Академический Документы

Профессиональный Документы

Культура Документы

May16 Adv PDF

Загружено:

Akshat joshiОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

May16 Adv PDF

Загружено:

Akshat joshiАвторское право:

Доступные форматы

PAPER – 5 : ADVANCED ACCOUNTING

Question No. 1 is compulsory.

Answer any five questions from the remaining six questions.

Wherever necessary, suitable assumption(s) may be made and disclosed by

way of note forming part of the answer.

Working Notes should form part of the respective answers.

Question 1

Answer the following questions:

(a) With reference to AS 4 "Contingencies and events occurring after the balance sheet

date", state whether the following events will be treated as contingencies, adjusting

events or non-adjusting events occurring after balance sheet date in case of a company

which follows April to March as its financial year.

(i) A major fire has damaged the assets in a factory on 5 th April, 5 days after the year

end. However, the assets are fully insured and the books have not been approved

by the Directors.

(ii) A suit against the company's advertisement was filed by a party on 10 th April, 10

days after the year end claiming damages of ` 20 lakhs.

(iii) It sends a proposal to purchase an immovable property for ` 30 lakhs in March.

The book value of the property is ` 20 lakhs as on year end date. However, the

deed was registered as on 15 th April.

(iv) The terms and conditions for acquisition of business of another company have been

decided by March end. But the financial resources were arranged in April and

amount invested was ` 40 lakhs.

(v) Theft of cash of ` 2 lakhs by the cashier on 31 st March but was detected the next

day after the financial statements have been approved by the Directo rs.

(b) AB Ltd. is in the process of finalizing its account for the year ended 31 st March, 2015.

The company seeks your advice on the following:

(i) The company's sale tax assessment for assessment year 2012-13 has been

completed on 14th February, 2015 with a demand of ` 5.40 crore. The company

paid the entire due under protest without prejudice to its right of appeal. The

company files its appeal before the appellate authority wherein the grounds of

appeal cover tax on additions made in the assessment order for a sum of ` 3.70

crore.

PS: The word ‘purchase’ should be read as ‘sell’.

© The Institute of Chartered Accountants of India

2 INTERMEDIATE (IPC) EXAMINATION: MAY, 2016

(ii) The company has entered into a wage agreement in May 2015 whereby the labour

union has accepted a revision in wage from June 2014. The agreement provides

that the hike till May 2015 will not be paid to the employees but will be settled to

them at the time of retirement. The company agrees to deposit the arrears in

Government Bonds by September 2015.

(c) ABC Ltd. purchased fixed assets for ` 50,00,000. Government grant received towards it

is 20%. Residual value is ` 8,00,000 and useful life is 8 years. Assumed depreciation is

on the basis of Straight Line Method, asset is shown in the Balance Sheet net of grant.

After one year, grant becomes refundable to the extent of ` 7,00,000 due to non-

compliance of certain conditions.

Pass Journal entries for 2nd year in the books of the company.

(d) Power Track Ltd. purchased a plant for US$ 50,000 on 31 st October, 2015 payable after

6 months. The company entered into a forward contract for 6 months @ ` 64.25 per

Dollar. On 31st October, 2015, the exchange rate was ` 61.50 per Dollar.

You are required to recognise the profit or loss on forward contract in the books of the

company for the year ended 31 st March, 2016. ( 4 × 5 = 20 Marks)

Answer

(a) According to AS 4 on ‗Contingencies and Events Occurring after the Balance Sheet

Date‘, adjustments to assets and liabilities are required for events occurring after the

balance sheet date that provide additional information materially affecting the

determination of the amounts relating to conditions existing at the balance sheet date.

However, adjustments to assets and liabilities are not appropriate for events occurring

after the balance sheet date, if such events do not relate to conditions existing at the

balance sheet date. ―Contingencies‖ used in the Standard is restricted to conditions or

situations at the balance sheet date, the financial effect of which is to be determined by

future events which may or may not occur.

(i) Fire has occurred after the balance sheet date and also the loss is totally insured.

Therefore, the event becomes immaterial and the event is non-adjusting in nature.

(ii) The contingency is restricted to conditions existing at the balance sheet date.

However, in the given case, suit was filed against the company‘s advertisement by a

party on 10 th April for amount of ` 20 lakhs. Therefore, it does not fit into the

definition of a contingency and hence is a non-adjusting event.

(iii) In the given case, proposal for deal of immovable property was sent before the

closure of the books of accounts. This is a non-adjusting event as only the

proposal was sent and no agreement was effected in the month of March i.e. before

the balance sheet date.

(iv) As the term and conditions of acquisition of business of another company had been

decided by the end of March, acquisition of business is an adjusting event

© The Institute of Chartered Accountants of India

PAPER – 5 : ADVANCED ACCOUNTING 3

occurring after the balance sheet date. Adjustment to assets and liabilities is

required since the event affects the determination and the condition of the amount s

stated in the financial statements for the financial year ended on 31st March.

(v) Since the financial statements have been approved before detection of theft by the

cashier of ` 2,00,000, it becomes a non-adjusting event and no disclosure is

required in the report of the Approving Authority.

(b) (i) Since the company is not appealing against the addition of ` 1.70 crore (` 5.40

crore less ` 3.70 crore), therefore, the same should be provided/ expensed off in its

accounts for the year ended on 31 st March, 2015. However, the amount paid under

protest can be kept under the heading ‗Long-term Loans & Advances / Short-term

Loans and Advances‘ as the case may be alongwith disclosure as contingent

liability of ` 3.70 crore.

(ii) The arrears for the period from June, 2014 to March, 2015 are required to be

provided for in the accounts of the company for the year ended on 31 st March, 2015

assuming that negotiations for hike in wages had already started in the year 2014 -

15 i.e. before the balance sheet date though the agreement was entered in May,

2015.

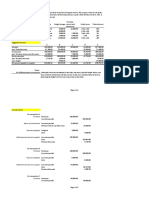

(c) Journal Entries in the books of ABC Ltd. for 2 nd year

Year Particulars ` in lakhs ` in lakhs

(Dr.) (Cr.)

2ndyear Fixed Asset Account Dr. 7

To Bank Account 7

(Being government grant on asset partly

refunded which increased the cost of fixed

asset)

Depreciation Account (W.N.) Dr. 5

To Fixed Asset Account 5

(Being depreciation charged on SLM on

revised value of fixed asset prospectively)

Profit & Loss Account Dr. 5

To Depreciation Account 5

(Being depreciation transferred to Profit and

Loss Account at the end of year 2)

Working Note:

Depreciation for year 2

` in lakhs

Cost of the Asset 50

© The Institute of Chartered Accountants of India

4 INTERMEDIATE (IPC) EXAMINATION: MAY, 2016

Less: Government grant received (10)

40

40 8

Less: Depreciation for the first year 4

8

Book value at the end of 1 st year 36

Add: Government grant refundable in 2 nd year 7

43

43 8

Depreciation for the second year 5

7

(d) Calculation of profit or loss to be recognized in the books of Power Track Lim ited

`

Forward contract rate 64.25

Less: Spot rate (61.50)

Loss on forward contract 2.75

Forward Contract Amount $ 50,000

Total loss on entering into forward contract = ($ 50,000 × ` 2.75) `1,37,500

Contract period 6 months

Loss for the period 1st November, 2015 to 31st March, 2016 i.e. 5 months

5 months falling in the year 2015-2016

Hence, Loss for 5 months will be ` 1,37,500

5

= ` 1,14,583

6

Thus, the loss amounting to ` 1,14,583 for the period is to be recognized in the year

ended 31st March, 2016.

Question 2

P and Q are partners of P & Co., sharing Profit and Losses in the ratio of 3:1 and Q and R are

partners of R & Co., sharing Profits and Losses in the ratio of 2:1. On 31 st March, 2015, they

decide to amalgamate and form a new firm M/s PQR & Co. wherein P, Q and R would be

partners sharing profits and losses in the ratio of 3:2:1. The Balance Sheets of two firms on

the above date are as under:

Liabilities P & Co. R & Co. Assets P & Co. R & Co.

(`) (`) (`) (`)

Capitals: Fixed assets:

P 2,50,000 - Building 50,000 60,000

© The Institute of Chartered Accountants of India

PAPER – 5 : ADVANCED ACCOUNTING 5

Q 1,80,000 2,20,000 Plant & Machinery 1,60,000 1,70,000

R 1,20,000 Office Equipment 50,000 46,000

Reserves 60,000 1,50,000 Current assets:

Sundry Creditors 1,30,000 1,36,000 Stock-in-trade 1,20,000 1,40,000

Due to P & Co. - 1,00,000 Sundry Debtors 1,60,000 2,00,000

Bank Overdraft 80,000 - Bank Balance 40,000 1,00,000

Cash in hand 20,000 10,000

Due from R& Co. 1,00,000 -

7,00,000 7,26,000 7,00,000 7,26,000

The amalgamated firm took over the business on the following terms:

(a) Building of P & Co. was valued at ` 1,50,000.

(b) Plant & Machinery of P & Co. was valued at ` 2,75,000 and that of R & Co. at

` 2,50,000.

(c) All stock in trade is to be appreciated by 20%.

(d) Goodwill of P & Co. was valued at ` 1,20,000 and of R & Co. at ` 60,000, but the same

will not appear in the books of PQR & Co.

(e) Partners of new firm will bring the necessary cash to pay other partners to adjust their

capitals according to the profit sharing ratio.

(f) Provisions for doubtful debts has to be carried forward at ` 15,000 in respect of debtors

of P & Co. and ` 30,000 in respect of debtors of R & Co.

You are required to prepare the Balance Sheet of new firm and capital accounts of the

partners in the books of old firms. (16 Marks)

Answer

Balance Sheet of M/s PQR & Co. as at 31st March, 2015

Liabilities ` Assets `

Capitals: Building

P 6,41,000 (1,50,000 + 60,000) 2,10,000

Q 4,27,333 Plant & machinery

(2,75,000+2,50,000) 5,25,000

R 2,13,667 12,82,000 Office equipment

Sundry creditors (50,000+46,000) 96,000

(1,30,000+1,36,000) 2,66,000 Stock-in-trade

Bank overdraft 80,000 (1,44,000+1,68,000) 3,12,000

© The Institute of Chartered Accountants of India

6 INTERMEDIATE (IPC) EXAMINATION: MAY, 2016

Sundry debtors

(1,60,000+2,00,000) 3,60,000

Less: Provision for

doubtful debts (45,000) 3,15,000

(15,000 +30,000)

Bank balance

(40,000+1,00,000) 1,40,000

Cash in hand 30,000

16,28,000 16,28,000

In the books of P & Co.

Partners’ Capital Accounts

Particulars P Q Particulars P Q

` ` ` `

To Capital A/cs – 5,53,000 2,81,000 By Balance b/d 2,50,000 1,80,000

M/s PQR & Co. By Reserve (3:1) 45,000 15,000

By Profit on

Realisation

A/c (W.N.3) 2,58,000 86,000

5,53,000 2,81,000 5,53,000 2,81,000

In the books of R & Co.

Partners’ Capital Accounts

Particulars Q R Particulars Q R

` ` ` ` `

To Capital A/cs – 4,12,000 2,16,000 By Balance b/d 2,20,000 1,20,000

M/s PQR & Co. By Reserve (2:1) 1,00,000 50,000

By Profit on

Realisation 92,000 46,000

(W.N.4)

4,12,000 2,16,000 4,12,000 2,16,000

` 20,000+ 10,000+ 1,78,000+ 27,667– 2,05,667= ` 30,000.

© The Institute of Chartered Accountants of India

PAPER – 5 : ADVANCED ACCOUNTING 7

Working Notes:

1. Computation of purchase considerations

P & Co. R & Co.

` `

Assets:

Goodwill 1,20,000 60,000

Building 1,50,000 60,000

Plant & machinery 2,75,000 2,50,000

Office equipment 50,000 46,000

Stock-in-trade 1,44,000 1,68,000

Sundry debtors 1,60,000 2,00,000

Bank balance 40,000 1,00,000

Cash in hand 20,000 10,000

Due from R & Co. 1,00,000 -

(A) 10,59,000 8,94,000

Liabilities:

Creditors 1,30,000 1,36,000

Provision for doubtful debts 15,000 30,000

Due to P & Co. - 1,00,000

Bank overdraft 80,000 -

(B) 2,25,000 2,66,000

Purchase consideration (A-B) 8,34,000 6,28,000

2. Computation of Capital Adjustments

P Q R Total

` ` ` `

Balance transferred from P & Co. 5,53,000 2,81,000 8,34,000

Balance transferred from R & Co. 4,12,000 2,16,000 6,28,000

5,53,000 6,93,000 2,16,000 14,62,000

Less: Goodwill written off in the

ratio of 3:2:1 (90,000) (60,000) (30,000) (1,80,000)

Existing capital 4,63,000 6,33,000 1,86,000 12,82,000

Proportionate capital (3:2:1) 6,41,000 4,27,333 2,13,667 12,82,000

Amount to be brought in (paid off) 1,78,000 (2,05,667) 27,667

© The Institute of Chartered Accountants of India

8 INTERMEDIATE (IPC) EXAMINATION: MAY, 2016

3. In the books of P & Co.

Realisation Account

` `

To Building 50,000 By Creditors 1,30,000

To Plant & machinery 1,60,000 By Bank overdraft 80,000

To Office equipment 50,000 By M/s PQR & Co. 8,34,000

To Stock-in-trade 1,20,000 (purchase consideration)

To Sundry debtors 1,60,000 (W.N.1)

To Bank balance 40,000

To Cash in hand 20,000

To Due from R & Co. 1,00,000

To Partners‘ capital A/cs

P 2,58,000

Q 86,000 3,44,000

10,44,000 10,44,000

4. In the books of R & Co.

Realisation Account

` `

To Building 60,000 By Creditors 1,36,000

To Plant & machinery 1,70,000 By Due to P & Co. 1,00,000

To Office equipment 46,000 By M/s PQR & Co. 6,28,000

To Stock-in-trade 1,40,000 (purchase consideration)

To Sundry debtors 2,00,000 (W.N.1)

To Bank balance 1,00,000

To Cash in hand 10,000

To Partners‘ capital A/cs

Q 92,000

R 46,000 1,38,000

8,64,000 8,64,000

© The Institute of Chartered Accountants of India

PAPER – 5 : ADVANCED ACCOUNTING 9

Question 3

(a) Following is the summarized Balance Sheet of Complicated Ltd. as on 31 st March, 2016 :

Liabilities Amount

(`)

Equity shares of ` 10 each fully paid up 12,50,000

Bonus shares 1,00,000

Share option outstanding Account 4,00,000

Revenue Reserve 15,00,000

Securities Premium 2,50,000

Profit & Loss Account 1,25,000

Capital Reserve 1,00,000

Revaluation Reserve 1,00,000

Unpaid dividends 1,00,000

12% Debentures (Secured) 18,75,000

Advance from related parties (Unsecured) 10,00,000

Current maturities of long term borrowings 16,50,000

Application money received for allotment due for refund 2,00,000

86,50,000

Fixed Assets 46,50,000

Current Assets 40,00,000

86,50,000

The Company wants to buy back 25000 equity shares of ` 10 each, on 1 st April, 2016 at

` 20 per share. Buy back of shares is duly authorised by its Articles and necessary

resolution has been passed by the Company towards this. The payment for buy back of

shares will be made by the Company out of sufficient bank balance available shown as

part of Current Assets.

Comment with your calculations, whether buy back of shares by the Company is within the

provisions of the Companies Act, 2013. If yes, pass necessary journal entries towards buy

back of shares and prepare the Balance Sheet after buy back of shares. (12 Marks)

(b) Mention the ways by which Redeemable Debentures may be redeemed under the

Companies Act, 2013. (4 Marks)

© The Institute of Chartered Accountants of India

10 INTERMEDIATE (IPC) EXAMINATION: MAY, 2016

Answer

(a) Determination of Buy back of maximum no. of shares as per the Companies

Act, 2013

1. Shares Outstanding Test

Particulars (Shares)

Number of shares outstanding (`12,50,000 + `1,00,000)/ ` 10 1,35,000

25% of the shares outstanding 33,750

2. Resources Test: Maximum permitted limit 25% of Equity paid up capital + Free

Reserves

Particulars

Paid up capital (`) ` 13,50,000

Free reserves (`) (15,00,000 + 2,50,000 + 1,25,000) ` 18,75,000

Shareholders‘ funds (`) ` 32,25,000

25% of Shareholders fund (`) ` 8,06,250

Buy back price per share ` 20

Number of shares that can be bought back (shares) 40,312

Actual Number of shares for buy back 25,000

3. Debt Equity Ratio Test: Loans cannot be in excess of twice the Equity Funds

post Buy Back

Particulars `

(a) Loan funds (`) (18,75,000+10,00,000+16,50,000 + 48,25,000

1,00,000 + 2,00,000)

(b) Minimum equity to be maintained after buy back in the ratio 24,12,500

of 2:1 (`) (a/2)

(c) Present equity/shareholders fund (`) 32,25,000

(d) Future equity/shareholders fund (`) (see W.N.) (32,25,000

– 2,70,833) 29,54,167

(e) Maximum permitted buy back of Equity (`) [(d) – (b)] 5,41,667

As per Section 68 (2) (d) of the Companies Act 2013, the ratio of debt owed by the company should not be more than

twice the capital and its free reserves after such buy-back. Further under Section 69 (1), on buy-back of shares out of

free reserves a sum equal to the nominal value of the share bought back shall be transferred to Capital Redemption

Reserve (CRR). As per section 69 (2) utilization of CRR is restricted to fully paying up unissued shares of the Company

which are to be issued as fully paid-up bonus shares only. It means CRR is not available for distribution as dividend.

Hence, CRR is not a free reserve. Therefore, for calculation of future equity i.e. share capital and free reserves, amount

transferred to CRR on buy-back has to be excluded from the present equity.

© The Institute of Chartered Accountants of India

PAPER – 5 : ADVANCED ACCOUNTING 11

(f) Maximum number of shares that can be bought back @ ` 27,083

20 per share Shares

(g) Actual Buy Back Proposed Shares 25,000

Summary statement determining the maximum number of shares to be bought

back

Particulars Number of

shares

Shares Outstanding Test 33,750

Resources Test 40,312

Debt Equity Ratio Test 27,083

Maximum number of shares that can be bought back [least of 27,083

the above]

Company qualifies all tests for buy-back of shares and conclusion is that it can buy

maximum 27,083 shares on 1 st April, 2016.

However, company wants to buy-back only 25,000 equity shares @ ` 20. Therefore,

buy-back of 25,000 shares, as desired by the company is within the provisions of the

Companies Act, 2013.

Journal Entries for buy-back of shares

Debit (`) Credit (`)

(a) Equity shares buy-back account Dr. 5,00,000

To Bank account 5,00,000

(Being buy back of 25,000 equity shares of ` 10

each @ ` 20 per share)

(b) Equity share capital account Dr. 2,50,000

Securities premium account Dr. 2,50,000

To Equity shares buy-back account 5,00,000

(Being cancellation of shares bought back)

(c) Revenue reserve account Dr. 2,50,000

To Capital redemption reserve account 2,50,000

(Being transfer of free reserves to capital

redemption reserve to the extent of nominal

value of capital bought back through free

reserves)

© The Institute of Chartered Accountants of India

12 INTERMEDIATE (IPC) EXAMINATION: MAY, 2016

Balance Sheet of Complicated Ltd.

as on 1st April, 2016

Particulars Note Amount

No `

EQUITY AND LIABILITIES

1 Shareholders' funds

(a) Share capital 1 11,00,000

(b) Reserves and Surplus 2 22,25,000

2 Non-current liabilities

(a) Long-term borrowings 3 28,75,000

3 Current liabilities

(a) Other current liabilities 4 19,50,000

Total 81,50,000

ASSETS

1 Non-current assets

(a) Fixed assets 46,50,000

2 Current assets (40,00,000-5,00,000) 35,00,000

Total 81,50,000

Notes to Accounts

` `

1. Share Capital

Equity share capital

1,10,000 Equity shares of `10 each 11,00,000

2. Reserves and Surplus

Profit and Loss A/c 1,25,000

Revenue reserves 15,00,000

Less: Transfer to CRR (2,50,000) 12,50,000

Securities premium 2,50,000

Less: Utilization for share buy-back (2,50,000) -

Share Option Outstanding Account 4,00,000

Capital Reserve 1,00,000

Revaluation Reserve 1,00,000

© The Institute of Chartered Accountants of India

PAPER – 5 : ADVANCED ACCOUNTING 13

Capital Redemption Reserve 2,50,000 22,25,000

3. Long-term borrowings

Secured

12% Debentures 18,75,000

Unsecured loans 10,00,000 28,75,000

4. Other Current Liabilities

Current maturities of long term borrowings 16,50,000

Unpaid dividend 1,00,000

Application money received for allotment due

for refund 2,00,000 19,50,000

Working Note:

Amount transferred to CRR and maximum equity to be bought back will be calculated by

simultaneous equation method.

Suppose amount transferred to CRR account is ‗x‘ and maximum permitted buy -back of

equity is ‗y‘.

Then

(` 32,25,000 – x) – ` 24,12,500 = y (1)

y

10 = x

20

Or 2x = y (2)

by solving the above equation we get x = ` 2,70,833 and y = ` 5,41,667

(b) Redemption of debentures must be done according to the terms of issue of debentures

and any deviation will be treated as a default by the company.

Redemption by paying off the debt on account of debentures issued can be done in one

of the following four methods viz:

(a) By payment in lump sum at the end of a specified period of time;

(b) By payment in annual installments;

(c) By purchasing its own debentures in the open market.

(d) By conversion into shares in full or in part depending on the terms of issue.

© The Institute of Chartered Accountants of India

14 INTERMEDIATE (IPC) EXAMINATION: MAY, 2016

Question 4

From the following particulars, prepare a Statement of Affairs and the Deficiency Account for

submission to official liquidator of Sun City Development Ltd., which went into liquidation on

31st March, 2016:

Liabilities (`) (`)

6,00,000 Equity shares of ` 10 each, ` 8 paid-up 48,00,000

6% 2,00,000 Preference shares of ` 10 each 20,00,000

Less: Calls in arrear 1,00,000 19,00,000

5% Debentures having a floating charge on the assets (interest

20,00,000

paid up to 30th September, 2015)

Mortgage on Land & Building 16,00,000

Trade Payable 53,10,000

Wage Payable 4,00,000

Secretary's Salary Payable @ ` 10,000 p.m. 60,000

Managing Director's Salary Payable @ ` 30,000 p.m. 1,20,000

Assets Estimated to produce (`) Book value(`)

Land & Building 26,00,000 24,00,000

Plant & Machinery 26,00,000 40,00,000

Tools & Equipments 80,000 4,00,000

Patents & Copyrights 6,00,000 10,00,000

Inventory 14,80,000 17,40,000

Investments in the hand of a Bank for an 34,00,000 36,00,000

Overdraft of ` 38,00,000

Trade Receivables 12,00,000 18,00,000

On 31st March, 2011 the Balance Sheet of the Company showed a General Reserve of

` 8,00,000 accompanied by a debit balance of ` 5,00,000 in the Profit & Loss Account.

In 2012, the Company made a profit of ` 8,00,000 and declared a dividend of 10% on Equity

Shares.

The Company suffered a total loss of ` 21,80,000 besides loss of stock due to fire to the tune

of ` 8,00,000 during financial years ending March 2013, 2014 and 2015. For the financial year

ended 31st March, 2016, accounts were not made.

The cost of winding-up is expected to be ` 3,00,000. (16 Marks)

© The Institute of Chartered Accountants of India

PAPER – 5 : ADVANCED ACCOUNTING 15

Answer

In the matter of the Companies Act and in the matter of Sun City Development Ltd. (in winding

up)

Statement of Affairs on 31st March, 2016, the date of winding up

Estimated realisable value

Assets `

Assets not specifically pledged (as per list A)

Trade receivables 12,00,000

Inventory 14,80,000

Plant and Machinery 26,00,000

Tools and Equipment 80,000

Patents and copyrights 6,00,000

Unpaid calls 1,00,000

60,60,000

Assets specifically pledged (as per list B)

Estimated Due to Deficiency Surplus

Realisation Secured Ranking as carried to the

Creditors Unsecured last column

Creditors

` ` ` ` `

Investments 34,00,000 38,00,000 4,00,000

Land & Building 26,00,000 16,00,000 10,00,000

60,00,000 54,00,000

Estimated surplus from assets specifically pledged 10,00,000

Estimated total assets available for preferential creditors, 70,60,000

debenture holders and unsecured creditors

Summary of Gross Assets:

Gross realisable value of -

assets specifically charged 60,00,000

others assets 60,60,000

1,20,60,000

Estimated total assets available for preferential creditors,

debenture holders, bank overdraft and unsecured

creditors brought forward 70,60,000

© The Institute of Chartered Accountants of India

16 INTERMEDIATE (IPC) EXAMINATION: MAY, 2016

Gross Liabilities Liabilities

` ` `

50,00,000 (34,00,000 Secured creditors (as per List B) to the

+16,00,000) extent to which claims are estimated to be

covered by assets specifically pledged

4,20,000* Preferential creditors as per list C 4,20,000*

Estimated balance of assets available for

Debenture holders, Bank & unsecured 66,40,000

creditors

20,50,000 (20,00,000 Debenture holders secured by a floating

+ 50,000) charge as per list D (20,50,000)

Surplus as regards debenture holders 45,90,000

Unsecured creditors as per list E

Estimated unsecured balance of claim of

creditors partly secured on

Specific assets 4,00,000

Trade payable 53,10,000

58,70,000 Outstanding expenses (40,000 + 1,60,000 58,70,000

1,20,000)

Estimated deficiency as regards creditors

being the difference between gross liabilities

- and gross assets 12,80,000

1,33,40,000

Issued & Called up Capital:

6,00,000 Equity shares or ` 10 each, `8 48,00,000

paid

6% 2,00,000 Preference shares of ` 10

each fully called 20,00,000 68,00,000

Estimated Deficiency as regards members

as per list H 80,80,000

*Note

(i) The Secretary of a Company, being an officer, is to be included within the definition of

‗employee‘ for the purpose of computing preferential creditors. The preferential creditor

for secretary‘s salary has been restricted to 4 months salary but maximum pay shall not

exceed ` 20,000 per claimant as per the requirement of the law.

© The Institute of Chartered Accountants of India

PAPER – 5 : ADVANCED ACCOUNTING 17

(ii) The above is subject to cost of winding up estimated as ` 3,00,000 and to any surplus /

deficiency on realisation of assets.

(iii) There are 6,00,000 shares unpaid @ ` 2 per share liable to be called up.

List H - Deficiency Account

A. Item contributing to Deficiency `

1. Excess of capital & liabilities over assets on 1-4-2011 NIL

2. Net dividend & bonuses during the period (4,80,000 + 1,14,000) 5,94,000

3. Net trading losses after charging depreciation, taxation, interest

on debentures, etc. during the same period

(` 21,80,000 + ` 26,26,000) 48,06,000

4. Losses other than trading losses written off or for which provision

has been made in the books during the same period - stock loss. 8,00,000

5. Estimated losses now written off or for which provision

has been made for the purpose of preparing the statement:

`

Plant and Machinery 14,00,000

Tools and equipments 3,20,000

Patents and copyrights 4,00,000

Inventories 2,60,000

Investments 2,00,000

Debtors 6,00,000 31,80,000

6. Other items contributing to deficiency NIL

93,80,000

B. Items reducing Deficiency

7. Excess of assets over capital and liabilities on 1st April, 2011

(8,00,000 – 5,00,000) 3,00,000

8. Net trading profit during the period 8,00,000

9. Profit & Incomes other than trading profit during the same period -

10. Other items - Profit expected on Land & Building (26,00,000 - 24,00,000) 2,00,000

13,00,000

Deficiency as shown by the Statement of Affairs (A) - (B) 80,80,000

Working Notes:

(1) Trial Balance to ascertain the amount of loss for the year ended 31 st March, 2016

Dr. Cr.

` `

Land & Building 24,00,000

© The Institute of Chartered Accountants of India

18 INTERMEDIATE (IPC) EXAMINATION: MAY, 2016

Plant and Machinery 40,00,000

Tools and Equipments 4,00,000

Patents and Copyrights 10,00,000

Inventories 17,40,000

Investment 36,00,000

Trade Receivables 18,00,000

Equity Capital 48,00,000

6% Preference share capital 19,00,000

5% Debentures 20,00,000

Interest Outstanding 50,000

Mortgage on Land & Building 16,00,000

Trade Creditors 53,10,000

Owing for Wages 4,00,000

Secretary‘s Salary 60,000

Managing Director‘s Salary 1,20,000

Bank Overdraft 38,00,000

Profit & Loss Account on 1.4.2015 24,74,000

1,74,14,000 2,00,40,000

Loss for the year (balancing figure) 26,26,000 -

2,00,40,000 2,00,40,000

2. Reserve & Surplus Account

` `

1.4.2011 To Profit & Loss 5,00,000 1.4.2011 By Balance 8,00,000

A/c (Transfer) b/d

31.3.2012 To Dividend- Equity 4,80,000 31.3.2012 By Profit for 8,00,000

Preference 1,14,000 the year

1.4.12 to To Profit & Loss 21,80,000 31.3.2015 By Balance 24,74,000

31.3.15 A/c (Loss) c/d

To Loss of Stock 8,00,000

40,74,000 40,74,000

© The Institute of Chartered Accountants of India

PAPER – 5 : ADVANCED ACCOUNTING 19

Question 5

(a) From the following information of Wealth Bank Limited, Prepare Profit and Loss Account

for the year ended 31 st March, 2016:

Particulars ` in lakhs Particulars ` in lakhs

Interest on Cash Credit 364 Interest paid on Recurring 17

Deposits

Interest on Overdraft 150 Interest paid on Savings Bank 12

Deposits

Interest on Term Loans 308 Auditor’s Fees and 24

Allowances

Income on Investments 168 Directors’ Fees and 50

Allowance

Interest on Balance with RBI 30 Advertisement 36

Commission on remittances 15 Salaries, allowances and 248

and transfer bonus to employees

Commission on Letters of 24 Payment to Provident Fund 56

Credit

Commission on Government 16 Printing & Stationery 28

Business

Profit on Sale of Land & 5 Repairs & Maintenance 10

Building

Loss on exchange 10 Postage, courier & telephones 16

transactions

Interest paid on Fixed 25

Deposits

Other Information:

` in lakhs

Earned Collected

(i) Interest on NPA is as follows:

Cash Credit 164 80

Term Loans 90 20

Overdraft 150 50

(ii) Classification of Non-performing Advances:

Standard 60

Sub-standard-fully secured 22

© The Institute of Chartered Accountants of India

20 INTERMEDIATE (IPC) EXAMINATION: MAY, 2016

Doubtful assets-fully unsecured 40

Doubtful assets covered fully by security:

Less than 1 year 6

More than 1 year upto 3 years 3

More than 3 years 2

Loss Assets 38

(iii) Investments

Bank should not keep more than 25% of its investment as ‘held-for-maturity'

investment; the market value of its rest 75% investment is `3,95,00,000 as on

31.03.2016.

(iv) Provide 35% of the profits towards provision for taxation.

(v) Transfer 20% of the profit to Statutory Reserves.

(b) Write short notes on the following principles and terms of Insurance Business:

(i) Principle of Indemnity

(ii) Insurable Interest

(iii) Principle of UBERRIMAE FIDEI

(iv) Catastrophic Loss (10 + 6 = 16 Marks)

Answer

(a) Wealth Bank Limited

Profit and Loss Account

For the year ended 31st March, 2016

` in lakhs

Particulars Schedule Year ended

31-3-2016

I Income

Interest earned 13 766

Other income 14 50

816

II Expenditure

Interest expended 15 54

Operating expenses 16 468

Provisions and Contingencies (Refer W.N.) 158.96

680.96

© The Institute of Chartered Accountants of India

PAPER – 5 : ADVANCED ACCOUNTING 21

III Profit/Loss

Net Profit/(Loss) for the year 135.04

Net Profit/(Loss) brought forward Nil

135.04

IV Appropriations:

Transfer to Statutory reserve (20% of the profits) 27.01

Balance carried to the balance sheet 108.03

Total 135.04

Schedule 13 - Interest Earned

Year ended 31-3-2016

(` in lakhs)

I Interest/discount on advances/bills

Interest on cash credit (364-84) 280

Interest on overdraft (150-100) 50

Interest on term loans (308-70) 238 568

II Income on investments 168

III Interest on Balance with RBI 30

766

Interest on NPA is recognized on cash basis, hence difference of accrued interest not

received have been reduced from the total accrued interest.

Schedule 14 - Other Income

Year ended 31-3-2016

(` in lakhs)

I Commission, Exchange and Brokerage:

Commission on remittances and transfer 15

Commission on letter of credit 24

Commission on Government business 16 55

II Profit on sale of Land and Building 5

III Loss on Exchange Transactions (10)

50

© The Institute of Chartered Accountants of India

22 INTERMEDIATE (IPC) EXAMINATION: MAY, 2016

Schedule 15 - Interest Expended

Year ended 31-3-2016

(` in lakhs)

I Interest on Deposits

Fixed deposits 25

Recurring deposits 17

Saving bank deposits 12 54

Schedule 16 - Operating Expenses

Year Ended 31-3-2016

(` in lakhs)

I Payment to and provision for employees

Salaries, allowances and bonus 248

Provident Fund Contribution 56 304

II Printing and Stationery 28

III Advertisement and publicity 36

IV Directors‘ fees, allowances and expenses 50

V Auditors‘ fees and expenses 24

VI Postage, telegrams, telephones etc. 16

VII Repairs and maintenance 10

468

Working Note:

Provisions and contingencies (` in lakhs)

Provision for Advances:

Standard 60 × 0.40% 0.24

Sub-standard 22 × 15% 3.3

Doubtful not covered by security 40× 100% 40

Doubtful covered by security:

Less than 1 year 6 x 25% 1.5 4.7

More than 1 year but less 3 x 40% 1.2

than 3 years 2 x 100% 2.0

More than 3 years

© The Institute of Chartered Accountants of India

PAPER – 5 : ADVANCED ACCOUNTING 23

Loss Assets (38 × 100%) 38

86.24

Provision for tax 35% of (Total Income –

Total Expenditure)

35% of [816-(54+468+86.24)]

35% of [816 - 608.24]

35% of 207.76 72.72

158.96

Notes :

1 As per RBI norms, every banking company incorporated in India is required to

transfer at least 25% of its profit to the statutory reserve. However, in the above

solution, transfer @ 20% of current profit has been done strictly on the basis of the

information given in the question.

2. Cost of investment is missing in the question. Therefore, it is assumed that cost of

75% of the investments, other than the investments held for maturity, is same as its

market value. Hence no diminution in the value is provided for in the given solution.

(b) (i) Principle of indemnity: Insurance is a contract of indemnity. The insurer is called

indemnifier and the insured is the indemnified. In a contract of indemnity, only those

who suffer loss are compensated to the extent of actual loss suffered by them. One

cannot make profit by insuring his risks.

(ii) Insurable interest: All cannot enter into contract of insurance. For example, A

cannot insure the life of B who is a total stranger. But if B. happens to be his wife or

his debtor or business manager, A has insurable interest i.e. vested interest and

therefore he can insure the life of B. For every type of policy insurable interest is

insisted upon. In the absence of such interest the contract will amount to a wagering

contract.

(iii) Principle of UBERRIMAE FIDEI: Under ordinary law of contract there is no positive

duty to tell the whole truth in relation to the subject-matter of the contract. There is

only the negative obligation to tell nothing but the truth. In a contract of insurance,

however there is an implied condition that each party must disclose every material

fact known to him. All contracts of insurance are contracts of uberrima fidei, i.e.,

contracts of utmost good faith. This is because the assessment of the risk and the

determination of the premium by the insurer depend on the full and frank disclosure

of all material facts in the proposal form.

(iv) Catastrophic Loss: A loss (or related losses) which is unbearable i.e. it causes

severe consequences such as bankruptcy to a family, organization, or insurer.

© The Institute of Chartered Accountants of India

24 INTERMEDIATE (IPC) EXAMINATION: MAY, 2016

Question 6

(a) There is transfer/sale among the three departments as below:

Department X sells goods to Department Y at a profit of 25% on cost and to Department

Z at 20% profit on cost.

Department Y sells goods to X and Z at a profit of 15% and 20% on sales respectively.

Department Z charges 20% and 25% profit on cost to Departments X and Y respectively.

Department Managers are entitled to 10% commission on net profit subject to urealised

profit on departmental sales being eliminated.

Departmental profits after charging Managers' commission, but before adjustment of

unrealised profit are as under:

`

Department X 1,80,000

Department Y 1,35,000

Department Z 90,000

Stocks lying at different Departments at the end of the year are as under:

Dept. X Dept. Y Dept. Z

Transfer from Department X - 75,000 57,000

Transfer from Department Y 70,000 - 60,000

Transfer from Department Z 30,000 25,000 -

Find out the correct departmental profits after charging Managers' commission.

(b) M/s ABC & Co. has head office at New York (U.S.A.) and branch in Bangalore (India).

Bangalore branch is an integral foreign operation of ABC & Co.

Bangalore branch furnishes you with its trial balance as on 31 st March, 2015 and the

additional information given thereafter:

Dr. Cr.

(Rupees in thousands)

Stock on 1st April, 2014 300

Purchases and Sales 800 1,200

Sundry Debtors & Creditors 400 300

Bills of Exchange 120 240

Wages & Salaries 560 -

Rent, Rates & Taxes 360 -

© The Institute of Chartered Accountants of India

PAPER – 5 : ADVANCED ACCOUNTING 25

Sundry Charges 160 -

Computers 240 -

Bank Balance 420 -

New York Office A/c - 1,620

3,360 3,360

Additional Information:

(a) Computers were acquired from a remittance of US $ 6,000 received from New York

head office and paid to the suppliers. Depreciate computers at 60% for the year.

(b) Unsold stock of Bangalore branch was worth ` 4,20,000 on 31st March, 2015.

(c) The rates of exchange may be taken as follows:

- On 01.04.2014 @ ` 55 per US $

- On 31.03.2015 @ ` 60 per US $

- Average exchange rate for the year @ ` 58 per US $

- Conversion in $ shall be made up to two decimal accuracy.

You are asked to prepare in US dollars the revenue statement for the year ended

31st March, 2015 and the balance sheet as on that date of Bangalore branch as would

appear in the books of New York head office of ABC & Co. You are informed that

Bangalore branch account showed a debit balance of US $ 29845.35 on 31.3.2015 in

New York books and there were no items pending reconciliation. (8 + 8= 16 Marks)

Answer

(a) Calculation of Correct Profit

Department X Department Y Department Z

` ` `

Profit after charging managers‘ 1,80,000 1,35,000 90,000

commission

Add back : Managers‘ commission (1/9) 20,000 15,000 10,000

2,00,000 1,50,000 1,00,000

Less: Unrealized profit on stock (W.N.) (24,500) (22,500) (10,000)

Profit before Manager‘s commission 1,75,500 1,27,500 90,000

Less : Commission for Department

Manager @ 10% (17,550) (12,750) (9,000)

Departmental Profits after manager‘s

commission 1,57,950 1,14,750 81,000

© The Institute of Chartered Accountants of India

26 INTERMEDIATE (IPC) EXAMINATION: MAY, 2016

Working Note:

Stock lying with

Dept. X Dept. Y Dept. Z Total

` ` ` `

Unrealized

Profit of:

Department X 1/5×75,000=15,000 20/120×57,000=9,500 24,500

Department Y 0.15×70,000=10,500 0.20×60,000=12,000 22,500

Department Z 20/120×30,000=5,000 25/125×25,000=5,000 10,000

(b) M/s ABC & Co.

Bangalore Branch Trial Balance in (US $)

as on 31st March, 2015

Conversion Dr. Cr.

rate per US $ US $ US $

(`)

Stock on 1.4.14 55 5,454.55 –

Purchases and sales 58 13,793.10 20,689.66

Sundry debtors and creditors 60 6,666.67 5,000.00

Bills of exchange 60 2,000.00 4,000.00

Wages and salaries 58 9,655.17 –

Rent, rates and taxes 58 6,206.90 –

Sundry charges 58 2,758.62 –

Computers – 6,000.00 –

Bank balance 60 7,000.00 –

New York office A/c – – 29,845.35

59,535.01 59,535.01

Trading and Profit & Loss Account

for the year ended 31st March, 2015

US $ US $

To Opening Stock 5,454.55 By Sales 20,689.66

To Purchases 13,793.10 By Closing stock 7,000.00

To Wages and salaries 9,655.17 (` 4,20,000/60)

© The Institute of Chartered Accountants of India

PAPER – 5 : ADVANCED ACCOUNTING 27

By Gross Loss c/d 1,213.16

28,902.82 28,902.82

To Gross Loss b/d 1,213.16 By Net Loss 13,778.68

To Rent, rates and taxes 6,206.90

To Sundry charges 2,758.62

To Depreciation on computers 3,600.00

(US $ 6,000 × 0.6)

13,778.68 13,778.68

Balance Sheet of Bangalore Branch

as on 31st March, 2015

Liabilities US $ Assets US $ US $

New York Office A/c 29,845.35 Computers 6,000.00

Less: Net Loss (13,778.68) 16,066.67 Less: Depreciation (3,600.00) 2,400.00

Sundry creditors 5,000.00 Closing stock 7,000.00

Bills payable 4,000.00 Sundry debtors 6,666.67

Bills receivable 2,000.00

Bank balance 7,000.00

25,066.67 25,066.67

Question 7

Answer any four of the following:

(a) What is the distinction between an Ordinary Partnership Firm and a Limited Liability

Partnership (LLP)?

(b) With reference to AS 29 "Provisions, Contingent Liabilities and Contingent Assets",

define:

(i) A Provision

(ii) A Liability

(iii) A Contingent Asset

(iv) Present Obligation

(c) Write short note on classification of advances in case of Banking Company.

(d) Give the basis of allocation of the following common expenditure among different

departments:

© The Institute of Chartered Accountants of India

28 INTERMEDIATE (IPC) EXAMINATION: MAY, 2016

(i) Insurance of Building

(ii) Discount and bad debts

(iii) Discount received

(iv) Repairs and maintenance of capital assets

(v) Advertisement expenses

(vi) Labour welfare expenses

(vii) PF/ESI contributions

(viii) Carriage inward

(e) Write short note on 'Suspension of Capitalisation' in context of Accounting Standard 16.

(4 x 4= 16 Marks)

Answer

(a) Distinction between an ordinary partnership firm and a Limited Liability

Partnership (LLP)

Key Elements Partnerships LLPs

1 Applicable Law Indian Partnership Act, Limited Liability Partnerships

1932 Act, 2008

2 Registration Optional Compulsory with ROC

3 Creation Created by an Created by Law

Agreement

4 Body Corporate Not a body corporate Yes, after registration with ROC,

it becomes a body corporate

5 Separate Legal It has no separate legal Yes, all body corporate are said

Identity identity to have a separate legal identity.

6 Perpetual Partnerships do not have It has perpetual succession and

Succession perpetual succession individual partners may come

and go

7 Number of Partners Minimum 2 and Minimum 2 but no maximum limit

Maximum 20 (subject to

10 for banks)

8 Ownership of Firm cannot own any The LLP as an independent

Assets assets. The partners entity can own assets

own the assets of the

firm

9 Liability of Liability of the partners is Liability of the partners is limited

unlimited. Partners are to the extent of their contribution

© The Institute of Chartered Accountants of India

PAPER – 5 : ADVANCED ACCOUNTING 29

Partners/Members severally and jointly towards LLP except in case of

liable for actions of other intentional fraud or wrongful act

partners and the firm of omission or commission by a

and their liability extends partner.

to personal assets

10 Principal Agent Partners are the agents Partners are agents of the firm

Relationship of the firm and of each only and not of other partners

other

(b) (i) A Provision is a liability which can be measured only by using a substantial degree

of estimation.

(ii) A Liability is a present obligation of the enterprise arising from past events, the

settlement of which is expected to result in an outflow from the enterprise of

resources embodying economic benefits.

(iii) A Contingent asset is a possible asset that arises from past events the existence

of which will be confirmed only by the occurrence or non-occurrence of one or more

uncertain future events not wholly within the control of the enterprise.

(iv) Present obligation - An obligation is a present obligation if, based on the evidence

available, its existence at the balance sheet date is considered probable, i.e., more

likely than not.

(c) Banks are required to classify their advances into four broad groups:

(i) Standard Assets — Standard assets are those which do not disclose any problems

and which do not carry more than normal risk attached to the business. Such an

asset is not a NPA (Non-performing asset).

(ii) Sub-standard Assets — Sub-standard asset is one which has been classified as

NPA for a period not exceeding 12 months. In other words, such an asset will have

well-defined credit weaknesses that jeopardize the liquidation of the debt and are

characterized by the distinct possibility that the bank will sustain some loss, if

deficiencies are not corrected.

(iii) Doubtful Assets — A doubtful asset is one which has remained sub-standard for a

period of at least 12 months. A loan classified as doubtful has all the weaknesses

inherent in assets that were classified as sub-standard with added characteristic

that the weaknesses make collection or liquidation in full, on the basis of currently

known facts, conditions and values, highly questionable and improbable.

(iv) Loss Assets — A loss asset is one where loss has been identified by the bank or

internal or external auditors or the RBI inspectors but the amount has not been

written off, wholly or partly. In other words such assets are considered uncollectable

or if collected of such low value that their being shown as bankable assets is not

warranted even though there may be some salvage or recoverable value.

© The Institute of Chartered Accountants of India

30 INTERMEDIATE (IPC) EXAMINATION: MAY, 2016

The classification of advances should be done taking into account (i) Degree of well

defined credit weakness and (ii) Extent of dependence on collateral security for the

recovery of dues.

This classification is meant for the purpose of computing the amount of provision to

be made in respect of advances.

(d)

S.No. Expenses Basis

(i) Insurance of building Floor area occupied by each department (if

given) otherwise on time basis

(ii) Discount and bad debts Sales of each department

(iii) Discount received Purchases of each department

(iv) Repairs and maintenance of Value of assets of each department

capital assets otherwise on time basis

(v) Advertisement expenses Sales of each department otherwise on time

basis or equally among departments

(vi) Labour welfare expenses Number of employees in each department

(vii). PF/ESI contributions Wages and salaries of each department

(viii) Carriage inward Purchases of each department

(e) Capitalization of borrowing costs should be suspended during extended periods in which

active development is interrupted.

Borrowing costs may be incurred during an extended period in which the activities

necessary to prepare an asset for its intended use or sale are interrupted. Such costs

are costs of holding partially completed assets and do not qualify for capitalization.

However, capitalization of borrowing costs is not normally suspended during a period

when substantial technical and administrative work is being carried out. Capitalization of

borrowing costs is also not suspended when a temporary delay is a necessary part of the

process of getting an asset ready for its intended use or sale.

For example, capitalization continues during the extended period needed for inventories

to mature or the extended period during which high water levels delay construction of a

bridge, if such high water levels are common during the construction period in the

geographic region involved.

© The Institute of Chartered Accountants of India

Вам также может понравиться

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- GrutzenДокумент28 страницGrutzenGhafoor MerajОценок пока нет

- UTS Bahasa Inggris Nanda Pratama Nor R 202210100087Документ4 страницыUTS Bahasa Inggris Nanda Pratama Nor R 202210100087Nanda Pratama Nor RochimОценок пока нет

- Ch02 SolutionДокумент56 страницCh02 Solutioncyrine chahbaniОценок пока нет

- What Is Talent ManagementДокумент8 страницWhat Is Talent ManagementarturoceledonОценок пока нет

- Handout No. 03 - Purchase TransactionsДокумент4 страницыHandout No. 03 - Purchase TransactionsApril SasamОценок пока нет

- Session 1 - FDДокумент24 страницыSession 1 - FDDaksh KhullarОценок пока нет

- Warsh (2007) 387 Knowledge & Wealth of NationsДокумент381 страницаWarsh (2007) 387 Knowledge & Wealth of NationsFazal RahmanОценок пока нет

- Introduction To GSTДокумент38 страницIntroduction To GSTMitul KapoorОценок пока нет

- SHOPPING (EP1-week 1)Документ11 страницSHOPPING (EP1-week 1)Athirah Fadzil100% (1)

- Biniam TassewДокумент74 страницыBiniam Tassewabel debebeОценок пока нет

- FPA Candidate HandbookДокумент32 страницыFPA Candidate HandbookFreddy - Marc NadjéОценок пока нет

- Australian Optometry TAM Stands at $4.2bnДокумент5 страницAustralian Optometry TAM Stands at $4.2bnabeОценок пока нет

- E Payment SystemДокумент47 страницE Payment SystemNamrata KshirsagarОценок пока нет

- Entreprunership Chapter 3Документ12 страницEntreprunership Chapter 3fitsumОценок пока нет

- The Importance of The Different Occupations in The SocietyДокумент2 страницыThe Importance of The Different Occupations in The Societysamed brionesОценок пока нет

- Temporary Employment ContractДокумент2 страницыTemporary Employment ContractLancemachang Eugenio100% (2)

- Sample B Business Management EeДокумент50 страницSample B Business Management Eeapi-529669983Оценок пока нет

- Capacity Development AgendaДокумент7 страницCapacity Development AgendaApple PoyeeОценок пока нет

- Jal Kal Vibhag, AgraДокумент1 страницаJal Kal Vibhag, AgraNeeraj gargОценок пока нет

- Sample HSE PolicyДокумент1 страницаSample HSE Policykoo langot67% (3)

- Week 4 - Module (Trade Discount)Документ8 страницWeek 4 - Module (Trade Discount)Angelica perezОценок пока нет

- Journalizing TransactionsДокумент38 страницJournalizing TransactionsPratyush mishraОценок пока нет

- Limitations of Mfrs 136Документ3 страницыLimitations of Mfrs 136Ros Shinie BalanОценок пока нет

- (Reyes) Portal of Installment LiquidationДокумент16 страниц(Reyes) Portal of Installment LiquidationChe NelynОценок пока нет

- Benefits Management - Key Principles (Ogc)Документ4 страницыBenefits Management - Key Principles (Ogc)Muhemmed AhmedОценок пока нет

- CIR V. MARUBENI 372 SCRA 577 (Contractors Tax)Документ2 страницыCIR V. MARUBENI 372 SCRA 577 (Contractors Tax)Emil BautistaОценок пока нет

- Management In: Verification NeededДокумент12 страницManagement In: Verification NeededLakshanmayaОценок пока нет

- Cameo Sports Agencies Pvt. LTDДокумент4 страницыCameo Sports Agencies Pvt. LTDBhupender TakshakОценок пока нет

- Labor Cost Per Bell Will Be Rs. 1 Variable Overheads 100% of Labor CostДокумент3 страницыLabor Cost Per Bell Will Be Rs. 1 Variable Overheads 100% of Labor CostanushkaОценок пока нет

- Case: Mired in Corruption - Kellogg Brown & Root in NigeriaДокумент9 страницCase: Mired in Corruption - Kellogg Brown & Root in NigeriakenkenОценок пока нет