Академический Документы

Профессиональный Документы

Культура Документы

Argus - DLR PDF

Загружено:

Jeff SturgeonОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Argus - DLR PDF

Загружено:

Jeff SturgeonАвторское право:

Доступные форматы

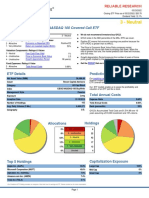

NYSE: DLR

DIGITAL REALTY TRUST INC Report created Nov 26, 2019 Page 1 OF 5

DLR shares are trading above the midpoint of their 52-week range of $100-$136. The shares trade at Argus Recommendations

17.2-times our 2020 AFFO estimate, compared to the five-year historical range of 12.0-20.6 and the peer

average of 19.4. DLR also trades at an EV/EBITDA multiple of 20.0, below the peer average of 21.0, despite

our expectations for superior growth. Twelve Month Rating SELL HOLD BUY

Analyst's Notes Five Year Rating SELL HOLD BUY

Analysis by Jacob Kilstein, CFA, November 25, 2019 Under Market Over

Sector Rating Weight Weight Weight

ARGUS RATING: BUY

Argus assigns a 12-month BUY, HOLD, or SELL rating to each

• Maintaining BUY on fast-growing data center REIT stock under coverage.

• We believe that DLR has strong opportunities in the global colocation market, and note that the • BUY-rated stocks are expected to outperform the market (the

benchmark S&P 500 Index) on a risk-adjusted basis over the

company has grown both organically and through acquisitions. next year.

• On October 29, concurrent with earnings, Digital Realty announced that it would acquire Interxion • HOLD-rated stocks are expected to perform in line with the

(NYSE: INXN), a European data storage company, for $8.4 billion in stock, representing a 20% market.

premium. The businesses are complementary and will triple DLR's European data center locations. • SELL-rated stocks are expected to underperform the market

on a risk-adjusted basis.

• We are lowering our 2019 FFO estimate to $6.62 per share from $6.68 based on our expectations for The distribution of ratings across Argus' entire company

lost revenue from dispositions. We are also lowering our 2020 FFO estimate to $6.87 from $6.99 universe is: 66% Buy, 34% Hold, 0% Sell.

based on integration costs from the INXN merger.

• DLR pays a quarterly dividend of $1.08 per share, or $4.32 annually, for a yield of about 3.6%. Over Key Statistics

the past four years, the board has raised the dividend at a 5.4% average annual rate. Key Statistics pricing data reflects previous trading day's closing

price. Other applicable data are trailing 12-months unless

INVESTMENT THESIS otherwise specified

We are maintaining our BUY rating on Digital Realty Trust Inc. (NYSE: DLR), a real Market Overview

estate investment trust that operates global interconnection and data centers, but lowering Price $118.25

our price target to $130 from $140 target price, based on our lower FFO estimates. The Target Price $130.00

company helps customers develop secure networks and cloud-neutral data center 52 Week Price Range $100.05 to $136.32

platforms, and is at the forefront of the secular transition from on-premises data centers to Shares Outstanding 208.72 Million

cloud colocation centers. (Colocation centers rent space to multiple tenants to house their Dividend $4.32

IT hardware.) Digital Realty's global platform serves customers in more than 35 major Sector Overview

markets on five continents. We believe that DLR has strong opportunities in the global Sector Real Estate

colocation market, and note that the company has grown both organically and through Sector Rating MARKET WEIGHT

acquisitions. The company recently announced an $8.4 billion acquisition of a European Total % of S&P 500 Market Cap. 3.00%

data storage company, Interxion, which should help DLR's growth prospects there. Financial Strength

We believe that DLR shares remain undervalued at current levels given the company's Financial Strength Rating MEDIUM-HIGH

strong growth prospects and record of dividend increases. Debt/Capital Ratio 50.5%

Return on Equity 17.3%

RECENT DEVELOPMENTS

Net Margin 9.2%

Payout Ratio 0.64

Market Data Pricing reflects previous trading week's closing price. Current Ratio --

200-Day Moving Average Target Price: $130.00 52 Week High: $134.25 52 Week Low: $115.75 Closed at $119.60 on 11/22 Revenue $3.20 Billion

Price After-Tax Income $295.04 Million

($)

Valuation

120

Current FY P/E 17.86

Prior FY P/E 17.92

100

Price/Sales 7.71

80 Price/Book 3.05

Book Value/Share $38.72

Market Capitalization $24.68 Billion

Rating BUY

HOLD

SELL Forecasted Growth

EPS 1 Year EPS Growth Forecast

($) 0.30%

5 Year EPS Growth Forecast

6.30%

Quarterly 1.50 1.54 1.51 1.55 1.63 1.66 1.63 1.68 1.73 1.64 1.67 1.60 1.66 1.70 1.72 1.78

6.14 6.60 6.62 ( Estimate) 6.87 ( Estimate)

1 Year Dividend Growth Forecast

Annual

5.20%

Revenue

($ in Mil.) Risk

Beta 0.70

Quarterly 616.0 627.0 616.0 629.0 744.4 754.9 768.9 778.3 814.5 800.8 806.5 797.1 817.0 822.7 850.0 872.7 Institutional Ownership 103.31%

Annual 2488.0 3046.5 3218.8 ( Estimate) 3362.4 ( Estimate)

FY ends Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4

Dec 31 2017 2018 2019 2020

Please see important information about this report on page 5

©2019 Argus Research Company Argus Analyst Report

NYSE: DLR

DIGITAL REALTY TRUST INC Report created Nov 26, 2019 Page 2 OF 5

Analyst's Notes...Continued

DLR shares have underperformed the S&P 500 over the last midpoint due to the closing of a $1.0 billion joint venture with

three months, declining 1%, compared to a 10% gain for the Mapletree in early November.

index. The shares have also underperformed over the past year, In 3Q19, Digital Realty signed new leases that are expected to

rising 9% compared to a gain of 19% for the broad market. The generate $69 million of annualized rental revenue. In addition, the

beta on DLR is 0.73, below the 0.84 average for data center REITs. company signed renewal leases representing $152 million of

On October 29, concurrent with earnings, Digital Realty annualized revenue. The company also acquired 22,000 square feet

announced that it would acquire Interxion (NYSE: INXN), a of land in South Korea for $15 million that it will use to develop its

European data storage company, for $8.4 billion in stock, global platform. Construction on a facility will begin in the next

representing a 20% premium. Shareholders of INXN will receive few months and be complete in 2021.

0.71 shares of DLR stock per share of INXN. DLR shareholders On September 16, the company announced the sale of 10

will own 80% of the combined company and INXN 20%. The powered base building data centers (undeveloped space with

deal is expected to close in 2020 following approval from connectivity already in place) to Mapletree Investments and

regulators and shareholders from both companies. Management Mapletree Industrial Trust, a REIT, for $557 million. Those

expects the merger to be dilutive to 2020 earnings and accretive in transactions are expected to close in early 2020. On November 4,

2021. The businesses are complementary and will triple DLR's the Mapletree entities bought 80% of three stabilized facilities for

European data center locations. $811 million. DLR is maintaining a 20% stake, and thereby

For 3Q19, DLR reported revenue of $806 million, up 5% from forming a joint venture with Mapletree. Proceeds from the sales

the prior-year period, helped by higher rental income. Revenue was will be used to pay down debt and fund investments.

below our estimate of $817 million and the consensus forecast of EARNINGS & GROWTH ANALYSIS

$814 million. Core FFO rose 4% to $365 million, partly due to

higher revenue. Core FFO per share rose 2% to $1.67, which beat We are lowering our 2019 FFO estimate to $6.62 per share

our estimate of $1.65 and the consensus forecast of $1.63. from $6.68 based on our expectations for lost revenue from

Concurrent with earnings, management lowered its full-year dispositions. We are also lowering our 2020 FFO estimate to $6.87

revenue guidance to $3.2 billion from $3.2-$3.3 billion, implying from $6.99 based on integration costs from the INXN merger.

5% growth. Management also lowered its core FFO guidance to FINANCIAL STRENGTH & DIVIDEND

$6.55-$6.65 per share from $6.60-$6.70, up less than 1% at the Our financial strength rating on DLR is Medium-High, the

Growth & Valuation Analysis Financial & Risk Analysis

GROWTH ANALYSIS

($ in Millions, except per share data) 2014 2015 2016 2017 2018

FINANCIAL STRENGTH 2016 2017 2018

Revenue 1,616 1,763 2,142 2,458 3,046

Cash ($ in Millions) 11 0 127

COGS 595 642 763 884 1,087

Working Capital ($ in Millions) -690 -756 -947

Gross Profit 1,022 1,121 1,380 1,574 1,960

Current Ratio 0.29 0.36 0.31

SG&A 102 114 162 172 175

LT Debt/Equity Ratio (%) 143.0 95.0 129.0

R&D — — — — —

Total Debt/Equity Ratio (%) 143.0 95.0 129.0

Operating Income 378 375 518 556 595

Interest Expense 188 204 241 255 318 RATIOS (%)

Pretax Income 209 308 442 264 343 Gross Profit Margin 64.4 64.0 64.3

Income Taxes 5 6 10 8 2 Operating Margin 24.2 22.6 19.5

Tax Rate (%) 3 2 2 3 1 Net Margin 15.5 7.0 8.2

Net Income 200 297 426 248 331 Return On Assets 2.8 1.0 1.1

Diluted Shares Outstanding 134 139 151 175 207 Return On Equity 9.1 2.6 2.8

EPS 0.99 1.56 2.20 0.99 1.21

RISK ANALYSIS

Dividend 3.32 3.40 3.52 3.72 4.04

Cash Cycle (days) — — —

GROWTH RATES (%) Cash Flow/Cap Ex — — —

Revenue 9.0 11.0 27.4 13.0 20.0 Oper. Income/Int. Exp. (ratio) 2.9 2.0 2.1

Operating Income -1.6 -0.9 38.1 7.4 7.0 Payout Ratio 225.4 249.3 303.3

Net Income -36.3 48.2 43.6 -41.7 33.4

EPS -53.3 57.6 41.0 -55.0 22.2 The data contained on this page of this report has been

Dividend 6.4 2.4 3.5 5.7 8.6 provided by Morningstar, Inc. (© 2019 Morningstar, Inc.

Sustainable Growth Rate -6.9 -9.2 -9.3 -6.0 -6.0 All Rights Reserved). This data (1) is proprietary to

VALUATION ANALYSIS Morningstar and/or its content providers; (2) may not be

Price: High $70.92 $77.26 $113.21 $127.23 $125.10 copied or distributed; and (3) is not warranted to be

Price: Low $48.85 $60.66 $69.89 $98.03 $96.56 accurate, complete or timely. Neither Morningstar nor its

content providers are responsible for any damages or

Price/Sales: High-Low 5.9 - 4.0 6.1 - 4.8 8.0 - 4.9 9.1 - 7.0 8.5 - 6.6

losses arising from any use of this information. Past

P/E: High-Low 71.6 - 49.3 49.5 - 38.9 51.5 - 31.8 128.5 - 99.0 103.4 - 79.8

performance is no guarantee of future results. This data

Price/Cash Flow: High-Low 13.9 - 9.5 14.6 - 11.5 18.7 - 11.5 21.5 - 16.6 18.8 - 14.5 is set forth herein for historical reference only and is not

necessarily used in Argus’ analysis of the stock set forth

on this page of this report or any other stock or other

security. All earnings figures are in GAAP.

Please see important information about this report on page 5

©2019 Argus Research Company Argus Analyst Report

NYSE: DLR

DIGITAL REALTY TRUST INC Report created Nov 26, 2019 Page 3 OF 5

Analyst's Notes...Continued

second-highest rank on our five-point scale. Standard & Poor's, DLR faces risks associated with acquisitions, expansion

Moody's, and Fitch rate DLR's debt at BBB, Baa2, and BBB, projects, and revenue streams that are largely concentrated in the

respectively. Americas. Digital Realty is expanding globally, which view

At the end of 3Q19, debt totaled $10.9 billion, down from positively, but revenue from properties inside the United States

$11.1 billion at the end of 2018. Cash and cash equivalents were accounted for almost 78% of 3Q19 revenue. As such, any

$7 million at the close of 3Q19, down from $127 million at the downturn in the U.S. market could significantly hurt overall results.

end of 2018. The net debt/adjusted EBITDA ratio stood at 6.1, REITs in general face interest rate risk, which may be

above the peer average of 5.7. The debt/capital ratio was 53%, exacerbated if acquisitions are funded with floating-rate debt, or if

compared to 56% for peers. EBITDA for the third quarter covered existing debt matures and credit conditions are tight. The high

interest expense by a factor of 5.6, above the peer average of 4.4. 3.6% yield may cause the stock to act more like a bond if interest

Lastly, the 3Q EBITDA margin was 59%, above the peer average rates rise.

of 50%. COMPANY DESCRIPTION

Digital Realty Trust pays a quarterly dividend of $1.08 per

share, or $4.32 annually, for a yield of about 3.6%. On November Digital Realty Trust is a real estate investment trust focusing on

20, DLR's board of directors declared a quarterly dividend of interconnected data centers. Digital Realty Trust also develops data

$1.08 per share, payable on January 15 to holders of record on center platforms for businesses involved in cloud software, IT,

December 13. Over the past four years, the board has raised the financial services, social media, and mobile services. The company

dividend at an average annual rate of 5.4%. Our dividend operates in more than 35 metropolitan markets on five continents.

estimates are $4.25 for 2019, lowered from $4.32, and $4.47 for VALUATION

2020, lowered from $4.52. DLR shares are trading above the midpoint of their 52-week

MANAGEMENT & RISKS range of $100-$136. The shares trade at 17.2-times our 2020

William Stein became the company's CEO in September 2014 AFFO estimate, compared to the five-year historical range of

and previously served as CFO and CIO. He has been with the 12.0-20.6 and the peer average of 19.4. DLR also trades at an

company since 2004. Andrew Power is the CFO, and has been with EV/EBITDA multiple of 20.0, below the peer average of 21.0,

the company since May 2015. despite our expectations for superior growth.

We are lowering our 12-month target price to $130 from $140

Peer & Industry Analysis

The graphics in this section are designed to

P/E

allow investors to compare DLR versus its Growth

industry peers, the broader sector, and the WY DLR vs.

market as a whole, as defined by the Argus Market

Universe of Coverage. DLR vs.

60 Sector

• The scatterplot shows how DLR stacks More Value More Growth

up versus its peers on two key

characteristics: long-term growth and Price/Sales

value. In general, companies in the lower DLR vs.

left-hand corner are more value-oriented, Market

while those in the upper right-hand corner 40 DLR vs.

are more growth-oriented. Sector

More Value More Growth

• The table builds on the scatterplot by

displaying more financial information. Price/Book

EQR AVB

• The bar charts on the right take the DLR vs.

20 PSA BXP PEAK DLR

analysis two steps further, by broadening Market

the comparison groups into the sector VTR DLR vs.

level and the market as a whole. This tool Sector

is designed to help investors understand More Value More Growth

Value

P/E

how DLR might fit into or modify a PEG

4 5 6

diversified portfolio.

5-yr Growth Rate(%) DLR vs.

Market

5-yr Net 1-yr EPS DLR vs.

Market Cap Growth Current Margin Growth Argus Sector

More Value More Growth

Ticker Company ($ in Millions) Rate (%) FY P/E (%) (%) Rating

PSA Public Storage 36,419 4.0 19.4 61.0 3.2 BUY 5 Year Growth

EQR Equity Residential Properties 31,361 4.5 24.4 29.9 4.3 BUY DLR vs.

AVB Avalonbay Communities Inc. 29,617 5.0 22.8 43.5 5.5 BUY Market

DLR vs.

DLR Digital Realty Trust Inc 24,681 6.3 17.9 9.2 3.8 BUY Sector

WY Weyerhaeuser Co. 21,907 5.0 71.7 -2.3 97.6 BUY More Value More Growth

VTR Ventas Inc 21,511 5.7 15.0 12.7 1.0 BUY Debt/Capital

BXP Boston Properties, Inc. 21,279 5.0 19.7 18.2 7.4 BUY

DLR vs.

PEAK Healthpeak Properties Inc 17,568 6.0 19.7 43.7 4.0 BUY Market

Peer Average 25,543 5.2 26.3 27.0 15.8 DLR vs.

Sector

More Value More Growth

Please see important information about this report on page 5

©2019 Argus Research Company Argus Analyst Report

NYSE: DLR

DIGITAL REALTY TRUST INC

Report created Nov 26, 2019 Page 4 OF 5

Analyst's Notes...Continued

as a result of our lower FFO estimates.

On November 25, BUY-rated DLR closed at $118.30, down

$1.30.

Please see important information about this report on page 5

©2019 Argus Research Company Argus Analyst Report

NYSE: DLR

METHODOLOGY & DISCLAIMERS Report created Nov 26, 2019 Page 5 OF 5

About Argus

Argus Research, founded by Economist Harold Dorsey in 1934, And finally, Argus’ Valuation Analysis model integrates a

has built a top-down, fundamental system that is used by Argus historical ratio matrix, discounted cash flow modeling, and peer

analysts. This six-point system includes Industry Analysis, Growth comparison.

Analysis, Financial Strength Analysis, Management Assessment, THE ARGUS RESEARCH RATING SYSTEM

Risk Analysis and Valuation Analysis. Argus uses three ratings for stocks: BUY, HOLD, and SELL.

Utilizing forecasts from Argus’ Economist, the Industry Analysis Stocks are rated relative to a benchmark, the S&P 500.

identifies industries expected to perform well over the next • A BUY-rated stock is expected to outperform the S&P 500 on

one-to-two years. a risk-adjusted basis over a 12-month period. To make this

The Growth Analysis generates proprietary estimates for determination, Argus Analysts set target prices, use beta as the

companies under coverage. measure of risk, and compare expected risk-adjusted stock

In the Financial Strength Analysis, analysts study ratios to returns to the S&P 500 forecasts set by the Argus Market

understand profitability, liquidity and capital structure. Strategist.

During the Management Assessment, analysts meet with and • A HOLD-rated stock is expected to perform in line with the

familiarize themselves with the processes of corporate management S&P 500.

teams. • A SELL-rated stock is expected to underperform the S&P 500.

Quantitative trends and qualitative threats are assessed under

the Risk Analysis.

Argus Research Disclaimer

Argus Research Co. (ARC) is an independent investment research provider whose parent company, Argus Investors’ Counsel, Inc. (AIC), is registered with the U.S. Securities and

Exchange Commission. Argus Investors’ Counsel is a subsidiary of The Argus Research Group, Inc. Neither The Argus Research Group nor any affiliate is a member of the FINRA or

the SIPC. Argus Research is not a registered broker dealer and does not have investment banking operations. The Argus trademark, service mark and logo are the intellectual

property of The Argus Research Group, Inc. The information contained in this research report is produced and copyrighted by Argus Research Co., and any unauthorized use,

duplication, redistribution or disclosure is prohibited by law and can result in prosecution. The content of this report may be derived from Argus research reports, notes, or analyses.

The opinions and information contained herein have been obtained or derived from sources believed to be reliable, but Argus makes no representation as to their timeliness,

accuracy or completeness or for their fitness for any particular purpose. In addition, this content is not prepared subject to Canadian disclosure requirements. This report is not an

offer to sell or a solicitation of an offer to buy any security. The information and material presented in this report are for general information only and do not specifically address

individual investment objectives, financial situations or the particular needs of any specific person who may receive this report. Investing in any security or investment strategies

discussed may not be suitable for you and it is recommended that you consult an independent investment advisor. Nothing in this report constitutes individual investment, legal or

tax advice. Argus may issue or may have issued other reports that are inconsistent with or may reach different conclusions than those represented in this report, and all opinions are

reflective of judgments made on the original date of publication. Argus is under no obligation to ensure that other reports are brought to the attention of any recipient of this report.

Argus shall accept no liability for any loss arising from the use of this report, nor shall Argus treat all recipients of this report as customers simply by virtue of their receipt of this

material. Investments involve risk and an investor may incur either profits or losses. Past performance should not be taken as an indication or guarantee of future performance.

Argus has provided independent research since 1934. Argus officers, employees, agents and/or affiliates may have positions in stocks discussed in this report. No Argus officers,

employees, agents and/or affiliates may serve as officers or directors of covered companies, or may own more than one percent of a covered company’s stock. Argus Investors’

Counsel (AIC), a portfolio management business based in Stamford, Connecticut, is a customer of Argus Research Co. (ARC), based in New York. Argus Investors’ Counsel pays Argus

Research Co. for research used in the management of the AIC core equity strategy and model portfolio and UIT products, and has the same access to Argus Research Co. reports as

other customers. However, clients and prospective clients should note that Argus Investors’ Counsel and Argus Research Co., as units of The Argus Research Group, have certain

employees in common, including those with both research and portfolio management responsibilities, and that Argus Research Co. employees participate in the management and

marketing of the AIC core equity strategy and UIT and model portfolio products.

Morningstar Disclaimer

© 2019 Morningstar, Inc. All Rights Reserved. Certain financial information included in this report: (1) is proprietary to Morningstar and/or its content providers; (2) may not be

copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising

from any use of this information. Past performance is no guarantee of future results.

©2019 Argus Research Company Argus Analyst Report

Вам также может понравиться

- Digital Realty Trust Inc: Analyst's NotesДокумент5 страницDigital Realty Trust Inc: Analyst's NotesJeff SturgeonОценок пока нет

- Argus Analyst ReportДокумент7 страницArgus Analyst ReportEr DiОценок пока нет

- NeuStar Argus 12.6.08Документ8 страницNeuStar Argus 12.6.08Dinesh MoorjaniОценок пока нет

- 7 Undervalued Stocks With High Growth Potential Over Next One YearДокумент6 страниц7 Undervalued Stocks With High Growth Potential Over Next One Yearhoney1002Оценок пока нет

- Argus - TMUSДокумент6 страницArgus - TMUSJeff SturgeonОценок пока нет

- EPD - Argus PDFДокумент5 страницEPD - Argus PDFJeff SturgeonОценок пока нет

- Intel - Argus - Q1-09 - Q4 EarningsДокумент5 страницIntel - Argus - Q1-09 - Q4 EarningsBUGGI1000Оценок пока нет

- Structured Products Solutions - Tata Capital Financial ServicesДокумент19 страницStructured Products Solutions - Tata Capital Financial ServicesAnonymous bdUhUNm7JОценок пока нет

- Expected Returns For Real Estate PDFДокумент12 страницExpected Returns For Real Estate PDFJaja JAОценок пока нет

- REITs - Listed REITs Have Failed To Sparkle - The Economic TimesДокумент2 страницыREITs - Listed REITs Have Failed To Sparkle - The Economic Timeskausthubh vitthalОценок пока нет

- HP - Argus PDFДокумент5 страницHP - Argus PDFJeff SturgeonОценок пока нет

- Duluth Holdings Inc.: October 8, 2018 DLTH - NasdaqДокумент3 страницыDuluth Holdings Inc.: October 8, 2018 DLTH - Nasdaqashok yadavОценок пока нет

- L 3 Ss 12 Los 25Документ12 страницL 3 Ss 12 Los 25pier AcostaОценок пока нет

- Insights Looking Overseas Amid Property Market Correction PDFДокумент310 страницInsights Looking Overseas Amid Property Market Correction PDFmonami.sankarsanОценок пока нет

- Initiating Coverage of Single-Family Rental Reits With Favorable View - Buy SFRДокумент50 страницInitiating Coverage of Single-Family Rental Reits With Favorable View - Buy SFRtempvjОценок пока нет

- Netflix Inc.: Content Ramp Adding Torque To The FlywheelДокумент30 страницNetflix Inc.: Content Ramp Adding Torque To The FlywheelKeyaОценок пока нет

- Netflix Inc.: Content Ramp Adding Torque To The FlywheelДокумент30 страницNetflix Inc.: Content Ramp Adding Torque To The FlywheelManvinder SinghОценок пока нет

- OKE - ArgusДокумент5 страницOKE - ArgusJeff SturgeonОценок пока нет

- Cie LKPДокумент9 страницCie LKPRajiv HandaОценок пока нет

- Sep 2017 Page 1Документ27 страницSep 2017 Page 1ajujkОценок пока нет

- Convertible Bonds Yield SingaporeДокумент18 страницConvertible Bonds Yield Singaporeapi-26109152Оценок пока нет

- Coffee With Dave 042110Документ3 страницыCoffee With Dave 042110Glenn BuschОценок пока нет

- WH at Is T H e M Ar K Et Doin G? Take A Look at The M Ajor Indices (SPY, IWM, QQQ) and The Equity SectorsДокумент4 страницыWH at Is T H e M Ar K Et Doin G? Take A Look at The M Ajor Indices (SPY, IWM, QQQ) and The Equity SectorsCSОценок пока нет

- Edelweiss Report PDFДокумент218 страницEdelweiss Report PDFabhilodhiyaОценок пока нет

- S&P Morning Briefing 20 November 2018Документ7 страницS&P Morning Briefing 20 November 2018Abdullah18Оценок пока нет

- Nasdaq 100 Index Product GuideДокумент3 страницыNasdaq 100 Index Product GuideNdemeОценок пока нет

- Earn Higher Returns With A Low Risk Asset Class: Drip CapitalДокумент2 страницыEarn Higher Returns With A Low Risk Asset Class: Drip CapitalMohammed Abrar AsifОценок пока нет

- Broking - Update - Mar19 - HDFC Sec-201903191711243793044Документ16 страницBroking - Update - Mar19 - HDFC Sec-201903191711243793044Sanjay RijhwaniОценок пока нет

- MSCI Real Estate Pitch DeckДокумент58 страницMSCI Real Estate Pitch DeckRianovel MareОценок пока нет

- Capital Market - Thematic Report - 28 Nov 22Документ123 страницыCapital Market - Thematic Report - 28 Nov 22bharat.divineОценок пока нет

- Cheat Sheet For Valuation (2) - 1Документ2 страницыCheat Sheet For Valuation (2) - 1RISHAV BAIDОценок пока нет

- India Grid Trust: Recalibrating The Growth PitchДокумент19 страницIndia Grid Trust: Recalibrating The Growth Pitchrchawdhry123Оценок пока нет

- Deck How To Trade SlidesДокумент39 страницDeck How To Trade SlidesN.a. M. TandayagОценок пока нет

- India REIT Paper - Nov 20Документ10 страницIndia REIT Paper - Nov 20Maitri maheshwariОценок пока нет

- Constructing A Systematic Asset Allocation Strategy:: The S&P Dynamic Tactical Allocation IndexДокумент26 страницConstructing A Systematic Asset Allocation Strategy:: The S&P Dynamic Tactical Allocation IndexSrinivasaОценок пока нет

- IDT Corp. (NYSE: IDT) : Unlocking Value With One of The World's Best Capital AllocatorsДокумент55 страницIDT Corp. (NYSE: IDT) : Unlocking Value With One of The World's Best Capital Allocatorsatgy1996Оценок пока нет

- Ratio AnalysisДокумент25 страницRatio AnalysisJulveОценок пока нет

- S&P Morning Briefing 4 Dec. 2018Документ8 страницS&P Morning Briefing 4 Dec. 2018Abdullah18Оценок пока нет

- Pidilite Industries: Robust Recovery Margin Pressure AheadДокумент15 страницPidilite Industries: Robust Recovery Margin Pressure AheadIS group 7Оценок пока нет

- Infosys: ESG Disclosure ScoreДокумент13 страницInfosys: ESG Disclosure ScoreShayan RCОценок пока нет

- Kotak International REIT FOF: India's First Global REIT Fund of FundДокумент27 страницKotak International REIT FOF: India's First Global REIT Fund of FundVinit ShahОценок пока нет

- SISF Global Equity SA enДокумент2 страницыSISF Global Equity SA enpcbethellОценок пока нет

- Case StudyДокумент4 страницыCase StudyJAYESH VAYAОценок пока нет

- Chapter12 ExercisesДокумент6 страницChapter12 ExercisesCharis ElОценок пока нет

- Akre Focus Fund Commentary First Quarter 2021Документ2 страницыAkre Focus Fund Commentary First Quarter 2021Pranab PattanaikОценок пока нет

- Investment Banking Valuation - Equity Value - and Enterprise ValueДокумент18 страницInvestment Banking Valuation - Equity Value - and Enterprise ValuejyguygОценок пока нет

- GS Cross Asset CarryДокумент16 страницGS Cross Asset CarryHarry MarkowitzОценок пока нет

- Prudent Investing: Invest in Mirae Asset Prudence Fund (MAPF)Документ2 страницыPrudent Investing: Invest in Mirae Asset Prudence Fund (MAPF)api-349453187Оценок пока нет

- Ntflix StockResearch Report MorningStarДокумент13 страницNtflix StockResearch Report MorningStarPendi AgarwalОценок пока нет

- Winslow Drake SMAДокумент9 страницWinslow Drake SMATodd SullivanОценок пока нет

- 3 - Neutral: Global X Funds: Global X NASDAQ 100 Covered Call ETFДокумент3 страницы3 - Neutral: Global X Funds: Global X NASDAQ 100 Covered Call ETFphysicallen1791Оценок пока нет

- Key Takeaways: Terminologies With Their Scope & MeaningДокумент2 страницыKey Takeaways: Terminologies With Their Scope & MeaningSunanda MathuriaОценок пока нет

- S&P Morning Briefing 28 Nov 2018Документ7 страницS&P Morning Briefing 28 Nov 2018Abdullah18Оценок пока нет

- Thinking in Bets (Homage To Annie Duke) : Greenhaven Road CapitalДокумент9 страницThinking in Bets (Homage To Annie Duke) : Greenhaven Road Capitall chanОценок пока нет

- Secondary MarketДокумент13 страницSecondary Marketgpriyanshi1606Оценок пока нет

- Nirmal Bang 26th July 2018 IPO NoteДокумент13 страницNirmal Bang 26th July 2018 IPO NoteNiruОценок пока нет

- Financial Terms Glossary LMДокумент15 страницFinancial Terms Glossary LMphilipsdОценок пока нет

- Greenlight Capital 4Q20 Investor LetterДокумент7 страницGreenlight Capital 4Q20 Investor LetterGabriel AntonieОценок пока нет

- Summary of Bruce C. Greenwald, Judd Kahn & Paul D. Sonkin's Value InvestingОт EverandSummary of Bruce C. Greenwald, Judd Kahn & Paul D. Sonkin's Value InvestingОценок пока нет

- Summary of Philip J. Romero & Tucker Balch's What Hedge Funds Really DoОт EverandSummary of Philip J. Romero & Tucker Balch's What Hedge Funds Really DoОценок пока нет

- EPD - Schwab PDFДокумент16 страницEPD - Schwab PDFJeff SturgeonОценок пока нет

- Schwab Ratios User GuideДокумент2 страницыSchwab Ratios User GuideJeff SturgeonОценок пока нет

- EPD - Argus PDFДокумент5 страницEPD - Argus PDFJeff SturgeonОценок пока нет

- HEP - Ratings PDFДокумент4 страницыHEP - Ratings PDFJeff SturgeonОценок пока нет

- MMP - RatingsДокумент4 страницыMMP - RatingsJeff SturgeonОценок пока нет

- Magellan Midstream Partners LP: Analyst's NotesДокумент4 страницыMagellan Midstream Partners LP: Analyst's NotesJeff SturgeonОценок пока нет

- MMP - RatingsДокумент4 страницыMMP - RatingsJeff SturgeonОценок пока нет

- HP - Argus PDFДокумент5 страницHP - Argus PDFJeff SturgeonОценок пока нет

- MDP - SchwabДокумент5 страницMDP - SchwabJeff SturgeonОценок пока нет

- OKE - SchwabДокумент5 страницOKE - SchwabJeff SturgeonОценок пока нет

- MMP - SchwabДокумент17 страницMMP - SchwabJeff SturgeonОценок пока нет

- OHI - RatingsДокумент4 страницыOHI - RatingsJeff SturgeonОценок пока нет

- OKE - ArgusДокумент5 страницOKE - ArgusJeff SturgeonОценок пока нет

- MDP - RatingsДокумент4 страницыMDP - RatingsJeff SturgeonОценок пока нет

- High DividendsДокумент2 страницыHigh DividendsJeff SturgeonОценок пока нет

- Growth - DividendДокумент6 страницGrowth - DividendJeff SturgeonОценок пока нет

- Aztec Gold Dry RubДокумент9 страницAztec Gold Dry RubJeff SturgeonОценок пока нет

- OKE - RatingsДокумент4 страницыOKE - RatingsJeff SturgeonОценок пока нет

- Oxford Income Letter 0420 Sal93Документ12 страницOxford Income Letter 0420 Sal93Jeff SturgeonОценок пока нет

- The All American DogДокумент4 страницыThe All American DogJeff SturgeonОценок пока нет

- Betts RF Benintendi LF Bogearts SS Martinez DH Devers 3B Nunez 2B Holt 1B Leon C Bradley Jr. CFДокумент16 страницBetts RF Benintendi LF Bogearts SS Martinez DH Devers 3B Nunez 2B Holt 1B Leon C Bradley Jr. CFJeff SturgeonОценок пока нет

- Baseball Team StatsДокумент6 страницBaseball Team StatsJeff SturgeonОценок пока нет

- Betts RF Benintendi LF Bogearts SS Martinez DH Devers 3B Nunez 2B Holt 1B Leon C Bradley Jr. CFДокумент16 страницBetts RF Benintendi LF Bogearts SS Martinez DH Devers 3B Nunez 2B Holt 1B Leon C Bradley Jr. CFJeff SturgeonОценок пока нет

- Betts RF Benintendi LF Bogearts SS Martinez DH Devers 3B Nunez 2B Holt 1B Leon C Bradley Jr. CFДокумент16 страницBetts RF Benintendi LF Bogearts SS Martinez DH Devers 3B Nunez 2B Holt 1B Leon C Bradley Jr. CFJeff SturgeonОценок пока нет

- Leibold RF Weaver 3B Collins 2B Jackson LF Felsch CF Gandil 1B Risberg SS Schalk C PДокумент12 страницLeibold RF Weaver 3B Collins 2B Jackson LF Felsch CF Gandil 1B Risberg SS Schalk C PJeff SturgeonОценок пока нет

- Betts RF Benintendi LF Bogearts SS Martinez DH Devers 3B Nunez 2B Holt 1B Leon C Bradley Jr. CFДокумент16 страницBetts RF Benintendi LF Bogearts SS Martinez DH Devers 3B Nunez 2B Holt 1B Leon C Bradley Jr. CFJeff SturgeonОценок пока нет

- Slagle CF Sheckard LF Schulte RF Chance 1B Steinfeldt 3B Tinker SS Evers 2B Kling C PДокумент12 страницSlagle CF Sheckard LF Schulte RF Chance 1B Steinfeldt 3B Tinker SS Evers 2B Kling C PJeff SturgeonОценок пока нет

- Byrne 3B Leach CF Clarke LF Wagner SS Miller 2B Abstein 1B Wilson RF Gibson C PДокумент12 страницByrne 3B Leach CF Clarke LF Wagner SS Miller 2B Abstein 1B Wilson RF Gibson C PJeff SturgeonОценок пока нет

- Betts RF Benintendi LF Bogearts SS Martinez DH Devers 3B Nunez 2B Holt 1B Leon C Bradley Jr. CFДокумент16 страницBetts RF Benintendi LF Bogearts SS Martinez DH Devers 3B Nunez 2B Holt 1B Leon C Bradley Jr. CFJeff SturgeonОценок пока нет

- Browne RF Donlin CF Mcgann 1B Mertes LF Dahlen Ss Devlin 3B Gilbert 2B Bresnahan C PДокумент12 страницBrowne RF Donlin CF Mcgann 1B Mertes LF Dahlen Ss Devlin 3B Gilbert 2B Bresnahan C PJeff SturgeonОценок пока нет

- Forecast Error (Control Chart)Документ2 страницыForecast Error (Control Chart)Jane OngОценок пока нет

- Contracts ChecklistДокумент3 страницыContracts ChecklistSteve WatmoreОценок пока нет

- 2022BusinessManagement ReportДокумент17 страниц2022BusinessManagement ReportkianaОценок пока нет

- Measures-English, Metric, and Equivalents PDFДокумент1 страницаMeasures-English, Metric, and Equivalents PDFluz adolfoОценок пока нет

- JURDING (Corticosteroids Therapy in Combination With Antibiotics For Erysipelas)Документ21 страницаJURDING (Corticosteroids Therapy in Combination With Antibiotics For Erysipelas)Alif Putri YustikaОценок пока нет

- A Tool For The Assessment of Project Com PDFДокумент9 страницA Tool For The Assessment of Project Com PDFgskodikara2000Оценок пока нет

- Bossa Nova Book PDFДокумент5 страницBossa Nova Book PDFschmimiОценок пока нет

- Olinger v. The Church of Jesus Christ of Latter Day Saints Et Al - Document No. 1Документ4 страницыOlinger v. The Church of Jesus Christ of Latter Day Saints Et Al - Document No. 1Justia.comОценок пока нет

- Ogayon Vs PeopleДокумент7 страницOgayon Vs PeopleKate CalansinginОценок пока нет

- CHAPTER 4 (B)Документ6 страницCHAPTER 4 (B)Jon Lester De VeyraОценок пока нет

- Ylarde vs. Aquino, GR 33722 (DIGEST)Документ1 страницаYlarde vs. Aquino, GR 33722 (DIGEST)Lourdes Loren Cruz67% (3)

- Commercial CrimesДокумент3 страницыCommercial CrimesHo Wen HuiОценок пока нет

- Scribe FormДокумент2 страницыScribe FormsiddharthgamreОценок пока нет

- Water On Mars PDFДокумент35 страницWater On Mars PDFAlonso GarcíaОценок пока нет

- Unsung Ancient African Indigenous Heroines and HerosДокумент27 страницUnsung Ancient African Indigenous Heroines and Herosmsipaa30Оценок пока нет

- Context: Lesson Author Date of DemonstrationДокумент4 страницыContext: Lesson Author Date of DemonstrationAR ManОценок пока нет

- J of Cosmetic Dermatology - 2019 - Zhang - A Cream of Herbal Mixture To Improve MelasmaДокумент8 страницJ of Cosmetic Dermatology - 2019 - Zhang - A Cream of Herbal Mixture To Improve Melasmaemily emiОценок пока нет

- Filipino HousesДокумент4 страницыFilipino HousesjackОценок пока нет

- Quarter 2-Module 7 Social and Political Stratification: Department of Education Republic of The PhilippinesДокумент21 страницаQuarter 2-Module 7 Social and Political Stratification: Department of Education Republic of The Philippinestricia100% (5)

- Fascinating Numbers: Some Numbers of 3 Digits or More Exhibit A Very Interesting PropertyДокумент2 страницыFascinating Numbers: Some Numbers of 3 Digits or More Exhibit A Very Interesting PropertyAnonymous JGW0KRl6Оценок пока нет

- Public BudgetingДокумент15 страницPublic BudgetingTom Wan Der100% (4)

- Welcome To The Jfrog Artifactory User Guide!Документ3 страницыWelcome To The Jfrog Artifactory User Guide!RaviОценок пока нет

- Internship Report On Effects of Promotion System On Employee Job Satisfaction of Janata Bank Ltd.Документ57 страницInternship Report On Effects of Promotion System On Employee Job Satisfaction of Janata Bank Ltd.Tareq Alam100% (1)

- Inside Out or Outside inДокумент6 страницInside Out or Outside inΧΡΗΣΤΟΣ ΠΑΠΑΔΟΠΟΥΛΟΣОценок пока нет

- E 18 - 02 - Rte4ltay PDFДокумент16 страницE 18 - 02 - Rte4ltay PDFvinoth kumar SanthanamОценок пока нет

- Clothing, Personality and Impressions PDFДокумент11 страницClothing, Personality and Impressions PDFAhmad RaoОценок пока нет

- AIDA Deconstruction of Surf Excel AdДокумент6 страницAIDA Deconstruction of Surf Excel AdRoop50% (2)

- Ministry of Truth Big Brother Watch 290123Документ106 страницMinistry of Truth Big Brother Watch 290123Valentin ChirilaОценок пока нет

- Sale Deed Document Rajyalakshmi, 2222222Документ3 страницыSale Deed Document Rajyalakshmi, 2222222Madhav Reddy100% (2)

- Analysing Worship in The Pentateuch and Its ApplicationДокумент12 страницAnalysing Worship in The Pentateuch and Its ApplicationDaniel Solomon100% (1)