Академический Документы

Профессиональный Документы

Культура Документы

Taxation

Загружено:

BlaceОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Taxation

Загружено:

BlaceАвторское право:

Доступные форматы

1. What donations are tax exempt?

A. “In the Case of Gifts made by a Resident

· Gifts made to or for the use of the National Government or any entity created by any

of its agencies which is not conducted for profit, or to any political subdivision of the said

Government; and

· Gifts in favor of an educational and/or charitable, religious, cultural or social welfare

corporation, institution, accredited non-government organization, trust or philanthropic

organization or research institution or organization: Provided, however, not more than

30% of said gifts will be used by such donee for administration purposes. For the

purpose of this exemption, a ‘non-profit educational and/or charitable corporation,

institution, accredited nongovernment organization, trust or philanthropic organization

and/or research institution or organization’ is a school, college or university and/or

charitable corporation, accredited nongovernment organization, trust or philanthropic

organization and/ or research institution or organization, incorporated as a nonstock

entity, paying no dividends, governed by trustees who receive no compensation, and

devoting all its income, whether students’ fees or gifts, donation, subsidies or other

forms of philanthropy, to the accomplishment and promotion of the purposes

enumerated in its Articles of Incorporation.” (Sec. 17 of RR No. 12-2018)

B. In the Case of Gifts Made by a Nonresident not a Citizen of the Philippines

· Gifts made to or for the use of the National Government or any entity created by any

of its agencies which is not conducted for profit, or to any political subdivision of the said

Government.

· Gifts in favor of an educational and/or charitable, religious, cultural or social welfare

corporation, institution, foundation, trust or philanthropic organization or research

institution or organization: Provided, however, that not more than thirty percent (30%) of

said gifts shall be used by such donee for administration purposes. (Sec. 101 (B) of

NIRC, as amended)

2. What are the bases in the valuation of property?

The properties comprising the gift/donation shall be valued based on their fair market

value as of the time of donation.

If the property is a real property, the fair market value thereof as of the time of donation

shall be, whichever is the higher of –

1. The fair market value as determined by the Commissioner, or

2. The fair market value as shown in the schedule of values fixed by the provincial and

city assessors.

In the case of shares of stocks, the fair market value shall depend on whether the shares

are listed or unlisted in the stock exchanges. Unlisted common shares are valued based

on their book value while unlisted preferred shares are valued at par value. In determining

the book value of common shares, appraisal surplus shall not be considered as well as

the value assigned to preferred shares, if there are any. On this note, the valuation of

unlisted shares shall be exempt from the provisions of RR No. 6-2013, as amended.

For shares which are listed in the stock exchanges, the fair market value shall be the

arithmetic mean between the highest and lowest quotation at a date nearest the date of

donation, if none is available on the date of donation.

The fair market value of units of participation in any association, recreation or amusement

club (such as golf, polo, or similar clubs), shall be the bid price nearest the date of

donation published in any newspaper or publication of general circulation.

To determine the value of the right to usufruct, use or habitation, as well as that of annuity,

there shall be taken into account the probable life of the beneficiary in accordance with

the latest basic standard mortality table, to be approved by the Secretary of Finance, upon

recommendation of the Insurance Commissioner. (Sec. 2, RR No. 17-2018 and Sec. 5 of

RR No. 12-2018)

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5795)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- DiMaggio, P Nonprofit Enterprise in The Arts PDFДокумент387 страницDiMaggio, P Nonprofit Enterprise in The Arts PDFIgnacia CossioОценок пока нет

- S Constructing Ottoman Beneficence, An Imperial Soup Kitchen in Jerusalem (2002) PDFДокумент257 страницS Constructing Ottoman Beneficence, An Imperial Soup Kitchen in Jerusalem (2002) PDFSilviu IliuțăОценок пока нет

- Parsi Philanthropy A Post Independence PerspectiveДокумент47 страницParsi Philanthropy A Post Independence PerspectiveJehangir KhambataОценок пока нет

- Profiling Form - AwraДокумент2 страницыProfiling Form - AwraBlaceОценок пока нет

- The 53 Questions:: 1. Was The Plan of Salvation Made After The Fall?Документ54 страницыThe 53 Questions:: 1. Was The Plan of Salvation Made After The Fall?BlaceОценок пока нет

- Christ Centered LifeДокумент2 страницыChrist Centered LifeBlaceОценок пока нет

- How To Survive With GodДокумент5 страницHow To Survive With GodBlaceОценок пока нет

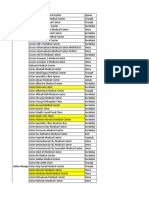

- Leena Quick ListДокумент8 страницLeena Quick ListmarioОценок пока нет

- UNCTAD - Social Responsibility of TNCДокумент75 страницUNCTAD - Social Responsibility of TNChrishiОценок пока нет

- New Venture Creation Entrepreneurship For The 21st Century 10th Edition Spinelli Test BankДокумент15 страницNew Venture Creation Entrepreneurship For The 21st Century 10th Edition Spinelli Test Banknathanmelanie53f18f100% (27)

- Ocala Magazine Charity RegisterДокумент21 страницаOcala Magazine Charity RegisterEric HeikkinenОценок пока нет

- Fund RaisingДокумент4 страницыFund RaisingMalik AwanОценок пока нет

- Open - Evaluationresourcesnorthwest - 9-23-06Документ7 страницOpen - Evaluationresourcesnorthwest - 9-23-06Teachers Without BordersОценок пока нет

- Social Trends in Online FundraisingДокумент5 страницSocial Trends in Online FundraisingLuna Media GroupОценок пока нет

- Large NPD Nomination Form 2011Документ14 страницLarge NPD Nomination Form 2011ben_fyffe3842Оценок пока нет

- Volunteer News: There Is A Place For You To Volunteer" "He Wahi Mohou Hei Tuao"Документ8 страницVolunteer News: There Is A Place For You To Volunteer" "He Wahi Mohou Hei Tuao"Gisborne Volunteer CentreОценок пока нет

- List of Non-Governmental Organisations Certified As EU Humanitarian Partners For The Period 2021-2027Документ6 страницList of Non-Governmental Organisations Certified As EU Humanitarian Partners For The Period 2021-2027Ganesan ShunmuganathanОценок пока нет

- Grade 3 Spelling Challenge 4Документ2 страницыGrade 3 Spelling Challenge 4Vaishnavi YelchurОценок пока нет

- Bastion's Annual Report 2022Документ27 страницBastion's Annual Report 2022Milena Rueda NavarroОценок пока нет

- Waqf Fundraising ManagementДокумент30 страницWaqf Fundraising ManagementRahimi SaadОценок пока нет

- Unit - 5 BECG - Corporate Social ResponsibilitiesДокумент7 страницUnit - 5 BECG - Corporate Social ResponsibilitiesrahulОценок пока нет

- The Revolution Will Not Be FundedДокумент5 страницThe Revolution Will Not Be FundedjulibazzoОценок пока нет

- Certificates-Ndep Quiz BeeДокумент9 страницCertificates-Ndep Quiz BeeLanie BadayОценок пока нет

- Ayodhya Disaster Management PlanДокумент107 страницAyodhya Disaster Management PlanHarshita MittalОценок пока нет

- Resource Mobilization Action Plan UpdateДокумент13 страницResource Mobilization Action Plan UpdateRuby GarciaОценок пока нет

- A Historical View of The Development of Philanthropy in Albania - Partners - Albania, Center For Change and Conflict ManagementДокумент124 страницыA Historical View of The Development of Philanthropy in Albania - Partners - Albania, Center For Change and Conflict ManagementlibrariОценок пока нет

- Unlocking Private Capital For Social Good in Central and Eastern EuropeДокумент59 страницUnlocking Private Capital For Social Good in Central and Eastern EuropeOxana MalanciucОценок пока нет

- Foundations Summit Report On Creating Community JailsДокумент30 страницFoundations Summit Report On Creating Community JailsJan LeeОценок пока нет

- Draft Schedule 2011Документ57 страницDraft Schedule 2011Lee DunnОценок пока нет

- Module 1 - Lesson 3 - Donor's Tax CreditДокумент6 страницModule 1 - Lesson 3 - Donor's Tax Creditohmyme sungjaeОценок пока нет

- Social Responsibility Framework: AppreciationДокумент7 страницSocial Responsibility Framework: AppreciationJunidick Gaud BayengОценок пока нет

- Groundwork Partners For FamiliesДокумент2 страницыGroundwork Partners For Familieslmarra2005Оценок пока нет

- A Transformative Moment For PhilanthropyДокумент6 страницA Transformative Moment For PhilanthropyBusiness Families FoundationОценок пока нет

- 2011 Gonski ReviewДокумент319 страниц2011 Gonski ReviewSimon McCarthyОценок пока нет