Академический Документы

Профессиональный Документы

Культура Документы

To, Ashutosh Kumar (Huf) Bunglow No. 92, RSC 2, SVP Nagar, Versova Andheri (West) MUMBAI 400053, Maharashtra India

Загружено:

Nikhil JainОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

To, Ashutosh Kumar (Huf) Bunglow No. 92, RSC 2, SVP Nagar, Versova Andheri (West) MUMBAI 400053, Maharashtra India

Загружено:

Nikhil JainАвторское право:

Доступные форматы

GOVERNMENT OF INDIA

MINISTRY OF FINANCE

INCOME TAX DEPARTMENT

OFFICE OF THE ASSISTANT COMMISSIONER OF INCOME TAX

CIRCLE 24(1), MUMBAI

To,

ASHUTOSH KUMAR (HUF)

BUNGLOW NO. 92, RSC 2,SVP NAGAR,

VERSOVA ANDHERI (WEST)

MUMBAI 400053,Maharashtra

India

PAN: Date: Status: Notice No:

AAKHA3180R 15/12/2019 HINDU UNDIVIDED ITBA/AST/S/156/2019-

FAMILY 20/1022396732(1)

*ITBA100022072998*

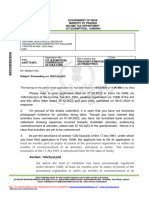

Subject: Notice of demand under section 156 of the Income-Tax Act, 1961

1. This is to give you notice that for the assessment year 2017-18 a sum of Rs. 28,48,769, details of

which are given on the reverse, has been determined to be payable by you.

2. The amount should be paid to the Manager, authorised bank/State Bank of India within 30 days of the

service of this notice. A challan is enclosed for the purpose of Payment.

3. If you do not pay the amount within the period specified above, you shall be liable to pay simple

interest at one per cent for every month or part of a month from the date commencing after the end of

the period aforesaid in accordance with section 220(2).

4. If you do not pay the amount of the tax within the period specified above, penalty (which may be as

much as the amount of tax in arrear) may be imposed upon you after giving you a reasonable

opportunity of being heard in accordance with section 221.

5. If you do not pay the amount within the period specified above, proceedings for the recovery thereof

will be taken in accordance with sections 222 to 227, 229 and 232 of the Income-tax Act, 1961.

6. If you intend to appeal against the assessment, you may present an appeal under Part A of Chapter

XX of the Income-tax Act, 1961, to the CIT (A) 36, Mumbai within thirty days of the receipt of this notice,

in Form No. 35, duly stamped and verified as laid down in that form.

MILIND AJAY JAGTAP

CIRCLE 24(1), MUMBAI

(In case the document is digitally signed please

refer Digital Signature at the bottom of the page)

Note: If digitally signed, the date of digital signature may be taken as date of document.

ROOM NO:604,6th Floor, PIRAMAL CHAMBER, LAL BAUG, PAREL, MUMBAI, Maharashtra, 400012

Email: MUMBAI.DCIT24.1@INCOMETAX.GOV.IN, Office Phone:02224125785

This document is digitally signed

* The Notice/Letter/Order No. mentioned above is the Document identification No. (DIN) of this Notice/Letter/Order.

Signer: MILIND AJAY JAGTAP

Date: 16 December 2019 10:54 AM

Location: MUMBAI, India

Вам также может понравиться

- PH Miracle Complete Whole Body Alkalizing Program-1201724Документ20 страницPH Miracle Complete Whole Body Alkalizing Program-1201724joao carlos100% (1)

- Plants Life Cycles and PartsДокумент5 страницPlants Life Cycles and PartsseemaОценок пока нет

- Outstanding 12m Bus DrivelineДокумент2 страницыOutstanding 12m Bus DrivelineArshad ShaikhОценок пока нет

- Structural - Analysis - Skid A4401 PDFДокумент94 страницыStructural - Analysis - Skid A4401 PDFMohammed Saleem Syed Khader100% (1)

- DR Onkar Nath IDDДокумент17 страницDR Onkar Nath IDDNikhil JainОценок пока нет

- 10music ContractsДокумент36 страниц10music ContractslucasmatОценок пока нет

- How integrity due diligence protects companies from risksДокумент17 страницHow integrity due diligence protects companies from risksNikhil Jain100% (1)

- Workers' Accommodation: Processes and StandardsДокумент38 страницWorkers' Accommodation: Processes and StandardsIFC Sustainability50% (2)

- B+V ELEVATOR SIDE DOOR Collar Type VS09 A4Документ19 страницB+V ELEVATOR SIDE DOOR Collar Type VS09 A4Игорь ШиренинОценок пока нет

- HDFC Home Loan Deduction StatementДокумент1 страницаHDFC Home Loan Deduction StatementArunОценок пока нет

- CGL Flame - Proof - MotorsДокумент15 страницCGL Flame - Proof - MotorspriteshОценок пока нет

- Account statement for Giangthanlung MpameiДокумент2 страницыAccount statement for Giangthanlung MpameiPamei DrumsОценок пока нет

- Shell Omala S2 G150 DatasheetДокумент3 страницыShell Omala S2 G150 Datasheetphankhoa83-1Оценок пока нет

- Principles of Marketing Eighth Edition Philip Kotler and Gary ArmstrongДокумент17 страницPrinciples of Marketing Eighth Edition Philip Kotler and Gary ArmstrongJunaid KhalidОценок пока нет

- Tata Mutual Fund: Account StatementДокумент4 страницыTata Mutual Fund: Account StatementKirti Kant SrivastavaОценок пока нет

- Account Statement 250622 140722Документ1 страницаAccount Statement 250622 140722Comred ComredОценок пока нет

- Jun State PDFДокумент3 страницыJun State PDFChandrashekar BGОценок пока нет

- Machine Tools Cutting FluidsДокумент133 страницыMachine Tools Cutting FluidsDamodara MadhukarОценок пока нет

- Migrating to Cloud ERP: Risks and BenefitsДокумент32 страницыMigrating to Cloud ERP: Risks and BenefitsNikhil Jain100% (1)

- ROOM NO:350,3rd Floor, AAYAKAR BHAVAN, MAHARISHI KARVE ROAD, MUMBAI, Maharashtra, 400020 Email: MUMBAI - ITO10.2.2@INCOMETAX - GOV.IN, Office Phone:02222120114Документ2 страницыROOM NO:350,3rd Floor, AAYAKAR BHAVAN, MAHARISHI KARVE ROAD, MUMBAI, Maharashtra, 400020 Email: MUMBAI - ITO10.2.2@INCOMETAX - GOV.IN, Office Phone:02222120114Nikhil Jain100% (1)

- Income Tax Reassessment Notice for AY 2014-15Документ1 страницаIncome Tax Reassessment Notice for AY 2014-15tomoreОценок пока нет

- 2023 - COM - 7000000057391312 - 75606367 - 2023 - COM - AYDPP9418N - Issue Letter - 1059838284 (1) - 18012024Документ2 страницы2023 - COM - 7000000057391312 - 75606367 - 2023 - COM - AYDPP9418N - Issue Letter - 1059838284 (1) - 18012024Jaswanth KumarОценок пока нет

- 2023 - ADM - CFIPC5376Q - Grievance Resolution Letter - 1056457278 (1) - 23092023Документ1 страница2023 - ADM - CFIPC5376Q - Grievance Resolution Letter - 1056457278 (1) - 23092023VINU KОценок пока нет

- To, Kanakadas Boddu 48-19-4/D, Sri Ramachandra Nagar KRISHNA 520008, Andhra Pradesh IndiaДокумент1 страницаTo, Kanakadas Boddu 48-19-4/D, Sri Ramachandra Nagar KRISHNA 520008, Andhra Pradesh IndiaSai BodduОценок пока нет

- KinnectДокумент1 страницаKinnectVidhi MehtaОценок пока нет

- AITPN6389G - Issue Letter - 1053923881 (1) - 23062023Документ2 страницыAITPN6389G - Issue Letter - 1053923881 (1) - 23062023Peddaiah KarthiОценок пока нет

- BMXPS2990B - Show Cause Notice For Proceedings Us 148A - 1049324741 (1) - 01022023Документ2 страницыBMXPS2990B - Show Cause Notice For Proceedings Us 148A - 1049324741 (1) - 01022023bhoomika rathodОценок пока нет

- Nee TP D:y: Moil LimitedДокумент53 страницыNee TP D:y: Moil LimitedSANJPODDОценок пока нет

- Invoice: Page 1 of 3Документ3 страницыInvoice: Page 1 of 3Rishikesh KallaОценок пока нет

- Web It CertДокумент1 страницаWeb It CertRana BiswasОценок пока нет

- AACCK3258R - Demand Notice Us 156 - 1052866885 (1) - 16052023Документ1 страницаAACCK3258R - Demand Notice Us 156 - 1052866885 (1) - 16052023Hitesh DhingraОценок пока нет

- Account Statement 030522 020822 PDFДокумент2 страницыAccount Statement 030522 020822 PDFIKRAM HUSSAINОценок пока нет

- City and Industrial Development Corporation of Maharashtra Limited Allotment LetterДокумент6 страницCity and Industrial Development Corporation of Maharashtra Limited Allotment LetterswapnilОценок пока нет

- Statement Sep 22 XXXXXXXX4970Документ4 страницыStatement Sep 22 XXXXXXXX4970Saumya BajpaiОценок пока нет

- Letter of Offer SummaryДокумент57 страницLetter of Offer SummarySubscriptionОценок пока нет

- Mentioned in The Subject of Your E-Mail. Replies Without DIN Shall Not Be Regarded As Compliance To The NoticeДокумент2 страницыMentioned in The Subject of Your E-Mail. Replies Without DIN Shall Not Be Regarded As Compliance To The NoticePonugoti Pavan kumarОценок пока нет

- TDS Certificate Form 16 SummaryДокумент3 страницыTDS Certificate Form 16 Summarydingle2Оценок пока нет

- SBI Tender for Supply and Installation of Modular Kitchens in Hyderabad FlatsДокумент46 страницSBI Tender for Supply and Installation of Modular Kitchens in Hyderabad FlatsNidhya Sudesh SinghОценок пока нет

- Premium ReceiptДокумент1 страницаPremium ReceiptthimothiОценок пока нет

- DeliveryOrder 20220914171635Документ1 страницаDeliveryOrder 20220914171635sukhpreet singhОценок пока нет

- BOHPxxxx5E Q3 2019-20Документ2 страницыBOHPxxxx5E Q3 2019-20Tamziul IslamОценок пока нет

- Collection Receipt Cum Adjustment Voucher: The New India Assurance Co. Ltd. (Government of India Undertaking)Документ2 страницыCollection Receipt Cum Adjustment Voucher: The New India Assurance Co. Ltd. (Government of India Undertaking)Mayank GandhiОценок пока нет

- ACVPS1970N - Notice Us21Документ2 страницыACVPS1970N - Notice Us21tomoreОценок пока нет

- Form 16-2021-2022Документ12 страницForm 16-2021-2022Kunal BansodeОценок пока нет

- 722354EAAD88Документ1 страница722354EAAD88Josiah Nathanael AberasОценок пока нет

- Motor Twowheeler PolДокумент2 страницыMotor Twowheeler PolDikshant ChaudhariОценок пока нет

- Form16 Mar 2019 PDFДокумент9 страницForm16 Mar 2019 PDFManish Kumar SinghОценок пока нет

- 7000000063771438_84032075_2023_EXM_7000000063771438_84032075_2023_EXM_AAETT3497L_Hearing Notice_1062307758(1)_09032024 (2)Документ2 страницы7000000063771438_84032075_2023_EXM_7000000063771438_84032075_2023_EXM_AAETT3497L_Hearing Notice_1062307758(1)_09032024 (2)prem kumaarОценок пока нет

- Form 16: CGI Information Systems and Management Consultants Private LimitedДокумент9 страницForm 16: CGI Information Systems and Management Consultants Private LimitedNimish ShuklaОценок пока нет

- RITES Limited LetterofOfferДокумент55 страницRITES Limited LetterofOffervikashОценок пока нет

- ITO notice for escaped incomeДокумент2 страницыITO notice for escaped incomeSukalp WarhekarОценок пока нет

- 4949224287Документ2 страницы4949224287Poonam PurohitОценок пока нет

- INVL-21957-SCOM10837Документ1 страницаINVL-21957-SCOM10837Shashank PalaiОценок пока нет

- Quote: Bill To: Shipping AddressДокумент4 страницыQuote: Bill To: Shipping AddressMuzammil SayedОценок пока нет

- Statement Nov 20 XXXXXXXX0037Документ1 страницаStatement Nov 20 XXXXXXXX0037Harikrishna GoudОценок пока нет

- Notification 3Документ1 страницаNotification 3Parmeet NainОценок пока нет

- XXXXXXXXXXXXX 2023-24 SignedДокумент2 страницыXXXXXXXXXXXXX 2023-24 SignedpinkyyymehtaОценок пока нет

- AOVPS7267Q - Show Cause Notice Us 270A - 1049078824 (1) - 25012023Документ3 страницыAOVPS7267Q - Show Cause Notice Us 270A - 1049078824 (1) - 25012023Basavaraj KorishettarОценок пока нет

- 056Документ1 страница056Dipak KotkarОценок пока нет

- Premium Receipt 2Документ1 страницаPremium Receipt 2dinesh 407Оценок пока нет

- Invoice INT2324 0329Документ2 страницыInvoice INT2324 0329madhankumar.kОценок пока нет

- Print - Udyam Registration Certificate Maverick ConvergenceДокумент1 страницаPrint - Udyam Registration Certificate Maverick ConvergenceAarav PanchalОценок пока нет

- Bayer-MSME Interest PaymentДокумент1 страницаBayer-MSME Interest PaymentTaherОценок пока нет

- Collection Receipt Cum Adjustment Voucher: The New India Assurance Co. Ltd. (Government of India Undertaking)Документ2 страницыCollection Receipt Cum Adjustment Voucher: The New India Assurance Co. Ltd. (Government of India Undertaking)dhirajОценок пока нет

- Tw Collectionreceipt 88441497Документ2 страницыTw Collectionreceipt 88441497gn2ffw2mt4Оценок пока нет

- DEMAND_NOTICEДокумент1 страницаDEMAND_NOTICEManuОценок пока нет

- AOVPS7267Q - Show Cause Notice Us 270A - 1045781439 (1) - 21092022Документ1 страницаAOVPS7267Q - Show Cause Notice Us 270A - 1045781439 (1) - 21092022Basavaraj KorishettarОценок пока нет

- 98-Uditi Salescorporation (FB) - GST-14Jan2021Документ1 страница98-Uditi Salescorporation (FB) - GST-14Jan2021poluri vinayОценок пока нет

- 'CL 2021 22 (1) 3Документ24 страницы'CL 2021 22 (1) 3aakash jainОценок пока нет

- 500 CR Declaration HRLДокумент2 страницы500 CR Declaration HRLOmkar VichareОценок пока нет

- NBFCS' Share in Lending Pie Slides To 5-Year Low Cpi Inflation Eases To 11-MONTH LOW OF 5.9%Документ18 страницNBFCS' Share in Lending Pie Slides To 5-Year Low Cpi Inflation Eases To 11-MONTH LOW OF 5.9%RAVI KUMAR JHAJHARIAОценок пока нет

- AG0000001339Документ4 страницыAG0000001339Puneet GuptaОценок пока нет

- 80G Tax Exemption Approval for Disease Control Non-ProfitДокумент2 страницы80G Tax Exemption Approval for Disease Control Non-ProfitAbbas AliОценок пока нет

- EMI Calculator For Home Loan, Car Loan & Personal Loan in IndiaДокумент7 страницEMI Calculator For Home Loan, Car Loan & Personal Loan in IndiaNikhil Jain100% (1)

- EMI Calculator For Home Loan, Car Loan & Personal Loan in IndiaДокумент7 страницEMI Calculator For Home Loan, Car Loan & Personal Loan in IndiaNikhil Jain100% (1)

- 5 6174606028823330851Документ20 страниц5 6174606028823330851Nikhil JainОценок пока нет

- Virtual Certificate Course On GST: GST & Indirect Taxes Committee of Icai, New DelhiДокумент41 страницаVirtual Certificate Course On GST: GST & Indirect Taxes Committee of Icai, New DelhiNikhil JainОценок пока нет

- Bos 16383Документ1 страницаBos 16383Kartik NathanОценок пока нет

- Hints For Drafting A Instrument of PartnershipДокумент30 страницHints For Drafting A Instrument of PartnershipNikhil JainОценок пока нет

- Order For Cancellation of RegistrationДокумент1 страницаOrder For Cancellation of RegistrationNikhil JainОценок пока нет

- 5 6174606028823330851Документ20 страниц5 6174606028823330851Nikhil JainОценок пока нет

- GST Bhavan Nodal Division 4 Contact ListДокумент1 страницаGST Bhavan Nodal Division 4 Contact ListNikhil JainОценок пока нет

- Arihant Simandhar SwamiДокумент5 страницArihant Simandhar SwamiAnonymous 28QYVCUcN2Оценок пока нет

- LPT BrochureДокумент15 страницLPT BrochureJoker JrОценок пока нет

- CBK v1.0Документ47 страницCBK v1.0Ala' Esam ZayadeenОценок пока нет

- Instruction: Department of DefenseДокумент9 страницInstruction: Department of DefenseNikhil JainОценок пока нет

- Ref: GSTN: Sub: Reply To Your Notice For Payment of Interest Period: July'2017 To Nov'2018Документ4 страницыRef: GSTN: Sub: Reply To Your Notice For Payment of Interest Period: July'2017 To Nov'2018Nikhil JainОценок пока нет

- Accommodation OptionsДокумент24 страницыAccommodation OptionsNikhil JainОценок пока нет

- Arts Program May 2015 0Документ36 страницArts Program May 2015 0Nikhil JainОценок пока нет

- Angers Accommodation OfferДокумент3 страницыAngers Accommodation OfferNikhil JainОценок пока нет

- National Lottery Fringe Visual Art Exhibition InfoДокумент15 страницNational Lottery Fringe Visual Art Exhibition InfoNikhil JainОценок пока нет

- 2017 Student Accommodation GuideДокумент24 страницы2017 Student Accommodation GuideNikhil JainОценок пока нет

- Migration and Occupation in Mumbai Issues and ImplicationsДокумент3 страницыMigration and Occupation in Mumbai Issues and ImplicationsNikhil JainОценок пока нет

- Employment Situation Analysis in MumbaiДокумент20 страницEmployment Situation Analysis in MumbaiNikhil JainОценок пока нет

- Hostel Checklist: Brand New!Документ11 страницHostel Checklist: Brand New!Nikhil JainОценок пока нет

- 3 Perquisites (Compatibility Mode)Документ34 страницы3 Perquisites (Compatibility Mode)Nikhil JainОценок пока нет

- Module 2 What It Means To Be AI FirstДокумент85 страницModule 2 What It Means To Be AI FirstSantiago Ariel Bustos YagueОценок пока нет

- Ohta, Honey Ren R. - Activity 7.2 (Reflection Agriculture and Religion)Документ5 страницOhta, Honey Ren R. - Activity 7.2 (Reflection Agriculture and Religion)honey ohtaОценок пока нет

- Badminton Lesson 1 4 - 5 Grade: TH THДокумент31 страницаBadminton Lesson 1 4 - 5 Grade: TH THLoxcey LopezОценок пока нет

- Lay Out New PL Press QltyДокумент68 страницLay Out New PL Press QltyDadan Hendra KurniawanОценок пока нет

- After EffectsДокумент56 страницAfter EffectsRodrigo ArgentoОценок пока нет

- 2113T Feasibility Study TempateДокумент27 страниц2113T Feasibility Study TempateRA MagallanesОценок пока нет

- 3240-B0 Programmable Logic Controller (SIEMENS ET200S IM151-8)Документ7 страниц3240-B0 Programmable Logic Controller (SIEMENS ET200S IM151-8)alexandre jose dos santosОценок пока нет

- Case Acron PharmaДокумент23 страницыCase Acron PharmanishanthОценок пока нет

- Optimum Work Methods in The Nursery Potting ProcessДокумент107 страницOptimum Work Methods in The Nursery Potting ProcessFöldi Béla100% (1)

- Developmen of Chick EmbryoДокумент20 страницDevelopmen of Chick Embryoabd6486733Оценок пока нет

- BILL of Entry (O&A) PDFДокумент3 страницыBILL of Entry (O&A) PDFHiJackОценок пока нет

- Contract To Sell LansanganДокумент2 страницыContract To Sell LansanganTet BuanОценок пока нет

- Case 1 1 Starbucks Going Global FastДокумент2 страницыCase 1 1 Starbucks Going Global FastBoycie TarcaОценок пока нет

- Assessment (L4) : Case Analysis: Managerial EconomicsДокумент4 страницыAssessment (L4) : Case Analysis: Managerial EconomicsRocel DomingoОценок пока нет

- Lec 5Документ22 страницыLec 5Abcdefgh EfghabcdОценок пока нет

- Minimum Fees To Be Taken by CAДокумент8 страницMinimum Fees To Be Taken by CACA Sanjay BhatiaОценок пока нет

- AI Search Iterative DeepeningДокумент4 страницыAI Search Iterative DeepeningNirjal DhamalaОценок пока нет

- IS 2848 - Specition For PRT SensorДокумент25 страницIS 2848 - Specition For PRT SensorDiptee PatingeОценок пока нет

- Cats - CopioniДокумент64 страницыCats - CopioniINES ALIPRANDIОценок пока нет

- Plumbing Arithmetic RefresherДокумент80 страницPlumbing Arithmetic RefresherGigi AguasОценок пока нет

- Chapter 04Документ3 страницыChapter 04gebreОценок пока нет