Академический Документы

Профессиональный Документы

Культура Документы

Disposal of Non-Current Assets

Загружено:

Tawanda Tatenda HerbertИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Disposal of Non-Current Assets

Загружено:

Tawanda Tatenda HerbertАвторское право:

Доступные форматы

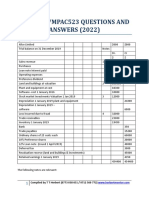

DISPOSAL OF NON-CURRENT ASSETS

Transaction Debit Credit

1. Removal of asset Disposals account Asset account

(cost price) sold

2. Removal of Provision for depreciation Disposal account

depreciation

3. Proceeds on disposal Cash book Disposal account

4. Profit on disposal Disposals account Income statement

5. Loss on disposal Income statement Disposals account

Question 1

The following non-current assets transactions took place during the period 1 March 2008 to 28 February

2012:

01 March 2008 Machine A purchased for $18 000

01 April 2009 Machine B purchased for $20 000

01 May 2011 Machine C purchased for $22 000

30 June 2011 Machine A was sold for $7 500

Notes

Machines are depreciated at 25% per annum using the straight line method.

In the year of purchase a full year of depreciation is charged.

In the year of disposal no depreciation is to be provided.

Requirement

a) Draw up the machines at cost account for the period ended 28 February 2012

b) Draw up the provision for machine depreciation account for the period ended 28 February 2012

c) Draw up the machine disposals account

d) Explain briefly the principal reason for maintaining a provision for depreciation account

Question 2

Grid Ltd maintains its non-current assets at cost. Provision for depreciation accounts, for each type of

asset are in use. Machinery is to be depreciated at a rate of 12½ % per annum, using the reducing

balance method. Depreciation is to be calculated on assets in existence at the end of the year, giving full

year’s depreciation even though the asset was bought part of the way through the year. The following

transactions in assets took place:

2005 01 January Bought machinery $6 400, fixtures $1 000

01 July Bought fixtures $2 000

2006 01 October Bought machinery $7 200

01 December Bought fixtures $500

The financial year end of the business is 31 December.

Requirement

a) Machinery account

b) Fixtures account

c) The two separate provision for depreciation accounts

1 Compiled by T T Herbert (0773 038 651 / 0712 560 772)

d) The non-current assets section of the SFP at the end of each year, for the years ended 31

December 2005 and 2006

Question 3

CB Ltd depreciates its plant at the rate of 20% per annum, straight line method, for each month of

ownership. From the following details draw up the plant account and the provision for depreciation

account for each of the years 2010, 2011, 2012 and 2013.

2010 Bought plant costing $9 000 on 1 January

Bought plant costing $6 000 on 1 October

2012 Bought plant costing $5 500 on 1 July

2013 Sold plant which had been bought for $9 000 on 1 January 2010 for the sum of $2 750

On 30 September 2013

You are also required to draw up the plant disposal account and the extracts from the SFP as at the end

of each year.

Question 4

A company maintains its non-current assets at cost. Depreciation accounts, for each asset are kept.

At 31 December 2010 the position was as follows:

Total cost to date Total depreciation to date

Machinery 52 590 25 670

Furniture 28 600 14 900

The following additions were made during the financial year ended 31 December 2011:

Machinery $24 800, Furniture $3 200.

Some old machines bought in 2007 for $28 000 were sold for $8 000 during the year.

The rates of depreciation are:

Machinery 10%, Furniture 5%, using straight line basis, calculated on the assets in existence at the end

of each financial year irrespective of date of purchase.

Requirement

a) Assets account

b) Depreciation accounts

c) SFP extract

Question 5

Parker’s car has the following details;

Cost $17 000

Estimated residual value $ 2 000

Estimated useful life 5 years

Calculate the accumulated depreciation and book value for Parker’s car after 3 years using:

a) Straight-line method [5]

b) Sum of year digits ignoring salvage value [5]

c) If Parker decides to switch to the reducing balance method from the straight-line method using

20% for year 4, what would be the book value for Parker’s car at the end of year 4 [5]

2 Compiled by T T Herbert (0773 038 651 / 0712 560 772)

Question 6

A company maintains its fixed assets at cost. Depreciation provision accounts, one for each type of

asset, are in use. Machinery is to be depreciated at the rate of 12½% per annum, and fixtures at the rate

of 10% per annum, using the reducing balance method. Depreciation is to be calculated on assets in

existence at the end of each year, giving a full year’s depreciation even though the asset was bought

part way through the year. The following transactions in assets took place:

2013 January 1 Bought machinery $640 000, Fixtures $100 000

2013 July 1 Bought fixtures $200 000

2014 October1 Bought machinery $720 000

2014 December 1 Bought fixtures $50 000

The financial year end of the business is 31 December.

You are required to show:

a) The machinery account [4]

b) The fixtures account [4]

c) The two separate provision for depreciation accounts [9]

d) Statement of financial position extract as at 31 December 2013 and 2014 [8]

[Adapted from ICMZ Fin Acc 1 Oct 2008]

Question 7

Sparks Ltd purchased a new machine on 1 January 2012 for $240 000. It is expected to be used for 5

years and then have a scrap value of $16 000.

Required

For each of the years 2012, 2013 and 2014, calculate, for Sparks Ltd, the amount to be charged to the

SCI, in respect of depreciation on the new machine, using each of the following methods:

(i) Straight line

(ii) Reducing balance

(iii) Sum of the year digits

3 Compiled by T T Herbert (0773 038 651 / 0712 560 772)

Вам также может понравиться

- "A" Level Accounting: DepreciationДокумент7 страниц"A" Level Accounting: DepreciationTARMAK MC LYONОценок пока нет

- Tut 8 PPE (I) AOP 2Документ6 страницTut 8 PPE (I) AOP 2xa. vieОценок пока нет

- Depreciation AssignmentДокумент2 страницыDepreciation AssignmentAdil Khan LodhiОценок пока нет

- Capital and Revenue ExpenditureДокумент22 страницыCapital and Revenue ExpenditureTimi Dele100% (1)

- Provision For Depreciation & DisposalДокумент3 страницыProvision For Depreciation & DisposalKristen NallanОценок пока нет

- Accounting For ManagersДокумент6 страницAccounting For ManagerskartikbhaiОценок пока нет

- at 1 October 2002 Jim Had Fixed Assets As FollowsДокумент3 страницыat 1 October 2002 Jim Had Fixed Assets As FollowsHussain ShahОценок пока нет

- Soal Aset TetapДокумент3 страницыSoal Aset TetapNamla Elfa Syariati67% (3)

- Test Chapter 04-05Документ3 страницыTest Chapter 04-05goharmahmood203Оценок пока нет

- Correction of Error ALДокумент6 страницCorrection of Error ALKwan Yin HoОценок пока нет

- Assig1 Fall20Документ3 страницыAssig1 Fall20Rakht e SafrОценок пока нет

- 會計學 (二) 第一次會考 1、 Multiple Choice:40%Документ5 страниц會計學 (二) 第一次會考 1、 Multiple Choice:40%ramОценок пока нет

- f3 Multiple Choice QuestionДокумент3 страницыf3 Multiple Choice QuestionsfipakistanОценок пока нет

- Assignment 1Документ3 страницыAssignment 1Sheikh AnasОценок пока нет

- Lecture Note DepreciationДокумент7 страницLecture Note DepreciationRia Athirah100% (2)

- Mid (Zara)Документ4 страницыMid (Zara)hbuzdarОценок пока нет

- Financial Reporting: (International Stream)Документ10 страницFinancial Reporting: (International Stream)ebukhory28Оценок пока нет

- Institute of Cost and Management Accountants of Pakistan New Fall (E) 2011, April 2012 ExaminationsДокумент3 страницыInstitute of Cost and Management Accountants of Pakistan New Fall (E) 2011, April 2012 ExaminationsAli SheikhОценок пока нет

- 438Документ6 страниц438Rehan AshrafОценок пока нет

- Dipifr 2003 Dec QДокумент10 страницDipifr 2003 Dec QWesley JenkinsОценок пока нет

- Fixed Assets - Disposal and DepreciationДокумент8 страницFixed Assets - Disposal and DepreciationTeo Yu XuanОценок пока нет

- Level 3 Accounting Update Text 2022Документ105 страницLevel 3 Accounting Update Text 2022KhinMgLwin100% (1)

- Financial Accounting Practice May 2009Документ8 страницFinancial Accounting Practice May 2009samuel_dwumfourОценок пока нет

- M - Limited Companies (After Edit)Документ41 страницаM - Limited Companies (After Edit)PublicEnemy007Оценок пока нет

- ACCT5001 Financial Accounting - 2019 - WДокумент3 страницыACCT5001 Financial Accounting - 2019 - WCaoshengjie123Оценок пока нет

- Intro To FA QP May 2018Документ10 страницIntro To FA QP May 2018Munodawafa ChimhamhiwaОценок пока нет

- Chapter 7 Depreciation - 1675244829Документ35 страницChapter 7 Depreciation - 1675244829Hsu Lae NandarОценок пока нет

- Tutorial 2 - Accruals and PPEДокумент7 страницTutorial 2 - Accruals and PPEFanboy100% (1)

- Depreciation O Level NotesДокумент5 страницDepreciation O Level NotesBijoy SalahuddinОценок пока нет

- Tutorial Chpater 10-11 Part BДокумент32 страницыTutorial Chpater 10-11 Part BKate BОценок пока нет

- Depreciation UDДокумент20 страницDepreciation UDrizwan ul hassanОценок пока нет

- Exercise Chap 11Документ7 страницExercise Chap 11JF FОценок пока нет

- Accounting Treatment of DepreciationДокумент5 страницAccounting Treatment of Depreciationwebsurfer755100% (3)

- Test 06-07Документ2 страницыTest 06-07goharmahmood203Оценок пока нет

- AIS16Exercises SCДокумент6 страницAIS16Exercises SCSarah GherdaouiОценок пока нет

- For CDEEДокумент7 страницFor CDEEmikiyas zeyedeОценок пока нет

- CMA April - 14 Exam Question - P-1Документ12 страницCMA April - 14 Exam Question - P-1MasumHasanОценок пока нет

- December 2003 ACCA Paper 2.5 QuestionsДокумент10 страницDecember 2003 ACCA Paper 2.5 QuestionsUlanda20% (1)

- ComprehensiveexamДокумент14 страницComprehensiveexamLeah BakerОценок пока нет

- 0452 s13 QP 11Документ20 страниц0452 s13 QP 11Naðooshii AbdallahОценок пока нет

- Coordinated Assignment 2 Spring 2021Документ4 страницыCoordinated Assignment 2 Spring 2021Affan AhmedОценок пока нет

- Kts g11 - Principles of Accounts Final AdjustmentsДокумент16 страницKts g11 - Principles of Accounts Final AdjustmentsBupe Banda100% (1)

- CMA April - 14 Exam Question PDFДокумент63 страницыCMA April - 14 Exam Question PDFArup Saha50% (2)

- Chapter 11 Corporations: Organization, Capital Stock Transactions, and DividendsДокумент12 страницChapter 11 Corporations: Organization, Capital Stock Transactions, and Dividendsehab_ghazallaОценок пока нет

- ACCA QuestionДокумент9 страницACCA QuestionAcca Fia TuitionОценок пока нет

- Latihan Chapter 9Документ2 страницыLatihan Chapter 9LiliОценок пока нет

- Acct CH.7 H.W.Документ8 страницAcct CH.7 H.W.j8noelОценок пока нет

- Cash Flow Exercises Set 1Документ3 страницыCash Flow Exercises Set 1chiong0% (1)

- 2010 LCCI Bookkeeping and Accounts Series 3Документ8 страниц2010 LCCI Bookkeeping and Accounts Series 3Fung Hui Ying75% (4)

- Mcboard - 2Nd Year (191) and 3Rd Year (181) : Financial Accounting and Reporting (Board Exam Subject)Документ14 страницMcboard - 2Nd Year (191) and 3Rd Year (181) : Financial Accounting and Reporting (Board Exam Subject)Vonna TerribleОценок пока нет

- Depreciation in Final AccountsДокумент26 страницDepreciation in Final Accountsndagarachel015Оценок пока нет

- Problems Inter Acc1Документ10 страницProblems Inter Acc1Chau NguyenОценок пока нет

- As Practice Paper 1Документ10 страницAs Practice Paper 1Farrukhsg100% (1)

- Questions & Solutions ACCTДокумент246 страницQuestions & Solutions ACCTMel Lissa33% (3)

- December 2002 ACCA Paper 2.5 QuestionsДокумент11 страницDecember 2002 ACCA Paper 2.5 QuestionsUlanda2Оценок пока нет

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionОт EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionОценок пока нет

- SIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)От EverandSIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)Рейтинг: 5 из 5 звезд5/5 (1)

- ACCA Taxation - Zimbabwe (ZWE) Revision Kit 2022 by T T HerbertДокумент77 страницACCA Taxation - Zimbabwe (ZWE) Revision Kit 2022 by T T HerbertTawanda Tatenda Herbert100% (4)

- ACCA Corporate & Business Law (LW-ZWE) Study Text 2022 by T. T. HerbertДокумент30 страницACCA Corporate & Business Law (LW-ZWE) Study Text 2022 by T. T. HerbertTawanda Tatenda Herbert100% (1)

- Corporate Law 2016 MAY QSNДокумент5 страницCorporate Law 2016 MAY QSNTawanda Tatenda HerbertОценок пока нет

- ACCA Corporate & Business Law (LW-ZWE) Study Text 2022 by T. T. HerbertДокумент30 страницACCA Corporate & Business Law (LW-ZWE) Study Text 2022 by T. T. HerbertTawanda Tatenda Herbert100% (1)

- ACCA Corporate & Business Law - Zimbabwe (LW-ZWE) Revision Kit 2022 by T. T. HerbertДокумент35 страницACCA Corporate & Business Law - Zimbabwe (LW-ZWE) Revision Kit 2022 by T. T. HerbertTawanda Tatenda HerbertОценок пока нет

- Ifrs 2 Share Based Payment (2021)Документ7 страницIfrs 2 Share Based Payment (2021)Tawanda Tatenda HerbertОценок пока нет

- IAS 1 Presentation of Financial Statements (2021)Документ17 страницIAS 1 Presentation of Financial Statements (2021)Tawanda Tatenda Herbert100% (1)

- IAS 40 Investment Property (2021)Документ7 страницIAS 40 Investment Property (2021)Tawanda Tatenda HerbertОценок пока нет

- Ifrs 5 (2021)Документ9 страницIfrs 5 (2021)Tawanda Tatenda HerbertОценок пока нет

- ACCA Corporate & Business Law - Zimbabwe (LW-ZWE) Revision Kit 2022 by T. T. HerbertДокумент35 страницACCA Corporate & Business Law - Zimbabwe (LW-ZWE) Revision Kit 2022 by T. T. HerbertTawanda Tatenda HerbertОценок пока нет

- IFRS 15 Revenue From Contracts With Customers (2021)Документ20 страницIFRS 15 Revenue From Contracts With Customers (2021)Tawanda Tatenda HerbertОценок пока нет

- Financial Instruments (2021)Документ17 страницFinancial Instruments (2021)Tawanda Tatenda Herbert100% (1)

- Horizontal Groups (2021)Документ5 страницHorizontal Groups (2021)Tawanda Tatenda HerbertОценок пока нет

- Groups With AssociatesДокумент5 страницGroups With AssociatesTawanda Tatenda HerbertОценок пока нет

- IAS 36 Impairment of Assets (2021)Документ12 страницIAS 36 Impairment of Assets (2021)Tawanda Tatenda HerbertОценок пока нет

- Ias 37 Provisions, Contingent Liabilities & Contingent AssetsДокумент12 страницIas 37 Provisions, Contingent Liabilities & Contingent AssetsTawanda Tatenda HerbertОценок пока нет

- IAS 29 FINANCIAL REPORTING IN HYPERINFLATIONERY ECONOMIES (2021 Latest)Документ5 страницIAS 29 FINANCIAL REPORTING IN HYPERINFLATIONERY ECONOMIES (2021 Latest)Tawanda Tatenda HerbertОценок пока нет

- IAS 20 Government Grants (2021)Документ5 страницIAS 20 Government Grants (2021)Tawanda Tatenda HerbertОценок пока нет

- Ias 21 Effects of Changes in Foreign Exchange RatesДокумент8 страницIas 21 Effects of Changes in Foreign Exchange RatesTawanda Tatenda HerbertОценок пока нет

- IAS 19 Employee Benefits (2021)Документ6 страницIAS 19 Employee Benefits (2021)Tawanda Tatenda Herbert100% (1)

- 2021 Revision QuestionsДокумент10 страниц2021 Revision QuestionsTawanda Tatenda HerbertОценок пока нет

- IAS 12 Income Taxes (2021)Документ18 страницIAS 12 Income Taxes (2021)Tawanda Tatenda HerbertОценок пока нет

- Ias 10 Events After The Reporting PeriodДокумент9 страницIas 10 Events After The Reporting PeriodTawanda Tatenda HerbertОценок пока нет

- MPACC512 Advanced Fin Reporting Answer Bank 2022Документ44 страницыMPACC512 Advanced Fin Reporting Answer Bank 2022Tawanda Tatenda HerbertОценок пока нет

- IAS 7 With Notes (2021) - GZU MastersДокумент16 страницIAS 7 With Notes (2021) - GZU MastersTawanda Tatenda HerbertОценок пока нет

- Hacc423 Question Bank 2021Документ13 страницHacc423 Question Bank 2021Tawanda Tatenda HerbertОценок пока нет

- Groups With Rights Issue (2021)Документ3 страницыGroups With Rights Issue (2021)Tawanda Tatenda HerbertОценок пока нет

- Bachelor of Commerce Honours Degree in Accounting and Finance Bachelor of Commerce Honours Degree in Purchasing and SupplyДокумент5 страницBachelor of Commerce Honours Degree in Accounting and Finance Bachelor of Commerce Honours Degree in Purchasing and SupplyTawanda Tatenda HerbertОценок пока нет

- MPAC523 WIP A 2020Документ8 страницMPAC523 WIP A 2020Tawanda Tatenda HerbertОценок пока нет

- Tax Question Bank 2020Документ37 страницTax Question Bank 2020Tawanda Tatenda HerbertОценок пока нет

- These Questions Help You Recognize Your Existing Background Knowledge On The Topic. Answer Honestly. Yes NoДокумент8 страницThese Questions Help You Recognize Your Existing Background Knowledge On The Topic. Answer Honestly. Yes NoEki OmallaoОценок пока нет

- Analisis Rasio Likuiditas Rasio SolvabilДокумент24 страницыAnalisis Rasio Likuiditas Rasio SolvabilCieeeebaperОценок пока нет

- Chapter24 Cashflowstatements2008Документ21 страницаChapter24 Cashflowstatements2008Marium Rafiq100% (2)

- SMC Financial Statements 2012Документ104 страницыSMC Financial Statements 2012Christian D. OrbeОценок пока нет

- Company Law-II ProjectДокумент22 страницыCompany Law-II ProjectAbhinavParasharОценок пока нет

- ILEC Unit 2Документ14 страницILEC Unit 2pacificcoasthighway1Оценок пока нет

- Ejercicios - Capitulo 16 y 17 FINANZASДокумент5 страницEjercicios - Capitulo 16 y 17 FINANZASPaulaОценок пока нет

- Kimberly C. GleasonДокумент44 страницыKimberly C. Gleasonfisayobabs11Оценок пока нет

- 1.1. The Principle of Separate Legal EntityДокумент9 страниц1.1. The Principle of Separate Legal Entityreine_jongОценок пока нет

- List of Hedge Funds From OdpДокумент5 страницList of Hedge Funds From OdpChris AbbottОценок пока нет

- Sampa Video Case SolutionДокумент10 страницSampa Video Case SolutionrahulsinhadpsОценок пока нет

- Final Project Financial ManagementДокумент10 страницFinal Project Financial ManagementMaryam SaeedОценок пока нет

- October 2020: Canada Core Pick ListДокумент3 страницыOctober 2020: Canada Core Pick ListblacksmithMGОценок пока нет

- Datatables UBold - Responsive Admin Dashboard TemplateДокумент2 страницыDatatables UBold - Responsive Admin Dashboard TemplatebijoyОценок пока нет

- 09 Elms Quiz - ArgДокумент3 страницы09 Elms Quiz - ArgKim Andrew Duane C. RosalesОценок пока нет

- Guia Opcyfut EngenДокумент62 страницыGuia Opcyfut EngensolajeroОценок пока нет

- Emtex Engineering Private Limited: Detailed ReportДокумент11 страницEmtex Engineering Private Limited: Detailed ReportAnishОценок пока нет

- Test Bank Accounting 25th Editon Warren Chapter 14 Long Term Liabi PDFДокумент86 страницTest Bank Accounting 25th Editon Warren Chapter 14 Long Term Liabi PDFMichael Linard SamileyОценок пока нет

- ImpairmentДокумент22 страницыImpairmentRaine PiliinОценок пока нет

- 02 IndividualsДокумент95 страниц02 IndividualsRoronoa Zoro67% (3)

- TarasДокумент3 страницыTarasSudipto KunduОценок пока нет

- Financial Analysis TechniquesДокумент11 страницFinancial Analysis Techniquesanum fatimaОценок пока нет

- Hedging ApolloДокумент3 страницыHedging ApolloAnish Tirkey 1910125Оценок пока нет

- CHAPTER 2 Review of Financial Statement Preparation, Analysis, and InterpretationДокумент6 страницCHAPTER 2 Review of Financial Statement Preparation, Analysis, and InterpretationCatherine Rivera100% (3)

- Module 6 Chapter 8 Output VAT Zero Rated SalesДокумент5 страницModule 6 Chapter 8 Output VAT Zero Rated SalesChris SumandeОценок пока нет

- Mergers and Acquisitions 2021Документ47 страницMergers and Acquisitions 2021Evelyne BiwottОценок пока нет

- Bank Reporting Example NABILДокумент54 страницыBank Reporting Example NABILSujit KoiralaОценок пока нет

- F - 2020 PSC Annual ReportДокумент252 страницыF - 2020 PSC Annual ReportTrisha Mae Mendoza MacalinoОценок пока нет

- Using The Gordon Dividend Model. Compare The Cost of Equity Computed On The BasisДокумент2 страницыUsing The Gordon Dividend Model. Compare The Cost of Equity Computed On The BasisONASHI DEVNANI BBAОценок пока нет

- Session 2 EMBA Interest Rate RiskДокумент24 страницыSession 2 EMBA Interest Rate Risksatu tanvirОценок пока нет