Академический Документы

Профессиональный Документы

Культура Документы

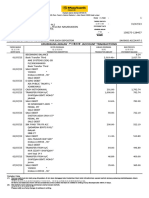

AFN CorpFin Erdhardt

Загружено:

Vinita VermaОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

AFN CorpFin Erdhardt

Загружено:

Vinita VermaАвторское право:

Доступные форматы

Chapter 14 Problems

1. Baxter Video Products’ sales are expected to increase from $5 million in 2007 to $6

million in 2008 or by 20%. Its assets totaled $3 million at the end of 2007. Baxter is at

full capacity, so its assets must grow at the same rate as projected sales. At the end of

2007, current liabilities were $1 million, consisting of $250,000 of accounts payable,

$500,000 of notes payable, and $250,000 of accruals. The after-tax profit margin is

forecasted to be 5%, and the forecasted payout ratio is 70%. Use the AFN formula to

forecast Baxter’s additional funds needed for the coming year.

AFN = (A*/S0)∆S - (L*/S0)∆S - MS1(1 - d)

$3,000,000 $500,000

= $1,000,000 - $1,000,000 - 0.05($6,000,000)(1 - 0.7)

$5,000,000 $5,000,000

= (0.6)($1,000,000) - (0.1)($1,000,000) - ($300,000)(0.3)

= $600,000 - $100,000 - $90,000

= $410,000.

4. Bannister Legal Services generated $2.0 million in sales during 2007, and its yearend

total assets were $1.5 million. Also, at year-end 2007, current liabilities were $500,000,

consisting of $200,000 of notes payable, $200,000 of accounts payable, and $100,000 of

accruals. Looking ahead to 2008, the company estimates that its assets must increase by

75 cents for every $1 increase in sales. Bannister’s profit margin is 5%, and its payout

ratio is 60%. How large a sales increase can the company achieve without having to raise

funds externally?

S2007 = $2,000,000; A2007 = $1,500,000; CL2007 = $500,000;

NP2007 = $200,000; A/P2007 = $200,000; Accruals2007 = $100,000;

PM = 5%; d = 60%; A*/S0 = 0.75.

AFN = (A*/S0)∆S - (L*/S0)∆S - MS1(1 - d)

$300,000

= (0.75)∆S - ∆S -(0.05)(S1)(1 - 0.6)

$2,000,000

= (0.75)∆S - (0.15)∆S - (0.02)S1

= (0.6)∆S - (0.02)S1

= 0.6(S1 - S0) - (0.02)S1

= 0.6(S1 - $2,000,000) - (0.02)S1

= 0.6S1 - $1,200,000 - 0.02S1

$1,200,000 = 0.58S1

$2,068,965.52 = S1.

Sales can increase by $2,068,965.52 - $2,000,000 = $68,965.52 without additional

funds being needed.

5. At year-end 2007, total assets for Bertin Inc. were $1.2 million and accounts payable

were $375,000. Sales, which in 2007 were $2.5 million, are expected to increase by 25%

in 2008. Total assets and accounts payable are proportional to sales, and that relationship

will be maintained. Bertin typically uses no current liabilities other than accounts

payable. Common stock amounted to $425,000 in 2007, and retained earnings were

$295,000. Bertin plans to sell new common stock in the amount of $75,000. The firm’s

profit margin on sales is 6%; 40% of earnings will be paid out as dividends.

a. What was Bertin’s total debt in 2007?

b. How much new, long-term debt financing will be needed in 2008? (Hint:

AFN _ New stock _ New long-term debt.) Do not consider any financing feedback

effects

Total liabilities Accounts Long - term Common Retained

a. .

and equity Payable debt stock earnings

$1,200,000 = $375,000 + Long-term debt + $425,000 + $295,000

Long-term debt = $105,000.

Total debt = Accounts payable + Long-term debt

= $375,000 + $105,000 = $480,000.

Alternatively,

Total

Total debt = liabilities - Common stock - Retained earnings

and equity

= $1,200,000 - $425,000 - $295,000 = $480,000.

b. Assets/Sales (A*/S) = $1,200,000/$2,500,000 = 48%.

L*/Sales = $375,000/$2,500,000 = 15%.

2006 Sales = (1.25)($2,500,000) = $3,125,000.

AFN = (A*/S)(∆S) - (L*/S)(∆S) - MS1(1 - d) - New common stock

= (0.48)($625,000) - (0.15)($625,000) - (0.06)($3,125,000)(0.6) - $75,000

= $300,000 - $93,750 - $112,500 - $75,000 = $18,750.

Alternatively, using the percentage of sales method:

Forecast

Basis % Additions (New

2007 2008 Sales Financing, R/E) Pro

Forma

Total assets $1,200,000 0.48

$1,500,000

Current liabilities $ 375,000 0.15 $ 468,750

Long-term debt 105,000 105,000

Total debt $ 480,000 $ 573,750

Common stock 425,000 75,000* 500,000

Retained earnings 295,000 112,500** 407,500

Total common equity $ 720,000 $ 907,500

Total liabilities

and equity $1,200,000

$1,481,250

AFN = Long-term debt = $ 18,750

*Given in problem that firm will sell new common stock = $75,000.

**PM = 6%; Payout = 40%; NI2008 = $2,500,000 x 1.25 x 0.06 = $187,500.

Addition to RE = NI x (1 - Payout) = $187,500 x 0.6 = $112,500

6. The Booth Company’s sales are forecasted to increase from $1,000 in 2007 to $2,000

in 2008. Here is the December 31, 2007, balance sheet:

Cash $100 Accounts payable $50

Accounts receivable $200 Notes payable $150

Inventories $200 Accruals $50

Net fixed assets $500 Long-term debt $400

Common stock $100

Retained earnings $250

Total assets $1,000 Total liabilities and equity $1,000

Booth’s fixed assets were used to only 50% of capacity during 2007, but its current assets

were at their proper levels. All assets except fixed assets increase at the same rate as

sales, and fixed assets would also increase at the same rate if the current excess capacity

did not exist. Booth’s after-tax profit margin is forecasted to be 5%, and its payout ratio

will be 60%. What is Booth’s additional funds needed (AFN) for the coming year?

Cash $ 100.00 2 = $ 200.00

Accounts receivable 200.00 2 = 400.00

Inventories 200.00 2 = 400.00

Net fixed assets 500.00 + 0.0 = 500.00

Total assets $1,000.00 $1,500.00

Accounts payable $ 50.00 2 = $ 100.00

Notes payable 150.00 150.00 + 360.00 = 510.00

Accruals 50.00 2 = 1 00.00

Long-term debt 400.00 400.00

Common stock 100.00 100.00

Retained earnings 250.00 + 40 = 290.00

Total liabilities

and equity $1,000.00 $1,140.00

AFN $ 360.00

Capacity sales = Sales/0.5 = $1,000/0.5 = $2,000.

Target FA/S ratio = $500/$2,000 = 0.25.

Target FA = 0.25($2,000) = $500 = Required FA. Since the firm currently has

$500 of fixed assets, no new fixed assets will be required.

Addition to RE = M(S1)(1 - Payout ratio) = 0.05($2,000)(0.4) = $40.

Вам также может понравиться

- Bond Pricing ActarialДокумент45 страницBond Pricing ActarialVinita VermaОценок пока нет

- Brealey. Myers. Allen Chapter 22 TestДокумент11 страницBrealey. Myers. Allen Chapter 22 TestShaikh Junaid100% (1)

- Prac TVM SolДокумент7 страницPrac TVM SolMikaela Dela CruzОценок пока нет

- Alibaba FCFEДокумент62 страницыAlibaba FCFEVinita VermaОценок пока нет

- CH 11 - CF Estimation Mini Case Sols Word 1514edДокумент13 страницCH 11 - CF Estimation Mini Case Sols Word 1514edVinita VermaОценок пока нет

- Chap7 GlobalBondInvesting Solutions PDFДокумент36 страницChap7 GlobalBondInvesting Solutions PDFVinita VermaОценок пока нет

- Binomial 2stepДокумент10 страницBinomial 2stepVinita VermaОценок пока нет

- PP 11Документ8 страницPP 11Abhishek RamОценок пока нет

- Binomial 2stepДокумент10 страницBinomial 2stepVinita VermaОценок пока нет

- Chapter 17 Questions V1Документ4 страницыChapter 17 Questions V1lyellОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- Fixed Assets ManagementДокумент62 страницыFixed Assets ManagementBâlãjï BālûОценок пока нет

- 72825cajournal Feb2023 22Документ4 страницы72825cajournal Feb2023 22S M SHEKARОценок пока нет

- Simulates Midterm Exam. IntAcc1 PDFДокумент11 страницSimulates Midterm Exam. IntAcc1 PDFA NuelaОценок пока нет

- Choose Letter of The Correct Answer.Документ3 страницыChoose Letter of The Correct Answer.Peng GuinОценок пока нет

- Shane and AssociatesДокумент2 страницыShane and AssociatesCheryl MountainclearОценок пока нет

- IRCTC Next Generation ETicketing SystemДокумент1 страницаIRCTC Next Generation ETicketing SystemsureshОценок пока нет

- Stephanie Calamba and Allan Brillantes SolutionДокумент6 страницStephanie Calamba and Allan Brillantes SolutionGerald RamiloОценок пока нет

- Ebook-Forextrading-Hq DERIVДокумент86 страницEbook-Forextrading-Hq DERIVMtashu100% (1)

- WWW Yourarticlelibrary ComДокумент5 страницWWW Yourarticlelibrary ComDhruv JoshiОценок пока нет

- IAS 36 - Impairment of Assets - 2020Документ17 страницIAS 36 - Impairment of Assets - 2020ayman el-saidОценок пока нет

- CPA REVIEW SCHOOL FINANCIAL RATIO ANALYSISДокумент16 страницCPA REVIEW SCHOOL FINANCIAL RATIO ANALYSISZein SkyОценок пока нет

- Company Act, 2013-1 PDFДокумент101 страницаCompany Act, 2013-1 PDFAakash JohnsОценок пока нет

- Super Secret Tax DocumentДокумент4 страницыSuper Secret Tax Documentk11235883% (6)

- FMV Magic Timber CaseДокумент6 страницFMV Magic Timber CaseEdward Berbari100% (1)

- 2013 Valuation OlympiadДокумент4 страницы2013 Valuation OlympiadAbhishek Puri0% (1)

- M2U SA 128457 Jul 2023Документ5 страницM2U SA 128457 Jul 2023syafiqah.mohdali38Оценок пока нет

- PT INDOFOOD CBP SUKSES MAKMUR TBK DAN ENTITAS ANAKNYAДокумент3 страницыPT INDOFOOD CBP SUKSES MAKMUR TBK DAN ENTITAS ANAKNYARama fauziОценок пока нет

- NEGOTIABLE INSTRUMENT LAW-NotesДокумент5 страницNEGOTIABLE INSTRUMENT LAW-NotesGhrace Segundo CocalОценок пока нет

- CryptoSoulz Lessons Cheat SheetДокумент38 страницCryptoSoulz Lessons Cheat SheetBintang PradanaОценок пока нет

- 2 Financial Reporting Theory UpdatedДокумент52 страницы2 Financial Reporting Theory UpdatedSiham OsmanОценок пока нет

- DSWD NCR Audit Program Semi ExpendablesДокумент4 страницыDSWD NCR Audit Program Semi ExpendablesAnn MarinОценок пока нет

- Stamp Duty Rules ExplainedДокумент3 страницыStamp Duty Rules ExplainedSausan SaniaОценок пока нет

- Investor Prospectus QuinateДокумент9 страницInvestor Prospectus QuinateRichard WestermannОценок пока нет

- Cambridge International Examinations Cambridge International General Certificate of Secondary EducationДокумент20 страницCambridge International Examinations Cambridge International General Certificate of Secondary EducationAung Zaw HtweОценок пока нет

- Unit I Introduction To Marketing FinanceДокумент3 страницыUnit I Introduction To Marketing Financerajesh laddhaОценок пока нет

- Financial ManagementДокумент96 страницFinancial ManagementAngelaMariePeñarandaОценок пока нет

- Pairs Trading Cointegration ApproachДокумент82 страницыPairs Trading Cointegration Approachalexa_sherpyОценок пока нет

- Genealogy ReportДокумент2 страницыGenealogy Reportzhaodonghk3Оценок пока нет

- 2016 April ResumeДокумент2 страницы2016 April Resumeapi-308709576Оценок пока нет

- HJR 192.original 1933 06 05Документ4 страницыHJR 192.original 1933 06 05WeberSteve90% (79)