Академический Документы

Профессиональный Документы

Культура Документы

Income Payee's Sworn Declaration of Gross Receipts - BIR Annex B-2

Загружено:

Records SectionАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Income Payee's Sworn Declaration of Gross Receipts - BIR Annex B-2

Загружено:

Records SectionАвторское право:

Доступные форматы

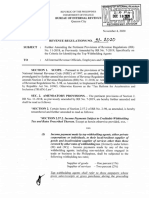

ANNEX “B-2”

INCOME PAYEE’S SWORN DECLARATION OF GROSS RECEIPTS/SALES

(F o r Self-Em ployed an d /o r Engaged in th e P ractice o f Profession w ith L one Incom e P ayor)

j o f legal age, single/ married to

I,. (Citizenship)

(Name)

permanently residing at _

(Name o f Spouse)

with

(Address)

Taxpayer Identification Number (TIN) after having been duly sworn in accordance with law

hereby depose and state:

I. That I derived my income only from

(business/professional) (Name of Lone Payor)

with Taxpayer Identification N umber__ and business address a t ____________

2. That for the current year________ , my gross receipts will not exceed Two Hundred Fifty Thousand Pesos (P250,000.00) and

that I am registered as a non-VAT taxpayer; that whatever is the amount o f income received, I will comply with the

requirement to file my Income Tax Return on the prescribed due date. For this purpose, I opt to avail o f either one o f the

following:

n Graduated Income Tax Rates under Section 24(A)(2)(a) o f the Tax Code, as amended, based on the taxable

income. With this selection, I acknowledge that I am subject to 0% income tax, thus, not subject to

creditable withholding tax; subject to percentage tax, if applicable, and will file the required percentage tax

returns or subject to withholding percentage tax, in case of government money payments.

n Eight Percent (8%) income tax rate under Section 24(A)(2)(b) o f the Tax Code, as amendeci, based on

gross receipts/sales and other non-operating income - with this selection, I understand that this is in lieu of

the graduated income tax rates and the Percentage Tax under Section 116 o f the Tax Code, as amended;

thus, no withholding tax shall be made;

3. That based on my selection above, if my gross sales/receipts and other non-operating income exceeds P250,000.00 but not

over P3,000,000.00, my afore-stated lone income payor shall automatically withhold the prescribed rate o f withholding tax:

a. In case o f Graduated Income Tax Rates, I acknowledge that aside fi-om income tax, I am subject to

business tax (Percentage Tax, if applicable) and creditable withholding o f income in excess o f

P250,000.00, and business tax withholding, if any, are applicable on the entire income payment; OR

b. In case of Eight Percent (8%) income tax rate, I acknowledge that I am only subject to income tax and

thus, to the creditable withholding income tax in excess o f P250,000.00;

4. That I duly execute this SWORN DECLARATION in compliance with the requirement prescribed under Section------ of

Revenue Regulations N o .________ ;

5. That I declare, under the penalties o f perjury, that this declaration has been made in good faith, and to the best o f my

knowledge and belief to be true and correct.

IN W ITNESS W H EREO F, I have hereunto set my hand th is___ day o f. J> 20___ at. _, Philippines

Signature over Printed Name o f Individual Taxpayer

SUBSCRIBED AND SWORN to before me th is _____ day o f. __ , 20___ in

Applicant exhibited to me his/her __________________ issued at on

(Govenment Issued ID and No.)

NOTARY PUBLIC

Doc. No.:

Page No.:

Book No.:

Series of

Affix P30.00

Documentary

Stamp Tax

(.____________

(To beJilled-oui by the withholding agent/lonepayor)

Date Received: Received by:

(MM-DD-YYYY-00001)

Signature over Printed Name o f the Withholding Agent Pa^-or or Authorized Officer

Designation Position o f Authorized Officer

Name of Withholding Agent Lone Payor

Вам также может понравиться

- VAT & EVAT Computation-AДокумент14 страницVAT & EVAT Computation-AGuilbert CimeneОценок пока нет

- RER FormДокумент2 страницыRER Formchristian100% (2)

- Credit Risk AnalysisДокумент1 страницаCredit Risk AnalysisPhilip JosephОценок пока нет

- Cash Endorsement FormДокумент1 страницаCash Endorsement FormJake CopradeОценок пока нет

- Annex DДокумент1 страницаAnnex DAnthonyОценок пока нет

- Open Economy Macroeconomics (PDFDrive)Документ399 страницOpen Economy Macroeconomics (PDFDrive)Karya BangunanОценок пока нет

- Pension Mathematics WinklevossДокумент368 страницPension Mathematics Winklevossannisa uswahtulhaq100% (3)

- TESDA Assessment Application Form PDFДокумент2 страницыTESDA Assessment Application Form PDFFrank Laurence Pansacala PandoОценок пока нет

- Promissory Note DraftДокумент2 страницыPromissory Note DraftRomela Eleria GasesОценок пока нет

- Anansit QP-DOC-01 Context of OrganizationДокумент5 страницAnansit QP-DOC-01 Context of OrganizationTan Tok Hoi100% (2)

- Hope You Had An Enjoyable Ride!: Your Grab E-ReceiptДокумент3 страницыHope You Had An Enjoyable Ride!: Your Grab E-ReceiptaslfkjОценок пока нет

- 0605Документ2 страницы0605Kath Rivera60% (42)

- Statement of Management ResponsibilityДокумент1 страницаStatement of Management ResponsibilityKristel Dianne U. Soliven100% (2)

- Sample FARM PLAN AND BUDGET - DennisДокумент1 страницаSample FARM PLAN AND BUDGET - Dennisl.a. lopez100% (2)

- Example Commission On Election Authorization LetterДокумент1 страницаExample Commission On Election Authorization LetterArianne De Castro100% (2)

- Green BusinessДокумент40 страницGreen BusinessHanisevae VisantiОценок пока нет

- Sworn Declaration FormДокумент1 страницаSworn Declaration FormAnawin FamadicoОценок пока нет

- TaxationДокумент7 страницTaxationAltair ColtraineОценок пока нет

- Sworn Declaration: Annex DДокумент1 страницаSworn Declaration: Annex DAdy100% (2)

- Notice of Salary Adjustment FormatДокумент1 страницаNotice of Salary Adjustment FormatCzarina Eura Ketch Alvaro67% (3)

- Affidavit of Loss Board RatingДокумент1 страницаAffidavit of Loss Board Ratingczabina fatima delicaОценок пока нет

- Income Payee'S Sworn Declaration of Gross Receipts/SalesДокумент4 страницыIncome Payee'S Sworn Declaration of Gross Receipts/SalesLeslie Darwin DumasОценок пока нет

- Peer FormДокумент1 страницаPeer Formgina_manrique0963% (8)

- Affidavit of Undertaking: Name of Parent/GuardianДокумент1 страницаAffidavit of Undertaking: Name of Parent/Guardianjulie rose100% (1)

- Endorsement LetterДокумент2 страницыEndorsement LettermitarikОценок пока нет

- Position Description Form (PDF) - Adas Ii PDFДокумент2 страницыPosition Description Form (PDF) - Adas Ii PDFArya Stark100% (1)

- Philhealth WaiverДокумент2 страницыPhilhealth WaiverMiguel Beltran100% (1)

- Action Plan 2020Документ3 страницыAction Plan 2020Maku Degollado100% (1)

- Pass Slip SampleДокумент3 страницыPass Slip SampleMondster BatzОценок пока нет

- Authorization Letter With Id of The Business Owner and RepresentativeДокумент2 страницыAuthorization Letter With Id of The Business Owner and RepresentativeMarco Regunayan100% (1)

- The Philippine Budget ProcessДокумент16 страницThe Philippine Budget ProcessMye Pintorera100% (2)

- RR No. 31-2020Документ3 страницыRR No. 31-2020nathalie velasquezОценок пока нет

- SPECIAL POWER OF ATTORNEY-MitziДокумент2 страницыSPECIAL POWER OF ATTORNEY-MitziJane Mara Aquino100% (1)

- Request Letter For New Business Permit CTCДокумент1 страницаRequest Letter For New Business Permit CTCJohn Lawrence de luna100% (3)

- LogisticsДокумент33 страницыLogisticsCaroline Swift100% (1)

- Contract of UsufructДокумент1 страницаContract of UsufructAllana Erica Cortes100% (1)

- Letter For Tax ClearanceДокумент1 страницаLetter For Tax ClearanceProbinsyana Ko0% (1)

- Innovative Finance in AgricultureДокумент142 страницыInnovative Finance in AgricultureJuan Pryor100% (1)

- SSS Contribution Table As of January 2007Документ3 страницыSSS Contribution Table As of January 2007ahnzlove100% (3)

- Annex C RR 11 2018 PDFДокумент1 страницаAnnex C RR 11 2018 PDFMahko albert RslesОценок пока нет

- Authorization Letter PhilhealthДокумент1 страницаAuthorization Letter PhilhealthDariel Baculbas Alvarez50% (4)

- Affidavit For No Pending or Filed Leave of Absence and ResignationДокумент1 страницаAffidavit For No Pending or Filed Leave of Absence and ResignationAnonymous oKaFcSFTcT100% (1)

- Letter PcsoДокумент1 страницаLetter PcsoDee ComonОценок пока нет

- Sworn Statement 2010 PalaroДокумент1 страницаSworn Statement 2010 PalaroOcir AyaberОценок пока нет

- Bir Form 2307 SampleДокумент3 страницыBir Form 2307 SampleErick Echual75% (4)

- SERVICE AGREEMENT in Funeral Parlor Commissioin BasisДокумент2 страницыSERVICE AGREEMENT in Funeral Parlor Commissioin BasisCARLO C. VILLANUEVA JR.Оценок пока нет

- WAIVER OF RIGHTS For Electric BillДокумент2 страницыWAIVER OF RIGHTS For Electric Billresist_phoebe18100% (1)

- New LOCATOR SLIPДокумент4 страницыNew LOCATOR SLIPJo-Ann GalupoОценок пока нет

- Liquidation Report: To Liquidate The MOOE Cash Advanced Made by Kibao Elementary School Per Check # 298152dated 9/16/16Документ3 страницыLiquidation Report: To Liquidate The MOOE Cash Advanced Made by Kibao Elementary School Per Check # 298152dated 9/16/16December Cool50% (2)

- Annex B-1 Guide, Instructions and Blank Copy: (Several Income Payors)Документ4 страницыAnnex B-1 Guide, Instructions and Blank Copy: (Several Income Payors)Kristel Anne LiwagОценок пока нет

- Affidavit of Ownership (Refrigerator)Документ1 страницаAffidavit of Ownership (Refrigerator)ChelissaRojas100% (1)

- Example Commission On Election Request LetterДокумент1 страницаExample Commission On Election Request LetterArianne De Castro50% (2)

- RER-Form No. 2Документ2 страницыRER-Form No. 2KenoyОценок пока нет

- Parents Waiver 2019 2020Документ1 страницаParents Waiver 2019 2020Keil Morada100% (2)

- Certification - Telephone BillДокумент1 страницаCertification - Telephone BillREGIONAL DIRECTOR SOUTHERN TAGALOG100% (1)

- Health Declaration Form: Depedcavite - Medical@deped - Gov.phДокумент2 страницыHealth Declaration Form: Depedcavite - Medical@deped - Gov.phAnne Esguerra100% (1)

- MEMORANDUM OF AGREEMENT - Zeth BakeryДокумент2 страницыMEMORANDUM OF AGREEMENT - Zeth BakeryRodel Amante MedicoОценок пока нет

- RMO 12 2013 List of Unused Expired ORsSIsCIs Annex DДокумент2 страницыRMO 12 2013 List of Unused Expired ORsSIsCIs Annex DMIS MijerssОценок пока нет

- Teacher 1 Sample CoEДокумент2 страницыTeacher 1 Sample CoELucito Cerna100% (1)

- Weight For Height Boys GirlsДокумент2 страницыWeight For Height Boys GirlsKristel Anne Mendoza75% (4)

- 1901 Jan 2018 ENCS V4 - 03.04.2019Документ1 страница1901 Jan 2018 ENCS V4 - 03.04.2019Andoy Domingo Carullo83% (6)

- Portable Timekeeper ManualДокумент25 страницPortable Timekeeper Manualba21100% (1)

- Checklist of Requirements For Terminal Leave BenefitsДокумент1 страницаChecklist of Requirements For Terminal Leave BenefitsKaren Feyt Mallari100% (2)

- Disbursing Officer IPCRF and CashierДокумент6 страницDisbursing Officer IPCRF and Cashierchari cruzmanОценок пока нет

- Jollibee Franchise ApplicationДокумент11 страницJollibee Franchise ApplicationKAKKAMPI100% (2)

- Bir Form 1601-CДокумент4 страницыBir Form 1601-Csanto tomas proper barangay100% (1)

- Joborder Annex A1 DhdgsfadskjfjkajgriuewyhfjandlasfjhjadsfbsjfkДокумент2 страницыJoborder Annex A1 DhdgsfadskjfjkajgriuewyhfjandlasfjhjadsfbsjfkvivianОценок пока нет

- Annex (A1)Документ1 страницаAnnex (A1)Jana Jonathan0% (1)

- Bir Form Pro FormaДокумент3 страницыBir Form Pro Formasamcoronel925Оценок пока нет

- Sample/Pre-Board Paper 9 Class X Term 1 Exam Nov - Dec 2021 English Language and Literature (Code 184)Документ6 страницSample/Pre-Board Paper 9 Class X Term 1 Exam Nov - Dec 2021 English Language and Literature (Code 184)Tamil FutureОценок пока нет

- Fin - 515 - Smart - Chapter 1 Overview of Corporate Finance - Tute Solutions - 1Документ3 страницыFin - 515 - Smart - Chapter 1 Overview of Corporate Finance - Tute Solutions - 1Ray Gworld50% (2)

- SupercellДокумент6 страницSupercellkrofta EngineeringОценок пока нет

- The Marshall Plan and Its ConsequencesДокумент11 страницThe Marshall Plan and Its Consequencesgelebele100% (3)

- KASSITAДокумент7 страницKASSITAMohamed BakaryОценок пока нет

- Airtel BillДокумент24 страницыAirtel BillCharu MehtaОценок пока нет

- Trader Website Fund Details - W - SummaryДокумент1 430 страницTrader Website Fund Details - W - SummaryGtc Diaz CarlosОценок пока нет

- Godrej Loud-PresentationДокумент12 страницGodrej Loud-PresentationBhargavОценок пока нет

- Farmaid Tractor Limited Case StudyДокумент2 страницыFarmaid Tractor Limited Case StudyRahul Savalia0% (1)

- Royce Credit and Financial Services, Inc.: MemorandumДокумент11 страницRoyce Credit and Financial Services, Inc.: MemorandumDPMC BANTAYОценок пока нет

- Financial Times Middle East - August 06, 2020Документ18 страницFinancial Times Middle East - August 06, 2020Ha NguyenОценок пока нет

- Problems in ConstructionДокумент2 страницыProblems in Constructionjkrs1990Оценок пока нет

- Chapter 3 Problem 9: R&E Supplies Facts and Assumptions ($ Thousands) Actual Forecast Forecast 2017 2018 2019Документ5 страницChapter 3 Problem 9: R&E Supplies Facts and Assumptions ($ Thousands) Actual Forecast Forecast 2017 2018 2019阮幸碧Оценок пока нет

- Assignment EcoДокумент5 страницAssignment EcoFatima AlsiddiqОценок пока нет

- 2242 3d Printronics GantryДокумент2 страницы2242 3d Printronics GantryRupen AryalОценок пока нет

- Sirona Invoice 1702366155-93Документ1 страницаSirona Invoice 1702366155-93mugentsukiyomi31Оценок пока нет

- Goods or Services Are Exempted From Payment of VatДокумент2 страницыGoods or Services Are Exempted From Payment of Vatfikru terfaОценок пока нет

- Unit 7Документ22 страницыUnit 7Sandhya ChimmiliОценок пока нет

- EMBA Operations Management Lecture 7Документ48 страницEMBA Operations Management Lecture 7Afrin ParvezОценок пока нет

- 2018 +Generali+Claim+form EN+ (Legal+rev) +-+171017Документ2 страницы2018 +Generali+Claim+form EN+ (Legal+rev) +-+171017Femi EvalnesОценок пока нет

- Kiem Tra 1 Tiet 12 TD Lan1 17-18Документ4 страницыKiem Tra 1 Tiet 12 TD Lan1 17-18Nguyen Phan Cam TuОценок пока нет