Академический Документы

Профессиональный Документы

Культура Документы

Managerial Accounting

Загружено:

Sharmaine Clemencio00 оценок0% нашли этот документ полезным (0 голосов)

119 просмотров7 страницManAcc

Оригинальное название

Managerial-Accounting

Авторское право

© © All Rights Reserved

Доступные форматы

DOCX, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документManAcc

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

119 просмотров7 страницManagerial Accounting

Загружено:

Sharmaine Clemencio0ManAcc

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 7

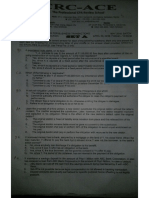

the following except

1 Which of the following statements is false?

A. At zero production level, fixed costs is also A. the mathematical calculations are relatively

zero. complex.

B. At zero production level, fixed costs are B. the high and low activity levels may not be

positive. representative.

C. At zero production level, variable costs are C. only two observations are used to develop

usually zero. the cost function.

D. At zero production level, total costs equal D. the method does not detect if the cost

total fixed costs. behavior is nonlinear.

2. NTQ, Inc.’s net sales in 1996 were 15% below the 7. Matias Corporation wishes to market a new

1995 level. NTQ’s semi-variable costs would product for P12.00 a unit. Fixed costs to manufacture

A. Increase in total and increase as a this product are P800,000 for less than 500,000 units

percentage of net sales. and P1,200,000 for 500,000 or more units.

B. Increase in total, but decrease as a Contribution margin is 20%. How many units must be

percentage of net sales. sold to realize a net income from this product of

C. Decrease in total, but increase as a P500,000?

percentage of net sales. A. 433,333 C. 666,667

D. Decrease in total and decrease as a B. 500,000 D. 708,333

percentage of net sales. 8. Singsing, Inc. manufactures and sells key

3. If the coefficient of correlation between two rings embossed with college names and slogans.

variables is zero, how might a scatter diagram of Last year, the key rings sold for P75 each, and the

these variables appear? variable costs to manufacture them were P22.50 per

A. Random points. unit. The company needed to sell 20,000 key rings to

B. A least squares line that slopes up to the break-even. The net income last year was P50,400.

right. The company expects the following for the coming

C. A least squares line that slopes down to the year:

right. The selling price of the key rings will be P90.

D. Under this condition a scatter diagram could Variable manufacturing costs per unit will

not be plotted on a graph. increase by one-third.

4. The relevant range is Fixed costs will increase by 10%.

A. a relatively wide range of sales where all The income tax rate will remain unchanged.

costs remain the same For the company to break-even the coming year, the

B. a relatively wide range of sales where total company should sell

variable costs remain the same A. 2,600 units. C. 21,250 units.

C. a relatively narrow range of production where B. 19,250 units. D. 21,600 units.

total variable costs remain the same 9. Wheels Corp. employs 45 sales personnel to

D. a relatively wide span of production where market its sedan cars. The average car sells for

total fixed costs are expected to remain the P690,000 and a 6% commission is paid to the sales

same person. It is considering changing the scheme to a

5. Saints Co. sells three chemicals: Simpol, Plutex, commission arrangement that would pay each person

and Coplex. Simpol is the most profitable product a package of P30,000 plus a commission of 2% of the

while Coplex is the least profitable. Which one of sales made by the person. The amount of total

the following events will definitely decrease the monthly car sales at which Wheels Corp. would be

firm’s overall B.E.P. for the upcoming accounting indifferent (answer may be rounded off) as to which

period? plan to select is

A. A decrease in Coplex’s selling price. A. P22,500,000 C. P36,500,000

B. An increase in Simpol raw materials cost. B. P33,750,000 D. P45,000,000

C. An increase in the overall market of Plutex. 10. A company manufactures a single product for

D. An increase in anticipated sales of Simpol its customers by contracting in advance of production.

relative to the sales of Plutex and Coplex. Thus, the company produces only units that will be

6. Weaknesses of the high-low method include all of

sold by the end of each period. For the last period, earned, operating profits must

the following data were available: A. Increase under the variable costing method.

Sales $40,000 B. Decrease under the variable costing method.

Direct materials 9,050 C. Increase under the absorption costing

Direct labor 6,050 method.

Rent (9/10 factory, 1/10 office) 3,000 D. Decrease under the absorption costing

Depreciation on factory equipment 2,000 method.

Supervision (2/3 factory, 1/3 office) 1,500 15. Both Company Y and Company Z produce

Salespeople’s salaries 1,300 similar products that need negligible

Insurance (2/3 factory, 1/3 office) 1,200 distribution costs. Their assets operation and

Office supplies 750 accounting are very similar in all respects

Advertising 700 except that Company Y uses direct costing

Depreciation on office equipment 500 and Company Z uses absorption costing.

Interest on loan 300 A. Co. Z would report a higher net income than

The gross profit margin percentage (rounded) was Co. Y for the years in which production

A. 34% C. 44% equals sales

B. 41% D. 46% B. Co. Y would report a higher inventory value

11. The change in period-to-period operating than Co. Z for the years in which production

income when using variable costing can be explained exceeds sales

by the change in the C. Co. Z would report a higher inventory value

A. Unit sales level multiplied by the unit than Co. Y for the years in which production

sales price. exceeds sales

B. Unit sales level multiplied by a D. Co. Y would report a higher inventory value

constant unit contribution margin. than Co. Z for the years in which production

C. Finished goods inventory level exceeds the normal or practical capacity

multiplied by the unit sales price. Questions 16 through 18 are based on the following

12. To apply direct costing method it is information.

necessary that you know The following information is available for X Co. for its

A. Variable and fixed cost related to first year of operations:

production Sales in units 5,000

B. Controllable and uncontrollable cost Production in units 8,000

of production

C. Contribution margin and break even

point in production Manufacturing costs:

D. Standard production rate and times Direct labor $3 per unit

of production elements Direct material 5 per unit

13. Jansen, Inc. pays bonuses to its managers Variable overhead 1 per unit

based on operating income. The company uses Fixed overhead $100,000

absorption costing, and overhead is applied on the Net income (absorption method) $30,000

basis of direct labor hours. To increase bonuses, Sales price per unit $40

Jansen’s managers may do all of the following except

A. Produce those products requiring 16. What would X Co. have reported as its

the most direct labor. income before income taxes if it had used variable

B. Defer expenses such as costing?

maintenance to a future period. A. ($30,000) C. $30,000

C. Decrease production of those items B. ($7,500) D. $67,500

requiring the most direct labor.

D. Increase production schedules 17. What was the total amount of SG&A expense

independent of customer demands incurred by X Co.?

14. If unit costs remain unchanged and sales volume A. $6,000 C. $36,000

and sales price per unit both increase from the B. $30,000 D. $62,500

preceding period when operating profits were

18. Based on variable costing, what would X Co. 22. All of the following are nonunit-based activity

show as the value of its ending inventory? drivers EXCEPT

A. $24,000 C. $64,500 A. number of direct labor hours C. number of

B. $27,000 D. $120,000 material moves

18. Traditional overhead allocations result in B. number of inspections D. number of setups

which of the following situations? 23. The primary difference between a fixed (static)

A. The resulting allocations cannot be used for budget and a variable (flexible) budget is that a

financial reports. fixed budget:

B. Overhead costs are assigned as period costs A. includes only fixed costs; while variable

to manufacturing operations. budget includes only variable costs

C. Low-volume products are assigned too much, B. cannot be changed after the period begins;

and high-volume products are assigned too while a variable budget can be changed after

little overhead. the period begins

D. High-volume products are assigned too much C. is concerned only with future acquisitions of

overhead, and low-volume products are fixed assets; while a variable budget is

assigned too little overhead. concerned with expenses that vary with sales

19. Which of the following is NOT a sign of poor cost D. is a plan for a single level of sales (or other

data? measure of activity); while a variable budget

A. The company seems to have a highly consists of several plans, one for each of

profitably niche all to itself. several levels of sales (or other measure of

B. Customers don’t balk at price increases for activity)

low-volume products. 24. Which of the following term is best identified

C. Competitors’ prices for low-volume products with a system of standard cost?

appear much too high. A. Contribution approach.

D. Competitors’ prices for high-volume products B. Management by exception.

appear much too high. C. Marginal costing.

20. Activity-based costing and generally accepted D. Standard accounting system.

accounting principles differ in that ABC 25. A company using very tight standards in a

A. does not define product costs in the same standard cost system should expect that

manner as GAAP. A. No incentive bonus will be paid

B. cannot be used to compute an income B. Most variances will be unfavorable

statement, but GAAP can. C. Employees will be strongly motivated to

C. information is useful only to managers, while attain the standard

GAAP information is useful to all D. Costs will be controlled better than if lower

organizational stakeholders. standards were used

D. is concerned only with costs generated from 26. For the doughnuts of McDonut Co. the

automated processes, but GAAP is Purchasing Manager decided to buy 65,000 bags

concerned with costs generated from both of flour with a quality rating two grades below that

manual and automated processes. which the company normally purchased. This

21. If activity-based costing is implemented in an purchase covered about 90% of the flour

organization without any other changes being requirement for the period. As to the material

effected, total overhead costs will variances, what will be the likely effect?

A. remain constant and simply be spread over A. B. C. D.

products differently. Price Favorabl Favorable Unfavorabl No effect

B. be reduced because of the elimination of varian e e

non-value-added activities. ce

C. be reduced because organizational costs will Usage Favorabl Unfavorable Favorable Unfavorabl

not be assigned to products or services. varian e e

D. be increased because of the need for ce

additional people to gather information on 27. The journal entry to record the direct materials

cost drivers and cost pools. quantity variance may be recorded

A. Only when direct materials are purchased

B. When inventory is taken at the end of the savings on this design work?

year. A. $300,000 savings. C. $500,000 savings.

C. Only when direct materials are issued to B. $500,000 overrun. D. $700,000 overrun.

production

D. Either (A) or (C)

28. Hankies Unlimited has a signature scarf for ladies 31. An effective management by objectives (MBO)

that is very popular. Certain production and marketing program can increase organizational

data are indicated below: effectiveness. Which of the following contributes

Cost per yard of cloth P36.00 to an effective MBO program?

Allowance for rejected scarf 5% of production A. Emphasis on "should do" rather than "must

Yards of cloth needed per scarf0.475 yard do" objectives.

Airfreight from supplier P0.60/yard B. Objectives that are quantified, clearly

Motor freight to customers P0.90 /scarf measurable, and state target dates for

Purchase discounts from supplier 3% completion.

Sales discount to customers 2% C. Managers who hold their subordinates strictly

The allowance for rejected scarf is not part of the 0.475 accountable for achieving their objectives

yard of cloth per scarf. Rejects have no market value. precisely as they have been written.

Materials are used at the start of production. D. All of the answers are correct.

Calculate the standard cost of cloth per scarf that Hankies 32. All of the following are elements of responsibility

Unlimited should use in its cost sheets. accounting except

A. P16.87 C. P17.76 A. Control reports.

B. P17.30 D. P18.21 B. Chart of accounts classification.

29. To improve productivity, ST. MICHAEL Corp. C. Responsibility center definition.

instituted a bonus plan where employees are paid D. Planning systems and systemic approaches.

75% of the time saved when production performance 33. Among the management accounting concepts is

exceeds the standard level of production. The controllability which means (3)

company computes the bonus on the basis of four- A. Accounting information must be of such

week periods. The standard production is set at 3 quality that confidence can be placed in it.

units per hour. Each employee works 37 hours per B. Management accounting must ensure that

week, and the wage rate is P24 per hour. Below are flexibility is maintained in assembling and

data for one 4-week period: interpreting information.

Weekly Production (Units) C. It is necessary at all times to identify the

Employe 1st 2nd responsibilities and key result areas of the

e individuals within the organization.

ALAN 107 100 D. Management accounting identified elements

JOEL 104 110 or activities which management can or

ROMY 108 112 cannot influence, and seeks to arrest risks

TONY 123 120 and sensitivity factors.

34. In a decentralized company in which divisions

The employee who had the inconsistent performance may buy goods from one another, the transfer-

(sometimes performing below standard) but got a pricing system should be designed primarily to

bonus is A. Increase in the consolidated value of

A. Alan = P36 bonus. C. Romy = inventory.

P126 bonus. B. Allow division managers to buy from

B. Joel = P54 bonus. D. Tony = outsiders.

P252 bonus. C. Minimize the degree of autonomy of division

30. A defense contractor for a government space managers.

project has incurred $2,500,000 in actual design D. Aid in the appraisal and motivation of

costs to date for a guidance system whose total managerial performance.

budgeted design cost is $3,000,000. If the design 35. Division P of Turbo Corporation has the capacity

phase of the project is 60% complete, what is the for making 75,000 wheel sets per year and

amount of the contractor's current overrun or regularly sells 60,000 each year on the outside

market. The regular sales price is $100 per wheel false?

set, and the variable production cost per unit is A. Planning and control are the essential

$65. Division Q of Turbo Corporation currently features of the budgeting process

buys 30,000 wheel sets (of the kind made by B. Capital expenditures budget shows the

Division P) yearly from an outside supplier at a availability of idle cash for investment

price of $90 per wheel set. If Division Q were to C. Budgeting provides a measuring device to

buy the 30,000 wheel sets it needs annually from which subsequent performances are

Division P at $87 per wheel set, the change in compared and evaluated.

annual net operating income for the company as D. Budget preparation is not the sole

a whole, compared to what it is currently, would responsibility of any one department and is

be: prepared by combining the efforts of many

A. $135,000. C. $600,000. individuals

B. $225,000. D. $750,000.

36. Among the costs relevant to a make-or-buy 41. This budgeting system places the burden of proof

decision include variable manufacturing costs as well on the manager to justify authority to spend any

as money whether or not there was spending in the

A. Avoidable fixed costs. C. Real estate taxes. previous period. Different ways of performing the

B. Plant depreciation. D. Unavoidable costs. same activity and different levels of effort for the

37. If a firm is at full capacity, the minimum special activity is evaluated. This system is called

order price must cover A. Budgeting by alternatives.

A. variable costs associated with the special B. Budgeting by responsibility and authority.

order C. Scenario budgeting.

B. variable and incremental fixed costs D. Zero-based budgeting.

associated with the special order 42. For a company that does not have resource

C. variable and fixed manufacturing costs limitations in what sequence would the budgets

associated with the special order be prepared?

D. variable costs and incremental fixed costs 1. cash budget 4. production budgets

associated with the special order plus 2. sales budget 5. purchase budgets

foregone contribution margin on regular units 3. inventory budgets

not produced A. sequence 2, 3, 4,1 and 5

E. both B and D. B. sequence 2, 3, 4, 5 and 1

38. An increase in direct fixed costs could reduce all C. sequence 2, 4, 3, 5 and 1

of the following except D. sequence 4, 3, 2, 1 and 5

A. corporate net income. C. product line operating

income. 43. Pera Inc. prepared the following sales budget

B. product line contribution margin. D. product line Month Cash Sales Credit

segment margin. Sales

39. Bolsa Co. estimates that 60,000 special zipper February P 80,000 P

will be used in the manufacture of industrial bags 340,000

during the next year. Sure Zipper Co. has quoted March 100,000 400,000

a price of P6 per zipper. Bolsa would prefer to April 90,000 370,000

purchase 5,000 units per month but Sure is May 120,000 460,000

unable to guarantee this delivery schedule. In June 110,000 380,000

order to ensure the availability of these zippers, Collections are 40% in the month of sale, 45% in the

Bolsa is considering the purchase of all 60,000 month following the sale, and 10% two months

units at the beginning of the year. Assuming that following the sale. The remaining 5% is expected to

Bolsa can invest cash at 12%, the company’s be uncollectible. The company’s total budgeted

opportunity cost of purchasing the 60,000 units collection from April to June amounts to

are the beginning of the year is A. P1,090,250 C. P1,397,500

A. P19,800 C. P39,600 B. P1,325,500 D. P1,468,500

B. P21,600 D. P43,200 44. How are financial ratios used in decision making?

40. In budgeting, which of the following statements is

A. They remove the uncertainty of the business A. Cost of capital. C. Time value of money.

environment. B. Different life of projects. D. Uncertainty.

B. They aren’t useful because decision making is too 51. In capital budgeting decisions, the following items

complex. are considered among others:

C. They give clear signals about the appropriate 1. Cash outflow for the investment.

action to take. 2. Increase in working capital requirements.

D. They can help identify the reasons for success and 3. Profit on sale of old asset

failure in business, but decision making requires 4. Loss on write-off of old asset.

information beyond the ratios. For which of the above items would taxes be

45. When a balance sheet amount is related to an relevant?

income statement amount in computing a ratio, A. Items 1 and 3 only. C. Items 3 and 4 only.

A. Comparisons with industry ratios are not B. Items 1, 3 and 4 only. D. All items.

meaningful.

B. The balance sheet amount should be Problem 52 and 53 are based on the following

converted to an average for the year. information.

C. The income statement amount should be Daneche’s, a tax-exempt entity, plans to purchase a

converted to an average for the year. new machine which they project to depreciate over a

D. The ratio loses its historical perspective ten-year period without salvage value. The new

because a beginning-of-the-year amount is machine will cost P200,000 and is expected to

combined with an end-of-the-year amount. generate cash savings of P60,000 per year in

Questions 46 thru 49 are based on the following operating costs. Daneche's cost of capital is 12%.

information. For ten periods at 12%, the present value of P1 is

You are requested to reconstruct the accounts of P0.3220, while the present value of an ordinary

Angela Trading for analysis. The following data were annuity of P1 is P5.650.

made available to you: 52. What is the net present value of the proposed

Gross margin for 19x8 investment, assuming Daneche uses a 12% discount

Ending balance of merchandise inventory rate?

A. P69,980 C. P185,640

Total stockholders’ equity as of December 31, B. P139,000 D. None of the above.

19x8 53. With the company’s initial investment on the

Gross margin ratio new machine, the accounting rate of return is

Debt to equity ratio A. 15% C. 25%

Times interest earned B. 20% D. None of the above.

Quick ratio 54. The Nativity Corporation has the following

Ratio of operating expenses to sales investment opportunities:

Long-term liabilities consisted of bonds payable Proposa Profitability Index Initial

with interest rate of 20% l Cash

Based on the above information, Outlay

46. What was the operating income for 19x8? 1 1.15 P200,000

A. P205,550 C. P229,500 2 1.13 125,000

B. P243,500 D. P472,500 3 1.11 175,000

47. How much was the bonds payable? 4 1.08 150,000

A. P114,750 C. P370,500 The firm has a budget constraint of P300,000.

B. P200,750 D. P400,000 What proposal(s) should be accepted?

48. Total current assets would amount to A. Proposal 4 because it has the

A. P580,000 C. P780,000 lowest profitability index.

B. P630,825 D. P930,825 B. Proposal 1 because it has the

49. Total current liabilities would amount to highest profitability index.

A. P485,250 C. P600,000 C. Proposals 1 and 2 because their

B. P550,000 D. P714,750 total net present values are the highest

50. Which of the following best identifies the among all possible proposal combinations.

reason for using probabilities in capital budgeting is

D. Proposals 2 and 3 because their that maximize profits or minimize costs.

total net present values are the highest 60. The calculation of reasonable probabilities

among all possible proposal combinations. about the future, based on the analysis of all the latest

55. Cost of capital is relevant information by tested and logically sound

A. The amount the company must pay for its statistical and economic techniques, and applied in

plant assets. terms of an executive’s personal judgement and

B. The dividends a company must pay on its knowledge of his business is

equity securities. A. Budgeting

C. The cost the company must incur to obtain its B. Business forecasting

capital resources. C. Planning and control

D. The cost the company is charged by D. Project feasibility studies

investment bankers who handle the issuance

of equity or long-term debt securities.

56. The pre-tax cost of capital is higher than the after-

tax cost of capital because

A. interest expense is deductible for tax

purposes.

B. the cost of capital is a deductible expense for

tax purposes.

C. principal payments on debt are deductible for

tax purposes.

D. dividend payments to stockholders are

deductible for tax purposes.

57. The market value of a firm’s outstanding common

shares will be higher, everything else equal, if

A. Investors expect lower dividend growth.

B. Investors have a lower required return on

equity.

C. Investors have longer expected holding

periods.

D. Investors have shorter expected holding

periods.

58. A quantitative technique used for selecting

the combination of resources that maximize profits or

minimize costs is

A. Curvilenear analysis C. Linear programming

B. Dynamic programming D. Queuing theory

59. Which of the following statements is the least

pertinent to the Project Evaluation Review

Technique (PERT)

A. It is a system, which uses network analysis

and critical path methods.

B. It is more useful for analyzing the

interrelationships of time and activities to

discover potential bottlenecks.

C. It involves measuring progress in relation to

schedule, evaluating changes to schedule,

forecasting future progress and predicting

and controlling costs.

D. Time is a primary consideration and this

technique is particularly suite for problems,

which involve the combination of resources

Вам также может понравиться

- CVP Exercises ReviewerДокумент2 страницыCVP Exercises Reviewerdaniellejueco1228Оценок пока нет

- Cost AccountingДокумент8 страницCost AccountingKim Nicole ReyesОценок пока нет

- Managerial Economics - Midterm Assignment No. 1 (CVP Analysis)Документ5 страницManagerial Economics - Midterm Assignment No. 1 (CVP Analysis)Ronel CaagbayОценок пока нет

- AE22 ChapterTest 4 6 - AnswerKeyДокумент6 страницAE22 ChapterTest 4 6 - AnswerKeyElrey IncisoОценок пока нет

- Quizzer - Cost Volume Profit AnalysisДокумент8 страницQuizzer - Cost Volume Profit AnalysisJethro Gutlay100% (3)

- PrelimQ2 - CVP Analysis AnsKeyДокумент7 страницPrelimQ2 - CVP Analysis AnsKeyaira atonОценок пока нет

- Strategic Cost Management Coordinated Quiz 1Документ7 страницStrategic Cost Management Coordinated Quiz 1Kim TaehyungОценок пока нет

- Cost-Volume-Profit & Breakeven Analysis QuizДокумент7 страницCost-Volume-Profit & Breakeven Analysis QuizNaddieОценок пока нет

- Module 3 Cost Volume Profit Analysis NA PDFДокумент4 страницыModule 3 Cost Volume Profit Analysis NA PDFMadielyn Santarin Miranda50% (2)

- PDF Rq1 With AnswersДокумент9 страницPDF Rq1 With AnswersCaleb GetubigОценок пока нет

- Differences Between Absorption Costing and Variable Costing MethodsДокумент11 страницDifferences Between Absorption Costing and Variable Costing MethodsSevastian jedd EdicОценок пока нет

- MANAGEMENT ADVISORY SERVICESДокумент16 страницMANAGEMENT ADVISORY SERVICESEnola HolmesОценок пока нет

- Manila Cavite Laguna Cebu Cagayan de Oro DavaoДокумент6 страницManila Cavite Laguna Cebu Cagayan de Oro Davaovane rondinaОценок пока нет

- Mas 3Документ9 страницMas 3Krishia GarciaОценок пока нет

- Ace 202Документ4 страницыAce 202bacad lyca jaynОценок пока нет

- CVP Analysis Multiple ChoiceДокумент5 страницCVP Analysis Multiple ChoiceHeinie Joy PauleОценок пока нет

- AC and VC Quiz SolutionДокумент5 страницAC and VC Quiz SolutionLevi Ackerman100% (1)

- Nfjpia Nmbe MS 2017 AnsДокумент9 страницNfjpia Nmbe MS 2017 AnsMicka EllahОценок пока нет

- Mock Reviewer in Management AccountingДокумент6 страницMock Reviewer in Management AccountingJA VicenteОценок пока нет

- Process CostingДокумент6 страницProcess Costingbae joohyun0% (2)

- Test Bank - Mgt. Acctg 2 - CparДокумент16 страницTest Bank - Mgt. Acctg 2 - CparChristian Blanza LlevaОценок пока нет

- CVP AnalysisДокумент3 страницыCVP AnalysiszairaОценок пока нет

- Midterm - Set AДокумент8 страницMidterm - Set ACamille GarciaОценок пока нет

- Quizzer CVPДокумент7 страницQuizzer CVPReese KimОценок пока нет

- ACCCA107 Sample Exam Key PointsДокумент7 страницACCCA107 Sample Exam Key PointsShaira Mae E. PacisОценок пока нет

- College of Business Administration and Accountancy Management Advisory Services I Pre-Final ExamДокумент3 страницыCollege of Business Administration and Accountancy Management Advisory Services I Pre-Final ExamVel JuneОценок пока нет

- Managerial Accounting Relevant Costing Decision MakingДокумент10 страницManagerial Accounting Relevant Costing Decision MakingGenalin Muaña EbonОценок пока нет

- Cost Volume Profit AnalysisДокумент9 страницCost Volume Profit AnalysisIce Voltaire Buban GuiangОценок пока нет

- Mas MockboardДокумент12 страницMas MockboardReynaldo corpuzОценок пока нет

- Costing methods and analysisДокумент15 страницCosting methods and analysisJames Louis BarcenasОценок пока нет

- Acca107 Preliminary ExaminationДокумент16 страницAcca107 Preliminary ExaminationNicole Anne Santiago SibuloОценок пока нет

- Masquerade (Regional Eliminations)Документ5 страницMasquerade (Regional Eliminations)Ayvee BlanchОценок пока нет

- Lyceum-Northwestern University: L-NU AA-23-02-01-18Документ8 страницLyceum-Northwestern University: L-NU AA-23-02-01-18Amie Jane MirandaОценок пока нет

- Strategic Cost Management Midterm ExamДокумент6 страницStrategic Cost Management Midterm Examrizzamaybacarra.birОценок пока нет

- CVP Excersise and ProjectsДокумент6 страницCVP Excersise and ProjectsbikilahussenОценок пока нет

- REO Winding-up May 2022 Management AdvisoryДокумент16 страницREO Winding-up May 2022 Management AdvisoryCovi LokuОценок пока нет

- Pinnacle First PB PDFДокумент125 страницPinnacle First PB PDFJSОценок пока нет

- CVP analysis and variable costingДокумент7 страницCVP analysis and variable costingIris FenelleОценок пока нет

- E. All of The Above. A. Total Revenue Equals Total CostДокумент22 страницыE. All of The Above. A. Total Revenue Equals Total CostNicole KimОценок пока нет

- Pamantasan ng Cabuyao Cost-Volume-Profit Analysis Long QuizДокумент10 страницPamantasan ng Cabuyao Cost-Volume-Profit Analysis Long QuiztanginamotalagaОценок пока нет

- Strategic Cost Management Midterm ExaminationДокумент9 страницStrategic Cost Management Midterm ExaminationJohn FloresОценок пока нет

- 1.4 Quizzer - CVP and Breakeven AnalysisДокумент6 страниц1.4 Quizzer - CVP and Breakeven AnalysisXyril MañagoОценок пока нет

- Reviewer # 3Документ5 страницReviewer # 3christannaviktoriaОценок пока нет

- Ms Quiz 2 Bsact Sir DДокумент5 страницMs Quiz 2 Bsact Sir DJustin Miguel IniegoОценок пока нет

- Cvpprac ExamДокумент4 страницыCvpprac ExamGwy PagdilaoОценок пока нет

- Bep and CVP Analysis Ms. NaparotaДокумент4 страницыBep and CVP Analysis Ms. Naparotarichelle ann rodriguezОценок пока нет

- Reviewer Acctg 11Документ9 страницReviewer Acctg 11ezraelydanОценок пока нет

- Mas Midterm 2020Документ5 страницMas Midterm 2020rodell pabloОценок пока нет

- Fill in The Blanks by Using The Words or Phrases Given BelowДокумент8 страницFill in The Blanks by Using The Words or Phrases Given BelowhokageОценок пока нет

- PrelimA2 - CVP AnalysisДокумент8 страницPrelimA2 - CVP AnalysishppddlОценок пока нет

- Cost Behavior AnalysisДокумент2 страницыCost Behavior AnalysisJocelyn ManuyagОценок пока нет

- Variable Costing ReviewerДокумент3 страницыVariable Costing Reviewerdaniellejueco1228Оценок пока нет

- CVP AssignmentДокумент5 страницCVP AssignmentAccounting MaterialsОценок пока нет

- Model Exit Exam of Cost & Managerial CostДокумент10 страницModel Exit Exam of Cost & Managerial Costnewaybeyene5Оценок пока нет

- Quiz1 - SET AДокумент8 страницQuiz1 - SET ACee Garcia100% (1)

- Abs and VarДокумент7 страницAbs and VarChloe Chiong50% (2)

- Cost Volume Profit AnalysisДокумент18 страницCost Volume Profit AnalysisLea GaacОценок пока нет

- Beyond Earnings: Applying the HOLT CFROI and Economic Profit FrameworkОт EverandBeyond Earnings: Applying the HOLT CFROI and Economic Profit FrameworkОценок пока нет

- A to Z Cost Accounting Dictionary: A Practical Approach - Theory to CalculationОт EverandA to Z Cost Accounting Dictionary: A Practical Approach - Theory to CalculationОценок пока нет

- Partnership TaxДокумент3 страницыPartnership TaxSharmaine Clemencio0Оценок пока нет

- 2010-2015 Tax Bar Based On The 2015 Bar Syllabus PDFДокумент124 страницы2010-2015 Tax Bar Based On The 2015 Bar Syllabus PDFNin BAОценок пока нет

- MacroExam2SelfTest AnswersДокумент9 страницMacroExam2SelfTest AnswersIves LeeОценок пока нет

- Acc8fsconso Sdoa2019Документ5 страницAcc8fsconso Sdoa2019Sharmaine Clemencio0Оценок пока нет

- Taxation of Income and CompensationДокумент5 страницTaxation of Income and CompensationSharmaine Clemencio0Оценок пока нет

- 2010 - 2015 - Income Tax PDFДокумент31 страница2010 - 2015 - Income Tax PDFExequielCamisaCrusperoОценок пока нет

- WrapUpProcedure CompletingTheAuditДокумент6 страницWrapUpProcedure CompletingTheAuditSharmaine Clemencio0Оценок пока нет

- GRP3Документ4 страницыGRP3Heinie Joy PauleОценок пока нет

- Audit SamplingДокумент14 страницAudit SamplingSharmaine Clemencio0Оценок пока нет

- MC Sampling MethodsДокумент2 страницыMC Sampling MethodsHeinie Joy PauleОценок пока нет

- Law On Sales and Agency CPARДокумент12 страницLaw On Sales and Agency CPARChristian Blanza LlevaОценок пока нет

- 4 - Audit of InvestmentsДокумент11 страниц4 - Audit of InvestmentsSharmaine Clemencio0Оценок пока нет

- Albano NegoДокумент9 страницAlbano NegoCELRennОценок пока нет

- Acc8fsconso Sdoa2019Документ5 страницAcc8fsconso Sdoa2019Sharmaine Clemencio0Оценок пока нет

- 4 - Audit of InvestmentsДокумент11 страниц4 - Audit of InvestmentsSharmaine Clemencio0Оценок пока нет

- Partnership essentials under 40 charsДокумент26 страницPartnership essentials under 40 charskat perezОценок пока нет

- 7 Review 2019 2020 Audit Objectives Proc. Evidence DocumentationДокумент5 страниц7 Review 2019 2020 Audit Objectives Proc. Evidence DocumentationSharmaine Clemencio0Оценок пока нет

- Consolidated Income and Equity Method CalculationДокумент3 страницыConsolidated Income and Equity Method CalculationSharmaine Clemencio0Оценок пока нет

- Business Law Testbanks / ReviewersДокумент32 страницыBusiness Law Testbanks / ReviewersPutoy Itoy100% (1)

- BLT Quizzer (Unknown) - Law On Negotiable InstrumentsДокумент7 страницBLT Quizzer (Unknown) - Law On Negotiable InstrumentsJasper Ivan PeraltaОценок пока нет

- BLT Quizzer (Unknown) - Law On Negotiable InstrumentsДокумент7 страницBLT Quizzer (Unknown) - Law On Negotiable InstrumentsJasper Ivan PeraltaОценок пока нет

- Albano NegoДокумент9 страницAlbano NegoCELRennОценок пока нет

- Business Law Preboard FinalДокумент7 страницBusiness Law Preboard Finalxxxxxxxxx100% (1)

- CRC RFBT Final Preboard May 2018Документ14 страницCRC RFBT Final Preboard May 2018Sharmaine Clemencio0Оценок пока нет

- Af201 Revision Package s1, 2021Документ4 страницыAf201 Revision Package s1, 2021Rachna ChandОценок пока нет

- Management Accounting CLCДокумент165 страницManagement Accounting CLCGiang MaОценок пока нет

- Problems SCMДокумент16 страницProblems SCMMohit ShahОценок пока нет

- Hotel Development Cost Survey 2014/15 highlights rising construction costsДокумент12 страницHotel Development Cost Survey 2014/15 highlights rising construction costsJose Miguel GonzalezОценок пока нет

- CH 11Документ25 страницCH 11Emmanuel TeoОценок пока нет

- Model Exit Exam of Cost & Managerial CostДокумент10 страницModel Exit Exam of Cost & Managerial Costnewaybeyene5Оценок пока нет

- Inventories - Key Accounting ConceptsДокумент5 страницInventories - Key Accounting ConceptsMary Claudette UnabiaОценок пока нет

- Bbe 2103 (Cost Accounting) Lecture Notes (Topic 3 - Process Costing)Документ16 страницBbe 2103 (Cost Accounting) Lecture Notes (Topic 3 - Process Costing)SAMSON OYOO OTUKENEОценок пока нет

- Imp Question Cost Accounting 3rd YearДокумент4 страницыImp Question Cost Accounting 3rd YearNancy JainОценок пока нет

- Cost Sheet of AmulДокумент7 страницCost Sheet of AmulKhushi DaveОценок пока нет

- Sap SapДокумент313 страницSap SapVenu Undavilli75% (4)

- Chapter 2 Cost AcctngДокумент10 страницChapter 2 Cost AcctngJustine Reine CornicoОценок пока нет

- Management AccountingДокумент223 страницыManagement Accountingcyrus100% (2)

- Answer Key Bacostmx-3tay2021-Finals Quiz 2Документ8 страницAnswer Key Bacostmx-3tay2021-Finals Quiz 2Marjorie Nepomuceno100% (1)

- PAC Proses PDFДокумент100 страницPAC Proses PDFAdnan FirdausОценок пока нет

- Cost & Management Accounting - MGT402 Power Point Slides Lecture 22Документ10 страницCost & Management Accounting - MGT402 Power Point Slides Lecture 22AnsariRiazОценок пока нет

- Atswa Cost AccountingДокумент504 страницыAtswa Cost AccountingIbrahim MuyeОценок пока нет

- Decision Making Using Cost Concept and CVP AnalysisДокумент7 страницDecision Making Using Cost Concept and CVP AnalysisRitesh Kumar DubeyОценок пока нет

- Pricing and Costing Manilyn E. AbaquitaДокумент29 страницPricing and Costing Manilyn E. AbaquitaApple Allyssah ComabigОценок пока нет

- Cost Accounting Chapter 10Документ66 страницCost Accounting Chapter 10Reshyl HicaleОценок пока нет

- Accounting 16 Final Exam ReviewДокумент11 страницAccounting 16 Final Exam ReviewAndrea Florence Guy VidalОценок пока нет

- Pressed 703 1015Документ313 страницPressed 703 1015GokulОценок пока нет

- Managerial Accounting Chapter 1 Exercises SolutionsДокумент12 страницManagerial Accounting Chapter 1 Exercises SolutionsDarrianAustinОценок пока нет

- 9.1 Objective 9.1: Chapter 9 Inventory Costing and Capacity AnalysisДокумент76 страниц9.1 Objective 9.1: Chapter 9 Inventory Costing and Capacity AnalysisMayank AgarwalОценок пока нет

- 15 Guidance Notes On Standard CostingДокумент49 страниц15 Guidance Notes On Standard Costingbcpl_nishikantОценок пока нет

- CMA April - 14 Exam Question - P-1Документ12 страницCMA April - 14 Exam Question - P-1MasumHasanОценок пока нет

- Singeten Fresh-Corner Business Plan for Ambo EthiopiaДокумент24 страницыSingeten Fresh-Corner Business Plan for Ambo EthiopiaAboma Mekonnen100% (3)

- The Cost of Security Risk Management For Ngos: Eisf ReportДокумент36 страницThe Cost of Security Risk Management For Ngos: Eisf ReportbenardОценок пока нет

- FNSACC507 Provide Management Accounting InformationДокумент13 страницFNSACC507 Provide Management Accounting InformationSyed Bilal AliОценок пока нет

- Chapter 11 Relevant Costing ExercisesДокумент3 страницыChapter 11 Relevant Costing ExercisesNCT100% (1)