок пока нет

- Akhbar-E-Jehan 09-15 December 2019Документ223 страницыAkhbar-E-Jehan 09-15 December 2019Hina NazОценок пока нет

- Samsung Xpress SL-M2885FW - SL-M2870FD - ETS - Parts.Документ28 страницSamsung Xpress SL-M2885FW - SL-M2870FD - ETS - Parts.Júlio Cesar Guimarães de SouzaОценок пока нет

- Boracay Foundation Inc V Province of AklanДокумент4 страницыBoracay Foundation Inc V Province of AklanPaul Arman MurilloОценок пока нет

- 7 Metro Construction Inc Vs Chatham Properties IncДокумент23 страницы7 Metro Construction Inc Vs Chatham Properties IncYen YenОценок пока нет

- RCBC Vs Court of Appeals, 178 SCRA 739 (1989)Документ1 страницаRCBC Vs Court of Appeals, 178 SCRA 739 (1989)Vikki AmorioОценок пока нет

- Salaries Allowances of Ministers Act 1952Документ4 страницыSalaries Allowances of Ministers Act 1952Latest Laws TeamОценок пока нет

- Cabanas vs. Pilapil Cabanas vs. Pilapil, 58 SCRA 94, No. L-25843 July 25, 1974Документ7 страницCabanas vs. Pilapil Cabanas vs. Pilapil, 58 SCRA 94, No. L-25843 July 25, 1974Ye Seul DvngrcОценок пока нет

- Frederick Felipe Vs MGM and AyalaДокумент2 страницыFrederick Felipe Vs MGM and AyalaDi ko alamОценок пока нет

- 1 Republic vs. Carlito Lacap G.R. No. 158253 March 2, 2007Документ1 страница1 Republic vs. Carlito Lacap G.R. No. 158253 March 2, 2007Maribeth G. TumaliuanОценок пока нет

- Maersk Line v. Court of Appeals, G.R. No. 94761 (May 17, 1993)Документ2 страницыMaersk Line v. Court of Appeals, G.R. No. 94761 (May 17, 1993)Lara YuloОценок пока нет

- Espiritu v. ValerioДокумент2 страницыEspiritu v. ValerioAmber AncaОценок пока нет

- Joint NDA-Non-Circumvent - Long FormДокумент2 страницыJoint NDA-Non-Circumvent - Long Formgernsby935100% (1)

- Agreement For Hirer of VehicleДокумент5 страницAgreement For Hirer of VehicleNihathamanie PereraОценок пока нет

- VAKALATNAMAДокумент6 страницVAKALATNAMABanerjee SuvranilОценок пока нет

- Topic 1 Part 1 175404 - Topic 1 - Membership and Members Rights (Part 1)Документ5 страницTopic 1 Part 1 175404 - Topic 1 - Membership and Members Rights (Part 1)ookay100% (1)