Академический Документы

Профессиональный Документы

Культура Документы

Dividend Crash Risk PDF

Загружено:

pnrahmanОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Dividend Crash Risk PDF

Загружено:

pnrahmanАвторское право:

Доступные форматы

The Bright Side of Paying Dividends: Evidence from Stock Price Crash Risk

Jeong-Bon Kim*

Department of Accountancy

City University of Hong Kong

Kowloon, Hong Kong, China

Email: jeongkim@cityu.edu.hk

Le Luo

Department of Accounting

Huazhong University of Science and Technology

Wuhan 430074, China

Email: luole@hust.edu.cn

Hong Xie

Von Allmen School of Accountancy

University of Kentucky

Lexington, Kentucky 40506, USA

Email: hongxie98@uky.edu

First draft: October 2013

Current version: September 2018

* Corresponding author (phone: +852 34427909).

We thank Leonce Bargeron, Brian Bratten, Monika Causholli, Ken Y. Chen, Mei Feng, Kristine Hankins, Paul Hribar,

Ying Huang, Bin Ke, Jing Liu, Matt Sooy, Ya Tang, Wei Zhu, participants at the 2013 University of Kentucky Fall

Accounting Colloquium, 2014 CKGSB Accounting Colloquium, 2014 AAA Annual Meeting, the joint workshop

between National Taiwan University and Peking University, Southwestern University of Finance and Economics

accounting workshop, and University of Kentucky finance brownbag for comments and suggestions. Hong Xie

acknowledges financial support from Gatton College of Business and Economics at University of Kentucky.

Electronic copy available at: https://ssrn.com/abstract=3127275

The Bright Side of Paying Dividends: Evidence from Stock Price Crash Risk

ABSTRACT: We examine the economic benefits of paying dividends from the perspective of

stock price crash risk. We find that dividend payments mitigate stock price crash risk. In addition,

we show that dividend payments reduce bad news hoarding (overinvestment) while bad news

hoarding (overinvestment) is positively associated with stock price crash risk, suggesting that

curbing bad news hoarding and curtailing overinvestment are two channels through which

dividend payments mitigate crash risk. Finally, our main results are robust to various sensitivity

checks including controls for potential endogeneity concerns. Our findings are important because

they (1) suggest that dividend payments, an easily observable cue, can help investors assess crash

risk and thus adjust their investment portfolios, (2) support some policymakers’ proposition that

dividend payments constrain managerial misreporting and protect shareholders (e.g., Breeden,

2003; Glassman, 2005), and (3) complement a recent literature about dividend payments

enhancing earnings quality (e.g., Skinner and Soltes, 2011) by adding that dividend payments

generate a net economic benefit in the form of reduced crash risk, curbed bad news hoarding, and

curtailed overinvestment.

Keywords: Dividends; Crash risk; Information asymmetry; Agency theory; Managerial

disclosure quality

Data Availability: Data used in this study are available from public sources identified in the text.

Electronic copy available at: https://ssrn.com/abstract=3127275

The Bright Side of Paying Dividends: Evidence from Stock Price Crash Risk

1. Introduction

A recent literature documents that earnings quality of dividend-paying firms is higher than

that of non-dividend-paying firms, where earnings quality is proxied by earnings persistence

(Skinner and Soltes, 2011), absolute discretionary accruals and accruals quality (Tong and Miao,

2011), fraudulent reporting (Caskey and Hanlon, 2013), and audit fees (Lawson and Wang, 2016).

These findings support some policymakers’ beliefs that paying dividends constrains managerial

earnings manipulation (Breeden, 2003) and protects shareholders (Glassman, 2005).1 However,

prior studies focus primarily on various aspects of earnings quality and have largely neglected the

economic consequences or benefits of paying dividends, which are important for us to have a

complete understanding of the governance role that dividends play.2 In this study, we fill this void

and examine the economic benefits of paying dividends by exploring whether a firm’s dividend

payments affect stock price crash risk—the occurrence of extreme negative stock returns—and, if

yes, the channels through which dividend payments affect stock price crash risk.

Stock price crash risk is a particularly relevant avenue for examining economic benefits.

First, stock price crashes cause significant losses in investors’ wealth and in their confidence in

1

In a 149-page report titled “Restoring Trust,” Richard Breeden, the WorldCom’s court-appointed corporate monitor,

states that “dividends are another method of gauging the reality of reported earnings. The ability to pay dividends is

dependent on the availability of cash, and significant differences between the levels of reported earnings and cash

available for dividends would eventually be a red flag of potential problems.” He recommends that WorldCom “should

set a target of paying annual dividends of at least 25% of the Company’s net income” because he believes that paying

dividends will make it harder for the company to play accounting games (Breeden, 2003). In 2002, when a

congressional committee asked James Glassman, a senior fellow at the American Enterprise Institute and a member

of the Investor Advisory Committee of the Securities and Exchange Commission (SEC) during 2012-2015, to testify

on “how to protect investors against another Enron,” he advised ending the double taxation of dividends in order to

give companies incentives to increase payouts and said that encouraging dividend payments is probably “the single

most important legislative step that can be taken to protect shareholders (emphasis added)” because dividends are the

most transparent evidence of profits (Glassman, 2005).

2

Dividends play a governance role by mitigating agency costs. This governance role can manifest itself in enhanced

earnings quality and reduced probability of fraudulent reporting as documented in prior studies or in reduced stock

price crash risk as documented in this study.

-1-

Electronic copy available at: https://ssrn.com/abstract=3127275

the capital markets (DeFond et al., 2015) and thus are of great concern to both investors and

policymakers. The occurrence (non-occurrence) of stock price crashes, therefore, is itself a natural

gauge of economic costs (benefits). In agreement with this notion, Bao et al. (2018) use stock price

crash risk to gauge the net cost or benefit of adopting clawback provisions and document a net cost

in the form of increased crash risk after a firm voluntarily adopts clawback provisions in executive

officers’ compensation contracts. Our paper is similar to Bao et al. (2018) in using crash risk as a

gauge of economic costs or benefits. Second, prior studies on stock price crash risk hypothesize

but do not directly test that (i) bad news hoarding and (ii) overinvestment are two underlying causes

for stock price crashes. By examining the channels through which dividend payments affect stock

price crashes, we shed light on whether dividend payments curb bad news hoarding and curtail

overinvestment, thereby revealing additional economic benefits of paying dividends.

We predict that dividend payments reduce crash risk drawing on two lines of prior

literature. First, Jensen (1986) points out that managers tend to overinvest and to grow their firms

beyond the optimal size (empire-building). He identifies free cash flows, i.e., cash flows in excess

of what are needed to fund positive NPV projects, as a major source that enables managers to

overinvest and recommends paying dividends to reduce free cash flows. In reviewing the dividend

literature in the past two decades prior to 2014, Farre-Mensa et al. (2014, p. 77) conclude that

“[t]he accumulated evidence on payout and agency indicates that firms use payouts to reduce

potential overinvestment by management.” If dividends curtail overinvestment, they lower stock

price crash risk.

Second, dividend payments reduce the need for bad news hoarding because dividend

payments curtail overinvestment, which usually leads to subsequent bad news and the need for

hiding such bad news. In addition, Easterbrook (1984) and Jensen (1986) point out that dividend

-2-

Electronic copy available at: https://ssrn.com/abstract=3127275

payments increase the possibility that firms need to access external capital markets to raise funds.

Dividend payments, thus, subject managers to external scrutiny and discipline by outside capital

providers and market intermediaries, which, in turn, reduces managers’ abilities to hide bad news.

To the extent that dividend payments curb managerial bad news hoarding, they reduce stock price

crash risk.

We first test our baseline hypothesis that dividend payments are negatively associated with

stock price crash risk. Following Chen et al. (2001), Hutton et al. (2009), and Kim et al. (2011),

we adopt two measures of firm-specific stock price crash risk: (1) the likelihood of the occurrence

of extreme negative firm-specific weekly returns and (2) the negative conditional skewness of

firm-specific weekly returns. Using a large sample of 74,435 firm-year observations during 1991-

2015 from the intersection of Compustat and CRSP, we find that crash risk is significantly and

negatively associated with dividend yield. This suggests that dividend-paying firms are less prone

to stock price crashes than non-dividend-paying firms, consistent with our first hypothesis.

Second and more importantly, prior literature suggests that bad news hoarding and

overinvestment are two underlying causes for stock price crashes but provides only indirect

evidence consistent with bad news hoarding causing stock price crashes. For example, Kim and

Zhang (2016) show that the negative association between conservatism and stock price crashes

varies in the cross-section and is more pronounced for firms with greater information asymmetry,

i.e., information asymmetry moderates the negative association between conservatism and crash

risk. Since information asymmetry is related to bad news hoarding, they interpret the finding as

suggesting that conservatism mitigates crash risk by curbing bad news hoarding.3 We argue that

3

When developing Hypothesis 2, Kim and Zhang (2016, p. 416) state that “a key point underlying Hypothesis 1 is

that conservatism curbs managerial incentives to hide private negative information. … in an environment of high

information asymmetry, conservatism plays a more important role in countering managerial incentive to withhold

negative information and has a stronger impact on crash risk.”

-3-

Electronic copy available at: https://ssrn.com/abstract=3127275

such studies based on a cross-sectional moderating analysis provide only indirect evidence. To

provide direct evidence that bad news boarding and overinvestment are two underlying causes for

stock price crashes, we explicitly measure bad news hoarding and overinvestment and follow a

two-stage mediation analysis procedure outlined in Hammersley (2006) and He and Tian (2013).

Specifically, we adopt a novel measure of bad news hoarding from Roychowdhury and

Sletten (2012) and a measure of misinvestment (i.e., over- or under-investment) from Chen et al.

(2011) and Biddle et al. (2009). In the first stage, we regress bad news hoarding (misinvestment)

on dividends and control variables for bad news hoarding (misinvestment). In the second stage,

we regress crash risk on bad news hoarding (misinvestment), dividend payments, and control

variables for crash risk. We find that dividend payments reduce bad news hoarding in the first

stage regression whereas bad news hoarding associates positively with stock price crashes in the

second stage regression, suggesting that curbing bad news hoarding is equivalent to reducing crash

risk because bad news hoarding is positively related to crash risk. Similarly, we document that

dividend payments reduce overinvestment but exacerbate underinvestment in the first stage

regression; however, only overinvestment associates positively with stock price crashes in the

second stage regression. This suggests that curtailing overinvestment is equivalent to reducing

crash risk because overinvestment is positively related to crash risk. To sum, the above findings

are consistent with our second hypothesis and provide direct evidence that curbing bad news

hoarding and curtailing overinvestment are two channels (or mediating variables) through which

dividend payments mitigate crash risk.

Third, we address potential endogeneity concerns for dividend payments using three

approaches. Our first approach is to exploit an exogenous shock—the Jobs and Growth Tax Relief

Reconciliation Act of 2003 (the 2003 Tax Act) which reduced tax rates on both capital gains and

-4-

Electronic copy available at: https://ssrn.com/abstract=3127275

dividends and also removed the tax penalty on dividends. This exogenous shock motivated many

firms to initiate dividends for the first time (Chetty and Saez, 2005). Using a difference-in-

differences design, we find that dividend initiators experience a decrease in crash risk subsequent

to the 2003 Tax Act, relative to control firms that do not pay dividends both before and after the

Act. Our second approach is to directly control for potential self-selection bias using the Heckman

(1979) two-stage regressions. We continue to find that dividends are negatively associated with

crash risk after controlling for self-selection. Our third approach is to use a matching method,

which mitigates a specific type of endogeneity called functional form misspecification (Shipman

et al., 2017). Following DeFond et al. (2017), we use the Coarsened Exact Matching (CEM) to

pair dividend-paying firms with non-dividend-paying firms on a set of firm characteristics. Again,

we find that dividend payments are negatively associated with crash risk using the CEM sample.

In short, our main results remain robust to above controls for potential endogeneity. Finally, our

main finding that dividend payments are negatively associated with stock price crash risk is robust

to several additional sensitivity checks. We also find no association between dividend payments

and the likelihood of stock price jumps, a diametrical opposite of stock price crashes. This suggests

that dividend payments are not associated with fat-tailed distributions of stock returns (i.e., the

extreme negative tail and extreme positive tail) in general but are specifically associated with the

reduction in the extreme negative tail of stock return distributions.

There is a significant change in corporate payout policy in the past decades with the

percentage of firms paying dividends (engaging in stock repurchases) decreasing (increasing) over

time (Fama and French, 2001; DeAngelo et al., 2004; Skinner, 2008). Similar to Skinner and Soltes

(2011), we include stock repurchases along with dividends in all our tests. We find that stock

repurchases, similar to dividends, also reduce crash risk. Out of our five measures of crash risk,

-5-

Electronic copy available at: https://ssrn.com/abstract=3127275

the effects of stock repurchases are smaller than (equal to) the effects of dividends in three (two)

measures. Thus, we find some evidence that stock repurchases reduce crash risk to a lesser extent

than dividends. This is consistent with the notion that stock repurchases are payout of transitory

increases in earnings (Skinner, 2008) and are a weaker commitment to distribute cash than

dividends (Skinner and Soltes, 2011). Another difference is that stock repurchases are significantly

positively associated with the likelihood of stock price jumps while dividends are not associated

with the likelihood of stock price jumps at all.

Our study contributes to the literature in several ways. First, we are the first to document a

net economic benefit of paying dividends in the form of reduced crash risk, in the same spirit as

Bao et al. (2018) who document a net economic cost of adopting clawback provisions in the form

of increased crash risk. Our finding is important to investors because it suggests that dividend

payments, an easily observable cue, can help investors assess stock price crash risk and thus adjust

their investment portfolios.4 Our finding is also important to policymakers because it supports

some policymakers’ proposition that dividend payments constrain managerial misreporting and

protect shareholders (e.g., Breeden, 2003; Glassman, 2005).

Second, we explicitly measure bad news hoarding following Roychowdhury and Sletten

(2012) and show that dividends curb bad news hoarding, i.e., dividend payments mitigate the

managerial “asymmetric disclosure behavior” (good news is leaked to the market early whereas

bad news is withheld to the last minute) documented in Kothari et al. (2009) and Roychowdhury

and Sletten (2012). This finding is important because it complements a recent literature about

dividend payments enhancing earnings quality. 5 Our finding suggests that dividend payments

4

Lawson and Wang (2016) make a similar observation that dividend payments are “an easily observable cue to

auditors and others that can be used when assessing a firm’s earnings quality.”

5

Important papers in this literature include the following. Skinner and Soltes (2011) and Tong and Miao (2011)

document that dividends enhance earnings quality when earnings quality is proxied by earnings persistence, absolute

-6-

Electronic copy available at: https://ssrn.com/abstract=3127275

mitigate a bias in corporate disclosure towards hiding bad news in addition to enhancing earnings

quality documented in prior studies. Curbing bad news hoarding enhances disclosure quality and

is related to but distinct from various measures of earnings quality examined in prior studies.

Moreover, our finding that dividend payments reduce crash risk further complements the recent

dividends-enhancing-earnings-quality literature by adding that dividend payments generate a net

economic benefit in the form of reduced crash risk, i.e., enhanced earnings quality for dividend-

paying firms documented in prior studies does matter economically. In sum, our study is closely

related to the recent dividends-enhancing-earnings-quality literature. We differ from prior studies

in our focus on crash risk, bad news hoarding, and overinvestment.

Third, we directly measure misinvestment and show that dividends curtail overinvestment

although they exacerbate underinvestment. Prior studies have examined the effect of dividends on

mitigating overinvestment. One line of research examines abnormal stock returns around dividend

announcements for firms with poor investment opportunities and excess cash (Lang and

Litzenberger, 1989; Lie, 2000; Officer, 2011). Positive abnormal returns are interpreted as

dividends reducing the agency costs of overinvestment or excess cash. Another line of research

examines dividend payments and firms’ life cycle. DeAngelo et al. (2006) and Denis and Osobov

(2008) document that dividend payments are concentrated among large, profitable, and mature

firms. Since it is reasonable to expect that firms in the mature stage of life cycle have positive free

cash flows, findings in this latter line of research are consistent with the view that dividend

payments reduce free cash flows. Importantly, both lines of research provide only circumstantial

evidence that dividends mitigate overinvestment or excess cash. In contrast, we explicitly measure

discretionary accruals, accruals quality, and earnings value relevance. Caskey and Hanlon (2013) find that paying

dividends discourages earnings manipulation and constrains fraudulent reporting. Lawson and Wang (2016) document

that dividend-paying firms pay lower audit fees than non-dividend-paying firms after controlling for common

determinants of audit fees, suggesting that auditors perceive earnings quality of dividend-paying firms as higher.

-7-

Electronic copy available at: https://ssrn.com/abstract=3127275

over- or under-investment, and show directly that dividends reduce overinvestment but exacerbate

underinvestment. These findings are consistent with Ramalingegowda et al. (2013) who find that

dividends constrain firms’ total investment and that high-quality financial reporting mitigates such

a constraining effect. Our findings complement Ramalingegowda et al. (2013) by suggesting that

the constraining effect of dividends on total investment is harmful only for underinvestment firms;

constraining overinvestment, in contrast, is one of the economic benefits of paying dividends.

The paper proceeds as follows. Section 2 reviews the relevant literature and develops our

hypotheses. Section 3 describes the sample and variable measurement. Section 4 presents

descriptive statistics, regression models, and multivariate regression results. Section 5 contains

additional analyses. The final section concludes.

2. Literature review and hypothesis development

2.1. Dividends and agency costs

Modigliani and Miller (1958) show that dividend policy is irrelevant (i.e., does not affect

firm value) when (1) capital markets are perfect, (2) there are no agency conflicts and asymmetric

information, and (3) there are no taxes and transaction costs. Relaxing one or more of these

assumptions, a large literature has emerged that attempts to find a role for dividends and explain

why firms pay dividends. As the dividend literature is huge, we only review a strand of research

that hypothesizes and tests a role of dividends in mitigating agency costs.

2.1.1 Role of dividends in curtailing overinvestment

Jensen (1986) points out that free cash flows are a major source of agency conflicts because

free cash flows enable managers to overinvest and pursue other “empire-building” activities that

-8-

Electronic copy available at: https://ssrn.com/abstract=3127275

maximize managers’ private benefits but reduce shareholder value. 6 He argues that paying

dividends reduces free cash flows and thus constrains managers’ ability to squander shareholder

wealth. Prior studies are generally consistent with the Jensen (1986) proposition that dividend

payments reduce agency costs of free cash flows. One line of prior studies examines abnormal

stock returns around dividend announcements for firms with poor investment opportunities and

excess cash. For example, Lang and Litzenberger (1989) use Tobin’s Q ratios as a proxy for

corporate investment opportunities with high (low) Tobin’s Q implying good (poor) investment

opportunities. They find significantly larger stock returns to an increase in dividend payment for

firms with poor investment opportunities (Tobin’s Q less than unity) than for those with good

investment opportunities (Tobin’s Q greater than unity), consistent with dividends reducing

agency costs of free cash flows. Using samples of firms with special dividends, regular dividend

increases, and share repurchases, Lie (2000) finds that all three types of firms tend to have funds

in excess of industry norms before the events. In addition, he shows that the market reaction to the

announcement of repurchases and large special dividends is positively related to the firm’s amount

of excess cash and negatively related to the firm’s investment opportunity set as measured by

Tobin’s Q. These results are consistent with the view that dividends reduce potential

overinvestment, especially for firms with limited investment opportunities, and enhance

shareholder wealth. Officer (2011) finds that firms with low Tobin’s Q and high cash flows have

significantly more positive dividend initiation announcement returns than do other firms. He

6

For example, Harford (1999) documents that cash-rich firms are more likely than other firms to attempt acquisitions

and that their acquisitions are value-destroying as evidenced by negative abnormal returns around acquisition

announcements. Bates (2005) examines the allocation of cash proceeds following 400 subsidiary sales. He finds that

firms that retain cash systematically overinvest relative to an industry benchmark. Finally, Richardson (2006) provides

large sample evidence that firms with high levels of free cash flows overinvest in non-value-maximizing projects or

activities.

-9-

Electronic copy available at: https://ssrn.com/abstract=3127275

interprets this result as consistent with the hypothesis that dividends reduce the agency costs of

overinvestment for firms with poor investment opportunities and ample cash flows.

Another line of prior studies examines dividend payments and the life cycle of firms.

DeAngelo et al. (2006) examine U.S. firms, and find that the probability of firms paying dividends

is higher when these firms’ retained earnings scaled by total equity are higher. A high ratio of

retained earnings to total equity is characteristic of mature firms. Denis and Osobov (2008) find

that, in the U.S., Canada, U.K., Germany, France, and Japan, the propensity to pay dividends is

higher for larger and more profitable firms and firms whose retained earnings comprise a large

fraction of total equity. These two studies suggest that dividend payments are concentrated among

large, profitable, and mature firms. With the assumption that firms in the mature stage of life cycle

have positive free cash flows, the above studies support the notion that dividend payments reduce

free cash flows. In sum, the above two lines of studies provide circumstantial evidence that

dividend payments mitigate free cash flows and overinvestment.

2.1.2 Role of dividends in curbing bad news hoarding

Because dividends reduce overinvestment, they reduce managers’ need or incentives for

bad news hoarding. This is because overinvestment leads to bad news and thus the need for hiding

bad news. In addition, Easterbrook (1984) and Jensen (1986) posit that dividend payments increase

the possibility that firms will have to raise external funds, which subjects managers to close

scrutiny of the external capital markets. In brief, dividends curb bad news hoarding by reducing

(1) managers’ incentives for hiding bad news through reducing overinvestment and (2) managers’

ability to hide bad news by subjecting managers to external monitoring.

Several studies find evidence supporting the monitoring and disciplining role of dividends.

Rozeff (1982) finds that firms establish higher dividend payouts when insiders hold a lower

- 10 -

Electronic copy available at: https://ssrn.com/abstract=3127275

fraction of the equity (i.e., greater agency conflicts) or a greater number of outside shareholders

(i.e., less outsider shareholder monitoring). This evidence supports the view that dividends serve

to reduce agency costs. Noronha et al. (1996) test Easterbrook’s (1984) monitoring rationale for

paying dividends, which, they argue, depends on the existence of alternative sources of monitoring.

They stratify their sample into subsamples according to the prevalence of non-dividend monitoring

mechanisms and growth-induced capital market monitoring, and then re-estimate the Rozeff

(1982) specification. They hypothesize that the Rozeff (1982) effects are present only for the

subsample with low non-dividend monitoring and low growth-induced capital market monitoring

(i.e., the subsample where dividends-induced monitoring is needed) and find evidence consistent

with their hypothesis. Finally, Leary and Michaely (2011) examine the determinants of dividend

smoothing (i.e., maintaining stable dividend payments). Consistent with dividends playing a

monitoring role to mitigate agency costs (Easterbrook, 1984; Jensen, 1986), they find that firms

that smooth dividends the most are those most susceptible to agency conflicts, i.e., firms that are

cash cows, with low growth prospects, and weaker governance. To sum, the above studies suggest

that dividend payments reduce agency costs and/or subject managers to the discipline of external

capital markets. To the extent that dividends reduce overinvestment and subject managers to

external scrutiny, they curb managers’ incentives and abilities to hoard bad news.

2.2. Determinants of stock price crash risk

A growing body of research has investigated external and internal determinants of stock

price crash risk. Chen et al. (2001) test a model in which investor heterogeneity in opinions,

coupled with short sale constraints for some investors, leads to stock price crashes. The underlying

cause for stock price crashes in their model is the accumulation of bad news induced by an external

financial market characteristic, short sale constraints, rather than a firm’s internal causes. In

- 11 -

Electronic copy available at: https://ssrn.com/abstract=3127275

contrast, Jin and Myers (2006) develop and test a model where a firm’s internal characteristics,

such as agency conflicts between corporate insiders and outside investors, combined with

opaqueness of the firm to outside investors, cause stock price crashes. They find that information

opaqueness increases the lieklihood of stock price crashes, consistent with their model predictions.

Jin and Myers (2006) measure opaqueness at the country-year level, i.e., the average

opaqueness of all firms in a country in a year. Their opaqueness measure, therefore, is not a firm-

specific variable. Hutton et al. (2009) extend Jin and Myers (2006) by examining the relation

between the crash risk of individual firms and a firm-specific measure of financial reporting

opaqueness—the sum of absolute discretionary accruals in prior three years. They find that a firm’s

financial reporting opacity increases the probability of stock price crash occurrence.

Since Hutton et al. (2009), a growing body of research has investigated firm-level

determinants of crash risk. First, Kim et al. (2011) find that tax avoidance provides managers with

masks and tools to hide bad news from shareholders and thus increases crash risk. Second, Kim et

al. (2016a) find that financial statement comparability alleviates bad news hoarding and thus

reduces crash risk. Hong et al. (2017) show that the deviation of ownership rights from control

rights in dual class firms, combined with financial reporting opacity, increases stock price crash

risk, because opaque firms with higher ownership-control deviation can withhold bad news more

aggressively. Third, Callen and Fang (2015) argue that religion, as a set of social norms, helps

curb managerial bad news hoarding and find that firms headquartered in counties with higher

religiosity are less prone to stock price crashes. To summarize, the above studies identify

determinants of stock price crashes that are related to bad news hoarding.

Agency theory suggests that managers have incentives to overinvest or delay the

termination of negative NPV projects to maximize their own private benefits (Jensen, 1986).

- 12 -

Electronic copy available at: https://ssrn.com/abstract=3127275

Recent studies investigate whether managerial tendency to overinvest or to keep bad projects alive

for too long leads to stock price crashes. First, in analyzing the problems of historical cost

accounting, Bleck and Liu (2007) analytically show that historical costs enable managers to hide

bad news about unprofitable projects and keep these unprofitable projects alive for too long by

recording these projects at historical costs when their market values are lower, thereby, increasing

the likelihood of asset price crashes. Second, Benmelech et al. (2010) show that stock-based

compensation induces managers to conceal bad news about growth options and to choose sub-

optimal investment policies to support the pretense of high growth. Thus, bad news and

unprofitable investments accumulate over time and eventually lead to stock price crashes. Third,

Kim et al. (2016b) argue that overconfident CEOs tend to ignore bad news, which is equivalent to

hoarding bad news. Moreover, overconfident CEOs may misperceive negative NPV projects as

value increasing and thus keep negative NPV projects alive for too long. The accumulated bad

news and unprofitable investments will lead eventually to stock price crashes. To summarize, the

above studies identify determinants of stock price crashes that are related to overinvestment.

2.3. Hypotheses

Our review of the dividend literature suggests that dividends curb bad news hoarding and

curtail overinvestment. Our review of the crash risk literature reveals two fundamental causes for

stock price crashes: bad news hoarding and overinvestment. Our literature review thus suggests

that dividend payments reduce stock price crash risk. We state our first hypothesis in alternative

form below:

H1: Dividend payments are negatively associated with stock price crash risk, ceteris

paribus.

After establishing a negative association between dividend payments and stock price crash

risk, we further investigate whether dividend payments reduce bad news hoarding and

- 13 -

Electronic copy available at: https://ssrn.com/abstract=3127275

overinvestment, thereby reducing crash risk. Note that prior literature reviewed above provides

only indirect or circumstantial evidence that dividends reduce bad news hoarding and

overinvestment. We are interested in directly examining whether curbing bad news hoarding and

curtailing overinvestment are two channels (or mediating variables) through which cash dividends

reduce crash risk. To this end, we explicitly measure bad news hoarding and overinvestment and

follow a two-stage mediation analysis procedure used in Hammersley (2006) and He and Tian

(2013). In the first stage, we regress bad news hoarding (or overinvestment) on dividends. In the

second stage, we regress crash risk on bad news hoarding (or overinvestment), along with dividend

payments. If dividend payments reduce crash risk through curbing bad news hoarding (curtailing

overinvestment), we predict that dividend payments are negatively associated with bad news

hoarding (overinvestment) in the first stage regression, while bad news hoarding (overinvestment)

is positively associated with crash risk in the second stage regression. Findings consistent with

these expectations establish curbing bad news hoarding and curtailing overinvestment as two

channels through which dividend payments reduce crash risk (Hammersley, 2006; He and Tian,

2013). We state our second hypothesis in alternative form below:

H2: Dividend payments are negatively associated with bad news hoarding

(overinvestment) while bad news hoarding (overinvestment) is positively associated with

stock price crash risk, ceteris paribus.

3. Sample and variable measurement

3.1. Sample selection

Our initial sample is obtained from the Compustat and CRSP merged files during 1991-

2015. We then delete firm-year observations where: (1) the book value of equity or total assets are

non-positive; (2) the fiscal year-end stock price is less than $1 per share; (3) there are less than 26

- 14 -

Electronic copy available at: https://ssrn.com/abstract=3127275

weeks of stock returns in a 12-month period ending three months after the fiscal year-end; (4)

stocks are not traded on NYSE, AMEX, or NASDAQ; (5) firms are in financial and public utilities

industries (Skinner and Soltes, 2011); (6) dividends are not paid in U.S. dollars; and (7) control

variables (see below for definitions) are missing. The above process yields a sample of 74,435

firm-year observations during 1991-2015 (year t).

3.2. Measurement of dividend payments and firm-specific crash risk

We measure dividend payments in the prior year, year t–1, because we measure stock price

crashes in the current year, year t. In terms of year t–1, our sample period is from 1990 to 2014.

We adopt two dividend payment measures. First, DIV_YLDjt–1 is cash dividend yield, measured as

cash dividends paid in year t–1 (according to CRSP) divided by the fiscal year-end stock price.

For firms that do not pay cash dividends in year t–1, their DIV_YLDjt–1 is zero. We adjust for stock

splits and stock dividends so that dividends and stock prices are on the same split-adjusted basis.

Second, DIV_DUMjt–1 is a dummy variable set to one if firm j pays cash dividends in year t–1 (i.e.,

DIV_YLDjt–1 > 0) and zero otherwise.

We adopt two measures of firm-specific crash risk. Following Hutton et al. (2009), Kim et

al. (2011), and Kim and Zhang (2016), our first measure of crash risk is an indicator variable for

the existence of crash weeks in a year. To identify crash weeks, we first calculate firm-specific

weekly returns (Wjτ) for each firm-year observation in our sample. Wjτ is defined as the natural log

of one plus the residual return (εjτ), i.e., Wjτ = log(1 + εjτ), and εjτ is estimated from the following

expanded market model:

rjτ = aj + b1jrmτ–2 + b2jrmτ–1 + b3jrmτ + b4jrmτ+1 + b5jrmτ+2 + εjτ, (1)

where rjτ is the raw stock return for firm j in week τ of year t and rmτ is the CRSP value-weighted

market index return in week τ of year t. As in Kim et al. (2011), we include the lead and lag terms

- 15 -

Electronic copy available at: https://ssrn.com/abstract=3127275

for the market index return to allow for nonsynchronous trading (Dimson 1979; Scholes and

Williams 1977).

We estimate Eq. (1) for firm j in year t using its weekly returns in the 12-month period

ending three months after the firm’s fiscal year end, requiring at least 26 weekly returns in year t.

We define crash weeks for firm j in year t as those weeks in which firm-specific weekly returns

(Wjτ) are 3.2 standard deviations below the mean firm-specific weekly returns in year t.7 Following

prior literature (Hutton et al. 2009; Kim et al. 2011), our first measure of firm-specific crash risk,

CRASHjt, is an indicator variable set to one if there is at least one crash week for firm j in year t,

and zero otherwise.

Our second measure of firm-specific crash risk is the negative conditional skewness of

firm-specific weekly returns, NCSKEWjt, as used in Chen et al. (2001) and Kim et al. (2011).

Specifically, NCSKEWjt for firm j in year t is the negative of the third moment of firm-specific

weekly returns in year t, divided by the cubed standard deviation of firm-specific weekly returns.

That is,

/ /

NCSKEWjt = 𝑛 𝑛 1 ∑𝑊 / 𝑛 1 𝑛 2 ∑𝑊 , (2)

where Wjτ is the firm-specific weekly return for firm j in week τ of year t (defined earlier) and n is

the number of the firm-specific weekly returns in year t.

3.3. Control variables

Skinner (2008) documents that stock repurchases are increasingly used in place of

dividends, even for firms that continue to pay dividends, in the past three decades. Because stock

repurchases and dividends are alternative ways of payout, our arguments for why dividends reduce

7

In the normal distribution, 3.2 standard deviations below the mean indicate a frequency of less than 0.1%. A return

that is 3.2 standard deviations below the mean, thus, is an extreme negative tail event.

- 16 -

Electronic copy available at: https://ssrn.com/abstract=3127275

crash risk also apply to stock repurchases. However, stock repurchases represent a less strong

commitment to pay out cash than dividends (Skinner, 2008). Consequently, the effect of stock

repurchases on crash risk is likely to be smaller than the effect of dividends. We adopt two

measures of stock repurchases, repurchase amount (REP_AMTjt–1) and repurchase dummy

(REP_DUMjt–1), corresponding to the two measures of dividends (DIV_YLDjt–1 and DIV_DUMjt–

1). We control for REP_AMTjt–1 (REP_DUMjt–1) when the dividends variable is DIV_YLDjt–1

(DIV_DUMjt–1). See Appendix A for definitions of all variables.

Following Chen et al. (2001) and Hutton et al. (2009), we include nine additional control

variables in our analyses. First, the variable NCSKEWjt–1 is the negative conditional skewness of

firm-specific weekly returns in year t–1. We control for NCSKEWjt–1 because Chen et al. (2001)

find that firms with high return skewness in year t–1 are likely to have high return skewness in

year t as well. Second, the variable DTURNjt–1 is the detrended average monthly share turnover.

We control for DTURNjt–1 because Chen et al. (2001) use DTURNjt–1 as a proxy for differences of

opinions among investors and find that it is positively related to crash risk. Third, the variable

SIGMAjt–1 is the standard deviation of firm-specific weekly returns, a measure of return volatility.

We control for SIGMAjt–1 because Chen et al. (2001) show that more volatile stocks are more likely

to experience stock price crashes in the future. Fourth, the variable RETjt–1 is the average firm-

specific weekly returns. We control for RETjt–1 because Chen et al. (2001) document that past stock

returns are positively related to crash risk. Fifth, the variable SIZEjt–1 is firm size. We control for

SIZEjt–1 because Chen et al. (2001) show that larger firms are more likely to have stock price

crashes. Sixth, the variable LEVjt–1 is financial leverage. We control for LEVjt–1 because Hutton et

al. (2009) and Kim et al. (2011) both show that leverage is negatively related to crash risk. Seventh,

the variable MBjt–1 is the market-to-book ratio. We control for MBjt–1 because Chen et al. (2001)

- 17 -

Electronic copy available at: https://ssrn.com/abstract=3127275

and Hutton et al. (2009) both report that growth firms are more likely to experience stock price

crashes. Eighth, the variable ROAjt–1 is return on assets. We control for ROAjt–1 because Hutton et

al. (2009) and Kim et al. (2011) find that it is negatively related to crash risk although Kim and

Zhang (2016) show that it is positively related to crash risk when crash risk is measured using the

negative conditional skewness (NCSKEWjt). 8 Finally, the variable ACCMjt–1 is a measure of

financial reporting opaqueness used in Hutton et al. (2009). We control for ACCMjt–1 because

Hutton et al. (2009) show that it is positively related to crash risk. See Appendix A for details of

variable definitions.

4. Empirical Findings

4.1. Summary statistics

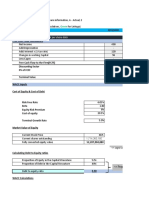

Table 1 reports the yearly distribution of our sample of 74,435 observations. The number

of observations in each year varies, with a minimum of 2,254 in 1991 and a maximum of 3,626 in

1999. The percentage of firms with stock price crashes (i.e., CRASHjt = 1) varies from 11.8%

(minimum) in 1995 to 23.9% (maximum) in 2015, with a mean of 17.2% in our sample period.

Our annual percentages of crashes are comparable to those reported in Kim et al. (2011) and other

prior studies. Overall, we also notice that the crash likelihood captured by CRASH is higher in the

later period of 2003-2015 than in the earlier period of 1991-2002.

[Insert Table 1 here]

Panel A of Table 2 presents descriptive statistics for our sample. To alleviate the influence

of extreme observations or outliers, we winsorize all continuous variables at the top and bottom

one percentiles in each year. The mean CRASHjt is 17.2% in our sample period. That is, 17.2% of

8

Callen and Fang (2015) find that return-on-equity, a measure closely related to return-on-assets, is positively related

to their measures of crash risk.

- 18 -

Electronic copy available at: https://ssrn.com/abstract=3127275

our sample observations experience one or more stock price crash weeks in year t. The mean and

median NCSKEWjt are -0.113 and -0.134, respectively. Regarding our dividend measures, the

mean (median) dividend yield, DIV_YLDjt–1, is 0.010 (0), suggesting that most firms in our sample

do not pay cash dividends. Similarly, the mean DIV_DUMjt–1 (dividend dummy) is 0.381,

suggesting that only 38.1% of our sample observations pay cash dividends.

[Insert Table 2 here]

Turning to control variables, the average amount of stock repurchases (REP_AMTjt–1) is

1.4% of market capitalization. The mean REP_DUMjt–1 is 0.410, suggesting that 41.0% of our

sample observations engage in stock repurchases. The descriptive statistics for other control

variables are roughly comparable to those reported in Kim et al. (2011). For example, our mean

and median ACCMjt–1 are 0.233 and 0.168, respectively. The counterparts in Kim et al. (2011) are

0.210 and 0.162, respectively.

Table 2, Panel B, reports Pearson correlations among our main variables. First, our two

measures of crash risk (CRASHjt and NCSKEWjt) are highly positively correlated with each other

(0.617, p-value = 0.000), consistent with prior studies. Second, cash dividend yield (DIV_YLDjt–1)

is negatively correlated with CRASHjt (-0.023, p-value = 0.000), consistent with H1, but is

positively correlated with NCSKEWjt (0.007, p-value = 0.067), inconsistent with H1. Third, our

two measures of crash risk are positively correlated with NCSKEWjt–1, DTURNjt–1, RETjt–1, SIZEjt–

1, MBjt–1, and ROAjt–1, but are negatively correlated with SIGMAjt–1. These findings are consistent

with Kim et al. (2011). Finally, our ACCMjt–1 is insignificantly correlated with CRASHjt but

significantly and negatively correlated with NCSKEWjt, consistent with Kim et al. (2011).

4.2. Multivariate tests of H1

- 19 -

Electronic copy available at: https://ssrn.com/abstract=3127275

We use the following regression model to test our first hypothesis that dividend payments

are negatively associated with stock price crash risk (H1):

CRASHVARjt = α0 + α1DIVVARjt–1 + ∑ 𝛼 (qth ControlVARjt–1)

+ Year fixed effects + Industry fixed effects + εjt, (3)

where CRASHVARjt is one of our two crash risk measures, CRASHjt and NCSKEWjt; DIVVARjt–1

is one of the two dividend payment measures; and qth ControlVARjt–1 is one of the ten control

variables defined earlier. We also include year fixed effects and industry fixed effects to control

for potential differences in dividend payments over time and across industries. DIVVARjt–1 is our

test variable and a significantly negative coefficient on DIVVARjt–1 (α1 < 0) supports H1 that

dividend payments reduce crash risk.

We estimate Eq. (3) using logistic regressions when the dependent variable is CRASHjt, a

dummy variable for the occurrence of extreme price drops, and OLS regression when the

dependent variable is NCSKEWjt, a continuous variable of negative conditional skewness in a

firm’s weekly stock return distribution. To mitigate the potential cross-sectional and time-series

dependence in our panel data, we report p-values based on robust standard errors corrected for

double (firm and year) clustering following Petersen (2009) and Gow et al. (2010).

Table 3, columns (1) and (2), reports our findings of estimating Eq. (3) when the dependent

variable is CRASHjt using logistic regressions. As shown in column (1), the coefficient on

DIV_DUMjt–1, an indicator variable for paying cash dividends, is significantly negative (-0.186, p-

value = 0.000). In column (2), the coefficient on DIV_YLDjt–1, a continuous measure of dividend

yield that is zero for those stocks that do not pay cash dividends, is again significant and negative

(-3.106, p-value = 0.000). These negative coefficients are consistent with H1 and suggest that

stocks that pay dividends are less crash-prone than stocks that do not pay dividends.

- 20 -

Electronic copy available at: https://ssrn.com/abstract=3127275

[Insert Table 3 here]

We now turn to control variables in columns (1) and (2) of Table 3. The coefficient on

REP_DUMjt–1 in column (1) is significantly negative (-0.039, p-value = 0.066). This suggests that

stock repurchases, like dividends, also mitigate stock price crash risk. However, the coefficient on

REP_AMTjt–1 in column (2) is insignificant. As shown at the bottom of Table 3, the null hypothesis

that the coefficient on DIV_DUMjt–1 is equal to the coefficient on REP_DUMjt–1 in column (1) is

rejected (F-stat. = 16.32, p-value = 0.000). The null hypothesis that the coefficient on DIV_YLDjt–

1 is equal to the coefficient on REP_AMTjt–1 in column (2) is also rejected (F-stat. = 13.81, p-value

= 0.000). These results suggest that stock repurchases tend to mitigate crash risk to a lesser extent

than dividends when crash risk is measured by CRASHjt. The coefficients on other control variables

are mostly consistent with prior literature. For example, we find significantly positive coefficients

on NCSKEWjt–1, consistent with Chen et al. (2001) and Kim et al. (2011). Our coefficients on

DTURNjt–1 are significantly positive, again consistent with Chen et al. (2001) and confirming their

argument that differences of opinions among investors lead to stock price crashes. In addition, our

coefficients on RETjt–1, SIZEjt–1, MBjt–1, and ACCMjt–1 are all significantly positive, consistent with

Chen et al. (2001), Hutton et al. (2009), and Kim et al. (2011).

Table 3, columns (3) and (4), presents the findings of estimating Eq. (3) when stock price

crash risk is measured by NCSKEWjt using OLS regressions. As shown, the coefficient on

DIV_DUMjt–1 and that on DIV_YLDjt–1 are both significantly negative, consistent with H1 that

dividend payments are negatively associated with stock price crashes.

The coefficient on REP_DUMjt–1 in column (3) and that on REP_AMTjt–1 in column (4) are

both significantly negative. The null hypotheses that the coefficient on DIV_DUMjt–1 is equal to

the coefficient on REP_DUMjt–1 in column (3) and the coefficient on DIV_YLDjt–1 is equal to the

- 21 -

Electronic copy available at: https://ssrn.com/abstract=3127275

coefficient on REP_AMTjt–1 in column (4) cannot be rejected. This suggests that stock repurchases

reduce crash risk to a similar extent as dividends when crash risk is measured by NCSKEWjt.

4.3. Multivariate tests of H2

Following Hammersley (2006, footnote 14) and He and Tian (2013, pp. 875-876), we use

the following two-stage mediation analysis models to examine our second hypothesis that dividend

payments are negatively associated with bad news hoarding (overinvestment) while bad news

hoarding (overinvestment) is positively associated with stock price crash risk, i.e., curbing bad

news hoarding and curtailing overinvestment are two channels through which dividend payments

mitigate crash risk:

CHANNELjt–1 = β0 + β1DIV_YLDjt–1 + ∑ 𝛽 (qth ControlVARjt–1)

+ Year fixed effects + Industry fixed effects + εjt–1 (4)

CRASHVARjt = γ0 + γ1CHANNELjt–1 + γ2DIV_YLDjt–1 + ∑ 𝛾 (qth ControlVARjt–1)

+ Year fixed effects + Industry fixed effects + εjt, (5)

where CHANNELjt–1 refers to the channel through which dividends reduce crash risk, and is equal

to bad news hoarding (BNHRDjt–1) or misinvestment (MISINVESTjt–1). Roychowdhury and Sletten

(2012, p. 1683) predict and find that BNHRDjt–1 is larger in bad-news periods than in good-news

periods because managers have incentives to withhold bad news, i.e., BNHRDjt–1 being large is

due to withholding bad news to the last minute. We thus adopt BNHRDjt–1 as a measure of bad

news hoarding and larger values of BNHRDjt–1 indicate greater bad news hoarding. See Appendix

A for a more detailed definition of BNHRDjt–1 and explanation for why BNHRDjt–1 captures bad

news hoarding. Following Chen et al. (2011) and Biddle et al. (2009), we define MISINVESTjt–1

as the residuals from the investment model. Since a positive (negative) MISINVESTjt–1 indicates

overinvestment (underinvestment), we define OVERINVESTjt–1 (UNDERINVESTjt–1) as equal to

- 22 -

Electronic copy available at: https://ssrn.com/abstract=3127275

MISINVESTjt–1 when MISINVESTjt–1 is greater than (less than or equal to) zero. We include

DIV_YLDjt–1 in Eq. (5) following Hammersley (2006) and He and Tian (2013) to test whether

dividends remain significantly negative after controlling for the channel variable (BNHRDjt–1 or

MISINVESTjt–1). All other variables in Eqs. (4) and (5) are discussed in detail below.

4.4.1. Role of dividends in curbing bad news hoarding

We discuss our tests of the relation between dividend payments and bad news hoarding

and the relation between bad news hoarding and crash risk in this section. In the first stage, we

estimate Eq. (4) by regressing bad news hoarding (BNHRDjt–1) on DIV_YLDjt–1 and six control

variables. We include stock repurchases (REP_AMTjt–1) as our first control variable to examine

whether stock repurchases, like dividends, mitigate bad news hoarding. We control for firm size

(LogATjt–1), because prior studies (e.g., Botosan, 1997) find that firm size is positively associated

with disclosure level. Managers of larger firms, thus, may be less likely to hoard bad news. We

control for financial leverage (LEVjt–1) because Botosan (1997) find that leverage is positively

related to disclosure level. That is, firms with higher financial leverage are less likely to hoard bad

news. We control for the market-to-book ratio (MBjt–1). Growth firms have greater information

asymmetry and agency costs (Smith and Watts, 1992), and hence we expect that firm growth

opportunities are positively associated with disclosure level and negatively related to bad news

hoarding. We also control for profitability (ROAjt–1) because Lang and Lundholm (1993) argue

that disclosures are likely to be related to a firm’s profitability. However, empirical findings on

the relation between firm performance and disclosure is mixed. Lang and Lundholm (1993)

conclude that “the results from theoretical and empirical research suggest disclosure could be

increasing, constant, or even decreasing in firm performance.” Lastly, we control for Big N

- 23 -

Electronic copy available at: https://ssrn.com/abstract=3127275

auditors (BigNjt–1) because larger auditors, being economically less dependent on a client, may

demand the client to have greater disclosure.

In the second stage, we estimate Eq. (5) by regressing crash risk (CRASHjt or NCSKEWjt)

on the channel variable (BNHRDjt–1), dividends (DIV_YLDjt–1), and the same ten control variables

as in Eq. (3). A significantly negative coefficient on DIV_YLDjt–1 in Eq. (4) and a significantly

positive coefficient on BNHRDjt–1 in Eq. (5) are consistent with H2.

Panel A of Table 4 reports our findings from estimating Eq. (4) in the first stage regression.

The coefficient on DIV_YLDjt–1 is significantly negative (-49.365, p-value = 0.026), suggesting

that dividend payments mitigate bad news hoarding. The coefficient on REP_ATMjt–1, however, is

positive (35.451, p-value = 0.054). We conjecture that an important motivation for firms to

repurchase shares is to boost stock prices and thus firms may have incentives to withhold bad news

around the time of repurchases. The F-test at the bottom of Panel A rejects the null hypothesis that

the coefficient on DIV_YLDjt–1 is equal to that on REP_AMTjt–1 (F-stat. = 14.53, p-value = 0.000).

The coefficient on LogATjt–1 (firm size) is insignificant and the coefficients on LEVjt–1 and MBjt–1

are both significantly negative. The coefficient on ROAjt–1 is significantly positive and that on

BigNjt–1 is insignificant.

[Insert Table 4 here]

Panel B of Table 4 shows the regression results from estimating Eq. (5) in the second stage

regression. The coefficients on BNHRDjt–1 (bad news hoarding) are significantly positive,

irrespective of whether crash risk is measured by CRASHjt or NCSKEWjt. This suggests that bad

news hoarding is positively associated with crash risk. The coefficients on DIV_YLDjt–1 remain

significantly negative (-2.778, p-value = 0.000; -0.533, p-value = 0.017), and, as expected, the

magnitudes of the coefficients are smaller than their respective counterparts in columns (2) and (4)

- 24 -

Electronic copy available at: https://ssrn.com/abstract=3127275

of Panel A of Table 3 (-3.106, p-value = 0.000; -0.612, p-value = 0.010). Since controlling for the

channel variable (BNHRDjt–1) does not eliminate the significance of dividends, dividends have a

residual effect on crash risk beyond bad news hoarding (He and Tian, 2013).

To summarize, the results of our mediation analysis in Panels A and B of Table 4 show

that dividend payments reduce bad news hoarding and bad news hoarding is positively associated

with stock price crash risk. These findings suggest that curbing bad news hoarding reduces crash

risk and thus establish curbing bad news hoarding as a channel through which dividends reduce

crash risk (see Hammersley, 2006; He and Tian, 2013).

4.4.2. Role of dividends in curtailing overinvestment

In this section, we discuss our tests of the relation between dividend payments and

misinvestment (i.e., OVERINVESTjt–1 or UNDERINVESTjt–1) and the relation between

misinvestment and crash risk. In the first stage, we partition our full sample into the overinvestment

(MISINVESTjt–1 > 0) and underinvestment (MISINVESTjt–1 ≤ 0) subsamples. Because H2 is about

overinvestment and we do not make predictions for underinvestment, we discuss the tests, mainly,

for overinvestment. Specifically, we regress OVERINVESTjt–1 on DIV_YLDjt–1, REP_AMTjt–1, and

four other control variables suggested in Chen et al. (2011) using Eq. (4). The four other control

variables are firm size (LogATjt–1), firm age (LogAGEjt–1), tangible assets (TANGjt–1), and financial

slack (SLACKjt–1). See Appendix A for definitions of these and all other variables. In the second

stage, we estimate Eq. (5) by regressing crash risk (CRASHjt or NCSKEWjt) on the channel variable

(OVERINVESTjt–1), dividends (DIV_YLDjt–1), and the same ten control variables as in Eq. (3). A

significantly negative coefficient on DIV_YLDjt–1 in Eq. (4) and a significantly positive coefficient

on OVERINVESTjt–1 in Eq. (5) are consistent with H2.

- 25 -

Electronic copy available at: https://ssrn.com/abstract=3127275

We estimate Eqs. (4) and (5) using the overinvestment subsample and the underinvestment

subsample, separately. Panel C of Table 4 shows the findings from estimating Eq. (4) in the first

stage regression. As shown, the coefficient on DIV_YLDjt–1 for the overinvestment subsample is

significantly negative (-35.734, p-value = 0.001), suggesting that dividend payments curtail

overinvestment. The coefficient on DIV_YLDjt–1 for the underinvestment subsample is also

significantly negative (-4.527, p-value = 0.025), suggesting that dividend payments exacerbate

underinvestment. Stock repurchases (REP_AMTjt–1) reduce overinvestment (-44.139, p-value =

0.000) but have no effect on underinvestment (-0.299, p-value = 0.769). Finally, a comparison of

the coefficients on DIV_YLDjt–1 across the overinvestment and underinvestment subsamples (-

35.734 versus -4.527) suggests that the curtailing effect of dividends on overinvestment is more

pronounced than the exacerbating effects of dividends on underinvestment. Taken together, our

findings show that dividend payments curtail overinvestment although they exacerbate

underinvestment.

Panel D of Table 4 presents the results from estimating Eq. (5) in the second stage

regression. As shown in the Overinvestment subsample column, the coefficients on

OVERINVESTjt–1 are positive and significant at less than the 1% level, suggesting that

overinvestment increases stock price crash risk. In contrast, the coefficients on UNDERINVESTjt–

1 in the Underinvestment subsample column are insignificant, suggesting that underinvestment is

not related to stock price crashes. Importantly, we find that dividends remain significantly and

negatively associated with crash risk, irrespective of whether crash risk is measured by CRASHjt

or NCSKEWjt in both the overinvestment and underinvestment subsamples after the channel

variable (OVERINVESTjt–1 or UNDERINVESTjt–1) is controlled for. This finding suggests that

dividends have a residual effect on crash risk beyond overinvestment (He and Tian, 2013).

- 26 -

Electronic copy available at: https://ssrn.com/abstract=3127275

In short, the results of our mediation analysis in Panels C and D of Table 4 show that

dividends mitigate overinvestment and aggravate underinvestment, but only overinvestment is

positively associated with stock price crash risk. These findings suggest that curtailing

overinvestment reduces crash risk and thus establish curtailing overinvestment as a channel

through which dividends reduce crash risk.

5. Additional analyses

5.1. Controlling for potential endogeneity

It is possible that high crash-prone firms choose not to pay dividends whereas low crash-

prone firms choose to pay dividends (i.e., reverse causality). It is also possible that firms self-select

into paying or not paying dividends, and thus their decision to pay dividends is a function of certain

observable firm characteristics (i.e., self-selection). Furthermore, it is possible that our Eq. (3) is

misspecified in that the relation between crash risk and our control variables is non-linear. As

pointed out in Shipman et al. (2017, p. 215), this misspecification, if any, engenders a specific type

of endogeneity called functional form misspecification. We address these endogeneity concerns

using three approaches: (1) a difference-in-differences design based on an exogenous shock; (2)

the Heckman (1979) two-stage regression approach; and (3) the Coarsened Exact Matching (CEM)

procedure.

5.1.1. A difference-in-differences test based on an exogenous shock

The Jobs and Growth Tax Relief Reconciliation Act of 2003 (hereafter, the 2003 Tax Act)

was signed into law by President George W. Bush on May 28, 2003. The 2003 Tax Act

substantially reduced the tax rates on both capital gains and dividends. More importantly, it

equalized the tax rates on capital gains and dividends for the first time since 1990 and thus removed

- 27 -

Electronic copy available at: https://ssrn.com/abstract=3127275

the tax penalty on dividends. This exogenous shock is unrelated to firm fundamentals but motivates

some firms to initiate dividends due to the removal of dividend tax penalty. Chetty and Saez (2005)

examine the effect of the 2003 Tax Act on firms’ dividend payment behavior. They find a surge

in dividend initiations in the quarters immediately following the enactment of the 2003 Tax Act.

The percentage of firms paying dividends, which had declined steadily from 66.5% in 1978 to

20.8% in 1999 according to Fama and French (2001), increases significantly from about 20 percent

in the fourth quarter of 2002 to almost 25% in the second quarter of 2004. Chetty and Saez (2005)

further estimate that the 2003 Tax Act increases total regular dividend payments by about 20

percent. In addition, there is no decline in dividend payments before 2003, suggesting that

observed increase in dividend payments subsequent to the enactment of the 2003 Tax Act is not

due to intertemporal substitution (retiming) of dividend payments. Moreover, they find no change

in dividend payments in firms whose largest owner is a nontaxable institution (these firms are little

affected by the 2003 Tax Act), suggesting a causal link between observed increases in dividend

payments in the post-2003-Tax-Act period and the 2003 Tax Act. In short, the findings of Chetty

and Saez (2005) confirm that the 2003 Tax Act is an exogeneous event that motivates many firms

to initiate dividends.

We examine four years between 2001 and 2004, and identify a group of dividend initiators

that pay no dividends during 2001-2003 but start paying dividends in 2004. We employ a

difference-in-differences research design to compare the change in crash risk for dividend

initiators with the corresponding change in crash risk for a control group before and after the 2003

Tax Act using the following model:

CRASHVARjt = δ0 + δ1INITIATORj + δ2POSTt–1 + δ3INITIATORj × POSTt–1

+∑ 𝛿 (qth ControlVARjt–1) + Industry fixed effects + εjt, (6)

- 28 -

Electronic copy available at: https://ssrn.com/abstract=3127275

where INITIATORj is a firm-specific dummy variable, set to equal one if firm j pays no dividends

in all three years during 2001-2003 but pays dividends in 2004, and equal zero if firm j pays no

dividends in all of the four years (from 2001 to 2004); POSTt–1 is a dummy variable, set to equal

one if the year is 2004 and zero if the year is from 2001 to 2003; all other variables in Eq. (6) are

the same as those for Eq. (3).

We construct a sample during 2001 to 2004 from our full sample (74,435 observations)

and exclude all observations where INITIATORj is missing (i.e., not equal to one or zero). This

difference-in-differences sample, thus, contains only dividend initiators (INITIATORj = 1) and

firms whose dividend policies are not affected by the 2003 Tax Act (INITIATORj = 0).

We estimate Eq. (6) using the difference-in-differences sample and present the results in

Table 5. As shown, the coefficient on INITIATORj × POSTt–1 is significantly negative (-0.356, p-

value = 0.000) when the dependent variable is CRASHjt, and is also significantly negative (-0.234,

p-value = 0.000) when the dependent variable is NCSKEWjt. These negative coefficients suggest

that crash risk decreases for firms that initiate dividends after the 2003 Tax Act relative to control

firms that do not change their dividend policies in the post-2003 Tax Act period. These findings

suggest that dividend payments (or dividends initiations) lower stock price crash risk. They are

inconsistent with the reverse causality argument that firms anticipating future crashes pay no

dividends whereas firms anticipating no future crashes pay dividends.

[Insert Table 5 here]

5.1.2. The Heckman (1979) two-stage regression

We also use the Heckman (1979) two-stage treatment effect regressions to control for

potential self-selection bias. In the first stage, we model a firm’s choice of paying dividends using

the following probit choice model based on DeAngelo et al. (2006):

- 29 -

Electronic copy available at: https://ssrn.com/abstract=3127275

DIV_DUMjt–1 = θ0 + ∑ 𝜃 (qth VARjt–1) + Year fixed effects

+ Industry fixed effects + εjt, (7)

where DIV_DUMjt–1 refers to an ex ante likelihood of dividend payments and is ex post coded one

for firms with dividend payments and zero otherwise; and qth VARjt–1 is one of the five

determinants of dividend payments identified in DeAngelo et al. (2006): retained earnings to total

common equity (RE_TEjt–1), total common equity to total assets (TE_TAjt–1), firm size (LogATjt–1),

profitability (ROAjt–1), and assets growth rate (GRWjt–1). See Appendix A for detailed definitions

of all variables.

In the first stage, we estimate Eq. (7) using a probit regression procedure, and then obtain

the inverse Mills ratio (LAMBDAjt–1). In the second stage, we expand and re-estimate Eq. (3) after

incorporating LAMBDAjt–1 as an additional explanatory variable to correct for potential self-

selection bias. Since four of the five independent variables in the first stage are not included in the

second stage, our Heckman (1979) two-stage specification meets the exclusion restriction

requirement (Lennox et al., 2012).

Panel A of Table 6 presents findings from estimating the Heckman (1979) two-stage

regression. In the first stage, we find that firms with higher proportions of retained earnings

(RE_TEjt–1), firms with higher equity-to-assets ratios (TE_TAjt–1), larger firms (LogATjt–1), more

profitable firms (ROAjt–1), or firms with lower growth (GRWjt–1) are more likely to pay dividends.

In the second stage, we find that the coefficients on DIV_DUMjt–1 remain significantly negative

even after including the inverse Mills ratio (LAMBDAjt–1) as an additional explanatory variable.

The coefficient on stock repurchases (REP_DUMjt–1) is significantly negative only when crash risk

is measured by NCSKEWjt. The above results, taken together, suggest that our main results reported

earlier are robust to controlling for potential self-selection bias.

- 30 -

Electronic copy available at: https://ssrn.com/abstract=3127275

[Insert Table 6 here]

5.1.3. The Coarsened Exact Matching procedure

According to Shipman et al. (2017), a useful way to address endogeneity arising from

functional form misspecification is to use a matching method such as Coarsened Exact Matching,

Propensity Score Matching, or other matching methods under which dividend-paying firms are

matched with non-dividend-paying firms based on a set of observable firm characteristics.

Following DeFond et al. (2017), we use the Coarsened Exact Matching (CEM) procedure to

identify a sample consisting of observations with cash dividends and with no cash dividends.9

CEM is an adapted application of conventional exact matching. Instead of requiring exact matches

on the matching covariates, CEM requires non-dividend-paying firms to match dividend-paying

firms only within an acceptable range (i.e., exact matching on strata of covariates rather than exact

covariate values). By stratifying data into subgroups with identical observable characteristics,

CEM mitigates the significant data demands in exact matching. For CEM, the matched sample

size is determined by the chosen coarsening level for each covariate. Loose (refined) coarsening

specifies fewer (more) strata and generates more (fewer) matches between dividend-paying firms

and non-dividend-paying firms.

To perform CEM, we choose as matching covariates from the ten control variables in Eq.

(3) and the five determinants of dividend payments in Eq. (7). We, however, do not include as

9

DeFond et al. (2017) point out that propensity score matching (PSM) requires several subjective research design

choices that affect the identification of the matched sample and the estimation of the treatment effect. These choices

include the number of control firms matched to each treatment firm, the closeness of the match, the choice of non-

linear terms in the logit model used to estimate the propensity score, and the choice of matching with or without

replacement. They conclude that CEM has two advantages compared to PSM. First, CEM directly matches on the

multivariate distributions of the matching variables rather than on a single predicted probability (i.e. the propensity

score). This helps alleviate PSM’s dependence on one scalar where balancing on one matching variable may cause

imbalances on other matching variables. Second, CEM does not rely on the discriminative ability of the first-stage

propensity score model to distinguish between the treatment and control firms, which could significantly influence

estimation of the treatment effect, especially when the numbers of the treatment and control firms are balanced in the

data.

- 31 -

Electronic copy available at: https://ssrn.com/abstract=3127275

matching covariates SIZEjt–1, LEVjt–1, and MBjt–1 from Eq. (3) because they are highly correlated

with LogATjt–1, TE_TAjt–1, and GRWjt–1, respectively, from Eq. (7). From the above procedure, we

obtain eleven matching covariates: REP_DUMjt–1, NCSKEWjt–1, DTURNjt–1, SIGMAjt–1, RETjt–1,

ROAjt–1, ACCMjt–1, RE_TEjt–1, TE_TAjt–1, LogATjt–1, and GRWjt–1. All matching variables are

defined earlier and in Appendix A.

We then match between dividend-paying and non-dividend-paying firms based on the

multivariate distribution of the above matching covariates. To ensure best matching, we choose

the maximum number of bins for each covariate suggested by Doane’s formula (1976).10 Our

matching is on a 1-to-1 basis without replacement. After the CEM procedure is applied, we obtain

the CEM sample that consists of 12,675 observations with positive dividends (the dividend-paying

subsample) and 12,675 observations with zero dividends (the non-dividend-paying subsample).

We assess match quality of the CEM sample using three metrics following DeFond et al.

(2017, p. 3634): (1) the difference in means of a covariate between the dividend-paying and non-

dividend-paying subsamples; (2) |%bias| of a covariate between the dividend-paying and non-

dividend-paying subsamples; and (3) L1 of a covariate between the dividend-paying and non-

dividend-paying subsamples. Three metrics provide the same assessment: the difference in means

of each control variable in Eq. (3) between the dividend-paying subsample and the non-dividend-

paying subsample of our CEM sample is drastically reduced, compared to its counterpart in the

unmatched sample (i.e., the sample used in Table 3). However, the difference in means remains

significant for several variables. Shipman et al. (2017, p. 218) indicate that it is not always possible

to have a completely balanced matched sample (balanced means no difference in means of each

10

According to DeFond et al. (2017), Doane (1976) proposes a formula to determine the maximum number of bins

for a matching covariate. Maximum number of bins = 1 + log2 (n) + log2 (1 + |skew|/ ), where n is the

number of observations in the unmatched sample, and skew is the unmatched sample skewness of a matching covariate.

- 32 -

Electronic copy available at: https://ssrn.com/abstract=3127275

explanatory variable between the two subsamples). They recommend that the covariates that

remain significantly different between the two subsamples be included as control variables in a

multiple regression to examine the treatment effect.11

Following the recommendation of Shipman et al. (2017), we use multiple regression to

estimate the effect of dividends on crash risk. Specifically, we estimate Eq. (3) using the CEM

sample. Panel B of Table 6 presents our estimated results. The coefficient on the dummy variable

of dividend payments, DIV_DUMjt–1, is significantly negative when the dependent variable is

CRASHjt (-0.136, p-value = 0.000) and is also significantly negative when the dependent variable

is NCSKEWjt (-0.028, p-value = 0.016). These negative coefficients indicate that dividend

payments reduce stock price crash risk after differences in firm characteristics between dividend-

paying and non-dividend-paying firms are controlled for through CEM. The coefficient on stock

repurchases (REP_DUMjt–1) is insignificant in both regressions. To summarize, the CEM results

above suggest that the significantly negative relation observed between dividend payments and

crash risk is unlikely to be driven by endogeneity due to functional form misspecification.

5.2. Longer forecasting windows

Our analysis thus far focuses on the power of dividends to predict one-year ahead stock

price crash risk. In this section, we test whether dividends have the predictive power for crash risk

beyond one-year forecasting horizon. Following Kim et al. (2011), we expand the forecasting

windows to two years and three years ahead into the future. Specifically, we estimate the likelihood

of crash occurrence during the two-year window (CRASH[jt, jt+1]) and three-year window (CRASH[jt,

jt+2]). We require that at least 100 and 150 firm-specific weekly returns for each firm be available

11