Академический Документы

Профессиональный Документы

Культура Документы

Assignment 2 PGDM

Загружено:

niftamИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Assignment 2 PGDM

Загружено:

niftamАвторское право:

Доступные форматы

1.

There is an overdraft in the joint names of A and B and there is a credit balance in the

name account of A. Can the banker set off the credit balance against the overdraft.

Give reason

2. D is the guarantor of a loan granted by the bank to S. The loan has become sticky.

There is a credit balance in the account of D. Can the banker set it off against D’s

liability as a guarantor?

3. On June 20th your branch received a garnishee order to attach all sums owing by the

bank to your customer X. X has a joint account with Y in your branch and an overdue

unsecured loan account in the name of X in which he owes the bank Rs. 1000.

4. You have a joint account of Mr and Mrs Desai as ‘joint account’ in your branch. Mrs.

Desai approaches you for knowing the account balance. How would you react?

5. As branch manager how will you deal with the following situations?

a. Your customer sends a crossed cheque drawn by A in favour of your bank for

crediting it his (the customer’s) account with your bank.

b. Smt. Radha P. Patel sends for the credit of her account with you a cheque

drawn in favour of Smt. R P Patel and endorsed by her as Smt. Radha Patel.

c. Cheque, dated 17th April 2009 presented on 8th July 2009

d. Paying a cheque to B which is drawn in favour of A and marked ‘not

negotiable’.

6. ‘Exclusive sports club’ wants to open a current account at your branch.

What are the formalities you will need for opening the account and the points you

will keep in mind in regard to the operation?

7. Two persons Mr. Rohit and Mr. Mohit maintain a joint saving account

with the operating style ‘either or survivor’. Mr. Mohit filed insolvency petition

and in the meantime a cheque drawn by Mr. Rohit is presented for payment. What

course of action will you take?

8. A cheque for Rs. 50,916 paid by a bank is found later to have been

chemically altered, the amount having been raised considerably, Can the bank

claim protection?

9. How would you deal with the following situations as a banker?

.

a) An income tax officer approaches you and requests to let him know the balances

in the accounts of three valuable customers of your branch. He informs that he

requires this information as the income tax department has to recover arrears of

tax payable by them.

b) There is a credit balance in the account of A. The banker wishes to set this off

against an overdraft in the joint name of A and B.

10. You are in the top management of a public sector bank which is facing a lot of

competition from other private and foreign sector banks. Your bank is into all fund–

based activities and you are given a target of raising the profits by another 20% by the

next year. What course of action will you suggest?

Вам также может понравиться

- How to Get a Business Loan for Commercial Real Estate: 2012 EditionОт EverandHow to Get a Business Loan for Commercial Real Estate: 2012 EditionОценок пока нет

- 01 Caselets On Banker Customer RelationshipДокумент3 страницы01 Caselets On Banker Customer RelationshipSTUTI SHRIVASTAVA-DM 21DM201Оценок пока нет

- 02 Cases On Banker Customer RelationshipДокумент4 страницы02 Cases On Banker Customer RelationshipVikashKumar100% (1)

- Case Studies of Banking & FinanceДокумент3 страницыCase Studies of Banking & FinancePooja Patil20% (5)

- BANKING LAW-case StudyДокумент1 страницаBANKING LAW-case StudySharad PatilОценок пока нет

- Mock Test JAIIBДокумент73 страницыMock Test JAIIBrkpo97100% (6)

- Case Studies - Banking Law&PracticeДокумент5 страницCase Studies - Banking Law&PracticeRedSun50% (4)

- Banking LawДокумент3 страницыBanking LawtrizahОценок пока нет

- Mock Practice Test 1: Banking Law QuestionsДокумент124 страницыMock Practice Test 1: Banking Law QuestionsAyan ChakraborttyОценок пока нет

- Credit CreationДокумент6 страницCredit CreationAamir NabiОценок пока нет

- Siil8zwja - Activity - Chapter 5 - Books of Accounts & Double-Entry SystemДокумент5 страницSiil8zwja - Activity - Chapter 5 - Books of Accounts & Double-Entry SystemLyra Mae De BotonОценок пока нет

- QuizДокумент4 страницыQuizTarun BansalОценок пока нет

- Baroda Manipal School of Banking Manipal Academy of Banking Bangalore Accounts and Financial ManagementДокумент7 страницBaroda Manipal School of Banking Manipal Academy of Banking Bangalore Accounts and Financial ManagementHolly ManningОценок пока нет

- Banking Analysis SOPДокумент5 страницBanking Analysis SOPVarunОценок пока нет

- 03 Special Types of Customers of A Bank CasesДокумент4 страницы03 Special Types of Customers of A Bank CasesVikashKumarОценок пока нет

- Key Elements of KYC Policy and Anti-Money Laundering GuidelinesДокумент7 страницKey Elements of KYC Policy and Anti-Money Laundering Guidelinestalrejajyoti73% (11)

- Athalia Chiu BFUNAC - EXERCISE 5Документ4 страницыAthalia Chiu BFUNAC - EXERCISE 5Allan AntonioОценок пока нет

- Quiz 2 Cash To ARДокумент4 страницыQuiz 2 Cash To ARGraziela MercadoОценок пока нет

- BA 114.1 - Quiz 1 SamplexДокумент12 страницBA 114.1 - Quiz 1 SamplexPamela May NavarreteОценок пока нет

- Boca Assignment: Issues and Challenges of Banking Sector and Alloted Bank: Bank of IndiaДокумент5 страницBoca Assignment: Issues and Challenges of Banking Sector and Alloted Bank: Bank of IndiaRahul KumarОценок пока нет

- DownloadДокумент2 страницыDownloadAshwani DhimanОценок пока нет

- MockTest 3Документ16 страницMockTest 3Pawan SharmaОценок пока нет

- Quiz Far 1Документ5 страницQuiz Far 1Jekah AnneОценок пока нет

- Kokan BankДокумент20 страницKokan BankramshaОценок пока нет

- Credit CreationДокумент7 страницCredit CreationwubeОценок пока нет

- Financial Accounting Exam ReviewДокумент15 страницFinancial Accounting Exam ReviewChjxksjsgskОценок пока нет

- Commerce Topic 2Документ16 страницCommerce Topic 2Anonymous lVpFnX3Оценок пока нет

- 2nd Q EXAMДокумент6 страниц2nd Q EXAMChristian TonogbanuaОценок пока нет

- Cash and Receivables Key PointsДокумент64 страницыCash and Receivables Key PointssevtenОценок пока нет

- Credit CreationДокумент25 страницCredit CreationPrachiОценок пока нет

- Chapter 5 A ServicesДокумент15 страницChapter 5 A ServicesSeid KassawОценок пока нет

- Final Demand Letter 2020Документ2 страницыFinal Demand Letter 2020Jhony Martin Alba100% (1)

- Ba 3Документ8 страницBa 3venkataramana143Оценок пока нет

- Pubali BankДокумент13 страницPubali BankAminul Islam100% (1)

- Chapter 01 02 Selected MCQsДокумент7 страницChapter 01 02 Selected MCQsLe Hong Phuc (K17 HCM)Оценок пока нет

- Opening a Savings Account at Bank of BarodaДокумент16 страницOpening a Savings Account at Bank of BarodaAnonymous lVpFnX3Оценок пока нет

- Quiz On Introduction To AccountingДокумент3 страницыQuiz On Introduction To AccountingCeejay MancillaОценок пока нет

- Bank Reconciliation Statement 70Документ6 страницBank Reconciliation Statement 70xyzОценок пока нет

- Rights and Obligations of BankerДокумент3 страницыRights and Obligations of BankerMoinuddin Khan Kafi100% (1)

- BCF Unit 3 Credit CreationДокумент3 страницыBCF Unit 3 Credit Creationlakshya mudgalОценок пока нет

- Work Book RBPC - Without AnswersДокумент21 страницаWork Book RBPC - Without AnswersVipin VipsОценок пока нет

- Half Yearly Examination 2011-12 Accounting Class XI-XIIДокумент3 страницыHalf Yearly Examination 2011-12 Accounting Class XI-XIISk SinghОценок пока нет

- Legal NoticeДокумент3 страницыLegal NoticeMuskaan SinhaОценок пока нет

- Quizzes - Chapter 5 - Books of Accounts & Double-Entry SystemДокумент4 страницыQuizzes - Chapter 5 - Books of Accounts & Double-Entry SystemAmie Jane Miranda89% (9)

- Understanding Commercial Mathematics: An Analysis of Banking Products and ServicesДокумент21 страницаUnderstanding Commercial Mathematics: An Analysis of Banking Products and ServicesKrish MhatreОценок пока нет

- Case Study Legal Aspects & NI ActДокумент23 страницыCase Study Legal Aspects & NI Actvarun_bathula100% (1)

- Angel High School & Junior Colllege, Loni Kalbhor Subject: Book Keeping & Accountancy Question BankДокумент21 страницаAngel High School & Junior Colllege, Loni Kalbhor Subject: Book Keeping & Accountancy Question BankShruti sukumarОценок пока нет

- Test 2Документ4 страницыTest 2Akmal AkramОценок пока нет

- XI Pre-BoardДокумент7 страницXI Pre-BoardSamar Singh Rathore0% (1)

- Money and Banking ProjectДокумент11 страницMoney and Banking Projectshahroze ALIОценок пока нет

- Module 2Документ57 страницModule 2Tejaswini TejuОценок пока нет

- Assessment Test 2nd Cash&RecДокумент6 страницAssessment Test 2nd Cash&RecMellowОценок пока нет

- Bar Exam Questions in Banking LawsДокумент54 страницыBar Exam Questions in Banking LawsKayzer SabaОценок пока нет

- Banking LawsДокумент90 страницBanking LawsKay VPОценок пока нет

- Banking Correspondence and Insurance LettersДокумент76 страницBanking Correspondence and Insurance LettersVindraj ChopdekarОценок пока нет

- Summative Test in Fabm 2 Name: - Grade/Section: - ScoreДокумент5 страницSummative Test in Fabm 2 Name: - Grade/Section: - ScorebethОценок пока нет

- Amount in Rupees CroreДокумент31 страницаAmount in Rupees CroreniftamОценок пока нет

- Msme Finance RajeevДокумент3 страницыMsme Finance RajeevniftamОценок пока нет

- Amount in Rupees CroreДокумент31 страницаAmount in Rupees CroreniftamОценок пока нет

- Boi 1Документ1 страницаBoi 1niftamОценок пока нет

- 1) A Bank Accepts A Deposit From A Corporate House.: B) Mortgage of The TractorДокумент17 страниц1) A Bank Accepts A Deposit From A Corporate House.: B) Mortgage of The TractoramitatforeОценок пока нет

- Fees Structure 20212022 PDFДокумент3 страницыFees Structure 20212022 PDFAhmedОценок пока нет

- Answer Chapter 1Документ5 страницAnswer Chapter 1Nguyễn Châu Mỹ KiềuОценок пока нет

- 654475993949_e-StatementBRImo_042301005930531_Feb2024_20240301_121426Документ3 страницы654475993949_e-StatementBRImo_042301005930531_Feb2024_20240301_121426Muhammad Awaludin HasanОценок пока нет

- Banco Filipino Savings and Mortgage Bank vs. Ybañez, 445 SCRA 482, G.R. No. 148163 December 6, 2004Документ4 страницыBanco Filipino Savings and Mortgage Bank vs. Ybañez, 445 SCRA 482, G.R. No. 148163 December 6, 2004Daysel FateОценок пока нет

- Role of Pune District Central Cooperative Bank in Rural DevelopmentДокумент16 страницRole of Pune District Central Cooperative Bank in Rural Developmentshubham jagtap100% (1)

- Interest Rate ParityДокумент5 страницInterest Rate Parityrosario correiaОценок пока нет

- 20180523153227XXXXXXX3302 PDFДокумент1 страница20180523153227XXXXXXX3302 PDFUMESH KUMAR YadavОценок пока нет

- Card Transaction History and FeesДокумент3 страницыCard Transaction History and FeesJEAN LAFORTUNEОценок пока нет

- Functions of Commercial BanksДокумент52 страницыFunctions of Commercial BanksPulkit_Saini_789Оценок пока нет

- (A) A Cheque Which Had Originally Been Crossed Is Presented To You For Payment at The Counter Bearing The Remark "Crossing Cancelled" Below The Crossing Under The Drawer's InitialsДокумент10 страниц(A) A Cheque Which Had Originally Been Crossed Is Presented To You For Payment at The Counter Bearing The Remark "Crossing Cancelled" Below The Crossing Under The Drawer's InitialsSajid IslamОценок пока нет

- This Study Resource Was: Jia T. Rañesis BSFT 3M2Документ6 страницThis Study Resource Was: Jia T. Rañesis BSFT 3M2Anonymous100% (1)

- Capital & CurrencyДокумент2 страницыCapital & CurrencybasudevduttaОценок пока нет

- Hatton National Bank PLC: Instance Type and TransmissionДокумент2 страницыHatton National Bank PLC: Instance Type and TransmissiontaraОценок пока нет

- MBA 7427 Sample Questions CH 6: Multiple ChoiceДокумент5 страницMBA 7427 Sample Questions CH 6: Multiple ChoiceAlaye OgbeniОценок пока нет

- Account StatementДокумент5 страницAccount StatementAabi GujjarОценок пока нет

- Statement Ending 11/30/2022: Summary of AccountsДокумент4 страницыStatement Ending 11/30/2022: Summary of AccountsGrégoire TSHIBUYI KATINAОценок пока нет

- BSP AND PHILIPPINE FINANCIALДокумент7 страницBSP AND PHILIPPINE FINANCIALChetan AggarwalОценок пока нет

- Analysis of The Financial Strategies of Grameen BankДокумент22 страницыAnalysis of The Financial Strategies of Grameen BankSha D ManОценок пока нет

- Dear Kim!Документ3 страницыDear Kim!carter michealОценок пока нет

- Dissertation Report On Microfinance in IndiaДокумент6 страницDissertation Report On Microfinance in IndiaPaySomeoneToDoMyPaperCorpusChristi100% (1)

- What Are The Four Most Fundamental Factors That Affect The Cost of MoneyДокумент1 страницаWhat Are The Four Most Fundamental Factors That Affect The Cost of MoneyAlice Loren50% (2)

- Financial Inclusion Strategy of The Timor-Leste GovernmentДокумент140 страницFinancial Inclusion Strategy of The Timor-Leste GovernmentPapers and Powerpoints from UNTL-VU Joint Conferenes in DiliОценок пока нет

- Fees Structur 2021-22Документ7 страницFees Structur 2021-22Avadhut MaliОценок пока нет

- INR A2 Form - GIC-20010184Документ2 страницыINR A2 Form - GIC-20010184JP0% (1)

- Pfms 1Документ3 страницыPfms 1tabish khanОценок пока нет

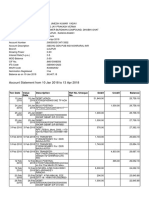

- Account Statement From 10 Jan 2018 To 13 Apr 2018Документ3 страницыAccount Statement From 10 Jan 2018 To 13 Apr 2018UMESH KUMAR YadavОценок пока нет

- DownloadДокумент4 страницыDownloadSruthi RenganathОценок пока нет

- Kotak811 BMS T&C PDFДокумент2 страницыKotak811 BMS T&C PDFmalle harshaОценок пока нет

- Business 2257 Tutorial #2Документ17 страницBusiness 2257 Tutorial #2westernbebeОценок пока нет

- Direct Taxes 639034001021902385Документ1 страницаDirect Taxes 639034001021902385Raghava KruthiventiОценок пока нет