Академический Документы

Профессиональный Документы

Культура Документы

Bonds - February 11 2020

Загружено:

Lisle Daverin Blyth0 оценок0% нашли этот документ полезным (0 голосов)

8 просмотров3 страницыBonds - February 11 2020

Авторское право

© © All Rights Reserved

Доступные форматы

PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документBonds - February 11 2020

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

8 просмотров3 страницыBonds - February 11 2020

Загружено:

Lisle Daverin BlythBonds - February 11 2020

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 3

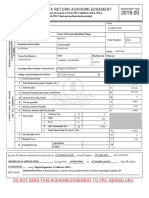

Markets and Commodity figures

11 February 2020

Total Market Turnover Statistics

Standard Turnover REPO 1 Turnover

Deals Nominal Consideration Deals Nominal Consideration

Current Day 1,092 59.63 bn Rbn 59.38 827 92.00 bn Rbn 92.58

Week to Date 2,227 104.18 bn Rbn 103.53 1,148 144.14 bn Rbn 145.03

Month to Date 10,792 447.28 bn Rbn 446.61 3,178 412.61 bn Rbn 417.10

Year to Date 31,769 1,279.92 bn Rbn 1,275.95 11,043 1,652.87 bn Rbn 1,694.09

Foreign Client Market Turnover Statistics

Standard Turnover REPO 1 Turnover

Party Deals Nominal Consideration Deals Nominal Consideration

Buy 88 11.18 bn Rbn 11.23 16 2.47 bn Rbn 2.33

Current Day Sell 82 9.02 bn Rbn 9.04 9 2.78 bn Rbn 2.73

Net 6 2.16 bn Rbn 2.18 7 -0.30 bn Rbn -0.40

Buy 167 18.24 bn Rbn 18.17 44 6.85 bn Rbn 6.48

Week to Date Sell 146 13.97 bn Rbn 14.02 12 3.69 bn Rbn 3.64

Net 21 4.27 bn Rbn 4.16 32 3.17 bn Rbn 2.84

Buy 709 64.92 bn Rbn 64.21 149 26.80 bn Rbn 25.59

Month to Date Sell 510 57.11 bn Rbn 57.29 25 8.14 bn Rbn 8.01

Net 199 7.81 bn Rbn 6.92 124 18.66 bn Rbn 17.58

Buy 2,298 173.03 bn Rbn 172.05 547 114.97 bn Rbn 109.25

Year to Date Sell 1,836 158.43 bn Rbn 158.83 48 20.89 bn Rbn 22.00

Net 462 14.60 bn Rbn 13.22 499 94.08 bn Rbn 87.25

Index Levels

Code Index Yield Index Previous Return MTD Return YTD

ALBI20 9.217%

All Bond Index Top 708.400

20 Composite 706.117 0.23% 1.42%

GOVI 9.208%Split - 700.570

ALBI20 Issuer Class GOVI 698.318 0.25% 1.42%

OTHI 9.268%

ALBI20 Issuer Class Split - 739.166

OTHI 736.747 0.12% 1.42%

CILI15 3.561%

Composite Inflation 261.240

Linked Index Top 15 261.211 0.55% 0.47%

ICOR 3.892%

CILI15 Issuer Class 313.825

Split - ICOR 313.867 0.97% 1.41%

IGOV 3.539%

CILI15 Issuer Class 258.984

Split - IGOV 258.957 0.53% 0.43%

ISOE 4.600%

CILI15 Issuer Class 277.733

Split - ISOE 277.291 0.61% 0.89%

MMI JSE Money Market Index

0 270.407 270.359 0.21% 0.85%

ALBI Constituent Bonds

Bond Issuer Maturity MTM Previous YTD Low YTD High

R159 REPUBLIC OF SOUTH

Jan 2023

AFRICA 7.660% 7.685% 7.59% 8.32%

R203 REPUBLIC OF SOUTH

Feb 2023

AFRICA 7.500% 7.525% 7.44% 8.12%

ES18 ESKOM HOLDINGSFebLIMITED

2023 6.630% 6.655% 6.54% 7.24%

R204 REPUBLIC OF SOUTH

Nov 2023

AFRICA 7.990% 8.015% 7.90% 8.61%

R207 REPUBLIC OF SOUTH

Aug 2025

AFRICA 9.420% 9.465% 9.35% 9.71%

R208 REPUBLIC OF SOUTH

Apr 2026

AFRICA 9.120% 9.165% 9.06% 9.45%

ES23 ESKOM HOLDINGSDecLIMITED

2026 7.980% 8.025% 7.91% 8.27%

DV23 DEVELOPMENT NovBANK

2028

OF SOUTHERN

9.960% AFRICA 10.005% 9.89% 10.31%

R2023 REPUBLIC OF SOUTH

Jan 2030

AFRICA 8.870% 8.900% 8.81% 9.08%

ES26 ESKOM HOLDINGSFebLIMITED

2031 9.120% 9.155% 9.06% 9.29%

R186 REPUBLIC OF SOUTH

Mar 2032

AFRICA 9.310% 9.350% 9.26% 9.49%

R2030 REPUBLIC OF SOUTH

Sep 2033

AFRICA 10.915% 10.970% 10.84% 11.04%

R213 REPUBLIC OF SOUTH

Feb 2035

AFRICA 9.730% 9.775% 9.64% 9.83%

R2032 REPUBLIC OF SOUTH

Mar 2036

AFRICA 9.805% 9.850% 9.70% 9.89%

ES33 ESKOM HOLDINGSJanLIMITED

2037 9.935% 9.980% 9.83% 10.04%

R209 REPUBLIC OF SOUTH

Jan 2040

AFRICA 10.075% 10.115% 9.95% 10.14%

R2037 REPUBLIC OF SOUTH

Feb 2041

AFRICA 10.010% 10.050% 9.89% 10.08%

R214 REPUBLIC OF SOUTH

Apr 2042

AFRICA 11.250% 11.290% 11.13% 11.32%

R2044 REPUBLIC OF SOUTH

Jan 2044

AFRICA 10.145% 10.195% 10.03% 10.23%

R2048 REPUBLIC OF SOUTH

Feb 2048

AFRICA 10.155% 10.205% 10.03% 10.23%

Other Rates

Code Description Rate Previous YTD Low YTD High

SAFEX SAFEX Overnight Deposit Rate6.100% 6.100% 6.09% 6.35%

JIBAR1 JIBAR 1 Month 6.383% 6.383% 6.38% 6.63%

JIBAR3 JIBAR 3 Month 6.558% 6.558% 6.56% 6.80%

JIBAR6 JIBAR 6 Month 7.100% 7.100% 7.10% 7.31%

RSA 2 year retail bond 6.75% 0 0 0

RSA 3 year retail bond 7.00% 0 0 0

RSA 5 year retail bond 8.00% 0 0 0

RSA 3 year inflation linked retail

3.50%

bond 0 0 0

RSA 5 year inflation linked retail

3.75%

bond 0 0 0

RSA 10 year inflation linked retail

3.75%

bond 0 0 0

Nominal Bond Curves (NACS)

9.62

9.12

8.62

8.12

7.62

7.12 Zero

6.62 Par/Swap

6.12

5.62

5.12

4.62

2015 2020 2026 2031 2037 2042 2048 2053 2059

DATA DISCLAIMER

To the extent allowed by law, JSE Limited (the JSE) does not (expressly, tacitly or implicitly) guarantee or warrant the availability,

sequence, accuracy, completeness, reliability or any other aspect of any of the data (Data), or that any Data is up to date.

To the extent allowed by law, neither the JSE nor any of its directors, officers, employees, contractors, agents or representatives are

liable in any way to the reader or to any other natural or juristic person (Person) for any loss or damage as a result of (i) the display

of any Data in this bulltetin, or (ii) any Data being unavailable in this bulletin at any time and for any reason, or (iii) any delay,

inaccuracy, error, or omission in relation to any Data, or (iv) any actions taken or not taken by or on behalf of any Person in reliance

on any Data. The JSE is entitled to terminate the production of any Data at any time, without notice and without liability to any Person.

These figures are supplied by parties external to Business Day. Business Day will not warrant the accuracy of the figures.

Вам также может понравиться

- Fuel Prices - December 11 2022Документ1 страницаFuel Prices - December 11 2022Lisle Daverin BlythОценок пока нет

- Liberty - December 11 2022Документ1 страницаLiberty - December 11 2022Lisle Daverin BlythОценок пока нет

- Sanlam Stratus Funds - July 15 2020Документ2 страницыSanlam Stratus Funds - July 15 2020Lisle Daverin BlythОценок пока нет

- Markets and Commodity Figures: 14 June 2017Документ2 страницыMarkets and Commodity Figures: 14 June 2017Tiso Blackstar GroupОценок пока нет

- Liberty - December 9 2022Документ1 страницаLiberty - December 9 2022Lisle Daverin BlythОценок пока нет

- Sanlam Stratus Funds - August 6 2020Документ2 страницыSanlam Stratus Funds - August 6 2020Lisle Daverin BlythОценок пока нет

- Bonds - December 11 2022Документ3 страницыBonds - December 11 2022Lisle Daverin BlythОценок пока нет

- Fairbairn - August 6 2020Документ2 страницыFairbairn - August 6 2020Lisle Daverin BlythОценок пока нет

- Fuel Prices - December 1 2022Документ1 страницаFuel Prices - December 1 2022Lisle Daverin BlythОценок пока нет

- Fairbairn - August 6 2020Документ2 страницыFairbairn - August 6 2020Lisle Daverin BlythОценок пока нет

- Sanlam Stratus Funds - December 6 2022Документ2 страницыSanlam Stratus Funds - December 6 2022Lisle Daverin BlythОценок пока нет

- Bonds - December 9 2022Документ3 страницыBonds - December 9 2022Lisle Daverin BlythОценок пока нет

- Fuel Prices - December 9 2022Документ1 страницаFuel Prices - December 9 2022Lisle Daverin BlythОценок пока нет

- Fuel Prices - December 6 2022Документ1 страницаFuel Prices - December 6 2022Lisle Daverin BlythОценок пока нет

- Liberty - December 6 2022Документ1 страницаLiberty - December 6 2022Lisle Daverin BlythОценок пока нет

- Fairbairn - December 5 2022Документ2 страницыFairbairn - December 5 2022Lisle Daverin BlythОценок пока нет

- Bonds - December 6 2022Документ3 страницыBonds - December 6 2022Lisle Daverin BlythОценок пока нет

- Sanlam Stratus Funds - August 6 2020Документ2 страницыSanlam Stratus Funds - August 6 2020Lisle Daverin BlythОценок пока нет

- Bonds - December 5 2022Документ3 страницыBonds - December 5 2022Lisle Daverin BlythОценок пока нет

- Bonds - December 1 2022Документ3 страницыBonds - December 1 2022Lisle Daverin BlythОценок пока нет

- Sanlam Stratus Funds - December 1 2022Документ2 страницыSanlam Stratus Funds - December 1 2022Lisle Daverin BlythОценок пока нет

- Liberty - December 5 2022Документ1 страницаLiberty - December 5 2022Lisle Daverin BlythОценок пока нет

- Liberty - December 1 2022Документ1 страницаLiberty - December 1 2022Lisle Daverin BlythОценок пока нет

- Sanlam Stratus Funds - July 15 2020Документ2 страницыSanlam Stratus Funds - July 15 2020Lisle Daverin BlythОценок пока нет

- Liberty - November 29 2022Документ1 страницаLiberty - November 29 2022Lisle Daverin BlythОценок пока нет

- Sanlam Stratus Funds - August 6 2020Документ2 страницыSanlam Stratus Funds - August 6 2020Lisle Daverin BlythОценок пока нет

- Liberty - November 30 2022Документ1 страницаLiberty - November 30 2022Lisle Daverin BlythОценок пока нет

- Bonds - November 30 2022Документ3 страницыBonds - November 30 2022Lisle Daverin BlythОценок пока нет

- Fairbairn - August 6 2020Документ2 страницыFairbairn - August 6 2020Lisle Daverin BlythОценок пока нет

- Fairbairn - November 29 2022Документ2 страницыFairbairn - November 29 2022Lisle Daverin BlythОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Chapter2 PDFДокумент9 страницChapter2 PDFnurulkhairunnajahОценок пока нет

- Liability FinalДокумент26 страницLiability FinalJomarie UyОценок пока нет

- 1.1 Export Import of India and Classification (Audio)Документ33 страницы1.1 Export Import of India and Classification (Audio)Abhishek kumarОценок пока нет

- International Trade FinanceДокумент302 страницыInternational Trade Financenaveen_ch522100% (1)

- Peapod-Smart Shopping For Busy PeopleДокумент20 страницPeapod-Smart Shopping For Busy Peoplemrsbellos100% (1)

- Vinastraws Competitive StrategyДокумент12 страницVinastraws Competitive StrategyNguyễn Việt NgaОценок пока нет

- Mergers and Acquisitions in Indian Banking SectorДокумент49 страницMergers and Acquisitions in Indian Banking SectorShafia Ahmad79% (104)

- Accounting Profession in BangladeshДокумент21 страницаAccounting Profession in BangladeshWahidОценок пока нет

- Decathlon - Group 2 - ContentДокумент43 страницыDecathlon - Group 2 - ContentBảo Châuu100% (6)

- Managerial Economics, 5th Edition PDFДокумент427 страницManagerial Economics, 5th Edition PDFAzoooОценок пока нет

- DocubДокумент24 страницыDocubGayli Cortiguerra100% (1)

- Impact of GST On Business and Start-Ups - Doc REPORT WRITING 10Документ60 страницImpact of GST On Business and Start-Ups - Doc REPORT WRITING 10Shruti UpadhyayОценок пока нет

- Chapter 9 The Analysis of Competitive MarketsДокумент16 страницChapter 9 The Analysis of Competitive MarketsRitesh RajОценок пока нет

- Foreclosure Letter - 20 - 26 - 19Документ3 страницыForeclosure Letter - 20 - 26 - 19Santhosh AnantharamanОценок пока нет

- MovingandRelocationServices - Proof of Publication - RedactedДокумент275 страницMovingandRelocationServices - Proof of Publication - RedactedJAGUAR GAMINGОценок пока нет

- Conclusion FdiДокумент2 страницыConclusion FdiYo PaisaОценок пока нет

- SumanДокумент52 страницыSumanUday KumarОценок пока нет

- Credit Risk (Marek Capiński, Tomasz Zastawniak) (Z-Library)Документ202 страницыCredit Risk (Marek Capiński, Tomasz Zastawniak) (Z-Library)Anderson DuarteОценок пока нет

- Chapter 8: Trade Liberalism and Restrictions On Migration of Third World LabourДокумент8 страницChapter 8: Trade Liberalism and Restrictions On Migration of Third World LabourQuenie De la CruzОценок пока нет

- Invitation Letter ERI-CEFE Training LPANДокумент2 страницыInvitation Letter ERI-CEFE Training LPANJoy VisitacionОценок пока нет

- Vanilla Term Sheet KFT VENДокумент11 страницVanilla Term Sheet KFT VENsefdeniОценок пока нет

- Itr 2018-19 PDFДокумент1 страницаItr 2018-19 PDFMalik MuzafferОценок пока нет

- Group 2: Wilkins, A Zurn Company: Aggregate Production PlanningДокумент10 страницGroup 2: Wilkins, A Zurn Company: Aggregate Production PlanningSiddhant SinghОценок пока нет

- Hangcha BrochureДокумент2 страницыHangcha Brochurehassanqr89Оценок пока нет

- Wolfx Signals ®Документ9 страницWolfx Signals ®Fale MensОценок пока нет

- Client MasterДокумент1 страницаClient Masterpauljones7975Оценок пока нет

- FPDS-NG - Anduril SocomДокумент3 страницыFPDS-NG - Anduril SocomforbesadminОценок пока нет

- Chapter 27Документ12 страницChapter 27Crizel DarioОценок пока нет

- Euro ComissionДокумент168 страницEuro ComissionForkLogОценок пока нет

- Tax and Regulatory: Epc Contracts - Fiscal ScenarioДокумент30 страницTax and Regulatory: Epc Contracts - Fiscal Scenariopranjal92pandeyОценок пока нет