Академический Документы

Профессиональный Документы

Культура Документы

Bby Aa

Загружено:

londonmorgan0 оценок0% нашли этот документ полезным (0 голосов)

11 просмотров1 страницаОригинальное название

bby aa

Авторское право

© © All Rights Reserved

Доступные форматы

PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

11 просмотров1 страницаBby Aa

Загружено:

londonmorganАвторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 1

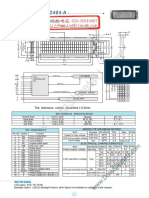

RESEARCH IN MOTION NDQ-RIMM RECENT

PRICE 168.27 P/ERATIO 38.1(Trailing:

Median: NMF) P/E RATIO 1.95 YLD

50.4 RELATIVE DIV’D

Nil VALUE

LINE

TIMELINESS 1 Raised 9/22/06 High:

Low:

31.6

3.4

87.9

11.6

38.6

6.9

14.8

4.2

35.5

5.4

103.6

33.0

84.6

51.0

142.7

61.0

169.6

119.8

Target Price Range

2010 2011 2012

SAFETY 3 Raised 3/17/06 LEGENDS

. . . . Relative Price Strength 320

TECHNICAL 5 Lowered 6/8/07 2-for-1 split 6/04

Options: Yes

BETA 1.45 (1.00 = Market) Shaded area indicates recession 200

2010-12 PROJECTIONS 160

Ann’l Total 2-for-1 120

Price Gain Return 100

High 270 (+60%) 13%

Low 180 (+5%) 1% 80

Insider Decisions 60

J A S O N D J F M

to Buy 0 0 0 0 0 0 0 0 0 40

Options 0 0 0 0 0 0 0 0 0

to Sell 0 0 0 0 0 0 0 0 0

% TOT. RETURN 5/07

Institutional Decisions THIS VL ARITH.

2Q2006 3Q2006 4Q2006 STOCK INDEX 18

Percent 120 1 yr. 155.9 22.2

to Buy 115 152 176 shares 80

to Sell 145 110 143 3 yr. 177.0 56.5

traded 40

Hld’s(000) 128479 137966 140994 5 yr. 2096.8 97.2

1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 © VALUE LINE PUB., INC. 10-12

-- -- -- -- -- -- .16 .37 .60 1.41 1.87 1.99 3.22 7.13 11.11 16.35 24.75 30.70 Revenues per sh AB 45.00

-- -- -- -- -- -- .01 .07 .11 .11 .07 d.16 .58 2.54 3.11 3.90 5.35 6.70 ‘‘Cash Flow’’ per sh 9.40

-- -- -- -- -- -- .01 .05 .08 .06 d.05 d.36 .31 2.11 2.53 3.33 4.80 6.15 Earnings per sh ABC 9.00

-- -- -- -- -- -- -- -- -- -- -- -- -- -- -- -- Nil Nil Div’ds Decl’d per sh Nil

-- -- -- -- -- -- .04 .07 .17 .44 .47 .26 .12 .58 .96 .85 .80 .80 Cap’l Spending per sh .75

-- -- -- -- -- -- .01 .84 2.19 5.77 5.56 4.57 9.29 10.47 10.75 13.40 18.10 24.20 Book Value per sh 45.00

-- -- -- -- -- - - 127.94 128.52 142.27 156.54 157.58 154.34 184.83 189.49 186.00 185.74 188.00 190.00 Common Shs Outst’g D 200.00

-- -- -- -- -- -- -- -- NMF NMF -- -- NMF 31.8 27.9 28.8 Bold figures are Avg Ann’l P/E Ratio 25.0

-- -- -- -- -- -- -- -- NMF NMF -- -- NMF 1.68 1.49 1.56 Value Line Relative P/E Ratio 1.65

estimates

-- -- -- -- -- -- -- -- -- -- -- -- -- -- -- -- Avg Ann’l Div’d Yield Nil

CAPITAL STRUCTURE as of 3/3/07 20.9 47.3 85.0 221.3 294.1 306.7 594.6 1350.4 2065.8 3037.1 4650 5830 Revenues ($mill) AB 9000

Total Debt $6.6 mill. Due in 5 Yrs $6.6 mill. 3.7% 16.2% 17.4% 1.8% NMF NMF 15.4% 33.6% 31.3% 30.0% 29.5% 29.5% Operating Margin 28.0%

LT Debt $6.3 mill. LT Interest $0.5 mill. 1.5 2.8 4.7 8.6 17.7 30.4 54.5 66.8 85.9 85.0 85.0 85.0 Depreciation ($mill) 80.0

(Less than 1% of Cap’l)

Leases, Uncapitalized: None .4 6.4 10.5 8.5 d7.0 d55.5 51.8 414.5 493.1 634.5 915 1185 Net Profit ($mill) 1800

No Defined Benefit Pension Plan 41.7% 25.9% 34.5% 53.3% -- -- -- 2.2% 21.4% 26.4% 25.0% 25.0% Income Tax Rate 25.0%

1.7% 13.5% 12.4% 3.9% NMF NMF 8.7% 30.7% 23.9% 20.9% 19.7% 20.3% Net Profit Margin 20.0%

Pfd Stock None 1.2 92.5 275.1 796.3 677.8 275.8 1146.5 913.5 977.9 1377.4 2200 3100 Working Cap’l ($mill) 6000

-- -- 6.5 6.3 11.9 5.8 6.2 6.5 6.9 6.3 6.0 6.0 Long-Term Debt ($mill) Nil

Common Stock 185,741,000 shs.

1.2 107.5 311.4 902.9 876.7 704.7 1716.3 1983.7 1998.8 2488.2 3400 4600 Shr. Equity ($mill) 9000

29.6% 6.0% 3.3% 1.0% NMF NMF 3.0% 20.8% 24.6% 25.5% 27.0% 26.0% Return on Total Cap’l 20.0%

MARKET CAP: $31.3 billion (Large Cap) 29.6% 6.0% 3.4% .9% NMF NMF 3.0% 20.9% 24.7% 25.5% 27.0% 26.0% Return on Shr. Equity 20.0%

CURRENT POSITION 2004 2005 3/3/07 29.6% 6.0% 3.4% .9% NMF NMF 3.0% 20.9% 24.7% 25.5% 27.0% 26.0% Retained to Com Eq 20.0%

($MILL.) -- -- -- -- -- -- -- -- -- -- Nil Nil All Div’ds to Net Prof Nil

Cash & ST securities 947.6 635.1 987.2

Receivables 240.9 347.1 612.8 BUSINESS: Research In Motion Limited develops and manufac- Berry hand-held devices. Research & development: 7.7% of fiscal

Inventory (FIFO) 92.5 134.5 255.9 tures wireless hand-held devices and radio modems, and provides 2006 sales. Has about 6,254 employees. Officers & directors own

Other 263.2 139.9 63.4

related services, for mobile computing and data communications. about 16% of common (5/07 Renewal form). Co-CEO: Jim Balsillie.

Current Assets 1544.2 1256.6 1919.3

The company’s BlackBerry services allow users to send and re- Pres. and Co-CEO: Mike Lazaridis. Incorporated: Ontario. Address:

Accts Payable 68.5 95.0 130.3

Debt Due .2 .3 .3 ceive e-mail and access personal information functions, including 295 Phillip Street, Waterloo, Ontario N2L 3W8. Telephone: 519-

Other 562.1 183.4 411.3 calendars, address books, and task lists, from its portable Black- 888-7465. Internet: www.rim.net.

Current Liab. 630.8 278.7 541.9

Research In Motion’s stock price vance of roughly 25% and a bottom-line in-

ANNUAL RATES Past Past Est’d ’03-’05 jumped almost 25% since our March crease of 25%-30%.

of change (per sh) 10 Yrs. 5 Yrs. to ’10-’12 report, reflecting strong growth in the In May, RIMM introduced the Black-

Revenues -- 55.0% 30.0%

‘‘Cash Flow’’ -- 85.0% NMF mobile communications market. The pri- Berry Curve smartphone, a small, light

Earnings -- 94.0% NMF mary driver is its strong BlackBerry prod- model with a large display, easy-to-use

Dividends -- -- Nil uct line, which is distributed worldwide by keyboard, and trackball navigation sys-

Book Value -- 28.0% 22.0%

a growing number of wireless carriers. tem. Features include a camera, media

Fiscal QUARTERLY REVENUES ($ mill.) AB Full

Year Fiscal RIMM is experiencing robust demand for player, and web browser, as well as Black-

Begins May Per Aug.Per Nov.Per Feb.Per Year its BlackBerry Pearl smartphone, a slim- Berry email and messaging capabilites.

2004 269.6 310.2 365.8 404.8 1350.4 profile model with a camera and music The balance sheet is solid with $1.41

2005 453.9 490.1 560.6 561.2 2065.8 player functions. The company continues billion ($7.61 a share) in cash assets, in-

2006 613.1 658.5 835.1 930.4 3037.1 to hold a dominant position in the enter- cluding $426 million in long-term invest-

2007 1050 1100 1215 1285 4650 prise market, despite rapidly changing ments, and practically no debt. Healthy

2008 1345 1385 1480 1620 5830 technology and aggressive competition. finances give the company the flexibility to

Fiscal EARNINGS PER SHARE ABCE Full

Year Fiscal Business metrics stay positive. Bene- invest in new products and technology.

Begins May Per Aug.Per Nov.Per Feb.Per Year fiting from the momentum in the wireless These shares are top ranked for rela-

2004 .36 .45 .59 .71 2.11 messaging market, RIMM added 1.02 mil- tive price performance over the next

2005 .56 .61 .71 .65 2.53 lion BlackBerry subscribers during the six to 12 months (Timeliness: 1). The

2006 .68 .74 .93 .99 3.33 February quarter, expanding the total sub- high ranking reflects the positive mo-

2007 1.06 1.11 1.26 1.37 4.80 scriber base to about 8.0 million, and es- mentum of earnings in recent periods and

2008 1.38 1.42 1.53 1.82 6.15

timates that it added over 1.1 million sub- the strong uptrend in the stock price over

Cal- QUARTERLY DIVIDENDS PAID Full scribers in the May interim. the past 12 months. Investors, however,

endar Mar.31 Jun.30 Sep.30 Dec.31 Year We are forecasting revenue growth of should keep in mind that trading in the

2003 over 50% for fiscal 2007 (ends Febru- shares can be volatile, as denoted by their

2004 NO CASH DIVIDENDS ary, 2008), following the 47% advance in low Stock Price Stability rating (15 out of

2005 BEING PAID fiscal 2006. Our forecast also calls for 100) and their relatively high Beta coeffi-

2006 share-profit expansion of nearly 45%. For cient (1.45).

2007 fiscal 2008, we are projecting a top-line ad- Lester Ratcliff June 15, 2007

(A) Reporting currency: U.S. dollars. Data (B) Fiscal year ends Saturday closest to the charges: ’00, $0.08; ’01, $0.11; ’02, $0.53; ’04, Company’s Financial Strength B++

through 8/31/99 restated from Canadian dollars last day of February of the following calendar $1.02. Next earnings report due early Jul. (D) Stock’s Price Stability 15

to U.S. dollars, using the 8/31/99 closing ex- year. (C) Canadian GAAP. Diluted earnings. In mill., adj. for split. (E) Sum of qtrs. may not Price Growth Persistence 70

change rate of C$1.488 per U.S.$1.00. Excludes amortization. Excludes extraordinary equal ann’l total due to rounding. Earnings Predictability 20

© 2007, Value Line Publishing, Inc. All rights reserved. Factual material is obtained from sources believed to be reliable and is provided without warranties of any kind.

THE PUBLISHER IS NOT RESPONSIBLE FOR ANY ERRORS OR OMISSIONS HEREIN. This publication is strictly for subscriber’s own, non-commercial, internal use. No part To subscribe call 1-800-833-0046.

of it may be reproduced, resold, stored or transmitted in any printed, electronic or other form, or used for generating or marketing any printed or electronic publication, service or product.

Вам также может понравиться

- Applied Time Series Econometrics: A Practical Guide for Macroeconomic Researchers with a Focus on AfricaОт EverandApplied Time Series Econometrics: A Practical Guide for Macroeconomic Researchers with a Focus on AfricaРейтинг: 3 из 5 звезд3/5 (1)

- Bby 2008Документ1 страницаBby 2008londonmorganОценок пока нет

- Apple - Report PDFДокумент1 страницаApple - Report PDFUwie AndrianaОценок пока нет

- Harley-Davidson: 29.4 20.0 Recent Price P/E Ratio Relative P/E Ratio Div'D YLDДокумент1 страницаHarley-Davidson: 29.4 20.0 Recent Price P/E Ratio Relative P/E Ratio Div'D YLDBrent UptonОценок пока нет

- Tri VLДокумент1 страницаTri VLJ Pierre RicherОценок пока нет

- Fund Report - Pure Stock Fund - Aug 2021Документ3 страницыFund Report - Pure Stock Fund - Aug 2021faleela IsmailОценок пока нет

- Historico PIB MexicoДокумент1 страницаHistorico PIB MexicoJUAN SINMIEDOОценок пока нет

- Mro Aa PDFДокумент1 страницаMro Aa PDFlondonmorganОценок пока нет

- Marathon Oil: 15.5 NMF Recent Price P/E Ratio Relative P/E Ratio Div'D YLDДокумент1 страницаMarathon Oil: 15.5 NMF Recent Price P/E Ratio Relative P/E Ratio Div'D YLDlondonmorganОценок пока нет

- EDIT Dimension PDFДокумент1 страницаEDIT Dimension PDFاسألك العفو والعافيهОценок пока нет

- 1a. Pagina, PresentationДокумент1 страница1a. Pagina, PresentationJose A. Bravo B.Оценок пока нет

- Jeddah Chamber PDF DrawingДокумент1 страницаJeddah Chamber PDF Drawingyunus humayunОценок пока нет

- SF No 28 Kadhampadi ModelДокумент1 страницаSF No 28 Kadhampadi ModelmanojОценок пока нет

- SF No 28 Kadhampadi ModelДокумент1 страницаSF No 28 Kadhampadi ModelmanojОценок пока нет

- Display Pc2404aДокумент1 страницаDisplay Pc2404aPedro MartinezОценок пока нет

- APFCB Slides 07 LipidsДокумент121 страницаAPFCB Slides 07 LipidsGPNОценок пока нет

- BP Stats Review 2019 Full Report 43Документ1 страницаBP Stats Review 2019 Full Report 43Sakaros BogningОценок пока нет

- Hardscape Layout-ModelДокумент1 страницаHardscape Layout-ModelJannet RodriguezОценок пока нет

- Batch5 - Task 5Документ1 страницаBatch5 - Task 537-Chinmay Pradeep DeshmukhОценок пока нет

- What Is TDS?: Usage Instructions Temperature Conversion ChartДокумент2 страницыWhat Is TDS?: Usage Instructions Temperature Conversion ChartyierbОценок пока нет

- 2-Wi Nding.. 64.7Документ1 страница2-Wi Nding.. 64.7MICHAEL MEDINA FLORESОценок пока нет

- Bta502 B501 45 Sheet 03Документ1 страницаBta502 B501 45 Sheet 03udataashutoshОценок пока нет

- Second Floor Plan: Saint Mary'S UniversityДокумент1 страницаSecond Floor Plan: Saint Mary'S UniversityAllison Bryan Domingo WasitОценок пока нет

- SW Drawing - 771754-0A - F - 2523148 - 290Документ1 страницаSW Drawing - 771754-0A - F - 2523148 - 290crochaplazaОценок пока нет

- Ground Floor Plan: Saint Mary'S UniversityДокумент1 страницаGround Floor Plan: Saint Mary'S UniversityAllison Bryan Domingo WasitОценок пока нет

- HDM 128GS24: Dimensional DrawingДокумент2 страницыHDM 128GS24: Dimensional DrawingMitchell DanielsОценок пока нет

- Convention Hydro Analysis Case 1 - 2.0Документ1 страницаConvention Hydro Analysis Case 1 - 2.0zaccОценок пока нет

- ROTRON Regenerative Blowers EN523 CP523 3.0HPДокумент2 страницыROTRON Regenerative Blowers EN523 CP523 3.0HPKHANNNОценок пока нет

- Farmland DimensionsДокумент1 страницаFarmland DimensionsKumar KingslyОценок пока нет

- ARC-2203 - Group No.5 - DraftДокумент7 страницARC-2203 - Group No.5 - DraftXAIRA ALEXA MARI CASTROОценок пока нет

- Model de Parter Și SuprafețeДокумент1 страницаModel de Parter Și SuprafețeI am DavidОценок пока нет

- Sheet ModelДокумент1 страницаSheet Modelvishal kaleОценок пока нет

- Plate No: College of Industrial Technology Bsit 3-A Drafting TechnologyДокумент1 страницаPlate No: College of Industrial Technology Bsit 3-A Drafting TechnologyShandy UrbanoОценок пока нет

- Planta Arquitectonica Apt - 1001Документ1 страницаPlanta Arquitectonica Apt - 1001Maria Alejandra VivancoОценок пока нет

- Walmart Inc PDFДокумент1 страницаWalmart Inc PDFWaqar AhmedОценок пока нет

- Dept Store Conceptual PlanДокумент1 страницаDept Store Conceptual PlanEdrian Louis Manalo TavasОценок пока нет

- Commercial Aspirin IR SpectrumДокумент1 страницаCommercial Aspirin IR SpectrumJoshua C. CastilloОценок пока нет

- Natwest - Student Living Index 2015Документ54 страницыNatwest - Student Living Index 2015Pedro BertonciniОценок пока нет

- SRMPCДокумент3 страницыSRMPCBHANUKRISHNA VISAKOTAОценок пока нет

- Rashvand Staple Holder TopДокумент1 страницаRashvand Staple Holder TopZiba BarootiОценок пока нет

- Cross Section 4-6Документ1 страницаCross Section 4-6alexОценок пока нет

- Specifications Discharge Curves 77 (25 ) : FM Series Battery For General UseДокумент2 страницыSpecifications Discharge Curves 77 (25 ) : FM Series Battery For General UseGuilber José Flores ZapataОценок пока нет

- OWNER-SRI.................... at Rampur Nayagonw, Gorakhnath, GorakhpurДокумент1 страницаOWNER-SRI.................... at Rampur Nayagonw, Gorakhnath, Gorakhpurmanish kumar singhОценок пока нет

- Gowtham Master PlanДокумент1 страницаGowtham Master PlanSachin SharmaОценок пока нет

- B400 B700 ManualДокумент2 страницыB400 B700 ManualMultiservicios aqualectОценок пока нет

- Frame 2 Moment Diagram For Load Combination 1: A B C D E F A B C D E FДокумент1 страницаFrame 2 Moment Diagram For Load Combination 1: A B C D E F A B C D E Fedgar salazarОценок пока нет

- Muro 2Документ1 страницаMuro 2Juan Camilo Guasmayan RomoОценок пока нет

- Muro 2Документ1 страницаMuro 2Juan Camilo Guasmayan RomoОценок пока нет

- VDS MasterplanДокумент1 страницаVDS MasterplanSamudrala SreepranaviОценок пока нет

- Safe-Test Point: AccessoriesДокумент2 страницыSafe-Test Point: AccessoriesBenjamin DipОценок пока нет

- CotasДокумент1 страницаCotasPaola VelascoОценок пока нет

- Gwapo FloorplanДокумент1 страницаGwapo FloorplanJayLord Mico PacisОценок пока нет

- Winstar Wh2004 20x4 LCDДокумент1 страницаWinstar Wh2004 20x4 LCDGeorge PapadoОценок пока нет

- F II Quality Report 08.02.2023Документ4 страницыF II Quality Report 08.02.2023AQUAОценок пока нет

- Sakya SHCMTC Diagram 2.0Документ1 страницаSakya SHCMTC Diagram 2.0zaccОценок пока нет

- 9f61agg301 DrawingДокумент1 страница9f61agg301 DrawingAlberto OrtizОценок пока нет

- Produced by An Autodesk Student Version: Disponible 12.53Документ1 страницаProduced by An Autodesk Student Version: Disponible 12.53DiegoArmandoRojasZarazoОценок пока нет

- HR Block VLДокумент1 страницаHR Block VLgutenberghoОценок пока нет

- Climate of Smart City - Aurangabad State:-Maha Rashtra, Dist: - AurangabadДокумент1 страницаClimate of Smart City - Aurangabad State:-Maha Rashtra, Dist: - AurangabadBhavik TrivediОценок пока нет

- Gay Research Integrity Officer ComplaintДокумент37 страницGay Research Integrity Officer ComplaintlondonmorganОценок пока нет

- Asian Development Bank Institute: ADBI Working Paper SeriesДокумент23 страницыAsian Development Bank Institute: ADBI Working Paper SerieslondonmorganОценок пока нет

- Mro Aa PDFДокумент1 страницаMro Aa PDFlondonmorganОценок пока нет

- Marathon Oil: 15.5 NMF Recent Price P/E Ratio Relative P/E Ratio Div'D YLDДокумент1 страницаMarathon Oil: 15.5 NMF Recent Price P/E Ratio Relative P/E Ratio Div'D YLDlondonmorganОценок пока нет

- 58-The DMI Stochastic PDFДокумент7 страниц58-The DMI Stochastic PDFlondonmorganОценок пока нет

- Stocks Comm Nov 2015Документ5 страницStocks Comm Nov 2015londonmorgan0% (1)

- PEGS and The Value PremiumДокумент2 страницыPEGS and The Value PremiumlondonmorganОценок пока нет

- The State of Retail Wealth ManagementДокумент12 страницThe State of Retail Wealth ManagementlondonmorganОценок пока нет

- Iluka 10kДокумент88 страницIluka 10klondonmorganОценок пока нет

- Usa Imports by End User Category 2013 Excellent Exports ImportsДокумент2 страницыUsa Imports by End User Category 2013 Excellent Exports ImportslondonmorganОценок пока нет

- What Is A Private PlacementДокумент3 страницыWhat Is A Private PlacementKritika TОценок пока нет

- Dr. Domingo Clinic Chart of Accounts: Account Numbers Account Titles Current AssetsДокумент2 страницыDr. Domingo Clinic Chart of Accounts: Account Numbers Account Titles Current AssetsmariaОценок пока нет

- Handout 7.2.INCOME TAX QUIZZER Lecturer'sДокумент15 страницHandout 7.2.INCOME TAX QUIZZER Lecturer'sApolinar Alvarez Jr.100% (4)

- Cost AccountingДокумент3 страницыCost AccountingXen XeonОценок пока нет

- Module 11 EntrepДокумент7 страницModule 11 EntrepRussell CastroОценок пока нет

- Chapter 2 and SolutionsДокумент6 страницChapter 2 and Solutionsgeo_biОценок пока нет

- Batch 74 Contact 0 Raghu Iyer NotesДокумент42 страницыBatch 74 Contact 0 Raghu Iyer NotesRajveer SinghОценок пока нет

- Capital Stock and Shares of StockДокумент58 страницCapital Stock and Shares of StockRache Gutierrez100% (1)

- Corporate Governance: The 4 PsДокумент14 страницCorporate Governance: The 4 PsMaricar Dela Cruz VLOGSОценок пока нет

- 07.ind As 102Документ35 страниц07.ind As 102Pranjul AgrawalОценок пока нет

- (Problems) - Audit of InvestmentsДокумент17 страниц(Problems) - Audit of Investmentsapatos50% (6)

- Cabaron, P - Module#1 - Fabm1 - Week3Документ9 страницCabaron, P - Module#1 - Fabm1 - Week3Jeje BalsoteОценок пока нет

- This Study Resource Was: F-ACADL-01Документ8 страницThis Study Resource Was: F-ACADL-01Marjorie PalmaОценок пока нет

- Bank Statement JUNE 2023Документ3 страницыBank Statement JUNE 2023TIONG JIE WONG0% (1)

- Managerial Accounting - HW Case 5-2 Celtex Feb 05 2011Документ1 страницаManagerial Accounting - HW Case 5-2 Celtex Feb 05 2011Gautam RandhawaОценок пока нет

- Havells India LTD: Actuals Key Financials (Rs. in CRS.)Документ159 страницHavells India LTD: Actuals Key Financials (Rs. in CRS.)milan kakkadОценок пока нет

- Chap 026Документ20 страницChap 026Li YichaoОценок пока нет

- Midterm Examination - AUDITING REVIEWДокумент7 страницMidterm Examination - AUDITING REVIEWFrancis MateosОценок пока нет

- Business Associations 1 Class NotesДокумент30 страницBusiness Associations 1 Class NotessakatuyaОценок пока нет

- Understanding Financial Statements PowerpointДокумент18 страницUnderstanding Financial Statements PowerpointVergel MartinezОценок пока нет

- Intrinsic Value Calculator Adam KhOOДокумент3 страницыIntrinsic Value Calculator Adam KhOOShereeAnnTorres25% (8)

- A211 MC4 MFRS108 Mfrs110-StudentДокумент6 страницA211 MC4 MFRS108 Mfrs110-StudentGui Xue ChingОценок пока нет

- Analyzing Investing Activities: Intercorporate InvestmentsДокумент34 страницыAnalyzing Investing Activities: Intercorporate InvestmentsVeenesha MuralidharanОценок пока нет

- Financial Management 2 Assignment 1: Dividend Policy at FPL GroupДокумент9 страницFinancial Management 2 Assignment 1: Dividend Policy at FPL GroupDiv_nОценок пока нет

- MBA Financial ManagementДокумент254 страницыMBA Financial ManagementMahoKukhianidze100% (2)

- Initial Public Offerings: Ibbotson, Roger G. Sindelar, Jody L. Ritter, Jay RДокумент16 страницInitial Public Offerings: Ibbotson, Roger G. Sindelar, Jody L. Ritter, Jay RsanjeevseshannaОценок пока нет

- I-Great Mega: ArketingДокумент12 страницI-Great Mega: ArketingApakElBuheiriGetbОценок пока нет

- Strategic Tax Management (Final Period Assignment Quiz)Документ4 страницыStrategic Tax Management (Final Period Assignment Quiz)Nelia AbellanoОценок пока нет

- Lesson 1 SFPДокумент14 страницLesson 1 SFPLydia Rivera100% (3)

- 2 - Acct 1 Branchs and UsersДокумент17 страниц2 - Acct 1 Branchs and UsersJoana AutosОценок пока нет