Академический Документы

Профессиональный Документы

Культура Документы

FA6e Ch09 SolutionsManual 052219

Загружено:

SylvesterОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

FA6e Ch09 SolutionsManual 052219

Загружено:

SylvesterАвторское право:

Доступные форматы

CHAPTER 9

Reporting and Analyzing Liabilities

Learning Objectives – coverage by question

Mini- Cases

Exercises Problems

Exercises and Projects

LO1 – Identify and account for 18, 19,

38 - 40, 43 51, 59

current operating liabilities. 21, 25, 33

LO2 – Describe and account for

current nonoperating (financial) 20, 21 49

liabilities.

LO3 – Explain and illustrate the

22, 31, 32, 41, 42,

pricing of long-term nonoperating 52 - 58 60, 61

34 - 37 44 - 48, 50

liabilities.

LO4 – Analyze and account for

20, 23, 24,

financial statement effects of

26 - 29, 41, 44 - 50 51 - 58 60, 61

long-term nonoperating

34 - 36

liabilities.

LO5 – Explain how solvency

ratios and debt ratings are

22, 30 60, 61

determined and how they

impact the cost of debt.

©Cambridge Business Publishers, 2020

Solutions Manual, Chapter 9 9-1

QUESTIONS

Q9-1. Current liabilities are obligations that require payment within the coming year or

operating cycle, whichever is longer.

Generally, current liabilities are normally settled with use of existing current

assets or operating cash flows.

Q9-2. If a company fails to take a cash discount that is offered by a supplier, it is

effectively paying a penalty for taking additional time to pay the account

payable. Depending on the size of the discount, this penalty (an implicit

interest rate) can be quite high.

The net-of-discount method records the inventory at the purchase cost less the

discount. If the discount is lost, the extra cost is treated as part of interest

expense for the period. This has two benefits: (1) the lost discount is not

capitalized as part of the cost of inventory, and (2) the lost discount is

highlighted, which is useful information that may be helpful in managing

accounts payable.

Q9-3. An accrual is the recognition of an event in the financial statements even

though no actual transaction has occurred. Accruals can involve both liabilities

(and expenses) and assets (and revenues).

Accruals are vital to the fair presentation of the financial condition of a company

as they impact both the recognition of revenue and the matching of expense.

Q9-4. The coupon rate is the rate specified on the face of the bond. It is used to

compute the amount of cash interest paid to the bond holder. The market rate

is the rate of return expected by investors that purchase the bonds. The market

rate determines the market price of the bond. It incorporates expectations about

the relative riskiness of the borrower and the rate of inflation. In general, there

is an inverse relation between the bond’s market rate and the bond’s market

price.

Q9-5. Bonds sold at face (par) value earn an effective interest rate equal to the bonds’

coupon rate. Bonds are sold at a discount when the effective interest rate is

higher than the coupon rate. Bonds are sold at a premium when the effective

interest rate is lower than the coupon rate.

©Cambridge Business Publishers, 2020

9-2 Financial Accounting, 6th Edition

Q9-6. Bonds are reported at historical cost, that is, the face amount plus (minus)

unamortized premium (discount). The market price of the bonds varies

inversely with the level of interest rates and fluctuates continuously. Differences

between the market price of a bond and its carrying amount represent

unrealized gains and losses. These unrealized gains (losses) are not reflected

in the financial statements (although they are disclosed in the footnotes). They

must be recognized upon repurchase of the bonds, the point at which they

become “realized.”

If the bonds are refunded (that is, replaced with new bonds reflecting current

market values and interest rates), the gain (or loss) that is recognized in the

current period will be offset by correspondingly higher (lower) interest payments

in the future. The present value of the future interest payments, along with the

present value of the difference between the face amount of the new bond and

the former face amount, exactly offset the reported gain (loss).

Q9-7. Debt ratings reflect the relative riskiness of the borrowing company. This

riskiness relates to the probability of default (e.g., not repaying the principal and

interest when due). Higher (greater quality) debt ratings result in higher market

prices for the bonds and a correspondingly lower effective interest rate for the

issuer. Lower (lesser quality) debt ratings result in lower market prices for the

bonds and a correspondingly higher effective interest rate for the issuer.

Q9-8. Reported gains or losses on bond redemption result from changes in the

market price of the bonds and the use of historical cost accounting. Because

bonds are typically reported at historical cost, fluctuations in bond prices are not

recognized until they are realized when the bonds are redeemed or refunded.

If the bonds are refunded (new bonds are issued), the gain or loss is offset by

the present value of lower (higher) future interest payments on the new bond

issue. (If the liabilities are reported at fair value, the gain or loss is the

difference between the last reported fair value and the sales price (assuming all

the fair value changes were recorded in income – meaning were not due to

instrument-specific credit risk changes.)

Q9-9. (a) Bonds payable – the liability account used to record the face value of

bonds issued by a company

(b) Call provision – the right for the bond issuer to repurchase the debt, before

it matures, at a predetermined price.

(c) Face value – the predetermined amount (typically $1,000) that must be

repaid when a bond matures

(d) Coupon rate – the rate specified on the face of the bond that determines

the periodic interest (coupon) payment

(e) Bond discount – the difference between the face value of the bond and the

market price when the price is lower than the face value; recorded as a

contra-liability

©Cambridge Business Publishers, 2020

Solutions Manual, Chapter 9 9-3

(f) Bond premium – the difference between the market price of a bond and the

face value when the market price is higher than the face value; recorded as

an adjunct-liability

(g) Amortization of premium or discount – the periodic reduction of the balance

in the premium or discount account recorded each time interest expense is

accrued; equal to the difference between the accrued interest and the

coupon payment (or payable)

Q9-10. The advantages of issuing bonds are (1) the interest payments are limited to

the predetermined amount specified on the bond; (2) the interest is tax

deductible; (3) bondholders do not have a vote when it comes to electing

directors and managing the company; (4) the additional financial leverage

created when bonds are issued increases profits in good years. The

disadvantages of bonds include (1) bonds must be repaid while common stock

is issued with an indefinite life; (2) bondholders can impose restrictive

covenants in the loan indenture; (3) the additional financial leverage created

when bonds are issued decreases profits in lean years.

Q9-11. $3,000,000 x [.98 + (.09 x 3/12)] = $3,007,500

Q9-12. The contract rate (or stated rate or coupon rate) determines the periodic

coupon payment. If this rate is not equal to the rate required by the market, the

bond price is adjusted to the present value of the cash payments from the bond

discounted at the applicable market rate of interest. If the market rate is higher

than the coupon rate, then the periodic coupon payments are insufficient and

the bond will be priced lower than the face value (a discount). If the market rate

is lower than the coupon rate, then the periodic coupon payments will be higher

than required by the market, and the bond will sell for a premium.

Q9-13. When the bonds mature, the book value of the bonds will be equal to the face

value. Over the life of the bonds, the change in the book value of the bonds will

be equal to face value less the market value at the time that the bonds are

issued.

Q9-14. When the effective interest method is used to amortize a bond discount or

premium, the effective rate is multiplied by the net balance in bonds payable

(bonds payable plus/minus the premium or discount). If the bond is issued at a

discount, the balance increases over the life of the bond; the interest expense

will increase as the balance increases. If the bond is issued at a premium, the

balance decreases over the life of the bond; the interest expense will decrease

as the balance decreases.

©Cambridge Business Publishers, 2020

9-4 Financial Accounting, 6th Edition

Q9-15. Bonds payable is presented in the balance sheet net of any discount or plus

any premium.

Q9-16. The loss is the difference between the retirement value and the book value of

the bond: (101% x $200,000) – $197,600 = $4,400.

Q9-17. Each payment includes both interest on the outstanding balance and

repayment of the principal. As each payment is made, the principal balance is

reduced. As a consequence, the interest component of the payment is smaller

each period.

©Cambridge Business Publishers, 2020

Solutions Manual, Chapter 9 9-5

MINI EXERCISES

M9-18. (15 minutes)

LO 1

a.

11/15 Inventory (+A) 6,076

Accounts payable (+L) 6,076

11/23 Accounts payable (-L) 6,076

Cash (-A) 6,076

$6,076 = $6,200 x 0.98

b.

+ Inventory (A) - - Accounts Payable (L) +

11/15 6,076 6,076 11/15

11/23 6,076

+ Cash (A) -

6,076 11/23

c. [($6,200 - $6,076)/$6,076] x [365/(30-10)] = 37.25%. (With interest compounding,

the annual rate of interest r can be solved from (1+r) (20/365)=1.02. The value that

solves this relationship is r = 43.5%.)

M9-19. (15 minutes)

LO 1

a.

1/20 Inventory (+A) 12,250

Accounts payable (+L) 12,250

2/15 Accounts payable (-L) 12,250

Interest expense, discounts lost (+E, -SE) 250

Cash (-A) 12,500

$12,250 = $12,500 x 0.98

©Cambridge Business Publishers, 2020

9-6 Financial Accounting, 6th Edition

b.

+ Inventory (A) - - Accounts Payable (L) +

1/20 12,250 12,250 1/20

2/15 12,250

+ Cash (A) - + Interest Expense, Discounts Lost (E) -

12,500 2/15 2/15 250

c. [($12,500- $12,250)/$12,250] x [365/(60-15)] = 16.55%. (With interest

compounding, the annual rate of interest r can be solved from (1+r) (45/365)=1.02. The

value that solves this relationship is r = 17.4%.)

M9-20. (10 minutes)

LO 2

a. Interest expense (+E,-SE)…………………… 24

Interest payable (+L)……………………. 24

$7,200 × 8% × (15/365) = $24

b.

- Interest Payable (L) + + Interest Expense (E) -

24 a. a. 24

c.

Balance Sheet Income Statement

Cash Noncash Liabil- Contrib. Earned Net

Transaction Asset + Assets = ities + Capital + capital Revenues - Expenses = Income

Accrued $24 +24 -24 +24 -24

interest on = Interest Retained - Interest =

note payable Payable Earnings Expense

M9-21. (15 minutes)

LO 1, 2

a. Accounts Payable, $110,000 (current liability).

b. Not recorded as a liability; an accountable transaction has not yet occurred.

c. Estimated liability for product warranty, $2,200 (current liability).

d. Bonuses Payable, $30,000 (current liability)—computed as $600,000 5%. This

liability must be reported since its payment is “probable” and can be “estimated.”

©Cambridge Business Publishers, 2020

Solutions Manual, Chapter 9 9-7

M9-22. (10 minutes)

LO 3, 5

a. Microsoft is offering bonds with a coupon (stated) rate of 3.3%% when the market

rate (yield) is higher (3.383%). In order to obtain this expected rate of return, the

bonds sell at a discount price of 99.31 (99.31% of par).

b. The first bond matures in 2027 while the second matures in 2057. There is,

generally, a higher rate (yield) expected for a longer maturity.

M9-23. (10 minutes)

LO 4

Amount paid to retire bonds ($400,000 x 102%)............................................. $408,000

Book value of retired bonds, net of $3,000 unamortized discount................... 397,000

Loss on bond retirement................................................................................. $ 11,000

M9-24. (10 minutes)

LO 4

a. The $3,546 million of debt that is due in 2018 is already listed as the current portion

of long-term debt in Pfizer’s current liabilities.

b. Pfizer will need to pay off the bonds when they mature. This will result in a cash

outflow that must come from operating activities if the bonds cannot be refinanced

prior to maturity. However, most of Pfizer’s long-term debt matures more than 5

years after the financial statement date (December 31, 2017). Thus, Pfizer’s near-

term cash needs for covering long-term debt should not place a significant burden

on the company’s operations.

M9-25 (10 minutes)

LO 1

a. Gain on Bond Retirement: In the other (nonoperating) income and expenses section of

the income statement.

b. Discount on Bonds Payable: Deduction from Bonds Payable; thus, a (contra) long-term

liability in the balance sheet (e.g., it is netted in the presentation of long-term liabilities).

c. Mortgage Notes Payable: Long-term liability in the balance sheet.

d. Bonds Payable: Long-term liability in the balance sheet.

©Cambridge Business Publishers, 2020

9-8 Financial Accounting, 6th Edition

e. Bond Interest Expense: In other (nonoperating) income and expenses section of the

income statement.

f. Bond Interest Payable: Current liability in the balance sheet.

g. Premium on Bonds Payable: Addition to Bonds Payable; thus, part of a long-term

liability in the balance sheet (e.g., it is included in the presentation of long-term

liabilities).

h. Loss on Bond Retirement: In the other (nonoperating) income and expenses section of

the income statement.

M9-26. (10 minutes)

LO 4

a. Restrictive loan covenants are typically designed to protect the bond holders against

actions by management that they feel would be detrimental to their interests. These

covenants might include restrictions against the impairment of liquidity, restrictions

on the amount of financial leverage the company can employ, and restrictions on the

payment of dividends. In addition, bond holders usually impose various covenants

prohibiting the acquisition of other companies or the divestiture of business

segments without their consent. All of these covenants, by design, restrict

management in its actions.

b. Management, facing imminent violation of one or more of its bond covenants, may

be pressured into taking actions in order to avoid default. These may include, for

example, foregoing profitable investments, reduction of discretionary spending such

as R&D or advertising in order to improve profitability, missing opportunities to take

cash discounts and other methods of “leaning on the trade,” or reduction of

receivables (via early payment incentives) and inventories (by marketing promotions

or delaying restocking) in order to boost cash balances. Actions may also include

questionable accounting measures, such as improper recognition of revenues or

delayed recognition of expenses.

c. When evaluating solvency, analysts should compare a company’s position relative to

its restrictive covenants. A company may appear solvent, but in fact may be in close

proximity to a restrictive covenant. Also, analysts should be aware of the potential

effect that restrictive covenants can have on management decisions (see the answer

to requirement b). Restricted assets, such as cash or securities, should not be

considered as general assets in an analysis of the firm’s liquidity or solvency

because they are not available to management for general corporate uses.

©Cambridge Business Publishers, 2020

Solutions Manual, Chapter 9 9-9

M9-27. (15 minutes)

LO 4

a.

1/1/2013 Cash (+A) ……………………………………..... 432,000

Bonds payable (+L) ………………..…… 400,000

Bond premium (+L) ………………..…… 32,000

1/1/2019 Bonds payable (-L) ………………………..….. 400,000

Bond premium (-L) ……………………..…….. 27,809

Cash (-A) ………………………………..... 412,000

Gain on retirement of bonds (+R, +SE) 15,809

b.

+ Cash (A) - - Bonds Payable (L) +

1/1/13 432,000 400,000 1/1/13

412,000 1/1/19 1/1/19 400,000

- Gain on Retirement of Bonds (R) + - Bond Premium (L) +

15,809 1/1/19 32,000 1/1/13

1/1/19 27,809

c.

Balance Sheet Income Statement

Cash Noncash Contrib. Earned Net

Transaction Asset + Assets = Liabilities + Capital + Capital Revenues - Expenses = Income

1/1/13 432,000 = +400,000 - =

Issue bonds Cash Bonds

at a Payable

premium.

+32,000

Bond

Premium

1/1/19 -412,000 = -400,000 +15,809 +15,809 - = +15,809

Retired Cash Bonds Retained Gain on

bonds issued Payable Earnings Retirement

on 1/1/13. of Bonds

-27,809

Bond

Premium

©Cambridge Business Publishers, 2020

9-10 Financial Accounting, 6th Edition

M9-28. (15 minutes)

LO 4

a.

7/1/2012 Cash (+A) ……………………………………. 240,000

Bond discount (+XL, -L) …………….….…. 10,000

Bonds payable (+L) ………………….. 250,000

7/1/2019 Bonds payable (-L) ………………………… 250,000

Loss on retirement of bonds (+E, -SE) … 9,314

Bond discount (-XL, +L) ……….…… 6,814

Cash (-A) ………………………………. 252,500

b.

+ Cash (A) - - Bonds Payable (L) +

7/1/12 240,000 250,000 7/1/12

252,500 7/1/19 7/1/19 250,000

+ Loss on Retirement of Bonds (E) - + Bond Discount (XL) -

7/1/19 9,314 7/1/12 10,000

6,814 7/1/19

c.

Balance Sheet Income Statement

Cash Noncash Contra Contrib. Earned Net

Transaction Asset + Assets = Liabilities - Liability + Capital + Capital Revenues - Expenses = Income

7/1/12 +240,000 = +250,000 +10,000 - =

Issue bonds

Cash Bonds Bond

at a discount

Payable Discount

7/1/19 Retired -252,500 = -250,000 -6,814 -9,314 - +9,314 = -9,314

bonds issued

Cash Bonds Bond Retained Loss on

on 7/1/12

Payable Discount Earnings retirement

of Bonds

M9-29. (10 minutes)

LO 4

Nissim: $18,000 0.10 40/365 = $197.26

Klein: $14,000 0.09 18/365 = 62.14

Bildersee: $16,000 0.12 12/365 = 63.12

$322.52

©Cambridge Business Publishers, 2020

Solutions Manual, Chapter 9 9-11

M9-30. (10 minutes)

LO 5

a. Unless there has been a decline in the General Mills’ operating liabilities, the Debt-

to-Equity ratio (D/E) will increase. The net effects of financing cash flows are to

increase financial liabilities and decrease shareholders’ equity. (although net income

would then increase equity, but still by an amount less than the increase in debt).

Times interest earned will likely decrease as additional interest cost on new

borrowing is added to the denominator. How much of an effect this will have

depends on the size of the change in net income.

b. Generally, the higher (lower) the firm's solvency measures, the higher (lower) the

firm's debt rating. In financial leverage terms, the higher (lower) the firm's leverage

the lower (higher) the firm's debt rating. Increasing the amount of debt while

decreasing equity may harm General Mills’ debt ratings, though increases in

operating results , could support additional financial liabilities.

M9-31. (15 minutes)

LO 3

a. Selling price of 9% bonds discounted at 8%

Present value of principal repayment ($500,000 0.45639) $228,195

Present value of interest payments ($22,500 13.59033) 305,782

Selling price of bonds $533,977

b. Selling price of 9% bonds discounted at 10%

Present value of principal repayment ($500,000 0.37689) $188,445

Present value of interest payments ($22,500 12.46221) 280,400

Selling price of bonds $468,845

M9-32. (15 minutes)

LO 3

a. Selling price of zero-coupon bonds discounted at 8%:

Present value of principal repayment ($500,000 0.45639) $228,195

b. Selling price of zero coupon bonds discounted at 10%:

Present value of principal repayment ($500,000 0.37689) $188,445

c. Based on the debt-to-equity ratio, financial leverage would increase from 2.0 [=($3 -

$1)/$1] to 2.19 [=($3 - $1 + $0.188)/$1)

©Cambridge Business Publishers, 2020

9-12 Financial Accounting, 6th Edition

M9-33. (15 minutes)

LO 1

a.

Month 1 2 3 4

Income statement:

Revenue $420 $420 $420 $420

Cost of goods sold 300 300 300 300

Operating expenses 110 110 110 110

Income $10 $10 $10 $10

Operating cash flows

Receipts $420 $420 $420 $420

Payments to suppliers 300 300 300 300

Payments for operating expenses 110 110 110 110

Net cash flow from operations $10 $10 $10 $10

b.

Month 1 2 3 4

Income statement:

Revenue $420 $420 $420 $420

Cost of goods sold 300 300 300 300

Operating expenses 110 110 110 110

Income $10 $10 $10 $10

Operating cash flows

Receipts $420 $420 $420 $420

Payments to suppliers 0 300 300 300

Payments for operating expenses 110 110 110 110

Net cash flow from operations $310 $10 $10 $10

The CFO’s proposal would increase the cash generated by operations, but only for

one month. Then the cash flows would revert to their original pattern. Therefore,

“leaning on the trade,” (deferring payables) is not likely to produce a steady source

of cash for expansion of the business.

©Cambridge Business Publishers, 2020

Solutions Manual, Chapter 9 9-13

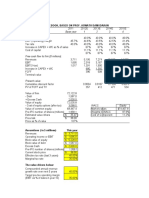

M9-34. (30 minutes)

LO 3, 4

©Cambridge Business Publishers, 2020

9-14 Financial Accounting, 6th Edition

M9-35. (15 minutes)

LO 3, 4

a. Gain on bond retirement Reported in the income statement under other

(nonoperating) income

b. Discount on bonds payable Contra-liability netted against bonds payable

under long-term liabilities in the balance sheet

c. Mortgage notes payable Long-term liability in the balance sheet; the

amount due within one year would be reported as

a current liability

d. Bonds payable Long-term liability in the balance sheet; the

amount due within one year would be reported as

a current liability

e. Bond interest expense Nonoperating expense reported in the income

statement

f. Bond interest payable A current liability in the balance sheet

g. Premium on bonds payable Adjunct-liability added to bonds payable under

long-term liabilities in the balance sheet

M9-36. (15 minutes)

LO 3, 4

a.

12/31/18 Cash (+A) …………………………………….. 700,000

Mortgage note payable (+L) ………….. 700,000

6/30/19 Interest expense (+E, -SE) ……………………. 42,000

Mortgage note payable (-L) …………………… 8,854

Cash (-A) ………………………………….. 50,854

12/31/19 Interest expense (+E, -SE) …………………… 41,469*

Mortgage note payable (-L) ………………….. 9,385

Cash (-A) …………………………………. 50,854

* $41,469 = ($700,000 – $8,854) x 12%/2.

©Cambridge Business Publishers, 2020

Solutions Manual, Chapter 9 9-15

b.

+ Cash (A) - - Mortgage Note Payable (L) +

12/31/18 700,000 700,000 12/31/18

50,854 6/30/19 6/30/19 8,854

50,854 12/31/19 12/31/19 9,385

+ Interest Expense (E) -

6/30/19 42,000

12/31/19 41,469

c.

Balance Sheet Income Statement

Cash Noncash Contrib. Earned Net

Transaction Asset + Assets = Liabilities + Capital + Capital Revenues - Expenses = Income

12/31/18 +700,000 = +700,000 - =

Borrow

Cash Mortgage

$700,000 on

Note

a 15-year

Payable

mortgage

note payable.

6/30/19 -50,854 = -8,854 -42,000 - +42,000 = -42,000

Interest

Cash Mortgage Retained Interest

payment

Note Earnings Expense

on note.

Payable

12/31/19 -50,854 = -9,385 -41,469 - +41,469 = -41,469

Interest

Cash Mortgage Retained Interest

payment

Note Earnings Expense

on note.

Payable

M9-37. (5 minutes)

LO 3

$900,000 x 0.55839 + [(900,000 x 10%/2) x 7.36009] = $833,755.

$833,755 / $900,000 = 92.6% of par value.

©Cambridge Business Publishers, 2020

9-16 Financial Accounting, 6th Edition

EXERCISES

E9-38. (15 minutes)

LO 1

a.

Total expected failures from units sold in the current period ............. 1,380*

Average cost per failure..................................................................... $50

Total expected warranty costs for current period sales...................... $ 69,000

Plus beginning warranty liability......................................................... $ 30,000

Minus warranty services provided..................................................... $ 27,000

Ending warranty liability..................................................................... $ 72,000

*(69,000 x 0.02)

The product warranty liability must be increased by $69,000 to cover the expected

repair costs of products sold during the period, and that amount would be recognized

as expense. With the opening liability balance of $30,000 and warranty services

provided of $27,000, the ending liability balance would be $72,000.

b. The warranty liability should be equal, at all times, to the expected dollar cost of

future repairs. Waymire Company should conduct an analysis similar to an aging of

accounts to determine which products are still under warranty and what the

expected cost will be. That estimate will provide the correct value for the warranty

liability and determines any required adjustments in the period’s warranty expense.

Analysis issues relate to whether the warranty liability exists and, if so, whether it is

at the correct amount. Understating (overstating) the accrual overstates

(understates) current period income at the expense (benefit) of future income.

c. The debt-to-equity ratio will increase and the operating cash flow to liabilities will

decrease. The times-interest earned ratio will decrease, because the increase in

liability causes an increase in warranty expense, which decreases earnings before

interest and taxes.

©Cambridge Business Publishers, 2020

Solutions Manual, Chapter 9 9-17

E9-39. (10 minutes)

LO 1

Item Accounting Treatment

a. Neither record nor disclose (neither probable nor reasonably possible)

b. Record a current liability for the note, no liability for interest until incurred as time

passes.

c. Disclose in a footnote (at least reasonably possible) (Also, if Shevlin is an SEC

registrant and the amount is material, the line item “Commitment and

contingencies” may need to be shown on the face of the balance sheet, with no

associated amounts for that line item.)

d. Record warranty liability on balance sheet and recognize expense in income

statement (costs are probable and reasonably estimable).

E9-40. (15 minutes)

LO 1

The company must accrue the $25,000 of wages that have been earned by employees

even though these wages will not be paid until the first of next month. The required

accounting accrual will:

Increase wages payable by $25,000 on the balance sheet

Increase wages expense by $25,000 in the income statement

Failure to make this accounting accrual (called an adjusting entry) would understate

liabilities, understate expenses, overstate income, and overstate stockholders’ equity.

E9-41. (15 minutes)

LO 3, 4

a. Selling price of bonds:

Present value of principal repayment ($300,000 0.30832) $ 92,496

Present value of interest payments ($16,500 17.29203) 285,318

Selling price of bonds $377,814

b.

1/1/19 Cash (+A) …………………………………….. 377,814

Bond premium (+L) …………………… 77,814

Bonds payable (+L) ……………...…… 300,000

6/30/19 Interest expense (+E, -SE) ………………… 15,113

Bond premium (-L) ……………...………….. 1,387

Cash (-A) ……………………………….. 16,500

Continued next page

©Cambridge Business Publishers, 2020

9-18 Financial Accounting, 6th Edition

b. continued

12/31/19 Interest expense (+E, -SE) ………………… 15,057

Bond premium (-L) …………………………. 1,443

Cash (-A) ……………………………….. 16,500

$15,057 = ($377,814 – $1,387) x 8%/2.

c.

+ Cash (A) - - Bonds Payable (L) +

1/1/19 377,814 300,000 1/1/19

16,500 6/30/19

16,500 12/31/19

+ Interest Expense (E) - - Bond Premium (L) +

77,814 1/1/19

6/30/19 15,113 6/30/19 1,387

12/31/19 15,057 12/31/19 1,443

d.

Balance Sheet Income Statement

Cash Noncash Contrib. Earned Net

Transaction Asset + Assets = Liabilities + Capital + Capital Revenues - Expenses = Income

1/1/19 +377,814 = +300,000 - =

Issue bonds

Cash Bonds

at a premium.

Payable

+77,814

Bond

Premium

6/30/19 -16,500 = -1,387 -15,113 - +15,113 = -15,113

Interest

Cash Bond Retained Interest

payment

Premium Earnings Expense

on bonds.

12/31/19 -16,500 = -1,443 -15,057 - +15,057 = -15,057

Interest

Cash Bond Retained Interest

payment

Premium Earnings Expense

on bonds.

©Cambridge Business Publishers, 2020

Solutions Manual, Chapter 9 9-19

E9-42. (10 minutes)

LO 3

Selling price of bonds

Present value of principal repayment ($900,000 0.44230) $398,070

Present value of interest payments ($49,500 9.29498) 460,102

Selling price of bonds $858,172

E9-43. (15minutes)

LO 1

a. Additions to the Warranty provision would be reflected in Warranty expense.

Warranty expense (+E, -SE) ………………………. 1,786

Warranty provision (+L)…………………… 1,786

b. Usage of the warranty provision would reflect Siemens providing warranty services

to its customers. The provision liability would be reduced, as would balances in

cash and perhaps inventory reflecting the resources needed for the warranty work.

Warranty provision (-L) …………………………….. 993

Cash or inventory (-A)……………………. 993

c. It can be useful to report the additions and reversals separately for a couple of

reasons. First, the reversals would reflect past periods’ errors in estimates, while the

additions could reflect the expected cost of providing warranty service for sales

made in the current period. In addition, it may provide insights into whether Siemens

tends to be systematically optimistic or pessimistic in its estimates. The numbers

reported indicate that Siemens tends to overestimate its warranty expenses.

d. 2018: €1,786/€83,044 = 2.15%

2017: €1,820/€82,863 = 2.20%

Warranty expense appears to have increased in 2014 as a percentage of sales

revenue.

©Cambridge Business Publishers, 2020

9-20 Financial Accounting, 6th Edition

E9-44. (15 minutes)

LO 3, 4

a.

5/1/18 Cash (+A) ………………………………………... 500,000

Bonds payable (+L) ………………………. 500,000

10/31/18 Interest expense (+E, -SE) ……………………. 22,5001

Cash (-A) …………………………………... 22,500

11/1/19 Bonds payable (-L) ……………………………... 300,000

Loss on retirement of bonds (+E, -SE) ………. 3,000

Cash (-A) …………………………………… 303,0002

1

$500,000 x 0.09 x 1/2 = $22,500 interest expense. Because the bonds were sold at par, there is no

discount or premium amortization.

2

Cash required to retire $300,000 of bonds at 101 = $300,000 x 1.01 = $303,000. The difference

between the cash paid and the carrying amount of the bonds is the gain or loss on the redemption. In

this case, the loss is $3,000. This calculation assumes that the interest was paid on 10/31/19, so

accrued interest is not recorded.

b.

+ Cash (A) - - Bonds Payable (L) +

5/1/18 500,000 500,000 5/1/18

22,500 10/31/18

303,000 11/1/19 11/1/18 300,000

+ Interest Expense (E) - + Loss on Retirement of Bonds (E) -

10/31/18 22,500 11/1/18 3,000

c.

Balance Sheet Income Statement

Cash Noncash Contrib. Earned Net

Transaction Asset + Assets = Liabilities + Capital + Capital Revenues - Expenses = Income

5/1/18 +500,000 = +500,000 - =

Issue bonds.

Cash Bonds

Payable

10/31/18 -22,500 = -22,500 - +22,500 = -22,500

Interest

Cash Retained Interest

payment

Earnings Expense

on bonds.

11/1/19 -303,000 = -300,000 -3,000 - +3,000 = -3,000

Early

Cash Bonds Retained Loss on

retirement

Payable Earnings Retirement

of bonds.

of Bonds

©Cambridge Business Publishers, 2020

Solutions Manual, Chapter 9 9-21

E9-45. (25 minutes)

LO 3, 4

a. Selling price of bonds

Present value of principal repayment ($250,000 0.41552) $103,880

Present value of interest payments ($10,000 11.68959) 116,896

Selling price of bonds $220,776

b.

1/1/19 Cash (+A) ………………………………………. 220,776

Bond discount (+XL, -L) ……………………… 29,224

Bonds payable (+L) …………………….. 250,000

6/30/16 Interest expense (+E, -SE) …………………… 11,039

Bond Discount (-XL, +L) ………….……. 1,039

Cash (-A) ………………………………….. 10,000

$11,039 = $220,776 0.05

12/31/19 Interest expense (+E, -SE) …………………. 11,091

Bond Discount (-XL, +L) …………….…. 1,091

Cash (-A) ………………………………….. 10,000

$11,091 = [$220,776 + $1,039] 0.05

c.

+ Cash (A) - - Bonds Payable (L) +

1/1/19 220,776 250,000 1/1/19

10,000 6/30/19

10,000 12/31/19

+ Interest Expense (E) - + Bond Discount (XL) -

1/1/19 29,224

6/30/19 11,039 1,039 6/30/19

12/31/19 11,091 1,091 12/31/19

d.

Balance Sheet Income Statement

Cash Noncash Contra Contrib. Earned Net

Transaction Asset + Assets = Liabilities - Liability + Capital + Capital Revenues - Expenses = Income

1/1/19 +220,776 = +250,000 +29,224 - =

Issue

Cash Bonds Bond

bonds at a

Payable Discount

discount.

6/30/19 -10,000 -1,039 -11,039 +11,039 -11,039

Interest

Cash Bond Retained Interest

payment

Discount Earnings Expense

on bonds.

12/31/19 -10,000 = -1,091 -11,091 - +11,091 = -11,091

Interest

Cash Bond Retained Interest

payment

Discount Earnings Expense

on bonds.

©Cambridge Business Publishers, 2020

9-22 Financial Accounting, 6th Edition

E9-46. (25 minutes)

LO 3, 4

a. Selling price of bonds:

Present value of principal repayment ($800,000 0.20829) $166,632

Present value of interest payments ($36,000 19.79277) 712,540

Selling price of bonds $879,172

b.

1/1/19 Cash (+A) ………………………………………... 879,172

Bond premium (+L) ……………………… 79,172

Bonds payable (+L) ……………………… 800,000

6/30/19 Interest expense (+E,-SE) ……………………. 35,167

Bond premium (-L) …………….……………… 833

Cash (-A) ………………………………….. 36,000

$35,167 = $879,172 x 0.04

12/31/19 Interest expense (+E,-SE) ……………………. 35,134

Bond premium (-L) …………….……………… 866

Cash (-A) ………………………………….. 36,000

$35,134 = ($879,172 - $833) x 0.04

c.

+ Cash (A) - - Bonds Payable (L) +

1/1/19 879,172 800,000 1/1/19

36,000 6/30/19

36,000 12/31/19

+ Interest Expense (E) - - Bond Premium (L) +

6/30/19 35,167 79,172 1/1/19

12/31/19 35,134 6/30/19 833

12/31/19 866

d.

Balance Sheet Income Statement

Cash Noncash Contrib. Earned Net

Transaction Asset + Assets = Liabilities + Capital + Capital Revenues - Expenses = Income

1/1/19 +879,172 = +800,000 - =

Issue Cash Bonds

bonds at a Payable

premium. +79,172

Bond

Premium

6/30/19 -36,000 = -833 -35,167 - +35,167 = -35,167

Interest Cash Bond Retained Interest

payment Premium Earnings Expense

on bonds.

12/31/19 -36,000 = -866 -35,134 - +35,134 = -35,134

Interest Cash Bond Retained Interest

payment Premium Earnings Expense

on bonds.

©Cambridge Business Publishers, 2020

Solutions Manual, Chapter 9 9-23

E9-47. (20 minutes)

LO 3, 4

a. There is an inverse relation between interest rates and bond prices (examine the

increasing discount rates as the yield increases in present value tables). Since the

bonds now trade at a premium and assuming that Deere’s credit ratings have not

changed, we can conclude that interest rates have fallen since the bonds were

issued.

b. No, once the bond is initially recorded, neither the coupon rate nor the yield used to

compute interest expense is changed. Bonds are recorded at historical cost (like

most other balance sheet assets and liabilities). As a result, changes in the general

level of interest rates have no effect on interest expense (or the interest payment)

that is reflected in the financial statements.

c. Because the bonds trade at a premium in the market, Deere would be paying more

to retire the bonds than the amount at which they are carried on its balance sheet.

This would result in a loss on the repurchase that would lower current profitability.

d. The face amount of the bonds will be paid at maturity. As a result, the market price

of the bonds must also equal their face amount ($200 million) at that time.

E9-48. (25 minutes)

LO 3 4

a. Selling price of bonds

Present value of principal repayment ($600,000 0.09722) $ 58,332

Present value of interest payments ($33,000 15.04630) 496,528

Selling price of bonds $554,860

b.

1/1/19 Cash (+A) …………………………………….. 554,860

Bond discount (+XL, -L) ………………..…… 45,140

Bonds payable (+L) …………………… 600,000

6/30/19 Interest expense (+E, -SE) …………………. 33,292

Bond discount (-XL, +L) ………………. 292

Cash (-A) ………………………………… 33,000

$33,292 = $554,860 .06.

12/31/19 Interest expense (+E, -SE) ………………… 33,309

Bond discount (-XL, +L) …………….…. 309

Cash (-A) ………….……………………. 33,000

$33,309 = ($554,860 + $292) 0.06.

©Cambridge Business Publishers, 2020

9-24 Financial Accounting, 6th Edition

c.

+ Cash (A) - - Bonds Payable (L) +

1/1/19 554,860 600,000 1/1/19

33,000 6/30/19

33,000 12/31/19

+ Interest Expense (E) - + Bond Discount (XL) -

1/1/19 45,140

6/30/19 33,292 292 6/30/19

12/31/19 33,309 309 12/31/19

d. At December 31, 2019 (after the coupon payment recorded in b), the book value of

the bonds would be $554,860 + $292 + $309 = $555,461. The market value would

be $600,000 X 1.01 = $606,000. Thus, a fair value adjustment of $50,539

(=$606,000-$555,461) would be recorded as follows:

12/31/19 Loss due to adjustment of bonds to fair value +E, -SE) 50,539

Fair value adjustment (+L) 50,539

The loss would be reported in net income for the period.

e. Coupon payments ($33,000 X 2) $ 66,000

Discount amortization ($292 + $309) 601

Total interest expense 66,601

Fair value adjustment (loss) 50,539

Total effect on income (deduction) $117,140

E9-49. (10 minutes)

LO 2, 4

Current liabilities:

Bond interest payable $ 25,000

Current maturities of long-term debt:

10% bonds payable due 2019 500,000

Total current liabilities $525,000

Long-term debt:

9% bonds payable due 2020, net of $19,000 discount $581,000

Zero coupon bonds payable due 2021 170,500

8% bonds payable due 2023, including $2,000 premium 102,000

Total long-term debt $853,500

©Cambridge Business Publishers, 2020

Solutions Manual, Chapter 9 9-25

E9-50. (20 minutes)

LO 3, 4

a.

12/31/18 Cash (+A) …………………………………………… 500,000

Mortgage note payable (+L) ………………. 500,000

3/31/19 Interest expense (+E, -SE) ………………………. 10,000

Mortgage note payable (-L) ……………………... 8,278

Cash (-A) ……………………………………… 18,278

6/30/19 Interest expense (+E, -SE) ………………………. 9,834

Mortgage note payable (-L) ……………………... 8,444

Cash (-A) ……………………………………… 18,278

$9,834 = ($500,000 – $8,278) x 8%/4.

b.

+ Cash (A) - - Mortgage Note Payable (L) +

12/31/18 500,000 500,000 12/31/18

18,278 3/31/19 3/31/19 8,278

18,278 6/30/19 6/30/19 8,444

+ Interest Expense (E) -

3/31/19 10,000

6/30/19 9,834

c.

Balance Sheet Income Statement

Cash Noncash Contrib. Earned Net

Transaction Asset + Assets = Liabilities + Capital + Capital Revenues - Expenses = Income

12/31/18 +500,000 = +500,000 - =

Borrow

Cash Mortgage

$500,000

Note

on a 10-year

Payable

mortgage note

payable.

3/31/19 -18,278 = -8,278 -10,000 - +10,000 = -10,000

Payment

Cash Mortgage Retained Interest

on note.

Note Earnings Expense

Payable

6/30/19 -18,278 = -8,444 -9,834 - +9,834 = -9,834

Payment

Cash Mortgage Retained Interest

on note.

Note Earnings Expense

Payable

©Cambridge Business Publishers, 2020

9-26 Financial Accounting, 6th Edition

PROBLEMS

P9-51. (20 minutes)

LO 1

a.

Hewlett-Packard Enterprise Company Cisco Systems

- Accrued Warranty Liability (L) + - Accrued Warranty Liability (L) +

475 17 bal. 407 17bal.

265 18 exp. 582 18 exp.

310 630

430 18 bal. 359 18 bal.

Hewlett-Packard incurred $310 million in warranty repair costs and settlements in

2018 while Cisco Systems, Inc. incurred costs of $630 million.

b. HPE’s ratio of warranty expense to sales was 1.40% in 2018 ($265/$19,504) down

slightly from 1.7% in 2017 ($292/$17,597). Cisco’s ratio was 1.59% in 2018

($582/$36,709) and 1.94% ($691/$35,705) in 2017. Cisco’s warranty expense is

slightly higher relative to sales revenue than that of HPE. In general, reasons for the

higher warranty expense-to-sales ratio include: (1) perhaps Cisco products require

more repairs than HPE products or (2) HPE may have a less generous warranty

policy than Cisco, resulting in fewer warranty repairs, even if the quality is the same.

The slight decrease in HPE’s warranty expense as a percent of sales indicates that

either (1) warranty costs have gone down, (2) the company overestimated warranty

costs in the past and needed to record smaller than normal accruals in 2018 to

correct the overestimation; or (3) HPE was building up a “cookie-jar reserve” by

increasing its warranty liability in past years.

P9-52. (20 minutes)

LO 3, 4

a. Cash (+A) ………………………………………….. 518,750

Accrued interest payable (+L) …………… 18,750

Bonds payable (+L) ……………………….. 500,000

$18,750 = $500,000 x .09 x 5/12

b. Interest expense (+E, -SE)………………………. 3,750

Accrued interest payable (-L) ………………….. 18,750

Cash (-A) …………………………………….. 22,500

$22,500 = $500,000 x 9% x 6/12

c. Interest expense (+E, -SE) ……………………… 7,500

Accrued interest payable (+L) …………… 7,500

$7,500 = $500,000 x 9% x 2/12

©Cambridge Business Publishers, 2020

Solutions Manual, Chapter 9 9-27

d. Fair value adjustment (+XL, -L) ……………….. 5,000

Gain from adjustment of bonds to fair value 5,000

(+R, +SE) ……………………………..

e. Interest expense (+E, -SE) ……………………… 15,000

Accrued interest payable (-L) ………………….. 7,500

Cash (-A) …………………………………….. 22,500

f. Bonds payable (-L) ………………………………. 300,000

Loss on retirement of bonds (+E, -SE) ………. 12,000

Cash (-A) …………………………………….. 303,000

Fair value adjustment (-XL, +L) … 9,000*

*($15,000 x 60%) = $9,000

g. If gains/losses on bond revaluations were reported in other comprehensive income

rather than net income, Eskew, Inc.’s December 31, 2018 income statement would

be lower because it would not include the $5,000 gain from part d above. The

$5,000 gain (after accounting for expected taxes) would increase the balance in an

account entitled accumulated other comprehensive income in Eskew, Inc.’s

shareholders’ equity, so shareholders’ equity would be unchanged. (Such

gains/losses would go through the income statement when Eskew, Inc. redeems the

bonds.)

P9-53. (15 minutes)

LO 3, 4

a. CVS reports interest expense of $1.04 billion, plus $8 million in capitalized

interest, giving a total interest cost of $1.048 billion on average debt of $27,266.5

million ([$27,002million + $27,531million]/2) for an average rate of 3.8%. Using

interest paid ($1.07 billion) instead of interest expense yields 3.92%. See the

answer to c below.

b. CVS reports coupon rates of 1.9% to 6.25%. In addition, no rates are reported

for capital leases, mortgage notes, commercial paper, or the floating rate notes. So,

the average rate seems reasonable given the information disclosed in the long-term

debt footnote.

c. Interest paid can differ from interest expense if bonds are sold at a premium or a

discount. It can also differ because of capitalized interest. CVS reported capitalized

interest of $8 million in 2017. Thus, CVS apparently amortized $22 million in net

bond discounts ($1,070 million - $1,040 million - $8 million).

©Cambridge Business Publishers, 2020

9-28 Financial Accounting, 6th Edition

P9-54. (25 minutes)

LO 3, 4

a. 7/1/19 Cash (+A) ……………………………………. 824,000

Accrued interest payable (+L) ……. 24,000

Bonds payable (+L) ………………… 800,000

$24,000 = $800,000 x .09 x 4/12

b. 9/1/19 Interest expense (+E, -SE) ……………..… 12,000

Accrued interest payable (-L) ……………. 24,000

Cash (-A) ……………………………… 36,000

$36,000 = $800,000 x 9%/2

c. 12/31/19 Interest expense (+E, -SE) ………………… 24,000

Accrued interest payable (+L) ……. 24,000

$24,000 = $800,000 x .09 x 4/12

d. 3/1/20 Interest expense (+E) ……………………… 12,000

Accrued interest payable (-L) ……………. 24,000

Cash (-A) ……………………………… 36,000

e. 3/1/20 Bonds payable (-L) ………………………… 200,000

Loss on retirement of bonds (+E, -SE) … 2,000

Cash (-A) …………………………….. 202,000

+ Cash (A) - - Bonds Payable (L) +

a. 824,000 36,000 b. 800,000 a.

36,000 d.

202,000 e. e. 200,000

+ Interest Expense (E) - - Accrued Interest Payable (L) +

b. 12,000 b. 24,000 24,000 a.

c. 24,000 d. 24,000 24,000 c.

d. 12,000

+ Loss on Retirement of Bonds (E) -

e. 2,000

continued next page

©Cambridge Business Publishers, 2020

Solutions Manual, Chapter 9 9-29

e. continued

Balance Sheet Income Statement

Cash Noncash Contrib. Earned Net

Transaction Asset + Assets = Liabilities + Capital + Capital Revenues - Expenses = Income

a. 7/1/19 +824,000 = +800,000 - =

Issue Cash Bonds

bonds. Payable

+24,000

Interest

Payable

b. 9/1/19 -36,000 = -24,000 -12,000 - +12,000 = -12,000

Interest Cash Interest Retained Interest

payment Payable Earnings Expense

on bonds.

c. 12/31/9 = +24,000 -24,000 - +24,000 = -24,000

Accrued Interest Retained Interest

interest Payable Earnings Expense

on bonds.

d. 3/1/20 -36,000 = -24,000 -12,000 - +12,000 = -12,000

Interest Cash Interest Retained Interest

payment Payable Earnings Expense

on bonds.

e. 3/1/120 -202,000 = -200,000 -2,000 - +2,000 = -2,000

Early Cash Bonds Retained Loss on

retirement Payable Earnings Retirement

of bonds. of bonds

P9-55. (20 minutes)

LO 3, 4

a.

Interest Cash Interest Discount Discount Bond Payable

Period Expense Paid Amortization Balance Net

0 $41,292 $678,708

1 $40,722 $39,600 $1,122 $40,170 $679,830

2 $40,790 $39,600 $1,190 $38,980 $681,020

$40,722 = $678,708 x 12%/2

$40,790 = $679,830 x 12%/2

b.

12/31/18 Cash (+A) ………………………………….. 678,708

Bond discount (+XL) ……………………. 41,292

Bonds payable (+L) ……………….. 720,000

6/30/19 Interest expense (+E,-SE) ………………. 40,722

Bond discount (-XL) ……………….. 1,122

Cash (-A) …………………………….. 39,600

12/31/19 Interest expense (+E,-SE) ………………. 40,790

Bond discount (-XL) ……………….. 1,190

Cash (-A) …………………………….. 39,600

©Cambridge Business Publishers, 2020

9-30 Financial Accounting, 6th Edition

c.

+ Cash (A) - - Bonds Payable (L) +

12/31/18 678,708 720,000 12/31/18

39,600 6/30/19

39,600 12/31/19

+ Interest Expense (E) - + Bond Discount (XL) -

12/31/18 41,292

6/30/19 40,722 1,122 6/30/19

12/31/19 40,790 1,190 12/31/19

d.

Balance Sheet Income Statement

Cash Noncash Contra Contrib. Retained Net

Transaction Asset + Assets = Liabilities - Liability + Capital + Earnings Revenues - Expenses = Income

12/31/18 +678,708 = +720,000 +41,292 - =

Issue bonds

Cash Bonds Bond

at a discount.

Payable Discount

6/30/19 -39,600 = -1,122 -40,722 - +40,722 = -40,722

Interest

Cash Bond Retained Interest

payment

Discount Earnings Expense

on bonds.

12/31/19 -39,600 = -1,190 -40,790 - +40,790 = -40,790

Interest

Cash Bonds Retained Interest

payment

Discount Earnings Expense

on bonds.

P9-56. (20 minutes)

LO 3, 4

a.

Interest Cash Discount Discount Bond Payable

Period Expense Interest Paid Amortization Balance Net

0 $43,230 $206,770

1 $8,271 $7,500 $771 $42,459 $207,541

2 $8,302 $7,500 $802 $41,657 $208,343

$8,271= $206,770 x 8%/2

$8,302 = $207,541 x 8%/2

b.

4/30/19 Cash (+A) …………………….……….………..…… 206,770

Bond discount (+XL, -L) …………………………. 43,230

Bonds payable (+L) …….…………………… 250,000

10/31/19 Interest expense (+E, -SE) ………………..….….. 8,271

Bond discount (-XL, +L) ……………………. 771

Cash(-A) ……………………………………….. 7,500

continued next page

©Cambridge Business Publishers, 2020

Solutions Manual, Chapter 9 9-31

b. continued

12/31/19 Interest expense (+E, -SE) ………………..….….. 2,767*

Bond discount (-XL, +L) ……………………. 267

Accrued interest payable (+L) …………….. 2,500

4/30/20 Interest expense (+E, -SE) …………………...….. 5,535**

Accrued interest payable (-L) ………..….………. 2,500

Bond discount (-XL, +L) ……………………. 535

Cash(-A) ……………………………………….. 7,500

Within each six-month period, interest is apportioned to individual months on a straight-line basis:

*$2,767 = ($8,302 x 2/6)

**$5,535 = ($8,302 x 4/6)

c.

+ Cash (A) - - Bonds Payable (L) +

4/30/19 206,770 250,000 4/30/19

7,500 10/31/19

7,500 4/30/20

+ Interest Expense (E) - + Bond Discount (XL) -

4/30/19 43,230

10/31/19 8,271 771 10/31/18

12/31/19 2,767 267 12/31/18

4/30/20 5,535 535 4/30/20

- Accrued Interest Payable (L) +

2,500 12/31/19

4/30/20 2,500

d.

Balance Sheet Income Statement

Cash Noncash Contra Contrib. Earned Net

Transaction Asset + Assets = Liabilities - Liability + Capital + Capital Revenues - Expenses = Income

4/30/19 +206,770 = +250,000 +43,230 - =

Issue bonds

Cash Bonds Bond

at a discount.

Payable Discount

10/31/19 -7,500 = -771 -8,271 - +8,271 = -8,271

Interest

Cash Bond Retained Interest

payment

Discount Earnings Expense

on bonds.

12/31/19 = +2,500 -267 -2,767 - +2,767 = -2,767

Accrued

Accrued Bond Retained Interest

interest

Interest Discount Earnings Expense

on bonds.

Payable

4/30/20 -7,500 = -2,500 -535 -5,535 - +5,535 = -5,535

Interest

Cash Accrued Bond Retained Interest

payment

Interest Discount Earnings Expense

on bonds.

Payable

©Cambridge Business Publishers, 2020

9-32 Financial Accounting, 6th Edition

P9-57. (20 minutes)

LO 3, 4

a. Payment x 12.46221 = $500,000; Payment = $500,000/12.46221 = $40,121.

b.

12/31/18 Cash (+A) ………………………………………..…… 500,000

Mortgage note payable (+L) ………………… 500,000

6/30/19 Interest expense (+E, -SE) ………………………… 25,000

Mortgage note payable (-L) ………………………. 15,121

Cash (-A) …………………………………..…… 40,121

$25,000 = $500,000 x 10%/2

12/31/19 Interest expense (+E, -SE) ……………………….… 24,244

Mortgage note payable (-L) ……………………….. 15,877

Cash (-A) …………………………………..…… 40,121

$24,244 = ($500,000 – $15,121) x 10%/2

c.

+ Cash (A) - - Mortgage Note Payable (L) +

12/31/18 500,000 500,000 12/31/18

40,121 6/30/19 6/30/19 15,121

40,121 12/31/19 12/31/19 15,877

+ Interest Expense (E) -

6/30/18 25,000

12/31/18 24,244

d.

Balance Sheet Income Statement

Cash Noncash Contrib. Earned Net

Transaction Asset + Assets = Liabilities + Capital + Capital Revenues - Expenses = Income

12/31/18 +500,000 = +500,000 - =

Borrow

Cash Mortgage

$500,000

Note

on a 10-year

Payable

mortgage note

payable.

6/30/19 -40,121 = -15,121 -25,000 - +25,000 = -25,000

Interest

Cash Mortgage Retained Interest

payment

Note Earnings Expense

on note.

Payable

12/31/19 -40,121 = -15,877 -24,244 - +24,244 = -24,244

Interest

Cash Mortgage Retained Interest

payment

Note Earnings Expense

on note.

Payable

©Cambridge Business Publishers, 2020

Solutions Manual, Chapter 9 9-33

P9-58. (20 minutes)

LO 3, 4

a. Payment x 16.35143 = $950,000; Payment = $950,000/16.35143 = $58,099.

b.

12/31/18 Cash (+A) ………………………………………..…… 950,000

Mortgage note payable (+L) ………………… 950,000

3/31/19 Interest expense (+E, -SE) ………………………… 19,000*

Mortgage note payable (-L) ………………………. 39,099

Cash (-A) …………………………………..…… 58,099

* $19,000 = $950,000 x 8%/4

6/30/19 Interest expense (+E, -SE) ………………………… 18,218*

Mortgage note payable (-L) ………………………. 39,881

Cash (-A) …………………………………..…… 58,099

* $18,218 = ($950,000 – $39,099) x 8%/4.

c.

+ Cash (A) - - Mortgage Note Payable (L) +

12/31/18 950,000 950,000 12/31/18

58,099 3/31/19 3/31/19 39,099

58,099 6/30/19 6/30/19 39,881

+ Interest Expense (E) -

3/31/19 19,000

6/30/19 18,218

d.

Balance Sheet Income Statement

Cash Noncash Contrib. Earned Net

Transaction Asset + Assets = Liabilities + Capital + Capital Revenues - Expenses = Income

12/31/18 +950,000 = +950,000 - =

Borrow

Cash Mortgage

$950,000

Note

on a 5-year

Payable

mortgage note

payable.

3/31/19 -58,099 = -39,099 -19,000 - +19,000 = -19,000

Payment

Cash Mortgage Retained Interest

on note.

Note Earnings Expense

Payable

6/30/19 -58,099 = -39,881 -18,218 - +18,218 = -18,218

Payment

Cash Mortgage Retained Interest

on note.

Note Earnings Expense

Payable

©Cambridge Business Publishers, 2020

9-34 Financial Accounting, 6th Edition

P9-59. (10 minutes)

LO 1

a. BP recorded the $9.2 billion estimate as an expense on its 2010 income

statement. This increased the company’s liabilities.

b. If BP had prepared its financial statements in accordance with U.S. GAAP, the

accrual would most likely have been at the low end of the range -- $6 million,

instead of the expected amount (best reliable estimate), or mid-point in the

range.

©Cambridge Business Publishers, 2020

Solutions Manual, Chapter 9 9-35

CASES and PROJECTS

C9-60. (30 minutes)

LO 3, 4, 5

a. The difference between interest expense and interest paid can be caused by three

factors: (1) interest capitalized as part of self-constructed assets is paid but not part

of interest expense (a detailed discussion is beyond the scope of this text); (2)

coupon payments differ from interest expense charged on bonds due to amortization

of discounts or premiums; (3) interest payments may not coincide with the fiscal

period, thus requiring the company to record accrued interest payable.

b. In 2017, Comcast’s debt had a fair value of $71.7 billion while its historical cost was

$64.6 billion. Thus, Comcast would report a fair value adjustment as a credit in its

balance sheet of $7.1 billion ($71.7 - $64.6). In 2016, the fair value was $66.3 billion

and the historical cost was $61.0 billion yielding a credit balance in the fair value

adjustment account of $5.3 billion ($66.3 - $61.0). The change in the fair value

adjustment from 2016 to 2017 ($1.8 = $7.1 – $5.3) would be recorded as follows:

12/31/17 Loss due to adjustment of bonds to fair value (+E, -SE) 1.8

Fair value adjustment (+L) 1.8

c. Debt-to-equity: $117,500 million/$69,449 million = 1.69

Times interest earned: ($15,322 million + $3,086 million)/$3,086 million = 5.97

Creditors are naturally concerned about the risk of default. The debt-to-equity ratio

measures the extent to which a company is relying on debt financing and the higher

the ratio, the greater chance of default. In addition, the times interest earned ratio

measures the company’s ability to pay the interest on the debt.

d. Management may bypass profitable investment projects or cut discretionary

expenditures such as R&D or advertising. It may also engage in questionable

accounting practices in an attempt to manage the ratios.

e. Note16 for Comcast discusses various contractual commitments – payment

schedules for future cash outflows as a result of their contractual agreements. These

are not recorded liabilities on the balance sheet, however. (We discuss these more

in Chapter 10). Comcast also discusses various contingent liabilities that it may

have, often as a result of litigation.

©Cambridge Business Publishers, 2020

9-36 Financial Accounting, 6th Edition

C9-61. (20 minutes)

LO 3, 4, 5

a. The gain results from the difference between the book value of the debt

($3,000,000) and the current redemption (market) value ($2,200,000). The gain

would be reported in the income statement under other (nonoperating) income. The

source of the gain should be adequately disclosed in the notes.

b. Currently, Foster is paying 4% interest on the $3,000,000 of long-term debt, or

$120,000 per year. Under the proposed refinancing, Foster would pay 8%, or

$240,000. The refinancing would generate an additional $800,000 in cash.

However, because interest costs are increasing by $120,000 per year ($240,000 -

$120,000), Foster is effectively borrowing the additional $800,000 at a rate of almost

15% ($120,000 / $800,000). As such, Foster would be paying in the future (in the

form of higher interest costs) for a one-time boost in current earnings.

c. The potential ethical conflict exists because Foster’s president is concerned that his

job might be dependent on producing short-term earnings. Because of this, he

might be tempted to accept this proposal and boost current earnings at the cost of

lower earnings in future years. This thinking is misguided because, given adequate

disclosure, analysts and investors would be able to identify and discount the source

of the earnings boost. The most serious unethical act would be to try to hide (or

obfuscate) the bond refinancing with inadequate disclosure.

©Cambridge Business Publishers, 2020

Solutions Manual, Chapter 9 9-37

Вам также может понравиться

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- CVP analysis and margin of safety for Lattin CorpДокумент17 страницCVP analysis and margin of safety for Lattin CorpSylvesterОценок пока нет

- AP 5904 InvestmentsДокумент9 страницAP 5904 InvestmentsJake BundokОценок пока нет

- Ch. 13 Leverage and Capital Structure AnswersДокумент23 страницыCh. 13 Leverage and Capital Structure Answersbetl89% (27)

- Statement of Purpose: Gurupdesh Kaur, A Prospective Student For Canada. I Am A Permanent Resident ofДокумент3 страницыStatement of Purpose: Gurupdesh Kaur, A Prospective Student For Canada. I Am A Permanent Resident ofajayОценок пока нет

- Session 4Документ18 страницSession 4SylvesterОценок пока нет

- Session 2Документ17 страницSession 2SylvesterОценок пока нет

- FA6e - Ch10 - SolutionsManual - Revised 062619Документ34 страницыFA6e - Ch10 - SolutionsManual - Revised 062619SylvesterОценок пока нет

- Session 1Документ8 страницSession 1SylvesterОценок пока нет

- FA6e - Ch07 - SolutionsManual - Revised 100719Документ23 страницыFA6e - Ch07 - SolutionsManual - Revised 100719SylvesterОценок пока нет

- FA6e Ch08 SolutionsManual 052219Документ23 страницыFA6e Ch08 SolutionsManual 052219SylvesterОценок пока нет

- FA6e Ch09 SolutionsManual 052219Документ37 страницFA6e Ch09 SolutionsManual 052219SylvesterОценок пока нет

- FA6e - Ch07 - SolutionsManual - Revised 100719Документ23 страницыFA6e - Ch07 - SolutionsManual - Revised 100719SylvesterОценок пока нет

- FA6e Ch08 SolutionsManual 052219Документ23 страницыFA6e Ch08 SolutionsManual 052219SylvesterОценок пока нет

- FA6e Ch06 SolutionsManual 052019Документ38 страницFA6e Ch06 SolutionsManual 052019SylvesterОценок пока нет

- FA6e - Ch10 - SolutionsManual - Revised 062619Документ34 страницыFA6e - Ch10 - SolutionsManual - Revised 062619SylvesterОценок пока нет

- Hyperinflation in ZimbabweДокумент16 страницHyperinflation in ZimbabweAmber HamzaОценок пока нет

- Centeral BankДокумент34 страницыCenteral Banksamfisher0528Оценок пока нет

- Low Long-Term Rates Explained by Global Labor Force ExpansionДокумент2 страницыLow Long-Term Rates Explained by Global Labor Force ExpansiongasepyОценок пока нет

- Kitkungvan CVДокумент1 страницаKitkungvan CVGoran LojpurОценок пока нет

- BUSINESS OPERATION and IMPLEMENTATIONДокумент51 страницаBUSINESS OPERATION and IMPLEMENTATIONclangdelacruz007Оценок пока нет

- Higher Education Commission of Pakistan Higher Education Commission of PakistanДокумент3 страницыHigher Education Commission of Pakistan Higher Education Commission of PakistanMuhammad SaleemОценок пока нет

- BRPD-14 PresentationДокумент41 страницаBRPD-14 PresentationErfan KhanОценок пока нет

- Submission Tutorial 2 - SolutionДокумент5 страницSubmission Tutorial 2 - SolutionNdisa ChumaОценок пока нет

- Proforma Financial Statements of Walt DisneyДокумент44 страницыProforma Financial Statements of Walt DisneyArif.hossen 30Оценок пока нет

- JioMart Invoice 1703171275601Документ2 страницыJioMart Invoice 1703171275601rugved670Оценок пока нет

- Definition OfUNDERLYINGДокумент6 страницDefinition OfUNDERLYINGvjvijay88Оценок пока нет

- Format of Noc To Be Obtained From SocietyДокумент1 страницаFormat of Noc To Be Obtained From SocietySushant Sawal78% (9)

- Money Mischief Chapter 1Документ3 страницыMoney Mischief Chapter 1Enzo MolinariОценок пока нет

- London Examinations Ordinary Level GCE in Accounting (7011) : Mark Scheme With Examiners' ReportДокумент13 страницLondon Examinations Ordinary Level GCE in Accounting (7011) : Mark Scheme With Examiners' ReportkarmenlopezholaОценок пока нет

- Government Grants AccountingДокумент2 страницыGovernment Grants AccountingCaseylyn RonquilloОценок пока нет

- EC334 Assessment Instructions: Please Complete All ProblemsДокумент4 страницыEC334 Assessment Instructions: Please Complete All ProblemsMiiwKotiramОценок пока нет

- Corporate Governance in Banks: Kose John, Sara de Masi and Andrea PaciДокумент19 страницCorporate Governance in Banks: Kose John, Sara de Masi and Andrea PaciRalkan KantonОценок пока нет

- 3 - FINREP - EBA ITS - v2.8Документ34 страницы3 - FINREP - EBA ITS - v2.8Miguel Angel OrtizОценок пока нет

- Financial Analysis of Britannia and DaburДокумент8 страницFinancial Analysis of Britannia and DaburBiplab MondalОценок пока нет

- pp16Документ64 страницыpp16Mousami BanerjeeОценок пока нет

- DCF Base Year 1 2 3 4 Assumptions:: Valuation of Facebook, Based On Prof. Aswath DamodaranДокумент12 страницDCF Base Year 1 2 3 4 Assumptions:: Valuation of Facebook, Based On Prof. Aswath DamodaranSahaana VijayОценок пока нет

- Account Maintenance and Transaction Fees L BPIДокумент4 страницыAccount Maintenance and Transaction Fees L BPISebastian GarciaОценок пока нет

- Mechanical theories of the money supply identitiesДокумент7 страницMechanical theories of the money supply identitiesHashifaGemelliaОценок пока нет

- 2307 PDFДокумент2 страницы2307 PDFAnonymous BVowhxQPОценок пока нет

- B4 IfaДокумент4 страницыB4 IfaadnanОценок пока нет

- Investment FormulasДокумент14 страницInvestment Formulasgatete samОценок пока нет

- Test Paper CA Final TpdtaaДокумент3 страницыTest Paper CA Final TpdtaayeidaindschemeОценок пока нет