Академический Документы

Профессиональный Документы

Культура Документы

Mock Solution FAR 1-KnS

Загружено:

Muhammad YahyaАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Mock Solution FAR 1-KnS

Загружено:

Muhammad YahyaАвторское право:

Доступные форматы

By Hassaan Khanani

KnS School of Business Studies – CAF 05 (Mock)

27 August 2018

September 2018: Mock Exam 3 hours – 100 Marks

Additional reading time – 15 minutes

Financial Accounting and Reporting – I

d

hi

Solution No 1

a

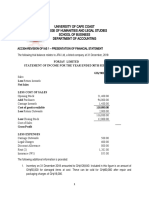

Talha Shahid Limited

Sh

Statement of Financial Position

As on 30 June 2018

Assets Rupees

a

Non-Current Asses

lh

Property plant and Equipment (1,681,000 - 110,000) 1,571,000

Less: Accumulated depreciation (324,000 - 1,100) (322,900)

Ta

1,248,100

Current Assets

Trade receivables (349,200 - 40,000 - 10,000 - 20,000) 279,200

i&

Less: Provision for doubtful debts (13,960)

265,240

Stock in trade (W-1) 312,000

an

Prepaid rent (W-2) 30,660

Cash and Bank 42,600

an

1,898,600

Equity and Liabilities

Kh

Equity

Share Capital (880,000 + 11,825 x 10) (W-6) 998,750

Share Premium (78,000 + 11,825 x 6) 149,250

an

Retained earnings (W-7) 358,020

Revaluation surplus (51,900 - 4720) (W-8) 47,180

Total equity 1,553,200

sa

Current liabilities

Bank Loan 120,000

as

Dividend payable 12,000

Interest payable (5,400 - 3,600) 1,800

H

Trade payable (216,600 - 40,000) 176,600

Tax payable 35,000

1,898,600

CAF 7 by Sir Hassaan Khanani at KnS .

No Sunday Classes , Fixed Time table Page 1 of 12

Sir Hassaan Khanani & Sir Talha Shahid

By Hassaan Khanani

KnS School of Business Studies – CAF 05 (Mock)

Talha Shahid Limited

Statement of Comprehensive income

For the year ended on 30 June 2018

Rupees

Sales (1,726,140 - 20,000) 1,706,140

d

Less: Cost of sales

Opening stock 168,000

hi

Purchases 1,229,700

a

Goods available for sales 1,397,700

Closing stock (W-1) (312,000)

Sh

Cost of sales (1,085,700)

Gross profit 620,440

Less: Operating expenses

a

Rent expense (W-2) 25,340

lh

Bad debts expense (W-3) 6,500

Salaries expense 46,900 CAF 7 , CAF 8 & CAF 9

Ta

Insurance expense 63,000 at KnS , fixed Time table

Miscellaneous expense 16,000 and No sunday Classes

Administrative expenses (W-4) 76,550

i&

Loss on disposal (W-5) 64,450 Sir Hassaan Khanani

(298,740) teaches full CAF 7 alone

Add: Other income (65,000 - 45,000) 20,000 and he is the only one to

an

Profit before interest and tax 341,700 teach 100% CAF 7 in

Less: Financial charges (120,000 x 6% x 9 /12) (5,400) Karachi as CAF 7

an

includes different topic

Profit before tax 336,300

Less: Taxation (35,000)

linking and its best if

single teacher teaches

Kh

Profit for the year 301,300

whole course.

Working Note:

1 – Closing stock

an

Rupees

Stock count at 20 June 2018 356,000

sa

Add: Purchases (21 June 2018 - 30 June 2018) 68,000

Less: Sales (21 June 2018 - 30 June 2018) [140,000 - 20,000] / 125% (96,000)

328,000

as

NRV Adjustment (36,000 - 20,000) (16,000)

312,000

H

2 – Rent expenses

56,000 = x + 1.1x + 1.1(1.1x) + 1.1 {1.1(1.1x)}

x = Rs. 12,066 i.e., rent of first six month

Now increase 10% in every six month.

Page 2 of 12

Sir Hassaan Khanani & Sir Talha Shahid

By Hassaan Khanani

KnS School of Business Studies – CAF 05 (Mock)

Rent expense : 12,066 + 110%(12,066) = Rs. 25, 340 (round off)

Prepaid rent : 56,000 – 25,340 = Rs. 30,660

3 – Provision for doubtful debt closing balance

= 349,200 – 20,000 – 40,000 – 10,000

= 279,200 x 5%

d

= Rs. 13,960

hi

Allowance for doubtful debts

Trade receivable (Written off) 10,000 b/d 17,460

a

c/d 13,960 Bad debts (Balancing figure) 6,500

Sh

23,960 23,960

4 – Administrative expenses

a

Rupees

lh

As per trial balance 77,100

Less: Depreciation (110,000 x 2% x 6/12) 550

Ta

76,550

5 – Loss on disposal

i&

Rupees

Revalued amount 110,000

an

Less Accumulated depreciation (110,000 x 2% x 3/12) (550)

Carrying amount 109,450

Sale proceeds 45,000

an

Loss on disposal 64,450

Kh

6 – Share Capital

Rupees

Share

Share Capital

premium

an

At beginning balance 880,000 78000

Add: Right issue (190,000 / 16) @ Rs. 10; @ 6 118,750 71250

At end balance 998,750 149,250

sa

7 – Retained earning

as

Rupees

Retained earnings at beginning 96,000

Add: Profit for the year 301,300

H

Less: Dividend (44,000)

Add: Transfer from revaluation surplus (W-8) 4,720

Retained earnings at end 358,020

Page 3 of 12

Sir Hassaan Khanani & Sir Talha Shahid

By Hassaan Khanani

KnS School of Business Studies – CAF 05 (Mock)

8 – Revaluation Surplus transfer to retained earnings

Rupees

Cost at 1 January 2015 112,000

Less: Accumulated depreciation

Depreciation - 30 June 2015 (112,000 x 2% x 6/12) 1,120

d

Depreciation - 30 June 2016 (112,000 x 2%) 2,240

hi

Depreciation - 30 June 2017 (112,000 x 2%) 2,240

Depreciation - 31 December 2017 (112,000 x 2% x 6/12) 1,120

a

6,720

Sh

Carrying amount 105,280

Revalued amount 110,000

Revaluation surplus 4,720

a

Solution No 2

lh

Ta

Revaluation

Stock 4,000 Land and Building 7,500

Furniture 200

Provision for doubtful debts 2,300

i&

Capital A (6/8) 750

Capital B (2/8) 250

an

1,000

7,500 7,500

an

Capital Account

A B C A B C

Kh

Goodwill reverse 30,000 10,000 10,000 b/d 60,000 32,000 -

General reserve 6,000 2,000 -

Cash (balancing

14,250 16,750 - Revaluation 750 250 -

figure)

an

Goodwill 37,500 12,500 -

C’ Capital

c/d 60,000 20,000 20,000 30,000

introduced)

sa

104,250 46,750 30,000 104,250 46,750 30,000

as

H

Statement of Financial PositionAs on 1 July 2018

Page 4 of 12

Sir Hassaan Khanani & Sir Talha Shahid

By Hassaan Khanani

KnS School of Business Studies – CAF 05 (Mock)

Assets Rupees Capital and Liabilities Rupees

Land and building 57,500 A Capital 60,000

Furniture 1,800 B Capital 20,000

Debtors 33,000 C Capital 20,000

d

Less: Provision for doubtful debts (3,300) 100,000

29,700 Creditors 70,000

hi

Other receivables 6,000

a

Stock in trade 36,000

Cash (45,000 + 25,000 - 14,250 - 16,750) 39,000

Sh

170,000 170,000

Working note:

C Capital = 15,000 + 5,000 + 10,000 = Rs. 30,000

a

Closing balance of capital = (15,000 + 5,000) / 20% = Rs.100,000

Closing balance of partner A = Rs. 100,000 x 60% = Rs. 60,000

lh

Closing balance of partner B = Rs. 100,000 x 20% = Rs. 20,000

Solution No 3

Ta

Amir

Income Statement For the year ended on 31 March 2017

Rupees

i&

Sales (132,500 + 156,500) + 4550 293,550

Less: Cost of sales

an

Opening stock (5,000 + 3,000) 8,000

Purchase (105,850 + 110,050) + 4550 220,450

Closing stock (4,600 + 3,500) (8,100)

an

Cost of sales 220,350

Gross profit 73,200

Kh

Less: operating expenses

Cash defalcation 24,150

Inventory lost 450

Repair 4,000

an

Rent (6,000 + 400 - 500) 5,900

Rate & Insurance (10,000 + 2,500 - 2,750) 9,750

sa

Electricity 4,000

Salary 15,000

Trade expenses 1,250

as

Audit fee 2,000

Depreciation (30,000 x 10%) + (800 x 10% x 3/12) 3,020

H

69,520

Net profit 3,680

Amir

Page 5 of 12

Sir Hassaan Khanani & Sir Talha Shahid

By Hassaan Khanani

KnS School of Business Studies – CAF 05 (Mock)

Statement of financial Position

As on 31 March 2017

Furniture & Fixture (30,000 + 800 - 3020) 27,780

Goodwill 9,500

Stock - Cosmetic 4,600

d

Stock - Confessionary 3,500

hi

Prepaid Rate & Insurance 2,750

Debtor - Cosmetic 1,400

a

Debtor - Confessionary 1,650

Sh

Advance to suppler - Cosmetic 300

Cash at bank 13,500

Cash in hand 250

65,230

a

lh

Capital 70,000

Profit 3,680

Ta

Drawing (15,000)

58,680

Creditor - Cosmetic 2,200

i&

Creditor - Confessionary 1,000

Creditor - Furniture 800

Rent payable 400

an

Audit fee payable 2,000

Advance from customer 150

an

65,230

Working note:

Kh

Creditor - Cosmetic

Bank (100,000 + 6,000) 106,000 b/d 2,500

Purchases (Credit) 105,400

an

c/d 2,200 c/d 300

108,200 108,200

sa

Creditor - Confessionary

Bank 110,000 b/d 2,000

as

Purchases (Credit) 109,000

c/d (1800 - 800) 1,000

111,000 111,000

H

Debtor - Cosmetic

Page 6 of 12

Sir Hassaan Khanani & Sir Talha Shahid

By Hassaan Khanani

KnS School of Business Studies – CAF 05 (Mock)

b/d - Cash (Balancing figure) 131,250

Sales 132,500

c/d 150 c/d 1,400

132,650 132,650

d

Debtor - Confessionary

hi

b/d 500 Cash (balancing figure) 155,350

Sales 156,500 c/d 1,650

a

157,000 157,000

Sh

Cosmetic Rupees

Sales 132,500

Less: Cost of sales

a

Opening stock 5,000

lh

purchases (105400 + 5000) - 4,550 105,850

Closing stock (4,850)

Ta

Cost of sales (@ 80%) 106,000

Gross profit (@ 20%) 26,500

i&

Confessionary Rupees

Sales 156,500

an

Less: Cost of sales

Opening stock 3,000

purchases (109,000 + 1500) - 450 110,050

an

Closing stock (3,500)

Cost of sales (70%) 109,550

Kh

Gross profit (@30%) 46,950

Cash

an

b/d 1,000 Bank 245,000

Customer (131,250 + 155,350) 286,600 Salaries 15,000

Owner take inventory 4,550 Confessionary purchases 1,500

sa

Trade expenses 1,250

Cosmetic purchase 5,000

Defalcation - Theft (balancing figure) 24,150

as

c/d 250

292,150 292,150

H

Bank

Page 7 of 12

Sir Hassaan Khanani & Sir Talha Shahid

By Hassaan Khanani

KnS School of Business Studies – CAF 05 (Mock)

b/d 23,500 Purchases of cosmetic (100,000 + 6,000) 106,000

Cash 245,000 Purchases of confessionary 110,000

Repairs 4,000

Rent 6,000

Rate & Insurance 10,000

d

Electricity 4,000

hi

Amir (Drawing) 15,000

c/d (Balancing figure) 13,500

a

268,500 268,500

Sh

Solution No 4

(a)

Units (x) Labour FOH y X2 xy

a

60,000 200,000 120,000 320,000 3,600,000,000 19,200,000,000

lh

80,000 260,000 150,000 410,000 6,400,000,000 32,800,000,000

140,000 730,000 10,000,000,000 52,000,000,000

Ta

y = a + bx

i&

an

b (variable) = 2 (52,000,000,000) – (140,000) (730,000) = Rs. 4.5 per unit

an

2 (10,000,000,000) – (140,000)2

a (fixed) = 730,000 – 4.5 (140,000) Rs. 50,000

Kh

y = (110,000 + 50,000) + (6 + 4.5) x

y = 160,000 + 10.5 x

an

(b) Cost of production of 90,000 units

y = 160,000 + 10.5 (90,000)

y = Rs. 1,105,000.

sa

as

H

Page 8 of 12

Sir Hassaan Khanani & Sir Talha Shahid

By Hassaan Khanani

KnS School of Business Studies – CAF 05 (Mock)

Solution No 5

d

a hi

Sh

a

lh

Ta

i&

an

an

Kh

an

sa

as

H

Page 9 of 12

Sir Hassaan Khanani & Sir Talha Shahid

By Hassaan Khanani

KnS School of Business Studies – CAF 05 (Mock)

d

a hi

Sh

Dep 2018 & Surplus

a

lh

Ta

i&

Depreciation 2019 & Incremental Depreciation 2019

Depreciation for 2019 after

an

revaluation(135*20%) 27

Depreciation Original if asset never revalued 22.87

an

(114.345*20%)

Incremental Dep 4.131

(27-22.87)

Kh

CA under revaluation Model on 31 dec 2019 108

Dep till 2020 & Incremental dep

an

sa

as

H

Page 10 of 12

Sir Hassaan Khanani & Sir Talha Shahid

By Hassaan Khanani

KnS School of Business Studies – CAF 05 (Mock)

Solution No 6

d

a hi

Sh

a

lh

Ta

i&

an

Solution No 7

an

Part (a)

Kh

an

sa

as

H

Page 11 of 12

Sir Hassaan Khanani & Sir Talha Shahid

By Hassaan Khanani

KnS School of Business Studies – CAF 05 (Mock)

Part (b)

d

a hi

Sh

a

lh

CAF 7 , 8 & 9 at KnS in sha Allah See you all , we assure maximum practice along

Ta

with 100% course coverage and summary of every topic.

i&

an

an

Kh

an

sa

as

H

Page 12 of 12

Sir Hassaan Khanani & Sir Talha Shahid

Вам также может понравиться

- Ans Jan 2018 Far410Документ8 страницAns Jan 2018 Far4102022478048Оценок пока нет

- CA Final - FR Faster Batch - Consolidation Additional QuestionsДокумент8 страницCA Final - FR Faster Batch - Consolidation Additional QuestionsRonaldo GOmesОценок пока нет

- Examen ANA FIN 2019+CORДокумент6 страницExamen ANA FIN 2019+CORfadali amineОценок пока нет

- RG301 - Revision Consols QUESДокумент2 страницыRG301 - Revision Consols QUESmssihle.ccОценок пока нет

- AccountingДокумент8 страницAccountingfarhan anwarОценок пока нет

- Class Problem: 2Документ7 страницClass Problem: 2Riad FaisalОценок пока нет

- ACC106 Assignment AccountДокумент5 страницACC106 Assignment AccountsyafiqahОценок пока нет

- Notes Holding CompanyДокумент4 страницыNotes Holding CompanySaurav NasaОценок пока нет

- ULOa Let's Analyze Week 8 9Документ2 страницыULOa Let's Analyze Week 8 9emem resuentoОценок пока нет

- Assignment No 1 - POF: Topics: Financial Statement Analysis & Time Value of MoneyДокумент2 страницыAssignment No 1 - POF: Topics: Financial Statement Analysis & Time Value of MoneyIQRAsummers 2021Оценок пока нет

- RTP June 2018 AnsДокумент29 страницRTP June 2018 AnsbinuОценок пока нет

- Chap 3Документ56 страницChap 3Basant OjhaОценок пока нет

- F7 (FR) Workbook (Mix)Документ6 страницF7 (FR) Workbook (Mix)Aye Myat ThawtarОценок пока нет

- 15 Sole Trader - 2020Документ34 страницы15 Sole Trader - 2020Philile NkwanyanaОценок пока нет

- Dec 2012Документ49 страницDec 2012Saroj ShresthaОценок пока нет

- Revision Ntragroup Transactions Sundry Aspects TaxationДокумент52 страницыRevision Ntragroup Transactions Sundry Aspects TaxationValerie Verity MarondedzeОценок пока нет

- Final AccountsДокумент39 страницFinal Accountsaayushsurana1204Оценок пока нет

- Accounts SOL 2022Документ12 страницAccounts SOL 2022akshitapaul19Оценок пока нет

- 162 PresummativeДокумент5 страниц162 PresummativeMeichigo SwadeeОценок пока нет

- Close LTDДокумент5 страницClose LTDXianFa WongОценок пока нет

- Coursebook Chapter 9 AnswersДокумент5 страницCoursebook Chapter 9 AnswersAhmed Zeeshan92% (12)

- Part 2 Joint Arrangements Class Consultation PDFДокумент6 страницPart 2 Joint Arrangements Class Consultation PDFidk520055Оценок пока нет

- ACC Individual AssignmentДокумент6 страницACC Individual AssignmentRuddyMartiniОценок пока нет

- ACCT 101 - Assignment Question (13861)Документ5 страницACCT 101 - Assignment Question (13861)Aneziwe ShangeОценок пока нет

- Interactive Question 4: Acquisition of A Subsidiary: Non-Current AssetsДокумент4 страницыInteractive Question 4: Acquisition of A Subsidiary: Non-Current AssetsRiad FaisalОценок пока нет

- ANSWER KEY - CHARLOTTE SERVICES - Classification of Account and Balances of The AccountsДокумент11 страницANSWER KEY - CHARLOTTE SERVICES - Classification of Account and Balances of The AccountsAnne MiguelОценок пока нет

- This Study Resource Was: Balance Sheet - ProblemsДокумент3 страницыThis Study Resource Was: Balance Sheet - Problemsvenice cambryОценок пока нет

- Chapter 07 - Financial StatementsДокумент40 страницChapter 07 - Financial StatementsMkhonto XuluОценок пока нет

- PracticeДокумент1 страницаPracticeNana CatОценок пока нет

- Tutorial 12Документ15 страницTutorial 12lkaixin 02Оценок пока нет

- CA IPCCAccounting314081 PDFДокумент17 страницCA IPCCAccounting314081 PDFJanhvi AroraОценок пока нет

- Final Accounts QuestionsДокумент6 страницFinal Accounts QuestionsKID ZONEОценок пока нет

- Final Accounts SumДокумент2 страницыFinal Accounts SumRohit Aswani25% (4)

- ACC304-IAS 1 Final AccountsДокумент4 страницыACC304-IAS 1 Final AccountsGeorge AdjeiОценок пока нет

- QQAA GREEN TECH Comprehensive ExampleДокумент7 страницQQAA GREEN TECH Comprehensive ExampleZulhelmy NazriОценок пока нет

- Advanced Accounting - Dayag 2015 - Chapter 11 - MC (B)Документ1 страницаAdvanced Accounting - Dayag 2015 - Chapter 11 - MC (B)John Carlos DoringoОценок пока нет

- ACP314 Competency PracticeДокумент1 страницаACP314 Competency PracticeJastine Rose CañeteОценок пока нет

- Notes - Cash Flow Statement and ProblemsДокумент4 страницыNotes - Cash Flow Statement and ProblemsDhruv MalhotraОценок пока нет

- Ratio Analysis (Divya Jadi Booti)Документ85 страницRatio Analysis (Divya Jadi Booti)Michael AdhikariОценок пока нет

- 12 - Incomplete Record - With - AnswerДокумент13 страниц12 - Incomplete Record - With - AnswerAbid faisal AhmedОценок пока нет

- Ans Intro 01-02-2021Документ4 страницыAns Intro 01-02-2021Shaheer MalikОценок пока нет

- Accounting I December 2020Документ5 страницAccounting I December 2020faraz hassanОценок пока нет

- Chapter 4 - Statement of Financial PositionДокумент15 страницChapter 4 - Statement of Financial PositionHan Yee YeoОценок пока нет

- Tutorial On Inventory and FSДокумент3 страницыTutorial On Inventory and FSNcediswaОценок пока нет

- Chapter 22 Financial Reporting in Hyperinflationary Eco Afar Part 2Документ12 страницChapter 22 Financial Reporting in Hyperinflationary Eco Afar Part 2Shane KimОценок пока нет

- Hapsburg SДокумент3 страницыHapsburg SMunir Muhammad Shafi, ACA, ACCAОценок пока нет

- Assignment AnswerДокумент2 страницыAssignment AnswerMims ChiiiОценок пока нет

- 08 Single Entry System PDFДокумент19 страниц08 Single Entry System PDFSamuel Jilowa100% (2)

- Sum No 9 Shri Rajesh ModiДокумент2 страницыSum No 9 Shri Rajesh ModiOm MansattaОценок пока нет

- Financial Statement AnalysisДокумент4 страницыFinancial Statement AnalysisAsad RehmanОценок пока нет

- Requirements: Provide The Journal Entries. Determine The Total Net Gail (Loss) FromДокумент1 страницаRequirements: Provide The Journal Entries. Determine The Total Net Gail (Loss) FromJaneОценок пока нет

- The Grape Group (Acquisition) : Cfap 1: A A F RДокумент1 страницаThe Grape Group (Acquisition) : Cfap 1: A A F R.Оценок пока нет

- MA - Vertical Statement Question BankДокумент18 страницMA - Vertical Statement Question Bankmanav.vakhariaОценок пока нет

- New Millennium Assignment2 School of Practical Accounting Darrel SamuelДокумент2 страницыNew Millennium Assignment2 School of Practical Accounting Darrel SamuelDarrel SamueldОценок пока нет

- Accounting I Mar 2022Документ4 страницыAccounting I Mar 2022Ishmaal KhanОценок пока нет

- FM1 ActivityДокумент4 страницыFM1 ActivityChieMae Benson Quinto100% (1)

- Chapter 4 - AssigmentДокумент2 страницыChapter 4 - AssigmentKryzzel Anne JonОценок пока нет

- Eacc1614 Test 2 Memo 2021 AdjДокумент10 страницEacc1614 Test 2 Memo 2021 AdjshabanguntandoyenkosiОценок пока нет

- The Institute of Chartered Accountants of Nepal: Suggested Answers of Advanced AccountingДокумент97 страницThe Institute of Chartered Accountants of Nepal: Suggested Answers of Advanced AccountingSujit DasОценок пока нет

- Hedging Techniques For Interest Rate Risk: MenuДокумент12 страницHedging Techniques For Interest Rate Risk: MenuMuhammad YahyaОценок пока нет

- Financial Reporting - 02Документ421 страницаFinancial Reporting - 02Muhammad YahyaОценок пока нет

- The Capital Asset Pricing Model - : Project-Specific Discount RatesДокумент8 страницThe Capital Asset Pricing Model - : Project-Specific Discount RatesMuhammad YahyaОценок пока нет

- CAPM: Theory, Advantages, and DisadvantagesДокумент9 страницCAPM: Theory, Advantages, and DisadvantagesMuhammad YahyaОценок пока нет

- The Capital Asset Pricing Model - : The Cost of EquityДокумент8 страницThe Capital Asset Pricing Model - : The Cost of EquityMuhammad YahyaОценок пока нет

- BFD Past Paper Analysis - For Summer 2021 ExamsДокумент7 страницBFD Past Paper Analysis - For Summer 2021 ExamsMuhammad Yahya100% (1)

- CIMA F3 Workbook Q PDFДокумент67 страницCIMA F3 Workbook Q PDFjjОценок пока нет

- Working Capital Management: MenuДокумент11 страницWorking Capital Management: MenuMuhammad YahyaОценок пока нет

- Accounts Receivable Management: MenuДокумент8 страницAccounts Receivable Management: MenuMuhammad YahyaОценок пока нет

- Factsheet IFRS7 Financial Instruments DisclosureДокумент23 страницыFactsheet IFRS7 Financial Instruments DisclosureMuhammad Ziaul HaqueОценок пока нет

- Dividend Theory: TheoriesДокумент8 страницDividend Theory: TheoriesMuhammad YahyaОценок пока нет

- CAF-6 Mock Solution by SkansДокумент6 страницCAF-6 Mock Solution by SkansMuhammad YahyaОценок пока нет

- What Is Behavioural Finance?Документ5 страницWhat Is Behavioural Finance?Muhammad YahyaОценок пока нет

- CFAP 4 Summer 2018Документ7 страницCFAP 4 Summer 2018Muhammad YahyaОценок пока нет

- Hacking - Become A World Class Hacker, Hack Any Password PDFДокумент69 страницHacking - Become A World Class Hacker, Hack Any Password PDFmuhammad saleem100% (2)

- BM - 2005 To 2016 Analysis Repeated Questions PDFДокумент5 страницBM - 2005 To 2016 Analysis Repeated Questions PDFMuhammad YahyaОценок пока нет

- Mercantile Law Past Papers PDFДокумент60 страницMercantile Law Past Papers PDFMuhammad YahyaОценок пока нет

- Financial Management Practice Manual (FMPM)Документ13 страницFinancial Management Practice Manual (FMPM)Muhammad YahyaОценок пока нет

- ACRPart BДокумент7 страницACRPart BMuhammad YahyaОценок пока нет

- B LAW Sec BC MidДокумент3 страницыB LAW Sec BC MidMuhammad YahyaОценок пока нет

- Mock Solution FAR 1-KnSДокумент12 страницMock Solution FAR 1-KnSMuhammad YahyaОценок пока нет

- CAF-4 Mock Paper by SkansДокумент3 страницыCAF-4 Mock Paper by SkansMuhammad YahyaОценок пока нет

- QH Pol 267Документ1 страницаQH Pol 267Muhammad YahyaОценок пока нет

- Business Management Past Papers Along With Icap Suggested AnswersДокумент81 страницаBusiness Management Past Papers Along With Icap Suggested AnswersatifОценок пока нет

- CAF-5 Mock Paper by SkansДокумент7 страницCAF-5 Mock Paper by SkansMuhammad YahyaОценок пока нет

- CAF-3 Mock Paper by SkansДокумент3 страницыCAF-3 Mock Paper by SkansMuhammad YahyaОценок пока нет

- F.E Past Papers With AnswersДокумент100 страницF.E Past Papers With AnswersMuhammad YahyaОценок пока нет

- Caf 6 All PDFДокумент80 страницCaf 6 All PDFMuhammad Yahya100% (1)

- 2019 Caf-7 Far-IiДокумент137 страниц2019 Caf-7 Far-IiMuhammad YahyaОценок пока нет

- Accounting RatiosДокумент38 страницAccounting RatiosMohan RajОценок пока нет

- Unit 1 WBsolutionFormation Acctba2Документ28 страницUnit 1 WBsolutionFormation Acctba2justinОценок пока нет

- Fabmi W3Документ10 страницFabmi W3rvinsmoke149Оценок пока нет

- Phil RatingsДокумент8 страницPhil RatingsTrisha Timpog100% (1)

- Pep Research: How Rich Are The Mayors?: The Guests at The WeddingДокумент4 страницыPep Research: How Rich Are The Mayors?: The Guests at The WeddingJelena Vranic-UgrinovskaОценок пока нет

- Chapter 5 Self Test PDFДокумент6 страницChapter 5 Self Test PDFMichelleОценок пока нет

- Business Planning Banking Sample Paper - AnswersДокумент32 страницыBusiness Planning Banking Sample Paper - Answerscima2k15Оценок пока нет

- Chapter 1 SolutionsДокумент53 страницыChapter 1 SolutionsMarwan YasserОценок пока нет

- Test Bank of KiesoДокумент43 страницыTest Bank of KiesoEmmanuel Tiglao100% (1)

- Applied Financial Accounting AFAC02-6: Formative Assessment - AssignmentДокумент7 страницApplied Financial Accounting AFAC02-6: Formative Assessment - AssignmentDesire PiRah GriffinsОценок пока нет

- Case 3 Chemalite Inc Cash FlowДокумент3 страницыCase 3 Chemalite Inc Cash Flowmohiyuddinsakhib3260Оценок пока нет

- Financial Accounting Workbook PDFДокумент89 страницFinancial Accounting Workbook PDFDianne Jonnalyn Cuba100% (1)

- Mergent Online As Reported - Tesla IncДокумент2 страницыMergent Online As Reported - Tesla IncLyca MaeОценок пока нет

- Module 10 Financial StatementsДокумент17 страницModule 10 Financial StatementsChristine CariñoОценок пока нет

- Liquidity Ratios: Ratio AnalysisДокумент3 страницыLiquidity Ratios: Ratio Analysisgautam1110851054Оценок пока нет

- Chapter 2 Supa My NotesДокумент40 страницChapter 2 Supa My NotesYousaf Jamal100% (1)

- Project On KFCДокумент24 страницыProject On KFCAk Abhi KhannaОценок пока нет

- Exit Exam New 2016Документ205 страницExit Exam New 2016naolmeseret22Оценок пока нет

- Notes - Partnership OlevelДокумент10 страницNotes - Partnership OlevelShahana MoorabyОценок пока нет

- Financial ManagementДокумент248 страницFinancial ManagementMadhurjya BoruahОценок пока нет

- Coetsee Meditari Vol 18 No 1 2010Документ16 страницCoetsee Meditari Vol 18 No 1 2010HientnОценок пока нет

- 06 Cafmst14 - CH - 04Документ35 страниц06 Cafmst14 - CH - 04Mahabub AlamОценок пока нет

- Strama Paper Del MonteДокумент26 страницStrama Paper Del MonteChristine Labao100% (2)

- Board of Studies Academic Capital Structure Questions 1649402823Документ6 страницBoard of Studies Academic Capital Structure Questions 1649402823Arundhathi MОценок пока нет

- Corporate Liquidation (Integration) PDFДокумент5 страницCorporate Liquidation (Integration) PDFCatherine Simeon100% (1)

- Case 2 - Marriott CorporationДокумент8 страницCase 2 - Marriott CorporationMorten LassenОценок пока нет

- Megaworld Corporation - SEC Form 17-Q (Ended September 30, 2021) - 10 November 2021Документ29 страницMegaworld Corporation - SEC Form 17-Q (Ended September 30, 2021) - 10 November 2021backup cmbmpОценок пока нет

- Equity Research On Ultratech CementДокумент17 страницEquity Research On Ultratech CementViral GalaОценок пока нет

- CH 3 - Lap Konsolidasi PengantarДокумент45 страницCH 3 - Lap Konsolidasi PengantarJulia Pratiwi ParhusipОценок пока нет