Академический Документы

Профессиональный Документы

Культура Документы

AKDITFPMMay 10

Загружено:

joker080Исходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

AKDITFPMMay 10

Загружено:

joker080Авторское право:

Доступные форматы

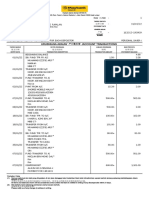

AKD Index Tracker Fund

For the month ending May 2010

Fund activity during the month:

The month under review witnessed a decline in KSE 100 index by 10.56%. The uncertainties resulting from various aspects of

budget which included capital gains tax, Value added tax and decrease in the power subsidy kept investors mostly out of the

market.

For the month under review AKD index tracker fund witnessed a decline of 10.61%, producing a tracking error of 5bp, this is the

result of the improvement of our tracking criteria and standardized procedures that we applied in the previous rebalancing phase.

In this new strategy we increased the tracking exposure of our fund from previous 65 stocks to 88 stocks, we apply different

standards such as market capitalization, moving average daily turnover, value weights etc to align our performance with that of

KSE-100 index.

Going forward, we opt to reduce the annualized tracking error of the fund in the range of 5% - 7%, much lower than our stated

mandate of 15% in the offering document.

Fund Performance

Investment Objective

10

To track the return of the KSE-100 index up to 85% accuracy, 10600

Providing investors with a high quality, indepth diversification

10200

instrument. 9

9800

9400

8

9000

Fund Information 7 8600

03-May-10

05-May-10

07-May-10

11-May-10

13-May-10

17-May-10

19-May-10

21-May-10

25-May-10

27-May-10

31-May-10

Fund Type Open-end

AKDITF (L.H.S) KSE100 (R.H.S)

Category Equity

Date of Fund launch October, 2005 YTD 1 Month 3 Month 6 Month 1 Year

Assets under Management 150.898mn KSE 100 30.22% -10.56% -3.43% 1.31% 28.17%

NAV (31st Mar 2010) 8.00 AKDITF 25.98% -10.61% -3.03% 1.39% 24.61%

Benchmark KSE100 Index

Dealing Days Mon to Fri Top Ten Equity Holdings

Cut-off Timings 9:00 am to 5:00 pm Oil and Gas Development 23.31% Pakistan Telecommunication 3.04%

Pricing Mechanism Forward Pricing Pakistan Petroleum 7.53% Fauji Fertilizer Company 2.88%

Muslim Commercial Bank 5.55% Nestle Pakistan 2.78%

Management Fee 0.75% (exceptionally low

Habib Bank LImited 3.83% United Bank Limited 2.54%

fees for Passive management)

National Bank 3.43% Engro Foods 2.34%

Trustee CDC

Auditor M. Yousaf Adil Saleem & Co. Asset Allocation (% of NAV) Apr 30, 2010 May 31, 2010

Asset Manager Rating AM3 Equities 95.56% 96.80%

Fixed Income 0.00% 0.00%

Cash 4.44% 3.20%

Leverage NIL NIL

Investment Committee Members Sector Allocation (% of NAV) Apr 30, 2010 May 31, 2010

Mr. Nadeem Naqvi Mr. Imran Motiwala Oil & Gas 34.85% 37.49%

Banks 24.67% 23.35%

Mr. Amin Hussain Mr. Muhammad Yaqoob

Chemicals 9.00% 8.70%

Mr. Ahmed Hassan Mr. Danish Owais Food Producers 5.63% 5.66%

Electricity 3.27% 3.37%

DISCLAIMER & CAUTION: This publication is for informational purposes only and nothing herein should be construed as a solicitation, recommendation or an offer to buy or sell

any fund. All investments in capital market instruments, including mutual funds, equities and fixed instruments are subject to market risk and issuer risk which includes volatility of

principal and returns as well as loss in value of the principal amount. The NAV based price of units of mutual funds and any dividends/returns thereon are dependent on forces and

factors affecting capital markets. These may go up or down based on market conditions. Past performance is not necessarily indicative of future results. Investors are urged to

carefully assess the risk factors prior to investing in capital market instruments.

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5795)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1091)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Mohsen Saadi Mohsen Saadi 4 Burnham Avenue Glenwood NSW 2768Документ9 страницMohsen Saadi Mohsen Saadi 4 Burnham Avenue Glenwood NSW 2768Cincin TiaОценок пока нет

- Bank StatementДокумент1 страницаBank StatementIsaiah Kipyego100% (1)

- Current Bill - New House PDFДокумент2 страницыCurrent Bill - New House PDFSwath M MuraliОценок пока нет

- Loans and Advances of The Sutex Co-Opertive Bank Ltd.Документ62 страницыLoans and Advances of The Sutex Co-Opertive Bank Ltd.sumesh8940% (1)

- Yap - ACP312 - ULOb - Let's CheckДокумент4 страницыYap - ACP312 - ULOb - Let's CheckJunzen Ralph YapОценок пока нет

- Fire InsuranceДокумент14 страницFire Insurancevipin sharmaОценок пока нет

- Insurance Syllabus 2018Документ10 страницInsurance Syllabus 2018Samii JoОценок пока нет

- Professional Banker Certificate - The Business of Banking and The Economic Environment (Chapter 1)Документ38 страницProfessional Banker Certificate - The Business of Banking and The Economic Environment (Chapter 1)KALKIDAN KASSAHUNОценок пока нет

- Depository SystemДокумент38 страницDepository SystemTarun SehgalОценок пока нет

- Mastering QuickBooks Level 2 Learning Manual (PDFDrive)Документ240 страницMastering QuickBooks Level 2 Learning Manual (PDFDrive)Kendrew Sujide100% (1)

- ACC 1100 Day 12&13 InventoryДокумент36 страницACC 1100 Day 12&13 InventoryMai Anh ĐàoОценок пока нет

- PFRS 9 - Financial InstrumentsДокумент20 страницPFRS 9 - Financial InstrumentsKrisha Mabel TabijeОценок пока нет

- S4H-BPD-FICO-Financial and Management ReportingДокумент13 страницS4H-BPD-FICO-Financial and Management ReportingPradeep Reddy FICOОценок пока нет

- Intercorporate Acquisitions and Investments in Other EntitiesДокумент31 страницаIntercorporate Acquisitions and Investments in Other EntitiesSayed Farrukh AhmedОценок пока нет

- HDFC AMC Case StudyДокумент34 страницыHDFC AMC Case StudyGrim ReaperОценок пока нет

- Project Report - Union BankДокумент203 страницыProject Report - Union BankAnkur Malhotra92% (12)

- PawnshopДокумент25 страницPawnshopapi-289042707Оценок пока нет

- Colorado UtilityДокумент1 страницаColorado UtilityAlex NeziОценок пока нет

- Thank You To The Amazing Font and Clip Artists For Their Work Contributing To This Product!Документ5 страницThank You To The Amazing Font and Clip Artists For Their Work Contributing To This Product!Kate BarrowsОценок пока нет

- San Jose, Vichelle Allana D. Vicedo, Krystel Ann B.: "The More Beautiful A Memory IsДокумент6 страницSan Jose, Vichelle Allana D. Vicedo, Krystel Ann B.: "The More Beautiful A Memory IsRio De LeonОценок пока нет

- Fast No Credit Check LoansДокумент3 страницыFast No Credit Check LoansRobinson52KristensenОценок пока нет

- A Partial Balance Sheet and Income Statement For King CorporatioДокумент1 страницаA Partial Balance Sheet and Income Statement For King CorporatioM Bilal SaleemОценок пока нет

- Split 162013 190909 - 20220331Документ5 страницSplit 162013 190909 - 20220331NUR FASIHAH BINTIОценок пока нет

- Bank of Baroda Recruitment 2024 For BC SupervisoreДокумент21 страницаBank of Baroda Recruitment 2024 For BC SupervisoreNiravMakwanaОценок пока нет

- Soal 1 A. Time Co Laporan Rekonsiliasi Bank Per 31 Januari Cash Balance Per Bank Statement $ 3,660.20Документ6 страницSoal 1 A. Time Co Laporan Rekonsiliasi Bank Per 31 Januari Cash Balance Per Bank Statement $ 3,660.20meifangОценок пока нет

- Technical Interview Questions Prepared by Fahad Irfan - PDF Version 1Документ4 страницыTechnical Interview Questions Prepared by Fahad Irfan - PDF Version 1Muhammad Khizzar KhanОценок пока нет

- MAS Synchronous May 13 Part 2Документ4 страницыMAS Synchronous May 13 Part 2Marielle GonzalvoОценок пока нет

- Comparative Study On Mutual Funds and Fixed Deposits: An OverviewДокумент5 страницComparative Study On Mutual Funds and Fixed Deposits: An Overviewmaau DhawaleОценок пока нет

- Hadiza Bala Usman's Access Bank Account StatementДокумент1 страницаHadiza Bala Usman's Access Bank Account StatementSahara ReportersОценок пока нет

- Dissolution of PartnershipsДокумент12 страницDissolution of PartnershipshasithlakashanОценок пока нет