Академический Документы

Профессиональный Документы

Культура Документы

The Analysis Regarding The Financial Ratios To

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

The Analysis Regarding The Financial Ratios To

Авторское право:

Доступные форматы

Volume 5, Issue 3, March – 2020 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

The Analysis Regarding the Financial Ratios to

Assess the Government Finance Performance at

Serang City on the Budget Year Periods of 2014-2018

Kevin Bukhari Gilang Arsyad Ramadhan

Student of Magister Management, Perbanas Institute Alumni of Economic and Business, Bina Bangsa University

Jakarta, Indonesia Serang, Indonesia

Abstract:- This research was intended to find out the The Ratio analysis of the regional budget must be

Regional Financial Independence ratio, PAD done to improve the quality of regional financial

Effectiveness Ratio and Capital Expenditure Ratio in management, besides increasing the quantity of regional

Financial Performance of Serang City Government for finance Management, ratio analysis to APBD realization

the 2014-2018 fiscal year period. This research methods could be used also as a tool to assess the effectiveness of

that have been used was the descriptive qualitative regional autonomy because of this policy which provide the

method with the data used came from the financial flexibility for regional governments to manage its finances

statements of Serang City office 2014-2018 period of so it should be able to improve the regional financial

year. The results of this research is the Regional performance itself.

Financial Independence Ratio from 2014 to 2018 which

has an average of 10.24% with very low criteria, the Regional Financial Independence Ratio has Shown

PAD Effectiveness Ratio from 2014 to 2018 has an that the capability level of an area to self-financing

average of 113.206% with very effective criteria, the the government activities, development and Provide the

ratio Harmony of Capital Expenditures from 2014 to good service to people who paid off the taxes and levies as

2018 has an average of 17.99% in the mismatched source of income whom needed by the region. The

category. Financial Independence Ratio Regions could be seen by the

amount of Local own-source revenue compared to other

Keywords:- Financial Ratios, Financial Performance. sources regional revenue (Transfer Income) such as: Profit

sharing tax, Profit sharing not from the natural resource

I. INTRODUCTION taxes, general fund allocation and special allocation,

emergency funds and loans.

A. Background of the Problems

Law Number 32 of 2004 was concerning about the The Effectiveness Ratios could be describe as the

Regional Government and Law Number 33 of 2004 was ability of local governments in realizing the long term

concerning about Financial Balance between the Central planned of local revenue compared to the target is

and Regional governments has huge impacts on the determined based on the real potential of the region. The

implementation of autonomy area. The Regional Effectiveness related with the level of success of an

Government was given the authority and obligation to carry operation in the public sector so that an activity which said

out the various government activities more independently, to be effective if the activity has a large influence on the

Including the optimizing financial management in ability to provide community service which is

particular management regarding the regional income. predetermined goals.

The Measurement of financial performance for public The congeniality ratio could describes how the local

benefit can be used as a basis for assessing government prioritized the allocation of funds for routine

the performance, namely to assess success or not an and development with optimally. The higher the percentage

organization of programs or activities other than that it of fundsWhich allocated for Routine Expenditures means

could also used as a benchmark to improving performance, the percentage of Investment Expenditures (Expenditures

especially financial local government in the next period. Development) which used to provide facilities and

There is regional autonomy resulting in the decentralization infrastructure people's economy tends to get smaller.

of the government system in Serang City, therefore the City

of Serang as the party entrusted with the task run the B. Problems Identification

wheels of government, development and community Based on the background whose described above, the

service must be submit financial accountability reports of identification of problems that writer found as its follows:

the region to be assessed whether the Serang City The addiction of Serang City regional government

Government has successfully carried out its duties properly towards the subsidies which provide by Central and

or not. provincial government as seen from the greater Regions

income compared to Local own-source Revenue (PAD).

IJISRT20MAR325 www.ijisrt.com 912

Volume 5, Issue 3, March – 2020 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

The role of the central government is more dominant regarding submitting the financial statement as form of

than the independence of the government area which liability .

reflected by the amount of transfer revenue from central

and Provincial Government. B. Local Government Financial Ratios

Lack of the regional capacity to explore the potential

sources of income As local own-source revenue it could Local Financial Independence Ratio (RKKD)

be seen as the smaller local own-source revenue (PAD) The Local Financial Independence Ratio (RKKD) has

compared to the total of Regional Income. shown the level of the ability for a region to finance its own

government activities , the development and assisted to

C. The Research Purposed people who have paid off the taxes and levies as a source of

To find out the independence ratio of financial income whom needed by the region. The local Financial

performance at Serang City Government Independence Ratio has indicated by the magnitude of

To find out the effectiveness ratio of financial Local Own-source Revenues and compared to the

performance at Serang City Government Regional Revenues which are comes from the other sources

To find out the balance ratio of capita; expenditure to (transfer income) such as: Tax revenue sharing, Non-tax

financial performance at Serang City Government revenue sharing, natural resources, general allocation funds

and special allocations, emergency funds and loans.

II. THEORETICAL STUDY

The formula that used to calculate the Independent Ratio is:

A. Local Government Financial Report 𝑃𝐴𝐷

The definition of financial statements in which 𝐼𝑛𝑑𝑒𝑝𝑒𝑛𝑑𝑒𝑛𝑐𝑒 𝑅𝑎𝑡𝑖𝑜 = × 100%

𝑇𝑟𝑎𝑛𝑓𝑒𝑟 𝐼𝑛𝑐𝑜𝑚𝑒

contained on the explanation Law Number 8 of 2006 that Source: Mahmudi (2016:140)

concern about the Financial Report and Performance of

Government Institute based on article 1 paragraph 1, Local Financial Independence Ratio has illustrates the

which form of accountability for managing the State and local dependence to Transfer Income (data source by

regional finances for one year period. external). The higher the Local Financial Independence

Ratio implies that the level of local dependence on aid

Based on the government regulation No. 71 of 2010 external parties are getting lower and vice versa. Local

which concern about the Standards of Government Financial Independence ratio also illustrates the level of

Accounting, the local government financial statements are community participant in regional development. As a guide

structured reports of financial position and transactions to seeing the pattern of relationships with regional

which conducted by a entity report staff. The entity report capabilities (from the financial side) could be describe as

is a unit of government which consisted of one or more the following table was presented:

compliant accounting entities based on the rules of the govt

Financial Ability Independence (%) Relationship Pattern

Very Low 0% -25% Instructive

Low 25%-50% Consultative

Medium 50%-75% Participatory

High 75%-100% Delegative

Table 1:- The Patterns related and The Levels of Local Ability

Source: Mahmudi (2016:140)

PAD Effectiveness Ratio 𝑃𝐴𝐷 𝑅𝑒𝑎𝑙𝑖𝑧𝑎𝑡𝑖𝑜𝑛

PAD Effectiveness Ratio illustrates the ability of 𝐸𝑓𝑓𝑒𝑐𝑡𝑖𝑣𝑖𝑡𝑦 𝑅𝑎𝑡𝑖𝑜 = × 100%

𝑃𝐴𝐷 𝑃𝑙𝑎𝑛𝑛𝑒𝑑

government regions in realizing the PAD that have Source: Mahmudi (2016:141)

been planned compared to the targets set based on the real

potential of the region. The more higher the PAD The Local governments were said to be able to carry

Effectiveness Ratio, the better the local government's out their duties if the ratio was achieved at least 1 or 100

performance. The formula that used to calculate the PAD percent. But the higher the ratio Effectiveness means the

Effectiveness Ratio is: ability of the region was getting better. in order to obtained

the better size this ratio needs to be accompanied by an

efficiency ratio. The government has compiled the research

guidelines for effectiveness the regional finances as it

follows:

IJISRT20MAR325 www.ijisrt.com 913

Volume 5, Issue 3, March – 2020 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

Effectiveness Criteria Percentage of Effectiveness (%)

Very Effective > 100

Effective > 90-100

Effective Enough > 80-90

Less Effective > 60-80

Not Effective < 60

Table 2:- Local Financial Effectiveness Criteria

The Balance Capital Expenditures Ratio economic infrastructure tends to get smaller. Simply, the

The Balance Ratio describes how the local balance ratio can be formulated as follows:

government prioritized the allocation of funds to Routine

and Development optimally. The higher the percentage of 𝑇ℎ𝑒 𝑡𝑜𝑡𝑎𝑙 𝑜𝑓 𝐶𝑎𝑝𝑖𝑡𝑎𝑙 𝐸𝑥𝑝𝑒𝑛𝑠𝑒𝑠

funds which allocated for routine expenditure means the 𝐶𝐸𝑅 = × 100%

𝑇ℎ𝑒 𝑡𝑜𝑡𝑎𝑙 𝑜𝑓 𝐿𝑜𝑐𝑎𝑙 𝐸𝑥𝑝𝑒𝑛𝑠𝑒𝑠

percentage of Investment Expenditures (Development Source of Mahmudi (2016:163)

Expenditures) used to provide the facilities and community

Balance Capital Criteria Percentage (%)

Mismatched 0% - 20%

Less Matched 20% - 40%

Fair Matching 40% - 60%

Matched 60% - 80%

So Matched 80% - 100%

Table 3:- The Criteria for Evaluating the Performance of Balance Capital Expenditures

Source: Mahmudi (2016:163)

III. RESEARCH METHODS In Year 2014

97,827,597,434

The analytical method that used in this research was × 100% = 11,2%

873,460,253,533

the analysis descriptive qualitative, which defined as

research that produces the descriptive data in form of In Year 2015

written words. The descriptive research method approach 111,062,806,774

the qualitative research by using data or document research × 100% = 11,2%

918,745,599,190

techniques, observations and interviews. The Research In Year 2016

analysis of content or document has specified for collect 126,900,900,019

and analyze the official documents or data that have × 100% = 12,6%

1,005,365,373,571

been validated and has guaranteed the validity.

In Year 2017

IV. RESEARCH FINDINGS 232,458,208,409

× 100% = 23,2%

The regional Independence Financial Ratios 998,886,437,141

Therefore the measurement of Regional Financial

Independence Ratio (RKKD) of Serang City during the In Year 2018

164,218,548,654

2014-2018 the fiscal year could be formulated as its × 100% = 16,3%

follows: 1,003,053,326,709

𝑃𝐴𝐷

𝐼𝑛𝑑𝑒𝑝𝑒𝑛𝑑𝑒𝑛𝑐𝑒 𝑅𝑎𝑡𝑖𝑜 = × 100% The amount of the Regional Financial Independence

𝑇𝑟𝑎𝑛𝑓𝑒𝑟 𝐼𝑛𝑐𝑜𝑚𝑒

Ratio (RKKD) was obtained from the allocations of local

own-source revenue (PAD) with the Transfer Income then

multiple by 100% times.

Year PAD (IDR) Transfer Revenue (IDR) Independence Ratio (%) Finance Ability

2014 97,827,597,434 73,460,253,533 11,2 Very Low

2015 111,062,806,774 918,745,599,190 12,1 Very Low

2016 126,900,900,019 1,005,365,373,571 12,6 Very Low

2017 232,458,208,409 998,886,437,141 23,2 Very Low

2018 164,218,548,654 1,003,053,326,709 16,3 Very Low

Average 10,24

Table 4:- The Independence Ratio of Serang City Regional Government during Fiscal Year 2014-2018

Source: Process by Author

IJISRT20MAR325 www.ijisrt.com 914

Volume 5, Issue 3, March – 2020 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

PAD Effectiveness Ratio In Year of 2016

There has amount of the Effectiveness ratio of 126,900,900,019

regional finances during the budget year of 2014-2018 as × 100% = 110,21%

115,139,113,647

its follows:

𝑃𝐴𝐷 𝑅𝑒𝑎𝑙𝑖𝑧𝑎𝑡𝑖𝑜𝑛 In Year of 2017

𝐸𝑓𝑓𝑒𝑐𝑡𝑖𝑣𝑖𝑡𝑦 𝑅𝑎𝑡𝑖𝑜 = × 100% 232,458,208,409

𝑃𝐴𝐷 𝑃𝑙𝑎𝑛𝑛𝑒𝑑

× 100% = 108,21%

214,818,694,7291

Source: Mahmudi (2016:141)

In Year of 2018

In Year of 2014 164,218,548,654

97,827,597,434 × 100% = 108,33%

× 100% = 120,56% 151,589,133,197

81,140,202,667

The amount of Effectiveness Ratio was obtained from

In Year of 2015 the results of the allocations of Local own-source revenue

111,062,806,774 (PAD) with the Budget (PAD) then multiplied by 100%,

× 100% = 118,72%

93,549,618,840 the higher the Effectiveness Ratio means the regional

progress is getting better.

Realization of PAD Effectiveness Ratio

Year PAD Budget (IDR) Effectiveness Criteria

(IDR) (%)

2014 97,827,597,434 81,140,202,667 120,56 Very Effectiveness

2015 111,062,806,774 93,549,618,840 118,72 Very Effectiveness

2016 126,900,900,019 115,139,113,647 110,21 Very Effectiveness

2017 232,458,208,409 214,818,694,729 108,21 Very Effectiveness

2018 164,218,548,654 151,589,133,197 108,33 Very Effectiveness

Average 10,24

Table 5:- The Effectiveness Ratios of Serang City Local Government PAD Fiscal Year of 2014-2018

Source: Process by Author

The Balance Capital Expenditures Ratio In Year of 2016

𝑇ℎ𝑒 𝑡𝑜𝑡𝑎𝑙 𝑜𝑓 𝐶𝑎𝑝𝑖𝑡𝑎𝑙 𝐸𝑥𝑝𝑒𝑛𝑠𝑒𝑠 169,833,426,482

𝐶𝐸𝑅 = × 100% × 100% = 15,03%

𝑇ℎ𝑒 𝑡𝑜𝑡𝑎𝑙 𝑜𝑓 𝐿𝑜𝑐𝑎𝑙 𝐸𝑥𝑝𝑒𝑛𝑠𝑒𝑠 1,129,841,327,429

Source: Mahmudi (2016:163) In Year of 2017

In Year of 2014 333,514,135,271

× 100% = 25,06%

151,309,166,795 1,330,488,751,791

× 100% = 15,92%

949,970,142,088

In Year of 2018

In Year of 2015 204,289,084,471

× 100% = 16,63%

183,910,387,759 1,227,871,712,658

× 100% = 17,31%

1,061,917,792,736

The amount of the Capital Expenditure Ratio was

obtained from the allocations of total expenditure capital

with total regional expenditure then multiplied by 100%.

Total of Capital Total of Regional Effectiveness Ratio

Year Information

Expenses (IDR) Expenses (IDR) (%)

2014 151,309,166,795 949,970,142,088 15,92 Not Matched

2015 183,910,387,759 1,061,917,792,736 17,31 Not Matched

2016 169,833,426,482 1,129,841,327,429 15,03 Not Matched

2017 333,514,135,271 1,330,488,751,791 25,06 Less Matched

2018 204,289,084,471 1,227,871,712,658 16,63 Not Matched

Average 17,99

Table 6:- The Balance Ratio of Capital Expenditures in Serang City Government during period fiscal year 2014 – 2018

Source: Process by Author

IJISRT20MAR325 www.ijisrt.com 915

Volume 5, Issue 3, March – 2020 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

V. CONCLUSIONS AND RECOMMENDATIONS The Regional Government of Serang City has advised

to conduct the socialization routinely against the

A. Conclusions taxpayers to increase the mandatory awareness tax on

Based on the results of research and discussion that obligations in the event of tax compliance on time.

has been done regarding to the regional Independence

Financial Ratios, PAD Effectiveness Ratios, and The REFERENCES

Balance ratio of Capital Expenditures at Serang City during

Fiscal period of 2014 - 2018. So it can be concluded that: [1]. Halim, Abdul. (2014). Analisi Keuangan Daerah

An assessment of the financial performance at Serang Akuntansi Sektor Publik. Jakarta: Salemba Empat.

City Regional Government seen from Regional [2]. Mahmudi. (2016), Analisis Laporan Keuangan

Financial Independence Ratio has an average value of Pemerintah Daerah, Universitas Gajah Mada,

10.24% according to the Pattern of Relationships and Yogyakarta.

the Level of Regional Capability included the range of [3]. Oktavia, Mega. (2015). Analisis Kinerja Keuangan

0% -25% ie has a very low level of ability and have Pemerintah Kabupaten Minahasa Selatan, Jurnal

Instructive relationship patterns. The Instructive EMBA.

relationship patterns namely roles the central [4]. Pramono, Joko. (2015). Analisis Keuangan Untuk

government has more dominant than the the regional Menilai Kinerja Keuangan Pemertintah Daerah

government (regions that unable to implement the Suyrakarta.

regional autonomy). [5]. Rahmayati, Anim. (2017). Analisis Kinerja Keuangan

An assessment of the financial performance of Serang Pemerintah Daerah Kabupaten Sukoharjo. Jurnal

City Regional Government it could be seen from The EMBA.

PAD Effectiveness Ratio has average value of [6]. Sugiyono. (2017). Metode Penelitian Kualitati,

113.206%. Based on guidelines for evaluating the level Kuantitatif, dan R&D. Bandung: Alfabeta.

of financial effectiveness with an average value of [7]. Zuhri, Muhammad. (2016). Analisis Kinerja

113,206% have very effective criteria because of the Keuangan Pemerintah Bengkulu. Bengkulu: Ekombis.

value was obtained more than 100%. This indicates the [8]. Republik Indonesia. (2006). Peraturan Mentri Dalam

ability of The Regional Government of Serang City in Negri Nomor 13 Tahun 2006 Tentang Pengelolaan

realizing the Local own-source Revenue that has been Keuangan Daerah. Diakses:

planned are exceeds the target set, https;www.peraturan/mentri/dalam/negri/no/13/tahun/

An assessment of the financial performance at Serang 2006.

City Regional Government could be seen from The [9]. Republik Indonesia. (2006). Undang-Undang Nomor

Balance ratio of Capital expenditure has an average of 8 Tahun 2006 Tentang Pelaporan Laporan Keuangan.

17.99% it was said to be incompatible because it has a Diakses:

value below 20%, and it was concluded that the https;//www.undang/undang/no/8/tahun/2006.

Regional Government of Serang City was still not [10]. Republik Indonesia. (2010). Peraturan Pemerintah No

optimal in allocating the capital expenditure. 71 Tahun 2010 Standar Akuntansi Pemerintahan. .

Diakses:

B. Recommendations https;www.peraturan/pemerintah/no/71/tahun2010.

Based on the results of these research and discussion

which conducted by the authors. There has several advice

could be provide by these following recommendations:

To develop this thesis it could be done by adding the

research period, probably by extend the longer period or

can be focus on a certain period or one year only and it

is recommended to compare financial performance with

other regions to get more accurate assessment.

Serang City Government must continue to improve its

performance, for example by:

Could be able to optimize the revenue from the

potential income that has been there. The initiative and

willingness of the Regional Government is needed

efforts to increase the local own-source revenue (PAD).

The Enhancement of Local own-source revenue (PAD)

could be done by the Regional Government through

optimally the implementing of tax collection and

regional levies and supervise and control.

The Regional Government of Serang City has advised

to collect the data routinely against the tax objects so

that potentially can be known that actually through the

tax object data, which later can be Increased by the

Local own-source Revenue (PAD) of Serang City.

IJISRT20MAR325 www.ijisrt.com 916

Вам также может понравиться

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Study Assessing Viability of Installing 20kw Solar Power For The Electrical & Electronic Engineering Department Rufus Giwa Polytechnic OwoДокумент6 страницStudy Assessing Viability of Installing 20kw Solar Power For The Electrical & Electronic Engineering Department Rufus Giwa Polytechnic OwoInternational Journal of Innovative Science and Research TechnologyОценок пока нет

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- An Industry That Capitalizes Off of Women's Insecurities?Документ8 страницAn Industry That Capitalizes Off of Women's Insecurities?International Journal of Innovative Science and Research TechnologyОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Factors Influencing The Use of Improved Maize Seed and Participation in The Seed Demonstration Program by Smallholder Farmers in Kwali Area Council Abuja, NigeriaДокумент6 страницFactors Influencing The Use of Improved Maize Seed and Participation in The Seed Demonstration Program by Smallholder Farmers in Kwali Area Council Abuja, NigeriaInternational Journal of Innovative Science and Research TechnologyОценок пока нет

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- Unmasking Phishing Threats Through Cutting-Edge Machine LearningДокумент8 страницUnmasking Phishing Threats Through Cutting-Edge Machine LearningInternational Journal of Innovative Science and Research TechnologyОценок пока нет

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- Blockchain Based Decentralized ApplicationДокумент7 страницBlockchain Based Decentralized ApplicationInternational Journal of Innovative Science and Research TechnologyОценок пока нет

- Cyber Security Awareness and Educational Outcomes of Grade 4 LearnersДокумент33 страницыCyber Security Awareness and Educational Outcomes of Grade 4 LearnersInternational Journal of Innovative Science and Research TechnologyОценок пока нет

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Forensic Advantages and Disadvantages of Raman Spectroscopy Methods in Various Banknotes Analysis and The Observed Discordant ResultsДокумент12 страницForensic Advantages and Disadvantages of Raman Spectroscopy Methods in Various Banknotes Analysis and The Observed Discordant ResultsInternational Journal of Innovative Science and Research TechnologyОценок пока нет

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Smart Health Care SystemДокумент8 страницSmart Health Care SystemInternational Journal of Innovative Science and Research TechnologyОценок пока нет

- Impact of Silver Nanoparticles Infused in Blood in A Stenosed Artery Under The Effect of Magnetic Field Imp. of Silver Nano. Inf. in Blood in A Sten. Art. Under The Eff. of Mag. FieldДокумент6 страницImpact of Silver Nanoparticles Infused in Blood in A Stenosed Artery Under The Effect of Magnetic Field Imp. of Silver Nano. Inf. in Blood in A Sten. Art. Under The Eff. of Mag. FieldInternational Journal of Innovative Science and Research TechnologyОценок пока нет

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Compact and Wearable Ventilator System For Enhanced Patient CareДокумент4 страницыCompact and Wearable Ventilator System For Enhanced Patient CareInternational Journal of Innovative Science and Research TechnologyОценок пока нет

- Visual Water: An Integration of App and Web To Understand Chemical ElementsДокумент5 страницVisual Water: An Integration of App and Web To Understand Chemical ElementsInternational Journal of Innovative Science and Research TechnologyОценок пока нет

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Smart Cities: Boosting Economic Growth Through Innovation and EfficiencyДокумент19 страницSmart Cities: Boosting Economic Growth Through Innovation and EfficiencyInternational Journal of Innovative Science and Research TechnologyОценок пока нет

- Parastomal Hernia: A Case Report, Repaired by Modified Laparascopic Sugarbaker TechniqueДокумент2 страницыParastomal Hernia: A Case Report, Repaired by Modified Laparascopic Sugarbaker TechniqueInternational Journal of Innovative Science and Research TechnologyОценок пока нет

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- Predict The Heart Attack Possibilities Using Machine LearningДокумент2 страницыPredict The Heart Attack Possibilities Using Machine LearningInternational Journal of Innovative Science and Research TechnologyОценок пока нет

- Keywords:-Ibadhy Chooranam, Cataract, Kann Kasam,: Siddha Medicine, Kann NoigalДокумент7 страницKeywords:-Ibadhy Chooranam, Cataract, Kann Kasam,: Siddha Medicine, Kann NoigalInternational Journal of Innovative Science and Research TechnologyОценок пока нет

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Insights Into Nipah Virus: A Review of Epidemiology, Pathogenesis, and Therapeutic AdvancesДокумент8 страницInsights Into Nipah Virus: A Review of Epidemiology, Pathogenesis, and Therapeutic AdvancesInternational Journal of Innovative Science and Research TechnologyОценок пока нет

- Implications of Adnexal Invasions in Primary Extramammary Paget's Disease: A Systematic ReviewДокумент6 страницImplications of Adnexal Invasions in Primary Extramammary Paget's Disease: A Systematic ReviewInternational Journal of Innovative Science and Research TechnologyОценок пока нет

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Parkinson's Detection Using Voice Features and Spiral DrawingsДокумент5 страницParkinson's Detection Using Voice Features and Spiral DrawingsInternational Journal of Innovative Science and Research TechnologyОценок пока нет

- The Relationship Between Teacher Reflective Practice and Students Engagement in The Public Elementary SchoolДокумент31 страницаThe Relationship Between Teacher Reflective Practice and Students Engagement in The Public Elementary SchoolInternational Journal of Innovative Science and Research TechnologyОценок пока нет

- Air Quality Index Prediction Using Bi-LSTMДокумент8 страницAir Quality Index Prediction Using Bi-LSTMInternational Journal of Innovative Science and Research TechnologyОценок пока нет

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Quantifying of Radioactive Elements in Soil, Water and Plant Samples Using Laser Induced Breakdown Spectroscopy (LIBS) TechniqueДокумент6 страницQuantifying of Radioactive Elements in Soil, Water and Plant Samples Using Laser Induced Breakdown Spectroscopy (LIBS) TechniqueInternational Journal of Innovative Science and Research TechnologyОценок пока нет

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- Investigating Factors Influencing Employee Absenteeism: A Case Study of Secondary Schools in MuscatДокумент16 страницInvestigating Factors Influencing Employee Absenteeism: A Case Study of Secondary Schools in MuscatInternational Journal of Innovative Science and Research TechnologyОценок пока нет

- An Analysis On Mental Health Issues Among IndividualsДокумент6 страницAn Analysis On Mental Health Issues Among IndividualsInternational Journal of Innovative Science and Research TechnologyОценок пока нет

- Harnessing Open Innovation For Translating Global Languages Into Indian LanuagesДокумент7 страницHarnessing Open Innovation For Translating Global Languages Into Indian LanuagesInternational Journal of Innovative Science and Research TechnologyОценок пока нет

- Diabetic Retinopathy Stage Detection Using CNN and Inception V3Документ9 страницDiabetic Retinopathy Stage Detection Using CNN and Inception V3International Journal of Innovative Science and Research TechnologyОценок пока нет

- Dense Wavelength Division Multiplexing (DWDM) in IT Networks: A Leap Beyond Synchronous Digital Hierarchy (SDH)Документ2 страницыDense Wavelength Division Multiplexing (DWDM) in IT Networks: A Leap Beyond Synchronous Digital Hierarchy (SDH)International Journal of Innovative Science and Research TechnologyОценок пока нет

- Advancing Healthcare Predictions: Harnessing Machine Learning For Accurate Health Index PrognosisДокумент8 страницAdvancing Healthcare Predictions: Harnessing Machine Learning For Accurate Health Index PrognosisInternational Journal of Innovative Science and Research TechnologyОценок пока нет

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- The Making of Object Recognition Eyeglasses For The Visually Impaired Using Image AIДокумент6 страницThe Making of Object Recognition Eyeglasses For The Visually Impaired Using Image AIInternational Journal of Innovative Science and Research TechnologyОценок пока нет

- The Utilization of Date Palm (Phoenix Dactylifera) Leaf Fiber As A Main Component in Making An Improvised Water FilterДокумент11 страницThe Utilization of Date Palm (Phoenix Dactylifera) Leaf Fiber As A Main Component in Making An Improvised Water FilterInternational Journal of Innovative Science and Research TechnologyОценок пока нет

- Terracing As An Old-Style Scheme of Soil Water Preservation in Djingliya-Mandara Mountains - CameroonДокумент14 страницTerracing As An Old-Style Scheme of Soil Water Preservation in Djingliya-Mandara Mountains - CameroonInternational Journal of Innovative Science and Research TechnologyОценок пока нет

- Kota Fibres PresentationДокумент16 страницKota Fibres Presentationdaedric13Оценок пока нет

- L15 Consumer Loans Credit CardsДокумент18 страницL15 Consumer Loans Credit CardsJAY SHUKLAОценок пока нет

- Exploring Corporate Strategy: Gerry Johnson, Kevan Scholes, Richard WhittingtonДокумент26 страницExploring Corporate Strategy: Gerry Johnson, Kevan Scholes, Richard Whittingtonnazish143Оценок пока нет

- Profitable Candlestick PatternsДокумент53 страницыProfitable Candlestick Patternsaan_pkppk88% (17)

- Manual Download 100 B - ArthurДокумент13 страницManual Download 100 B - ArthurSlamet S89% (9)

- ModelingDerivatives GalleyДокумент268 страницModelingDerivatives Galleygdellanno100% (1)

- First National City Bank of New York Vs Tan - G.R. No. L-14234. February 28, 1962Документ4 страницыFirst National City Bank of New York Vs Tan - G.R. No. L-14234. February 28, 1962RonStephaneMaylonОценок пока нет

- 01 Seatwork VAT Subject TransactionДокумент2 страницы01 Seatwork VAT Subject TransactionJaneLayugCabacunganОценок пока нет

- Prepared by M Suresh Kumar, Chief Manager Faculty, SBILD HYDERABADДокумент29 страницPrepared by M Suresh Kumar, Chief Manager Faculty, SBILD HYDERABADBino JosephОценок пока нет

- BS50619006056314 PDFДокумент3 страницыBS50619006056314 PDFAldrin Frank ValdezОценок пока нет

- Employee Provident Fund - FAQДокумент5 страницEmployee Provident Fund - FAQArgha SarkarОценок пока нет

- Alok Industries Final Report 2010-11.Документ117 страницAlok Industries Final Report 2010-11.Ashish Navagamiya0% (1)

- Introduction To Agricultural AccountingДокумент54 страницыIntroduction To Agricultural AccountingManal ElkhoshkhanyОценок пока нет

- Case 2 AuditДокумент8 страницCase 2 AuditReinhard BosОценок пока нет

- Investment Analysis and Portfolio Management: Prof - Rajiv@cms - Ac.inДокумент41 страницаInvestment Analysis and Portfolio Management: Prof - Rajiv@cms - Ac.inAshish kumar NairОценок пока нет

- Jun 2006 - Qns Mod AДокумент11 страницJun 2006 - Qns Mod AHubbak Khan100% (2)

- MGT8200 - Chapter 3Документ9 страницMGT8200 - Chapter 3Si WongОценок пока нет

- 07 Segment Reporting 1Документ4 страницы07 Segment Reporting 1Irtiza AbbasОценок пока нет

- (Pieki Algo) Signals and Overlays (v.2.0)Документ13 страниц(Pieki Algo) Signals and Overlays (v.2.0)Rafael RubioОценок пока нет

- Taxation: Dr. Maina N. JustusДокумент10 страницTaxation: Dr. Maina N. JustusSkyleen Jacy VikeОценок пока нет

- Session 9 - AmmortizationДокумент26 страницSession 9 - Ammortizationjeff bansОценок пока нет

- Choudhry FTP Principles Jan 2018Документ133 страницыChoudhry FTP Principles Jan 2018James BestОценок пока нет

- Chapter 21 - GDPДокумент6 страницChapter 21 - GDPNoneОценок пока нет

- Contract Admin Manual 2 Works May 2018 PDFДокумент149 страницContract Admin Manual 2 Works May 2018 PDFSaddam H. MussieОценок пока нет

- Chapter 15Документ27 страницChapter 15Busiswa MsiphanyanaОценок пока нет

- PWC Insights Examples Reporting Impact of Covid 19 On Going Concern and Subsequent EventsДокумент10 страницPWC Insights Examples Reporting Impact of Covid 19 On Going Concern and Subsequent EventsSuman UroojОценок пока нет

- Democracy and The Policy Preferences of Wealthy AmericansДокумент53 страницыDemocracy and The Policy Preferences of Wealthy AmericansUmkc EconomistsОценок пока нет

- GD-WAT BibleДокумент84 страницыGD-WAT BibleKesava Krsna Das100% (1)

- #RWRI Second Order ThoughtsДокумент6 страниц#RWRI Second Order ThoughtsonlineprofessorОценок пока нет

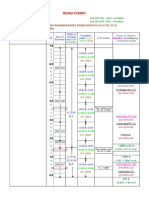

- Road Chart: Kakinada-Rajahmundry Road From KM 0/0 To 27/0Документ4 страницыRoad Chart: Kakinada-Rajahmundry Road From KM 0/0 To 27/0Phani PitchikaОценок пока нет