Академический Документы

Профессиональный Документы

Культура Документы

Su 20200131

Загружено:

Master PogiОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Su 20200131

Загружено:

Master PogiАвторское право:

Доступные форматы

THIS IS FOR THE EXCLUSIVE USE OF TRULYRICH CLUB MEMBERS • THIS IS FOR THE EXCLUSIVE USE OF TRULYRICH CLUB

MEMBERS • THIS IS FOR THE EXCLUSIVE USE OF TRULYRICH CLUB MEMBERS • THIS IS FOR THE EXCLUSIVE USE OF TRULYRICH CLUB MEMBERS

THIS IS FOR THE EXCLUSIVE USE OF TRULYRICH CLUB MEMBERS • THIS IS FOR THE EXCLUSIVE USE OF TRULYRICH CLUB MEMBERS • THIS IS FOR THE EXCLUSIVE USE OF TRULYRICH CLUB MEMBERS • THIS IS FOR THE EXCLUSIVE USE OF TRULYRICH CLUB MEMBERS

Guidance for Stock Market Investing Exclusively for TrulyRichClub Members

Note: To understand the Stocks Update, first read Bo’s e-book, My Maid Invests in the Stock Market.

Click here www.TrulyRichClub.com to download now.

Volume 12, No. 2 January 2020

The Problem with Eggs:

They Break!

In the 1700s, there was a poultry farmer riding his horse, pulling a huge cart overloaded with eggs. Alas, the driver

was old, the horse was old, and the cart was old. It was a disaster waiting to happen. And in one steep incline through

a hilly path, one of its wheels hit a rock, breaking its spokes, and the entire cart tipped over, scattering its cargo of eggs

down the slope, painting the green canvas with hues of white and yellow.

One passerby, seeing the mess, shook his head and said, “Don’t put all your eggs in one basket!”

I’m sure the man who uttered those words would never have predicted that his one line would become a solid

fixture in personal finance for the next centuries.

Here in the TrulyRichClub, we apply this “eggs” principle in two very important ways: Our stock market investing,

and more broadly, all our assets.

1. Stock Market Diversification

We recommend that you grow your portfolio to five to eight stocks. We spread

our eggs in various baskets—because even if one or two companies are doing well, we

cannot predict the future.

In life, unexpected events called “black swans” will always happen, and these

events will derail or delay the company’s growth. (Case in point: The government’s

tussle with the water concessionaires, which caused the stock prices of two of our SAM

stocks—AC and MPI—to fall. It has inched its way up since then. Our great advantage

is that we are always long-term and can take it in stride.)

Stocks Update Volume 12, No. 2 • January 2020 1

THIS IS FOR THE EXCLUSIVE USE OF TRULYRICH CLUB MEMBERS • THIS IS FOR THE EXCLUSIVE USE OF TRULYRICH CLUB MEMBERS • THIS IS FOR THE EXCLUSIVE USE OF TRULYRICH CLUB MEMBERS • THIS IS FOR THE EXCLUSIVE USE OF TRULYRICH CLUB MEMBERS

THIS IS FOR THE EXCLUSIVE USE OF TRULYRICH CLUB MEMBERS • THIS IS FOR THE EXCLUSIVE USE OF TRULYRICH CLUB MEMBERS • THIS IS FOR THE EXCLUSIVE USE OF TRULYRICH CLUB MEMBERS • THIS IS FOR THE EXCLUSIVE USE OF TRULYRICH CLUB MEMBERS

2. Assets Diversification

We recommend that aside from the stock market, you also invest in real estate and business.

For real estate, owning your home has always been a wise move. I must note, however, that there are a few

sophisticated investors who have chosen to rent forever, because they like the ease of transferring homes and they

profitably grow their investments in other ways. As long as

the investment streams are doing well, this is an acceptable

strategy. But for most people, owning a home is an emotional

issue, not a financial issue. It puts their mind at ease—that

no matter what happens, they have a title to their home.

Some of our TRC members have successfully ventured

into buying rental property and earning passive income,

because they learned from Larry Gamboa’s “Think Rich

Pinoy Abundance Seminar.”

I also strongly recommend our members to have a

side hustle. Learn how to sell. Grow your business.

In the future, when your investments have grown to a certain size, you could also look at other more sophisticated

investments, but only if you have a passion for it. Two of our TRC Mentors—Ronnie Siasoyco and Rex Mendoza—lead

in this regard. They buy paintings and watches, not only because they are beautiful but also as a way of diversifying and

growing investments. Like everything else, don’t go into anything you know nothing about. You must study the craft.

Keep investing.

Keep growing.

Take care of those eggs.

Happy investing!

May your dreams come true,

Bo Sanchez

Stocks Update Volume 12, No. 2 • January 2020 2

THIS IS FOR THE EXCLUSIVE USE OF TRULYRICH CLUB MEMBERS • THIS IS FOR THE EXCLUSIVE USE OF TRULYRICH CLUB MEMBERS • THIS IS FOR THE EXCLUSIVE USE OF TRULYRICH CLUB MEMBERS • THIS IS FOR THE EXCLUSIVE USE OF TRULYRICH CLUB MEMBERS

THIS IS FOR THE EXCLUSIVE USE OF TRULYRICH CLUB MEMBERS • THIS IS FOR THE EXCLUSIVE USE OF TRULYRICH CLUB MEMBERS • THIS IS FOR THE EXCLUSIVE USE OF TRULYRICH CLUB MEMBERS • THIS IS FOR THE EXCLUSIVE USE OF TRULYRICH CLUB MEMBERS

Power Sector Outlook

By Mike Viñas

For this issue of our Stocks Update, we are going to take a pause from the usual company updates and instead

give you a prospective outlook on the different sectors that our SAM stocks belong to. This will help us know what to

expect this coming year in terms of these industries and, thus, have an idea on how our SAM stocks that are part of that

particular sector or industry will perform. For our first outlook, we will be covering the power industry. The SAM stocks

that are part of this industry are Aboitiz Power (AP) and First Gen Corporation (FGEN).

Analysts are saying that the current oversupply situation in the country’s power capacity will most likely continue

throughout 2020. The full-year operation of new capacities added in 2019, which is around 2,000 megawatts, along with

the new capacities that will be added this 2020, which is around 1,200 megawatts, represent around 14.5 percent of the

country’s current power generation capacity. Furthermore, total capacity by the end of 2020 is expected to be around

12 percent higher than the country’s projected peak demand for 2020, including the required reserve margin. With this

oversupply condition this year, the selling price of new power contracts will likely be lower compared to past contracts.

For FGEN, they have the least exposure to re-pricing risk because the bulk of its gas capacity, amounting to 95

percent, is already covered by long-term power supply contracts. On the other hand, AP will somehow be affected by

re-pricing risk due to the expiration last year of its power supply agreements that cover 15 percent of its attributable

capacity. In fact, another nine percent is scheduled to expire this 2020.

One effect of the ongoing oversupply situation is that it will keep spot prices in the Wholesale Electricity Spot

Market (WESM) subdued, unless supply is temporarily disrupted by power plant outages, which is said to be one of

the major risks of the power sector this year. This risk of unplanned outages of large baseload plants is heightened due

to the aging of power plants. Sixty-five percent of the country’s power generation capacity is at least 10 years old or

above. Unplanned outages could possibly result to higher WESM prices and be beneficial for companies with capacities

that are not contracted at that time. But such a development will be detrimental to companies which have to purchase

replacement power from the spot market. Among the power companies listed, AP has the largest exposure to the spot

market. It sells around 8.8 percent of its total attributable capacity to the WESM.

However, research analysts believe that the oversupply condition we’re seeing now will end in 2023. This is because

of the ruling of the Supreme Court in May 2019 that all power supply agreements (PSA) submitted on or after June 30,

2015 should go through a Competitive Selection Process (CSP) before being able to obtain PSAs with power distribution

firms. This development affected seven new power projects with an aggregate supply of 3,551MW. These plants would

have increased the country’s power supply by around 16 percent starting 2021. However, due to the Supreme Court

Stocks Update Volume 12, No. 2 • January 2020 3

THIS IS FOR THE EXCLUSIVE USE OF TRULYRICH CLUB MEMBERS • THIS IS FOR THE EXCLUSIVE USE OF TRULYRICH CLUB MEMBERS • THIS IS FOR THE EXCLUSIVE USE OF TRULYRICH CLUB MEMBERS • THIS IS FOR THE EXCLUSIVE USE OF TRULYRICH CLUB MEMBERS

THIS IS FOR THE EXCLUSIVE USE OF TRULYRICH CLUB MEMBERS • THIS IS FOR THE EXCLUSIVE USE OF TRULYRICH CLUB MEMBERS • THIS IS FOR THE EXCLUSIVE USE OF TRULYRICH CLUB MEMBERS • THIS IS FOR THE EXCLUSIVE USE OF TRULYRICH CLUB MEMBERS

ruling, analysts believe that many of the projects will be delayed or cancelled. Hence, leading to a power shortage after

2022. With the expected shortage in 2023, power prices should be going up, moving forward. This improves the long-

term outlook of power generation companies.

As for coal prices, it has gone down by 29 percent in 2019. This is a 40 percent decrease from its recent high in

July 2018. If coal prices continue to go down this year, analysts are saying that this will have a mixed impact on power

companies. AP will benefit because some of its power supply contracts through Retail Electricity Supply (RES) are not

protected by fuel pass through provisions. Thus, lower coal prices will lead to higher margins. As for FGEN, they will not

be affected as well, since the capacity of its entire gas plant is covered by power supply contracts where savings in terms

of fuel cost are passed through to customers.

Despite expectations of lower re-priced contracts, net income of most power firms is still expected to go higher

in 2020. This will be significantly driven by the income distribution from new capacity. AP’s end-of-2020 earnings is

projected to go higher by 35 percent to P25.6 billion. AP will benefit from the first full-year earnings contribution of its

300MW Cebu Coal Project and the 68MW Manolo-Fortich hydroelectric plant. Last year, earnings were unusually low due

to unplanned outages and higher replacement power costs. For FGEN, analysts forecast that its end-of-2020 net income

will grow by 2.6 percent to US$204 million. This is expected to be driven by the higher earnings contribution of its FG

Hydro and EDC.

Currently, we continue to recommend AP as part of our SAM stocks. However, we do have to wait as to when we

can buy AP again, as it is above its buy-below price as of this writing. But this recommended inclusion in our SAM stocks

is because its profits are expected to grow by a CAGR of 15.6 percent from 2019 to 2021. This is the fastest in the power

sector, despite its lower contract prices. As for FGEN, we have a buy recommendation for it because of its relatively stable

cash flow and it is the only clean energy play in the Philippine Stock Exchange.

TRC STARTER STOCKS GUIDE FOR JANUARY 2020

The figures below (P50,000 and P250,000) are simply our recommendations, designed for safety and less volatility (up and down movements). But if you so

choose, even if your money hasn’t reached yet the figures indicated, you can buy the other stocks listed in the SAM Table, provided you’re psychologically

prepared to stay calm through the volatility.

For more clarity, we outline here two baby steps you can take to grow your investments if you’re a newbie investor:

Baby Step #1: If your portfolio is below P50,000, buy Philequity Index Fund first before you buy specific stocks. It’s less volatile than any stock and

you also get to invest the entire amount that you put into your account, unlike in stocks where there is a minimum board lot.

Baby Step #2: If your portfolio is between P50,000 to P250,000, buy our recommended starter stocks below (first table). Each month, we specify

what these two or three stocks are, based on what we believe are the most stable and least volatile of our SAM stocks (second table below).

Once again, these are only our suggestions. If you feel you can handle the up-and-down, roller-coaster ride of our other stocks, then by all means,

buy our other SAM stocks. They are all great companies that will do well over the long term.

Portfolio Amount Recommendation

P50,000 and below Philequity PSE Index Fund

Starter Stocks:

P50,000 – P250,000

MPI, DNL, FLI

P250,000 and above Stocks from the SAM Table

Stocks Update Volume 12, No. 2 • January 2020 4

THIS IS FOR THE EXCLUSIVE USE OF TRULYRICH CLUB MEMBERS • THIS IS FOR THE EXCLUSIVE USE OF TRULYRICH CLUB MEMBERS • THIS IS FOR THE EXCLUSIVE USE OF TRULYRICH CLUB MEMBERS • THIS IS FOR THE EXCLUSIVE USE OF TRULYRICH CLUB MEMBERS

THIS IS FOR THE EXCLUSIVE USE OF TRULYRICH CLUB MEMBERS • THIS IS FOR THE EXCLUSIVE USE OF TRULYRICH CLUB MEMBERS • THIS IS FOR THE EXCLUSIVE USE OF TRULYRICH CLUB MEMBERS • THIS IS FOR THE EXCLUSIVE USE OF TRULYRICH CLUB MEMBERS

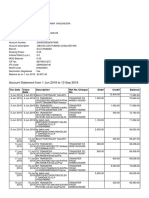

Here are our SAM and Mutual Fund Tables as of January 23, 2020 Market Recess:

Cash

current buy target action

stock max% Dividend

price below price price to take

Yield

AC 728.00 915.00 1,077.00 Continue buying 15% 0.9%

ALI 40.35 45.00 53.00 Continue buying 15% 0.5%

CEB 85.20 101.00 135.00 Continue buying 5% 7.2%

CHIB 25.00 27.40 36.50 Continue buying 5% 3.5%

FGEN 20.75 24.20 32.27 Continue buying 10% 3.6%

FLI 1.51 1.80 2.56 Continue buying 10% 3.5%

GTCAP 774.00 897.00 1,055.00 Continue buying 10% 3.8%

MBT 64.50 66.00 88.50 Continue buying 10% 0.3%

MEG 4.27 5.30 7.60 Continue buying 10% 1.6%

MPI 3.46 7.00 9.37 Continue Buying 10% 2.3%

SHLPH 31.85 42.00 56.00 Continue buying 5% 8.9%

TEL 1,035.00 1,224.00 1,440.00 Continue buying 10% 6.5%

BDO 154.50 122.00 144.00 Hold 10% 0.8%

AP 32.55 32.00 43.10 Stop buying 10% 3.7%

DNL 8.94 7.00 9.20 Stop buying 10% 3.4%

RLC 27.55 25.30 29.82 Stop buying 10% 2.0%

SM 1,032.00 920.00 1,082.00 Stop buying 15% 0.9%

SMPH 40.15 36.00 42.30 Stop buying 15% 0.9%

NAVPS WHEN CURRENT

ESTIMATED

FUND CODE FUND BOUGHT NAVPS RECOMMENDATION

RETURN

(01/12/16) (01/23/20)

XPEEQ Philequity Fund 31.0639 36.2337 16.64% Continue buying

XPEIF Philequity Index Fund 4.2155 4.9882 18.33% Continue buying

Sunlife Prosperity Equity

XSLEQ 3.4805 3.9792 14.33% Continue buying

Fund

Stocks Update Volume 12, No. 2 • January 2020 5

THIS IS FOR THE EXCLUSIVE USE OF TRULYRICH CLUB MEMBERS • THIS IS FOR THE EXCLUSIVE USE OF TRULYRICH CLUB MEMBERS • THIS IS FOR THE EXCLUSIVE USE OF TRULYRICH CLUB MEMBERS • THIS IS FOR THE EXCLUSIVE USE OF TRULYRICH CLUB MEMBERS

THIS IS FOR THE EXCLUSIVE USE OF TRULYRICH CLUB MEMBERS • THIS IS FOR THE EXCLUSIVE USE OF TRULYRICH CLUB MEMBERS • THIS IS FOR THE EXCLUSIVE USE OF TRULYRICH CLUB MEMBERS • THIS IS FOR THE EXCLUSIVE USE OF TRULYRICH CLUB MEMBERS

SAM PRICE WATCH

CHEAP % FROM TARGET PRICE ESTIMATE EXPENSIVE

-45% to -30% to -15% to 0% to 15% to 30% to

-30% -15% 0% 15% 30% 45%

Banking &

CHIB MBT BDO

Financials

Commercial & SHLPH

Industrial CEB

Holding AC SM

GTCAP

Companies MPI

Consumer DNL

Gaming

Mining

Power AP, FGEN

FLI

Property ALI SMPH

MEG RLC

Telecoms TEL

LEGEND CONTINUE BUYING STOP BUYING HOLD

Mike Viñas is a stock market investment trainer, Certified Securities Representative, and Certified Investment

Solicitor of COL Financial Group, Inc.

Stocks Update Volume 12, No. 2 • January 2020 6

THIS IS FOR THE EXCLUSIVE USE OF TRULYRICH CLUB MEMBERS • THIS IS FOR THE EXCLUSIVE USE OF TRULYRICH CLUB MEMBERS • THIS IS FOR THE EXCLUSIVE USE OF TRULYRICH CLUB MEMBERS • THIS IS FOR THE EXCLUSIVE USE OF TRULYRICH CLUB MEMBERS

THIS IS FOR THE EXCLUSIVE USE OF TRULYRICH CLUB MEMBERS • THIS IS FOR THE EXCLUSIVE USE OF TRULYRICH CLUB MEMBERS • THIS IS FOR THE EXCLUSIVE USE OF TRULYRICH CLUB MEMBERS • THIS IS FOR THE EXCLUSIVE USE OF TRULYRICH CLUB MEMBERS

2018 Top Winners of the TrulyRichClub’s Stocks

STOCK TIME ESTIMATED PRICE ESTIMATED

STOCKS

SYMBOL RECOMMENDED TIME HELD RANGE RETURN

May 2016 to 29.07

Unionbank UBP 24 months P59.00 to P91.40

May 2018 percent

June 2011 to January 28.63

Metrobank MBT 42 months P50.06 to P93.94

2018 (partially sold) percent

December 2016 to 11.21

Meralco MER 16 months P275.00 to P307.00

April 2018 percent

July 2017 to January P1230.00 to 10.47

GT Capital GTCAP 6 months

2018 (partially sold) P1350.00 percent

Top Past Winners of TrulyRichClub’s Stocks

STOCK TIME ESTIMATED PRICE ESTIMATED

STOCKS

SYMBOL RECOMMENDED TIMEHELD RANGE RETURN

June 2011 to February 2012 P15.09 to

Ayala Land ALI 9 Months 35 percent

(3rd week) P21.65

Bank of The

February 2012 to November P68.45 to 34.29

Philippine BPI 10 Months

2012 (4th week) P91.00 percent

Islands

SM Prime February 2012 to December P12.48 to 27.75

SMPH 10 Months

Holdings 2012 (1st week) P17.00 percent

January 2013 to April 2013 P268.00 to 28.05

Meralco MER 3 Months

P377.00 percent

32.92

First Phlippine P63.18 to

FPH June 2011 to June 2013 25 Months percent

Holdings P95.20

percent

JG Summit P25.75 to 39.96

JGS February 12 to October 2013 18 Months

Holdings P43.50 percent

D&L Industries DNL February 2013 to April 2014 14 Months P6.45 to P10.00 44 percent

May 2016 to P59.00 to 29.07

Unionbank UBP 24 months

May 2018 P91.40 percent

June 2011 to January 2018 P50.06 to 28.63

Metrobank MBT 42 months

(partially sold) P93.94 percent

P89.60 to 24 percent

Banco De Oro BDO April 2013 to August 2014 16 Months

P93.00 percent

(Disclaimer: Past performance doesn’t guarantee that you’ll have the exact same results in the future. After all, your earnings depend on

the market’s performance.)

Stocks Update Volume 12, No. 2 • January 2020 7

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5782)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- Applywing Two-Sided Market Theory - The Mastercard and American Express DecisionsДокумент29 страницApplywing Two-Sided Market Theory - The Mastercard and American Express DecisionsFrancisca Lobos CОценок пока нет

- UTI Scam: Robbery Through Other Means: What Is The UTI ?Документ3 страницыUTI Scam: Robbery Through Other Means: What Is The UTI ?Joseph JenningsОценок пока нет

- WWW Stechies Com Sdfi IntegrationДокумент14 страницWWW Stechies Com Sdfi IntegrationRajan S PrasadОценок пока нет

- System Failure at EOBIДокумент54 страницыSystem Failure at EOBIMaham Khan100% (1)

- Phil Guaranty v. CIRДокумент2 страницыPhil Guaranty v. CIR8111 aaa 1118Оценок пока нет

- Calculate Simple Interest Rates and Future AmountsДокумент2 страницыCalculate Simple Interest Rates and Future AmountsNathan Dungog100% (2)

- Landl Co vs. Metropolitan Bank & Trust CompanyДокумент1 страницаLandl Co vs. Metropolitan Bank & Trust Companyvallie21Оценок пока нет

- G.R. No. 149840-41 - SPS. FRANCISCO AND RUBY REYES v. BPI FAMILY SAVINGS BANK, INC., ET AL.Документ5 страницG.R. No. 149840-41 - SPS. FRANCISCO AND RUBY REYES v. BPI FAMILY SAVINGS BANK, INC., ET AL.Iris Jianne MataОценок пока нет

- Stock Trak ReportДокумент5 страницStock Trak Reportnhausaue100% (6)

- s5 PDFДокумент5 страницs5 PDFKeshav KumarОценок пока нет

- C&S Wholesale Grocers ReportДокумент6 страницC&S Wholesale Grocers ReportSergio R. BichaoОценок пока нет

- SAP US Payroll Tax - Well ExplainedДокумент45 страницSAP US Payroll Tax - Well ExplainedSuren Reddy67% (15)

- Manage Bonds PayableДокумент3 страницыManage Bonds PayableKonrad Lorenz Madriaga UychocoОценок пока нет

- A Study On Customer Prefernces Towards Credit Cards in HDFC BankДокумент40 страницA Study On Customer Prefernces Towards Credit Cards in HDFC BankSharathОценок пока нет

- HC 4.3: Financial Services Venture Capital: Module - 3Документ15 страницHC 4.3: Financial Services Venture Capital: Module - 3AishuОценок пока нет

- Research Project ON Double Taxation: Faculty of Law Dr. Shakuntala Misra National Rehabilitation University, LucknowДокумент9 страницResearch Project ON Double Taxation: Faculty of Law Dr. Shakuntala Misra National Rehabilitation University, LucknowshubhamОценок пока нет

- Alberta Probate KitДокумент24 страницыAlberta Probate Kitjmackinlay8_893048930% (1)

- Just EmneyiДокумент60 страницJust EmneyiImam Hossain MishorОценок пока нет

- Exercise 7-8 Through 7-19Документ11 страницExercise 7-8 Through 7-19Thanh TrầnОценок пока нет

- Lead INDmoney's InsuranceДокумент2 страницыLead INDmoney's InsuranceShashank YadavОценок пока нет

- Practical 10 - Javascript Practical Exercise 2: AACS1483 Web Design & Development Practical 10Документ5 страницPractical 10 - Javascript Practical Exercise 2: AACS1483 Web Design & Development Practical 10J2XОценок пока нет

- Metlife Information Request FormДокумент1 страницаMetlife Information Request Formbscherff222Оценок пока нет

- PARTNERSHIP FORMATIONДокумент43 страницыPARTNERSHIP FORMATIONnash67% (3)

- AgarwalДокумент1 страницаAgarwalpawanumarji1100% (1)

- Analyzing Lease vs Buy for Assembly Line EquipmentДокумент6 страницAnalyzing Lease vs Buy for Assembly Line EquipmentToufiqul IslamОценок пока нет

- Syndicate 1 - An Introduction To Debt Policy and ValueДокумент11 страницSyndicate 1 - An Introduction To Debt Policy and ValueAntonius Cliff Setiawan100% (1)

- Balance Sheet and P&L Accounts for Asset Acquisition and SalesДокумент1 страницаBalance Sheet and P&L Accounts for Asset Acquisition and SalesPromoth JaidevОценок пока нет

- Salary Sheet Is A ReadyДокумент12 страницSalary Sheet Is A ReadyFarhang PrintingОценок пока нет

- Case studies of separate legal personalityДокумент2 страницыCase studies of separate legal personalityshaurya JainОценок пока нет

- Ra 8763Документ72 страницыRa 8763Junjie Tebrero100% (1)