Академический Документы

Профессиональный Документы

Культура Документы

Module 07.5 - Foreign Currency Accounting PS

Загружено:

Fiona MoralesОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Module 07.5 - Foreign Currency Accounting PS

Загружено:

Fiona MoralesАвторское право:

Доступные форматы

1

ADVANCED ACCOUNTING

Module 7: Foreign Currency Accounting

Practice Set 7.1: Foreign Currency Transactions/Translation

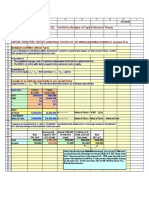

1. Entity A owns majority of the outstanding ordinary shares of Entity B which is operating in

United States of America wherein the functional currency is the USA $. However, the

presentation currency of Entity B is the Philippine Peso because that is the presentation

currency of Entity A. For the year ended December 31, 2020, Entity B presented its

Statement of Financial Position in its functional currency of USA $:

Current Assets $10,000 Current Liabilities $10,000

Noncurrent Assets 40,000 Noncurrent Liabilities 20,000

Ordinary Share Capital 5,000

Preference Share Capital 8,000

Retained Earnings 7,000

Total Assets $50,000 Total Liabilities & Equity $50,000

The ordinary shares are issued on January 1, 2019 while the preference shares are issued

on July 1, 2019.

B reported $1,000 net income during 2020 and declared dividends in the amount of $200

on December 1, 2020.

The translated amount of retained earnings on December 31, 2019 is P300,000.

The following direct exchange rates are provided:

January 1, 2019 P40

July 1, 2019 42

December 31, 2019 43

December 1, 2020 41

December 31, 2020 45

Average Rate 2020 44

a. What is the amount of net assets in US dollars on December 31, 2019? 58,500

b. What amount of translation gain as component of other comprehensive income

should be presented in the statement of comprehensive income for the year ended

December 31, 2020? 67500

c. What is the translated retained earnings balance on December 31, 2020? 47000

d. What is the cumulative translation credit that should be presented in the statement

of financial position on December 31, 2020? 4000

2. GWA Corporation of Makati paid P1,128,750 for a 35% interest in KYJ Company in Taiwan

on January 1, 2022, when KYJ’s net asset totaled 375,000 NT Dollar and the exchange rate

for NT Dollar was P8.60. A summary of changes in KYJ’s net assets during 2022 is as follows:

NT Dollar Exchange Rates

Net assets, January 1 375,000 P8.60

Net income for 2022 75,000 8.55

Dividends paid for 2022 25,000 8.54

GWA Corporation anticipated a strengthening of the Philippine peso against the NT Dollar

during the last half of 2022, and it borrowed 150,000 NT Dollar from a Taiwanese bank for

one year at 10% interest on July 1, 2022 to hedge its net investment in KYJ.

The loan was made when the exchange rate for NT Dollar was P8.55. The loan was

denominated in NT dollar and the current exchange rate at December 31, 2022 was P8.50.

a. What is the Other Comprehensive Income – translation adjustment presented in

equity in 2022 as a result of hedging? Loss of 98658

ADVACC (Acctg 630) – MODULE 7: FOREIGN CURRENCY ACCOUNTING

Ateneo de Zamboanga University – School of Management and Accountancy

2

3. Honda Phil. is a subsidiary of Honda Japan. The functional currency of Honda Phil. is peso

while the presentation of its parent, Honda Japan, is yen. For the year ended December 31,

2020, Honda Phil. has the following foreign currency denominated assets: Accounts

Receivable of $1,000, and Prepaid Asset of $100. The exchange rate on December 31, 2020

is $1=P40 and P1=¥3

The historical rates are:

Dollar Yen

Accounts Receivable $1=P30 P1=¥2

Prepaid Asset $1=P20 P1=¥4

a. In the separate Statement of Financial Position of Honda Phil. on December 31, 2020,

what is the book value of accounts receivable and prepaid asset, respectively?

b. Using the same data above, what is the book value of accounts receivable and prepaid

asset, respectively, in the Consolidated Statement of Financial Position of Honda

Japan?

Practice Set 7.1: Foreign Currency Hedging

1. On November 1, 2020, an entity acquired on account goods from a foreign supplier at a cost

of $1,000. The accounts payable are paid on January 30, 2021.

On December 1, 2020, an entity sold on account the said goods to a foreign customer at a

selling price of $1,500. The accounts receivable are collected on February 28, 2021.

The entity is operating in Philippine economy wherein the functional currency is the

Philippine Peso.

The following direct exchange rates are provided:

Buying spot rate Selling spot rate

November 1, 2020 P40 P42

December 1, 2020 39 40

December 31, 2020 45 47

a. What is the sales revenue for 2020?

b. What is the carrying amount of accounts receivable on December 31, 2020?

c. What is the carrying amount of accounts payable on December 31, 2020?

d. What is the net foreign currency gain for 2020?

2. Vector Corporation issued a promissory note denominated in foreign currency for the

purchase made from a supplier in England on December 1, for a 60-day, 18% promissory

note for 108,000 pounds, at a selling rate of 1FC to P74.20. On December 31, the selling spot

rate is 1FC to P74.85. On January 30, the selling spot rate is 1FC to P75.75.

a. On the settlement date, how much is the foreign exchange gain/loss?

3. Uragon Company sold warehouse facilities for $8,340,000 to a customer in Oregon, USA on

November 02, 2020. Collection in US dollars was due on January 31, 2021. On the same date,

to hedge this foreign currency exposure, Uragon Company entered into a forward contract

to sell $8,340,000 to Export bank for delivery on January 31, 2021. Indirect exchange rates

on different dates were as follows:

Nov 2 Dec 31 Jan 31

Spot rate 0.02387 0.02457 0.02494

30-day futures 0.02364 0.02475 0.02278

60-day futures 0.02392 0.02481 0.02437

90-day futures 0.02463 0.02403 0.02304

a. How much is the effect on earnings due to hedged item in the 2020 P/L statement?

b. How much is the effect on earnings due to hedged item in the 2021 P/L statement?

ADVACC (Acctg 630) – MODULE 7: FOREIGN CURRENCY ACCOUNTING

Ateneo de Zamboanga University – School of Management and Accountancy

3

4. Barako Company acquired heavy equipment for $14,100 from a supplier in Detroit, USA on

December 1, 2020. Payment in US dollars was due on March 31, 2021. On the same date, to

hedge this foreign currency exposure, Barako entered into a forward contract to purchase

$14,100 from Citibank for delivery on March 31, 2021. Direct exchange rates for dollars on

different dates were as follows:

Spot Rates

Bid Offer

December 1, 2020 41.6 41.4

December 31, 2020 42.5 42.3

March 31, 2021 43.4 43.7

Forward Rates

Dec 1 Dec 31 Mar 31

30-day futures 42.3 41.8 43.2

60-day futures 41.8 42.2 42.6

90-day futures 40.6 42.5 43.4

120-day futures 42.2 42.8 42.9

a. What is the reported value of the liability to the vendor at December 31, 2020?

b. What is the net impact in Barako Company’s income in 2020 as a result of this

hedging activity?

5. On November 2, 2020, P Corp entered into a firm commitment with Japanese firm to acquire

equipment, delivery and passage of title on march 31, 2021, at a price of 4,375 yen. On the

same date, to hedge against unfavorable changes in the exchange rate of the yen, P Corp.

entered into a 150-day forward contract with BPI for 4,375 yen. The relevant exchange

rates were as follows:

11/02/2020 12/31/2020 03/31/2021

Spot Rate P37 P38 P35

Forward Rate P40 P33 P35

a. What is the foreign currency gain/loss due to the change in the fair value of the

underlying purchase commitment on December 31, 2020?

b. What is the amount debited to the equipment account?

6. On November 1, 2020, 7D Co. entered into a firm commitment with Toki-Toki Japanese

Company for the export of dried mangoes with a contract price of 10,000 Yen. The goods

will be delivered by 7D Co. on January 31, 2021. On the same day, in order to protect itself

from the risk of changes in fair value of the firm commitment due to changes in underlying

foreign currency, 7D Co. entered into a forward contract with BDO for the sale of 10,000 Yen

at the forward rate on November 1, 2020. IAS 29 provides that hedge of the foreign

currency risk of a firm commitment may be accounted for as either fair value hedge or cash

flow hedge. 7D Co. elected to account for the hedge of the firm commitment using fair value

hedge. The following direct exchange rates are provided:

November 1, 2020 December 31, 2020 January 30,2021

Buying spot rate P10 P13 P12

Selling spot rate P13 P15 P16

Forward buying 90-days P11 P14 P15

Forward selling 90-days P13 P16 P17

Forward buying 60-days P14 P17 P16

Forward selling 60-days P15 P18 P14

Forward buying 30-days P11 P15 P12

Forward selling 30-days P13 P11 P14

a. What is the foreign currency gain (loss) due to hedged item for the year ended

December 31, 2020?

b. What is the foreign currency gain (loss) due to hedging instrument for the year ended

December 31, 2021?

ADVACC (Acctg 630) – MODULE 7: FOREIGN CURRENCY ACCOUNTING

Ateneo de Zamboanga University – School of Management and Accountancy

4

7. On October 1, 2020, the company took delivery from a Bahrain firm of inventory costing

850,000 dinar. Payment is due on January 30, 2021. Concurrently the company paid

P11,700 at-the-money call option for 850,000 Bahrain dinar. The strike price is P9.40.

Market Price Fair Value of the call option

October 1, 2020 9.400 11,700

December 31, 2020 9.423 23,200

January 30, 2021 9.435 29,750

a. If changes in the time value will be excluded from the assessment of hedge

effectiveness, what is the forex gain (loss) on the hedging instrument due to change in

the ineffective portion on December 31, 2020?

b. If the changes in the time value will be included in the assessment of hedge

effectiveness, what is the forex gain (loss) in the hedging instrument in 2021?

c. If split accounting is used in the assessment of hedge effectiveness, what is the forex

gain (loss) on the option contract due to change in intrinsic value on December 31,

2021?

8. On October 1, 2020, 5J sold on account an inventory to a US-based company at a price of

$5,000 collectible on January 30, 2021. On November 1, 2020, 5J purchased on account an

inventory to a US-based company at a price of $8,000 payable on March 2, 2021.

On October 1, 2020, in order to hedge the foreign currency risk related to its foreign

currency denominated accounts receivable, 5J acquired a 120-day put option from RCBC to

sell $5,000 at a strike price of P40 by paying option premium of P500. On November 1,

2020, in order to hedge the foreign currency risk related to its foreign currency

denominated accounts payable, 5J acquired a 120-day call option from RCBC to buy $8,000

at an option premium of P600.

The following additional data are provided:

10/1/2020 11/1/2020 12/31/2020 1/30/2021 3/2/2021

Buying spot rate P40 P38 P36 P37 P39

Selling spot rate P39 P41 P44 P41 P42

FV of put option ? ? P23,000 ? ?

FV of call option ? ? P25,000 ? ?

a. What is the net foreign currency gain or loss as a result of hedging activity to be

reported by 5J Inc. for the year end December 31, 2020?

b. What is the net foreign currency gain or loss as a result of hedging activity to be

reported by 5J Inc. for the year ended December 31, 2021?

9. On September 1, 2020, 2B Co. anticipated the purchase of merchandise from a foreign

vendor at a price of $1,000. The purchase would probably occur on January 30, 2021. On

October 1, 2020, 2B Co. forecasted the sale of merchandise to a foreign customer at a price

of $3,000. The sale would probably occur on March 31, 2021.

On September 1, 2020, 2B Co. purchased a 150-day call option to buy $1,000 at an option

price of P20 by paying option premium of P200. On October 1, 2020, 2B Co. purchased a

180-day put option to sell $3,000 at a strike price of P24 by paying option premium of P300.

The company prepares calendar year financial statements.

The forecasted purchase and sales transaction occurred on the date anticipated. For the

year ended December 31, 2021, all foreign currency receivables are collected but only 80%

of purchased inventories from the foreign vendor were sold to third person.

The following additional data are provided:

9/1/2020 10/1/2020 12/31/2020 1/30/2021 3/31/2021

Buying spot rate P23 P24 P21 P22.50 P22

Selling spot rate P20 P21 P24 P23 P21

FV of put option ? ? P10,000 ? ?

FV of call option ? ? P4,500 ? ?

ADVACC (Acctg 630) – MODULE 7: FOREIGN CURRENCY ACCOUNTING

Ateneo de Zamboanga University – School of Management and Accountancy

5

a. What is the net foreign currency gain or loss in Other Comprehensive Income of

Statement of Comprehensive Income for the year ended December 31, 2020?

b. What is the net foreign currency gain or loss in Other Comprehensive Income of

Statement of Comprehensive Income for the year ended December 31, 2021?

c. What is the net cumulative Other Comprehensive Income in December 31, 2021?

ADVACC (Acctg 630) – MODULE 7: FOREIGN CURRENCY ACCOUNTING

Ateneo de Zamboanga University – School of Management and Accountancy

Вам также может понравиться

- Foreign Currency HedgingДокумент4 страницыForeign Currency HedgingBianca Iyiyi100% (4)

- A Owns Majority of The Outstanding Ordinary SharesДокумент2 страницыA Owns Majority of The Outstanding Ordinary Sharesasdfghjkl zxcvbnm100% (1)

- 01 - Preweek Lecture and ProblemsДокумент15 страниц01 - Preweek Lecture and ProblemsMelody GumbaОценок пока нет

- Test AfarДокумент24 страницыTest AfarZyrelle Delgado100% (3)

- On November 1Документ2 страницыOn November 1asdfghjkl zxcvbnmОценок пока нет

- Forex - Transaction and TranslationДокумент13 страницForex - Transaction and TranslationJoyce Anne MananquilОценок пока нет

- p2 - Guerrero Ch10Документ28 страницp2 - Guerrero Ch10JerichoPedragosa67% (3)

- Prerev FOREX 2019Документ8 страницPrerev FOREX 2019RojParcon50% (4)

- Foreign CurrencyДокумент4 страницыForeign CurrencyDyheeОценок пока нет

- Forward ContractДокумент8 страницForward ContractZham JavierОценок пока нет

- AccgovДокумент11 страницAccgovJanella Patrizia100% (2)

- Accounting For Foreign Currency TransactionДокумент4 страницыAccounting For Foreign Currency TransactionDymphna Ann Calumpiano100% (3)

- FL AfarДокумент20 страницFL AfarKenneth Robledo50% (2)

- Accounts Receivable Accounts Payable: A. P19,500 GainДокумент6 страницAccounts Receivable Accounts Payable: A. P19,500 GainTk KimОценок пока нет

- 11 Foreign Currency Transactionsxx PDFДокумент111 страниц11 Foreign Currency Transactionsxx PDFAnjell Reyes71% (17)

- Advanced Acctg 2018 NotesДокумент10 страницAdvanced Acctg 2018 NotesApril Bonus0% (2)

- Forex - DerivativesДокумент5 страницForex - DerivativesAllyse CarandangОценок пока нет

- CPAR PreweekДокумент20 страницCPAR Preweekrochielanciola100% (1)

- Derivatives and Foreign Currency Transactions Joint VentureДокумент3 страницыDerivatives and Foreign Currency Transactions Joint VentureVincent Larrie MoldezОценок пока нет

- Translation - Quizzer 001Документ3 страницыTranslation - Quizzer 001Kenneth Bryan Tegerero TegioОценок пока нет

- Chapter 14 Multiple Choices: PROB. 14 - 1 (IAS)Документ12 страницChapter 14 Multiple Choices: PROB. 14 - 1 (IAS)jek vinОценок пока нет

- p2 Foreign CurrencyДокумент4 страницыp2 Foreign CurrencyJustine Goes KaizerОценок пока нет

- Activity For Finals TermДокумент6 страницActivity For Finals TermRhegee Irene RosarioОценок пока нет

- Advance Acctg Foreign Currency ProblemsДокумент6 страницAdvance Acctg Foreign Currency ProblemsManila John20% (5)

- Effects of Changes in ForEx RatesДокумент40 страницEffects of Changes in ForEx RatesEnrique Paolo Mendoza80% (5)

- Acctg Solution Chapter 19Документ17 страницAcctg Solution Chapter 19xxxxxxxxx33% (3)

- AFAR QuizДокумент18 страницAFAR QuizHans Even Dela Cruz100% (1)

- Home and Branch Part 1Документ4 страницыHome and Branch Part 1Jessica Libunao100% (1)

- Final Exam - ADV ACCTG 2 - 2nd Sem2011-2012Документ26 страницFinal Exam - ADV ACCTG 2 - 2nd Sem2011-2012R De GuzmanОценок пока нет

- Govacc TheoriesДокумент82 страницыGovacc Theoriesorly100% (1)

- Derivatives As Hedging Instrument in Managing Foreign Currency ExposuresДокумент52 страницыDerivatives As Hedging Instrument in Managing Foreign Currency ExposuresCasper John Nanas MuñozОценок пока нет

- Batohinog, Tricia Jean B. 1: Name Block: Write Your Final Answers in The Table Provided. Indicate If Gain or LossДокумент7 страницBatohinog, Tricia Jean B. 1: Name Block: Write Your Final Answers in The Table Provided. Indicate If Gain or LossivankingbachoОценок пока нет

- Construction Contracts ProblemsДокумент14 страницConstruction Contracts ProblemsAngela A. MunsayacОценок пока нет

- AFAR8719 - Foreign Currency Transaction and TranslationДокумент5 страницAFAR8719 - Foreign Currency Transaction and TranslationSid TuazonОценок пока нет

- QuizДокумент3 страницыQuizAlex100% (2)

- Multiple Choices QuestionsДокумент10 страницMultiple Choices QuestionsChristopher Price0% (1)

- NPO ProblemsДокумент3 страницыNPO ProblemsAdam Smith50% (2)

- Adfianp - Forex - Quizzer - 2016nДокумент9 страницAdfianp - Forex - Quizzer - 2016nKenneth Bryan Tegerero Tegio100% (1)

- AFAR8722 - Nonprofit Organizations PDFДокумент2 страницыAFAR8722 - Nonprofit Organizations PDFSid Tuazon100% (1)

- 47 - Financial Reporting and Changing PricesДокумент3 страницы47 - Financial Reporting and Changing PricesYvonne Joy Mondano TehОценок пока нет

- ACRV 1023 Final Exams With Answers PDFДокумент8 страницACRV 1023 Final Exams With Answers PDFMary Grace Narag100% (1)

- CPA Board Examination Operation - Advance Accounting: Page 1 of 11Документ11 страницCPA Board Examination Operation - Advance Accounting: Page 1 of 11Janella Patrizia0% (1)

- MCQ With AnswersДокумент27 страницMCQ With AnswersAnonymous qi4PZkОценок пока нет

- ConstructiveДокумент5 страницConstructiveLobotОценок пока нет

- Accounting For SMEs Illustrative ProblemsДокумент5 страницAccounting For SMEs Illustrative ProblemsKate AlvarezОценок пока нет

- T R S A: Ap-200Q: Quizzer On Financing Cycle: Audit of Stockholders' EquityДокумент12 страницT R S A: Ap-200Q: Quizzer On Financing Cycle: Audit of Stockholders' Equityprincess sibugОценок пока нет

- DocДокумент5 страницDocYour Materials33% (3)

- Practice Problems AcctgДокумент10 страницPractice Problems AcctgRichard ColeОценок пока нет

- AfarДокумент14 страницAfarKenneth RobledoОценок пока нет

- Set AДокумент5 страницSet ASomersОценок пока нет

- Ho Branch Quiz 3 2016Документ9 страницHo Branch Quiz 3 2016shampaloc100% (2)

- P2 06Документ9 страницP2 06Herald Gangcuangco33% (3)

- Identify The Choice That Best Completes The Statement or Answers The QuestionДокумент5 страницIdentify The Choice That Best Completes The Statement or Answers The QuestionErwin Labayog MedinaОценок пока нет

- Advanced Accounting Part 1 Dayag 2015 Chapter 8Документ5 страницAdvanced Accounting Part 1 Dayag 2015 Chapter 8Killua Zoldyck67% (3)

- Apr 4/accounting For Business Combinations: General InstructionДокумент8 страницApr 4/accounting For Business Combinations: General InstructionJoannah maeОценок пока нет

- Pas 21 The Effects of Changes in Foreign Exchange RatesДокумент2 страницыPas 21 The Effects of Changes in Foreign Exchange RatesRaven BermalОценок пока нет

- A Owns Majority of The Outstanding Ordinary SharesДокумент2 страницыA Owns Majority of The Outstanding Ordinary Sharesasdfghjkl zxcvbnmОценок пока нет

- Quiz Foreign Currency Transaction, Hedging & Translation: U AnsweredДокумент25 страницQuiz Foreign Currency Transaction, Hedging & Translation: U AnsweredDenise Jane RoqueОценок пока нет

- Accounting For Foreign Exchange Ias 21 PDFДокумент3 страницыAccounting For Foreign Exchange Ias 21 PDFJade jade jadeОценок пока нет

- AFAR02-10 - ForexДокумент2 страницыAFAR02-10 - ForexNicoleОценок пока нет

- EngagementLetter ArdentHuskies GC2019Документ4 страницыEngagementLetter ArdentHuskies GC2019Fiona MoralesОценок пока нет

- Practice SetДокумент2 страницыPractice SetFiona MoralesОценок пока нет

- Problem No. 1: Practice Set Property Plant and EquipmentДокумент4 страницыProblem No. 1: Practice Set Property Plant and EquipmentFiona MoralesОценок пока нет

- MAS Long QuizДокумент3 страницыMAS Long QuizFiona MoralesОценок пока нет

- Law Oblicon :) )Документ9 страницLaw Oblicon :) )Fiona MoralesОценок пока нет

- Inventory EstimationДокумент2 страницыInventory EstimationFiona MoralesОценок пока нет

- Finance Satyam AnalysisДокумент12 страницFinance Satyam AnalysisNeha AgarwalОценок пока нет

- Fundamentals of Accountancy, Business and Management 2: Quarter 2 - Module Week 1Документ9 страницFundamentals of Accountancy, Business and Management 2: Quarter 2 - Module Week 1Joana Jean SuymanОценок пока нет

- IMTCDL FINC512 Exam GuideДокумент30 страницIMTCDL FINC512 Exam GuidePranav Sharma0% (1)

- Chapter 3 - IAS 23Документ5 страницChapter 3 - IAS 23Chandan SamalОценок пока нет

- FinancialStatement 2019Документ298 страницFinancialStatement 2019Tonga ProjectОценок пока нет

- TM 1 - Definition, Aspects, Structure and Corporate Governance SourcesДокумент5 страницTM 1 - Definition, Aspects, Structure and Corporate Governance SourcesMuh Rizky HendrawanОценок пока нет

- BRANCH ACCOUNTS - Assignment SolutionsДокумент9 страницBRANCH ACCOUNTS - Assignment SolutionsNaveen C GowdaОценок пока нет

- FINA 2330 Assignment 5Документ4 страницыFINA 2330 Assignment 5rebaОценок пока нет

- A Report: Standard Chartered BankДокумент77 страницA Report: Standard Chartered BankVinay Singh80% (5)

- Financial Acctg 1 ReviewerДокумент9 страницFinancial Acctg 1 ReviewerAllyza May GasparОценок пока нет

- Annual Report 2014Документ249 страницAnnual Report 2014BETTY ELIZABETH JUI�A QUILACHAMINОценок пока нет

- Quiz 1-CfasДокумент8 страницQuiz 1-CfasRizelle ViloriaОценок пока нет

- Tarea 4 - Riesgo y Rendimiento Parte 1Документ30 страницTarea 4 - Riesgo y Rendimiento Parte 1Edgard Alberto Cuellar IriarteОценок пока нет

- Ashok Leyland - Annual Report 2017-18Документ220 страницAshok Leyland - Annual Report 2017-18Kumar Prakash100% (1)

- Daftar Akun UD Buana (Lisa Nabila)Документ1 страницаDaftar Akun UD Buana (Lisa Nabila)Lisa NabilaОценок пока нет

- Annual Report Final March 2009Документ192 страницыAnnual Report Final March 2009townmakerОценок пока нет

- Chapter 26. Tool Kit For Analysis of Capital Structure TheoryДокумент11 страницChapter 26. Tool Kit For Analysis of Capital Structure TheoryJITIN ARORAОценок пока нет

- 26-06-2020 Financial Management Suggested AnswersДокумент3 страницы26-06-2020 Financial Management Suggested AnswersJEANОценок пока нет

- ACT 501 - AssignmentДокумент6 страницACT 501 - AssignmentShariful Islam ShaheenОценок пока нет

- Working CapitalДокумент26 страницWorking CapitalJuan CarlosОценок пока нет

- ACCOUNTING P1 GR12 AB SEPT - EnglishДокумент11 страницACCOUNTING P1 GR12 AB SEPT - EnglishSthockzin EntОценок пока нет

- Principles of Accounting Spring 2022 Bba 1-A & B Worksheet No 1: Basic Accounting Equation - Identification of AccountsДокумент3 страницыPrinciples of Accounting Spring 2022 Bba 1-A & B Worksheet No 1: Basic Accounting Equation - Identification of AccountsYumna TauqeerОценок пока нет

- JK Cement LTD Annual Report 2019 20 Including Notice DR CGR Mda EtcДокумент204 страницыJK Cement LTD Annual Report 2019 20 Including Notice DR CGR Mda EtcVatsal JainОценок пока нет

- BFL LAS Product Note INTERNAL 27.04.17Документ3 страницыBFL LAS Product Note INTERNAL 27.04.17Prachi PatwariОценок пока нет

- REVIEWERДокумент10 страницREVIEWERRhyna Vergara SumaoyОценок пока нет

- Role of Adjudicating Authority in CIRP & Liquidation Under Insolvency and Bankruptcy LawДокумент11 страницRole of Adjudicating Authority in CIRP & Liquidation Under Insolvency and Bankruptcy LawShachi SinghОценок пока нет

- FABM 2121 SourceДокумент219 страницFABM 2121 SourceJeamie Sayoto80% (5)

- Financial Derivatives 260214 PDFДокумент344 страницыFinancial Derivatives 260214 PDFNithin IthanadkaОценок пока нет

- Tencent Business Registration in SingaporeДокумент5 страницTencent Business Registration in SingaporeSGEОценок пока нет

- Indian Accounting Standards 101Документ8 страницIndian Accounting Standards 101santhosh MohankumarОценок пока нет