Академический Документы

Профессиональный Документы

Культура Документы

ACCTGREV1 - 002 Notes Payable and Restructuring

Загружено:

Renz Angel M. RiveraОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

ACCTGREV1 - 002 Notes Payable and Restructuring

Загружено:

Renz Angel M. RiveraАвторское право:

Доступные форматы

MABALACAT CITY COLLEGE ACCOUNTING REVIEW 1

INSTITUTE OF BUSINESS AND EDUCATION NOTES PAYABLE AND DEBT RESTRUCTURING

Problem 1: On February 28, 2019, XYZ Company issued a 12% note payable to WWW Company for P500,000. Interest

and principal is payable on Feb 1, 2020.

Additionally, on June 30, 2019, XYZ company purchased a machine from CDE Company in exchange for a noninterest

bearing note requiring eight semiannual payments of P 200,000 every Dec and June. The first payment was made on Dec

31, 2019. At issue date, the prevailing annual interest rate for this type of note was 11%. PV of an ordinary annuity of 1

at 11% for 8 periods is 5.146 and PV of an ordinary annuity of 1 at 5.5% for 8 periods is 6.335.

1

1. What is the accrued interest payable to be recorded at Dec 31, 2019 balance sheet? P 60,000

Page

2. How much is the interest expense to be recorded for 2019? P 129,685

Problem 2: During 2019, DEF Company issued two separate notes payable:

● On Jan 1, 2019, DEF Company purchased a machine in exchange for a noninterest bearing note requiring ten

payments of P 500,000. The first payment was made on Dec 31, 2019, and the others due annually on Dec 31.

Prevailing rate of interest for this type of note at date of issuance was 12%. The PV of an ordinary annuity of 1 at 12% for

ten periods is 5.65 while the PV of 1 at 12% for 10 years is .322.

● On April 31, 2019, DEF Company borrowed P3,000,000 from ABC Company by issuing a two-year noninterest

bearing note. Recently, the entity has paid a 12% interest for this type of note. The PV of 1 at 12% for 2 years is

.80 and the PV of an ordinary annuity of 1 at 12% for 2 years is 1.69.

1. What is the interest expense for 2019 relating to this borrowings? P 531,000

2. What is the total carrying amount for notes payable to be presented in 2019 balance sheet? P 5,256,000

Problem 3: On March 1, 2019, DVD Company borrowed P 1,000,000 and signed a 2-year interest bearing note at 12% per

annum compounded semiannually every Aug and Feb. Interest is payable in full at maturity on Feb 28, 2021.

1. What amount should be reported as accrued interest payable on Dec 31, 2019? P 102,400

2. What is the interest expense to be recorded for 2020? 136,256.64

3. How much would be paid in Feb 28, 2021 to settle the notes payable? 1,262,477

Problem 4: On July 1, 2019, CDO Company obtained a P 2,000,000, 180-day bank loan at an annual rate of 12%.

The loan agreement requires Cody to maintain a P 400,000 compensating balance in its checking account.

CDO would otherwise maintain a balance of only P 200,000 in this account. The checking account earns interest

at an annual rate of 6%. The checking account earns interest at an annual rate of 6%.

1. What is the effective interest rate on the borrowing? 12.67%

Problem 5: On April 1, 2019, JRS Company borrowed P 1,000,000 on a 10% five-year note payable.

The fair value of the note is determined to be P 975,000 and P 950,000 on December 2019 and December

2020,respectively, based on market and interest factors.

The entity has elected the fair value option for reporting the financial liability.

1. What amount should be reported as interest expense for 2019? P 75,000

2. What is the carrying amount of the note payable on Dec 31, 2019? P 975,000

3. What is the gain/loss to be recognized in 2019 as a result of the fair value option? P 25,000

4. What is the gain/loss to be recognized in 2020 as a result of the fair value option? P 25,000

5. Assume that on Dec 2021, JRS recorded an P85,000 loss from the liability, how much is the notes fair value? P

1,035,000

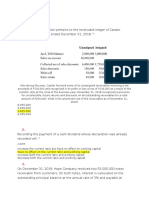

Problem 6: JDS Company, after having experienced financial difficulties in 2019, negotiated with a major creditor and

arrived at an agreement to restructure a note payable on Dec 31, 2019.

The creditor was owed principal of P 3,600,000 and interest of P 400,000 but agreed to accept equipment with a fair

value of P 700,000 and note receivable from JDS’ customer with carrying amount of P 2,700,000. The equipment had an

original cost of P 900,000 and accumulated depreciation of P 300,000.

1. What amount should be recognized as gain from debt extinguishment on Dec 31, 2017 under PFRS? P 700,000

2. Under US GAAP, how much should be reported as gain/loss on transfer of asset? P 100,000 Gain

3. Under US GAAP, how much should be reported as gain/loss on restructuring? P 600,000 Gain

COMPILED BY: WENSTON DEL ROSARIO ACCTGREV1_002

MABALACAT CITY COLLEGE ACCOUNTING REVIEW 1

INSTITUTE OF BUSINESS AND EDUCATION NOTES PAYABLE AND DEBT RESTRUCTURING

Problem 7: CEC Company is experiencing financial difficulty and is negotiating debt restructuring with its creditor to

relieve its financial stress. It has an outstanding P 2,500,000, 12% debt issued 1 Jul 2018 to a certain bank. It was unable

to pay interest since issuance.

On April 30, 2019, the bank accepted an equity interest in CEC Company in the form of 200,000 ordinary shares quoted

at P12 per share. The par value is P 10 per share.

2

The fair value of the note payable on the date of restructuring is P 2,300,000.

Page

1. What amount should be recognized as gain from debt extinguishment as a result of the equity swap? P 350,000

2. What amount should be recognized as share premium from the issuance of the shares? P 400,000

3. If the shares have no fair value, what amount should be recognized as gain on extinguishment? P 450,000

4. If both the shares and the note payable do not have fair value, what amount should be recognized as gain from

extinguishment of debt? P Zero

Problem 8:During 2019, MNO Company experience financial difficulties and is likely to default on a P 5,000,000, 12%

three-year note dated Jan 1, 2017.Interest was being paid semiannually until June 30, 2019 when the company started

being in trouble. On Dec 31, 2019, the bank agreed to settle the note and unpaid interest for the last 6mos for P 4,770,000

cash payable on Jan 31, 2020.

1. What amount should be reported as gain from extinguishment of debt in 2019? P 530,000

Problem 8: Due to extreme financial difficulties, ARMM Company had negotiated a restructuring of a 10% P 5,000,000

note payable due on Dec 31, 2019. Unpaid interest on the note on such date is P 375,000.

The creditor had agreed to reduce the face value to P 4,000,000, forgive the unpaid interest, reduce the interest rate to

8% and extend the due date three years from Dec 31, 2019.

The PV of 1 at 10% for three periods is 0.75 and the PV of an ordinary annuity of 1 at 10% for three periods is 2.49.

1. What is the gain on extinguishment of debt in 2019? P 1578,200

2. What is the interest expense for 2020? P 379,680

3. Assume that the modified terms were as follows: Face amount is reduced only by P200,000, unpaid interest is

forgiven, retain interest rate, and term extended to 1 year only from 2019. How much is the gain on

extinguishment to be recognized in 2019? (relevant PV factor is .90) Zero

4. What is the discount/premium on the new notes payable using the assumptions in #3? P 575,000 premium

COMPILED BY: WENSTON DEL ROSARIO ACCTGREV1_002

Вам также может понравиться

- CFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)От EverandCFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)Рейтинг: 4.5 из 5 звезд4.5/5 (5)

- Chapter 5 Accrual Accounting Adjustments: Discussion QuestionsДокумент7 страницChapter 5 Accrual Accounting Adjustments: Discussion QuestionskietОценок пока нет

- CFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)От EverandCFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Рейтинг: 5 из 5 звезд5/5 (1)

- PROBLEM 1. at December 31, 2019, Sally Company's Notes ReceivableДокумент16 страницPROBLEM 1. at December 31, 2019, Sally Company's Notes ReceivableAccounting 201100% (1)

- Financial Asset at Amortized CostДокумент1 страницаFinancial Asset at Amortized CostExcelsia Grace A. Parreño25% (12)

- INTACC2 Liabilities Questions ARALJPIAДокумент3 страницыINTACC2 Liabilities Questions ARALJPIAKiba YuutoОценок пока нет

- Debt RestructuringДокумент2 страницыDebt RestructuringDañella Jane Baisa0% (1)

- Module 13 Notes Payable - Debt ResructuringДокумент10 страницModule 13 Notes Payable - Debt ResructuringryanОценок пока нет

- ApДокумент8 страницApMonina Cabalag100% (1)

- Module 1 and 3 AssignmentДокумент12 страницModule 1 and 3 AssignmentPrincess Maeca OngОценок пока нет

- Far Quiz 2Документ13 страницFar Quiz 2Shiela Jane CrismundoОценок пока нет

- Chapter 2Документ8 страницChapter 2cindyОценок пока нет

- 4 FAR Handout Notes ReceivableДокумент2 страницы4 FAR Handout Notes Receivablealford sery CammayoОценок пока нет

- 103 CompilationДокумент12 страниц103 CompilationLyn AbudaОценок пока нет

- Far Review - Notes and Receivable AssessmentДокумент6 страницFar Review - Notes and Receivable AssessmentLuisa Janelle BoquirenОценок пока нет

- ASSET 2019 Mock Boards - FARДокумент7 страницASSET 2019 Mock Boards - FARKenneth Christian WilburОценок пока нет

- Far FinalДокумент24 страницыFar FinalJon MickОценок пока нет

- Module 2 AssignmentДокумент3 страницыModule 2 Assignmentricamae saladagaОценок пока нет

- Intermediate Accounting 2 Reviewer PDFДокумент133 страницыIntermediate Accounting 2 Reviewer PDFCarl CagampzОценок пока нет

- 02 Notes Loans and Bonds Payables and Debt Restructuring PDFДокумент6 страниц02 Notes Loans and Bonds Payables and Debt Restructuring PDFKlomoОценок пока нет

- Ae 211 Solutions-PrelimДокумент10 страницAe 211 Solutions-PrelimNhel AlvaroОценок пока нет

- Practice Problems - Notes and Loans Receivable: General InstructionsДокумент2 страницыPractice Problems - Notes and Loans Receivable: General Instructionseia aieОценок пока нет

- Financial Liabilities - Notes Payable - Practice Set (QUESTIONNAIRE)Документ2 страницыFinancial Liabilities - Notes Payable - Practice Set (QUESTIONNAIRE)ashleydelmundo14Оценок пока нет

- Assignment 2Документ1 страницаAssignment 2mallarijhoana21Оценок пока нет

- Answer Key - M1L2 PDFДокумент4 страницыAnswer Key - M1L2 PDFEricka Mher IsletaОценок пока нет

- HANDOUT - Bonds PayableДокумент4 страницыHANDOUT - Bonds PayableMarian Augelio PolancoОценок пока нет

- 1st Compre NR and LR PDFДокумент3 страницы1st Compre NR and LR PDFHelton Jun M. TuralbaОценок пока нет

- ACC 211 - Seventh QuizzerДокумент1 страницаACC 211 - Seventh QuizzerKate FernandezОценок пока нет

- Chapter 21 Reclassification of Financial Assets PDFДокумент1 страницаChapter 21 Reclassification of Financial Assets PDFRonОценок пока нет

- Far 2 LQДокумент14 страницFar 2 LQJennifer AdvientoОценок пока нет

- Activity 2 - ReceivableДокумент2 страницыActivity 2 - ReceivableMa. Alexandra Teddy Buen0% (1)

- Self Exercise No. 2Документ4 страницыSelf Exercise No. 2Pola PolzОценок пока нет

- Adjustments Quiz 1Документ5 страницAdjustments Quiz 1Christine Mae BurgosОценок пока нет

- Contingent Liab Bonds PayableДокумент11 страницContingent Liab Bonds PayableKristine Lirose Bordeos100% (1)

- InvestmentsДокумент5 страницInvestmentsEdmar HalogОценок пока нет

- IA2 Quiz 1 QuestionsДокумент6 страницIA2 Quiz 1 QuestionsJames Daniel SwintonОценок пока нет

- AEC 210 FinalRequirementДокумент9 страницAEC 210 FinalRequirementALMA MORENAОценок пока нет

- 3 - Accounting For Loans and ImpairmentДокумент1 страница3 - Accounting For Loans and ImpairmentReese AyessaОценок пока нет

- Audit of Long-Term LiabilitiesДокумент3 страницыAudit of Long-Term LiabilitiesRonamae RevillaОценок пока нет

- Ppe Pas 16 AccountingДокумент2 страницыPpe Pas 16 Accountingelsana philipОценок пока нет

- FAR Quiz Bee LiabilitiesДокумент39 страницFAR Quiz Bee LiabilitiesRose Gwenn VillanuevaОценок пока нет

- ROGEN AssignmentДокумент9 страницROGEN AssignmentRogen Paul GeromoОценок пока нет

- D. Discounted - YES Pledged - NOДокумент9 страницD. Discounted - YES Pledged - NOJasper LuagueОценок пока нет

- Intacc Quiz 2 - REVIEWERДокумент15 страницIntacc Quiz 2 - REVIEWERRENZ ALFRED ASTREROОценок пока нет

- Quiz 2 Problem 1Документ2 страницыQuiz 2 Problem 1Jerah Marie PepitoОценок пока нет

- Topic 3 Bonds Payable and Other ConceptsДокумент2 страницыTopic 3 Bonds Payable and Other ConceptsDustinEarth Buyo MontebonОценок пока нет

- Prac 1 Final PreboardДокумент10 страницPrac 1 Final Preboardbobo kaОценок пока нет

- Receivables QuizДокумент3 страницыReceivables QuizAshianna KimОценок пока нет

- AE 111 Final Summative Assessment 1Документ3 страницыAE 111 Final Summative Assessment 1Djunah ArellanoОценок пока нет

- 04 Quiz 1Документ3 страницы04 Quiz 1prettyboiy19Оценок пока нет

- Notes Receivable Discussion ExercisesДокумент1 страницаNotes Receivable Discussion ExercisesFrancine Thea M. LantayaОценок пока нет

- Financial Accounting Vol. 2 Example QuestionsДокумент8 страницFinancial Accounting Vol. 2 Example QuestionsMarisolОценок пока нет

- FINACC 2 - Quiz 3Документ7 страницFINACC 2 - Quiz 3Kim Ruwen AblazaОценок пока нет

- Receivable-to-Receivable-Financing (PRACTICE)Документ3 страницыReceivable-to-Receivable-Financing (PRACTICE)liezelkatemesina82Оценок пока нет

- Quiz Notes and Loans Receivable SY 2022 2023 SolutionДокумент4 страницыQuiz Notes and Loans Receivable SY 2022 2023 Solutionreagan blaireОценок пока нет

- Correct!: Accrued and DisclosedДокумент111 страницCorrect!: Accrued and DisclosedJaeОценок пока нет

- 9.3 Debt InvestmentsДокумент7 страниц9.3 Debt InvestmentsJorufel PapasinОценок пока нет

- Receivables Mock QuizДокумент5 страницReceivables Mock QuizChester CariitОценок пока нет

- A. 65,000 Loss B. 5,000 Loss D. 65,000 GainДокумент3 страницыA. 65,000 Loss B. 5,000 Loss D. 65,000 GainLyn AbudaОценок пока нет

- Far 103 - Accounting For Receivables and Notes ReceivableДокумент4 страницыFar 103 - Accounting For Receivables and Notes ReceivablePatrishaОценок пока нет

- MULTIPLE CHOICE - OdtДокумент91 страницаMULTIPLE CHOICE - OdtAngelica Joy ManaoisОценок пока нет

- Solution ManualДокумент7 страницSolution ManualHamed Idriss KemokaiОценок пока нет

- 19 April AEO ReportДокумент1 страница19 April AEO ReportHmingsangliana HauhnarОценок пока нет

- Barrazona V RTC City of Baguio - EjectmentДокумент9 страницBarrazona V RTC City of Baguio - Ejectmentdoc dacuscosОценок пока нет

- Astm A391-A391m-07Документ3 страницыAstm A391-A391m-07NadhiraОценок пока нет

- Currency Derivatives ArbitrageДокумент27 страницCurrency Derivatives ArbitrageMinh NgọcОценок пока нет

- Reading Wwii ApushДокумент12 страницReading Wwii Apushapi-297350857Оценок пока нет

- Chapman University Admission EssaysДокумент2 страницыChapman University Admission EssaysjenniferuglyОценок пока нет

- Case DigestДокумент14 страницCase DigestMerxeilles Santos100% (5)

- 19.3 Simple CircuitsДокумент35 страниц19.3 Simple CircuitsHasan AlzaghalОценок пока нет

- Lya - Benjamin - Politica - Antievreiască - A - Regimului - Antonescu - (1940-1944)Документ24 страницыLya - Benjamin - Politica - Antievreiască - A - Regimului - Antonescu - (1940-1944)Paul DumitruОценок пока нет

- Baleno BalenoRS Accessories - Brochure PDFДокумент9 страницBaleno BalenoRS Accessories - Brochure PDFmoorpvrОценок пока нет

- International Environmnet Law in IndiaДокумент17 страницInternational Environmnet Law in IndiaAnushka TRivediОценок пока нет

- Offences Against ChildДокумент29 страницOffences Against Child20225 SALONEE SHARMAОценок пока нет

- HRPTA AttendanceДокумент3 страницыHRPTA AttendanceApril Joy LascuñaОценок пока нет

- LECTURE NOTES-Translation of Foreign FSДокумент4 страницыLECTURE NOTES-Translation of Foreign FSGenesis CervantesОценок пока нет

- Take Home Quiz 1Документ9 страницTake Home Quiz 1Akira Marantal Valdez100% (1)

- Tendernotice 1Документ4 страницыTendernotice 1alokОценок пока нет

- Midterm VBF 2015 - Full Report - Eng PDFДокумент352 страницыMidterm VBF 2015 - Full Report - Eng PDFngocbephamОценок пока нет

- Trans PenaДокумент3 страницыTrans Penavivi putriОценок пока нет

- Answer Key To Newtons Laws of MotionДокумент2 страницыAnswer Key To Newtons Laws of MotionMARICEL CANTARAОценок пока нет

- Labor Standards SSS CasesДокумент77 страницLabor Standards SSS CasesCharenz Santiago SantiagoОценок пока нет

- Limbauan Vs AcostaДокумент6 страницLimbauan Vs AcostaJENNY BUTACANОценок пока нет

- Gaanan V Intermediate Appellate CourtДокумент3 страницыGaanan V Intermediate Appellate CourtVanessa Yvonne Gurtiza100% (1)

- Cultural, Social and Political InstitutionsДокумент26 страницCultural, Social and Political InstitutionsNica de los SantosОценок пока нет

- MRP Project ReportДокумент82 страницыMRP Project ReportRaneel IslamОценок пока нет

- (DAILY CALLER OBTAINED) - Doe V San Diego Unified SCH Dist Doc. 5 1 Urgent Motion For IPAДокумент53 страницы(DAILY CALLER OBTAINED) - Doe V San Diego Unified SCH Dist Doc. 5 1 Urgent Motion For IPAHenry Rodgers100% (1)

- BK 291Документ108 страницBK 291Santi Jonas LopezОценок пока нет

- Excursion Parent Consent Form - 2021 VSSECДокумент8 страницExcursion Parent Consent Form - 2021 VSSECFelix LeОценок пока нет

- Joint Affidavit of Birth Registration (Of Age)Документ2 страницыJoint Affidavit of Birth Registration (Of Age)russell apura galvezОценок пока нет