Академический Документы

Профессиональный Документы

Культура Документы

E General Electrics

Загружено:

Maria Alejandra RamirezОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

E General Electrics

Загружено:

Maria Alejandra RamirezАвторское право:

Доступные форматы

GENERAL ELECTRICS

FINANCIAL STRATEGY ANALYSIS

Date: 18th march 2020

Authors: Maria A. Ramirez, Dennis Listopad, Paula Buscail

Course: Financial Strategy

Professor’s Name: Silvia Cartañá

FINAL EXAM REPORT

General Electric Company at a Glance

General Electric Company (GE) is a leading high-tech diversified industrial firm that operates

across the globe. According to the most recent financial report, it oversees these operations through

four major segments, that is, the Industrial, Power, Renewable Energy, Aviation and Healthcare as

well as the Capital division (General Electric Company 3). Each segment offers unique products and

services in the more than 170 countries and territories that the entity operates. It is also important to

note that General Electric faces stiff competition in its global business activities characterized by

rapidly changing technology with major competitors such as 3M, Honeywell, Emerson Electric and

Siemens. Main risk factors, including regulations, inflation, and exchange rate volatilities, also have a

direct significant impact on GE’s financial performance. The suggestion is that the company must

invest heavily in research and development in order to retain a competitive edge. Moreover, many

companies competing in this industry are constantly looking for new M&A that will be profitable in the

long run. For GE, this Synergy is important when deciding which additions to the company will be the

most beneficial.

When it comes to their nearest current situation, there is another important factor to take into

account. GE stated last week that the Covid-19 outbreak has disrupted supply chains and affected

business activity worldwide and therefore, weighed on its first-quarter results, presenting CEO, Larry

Culp, a new challenge in his attempt to mitigate the impact of the virus.

The free cash flow from GE's manufacturing operations will impact up to $ 500 million due to

the outbreak (Root, Al). The situation will also be a burden of up to US $ 300 million in operating

profit. Furthermore, and as almost every other company on the stock exchange, GE is suffering a

considerable decrease in their stock price .

ESADE Ramírez, Listopad, Buscail | Page 1

FINAL EXAM REPORT

Assessment of the Current Valuation

As mentioned earlier, valuation techniques, such as financial ratios, multiples comparison, and

historical trends, can be used to analyze GE’s stock. Figure 1 illustrates the firm’s main financial

ratios. It shows that asset turnover improved slightly from 0.31 times in 2018 to around 0.36 times in

2019. In addition, the inventory turnover decreased 5.3 and 5.0 times during the period. This means

that the management is losing the ability to produce income through the available assets. In other

words, the company has idle capacity that should be utilized to boost and sustain financial

performance. As a result, it is advisable to sell the stock.

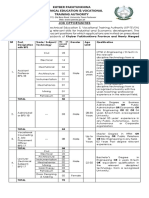

Figure 1: General Electric’s Financial Ratios

Ratio Formula General Electric Company

2019 2018

Activity

Asset turnover

Inventory

turnover

Profitability

Gross margin

*100

Net margin

*100

Liquidity

Current ratio

Leverage

Debt ratio

Debt-to-equity

ESADE Ramírez, Listopad, Buscail | Page 2

FINAL EXAM REPORT

Profitability ratios also provide a chance for measuring the value of GE’s stock. As Figure 1

indicates, the firm’s gross margin increased from 24.9% in 2018 to around 26.5% the following year.

In addition, its net margin was-23.5% and -5.71% in 2018 and 2019 respectively. While both gross

and net margin improved slightly during the period, they were relatively low compared to the industry

averages. Equally important, the negative net profit margin shows that the management do not have

adequate control over operating expenses. For this reason, GE is not financially stable and rational

investors should contemplate the idea of selling the financial asset.

Additionally, to know if the company is correctly valued by the market we can use Multiples.

The first step in the application of multiples is to select a set of comparable firms, for this companies in

the Diversified Industrials Industry (large companies that operate in a number of diversified fields)

must be selected and used to analyze the different multiples of our firm with the average of the

selected comparable. The criteria we used to choose these comparable were: Diversified Industrials

that are listed on the stock market, high Market CAP and similar leverage ratio. The reason for this is

because we are going to be using the P/E multiple for this valuation and for this the leverage is crucial

because two companies may be similar in many aspects except the debt ratio. We know that if the

debt ratio is high the firm will have fewer shares, higher EPS and thus a lower P/E multiple.

In theory, the lower the P/E ratio, the less we are paying for a company's earnings, so the

more undervalued the company. In the case of GE, we can see that the P/E is extremely high

meaning that they are overvalued by the market. Compared to the other companies, 3M and

Honeywell have a medium P/E which is signaling that both firms are correctly priced. However,

Danaher has a high P/E which would suggest that the market is expecting earnings to grow in the

future and this is why the stock price has increased more rapidly than the earnings.

ESADE Ramírez, Listopad, Buscail | Page 3

FINAL EXAM REPORT

Figure 2: Industry Comparables market overview

Company Market Debt EV/EBIT Forward

Price EPS P/E

Name cap Ratio DA P/E

Honeywell

Internation 93.22B 0.681 114.17 11.6X 8.52 20.3X 15.1X

al Inc.

Danaher

91.75B 0.51 122.03 21.5X 3.31 45.4X 22X

Corporation

3M

77.4B 0.77 133.94 11.0X 7.92 22.1X 13.6X

Company

General

Electric 61.8B 0.59 6.28 12.0X -0.01 146X 12X

Company

Average 14.7 6.6 29.27 16.9

When compared to the Forward P/E we know that if the earnings are expected to grow in the

future, the forward P/E will be lower than the current P/E, so Danaher is expected to continue being a

very favorable stock and 3M and Honeywell are also going to improve their positions. The forward P/E

of GE thus appears to be highly optimistic, especially with the current COVID-19 issues, which are

causing financial distress.

As aforementioned, historical price trends allow investors and other interested parties to

assess the value of a stock. This simply refers to monitoring General Electric’s past stock prices to

identify the factors that may have had a significant impact on shareholders’ value. Figure 3 illustrates

the company’s stock price trends over the past two years. It shows that the stock’s price has been

highly volatile. This implies that the entity’s value largely depends on both internal and external factors

thus making it highly risky.

Figure 3: GE’s Share Prices, 2018-19

ESADE Ramírez, Listopad, Buscail | Page 4

FINAL EXAM REPORT

Moreover, because of the diversified nature of GE’s business several external factors can

have a direct significant impact on the value of General Electric’s stock. It is obvious that the Covid-19

pandemic poses a real threat to the value of the company (UBS 2), due to the fact that the disease

has set a global economic stagnation and adversely affected the company’s many different

operations. In addition, it has disrupted the global supply chain that enables General Electric to run

operations across the world. This means that the stock price is likely to fall below $5 in the short-run.

Quantitative easing measures like rate cuts can reverse this situation, which implies that the federal

governments should create an enabling business environment. It is important to note that it is too

soon to fully understand the overall impacts of the virus in the business, but we expect that it will

continue to change in a more negative way.

ANALYSIS OF GENERAL ELECTRIC’S FINANCIAL DECISIONS

ESADE Ramírez, Listopad, Buscail | Page 5

FINAL EXAM REPORT

Capital Structure

It is also worth noting that capital structure decisions create a meaningful way of evaluating

financial stability of General Electric. For fiscal 2018 and 2019, the company was primarily financed by

external debts, as indicated by the debt to equity ratio of 3.5 and 5.3 respectively (see Figure 1).

Evidence suggests that the companies in the specialty industrial machinery industry often prefer debt

financing. Of course, this is unsurprising as the trade-off theory indicates that the form of capital has a

wide range of benefits compared to the other alternatives (Jarallah, Saleh, and Salim 205). For

example, tax-shield benefits create a rational opportunity for General Electric to minimize liabilities

and boost financial performance.

In addition to tax-shield benefits, the decision to primarily use external debts reflects an

attempt to retain organizational control. Literature indicates that debt holders do not have voting

rights, which means that they do not participate in key decision-making processes (Nenu, Vintila, and

Gherghina 5). This creates a realistic opportunity for minimizing agency conflicts and maximizing

financial performance.

Equally significant, it is important to note that General Electric’s financial report has both short-

and long-term borrowings. According to the most recent report, short-term borrowings were $12,776

and $22,072 million in 2018 and 2019 respectively. This means that the company acquired more

short-term debts and it may experience financial distress in the future. On the contrary, long-term

borrowings decreased from $88,949 to $67,155 million during the period. This trend highlights the

management’s commitment to reduce leverage and improve financial sustainability. In addition, the

company’s debts form a relatively large portion of the total liabilities and equities, which imply that it

may be unable to obtain additional funding. This can also hinder General Electric from investing in the

available growth opportunities and maintaining strong financial performance.

ESADE Ramírez, Listopad, Buscail | Page 6

FINAL EXAM REPORT

General Electric’s capital structure is a reliable signal of the company’s current financial

condition and stability. As aforementioned, it has a relatively high proportion of external debts

compared to equity. According to the trade-off theory, this strategy helps the entity minimize cost of

capital. In other words, tax-shield benefits and the ability to retain control motivate General Electric to

use the capital structure (Servaes and Tufano 24). The suggestion is that it has a significant impact on

shareholders’ wealth, as it allows the management to cut costs and improve financial performance.

However, the excessive leverage may lead to financial crisis, especially in the event of economic

recession. As such, investors need to sell the stock.

Dividend Policy

What is more, dividend payout policy can have a significant impact on General Electric’s

financial performance. For fiscal 2018 and 2019, the company declared dividend amounting to $0.37

and $0.04 per share respectively. One of the conspicuous observations is that the firm employs the

residual dividend policy in the sense that the dividends vary with the level of income. The dividend per

share decrease implies that investors earned less than the previous years and General Electric is not

a viable investment vehicle. In addition, the negative dividend trend shows that the entity is losing the

ability to generate income from its resources.

It is also important to note that General Electric has both common and preferred shareholders.

Preferred stock dividends amounted to $447 million and $460 million in 2018 and 2019 respectively.

The suggestion is that GE relies on residual dividend policy, as the distributed income increased

slightly from 2018 to 2019. A further implication is that preferred stock dividends show that the

company had adequate free cash flows to invest in the available positive growth opportunities.

Nonetheless, these shareholders’ dilute ownership and control structure as some have voting rights.

This means that they may make the organization to experience financial difficulties in the foreseeable

future.

ESADE Ramírez, Listopad, Buscail | Page 7

FINAL EXAM REPORT

There is a wide range of reasons that explain the decision to utilize the residual dividend

policy. Firstly, it helps the company to forfeit dividend payment if it has myriad growth opportunities.

The suggestion is that dividends signal ongoing business success, as the company only pays during

the profitable period. While the approach favors the company, it has a negative impact on income

investors. This implies that General Electric’s stock is not a feasible investment for individuals seeking

regular income. A further implication is that dividend payments have a negative impact on

shareholders’ wealth. A decrease in declared dividend may be a signal of tough days ahead and

cause investors to sell their financial assets (Golden and Kohlbeck 426). The result will be low

demand and high supply that will eventually trigger a decline of the shareholders’ value.

Moreover, the different shareholder categories provide a realistic pathway for General Electric

to diversify risks and maximize financial performance. Differential earnings distribution ranks enable

the firm to forfeit payment of income to some owners. This means that General Electric does not have

many restrictions that may hinder management from undertaking the available growth opportunities.

However, the relatively high cost of preferred stock is a major limitation and potential drawback to the

company’s goal of retaining strong financial performance.

Share Buybacks

GE had a share repurchase program that enabled the management to buy-back some

outstanding shares. Under the initiative, the firm repurchased 19.5 million in 2018 and 1.1 million

shares in 2019. This amounted to $235 million and $10 million in each respective year. This had a

significant impact on total equity, as indicated by the decrease from $51,480 in 2018 to $29,721

million the following year. In other words, the share repurchase program leads to a significant decline

in the book value of outstanding common shares.

ESADE Ramírez, Listopad, Buscail | Page 8

FINAL EXAM REPORT

What is more, General Electric uses long-term share repurchase programs. For instance, the

company plan was to buy-back up to $50 billion of outstanding shares between 2015 and 2018. In

addition, the firm acquired shares of $10 million in 2019. It was a significant decrease from the $235

million purchased the previous year. This implies that the firm’s free cash flows declined and it is not

financially stable. In other words, we would sell the stock to minimize the likelihood of huge losses.

It is also worth noting that share buybacks are often a sign of whether a stock is undervalued

or overvalued. A large body of literature indicates that managers’ buy-back undervalued stocks. A

further implication is that repurchasing the stock will create an opportunity for boosting shareholders’

wealth due to the fact that the price will eventually move towards equilibrium (Manconi, et al. 1912).

Moreover, share repurchases show that the firm has adequate free cash flows.

The Structure of Ownership and Management

General Electric is a public liability company registered on the New York Stock Exchange. For

the global business to access adequate capital for sustained growth, it is essential to borrow from the

capital markets. This situation leads to a complex ownership structure at GE. In addition, ownership

and management separation creates agency problems. The management, agent, acting on the behalf

of owner, principal, is supposed to align the interest of all key stakeholders. Divergence of interests

may lead to dysfunctional conflict and direct inverse impact on firm value. Moreover, the separation of

ownership creates an opportunity for agents to purse their self-interests at the expense of boosting

shareholders’ wealth.

To deal with this problem, both GE’s directors and shareholders incur monitoring and bonding

costs. For instance, compliance with the established ethical standards creates a chance for the

company to align interests of different stakeholders. Not only is the firm honest and straightforward in

ESADE Ramírez, Listopad, Buscail | Page 9

FINAL EXAM REPORT

all its undertakings, but it also adheres to all relevant regulations. In addition, it has an independent

Board of directors that is responsible for developing strategic goals.

Bonding costs can also create a realistic opportunity for minimizing conflicts of interest among

GE’s stakeholders. The suggestion is that compensation programs should be competitive and able to

attract and retain the most capable directors. For incentives to achieve the desired goals, GE needs to

establish a clear link between the financial benefits, strategy, and shared organizational purpose. In

addition to fixed pay, top executives also receive annual bonuses and share options. Remuneration

will incentive the management to sell undervalued stock, maximize shareholders’ value, and improve

financial performance. As a result, separation of ownership and management has a direct impact on

capital structure decisions and organizational sustainability.

M&A and other decisions

In 2016, GE merged its Oil & Gas segment with Baker Hughes Incorporated in a deal valued

at roughly $30 billion. When the merger was complete, the Oil & Gas segment represented GE's

ownership interest of about 50.4% of the newly merged company. In total, GE owned about 62.5% of

Baker Hughes at the time of the acquisition. The Baker Hughes acquisition in July of 2017 contributed

more than $5 billion in revenue growth for the first half of 2018. However, as of 2019, GE stated its

intention to sell down the remainder of its stake in Baker Hughes in the coming months and years.

Also in 2019, GE agreed to the sale of its biopharmaceutical business to the US-based Danaher for a

cash amount of $ 21.4 billion, about 19 billion euros. This caused the company to go up to 10% due to

divestments in the stock exchange.

Conclusion

ESADE Ramírez, Listopad, Buscail | Page 10

FINAL EXAM REPORT

General Electric’s most recent financial report indicates that suboptimal capital structure

significantly affected management efficiency, profitability, and shareholders’ value in 2018 and 2019.

Its excessive leverage could lead to financial difficulties and affect the firm’s ability to continue

operating as a going concern. Separation of ownership and management is one of the factors that

affects capital decisions, which means that the company should establish and adopt effective

measures, including bonding and monitoring mechanisms, in order to align interests of stakeholders.

Stock prices are highly volatile and the value of GE assets may change over time. As such, it is

important to closely monitor price trends. As to the effect of the COVID-19 it is clear that it is affecting

not only the stock price but also the day to day business activities of GE, for example in the aviation

sectors flights are expected to be lower in the upcoming months. Although it is still early to tell, the

nature of GE diversified business makes it more vulnerable to external factors like the virus and the

whole market stagnation.

ESADE Ramírez, Listopad, Buscail | Page 11

FINAL EXAM REPORT

Works Cited

General Electric Company. Form 10-K for the Fiscal Year Ended December 31, 2019, General Electric

Company, 2020, www.ge.com/investor-relations/sites/default/files/GE_AR19_10-K.pdf. Accessed 15 Mar.

2020.

Root, Al. “GE Stock Has Gotten Hammered by Coronavirus and Debt Worries.” GE Stock Hit by Coronavirus

and Debt Worries. What Could Fix It. - Barron's, Barrons, 17 Mar. 2020, www.barrons.com/articles/ge-stock-

coronavirus-debt-worries-51584395010?siteid=yhoof2&yptr=yahoo.

Golden, Joanna, and Kohlbeck Mark. “The Unintended Effects of Financial Accounting Standard 123R on

Stock Repurchase and Dividend Activity.” Journal of Accounting, Auditing and Finance, vol. 34, no. 3, 2019,

pp. 411-433.

Jarallah, Shaif, Saleh Ali, and Salim, Ruhul. “Examining Pecking Order versus Trade-Off Theories of Capital

Structure: New Evidence from Japanese Firms.” International Journal of Finance and Economics, vol. 24,

2019, pp. 204-211.

Manconi, Alberto, et al. “Are Buybacks Good for Long-Term Shareholder Value? Evidence from Buybacks

around the World.’ Journal of Financial and Quantitative Analysis, vol. 54, no. 5, 2019, pp. 1899-1935.

Nenu, Elena, Vintila Georgeta, and Gherghina Stefan. “The Impact of Capital Structure on Risk and Firm

Performance: Empirical Evidence for the Bucharest Stock Exchange Listed Companies. International Journal

of Financial Studies, vol. 6, no. 41, 2018, pp. 2-29.

Servaes, H., and Tufano, P. The Theory and Practice of Corporate Debt Structure, 2006, Deutsche Bank.

UBS. General Electric Co: Transient Force Majeure Creates Prime Opportunity for Multi-Year Turnaround.

Reiterate But. PT $15.

Yahoo! Finance. General Electric Company (GE): Historical Prices, Yahoo, 2020,

finance.yahoo.com/quote/GE/history?

period1=1514764800&period2=1577750400&interval=1d&filter=history&frequency=1d.

General Electric resurge en Bolsa con la venta de su negocio biofarmacéutico. Expansión, 2019.

https://www.expansion.com/mercados/2019/02/25/5c73def3ca474131758b4591.html

The Complete Toolbox for Investors, finbox.com/NYSE:HON.

https://finbox.com/NYSE:HON

ESADE Ramírez, Listopad, Buscail | Page 12

Вам также может понравиться

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- Lesson 5 Designing and Developing Social AdvocacyДокумент27 страницLesson 5 Designing and Developing Social Advocacydaniel loberizОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Rule 113 114Документ7 страницRule 113 114Shaila GonzalesОценок пока нет

- Parliament of India: Rajya SabhaДокумент64 страницыParliament of India: Rajya SabhaSivapothuraju KonathalaОценок пока нет

- Psychological Contract Rousseau PDFДокумент9 страницPsychological Contract Rousseau PDFSandy KhanОценок пока нет

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Heterogeneity in Macroeconomics: Macroeconomic Theory II (ECO-504) - Spring 2018Документ5 страницHeterogeneity in Macroeconomics: Macroeconomic Theory II (ECO-504) - Spring 2018Gabriel RoblesОценок пока нет

- Benevisión N15 Mindray Service ManualДокумент123 страницыBenevisión N15 Mindray Service ManualSulay Avila LlanosОценок пока нет

- UC 20 - Produce Cement Concrete CastingДокумент69 страницUC 20 - Produce Cement Concrete Castingtariku kiros100% (2)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- KP Tevta Advertisement 16-09-2019Документ4 страницыKP Tevta Advertisement 16-09-2019Ishaq AminОценок пока нет

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- DarcДокумент9 страницDarcJunior BermudezОценок пока нет

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- On Derridean Différance - UsiefДокумент16 страницOn Derridean Différance - UsiefS JEROME 2070505Оценок пока нет

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- 5c3f1a8b262ec7a Ek PDFДокумент5 страниц5c3f1a8b262ec7a Ek PDFIsmet HizyoluОценок пока нет

- Chapter 1 To 5 For Printing.2Документ86 страницChapter 1 To 5 For Printing.2Senku ishigamiОценок пока нет

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Ron Kangas - IoanДокумент11 страницRon Kangas - IoanBogdan SoptereanОценок пока нет

- 15.053/8 February 7, 2013: More Linear and Non-Linear Programming ModelsДокумент42 страницы15.053/8 February 7, 2013: More Linear and Non-Linear Programming ModelsShashank SinglaОценок пока нет

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- ReadmeДокумент3 страницыReadmedhgdhdjhsОценок пока нет

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- Business Plan 3.3Документ2 страницыBusiness Plan 3.3Rojin TingabngabОценок пока нет

- Carriage RequirementsДокумент63 страницыCarriage RequirementsFred GrosfilerОценок пока нет

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- Homework 1 W13 SolutionДокумент5 страницHomework 1 W13 SolutionSuzuhara EmiriОценок пока нет

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- DNA ReplicationДокумент19 страницDNA ReplicationLouis HilarioОценок пока нет

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Pe 03 - Course ModuleДокумент42 страницыPe 03 - Course ModuleMARIEL ASIОценок пока нет

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- RSA - Brand - Guidelines - 2019 2Документ79 страницRSA - Brand - Guidelines - 2019 2Gigi's DelightОценок пока нет

- Azimuth Steueung - EngДокумент13 страницAzimuth Steueung - EnglacothОценок пока нет

- BNF Pos - StockmockДокумент14 страницBNF Pos - StockmockSatish KumarОценок пока нет

- Lithuania DalinaДокумент16 страницLithuania DalinaStunt BackОценок пока нет

- Working Capital in YamahaДокумент64 страницыWorking Capital in YamahaRenu Jindal50% (2)

- IEC ShipsДокумент6 страницIEC ShipsdimitaringОценок пока нет

- Retailing in IndiaДокумент11 страницRetailing in IndiaVinod MalkarОценок пока нет

- DPSD ProjectДокумент30 страницDPSD ProjectSri NidhiОценок пока нет

- g6 - AFA - Q1 - Module 6 - Week 6 FOR TEACHERДокумент23 страницыg6 - AFA - Q1 - Module 6 - Week 6 FOR TEACHERPrincess Nicole LugtuОценок пока нет

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Traveling Salesman ProblemДокумент11 страницTraveling Salesman ProblemdeardestinyОценок пока нет