Академический Документы

Профессиональный Документы

Культура Документы

Punjab National Bank Audit Manual PDF

Загружено:

Nitish AggarwalОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Punjab National Bank Audit Manual PDF

Загружено:

Nitish AggarwalАвторское право:

Доступные форматы

HEAD OFFICE, FINANCE DIVISION, SECTOR-10, DWARKA, NEW DELHI

13 March, 2019

TO ALL OFFICES

FINANCE DIVISION CIRCULAR NO. FD:BS: 08/2019

MANUAL FOR ANNUAL ACCOUNTS 2018-19

Finance Division has been issuing Manual containing consolidated instructions /

guidelines of various Head Office Divisions for the purpose of Annual Audit every

year.

Like in previous years, this year also Manual is being issued in soft copy only

as part of "Green initiative" of the Bank and no printed copy of the Manual will

be issued.

:14

Similarly submission of LFAR & Tax Audit Report will also be by soft copy

through CFA (a web application) and no hard copy needs to be submitted.

12

This Manual not only provides complete instructions/guidelines at one place but also

/20 19

enables the Branches/Offices to complete the entire audit process smoothly and well

in time.

19

/03 633

In this 17th Edition of Manual, closing instructions / guidelines from all Head Office

Divisions have been incorporated for Annual Audit of Financial Year 2018-19.

In case of any clarification / suggestion, please send an email at finbs@pnb.co.in or

contact the following official-

1. Mr. P.K. Varshney Chief Manager 9602222660

2. Mr. N. S. Rana Senior Manager 8860257980

3. Mr. Amit Dobhal Senior Manager- CA 9873071298

23

4. Mr. Sachin Ludhiyani Senior Manager- CA 9827328803

5. Mr. Mohit Goel Manager- CA 9873572655

All concerned are advised to ensure meticulous compliance of the instructions /

guidelines and completion of the Annual Audit in time.

P. K. Sharma

General Manager

Enclosed: as above

PNB-FD-HO-N Delhi Page 1

HEAD OFFICE, FINANCE DIVISION, SECTOR-10, DWARKA, NEW DELHI

INDEX

CHAPTER PAGE

SUBJECT

NO. NO.

1. (1a) Important issues related to 2018-19 Audit 3-17

(1b) List of Scheduled Banks Annexure I 18-20

(1c) Statements / Certificates to be prepared by Branches. 21-28

Annexure II

2. Role of Branches & Circle Offices 29-30

3. CBPMS (Centralised Balance Sheet & Profit Loss 31-38

Management System), CFA, PS&FI & DICGC (Deposits)

and Digital Signatures

:14

4. Preparation of First Dispatch 39-49

5. Second Dispatch- Loan Returns

12 50-59

/20 19

6. Second Dispatch-Guidelines for Income Recognition, Asset 60-120

Classification & Provisioning

19

/03 633

7. Second Dispatch- Capital Adequacy Statement. 121-144

8. Third Dispatch – General Guidelines 145-156

9. Fixed Assets Accounting 157-163

10. Statement of Contingent Liabilities 164-165

11. Memorandum Of Changes (MOCs) 166-169

23

12. Certificates required from Auditors 170-217

13. Long Form Audit Report (LFAR) 218-222

14. Tax Audit Report : Instructions for Tax Audit for FY 2018-19 223-278

15. (15a) Role of Balance Sheet Cell at circle offices 279-280

(15b) List of state-wise holidays 281

(15c) List of telephone numbers of the officials of Finance 282-283

Division

16. Guidelines for administration of Subsidies 284-286

17. List of phone numbers of key Officials at Circle Offices 287-299

PNB-FD-HO-N Delhi Page 2

HEAD OFFICE, FINANCE DIVISION, SECTOR-10, DWARKA, NEW DELHI

CHAPTER – 1: IMPORTANT ISSUES RELATED TO AUDIT / REVIEW

1. IMPORTANT GUIDELINES

1.1 Web based and automated certificates are available in CBPMS/CFA, printout to

be taken after submitting the data in the respective module. All the manual

certificates have been placed at “Compendium of Certificates” intended for Audited

branches & un-audited branches separately. Branches are advised to refer the

Compendium available at the below link to download the Certificate formats:

1.1.1 Compendium of Certificates- Audited Branches Click Here

1.1.2 Compendium of Certificates- Un-Audited Branches Click Here

1.2 The detailed guidelines on Centralized Loan Processing Centres (CLPC) were

issued vide IRMD circular Nos. 55 dt 28/06/2018, 91 dt 20/09/2018 and 101 dt

20/10/2018. For the current FY 2018-19, statutory audit of CLPC linked branches will

be conducted at the respective branches as the system of CLPC is not yet fully

:14

stabilized. The officials of CLPC are to coordinate with the linked branches for audit.

Branch heads will be responsible for smooth audit and CH / ZM to closely monitor

such branches. DGM (ZO) / AGM (CO) may be made responsible for smooth and

timely audit of such branches by way of office order.

12

/20 19

1.3 To facilitate meaningful restructuring of MSME accounts that have become

stressed, it has been decided to permit a one-time restructuring of existing loans to

MSMEs classified as ‘standard’ without a downgrade in the asset classification,

19

/03 633

subject to the conditions as stated in MSME circular no 03/19 dated 14.01.2019.

(For detailed guidelines refer Chapter -6 of Manual).

1.4 Reserve Bank of India has announced the Interest Equalization Scheme on Pre

and Post Shipment Rupee Export Credit to eligible exporters with effect from 1st

April, 2015 for a period of 5 years. Detailed guidelines for the same have been

circulated vide IRMD (L&A) Circular No. 116 Dated 09.12.2015 and Circular No. 38

dated 18.05.16 and subsequent circulars and guidelines, to be followed while

passing on the benefit to the eligible exporters. “RBI vide notification

DBR.DIC.BC.NO.09/04.02.001/2018-19 dated 29.11.2018 has advised that it has

23

been decided by the Government of India to increase Interest Equalization rate from

3% to 5% w.e.f. November 02, 2018 in respect of exports by the Micro, Small &

Medium Enterprises (MSME) sector manufacturers under the Interest Equalization

Scheme on Pre and Post Shipment Rupee Export Credit. RBI vide notification

DBR.Dir.BC.NO.22/04.02.001/2018-19 dated 11.01.2019 has advised that it has

been decided by the Government of India to include Merchant Exporters also, w.e.f.

January 2, 2019, under the ongoing Interest Equalization Scheme for Pre and Post

Shipment Rupee Export Credit and allow them interest equalization at the rate of 3%

on credit for export of products covered under 416 tariff lines identified under the

Scheme.(For detailed guidelines refer Chapter -12 of Manual).

1.5 During the current Financial year MSME Division has issued guidelines for

providing 2% interest subvention to MSME units which are registered under GST

and having valid udyog aadhar number(UAN) vide MSME circular no 62/2018 dated

28.12.2018 & circulating format for submission of claims vide MSME Circular No.09

dated 25.02.2019.(For detailed guidelines refer Chapter -12 of Manual).

PNB-FD-HO-N Delhi Page 3

HEAD OFFICE, FINANCE DIVISION, SECTOR-10, DWARKA, NEW DELHI

1.6 RBI vide its notification no. RBI/2018-19/126

DBR.BP.BC.No.25/21.06.001/2018-19 dated 22.02.2019 has reviewed the

guidelines & advised that exposures to all NBFCs, excluding Core Investment

Companies (CICs), will be risk weighted as per the ratings assigned by the rating

agencies registered with SEBI and accredited by the Reserve Bank of India, in a

manner similar to that of corporate. However, exposures to CICs, rated as well as

unrated, will continue to be riskweighted at 100%..(For detailed guidelines refer

Chapter -7 of Manual).

1.7 During the year HO GSAD has amended the policy for application of

depreciation of Fixed Assets:

1.7.1 In case of fresh additions to the assets during the year, depreciation as

per applicable rates be charged, starting from the date of

purchase/addition i.e. on daily basis instead of monthly basis.

:14

1.7.2 In case of fixed assets sold/ disposed of during the year, depreciation

would be charged up to the date of sale/disposal by passing accounting

voucher, to be generated by system i.e. on daily basis instead of monthly

basis. 12

/20 19

1.7.3 Capitalization of Fixed assets : Capitalize the assets on fulfilling of any

one of the following conditions, whichever is earlier:

19

At the time of full payment of consideration.

/03 633

Date of put to use.

Date of obtaining Occupancy certificate

1.7.4 Procedure for Collection, Scrutiny, Consolidation and Forwarding

of SFF / MCC / Premises Statements : Circle Office will submit the

consolidated statement to Zonal Office. Zonal Offices will collect and

consolidate the statements from Circle Office and submit to Head Office

for further consolidation

(For detailed guidelines refer Chapter -9 of Manual).

23

1.8 As per GST Law every taxable person who has been granted multiple

registrations under the existing service tax or VAT law on the basis of a single PAN

in a State, shall be granted only one provisional registration under the GST Act in

that State or Union territory in which it is already registered under the existing law.

In view of the same, Bank has obtained single registration in every State and Union

Territory where it operates through Branches/ Offices. Hence, we have designated

the Circle offices located in the Capital of each State as Nodal Offices for GST

compliance within that State. The States where we do not have Circle offices, the

Main branch located in the Capital of that State has been designated as Nodal Office

for GST compliance in that State. The Bank has obtained Registration at 35 Nodal

Offices (29 states and 6 Union Territories). –Refer Chapter 14 for GSTIN list.

PNB-FD-HO-N Delhi Page 4

HEAD OFFICE, FINANCE DIVISION, SECTOR-10, DWARKA, NEW DELHI

CBS has been customized for charging/collection of GST on taxable transactions

and availing of Input Tax Credit on expenses. The amount of GST Collected every

month in all the Branches/Offices is transferred at the end of every month to the

State Nodal Offices for further remittance to Government. Monthly GST Returns for

all the 35 Registrations are filed through HO, Finance Division. GST Annual Audit as

prescribed under GST Law will be centrally got done at HO Finance Division.

1.9 Due to implementation of Goods and Service Tax (GST), Statutory Branch

Auditor’s Audit Fee as well as TA/DA etc. is to be paid by respective Circles and

Nodal Offices. In this regard kindly adhere to Finance Division Circular

No.HO/FD/22/2017 dated 07.09.2017, which contains the procedure for payment of

Audit Fee and TA/DA/Hotel Bill to SBAs.Circles must ensure to adhere the

guidelines related to GST and TDS applicable from time to time in this regard. Audit

fee to SBAs is to be treated in FY 2018-19 (Assessment Year 2019-20) and

Circles/Nodal Offices must ensure to deposit TDS on account of provision of Audit

Fee payable to SBAs, as per TDS guidelines i.e. on or before 15.04.2019 for

depositing it in Govt. account through TDS Cell, Head office, to avoid penalty/interest

:14

on late depositing.

1.10 ICAI has made it mandatory for all Chartered Accountants (CAs) in practice to

12

register all certificates at UDIN portal, which are being issued on or after 1 Feb.

/20 19

2019, vide Press Release dt. 24 Jan. 2019, i.e. a Unique Document Identification

Number (UDIN) comprising of 18 Digits is required to be generated via system as

unique number for every document certified/ attested by Practicing Chartered

19

/03 633

Accountants. UDIN is to be generated at the time of signing the Certificate. However,

the same can be generated within 15 days of the signing of the same (i.e within 15

days from the date mentioned at Certificates and not beyond that). Further, no

document is required to be uploaded for generating UDIN. It may be noted that ICAI

has already issued Advisory for Practicing Chartered Accountants (CAs) to register

all certified/ attested documents at UDIN Portal (https://udin.icai.org) and to generate

respective Unique Document Identification Number (UDIN) for each such document

for future reference by stakeholders who wish to check authenticity thereof. It is to

ensure that the certificates issued by the Chartered Accountants must contain UDIN.

23

1.11 “Section 40A(3) of the Income Tax Act, provides that any expenditure in respect

of which payment or aggregate of payments made to a person in a day, otherwise

than by an account payee cheque drawn on a bank or account payee bank

draft, exceeds ten thousand rupees, shall not be allowed as a deduction except in

specified circumstances. However, if the payments are made for hiring or leasing

carriages for goods such as lorries, trucks etc then the limit is extended to Rs

35,000/-. During the Tax Audit of the Bank for FY 2017-18, it was observed that still

many Branches incur expenditure in cash/ bearer cheque for an amount exceeding

Rs 10,000/- which resulted in disallowance of expenditure in Income Tax. As such,

it is hereby advised to all the offices to avoid making any payments over Rs

10,000/- by bearer cheque or cash to a single person in a day.”

1.12 Tax Audit Report (TAR) As per Section 44AB of Income Tax Act, 1961, the

Bank is under statutory obligation to get the Tax Audit conducted for the financial

PNB-FD-HO-N Delhi Page 5

HEAD OFFICE, FINANCE DIVISION, SECTOR-10, DWARKA, NEW DELHI

year 2018-19. Bank has decided to get it done along with Annual Audit of

branches/other offices.

From the Financial Year 2013-14, the system of sending hard copies of Tax Audit

Report has been replaced by on-line submission of TAR to be captured through a

web application namely CFA (Centralized Financial Audit). Detailed guidelines in

this regard are given in Chapter 14.

During the financial year 2017-18, Bank has centralized process of e-filing of TDS

returns at Head Office. A Centralized E-TDS Cell has been constituted at Finance

Division, HO for E-filing of TDS Returns as well as Form 15G/H Returns w.e.f quarter

ending September 2017 onwards. The remittance of TDS deducted is also being

done centrally at Head office.

As per the policy, TDS Returns of the Branches have been consolidated at their

respective 76 Circle Offices under 76 TANs. However Returns for the HO Divisions

continued to be filed against their respective TANs. For Branches/Offices where

:14

Lower TDS Deduction Certificate has been obtained by our customers on Branch

TAN, returns are filed on Branch TAN and not on their Circle Office TAN.However

TDS returns 24Q is being filed against three TANs separately for Salary, Staff

12

Pension and Public Pension. The centralized TDS Returns filed at E-TDS Cell at HO

/20 19

is as below:

19

/03 633

RETURNS PARTICULARS TANs Used

Salary DELP26003F

24Q Pension-Ex Staff DELP09293E

Pension DELP26004G

Fd/Rd & Misc Payments 76 Circle Wise TAN

26Q

Scss DELP09293E

27Q Nri 76 Circle Wise TAN

23

Detailed guidelines on Centralization of E-filing of TDS at Head Office has been

circulated vide HO Finance 18/2017.

The tax deposited under various heads along with details of challans and TDS

returns for all the quarters of FY 2018-19 will be provided by E-TDS Cell, Head

Office at E-TDS Portal on Non CBS Page. Branch Office can login into the E-TDS

Portal by entering the Login Id (6 digit Sol Id of Branch) and Password (6 digit Sol Id

of Branch). After login, select Financial Year 2018-19 and click Ok. In the next

screen, at item No 5, Tax Audit Data for FY 2018-19 will be available.

Report on interest paid on Fixed Deposits and EXTM transactions is available in

TDSRPT 1/1G and TDSRPT 2/10A respectively. These reports contain details of

TDS deducted on the interest paid on FD and EXTM transactions. Transaction on

which TDS has not been deducted is also available in these reports. Branches are

advised to generate the reports periodically and ensure that TDS has been deducted

as per the Income Tax Act/ Bank’s guidelines.

PNB-FD-HO-N Delhi Page 6

HEAD OFFICE, FINANCE DIVISION, SECTOR-10, DWARKA, NEW DELHI

On the basis of past experience of consolidating Tax Audit Report at Head

Office, the Branches/ Circle Offices are advised to take care of following

important points during Tax Audit of current year:

During Tax Audit for FY 2017-18, it has been observed that in Annexure XA –

Payments where TDS is to be deducted but has not been deducted and

Annexure XB – Payments where tax has been deducted but has not been paid,

many transactions were wrongly reported. Those transactions were also reported

where TDS was already deducted/ deposited or TDS was not required to be

deducted resulting in wrong reporting of the data. Nodal Officers for TDS at

Circle Offices are advised to ensure the correctness of data reported in

Annexure XA and XB on daily basis during the time of Audit.

Expenditure of capital nature debited to revenue in respect of which MOC have

been passed to capitalize the item should not be reported under Annexure VII.

:14

Payment to Banker’s Club, rotary/ lion clubs which are not for entertainment but

are incidental to Banking are not to be reported under Annexure VIII.

12

/20 19

Payment of rent revised on or after 01.04.2018 from back date for months of

prior years and booked during FY 2018-19 and refund/ reversal of interest/

charges/ commission of LG etc during FY 2018-19 are not prior period

19

/03 633

expenditure. Hence, such expenditure should not be reported under

Annexure XVIII.

With the help of TDS statement(s) (which should be readily available with all the

offices for all the quarters), Branches/Offices to keep data ready as per clause 34

(a), (b) & (c) before the commencement of audit to avoid any delay in completion of

statutory audit and submission of Tax Audit Report.

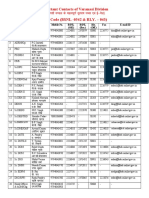

The details of all 76 Circle Offices with their respective TANs are as below:

23

Circle Office TAN Circle Office TAN

Dealing officer at HO: Anil Popli Dealing officer at HO: Kiran Mathur

Ahmedabad AHMP00414B Alwar JPRP02809C

Amritsar AMRP10222C Bharatpur JPRP01913C

Bhatinda AMRP11501A Bhopal BPLP01500C

Bhuvaneshwar BBNP00112A Bilaspur JBPP04343D

Burdwan CALP04782B Faizabad LKNP05284G

Guwahati SHLR00021A Gorakhpur ALDP00363G

Hoshiarpur JLDP03186B Gwalior BPLP06135D

Jalandhar JLDP01650F Indore BPLP01543D

Kapurthala JLDP01270D Jabalpur JBPP00426G

Kolkata CALP01175G Jaipur JPRP00020G

PNB-FD-HO-N Delhi Page 7

HEAD OFFICE, FINANCE DIVISION, SECTOR-10, DWARKA, NEW DELHI

Ludhiana JLDP01551E Jhansi AGRP10542A

Midnapur CALP05407D Jodhpur JDHP02171B

Mumbai City MUMP34534D Kanpur KNPP01347D

Mumbai Suburb MUMP17079G Lucknow LKNP05297F

Nagpur NGPR01771A Noida MRTP03474C

North Delhi DELP09235C Raipur JBPP00552G

Patiala PTLP13884D Sri Ganganagar JDHP01903G

Pune PNEP07956E Udaipur JDHP06984F

Sambalpur BBNP01915E Varanasi ALDP00456B

Surat SRTP05184E Dealing officer at HO: Vishwa Mohan

Dealing officer at HO: Vijay Malviya Agra AGRP10528A

:14

Andhra - Vijaywada HYDP09833F Allahabad ALDP02370E

Bangalore BLRP04506F Arrah PTNP00876B

Chandigarh PTLP11205F

12 Bareilly LKNP05173A

Chennai CHEP00190B Bihar Shariff PTNP00692G

/20 19

Coimbatore CHEP06671A Bokaro RCHP01629F

Dharamshala PTLP11847D Bulandshahr MRTR01107B

19

/03 633

Ernakulam CHNP03612A Central Delhi DELP18835F

Hamirpur PTLR11364D Darbhanga PTNP00599E

Hissar RTKP02285D Dehradun MRTP01168G

Hyderabad HYDA02285D Gaya PTNP00805A

Jammu AMRP10747C Haridwar MRTP00651A

Karnal RTKP03138C Kashipur MRTP01452D

Kozhikode CHNP01028G Meerut MRTP00121C

Kurukshetra RTKP05128E Moradabad LKNP05443E

23

Mandi PTLP12442D Muzaffarnagar MRTP00971F

Rohtak RTKP02509D Muzaffarpur PTNR00810F

Shimla PTLP11522A Patna PTNP00369F

South Delhi DELP16664E Ranchi RCHP00166F

For any further details/ clarification on TDS related matters, contact numbers and

details of E TDS Cell at Head Office are as below:

Murli Dhar, Senior Manager

Contact: 8586983871

E-mail: hotdscell@pnb.co.in

Vishwa Mohan Mishra, Kiran Mathur, Vijay Malviya, Anil Popli,

Manager Manager Officer Officer

8586983872 8586983873 8586983875 8586983874

PNB-FD-HO-N Delhi Page 8

HEAD OFFICE, FINANCE DIVISION, SECTOR-10, DWARKA, NEW DELHI

Circle offices to ensure that all the branches/offices compile their Tax Audit

Report as per various annexures having certain data so that the same may be

timely submitted through CFA, as any delay in submission of TAR may uphold

the audit process.

The Branch Heads should impress upon the branch auditors that the branch

tax audit is conducted simultaneously with the statutory audit as no separate

TA/DA is payable to them for a second visit for Tax Audit.

1.13 Changes related to various certificate

New Certificate:

a) RBD (advances) has issued 16 new certificates for lodging claim of interest

subsidy on educational loan for overseas study for the students belonging to

:14

minority communities under Padho Pardesh Scheme.

b) The Government of Uttar Pradesh has formulated a Crop Loan redemption

scheme for upliftment and Sustainable Development of Small & Marginal

12

farmers (Applicable for UP state only). The scheme stipulates one of the

/20 19

conditions that the lending institution (those branches identified for Debt

Waiver) will provide AUDITED CERTIFICATE (Statutory Branch Auditor) to

their respective DLCs (District Level Committee), regarding the correctness of

19

/03 633

eligible farmers and the amount credited to their identified crop loan accounts

under the scheme. In this respect all branches to ensure obtention of the

auditor’s certificate in four copies as per the scheme (One for branch; One

for SBA; One for Zonal Office Lucknow & One for DLC). Branches will

send one copy to ZM Lucknow and one copy directly to their respective DLCs

(district level committees, headed by DMs). Format of certificate will be

shared separately.

c) During the current Financial year MSME Division has issued guidelines for

providing 2% interest subvention to MSME units which are registered under

23

GST and having valid udyog aadhar number(UAN) vide MSME circular no

62/2018 dated 28.12.2018 & circulating format for submission of claims vide

MSME Circular No.09 dated 25.02.2019. The claim of interest subvention for

all eligible accounts of entire Bank is to be submitted by Bank to SIDBI who is

Nodal agency for disbursement of claims to Banks. Every bank has to submit

claim certificate duly certified by Statutory Auditors on half yearly basis to

SIDBI for the demanded claim on the format prescribed by RBI in its circular

dated 21.02.2019. Formats of certificate and role of branches/circles and

zones will be communicated by MSME division separately. In case of any

query please contact:

Shri Sudhir Kumar, Chief Manager - Mob. No.: 7389908622

Shri Ved Prakash, Sr. Manager (Industry) – Mob. No.: 8800661252

2. GENERAL INSTRUCTIONS

PNB-FD-HO-N Delhi Page 9

HEAD OFFICE, FINANCE DIVISION, SECTOR-10, DWARKA, NEW DELHI

2.1 In continuation to steps towards paperless audit, all the MOCs & other

statements will be signed digitally in CBPMS by Statutory Branch Auditors and

Incumbents Incharge, as done during previous Quarterly Reviews & Annual Audit of

2017-18. Circle office must ensure that Incumbents Incharge of all branches under

audit for March 2019 have Digital Signatures for submitting identified statements in

CBPMS. Following certificates/ statements will be submitted with Digital Signatures,

for 31st March 2019 -

All MOCs.

Branch Audit Report

Certificate related to compliance of Income Recognition and Asset

Classification (IRAC) norms.

Certificate for having passed the necessary vouchers for the changes

suggested by the auditors through MOCs for the year ended 31.03.2018,

wherever suggested.

Balance with Banks & Supplementary information for Basel III.

Please refer Chapter 3 for guidelines related to Digital Signatures.

:14

2.2 Statement of Balance with Bank (pls. refer chapter 4) contains the balance with

other banks in credit /debit. Branches will mention Name of the Bank/Banks with

which they are maintaining the account.12

/20 19

2.3 The bifurcation of signing and verification of the MOCs (Loan) will be as

under:

19

/03 633

MOC (Loan) up to Rs. 10.00 Lac will be signed by Branch Manager &

Auditor.

MOC (Loan) for more than Rs. 10.00 Lac and upto Rs. 2 crore will be

signed by Branch Manager & Auditor and will be verified by Executive

Incharge at Circle Office.

MOC (Loan) for more than Rs. 2 core and upto Rs. 5 crore will be signed

by Branch Manager & Auditor and will be verified by Circle Head at Circle

Office.

23

MOC (Loan) for more than Rs. 5 crore will be signed by Branch Manager

& Auditor and will be verified by GM/DGM at respective Zonal office.

2.4 At the time of passing the MOC(s) in relation to the Income on Advances,

classification e.g. Loan to Real Estate - Commercial / Housing Loans / others, loan

Advances to Capital Market, Agriculture Loan, Industrial Loan etc. is also to be

provided.

2.5 At the time of passing the MOC(s) in relation to the Expenditure interest paid on

Deposits, classification e.g. Interest paid on time deposit for >Rs. 15Lakh, Rs. 15

Lakh >Rs.1 cr., Rs.1 cr. > Rs.10 cr. etc. is also to be provided.

2.6 CBPMS (Centralized Balance Sheet and Profit & Loss Management System) is

the Software for posting of MOCs (Memorandum of changes) suggested by the

Statutory Branch Auditors / Circle Offices / Concurrent Auditors (Only for quarterly

closing), related to assets, liabilities, income, expenditure, loans (fund based &non-

PNB-FD-HO-N Delhi Page 10

HEAD OFFICE, FINANCE DIVISION, SECTOR-10, DWARKA, NEW DELHI

fund based) & Capital Adequacy and for generation of various reports. For the year

ending March, 2019 also, all branches under statutory audit will post the MOCs by

logging in the CBPMS. Detailed guidelines for use of CBPMS are given in the

Chapter - CBPMS (Chapter 3) & Memorandum of Changes (Chapter 11).

MOCs pertaining to Capital Adequacy - BASEL III are also to be posted in CBPMS.

(Refer Chapter 11 for details). Further, printout of MOCs from CBPMS will be taken

out for the signatures of the Statutory Branch Auditor & Incumbent Incharge which

will become part of the Branch Auditor's Report. As these MOCs will be digitally

signed by the Incumbent Incharge and Statutory Branch Auditors, no hard copies to

be submitted to circle office and Head Office. However, hard copies for Branch,

Statutory Branch Auditors and Statutory Central Auditors will be taken.

EVEN IN CASE OF NO CHANGES, NIL MOCs will be generated by the branches

from CBPMS.

In most of the branches, following statements may be NIL - (Refer Chapter 12)

a) DICGC Transactions

:14

b) TUFS - SSI Sector

c) Credit Linked Capital Subsidy Scheme

If no data is to be reported in any one or more of these statements, branch will mark

12

NIL against it and generate consolidated NIL statement. However, those branches

/20 19

who have to report under any or all of the above statement may mention that

statement is annexed.

19

/03 633

Branches to ensure following on regular basis -

2.7 VALIDATION OF DATA - Every month Balance sheet and Profit & Loss data for

last working day is provided to Circles from Finance Division along with

discrepancies list for validation. Circles in turn follow up with the branches for the

rectification of these entries. Checking and Rectification of errors (like wrong head

debited, credit balance in revenue heads etc.) should be an ongoing exercise at

branch level. Branches should make correction in the system regularly and avoid

23

passing of MOCs due to these reasons. Concurrent Auditors should ensure

rectification of these errors. Zonal Audit Offices should ensure that Concurrent

Auditors are getting the rectification done by the branches before the closing date

and no MOC is passed for such discrepancies. ITD has made a report PNBREP

10/39 available in the MIS server of CBS for checking the discrepancies of Balance

Sheet and Revenue. Branches have been instructed to take out the report

themselves and make the required corrections in the system. Circle offices have also

been instructed to generate the report every fortnight for branches under their

jurisdiction and take necessary action for rectification of errors. Zonal audit offices

have also been instructed to generate report for all the branches in circles under

their jurisdiction and ensure that all errors are rectified on monthly basis.

2.8 Branches will ensure reconciliation of Imprest accounts & Bankers' account

maintained in their sols. Branches should make sure no entry should remain

outstanding/unresponded in Banker’s account (including account with RBI).

PNB-FD-HO-N Delhi Page 11

HEAD OFFICE, FINANCE DIVISION, SECTOR-10, DWARKA, NEW DELHI

2.9 Balance with Head Office - Weekly code 32111 is now not available for any

transaction between branches. Branches should use Intersol head for any

transaction instead of Balance with Head Office.

2.10 MOC IEAL is given for any correction in CBS data (any change in the GL/SGL

head) whereas MOC Loans is given for any correction in LADDER. It means that -

MOC Loans will come only if any change is required in ladder.

If any correction is required in CBS then only MOC IEAL will be

passed.

If change is required in both CBS and Ladder then both MOCs will be

passed.

2.11 MOC Loans - Circle Head / Executives at Circle office / Zonal office will confirm

MOC loans in CBPMS, wherever the change in the asset classification is done

:14

through MOC as per paragraph 2.3.

2.12 Formats of the following Statements are NOT BEING PRINTED, as the

12

information is available through CBS (morning checking):

/20 19

(I) Balance Sheet (PNB 259) (II) Revenue Statement (PNB 260)

(III) Suspense Statement (PNB 268) (IV) Sundries Statement (PNB 269)

19

/03 633

However, branches under statutory audit for the year ending March, 2019 must

ensure that hard copies of Balance Sheet and Revenue Statement generated

through CBS (morning checking), are made available to the Statutory Branch

Auditors, for verification and certification by them.

One page report named "Abridged Balance Sheet & Profit-Loss statement"

(available in the morning checking report in CBS) will also be signed by

Auditors.

23

Entries related to Suspense and Sundries, if desired by the Auditors, be got

checked in the CBS, through a “Read Only Screen”.

For SFF statements (PNB 263) please follow instructions in Chapter 9 of this

manual.

2.13 Following Statements will be generated from CBS and verified by the SCAs at

the corporate level, therefore are NOT REQUIRED to be submitted by the

branches:

Statement of Rural Advances (PNB-260B)

Certificate of CD Ratio

Maturity Pattern of Loans & Advances-S-1

Maturity Pattern of Deposits S-4

PNB-FD-HO-N Delhi Page 12

HEAD OFFICE, FINANCE DIVISION, SECTOR-10, DWARKA, NEW DELHI

Income from legal settlement

Certificate of Cash & Bank Balance (Treasury Division)

2.14 Transfer of Income & Expenditure for the year 2018-19 to H.O Accounts

Department (Finance Division) - Distinctive Number-014400 will be taken care of by

the Data Centre.

2.15 Old formats should not be used under any circumstances. Cutting and

overwriting must be avoided. However, in case of unavoidable circumstances,

cutting/ overwriting must be authenticated by Incumbent In-charge.

2.16 All the Closing Returns must be signed by the Incumbents and Concurrent

Auditors (wherever posted) during quarterly closing of June, Sep & Dec. Annual

Closing Returns shall be signed by Statutory Branch Auditor & Incumbent Incharge

in branches under Audit for March 2019 and by Incumbent Incharge in branches not

under audit for March 2019.

:14

2.17 Number of copies and statements/certificates to be obtained from the

Statutory Branch Auditors are mentioned in the Annexure-II Table I of this

Chapter and statements/certificates to be submitted by unaudited branches to

circle office are mentioned in the Annexure – II Table II of this chapter.

12

/20 19

2.18 All Incumbents and Concurrent Auditors (wherever posted) must ensure

correctness of Cost of Deposits (COD) & Yield on Advances (YOA). The officials at

the respective Circle Offices must regularly check branch-wise position of COD &

19

/03 633

YOA and in case of any abnormality the reasons be ascertained from the branches

and corrective action be initiated, wherever required.

2.19 Incumbents must ensure that advances and deposits of the branches are

correctly reported and there should be No Window Dressing e.g. utilizing un-drawn

cash credit limits and placing the amount in deposits at the year end. Such actions

will be viewed very seriously and also call for penal action from RBI under Section 46

of the Banking Regulation Act. All concerned are advised to ensure meticulous

compliance of instructions issued by Inspection and Audit Division vide their circular

no.IAD/ 13/2015 dated 24.08.2015.

23

2.20 Circle Offices (COs) must ensure to undertake the exercise on regular basis

in respect of the following and in case of aberrations, wherever necessary, corrective

action be initiated:

Variations in the Income & Expenditure heads compared to the

corresponding previous year/period of the previous year.

Sundry Provision-Others (Code 42044) showing Nil, Negligible Balance or

same amount as per previous quarter. Normally the balance

outstanding against this head cannot be Nil, unless the branch has

already paid the expenses related to telephone, water, rent,

electricity etc. of the last month of the quarter.

Sundry -Provision for expenses - Paid through suspense (42041) should

tally with Suspense - Items against which provision is lying in Sundries

(63563).

PNB-FD-HO-N Delhi Page 13

HEAD OFFICE, FINANCE DIVISION, SECTOR-10, DWARKA, NEW DELHI

3. INCOME & EXPENDITURE

3.1 Branches must ensure that full and adequate provisions and accruals are

made for all items of Expenditure & Income before closing and while

preparing closing returns. Short/excess provisioning of expenditure or booking

of income MUST BE AVOIDED.

3.2 All branches must ensure that, Interest Failure Reports for advances &

deposits are generated on regular basis (especially on the quarter closing

dates) and discrepancies wherever observed are immediately rectified. Circle

offices to ensure compliance of these guidelines. Incumbents must ensure

compliance of Inspection & Audit Division’s Circulars issued from time to time

to check for revenue leakage.

3.3 The administrative offices (ZO/CO) to ensure that expenditure incurred for

CCD and CSR is debited to the correct code of Revenue expenditure. Please

also ensure that expenditure incurred under the decentralized heads of

Publicity for which the budget has been allocated by concerned Division are to

:14

be reflected by Zonal/Circle Offices in their Monthly Revenue Statement at

appropriate Code Number of Revenue expenditure:

12

(a) Electronic Media on Local Cable TV Network (b) Fair Exhibitions designing

/20 19

production fabrication (c) Library cum reading room renewal (d)

Advertisement and Publicity (e) PR Expenditure (f) Advertisements in

Newspapers (g) Programme under Innovative PR activities (h) Tender Notices

19

/03 633

and Public Notices (i) Advertisements expenses GAD matter (j) Corporate

Social Responsibility (k) Sports & Cultural Activities.

(For further details, refer Circular No. ITD/CBS/15/2014 dated 30.04.2014).

At the time of finalization of annual accounts of the Zonal offices, the

necessary provision is to be made for the Expenditure- Publicity and CSR

which are accrued but not paid by crediting Sundry Provision Account. Any

unutilized provision left in the Sundry Provision Account after the payment of

expenditure accrued and provision made for, should be credited to the

respective head of Expenditure of Revenue statement.

23

The necessary instructions and guidelines issued from time to time by the

Finance & Taxation Division (HO) in respect of tax deductions at source are to

be adhered strictly, while making payment to the advertising

agencies/contractors/suppliers. The Zonal Offices/Circle Offices should

keep the proper record of the Bills/Receipts, duly verified in respect of

expenditure incurred.”

4. IMPERSONAL HEADS

4.1 Suspense entry related to the cash given to the outside agencies for deposit

in the ATMs must be adjusted on the T+2 days basis and no such entry

should remain outstanding on the date of the balance sheet.

4.2 Entries relating to Remittance in Transit, Imprest account and Inter-

branch clearing account should be adjusted by timely follow up and

reconciliation. No RIT should be outstanding at year/quarter end.

PNB-FD-HO-N Delhi Page 14

HEAD OFFICE, FINANCE DIVISION, SECTOR-10, DWARKA, NEW DELHI

4.3 All possible steps must be initiated by the branches/ offices for immediate

reversal/ adjustment of the entries outstanding against “Impersonal Heads”.

It is imperative to mention that all such eligible entries under Impersonal

Heads e.g Suspense, Inter Bank etc. outstanding for more than 1 year as on

31.03.2019 attract 100% provisioning requirement as per Bank’s extant

guidelines, thus affecting the Bank’s profit & CRAR adversely.

However, it must be ensured that only those entries are reported in the

“Annexure-Impersonal Heads - Part B” which are of adjustable nature.

A list of entries which do not require any provision is given below, which is

suggestive in nature and not exhaustive:

Entries which are not of adjustable nature i.e normally remain in books of

accounts, almost permanently e.g advance rent given to the landlord of the

premises under use by Bank.

Entries pertaining to Govt. or Govt. Departments e.g Pension, Gratuity, Arrears of

:14

Pension paid to the Pensioners, Interest Subvention, Export Subvention, Deposit

with Govt. Deptt. as Security & Deposit with Court as deposit/ Security etc. for

which provision is not required to be maintained. Entries outstanding for less

12

than 1 year.

/20 19

Branches must ensure to report eligible entries in the Annexure-Impersonal head (XII

19

/03 633

vii), Circle Offices will consolidate the information, received from, both audited and

un-audited branches, for further submission to the Head Office. However,

Circle Offices will send the consolidated position of ONLY THOSE ENTRIES

FOR WHICH PROVISION IS REQUIRED TO BE MADE, to Head Office,

Inspection & Audit Division at iadimpersonal@pnb.co.in for scrutiny &

consolidation. IAD would consolidate the data (circles and Head Office

Divisions) for bank as a whole and get it audited by the Central Statutory

Auditor of the Division and inform Finance Division the amount of Provision

23

required against each head for passing necessary accounting vouchers .

5. LOANS

5.1 Whenever reschedulement / restructuring package/change in repayment plan

is approved, EMI for repayment of loan must be suitably amended, wherever

permitted, under proper authority, as per the revised sanction.

5.2 Proper care be taken while entering the data in CBS with special

emphasis on correct reporting of Retail Loan accounts including

reschedulement, if any, stock statement, renewal of limit, moratorium, EMI,

repayment schedule. SIMILARLY DUE CARE MUST BE TAKEN WHILE

POSTING THE DATA RELATED TO CRAR (BASEL-III) E.G. RELATED TO

CATEGORY OF ADVANCE I.E. COUNTER PARTY-RETAIL, CORPORATE,

DOMESTIC SOVERIGN RESTRUCTURED ETC. Branch / Circle Office

Must Ensure That No Account Is Identified As NPA Due To Non Financial

Reasons .

PNB-FD-HO-N Delhi Page 15

HEAD OFFICE, FINANCE DIVISION, SECTOR-10, DWARKA, NEW DELHI

5.3 Whenever there is change in rate of interest to be charged in loan accounts

due to any reason branches must ensure to make suitable amendments in the

CBS system, as per IT guidelines, so that correct income is booked.

5.4 Branches must ensure correct classification of advances under Retail

and Corporate categories to ensure that there is no distortion in Segment

reporting of the bank.

For example in Large Corporate, Mid Corporate branches, most of the loan

accounts are of the corporate borrowers and the income generated is

obviously from corporate banking. On the other hand in case of rural/semi-

urban branches, most of the borrowers will be under Retail Category.

5.5 The Banks has in place its duly approved Loan Review Mechanism Policy for

the year 2018-19 which provides that all standard risk rated accounts

except (a) Retail Banking segments (i) Rule Based Lending (housing, vehicles

& personal loan) (ii) Advances against consumer durables, (b) Advances

:14

against Bank Deposits, LIC policies, Govt. securities, Gold/silver jewellery &

ornaments, advance against shares, debentures & Mutual Fund) will be

covered under credit audit.

12

The cut off limit for the purpose of credit audit of risk rated standard accounts

/20 19

shall be as under:

All rated standard accounts with exposure of Rs.10 cr. & above. In

19

/03 633

case of accounts with combined group exposure of Rs.10 cr. and

above all the accounts irrespective of individual limits shall be

subjected to credit audit.

Top 5 rated standard accounts of Circle with minimum balance of Rs.

5.00 cr. and above where auditable accounts are less than 10 in a

financial year.

Credit audit of taken over accounts: In case of taken over borrowal

accounts, credit audit are also to be conducted for accounts with exposure of

Rs.1 crore and above. The first such audit is to be done within three months

23

of the takeover and the next audit is to be carried out within three months after

completion of one year of first credit audit. On takeover of such accounts the

branches are to inform CARD, HO through respective Circle Office for

ensuring first credit audit within three months of takeover

For detailed guidelines refer Credit Audit & Review Division Circular

No. 4 /2018 dated 26.04.2018.

6. OTHER GUIDELINES

6.1 Calculation of Provision on NPA in Loan MOCs has been automated, which will

be calculated at central level after processing of MOCs. Further, pre MOC

details in Loan MOCs (as per Ladder) will be automatically picked up by the

system on entering the CBS account number. Please ensure that account

number in which MOC is suggested is correctly entered.

6.2 Certificate pertaining to additional information of deposits required for payment

of insurance premium to Deposit Insurance Corporation by the bank.

PNB-FD-HO-N Delhi Page 16

HEAD OFFICE, FINANCE DIVISION, SECTOR-10, DWARKA, NEW DELHI

(Statement DI, DI-01 & DI-02 ) is now required to be submitted online through

CFA (Centralized Financial Audit). The same certificates are required to be

digitally signed by branch auditor and incumbent incharge in case of audited

branches. Further, branches/offices are required to ensure to install internet

explorer 9 or higher versions for proper functioning of these certificates. For

details please refer page number 35-37 of chapter 3.

6.3 Certificates in respect of FLCs/FLGs are required to be submitted in CBPMS.

The FLCs/FLGs certificates are also required to be manually signed by branch

auditors and branch incumbent. Circle offices shall prepare one set of

consolidation based on the data collected from CBPMS (Centralized Balance

Sheet and Profit & Loss Management System) and another set as per old

system and send the consolidated position of FLGs and FLCs (Annexure-

FLCs/FLGs- Circle) currency-wise after recalculating their value at FEDAI

rates of the respective currencies for implication of CRAR/Risk –weight

accordingly.

6.4 Fixed Asset Management System – (FAMS):- GSAD, Head Office has

:14

integrated FAMS with CBS and is operational in all respect. Statement of SFF

& MCC (PNB 263) as well as Schedule X, are to be generated through CBS

menu option FAMS RPT 8 (PNB 263 REMODELLED for SFF/MCC) & FAMS

12

RPT 15 (SCHEDULE – X) respectively. Further Sol-wise PNB 263 & Schedule

/20 19

X shall be placed in the morning checking report of respective sols by ITD HO.

Before sending the concerned Statements, offices are advised to ensure that

19

Opening balance as on 01.04.2018 as well as closing balances as on

/03 633

31.03.2019 are duly tallied with the balances conveyed by our Division. For any

other query, field functionaries may send email to fams@pnb.co.in. Please refer

chapter 9 for further details.

6.5 Annexure I, II, III and IV related to restructured accounts and template for

calculation of Diminution in Fair Value of restructured accounts would be

submitted online through CFA after being digitally signed by Statutory Branch

Auditors (SBA) and incumbent incharge where the Branches are under audit.

For branches which are not under audit, Annexure and Template are required

23

to be uploaded.

6.6 At the start of the audit at Branch, the Auditor is required to fill in certain details

e.g. name, membership no., FRN, UN number, GST number(if available),bank

account details etc under “Auditor’s Profile Registration” link of CBPMS.

Further, Auditor has to register his/her digital signature by clicking on “Auditor

Registration” link.The date on which auditor’s digital signature is registered in

CBPMS will be treated as date of commencement of audit. The report of

commencement of audit shall be made available to Circle Offices also. Circle

Office to ensure that all the auditors have registered their digital signature on

commencement of branch audit.

Note: As soon as auditor’s reach the branch they should immediately register their

Digital signature into CBPMS portal.

PNB-FD-HO-N Delhi Page 17

HEAD OFFICE, FINANCE DIVISION, SECTOR-10, DWARKA, NEW DELHI

Annexure-I

LIST OF SCHEDULED COMMERCIAL BANKS

List of Private Sector Banks in India List of Public Sector Banks in India

Sr. Sr.

Name of the Bank Name of the Bank

No No

1 Axis Bank Ltd. 1 Allahabad Bank

2 Bandhan Bank Ltd. 2 Andhra Bank

3 Catholic Syrian Bank Ltd. 3 Bank of Baroda

4 City Union Bank Ltd. 4 Bank of India

5 DCB Bank Ltd. 5 Bank of Maharashtra

6 Dhanlaxmi Bank Ltd. 6 Canara Bank

:14

7 Federal Bank Ltd. 7 Central Bank of India

8 HDFC Bank Ltd 8 Corporation Bank

9 ICICI Bank Ltd. 9 Dena Bank

10 IndusInd Bank Ltd 12 10 IDBI Bank Limited

11 IDFC Bank Ltd. 11 Indian Bank

/20 19

12 Jammu & Kashmir Bank Ltd. 12 Indian Overseas Bank

13 Karnataka Bank Ltd. 13 Oriental Bank of Commerce

14 Karur Vysya Bank Ltd. 14 Punjab & Sind Bank

19

/03 633

15 Kotak Mahindra Bank Ltd 15 Punjab National Bank

16 Lakshmi Vilas Bank Ltd. 16 State Bank of India

17 Nainital bank Ltd. 17 Syndicate Bank

18 RBL Bank Ltd. 18 UCO Bank

19 South Indian Bank Ltd. 19 Union Bank of India

20 Tamilnad Mercantile Bank Ltd. 20 United Bank of India

21 YES Bank Ltd. 21 Vijaya Bank

List of Local Area Banks (LAB)

22 Coastal Local Area Bank Ltd List of Financial Institutions in India

23

Sr.

23 Krishna Bhima Samruddhi LAB Ltd Name of the Bank

No

National Bank for Agriculture and

24 Subhadra Local Bank Ltd 1

Rural Development

List of Small Finance Banks (SFB) 2 Export-Import Bank of India

25 Au Small Finance Bank Ltd. 3 National Housing Bank

Small Industries Development

26 Capital Small Finance Bank Ltd 4

Bank of India

27 Fincare Small Finance Bank Ltd.

28 Equitas Small Finance Bank Ltd List of Regional Rural Banks in India

Sr.

29 ESAF Small Finance Bank Ltd. Name of the RRB

No.

Andhra Pradesh Grameena Vikas

30 Suryoday Small Finance Bank Ltd. 1

Bank

31 Ujjivan Small Finance Bank Ltd. 2 Andhra Pragathi Grameena Bank

Chaitanya Godavari Grameena

32 Utkarsh Small Finance Bank Ltd. 3

Bank

PNB-FD-HO-N Delhi Page 18

HEAD OFFICE, FINANCE DIVISION, SECTOR-10, DWARKA, NEW DELHI

33 North East Small finance Bank Ltd 4 Telengana Grameena Bank

34 Jana Small Finance Bank Ltd 5 Saptagiri Grameena Bank

List of Payments Banks (PB) 6 Arunachal Pradesh Rural Bank

35 Airtel Payments Bank Ltd 7 Assam Gramin Vikash Bank

36 India Post Payments Bank Ltd 8 Langpi Dehangi Rural Bank

37 FINO Payments Bank Ltd 9 Bihar Gramin Bank

38 Paytm Payments Bank Ltd 10 Madhya Bihar Gramin Bank

39 Aditya Birla Idea Payments Bank Ltd. 11 Uttar Bihar Gramin Bank

40 Jio Payments Bank Ltd 12 Chattisgarh Rajya Gramin Bank

41 NSDL Payments Bank Limited 13 Baroda Gujarat Gramin Bank

14 Dena Gujarat Gramin Bank

List of foreign banks having branch -

15 Saurashtra Gramin Bank

presence in India

Sr.

Name of the bank 16 Sarva Haryana Gramin Bank

No

Australia and New Zealand Banking

1 17 Himachal Pradesh Gramin Bank

Group Ltd.

:14

2 National Australia Bank 18 Ellaquai Dehati Bank

Jammu & Kashmir Grameen

3 Westpac Banking Corporation 19

Bank

4 Bank of Bahrain & Kuwait BSC 12 20 Jharkhand Gramin Bank

5 AB Bank Ltd. 21 Vananchal Gramin Bank

/20 19

6 Sonali Bank Ltd. % 22 Kaveri Grameena Bank

7 Bank of Nova Scotia 23 Karnataka Vikas Grameena Bank

19

Industrial & Commercial Bank of China

/03 633

8 24 Pragathi Krishna Gramin Bank

Ltd. #

9 BNP Paribas 25 Madhyanchal Gramin Bank

Credit Agricole Corporate & Investment

10 26 Narmada Jhabua Gramin Bank

Bank #

Central Madhya Pradesh Gramin

11 Societe Generale 27

Bank

12 Deutsche Bank 28 Vidharbha Konkan Gramin Bank

13 HSBC Ltd # 29 Maharashtra Gramin Bank

14 PT Bank Maybank Indonesia TBK 30 Manipur Rural Bank

15 Mizuho Bank Ltd. 31 Meghalaya Rural Bank

23

16 Sumitomo Mitsui Banking Corporation 32 Mizoram Rural Bank

17 The Bank of Tokyo- Mitsubishi UFJ, Ltd. 33 Nagaland Rural Bank ^

18 Cooperatieve Rabobank U.A. 34 Utkal Grameen bank

19 Doha Bank 35 Odisha Gramya Bank

20 Qatar National Bank SAQ 36 Puduvai Bharathiar Grama Bank

21 JSC VTB Bank 37 Malwa Gramin Bank

22 Sberbank 38 Punjab Gramin Bank

23 DBS Bank Ltd. 39 Sutlej Gramin Bank

Baroda Rajasthan Kshetriya

24 United Overseas Bank Ltd. 40

Gramin Bank

Rajasthan Marudhara Gramin

25 FirstRand Bank Ltd. 41

Bank

26 Shinhan Bank 42 Pallavan Grama Bank

27 Woori Bank 43 Pandyan Grama Bank

28 KEB Hana Bank 44 Tripura Gramin Bank

29 Industrial Bank of Korea # 45 Allahabad UP Gramin Bank

30 Bank of Ceylon 46 Gramin Bank of Aryavart

PNB-FD-HO-N Delhi Page 19

HEAD OFFICE, FINANCE DIVISION, SECTOR-10, DWARKA, NEW DELHI

31 Credit Suisse A.G 47 Baroda UP Gramin Bank

Kashi Gomti Samyut Gramin

32 CTBC Bank Co., Ltd. 48

Bank

33 Krung Thai Bank Public Co. Ltd. $ 49 Prathama Bank

34 Abu Dhabi Commercial Bank Ltd. 50 Purvanchal Bank

35 Mashreq Bank PSC 51 Sarva UP Gramin Bank

36 First Abu Dhabi Bank PJSC 52 Uttarakhand Gramin Bank

37 Emirates NBD Bank PJSC 53 Bangiya Gramin Vikas Bank

38 Barclays Bank Plc. 54 Paschim Banga Gramin Bank

Uttarbanga Kshetriya Gramin

39 Standard Chartered Bank 55

Bank

40 The Royal Bank of Scotland plc 56 Kerala Gramin Bank

41 American Express Banking Corp.

42 Bank of America

43 Citibank N.A.

44 J.P. Morgan Chase Bank N.A.

:14

12

/20 19

19

/03 633

23

PNB-FD-HO-N Delhi Page 20

HEAD OFFICE, FINANCE DIVISION, SECTOR-10, DWARKA, NEW DELHI

Annexure II

STATEMENTS/CERTIFICATES TO BE PREPARED BY BRANCHES FOR AUDIT

PURPOSE

1. All branches which ARE UNDER STATUTORY AUDIT AS ON 31.03.2019

will prepare copies of Certificate/Statement/Information as per details given

below in Table I, for submission to the branch auditors.

2. All branches/offices which are NOT UNDER STATUTORY AUDIT AS ON

31.03.2019 will prepare copies of Certificate/Statement/Information as per

details given below in Table II.

3. However, all branches i.e. both audited & un-audited will submit an

advance copy of ONLY following statements to their Circle Office by 4th

April, 2019:

:14

(i)Statement of SFF/MCC (PNB 263) (ii) Annexure-Impersonal Heads

(iii) Information related to Restructured Accounts

Based on the un-audited copies of the above mentioned statements, Circle

12

Offices will consolidate the data and in case of any discrepancies, will take up

/20 19

immediately with the branches so that corrections, if required may be carried

out, before submission of the same, to the statutory auditors .

19

/03 633

Table I:

Certificates/Statements/ Information to be submitted by Audited Branches

S. Particulars

No.

Two copies (Printout) of following statements / certificates to be prepared (One -

Branch & One - Statutory Branch Auditor (SBA))

23

1 B. Sheet (available in morning checking report) PNB –259

2 P&L A/c (available in morning checking report) PNB –260

3 Annexure-E (Containing information in respect of all advances) generated

through Ladder+.

4 Master Summary of Capital Adequacy Statement (generated through Ladder+)

- as per Basel-III.

Six copies (Printout) of following statements / certificates to be prepared (One -

Branch / One - SBA / One – SCA / One - Circle / One Finance Division / One -

Concerned HO Division)

5 Third Dispatch- Certificate related to Lending to Sensitive Sector and Maturity

Pattern of Borrowings Annexure PNB/CAD/AD/S-2, PNB/CAD/AD/S-3

PNB/PSFI/AD/S-7. (Refer Chapter-8)

PNB-FD-HO-N Delhi Page 21

HEAD OFFICE, FINANCE DIVISION, SECTOR-10, DWARKA, NEW DELHI

6 Statement of SFF/MCC PNB –263 (Refer Chapter 9).

7 Certificate of additional depreciation charged on account of impairment of assets

for the year ended 31.3.2019 – Annexure GSAD-1 (Refer Chapter 9)

8 Statement of Bank's own premises pending for registration/execution of title

deeds as on 31.03.2019 – Annexure GSAD-2 (Refer Chapter 9)

9 Statement of Contingent Liabilities (Refer Chapter 10 )

10 Certificate of Attendance- (Refer Chapter 12).

11 Claim for Interest Subvention on loans to SHGs (Refer Chapter 12).

12 Interest Subvention of additional 3% on loans to SHGs (Refer Chapter 12).

13 Central sector interest subsidy scheme on educaitonal loans to students

:14

belonging to economically weaker section (ews) for March quarter of scheme

year 2017-18 (Refer chapter 12).

Padho Pardesh-Statement on Interest subsidy claimed for the quarter ending

12

/20 19

December 2016 (Scheme Year: 2016-17). (Refer chapter 12).

Padho Pardesh-Statement on Interest subsidy claimed for the quarter ending

19

/03 633

March 2017 (Scheme Year: 2016-17). (Refer chapter 12).

Padho Pardesh-Statement on Interest subsidy claimed for the quarter ending

June 2017 (Scheme Year: 2017-18). (Refer chapter 12).

Padho Pardesh-Statement on Interest subsidy claimed for the quarter ending

September 2017 (Scheme Year: 2017-18) (Refer chapter 12).

Padho Pardesh-Statement on Interest subsidy claimed for the quarter ending

December 2017(Scheme Year: 2017-18). (Refer chapter 12).

23

Padho Pardesh-Statement on Interest subsidy claimed for the quarter ending

March 2018 (Scheme Year: 2017-18). (Refer chapter 12).

Padho Pardesh-Statement on Interest subsidy claimed for the quarter ending

June 2018 (Scheme Year: 2018-19). (Refer chapter 12).

Padho Pardesh-Statement on Interest subsidy claimed for the quarter ending

September 2018 (Scheme Year: 2018-19). (Refer chapter 12).

Padho Pardesh-Statement on Interest subsidy claimed for the quarter ending

December 2018 (Scheme Year: 2018-19). (Refer chapter 12).

Padho Pardesh-Statement on Interest subsidy claimed for all the quarters of FY

2013-14 (Scheme Year: 2013-14)-Left out Cases. (Refer chapter 12).

Padho Pardesh-Statement on Interest subsidy claimed for all the quarters of FY

PNB-FD-HO-N Delhi Page 22

HEAD OFFICE, FINANCE DIVISION, SECTOR-10, DWARKA, NEW DELHI

2014-15 (Scheme Year: 2014-15)-Left out Cases. (Refer chapter 12).

Padho Pardesh-Statement on Interest subsidy claimed for all the quarters of FY

2015-16 (Scheme Year: 2015-16)-Left out Cases. (Refer chapter 12).

Padho Pardesh-Statement on Interest subsidy claimed for all the quarters of FY

2016-17(Scheme Year: 2015-16)-Left out Cases. (Refer chapter 12).

Padho Pardesh-Statement on Interest subsidy claimed for all the quarters of FY

2017-18(Scheme Year: 2017-18)-Left out Cases. (Refer chapter 12).

Padho Pardesh-Statement on Interest subsidy claimed for all the quarters of FY

2018-19 (Scheme Year: 2018-19)-Left out Cases. (Refer chapter 12).

Certificate Regarding Claim Under Dr. Ambedkar Central Sector Scheme of

Interest Subsidy (ACSIS) for the students belonging to OBCs & EBCs for March

quarter of scheme year 2017-18. (Refer chapter 12).

:14

Certificate Regarding Claim Under Dr. Ambedkar Central Sector Scheme of

Interest Subsidy (ACSIS) for the students belonging to OBCs & EBCs for June

quarter scheme year 2018-19. (Refer chapter 12).

12

/20 19

Certificate Regarding Claim Under Dr. Ambedkar Central Sector Scheme of

Interest Subsidy (ACSIS) for the students belonging to OBCs & EBCs for Sep

19

/03 633

quarter scheme year 2018-19. (Refer chapter 12).

14 Interest Equalization Scheme on Rupee Export to the specified category of

Exporters for the period 01.04.18 to 31.03.19 (Refer Chapter 12).

15 Certificate for payment of premium to Deposit Insurance Corporation by bank-

Statement DI-01, DI-02 & work sheet (for Sep.2018 and March, 2019 half-year).

This certificate is also required to be filled in CFA and digitally signed. (Refer

Chapter 3 & 12).

23

16 Certificate FLCs/FLGs – To be filled in CBPMS also (Refer Chapter-12)

17 Country-wise Risk & Exposure (Only For Selected Branches)-(Refer Chapter-

12).

18 Annexure-Impersonal Heads for entries older than 1 year (Refer Chapter -12).

19 Certificate related to Disclosures on Unsecured Advances (Refer Chapter-

12).

20 Certificate related to Prime Minister’s Employment Generation Programme

(PMEGP) (Refer Chapter 12).

21 Certificate of Interest claims under TUFS-Non-SSI Sector (Refer Chapter 12).

Three copies (Printout) of following statements / certificates to be prepared (One

- Branch / One - SBA / One – Statutory Central Auditor (SCA)). Serial No. 22 to 25

are available in CBPMS and are to be digitally signed.

PNB-FD-HO-N Delhi Page 23

HEAD OFFICE, FINANCE DIVISION, SECTOR-10, DWARKA, NEW DELHI

22 Branch Auditor’s Report Digitally Signed.

MOCs if any are also to be submitted in CBPMS and are to be digitally signed.

23 Certificate pertaining to IRAC (NPA) norms- Digitally Signed (Refer Chapter 12)

24 Certificate pertaining to MOC entries for the previous year – Digitally Signed (Ref

Chapter 12).

25 Balance with Banks & Supplementary information for Basel III

PNB –270- Digitally Signed (Refer Chapter 12).

Three Copies (Printout) of following Certificates available in CBPMS (not to be

signed digitally) (S. No. 26 - 30) – Hard Copies generated from CBPMS to be

signed by SBA and Incumbent Incharge in audited branch

26 Certificate of Interest claims under TUFS-SSI Sector (Refer Chapter 12).

(Available in CBPMS)

:14

27 Certificate pertaining to DICGC Transactions (Refer Chapter 12).(Available in

CBPMS)

28 Certificate of Credit Linked Capital Subsidy Scheme

12 (Refer Chapter

12).(Available in CBPMS)

/20 19

29 Certificate of Compliance of Ghosh and Jilani Committee- (Refer Chapter 12).

(Available in CBPMS)

19

/03 633

30 CGTMSE Recovery Certificate (CGTMSE B) (Refer Chapter 12).(Available in

CBPMS)

Certificates available in CFA (new web application) to be digitally signed by

Incumbent Incharge / SBA.

31 Interest subvention on Short Term Crop Loan (to be digitally signed) (Refer

Chapter 12).

Interest subvention on Produce (Marketing) Loan (to be digitally signed) (Refer

23

Chapter 12).

Interest Subvention on KCC/ Short Term Crop Loans restructured (to be digitally

signed) (Refer Chapter 12).

Interest Subvention of additional 3% for short term crop loan (to be digitally

signed) (Refer Chapter 12).

32 LFAR (Refer Chapter 13)

31 Tax Audit Report (Refer Chapter 14)

33 Location Certificate (Selected Branches) * (At 3 locations only)

34 Annexure I, II, III, and IV related to Restructured Accounts and Template for

calculation of – Diminution in fair value for restructured accounts (Refer Chapter

12).

PNB-FD-HO-N Delhi Page 24

HEAD OFFICE, FINANCE DIVISION, SECTOR-10, DWARKA, NEW DELHI

*Securities/statement of holdings (in case of Treasury Division Securities held)

are located at the following 3 locations only (for rest of the branches Location

Certificate is NIL):

(i) BO: Bhikhaiji Cama Place, New Delhi

(ii) HO Treasury Division, Mumbai (Statement of Holdings-in case of

Venture Capital Funds, Mutual Funds)

(iii) Custodian SHCIL, Mumbai

Table II:

Certificates/Statements/ Information to be submitted by Unaudited Branches

S. Particulars

No.

One copy (Printout) of following statements / certificates to be prepared ( for

:14

their own record)

1 Balance Sheet (available in morning checking report) PNB –259

2 P&L A/c (available in morning checking report) PNB –260

12

3 Annexure-E (Containing information in respect of all advances) generated

/20 19

through Ladder+.

19

4 Master Summary of Cap. Adequacy Statement (generated through Ladder+)-

/03 633

as per Basel-III.

Three copies (Printout) of following statements / certificates to be prepared

(One - Branch/One – Circle/One – HO Division).

5 Third Dispatch- Certificate related to Lending to Sensitive Sector and Maturity

Pattern of Borrowings Annexure PNB/CAD/AD/S-2, PNB/CAD/AD/S-3

PNB/PSFI/AD/S-7 (Refer Chapter-8)

Statement of SFF/MCC PNB –263 (Refer Chapter 9).

23

6

7 Certificate of additional depreciation charged on account of impairment of

assets for the year ended 31.3.2019 – Annexure GSAD-1 (Refer Chapter 9)

8 Statement of Bank's own premises pending for registration/execution of title

deeds as on 31.03.2019 – Annexure GSAD-2 (Refer Chapter 9)

9 Statement of Contingent Liabilities (Refer Chapter 10 )

10 Claim for Interest Subvention on loans to SHGs. (Refer Chapter 12).

11 Interest Subvention of additional 3% on loans to SHGs (Refer Chapter 12).

12 Central sector interest subsidy scheme on educaitonal loans to students

belonging to economically weaker section (ews) for March quarter of scheme

year 2017-18 (Refer chapter 12).

PNB-FD-HO-N Delhi Page 25

HEAD OFFICE, FINANCE DIVISION, SECTOR-10, DWARKA, NEW DELHI

Padho Pardesh-Statement on Interest subsidy claimed for the quarter ending

December 2016 (Scheme Year: 2016-17). (Refer chapter 12).

Padho Pardesh-Statement on Interest subsidy claimed for the quarter ending

March 2017 (Scheme Year: 2016-17). (Refer chapter 12).

Padho Pardesh-Statement on Interest subsidy claimed for the quarter ending

June 2017 (Scheme Year: 2017-18). (Refer chapter 12).

Padho Pardesh-Statement on Interest subsidy claimed for the quarter ending

September 2017 (Scheme Year: 2017-18) (Refer chapter 12).

Padho Pardesh-Statement on Interest subsidy claimed for the quarter ending

December 2017(Scheme Year: 2017-18). (Refer chapter 12).

Padho Pardesh-Statement on Interest subsidy claimed for the quarter ending

March 2018 (Scheme Year: 2017-18). (Refer chapter 12).

:14

Padho Pardesh-Statement on Interest subsidy claimed for the quarter ending

June 2018 (Scheme Year: 2018-19). (Refer chapter 12).

12

Padho Pardesh-Statement on Interest subsidy claimed for the quarter ending

/20 19

September 2018 (Scheme Year: 2018-19). (Refer chapter 12).

Padho Pardesh-Statement on Interest subsidy claimed for the quarter ending

19

/03 633

December 2018 (Scheme Year: 2018-19). (Refer chapter 12).

Padho Pardesh-Statement on Interest subsidy claimed for all the quarters of

FY 2013-14 (Scheme Year: 2013-14)-Left out Cases. (Refer chapter 12).

Padho Pardesh-Statement on Interest subsidy claimed for all the quarters of

FY 2014-15 (Scheme Year: 2014-15)-Left out Cases. (Refer chapter 12).

Padho Pardesh-Statement on Interest subsidy claimed for all the quarters of

FY 2015-16 (Scheme Year: 2015-16)-Left out Cases. (Refer chapter 12).

23

Padho Pardesh-Statement on Interest subsidy claimed for all the quarters of

FY 2016-17(Scheme Year: 2015-16)-Left out Cases. (Refer chapter 12).

Padho Pardesh-Statement on Interest subsidy claimed for all the quarters of

FY 2017-18(Scheme Year: 2017-18)-Left out Cases. (Refer chapter 12).

Padho Pardesh-Statement on Interest subsidy claimed for all the quarters of

FY 2018-19 (Scheme Year: 2018-19)-Left out Cases. (Refer chapter 12).

Certificate Regarding Claim Under Dr. Ambedkar Central Sector Scheme of

Interest Subsidy (ACSIS) for the students belonging to OBCs & EBCs for

March quarter of scheme year 2017-18. (Refer chapter 12).

Certificate Regarding Claim Under Dr. Ambedkar Central Sector Scheme of

Interest Subsidy (ACSIS) for the students belonging to OBCs & EBCs for June

PNB-FD-HO-N Delhi Page 26

HEAD OFFICE, FINANCE DIVISION, SECTOR-10, DWARKA, NEW DELHI

quarter scheme year 2018-19. (Refer chapter 12).

Certificate Regarding Claim Under Dr. Ambedkar Central Sector Scheme of

Interest Subsidy (ACSIS) for the students belonging to OBCs & EBCs for Sep

quarter scheme year 2018-19. (Refer chapter 12).

13 Interest Equalization Scheme on Rupee Export to the specified category of

Exporters for the period 01.04.18 to 31.03.19 (Refer Chapter 12).

14 Certificate for payment of premium to Deposit Insurance Corporation by bank-

Statement DI-01, DI-02 & work sheet (for Sep.2018 and March, 2019 half-

year). This certificate is also required to be filled in CFA and digitally signed.

(Refer Chapter 3 & 12).

15 Certificate FLCs/FLGs – To be filled in CBPMS also (Refer Chapter-12)

16 Country-wise Risk & Exposure (Only For Selected Branches)-(Refer Chapter-

:14

12).

17 Annexure-Impersonal Heads for entries older than 1 year (Refer Chapter -12).

18 Certificate related to Disclosures on Unsecured Advances (Refer Chapter-

12

12).

/20 19

19 Certificate related to Prime Minister’s Employment Generation Programme

(PMEGP) (Refer Chapter 12).

19

/03 633

20 Certificate of Interest claims under TUFS-Non-SSI Sector (Refer Chapter 12).

Certificates available in CBPMS (not to be signed digitally) (S. No. 21-28) –

Three Hard Copies (One – Branch / One - Circle / One - Concerned HO Division)

generated from CBPMS to be signed by Incumbent Incharge and to be

submitted to circle office.

21 Certificate pertaining to IRAC (NPA) norms- (Refer Chapter 12)

22 Certificate pertaining to MOC entries for the previous year (Refer Chapter 12)

23

23 Balance with Banks & Supplementary information for Basel III

PNB –270- Digitally Signed (Refer Chapter 12).

24 Certificate of Interest claims under TUFS-SSI Sector (Refer Chapter 12).

(Available in CBPMS)

25 Certificate pertaining to DI&CGC Transactions (Refer Chapter 12).(Available

in CBPMS)

26 Certificate of Credit Linked Capital Subsidy Scheme (Refer Chapter

12).(Available in CBPMS)

27 Certificate of Compliance of Ghosh and Jilani Committee- (Refer Chapter 12).

(Available in CBPMS)

28 CGTMSE Recovery Certificate (CGTMSE A). (Refer Chapter 12).(Available

in CBPMS)

PNB-FD-HO-N Delhi Page 27

HEAD OFFICE, FINANCE DIVISION, SECTOR-10, DWARKA, NEW DELHI

Certificates available in CFA (new web application) to be signed by Incumbent

Incharge.

29 Interest subvention on Short Term Crop Loan (to be digitally signed) (Refer

Chapter 12).

Interest subvention on Produce (Marketing) Loan (to be digitally signed)

(Refer Chapter 12).

Interest Subvention on KCC/ Short Term Crop Loans restructured (to be

digitally signed) (Refer Chapter 12).

Interest Subvention of additional 3% for short term crop loan (to be digitally

signed) (Refer Chapter 12).

30 Tax Audit Report

31 Annexure I, II, III, and IV related to Restructured Accounts and Template for

calculation of – Diminution in fair value for restructured accounts (Refer

Chapter 12).

:14

************************************************************************************************

12

/20 19

In most of the branches, there is nothing to report in respect of the following

statements - (Chapter 12)- (a) DICGC Transactions (b) TUFS - SSI Sector (c)

19

Credit Linked Capital Subsidy Scheme

/03 633

Hence a consolidated NIL statement is introduced in CBPMS. If nothing is to be

reported in a particular statement marks NIL against it. However, those branches

who have to report under any or all of the above statement may mention that

statement is annexed. Printout of NIL and the reported statement be taken out

for the required number of copies and got signed by the Incumbent Incharge

and the Statutory Branch Auditor before submitting it to Circle office for

onward submission to Head Office.

23

PNB-FD-HO-N Delhi Page 28

HEAD OFFICE, FINANCE DIVISION, SECTOR-10, DWARKA, NEW DELHI

CHAPTER-2: ROLE OF BRANCHES & CIRCLE OFFICES

1. Branches must contact their Circle Office (CO) in case no communication

is received about name and address of the Statutory Branch Auditor by 26th

March, 2019.

2. It must be ensured that Audit of the branch commences positively on or

before 2nd April, 2019 and branches must ensure to inform CO

immediately. Auditors be allowed to start audit on the strength of

appointment letter issued by Finance Division, HO, bearing PA No. of the

authorized signatories.

3. Do prepare sufficient number of copies (refer Annexure-II, Chapter-1) for

certification by the auditors and ensure that Statutory Branch Auditors certify

all the required statements/certificates including LFAR and Tax Audit report

and any other information as per HO guidelines.

Set of return for the Statutory Central Auditor Firm to be sent at

:14

following address:

M/s _____________________ (Name of the SCA Firm)

Punjab National Bank 12

Head Office, Finance Division (East Wing, 1st Floor)

/20 19

Sector-10, Dwarka

19

New Delhi-110075.

/03 633

4. No alteration/rectification is to be made on the returns already submitted to

Circle Office. Any change, if required, is to be suggested only through an

MOC (Memorandum of Changes).

5. Ensure early completion of audit and receipt of audit reports from statutory

auditors and for this:

5.1 It is desirable that Incumbent Incharge and other officials associated

with audit, do not avail leave till the audit is completed.

23

5.2 If desired by the auditors, Incumbent should make available latest Inspection

Report, previous Statutory Audit Report, Long Form Audit Report, Revenue

Audit Report, RBI Inspection Report, Concurrent Audit Report, previous

period’s MOC details, Acknowledgement of TDS return etc. to Statutory

Auditors. All these reports must be kept ready with the Incumbent In-charge.

5.3 The Incumbent should personally attend to the Auditors as well as their

queries and furnish them desired information so as to avoid any observation/

qualification by the Auditors not based on the facts. In case of any difficulty,

branches should contact respective COs, for their guidance and instructions.

Auditors have also been requested to discuss the observations/queries etc.

with the Incumbent In-charge before incorporating in the Report.

5.4 All MOCs are required to be discussed and finalized at branch level or at the

most CO level. NO MOC WILL BE DISCUSSED AT HO LEVEL.

5.5 Branches must ensure that all relevant information/records are kept ready for

the auditors to finalize Tax Audit & LFAR, along-with the branch audit.

PNB-FD-HO-N Delhi Page 29

HEAD OFFICE, FINANCE DIVISION, SECTOR-10, DWARKA, NEW DELHI

6. DO NOT ALLOW ANY ADVANCE AGAINST FEE, TA/DA, Hotel Bill etc. TO

THE AUDITORS.

7. Do ensure that Certificate of Attendance complete in all respect is issued to

the Auditors, only after completion of Audit/LFAR/Tax Audit. A copy of the

certificate issued, be sent to Circle office immediately on completion of Audit

for processing and payment of their TA/DA bill. In no case, any blank

certificate is to be signed.

8. All the IT Service Desks at Circle Offices to inform the concurrent auditors of

the branches wherever posted to share their user ID and password with the

statutory auditors visiting the branches. In respect of the branches where

concurrent auditors are not posted, 3rd user_id be created by IT Service Desk

at Circle Office in the name of DB user of the branch with Application name

as ‘IN’ and workclass of ‘200’ and the same be provided to the statutory

auditors with ‘Read’ access only. Once the task is completed by the statutory

auditors, the concurrent auditors sharing their user_id should change their

password and the IT Service Desk would also delete the 3 rd user_id created

:14

for the purpose.

9. COs must maintain proper follow up with the Auditors and branches/offices.

12

/20 19

19

/03 633

23