Академический Документы

Профессиональный Документы

Культура Документы

Budgeting Tute 01

Загружено:

Maithri Vidana KariyakaranageАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Budgeting Tute 01

Загружено:

Maithri Vidana KariyakaranageАвторское право:

Доступные форматы

Tutorial – Budgeting

Question No. 01

A company manufactures two products, Aye and Bee. Standard cost data for the products for next year

are as follows:

Product Aye Product Bee

per unit per unit

Direct materials:

X at Rs.2 per kg 24 kg 30 kg

Y at Rs.5 per kg 10 kg 8 kg

Z at Rs.6 per kg 5 kg 10 kg

Direct wages:

Unskilled at Rs.6 per hour 10 hours 5 hours

Skilled at Rs.10 per hour 6 hours 5 hours

Budgeted inventories for next year are as follows:

Product Aye Product Bee

units units

1 January 400 800

31 December 500 1,100

Material X Material Y Material Z

Kg kg kg

1 January 30,000 25,000 12,000

31 December 35,000 27,000 12,500

Budgeted sales for next year: product Aye 2,400 units; product Bee 3,200 units.

You are required to prepare the following budgets for next year:

(a) production budget, in units;

(b) material usage budget, in kilos;

(c) material purchases budget, in kilos and Rs.;

(d) direct labour budget, in hours and Rs..

Question No. 02

Watson Ltd is preparing its budgets for the next quarter. The following information has been drawn

from the budgets prepared in the planning exercise so far:

Sales value June Rs.12,500

July Rs.13,600

August Rs.17,000

September Rs.16,800

Direct wages Rs.1,300 per month

Direct material purchases June Rs.3,450

July Rs.3,780

August Rs.2,890

September Rs.3,150

Other information

[Management Accounting] Page | 1

● Watson sells 10% of its goods for cash. The remainder of customers receive one month’s credit.

● Payments to material suppliers are made in the month following purchase.

● Wages are paid as they are incurred.

● Watson takes one month’s credit on all overheads.

● Production overheads are Rs.3,200 per month.

● Selling, distribution and administration overheads amount to Rs.1,890 per month.

● Included in the amounts for overhead given above are depreciation charges of Rs.300 and

Rs.190, respectively.

● Watson expects to purchase a delivery vehicle in August for a cash payment of Rs.9,870.

● The cash balance at the end of June is forecast to be Rs.1,235.

You are required to prepare a cash budget for each of the months July to September.

Question No. 03

The following information relates to XY Ltd:

Wages incurred Materials purchases Overhead Sales

Month Rs.000 Rs.000 Rs.000

Rs.000

February 6 20 10 30

March 8 30 12 40

April 10 25 16 60

May 9 35 14 50

June 12 30 18 70

July 10 25 16 60

August 9 25 14 50

It is expected that the cash balance on 31 May will be Rs.22,000.

The wages may be assumed to be paid within the month they are incurred.

It is company policy to pay suppliers for materials three months after receipt.

Credit customers are expected to pay two months after delivery.

Included in the overhead figure is Rs.2,000 per month which represents depreciation on

two cars and one delivery van.

There is a one-month delay in paying the overhead expenses.

Ten per cent of the monthly sales are for cash and 90 per cent are sold on credit.

A commission of 5 per cent is paid to agents on all the sales on credit but this is not paid

until the month following the sales to which it relates; this expense is not included in the

overhead figures shown.

It is intended to repay a loan of Rs.25,000 on 30 June.

Delivery is expected in July of a new machine costing Rs.45,000 of which Rs.15,000 will

be paid on delivery and Rs.15,000 in each of the following two months.

Assume that overdraft facilities are available if required.

You are required to prepare a cash budget for each of June, July and August.

[Management Accounting] Page | 2

Вам также может понравиться

- CautionaboutbondsДокумент3 страницыCautionaboutbondsWayne Lund100% (3)

- Cash BudgetДокумент3 страницыCash Budgetkeshav madamОценок пока нет

- Taller de Ejercicios de PresupuestosДокумент11 страницTaller de Ejercicios de PresupuestosalexОценок пока нет

- c5 Solutions BudgetingДокумент13 страницc5 Solutions BudgetingChinnam Lalitha100% (1)

- Global Money Notes #30: SingularityДокумент18 страницGlobal Money Notes #30: Singularitymike liangОценок пока нет

- Cash Budgeting QuestionsДокумент5 страницCash Budgeting QuestionsAnissa GeddesОценок пока нет

- Ch03 Tool KitДокумент24 страницыCh03 Tool KitNino Natradze100% (1)

- Master BudgetДокумент10 страницMaster BudgetFareha Riaz0% (1)

- Administrative Remedies of The GovernmentДокумент5 страницAdministrative Remedies of The GovernmentrobbyОценок пока нет

- Months: Sales Purchases Wages ExpensesДокумент2 страницыMonths: Sales Purchases Wages Expensespranay639Оценок пока нет

- Cash BudgetДокумент4 страницыCash BudgetSANDEEP SINGH0% (1)

- Final Exam - Sent StudentsДокумент6 страницFinal Exam - Sent StudentsYến Hoàng HảiОценок пока нет

- Budgetary ControlДокумент6 страницBudgetary ControlVaibhav SehgalОценок пока нет

- Budget and Budgetary Control - Mba Ca. Asim K. Biswas: Question # 1Документ7 страницBudget and Budgetary Control - Mba Ca. Asim K. Biswas: Question # 1Suraj KumarОценок пока нет

- Budgeting - 2Документ4 страницыBudgeting - 2Muhammad MansoorОценок пока нет

- Cash Management QuestionsДокумент5 страницCash Management QuestionsManasi Jamsandekar100% (1)

- Budgeting NumericalsДокумент6 страницBudgeting NumericalsAll in ONEОценок пока нет

- Cash Management: ProblemsДокумент4 страницыCash Management: ProblemsPoojitha ReddyОценок пока нет

- Cash Management NumericalsДокумент5 страницCash Management NumericalsAnjali Jain100% (1)

- Budgeting Tute 2Документ4 страницыBudgeting Tute 2Maithri Vidana KariyakaranageОценок пока нет

- Cash Budget Sums Mcom Sem 4Документ14 страницCash Budget Sums Mcom Sem 4Prachi BhosaleОценок пока нет

- Assignment QuestionsДокумент3 страницыAssignment QuestionsmaheeshОценок пока нет

- Cash Budget Problems and SolutionsДокумент6 страницCash Budget Problems and Solutionstamberahul1256Оценок пока нет

- Question on Budget a LevelДокумент3 страницыQuestion on Budget a LevelMUSTHARI KHANОценок пока нет

- Budgeting - 1Документ3 страницыBudgeting - 1Muhammad MansoorОценок пока нет

- Cash Budget for Calgon Products for September 20x4Документ11 страницCash Budget for Calgon Products for September 20x4신두Оценок пока нет

- Final Exam - Sent StudentsДокумент5 страницFinal Exam - Sent StudentsTrần Nguyễn Tuệ MinhОценок пока нет

- BudgetingДокумент51 страницаBudgetingVignesh KivickyОценок пока нет

- Total Factory Overheads For Each Type of Product (Variable)Документ2 страницыTotal Factory Overheads For Each Type of Product (Variable)Mayank JainОценок пока нет

- Case Analysis (1 30)Документ3 страницыCase Analysis (1 30)manishadaaОценок пока нет

- Problem On Cash Budget: 8 (The End of The Prior Quarter), The Company's Balance Were As FollowsДокумент4 страницыProblem On Cash Budget: 8 (The End of The Prior Quarter), The Company's Balance Were As Followsshreya chapagainОценок пока нет

- Form Ngao Limited to acquire businessДокумент6 страницForm Ngao Limited to acquire businessJames WisleyОценок пока нет

- Chap07 Rev. FI5 Ex PRДокумент11 страницChap07 Rev. FI5 Ex PRKhryzha Hanne Dela CruzОценок пока нет

- BB3504 As01Документ3 страницыBB3504 As01vasukapil03Оценок пока нет

- Class 11Документ4 страницыClass 11Harshada satavОценок пока нет

- Assignment On Budgeting-MANACДокумент3 страницыAssignment On Budgeting-MANACLaksheya KhannaОценок пока нет

- BUDGETINGДокумент7 страницBUDGETINGuma selvarajОценок пока нет

- Mr Kaybee's cash budgetДокумент2 страницыMr Kaybee's cash budgetPrince TshepoОценок пока нет

- Cash budget for manufacturing company May-JulyДокумент5 страницCash budget for manufacturing company May-JulyNidheena K SОценок пока нет

- Budgeting - ExamplesДокумент2 страницыBudgeting - Examplessunil.ctОценок пока нет

- MASTER-BUDGETДокумент36 страницMASTER-BUDGETRafols AnnabelleОценок пока нет

- Partnership Fundamentals: Interest on Capital, Drawings, and Profit DistributionДокумент4 страницыPartnership Fundamentals: Interest on Capital, Drawings, and Profit DistributionBHUMIKA JAINОценок пока нет

- Accounts - First Half TestДокумент4 страницыAccounts - First Half TestPeriyanan VОценок пока нет

- Chap07 Rev. FI5 Ex PR 1Документ10 страницChap07 Rev. FI5 Ex PR 1Beyond ThatОценок пока нет

- Unit 1 Batch Costing and Contract CosstingДокумент4 страницыUnit 1 Batch Costing and Contract Cosstingekta maniarОценок пока нет

- BudgetingДокумент130 страницBudgetingRevathi AnandОценок пока нет

- THE FOUNDATIONAL 15Документ8 страницTHE FOUNDATIONAL 15Shafa AlyaОценок пока нет

- Master Budget Cash Flow ProjectionsДокумент9 страницMaster Budget Cash Flow Projections신두Оценок пока нет

- BudgetingДокумент74 страницыBudgetingRevathi AnandОценок пока нет

- Budgeting - Planning: A325 Discussion - March 19, 2012Документ8 страницBudgeting - Planning: A325 Discussion - March 19, 2012alfaОценок пока нет

- Problem On Cash BudgetДокумент1 страницаProblem On Cash BudgetRusheel ChavaОценок пока нет

- Cost Accounting Assignment QuestionsДокумент8 страницCost Accounting Assignment Questionspritika mishraОценок пока нет

- Tutorial 6Документ5 страницTutorial 6Steven CHONGОценок пока нет

- M5 Management of Cash Pract. ProbДокумент5 страницM5 Management of Cash Pract. ProbAmruta PeriОценок пока нет

- Modul Akuntansi Manajemen II 2019-2020-Converted-Converted - 209630662Документ30 страницModul Akuntansi Manajemen II 2019-2020-Converted-Converted - 209630662hendy DidoОценок пока нет

- FAR Handout Borrowing CostsДокумент4 страницыFAR Handout Borrowing CostsBAROTEA Cressia Mhay G.Оценок пока нет

- Tutorial Budget StudentДокумент4 страницыTutorial Budget StudentDanial NorazmanОценок пока нет

- AFM-CM-Cash BudgetДокумент9 страницAFM-CM-Cash BudgetCharith shettigarОценок пока нет

- Cash Budget (Problem-1)Документ1 страницаCash Budget (Problem-1)Hakimzada Sharafat Ali HakimОценок пока нет

- Additional Information:: From The Following Information Prepare A Cash Budget For The Months of June and JulyДокумент2 страницыAdditional Information:: From The Following Information Prepare A Cash Budget For The Months of June and JulyNsscollege RajakumariОценок пока нет

- Budgetary Control-5Документ3 страницыBudgetary Control-5Prabhmeet SethiОценок пока нет

- Modified Dairy Project 10 CRДокумент6 страницModified Dairy Project 10 CRRajkumarОценок пока нет

- 2017 International Comparison Program in Asia and the Pacific: Purchasing Power Parities and Real Expenditures—A Summary ReportОт Everand2017 International Comparison Program in Asia and the Pacific: Purchasing Power Parities and Real Expenditures—A Summary ReportОценок пока нет

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionОт EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionОценок пока нет

- Research Intent DushyanthiДокумент1 страницаResearch Intent DushyanthiMaithri Vidana KariyakaranageОценок пока нет

- The Marketing Strategy of Innocent Drinks: January 2016Документ5 страницThe Marketing Strategy of Innocent Drinks: January 2016Maithri Vidana KariyakaranageОценок пока нет

- Research Intent - HusbandДокумент1 страницаResearch Intent - HusbandMaithri Vidana KariyakaranageОценок пока нет

- Walmart Activity Map PDFДокумент1 страницаWalmart Activity Map PDFMaithri Vidana KariyakaranageОценок пока нет

- SM Assignment MalithДокумент14 страницSM Assignment MalithMaithri Vidana KariyakaranageОценок пока нет

- Test 1Документ8 страницTest 1Maithri Vidana KariyakaranageОценок пока нет

- Dinesh - SM PaperДокумент9 страницDinesh - SM PaperMaithri Vidana KariyakaranageОценок пока нет

- AnswersДокумент12 страницAnswersMaithri Vidana KariyakaranageОценок пока нет

- CF AssignmentДокумент1 страницаCF AssignmentMaithri Vidana KariyakaranageОценок пока нет

- SM Assignment MalithДокумент14 страницSM Assignment MalithMaithri Vidana KariyakaranageОценок пока нет

- AnswersДокумент12 страницAnswersMaithri Vidana KariyakaranageОценок пока нет

- Analysis of A Modern Management Accounting TechniqueДокумент1 страницаAnalysis of A Modern Management Accounting TechniqueMaithri Vidana KariyakaranageОценок пока нет

- Budgeting Tute 2Документ4 страницыBudgeting Tute 2Maithri Vidana KariyakaranageОценок пока нет

- CF AssignmentДокумент9 страницCF AssignmentMaithri Vidana KariyakaranageОценок пока нет

- MAlith RatioДокумент32 страницыMAlith RatioMaithri Vidana KariyakaranageОценок пока нет

- Management Accounting-ABF205SL Coursework: Plymouth UniversityДокумент15 страницManagement Accounting-ABF205SL Coursework: Plymouth UniversityMaithri Vidana KariyakaranageОценок пока нет

- Sri Lanka Accounting Standard-LKAS 31: Interests in Joint VenturesДокумент17 страницSri Lanka Accounting Standard-LKAS 31: Interests in Joint VenturesMaithri Vidana KariyakaranageОценок пока нет

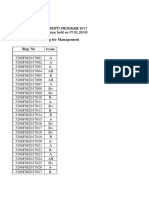

- MBA Exam Results 2017 Accounting GradeДокумент5 страницMBA Exam Results 2017 Accounting GradeMaithri Vidana KariyakaranageОценок пока нет

- NSBM Student Well-Being Association: Our LogoДокумент4 страницыNSBM Student Well-Being Association: Our LogoMaithri Vidana KariyakaranageОценок пока нет

- "Wall Street" Inter School Quiz Competition - Rules and RegulationsДокумент1 страница"Wall Street" Inter School Quiz Competition - Rules and RegulationsMaithri Vidana KariyakaranageОценок пока нет

- Answers AFAДокумент6 страницAnswers AFAMaithri Vidana KariyakaranageОценок пока нет

- Financial ManagementДокумент7 страницFinancial ManagementMaithri Vidana KariyakaranageОценок пока нет

- Task 01Документ15 страницTask 01Maithri Vidana KariyakaranageОценок пока нет

- Group 13Документ25 страницGroup 13Maithri Vidana KariyakaranageОценок пока нет

- MY035 - Final (Repaired)Документ9 страницMY035 - Final (Repaired)Maithri Vidana Kariyakaranage100% (1)

- Analysis of A Modern Management Accounting TechniqueДокумент1 страницаAnalysis of A Modern Management Accounting TechniqueMaithri Vidana KariyakaranageОценок пока нет

- EAR UpdatedДокумент16 страницEAR UpdatedMaithri Vidana KariyakaranageОценок пока нет

- CP AnswersДокумент2 страницыCP AnswersMaithri Vidana KariyakaranageОценок пока нет

- Introduction To The Compan1Документ7 страницIntroduction To The Compan1Maithri Vidana KariyakaranageОценок пока нет

- Week 3 The Accounting Cycle Merchandising BusinessДокумент8 страницWeek 3 The Accounting Cycle Merchandising BusinessVinz Danzel BialaОценок пока нет

- Certificate for claiming house rent allowanceДокумент1 страницаCertificate for claiming house rent allowanceTally AnuОценок пока нет

- LIC, SBI & RelianceДокумент5 страницLIC, SBI & RelianceK.N. BabujeeОценок пока нет

- Omani Commercial LawДокумент8 страницOmani Commercial LawDorian BallОценок пока нет

- Afs - Final Project - Bajaj Auto PDFДокумент19 страницAfs - Final Project - Bajaj Auto PDFKaushik GowdaОценок пока нет

- ACT 205 Assignment - Spring 2019-20Документ5 страницACT 205 Assignment - Spring 2019-20Muhammad AhamdОценок пока нет

- Intermediate Macroeconomics: The Great RecessionДокумент23 страницыIntermediate Macroeconomics: The Great RecessionkaurОценок пока нет

- Standalone Cash Flow Statement InsightsДокумент2 страницыStandalone Cash Flow Statement InsightsRupasinghОценок пока нет

- Statement of Financial PositionДокумент9 страницStatement of Financial PositionIsye NingrumОценок пока нет

- Traditional Theory of Capital StructureДокумент4 страницыTraditional Theory of Capital StructurederrickОценок пока нет

- Chapter 07 - Financial Literacy RBI InitiativesДокумент4 страницыChapter 07 - Financial Literacy RBI Initiativesshubhram2014Оценок пока нет

- APB - TF Presentation 2013Документ14 страницAPB - TF Presentation 2013HOUELОценок пока нет

- Project On Significance of PANДокумент6 страницProject On Significance of PANpragati agarwalОценок пока нет

- Monetary Policy of PakistanДокумент8 страницMonetary Policy of PakistanWajeeha HasnainОценок пока нет

- Impact of MacroeconomicsДокумент5 страницImpact of MacroeconomicsChetan ChanneОценок пока нет

- BSBFIA402 Assessment 1Документ2 страницыBSBFIA402 Assessment 1YingsriManaweepОценок пока нет

- CRG 660Документ29 страницCRG 660No OneОценок пока нет

- WorkSafeBC Bus Letter July20.20Документ9 страницWorkSafeBC Bus Letter July20.20Tom FletcherОценок пока нет

- Indian Banking System - Structure and Other Details (With Diagrams)Документ14 страницIndian Banking System - Structure and Other Details (With Diagrams)krunaldedehiya100% (1)

- Guide to Philippine Income and Withholding TaxesДокумент8 страницGuide to Philippine Income and Withholding TaxesEunice SerneoОценок пока нет

- Fund flow statement summaryДокумент10 страницFund flow statement summarypriyasunil2008Оценок пока нет

- Annastasia's Islamic Finance ObjectivesДокумент3 страницыAnnastasia's Islamic Finance Objectivesannastasia luyahОценок пока нет

- Jardenil V SalasДокумент1 страницаJardenil V Salascmv mendozaОценок пока нет

- LPA120 Fees Exemptions RemissionsДокумент4 страницыLPA120 Fees Exemptions RemissionssriharshamysuruОценок пока нет

- Lessons Learnt From Security Analysis-100Документ8 страницLessons Learnt From Security Analysis-100ravi_405Оценок пока нет

- PT Colorpak Indonesia TBK Dan Entitas Anaknya/and Its SubsidiaryДокумент70 страницPT Colorpak Indonesia TBK Dan Entitas Anaknya/and Its Subsidiaryrengkujeffry5323Оценок пока нет