Академический Документы

Профессиональный Документы

Культура Документы

Time Value of Money Formulas Sheet PDF

Загружено:

Mîñåk ŞhïïОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Time Value of Money Formulas Sheet PDF

Загружено:

Mîñåk ŞhïïАвторское право:

Доступные форматы

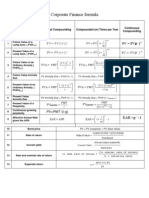

Time Value of Money Formula Sheet

# Time Value of Money Formula for Annual Intra Year Continuous

Future and Present Value of Lump Sum:

1 Future Value by Sample Interest SIn = P + (P * i * n) Nil Nil

n n*m i*n

2 Future Value by Compound Interest FVn = PV * (1 + i) FVn = PV * (1 + i / m) FVn = PV * e

3 Future Value by Factor Formula FVn = PV * (FVIF i , n) FVn = PV * (FVIF i / m , n * m) FVn = PV * e (i/m) * (n*m) #

4 Present Value of Single Cash Flow PVn = FV / (1 + i) n PVn = FV / (1 + i / m) n*m PVn = FV / e i*n

5 Present Value by Factor Formula PVn = FV * (PVIF i, n) PVn = FV * (PVIF i/m, n*m) PVn = FV / e (i/m)* (n*m)

Future and Present Value of Annuity:

6 Future Value of Constant Cash Flow (CCF) O. Annuity FVAn = CCF [(1 + i) n - 1 / i] %

FVAn = CCF [(1 + i/m) n * m - 1 / i/m] FVAn = CCF [(ei * n - 1) / (ei - 1)]

7 Future Value of Ordinary Annuity by Factor Formula FVAn = CCF * (FVIFA i, n) FVAn = CCF * (FVIFA i/m, n*m) FVAn = CCF [(e (i/m) * n*m )

- 1) / (ei/m - 1)] ##

8 Future Value of Constant Cash Flow (CCF) Annuity Due FVADue = CCF [(1 + i) n - 1 / i] * (1+i) %%

FVADue = CCF [(1 + i/m) n*m - 1 / (i/m)] * (1+i/m) Nil

9 Future Value of Annuity Due by Factor Formula FVADue = CCF * (FVIFA i, n) * (1 + i) FVADue = CCF * (FVIFA i/m, n*m) * (1 + i/m) Nil

n # n*m -i*n

10 Present Value of Constant Cash Flow (CCF) O. Annuity PVAn = CCF [1-{1 / (1+i) } / i] PVAn = CCF [1-{1 / (1+i/m) } / i/m] PVAn = CCF [{(1-e) } / {(e i – 1)}]

-(i/m) * (n*m)

11 Present Value of Ordinary Annuity by Factor Formula PVAn = CCF * (PVIFA i, n) PVAn = CCF * (PVIFA i/m, n*m) PVAn = CCF [{(1-e) } / {(e i/m – 1)}]###

12 Present Value of Constant Cash Flow (CCF) Annuity Due PVADue = CCF [1-{1 / (1+i) n} / i] * (1+i) ##

PVADue= CCF [1-{1 / (1+i/m) n*m} / i/m] * (1+i/m) Nil

13 Present Value of Annuity Due by Factor Formula PVADue = CCF * (PVIFA i, n) * (1+i) PVADue = CCF * (PVIFA i/m, n*m) * (1+i/m) Nil

Special Applications:

14 Perpetuity PVp = CCF / i Nil Nil

Effective Annual Rate when Annual Percentage Rate is

15 given EAR = i EAR = (1 +APR / m) m - 1 Nil

1/m

16 Annual Percentage when Effective Annual Rate is given i = EAR i = m [(1 + EAR) - 1] Nil

17 Real Interest Rate RIR = NR - IR Nil Nil

18 Rule of Doubling n = 72 / i n = 0.35 + 69 / i Nil

The length of time required for a single cash flow to grow

19 to a specified future amount at a given rate of interest n = {Log (FV / PV)} / {Log (1 + i)} n = {Log (FV / PV)} / {m * Log (1 + i/m)} n = 1/i {Log (FV / PV)

The simple rate of interest required for a single cash flow

20 to grow to a specified future cash flow. i = {(FV/PV) 1 / n} - 1 i = m {(FV / PV) 1 / (n * m)} - 1 i = 1/n {In (FV / PV)}

The length of time required for a series of constant cash

21 flows to grow to a specific future amount. n = In {(FVA) (i) / CCF + 1} In (1 + i) n = In {(i/m) (FVA/CCF) + m/i} / [m * {In (1 + i\m}] Nil

Present value of a finite series of cash flows growing at a

22 constant rate (g) for (n) periods with constant (i). PV = {CCF (1 + g) / (i - g)} * [1-{1+g) / (1 + i} n] Nil Nil

#, ##, ###

Continuous Compound and Discounting do not have factor formulas. These line use for Intra Year in case of continuous compounding and discounting.

%

FVAn = CCF (1 + i) n-1 + CCF (1 + i) n-2 + CCF (1 + i) n-3 + ………. + CCF (1 + i) n-n

%%

FVADue = CCF (1 + i) 1 + CCF (1 + i) 2 + CCF (1 + i) 3 + ………. + CCF (1 + i) n or FVADue = Future Value of Ordinary Annuity (1 + i)

#

PVAn = CCF (1/1+i) 1 + CCF (1/1+i) 2 + CCF (1/1+i) 3 + ………. + CCF (1/1+i) n

##

PVAn = CCF (1/1+i) n-1 + CCF (1/1+i) n-22 + CCF (1/1+i) n-3 + ………. + CCF (1/1+i) n-n or PVADue = Present Value of Ordinary Annuity (1 + i)

www.accountancyknowledge.com (Note that our notations are different from those used by text book)

Вам также может понравиться

- Time value of money cheat sheetДокумент3 страницыTime value of money cheat sheetTechbotix AppsОценок пока нет

- Time Value of Money: FormulaДокумент2 страницыTime Value of Money: FormulaParvez RahmanОценок пока нет

- ICT formula sheet shortcutsДокумент2 страницыICT formula sheet shortcutsNat Siow100% (1)

- Time Value of Money FormulasДокумент1 страницаTime Value of Money FormulasAmit Shankar Choudhary100% (1)

- Engineering formulas guide for financial analysisДокумент4 страницыEngineering formulas guide for financial analysisJeff JabeОценок пока нет

- Formulas Bonds: Cpn Income+ price change APY(Approximate Yield to MaturityДокумент1 страницаFormulas Bonds: Cpn Income+ price change APY(Approximate Yield to MaturityGhitaОценок пока нет

- Time Value of Money ConceptsДокумент2 страницыTime Value of Money ConceptsBrandon RaoОценок пока нет

- Formula Sheet Corporate Finance (COF) : Stockholm Business SchoolДокумент6 страницFormula Sheet Corporate Finance (COF) : Stockholm Business SchoolLinus AhlgrenОценок пока нет

- Equation Formula: 1 1 FV PMT 1Документ3 страницыEquation Formula: 1 1 FV PMT 1JMSB09Оценок пока нет

- Formula Sheet - Time Value of Money PDFДокумент11 страницFormula Sheet - Time Value of Money PDFJainil ShahОценок пока нет

- FMV Cheat SheetДокумент1 страницаFMV Cheat SheetAyushi SharmaОценок пока нет

- Concept of Time Value of Money (TVM) Need / Reasons For Time Value of MoneyДокумент34 страницыConcept of Time Value of Money (TVM) Need / Reasons For Time Value of MoneyRasumathi SОценок пока нет

- Fin Cheat SheetДокумент3 страницыFin Cheat SheetChristina RomanoОценок пока нет

- Economics Cheat SheetДокумент2 страницыEconomics Cheat Sheetalysoccer449100% (2)

- Cheat Sheet - CHE374Документ26 страницCheat Sheet - CHE374JoeОценок пока нет

- Elasticity and Demand ExerciseДокумент7 страницElasticity and Demand ExerciseKhairul Bashar Bhuiyan 1635167090Оценок пока нет

- Watson Introduccion A La Econometria PDFДокумент253 страницыWatson Introduccion A La Econometria PDF131270Оценок пока нет

- Important Notes For Midterm 2Документ11 страницImportant Notes For Midterm 2Abass Bayo-AwoyemiОценок пока нет

- Formula Sheet FIMДокумент4 страницыFormula Sheet FIMYОценок пока нет

- FIN205 Formula SheetДокумент5 страницFIN205 Formula SheetAamir SaeedОценок пока нет

- Time Value of Money Formula SheetДокумент2 страницыTime Value of Money Formula SheetMD Abrar FaiyazОценок пока нет

- Open Economy MacroeconomicsДокумент15 страницOpen Economy MacroeconomicssrpsinghОценок пока нет

- Bond ValuationДокумент17 страницBond ValuationMatthew RyanОценок пока нет

- Coach Huber AP Macroeconomics: Gross Domestic ProductДокумент18 страницCoach Huber AP Macroeconomics: Gross Domestic Productapi-255899090Оценок пока нет

- ECN 2215 - Topic - 2 PDFДокумент54 страницыECN 2215 - Topic - 2 PDFKalenga AlexОценок пока нет

- Chapter 4 Interest Rate FormulasДокумент4 страницыChapter 4 Interest Rate FormulasJohnОценок пока нет

- Operating Ratio + Operating Profit Ratio 1Документ6 страницOperating Ratio + Operating Profit Ratio 1Prakash ReddyОценок пока нет

- Case 1Документ2 страницыCase 1Chiks JpegОценок пока нет

- Formula Sheet Econometrics PDFДокумент2 страницыFormula Sheet Econometrics PDFJustin Huynh100% (2)

- Time Value of Money NotesДокумент10 страницTime Value of Money Notespaul sagudaОценок пока нет

- Elasticity EconomicsДокумент14 страницElasticity EconomicsYiwen LiuОценок пока нет

- CH 3 Macroeconomics AAUДокумент90 страницCH 3 Macroeconomics AAUFaris Khalid100% (1)

- Formula Sheet Foundations of FinanceДокумент5 страницFormula Sheet Foundations of Financeyukti100% (1)

- Bond AnalysisДокумент45 страницBond AnalysisAbhishekОценок пока нет

- Homework EconometricsДокумент7 страницHomework EconometricstnthuyoanhОценок пока нет

- Cheat Sheet Derivatif Securities UTSДокумент2 страницыCheat Sheet Derivatif Securities UTSNicole sadjoliОценок пока нет

- Corporate Finance NPV and IRR SolutionsДокумент3 страницыCorporate Finance NPV and IRR SolutionsMark HarveyОценок пока нет

- MAF101 Formula Sheet-2010TR1Документ2 страницыMAF101 Formula Sheet-2010TR1Ann VuОценок пока нет

- C 2 T V M: Hapter IME Alue of OneyДокумент32 страницыC 2 T V M: Hapter IME Alue of OneyZahid UsmanОценок пока нет

- 9.6 Keynesian MultiplierДокумент23 страницы9.6 Keynesian MultiplierkimmoОценок пока нет

- Formulae Sheets: Ps It Orp S It 1 1Документ3 страницыFormulae Sheets: Ps It Orp S It 1 1Mengdi ZhangОценок пока нет

- Corporate Finance Chapter 9Документ31 страницаCorporate Finance Chapter 9dia0% (2)

- Discount Factor TemplateДокумент5 страницDiscount Factor TemplateRashan Jida ReshanОценок пока нет

- Econ 201 Mid Term ReviewДокумент7 страницEcon 201 Mid Term ReviewGeorge DhimaОценок пока нет

- Cost of Capital: Dr. Md. Anwar Ullah, FCMA Southeast UniversityДокумент23 страницыCost of Capital: Dr. Md. Anwar Ullah, FCMA Southeast Universityasif rahanОценок пока нет

- Managerial Economics: Cheat SheetДокумент110 страницManagerial Economics: Cheat SheetSushmitha KanasaniОценок пока нет

- Ecn 1215 - Take - Home - Test - 06 - 05 - 2019-1 PDFДокумент2 страницыEcn 1215 - Take - Home - Test - 06 - 05 - 2019-1 PDFCaristo MumbaОценок пока нет

- THE CAPITAL STOCK ADJUSTMENT THEORY OF INVESTMENTДокумент1 страницаTHE CAPITAL STOCK ADJUSTMENT THEORY OF INVESTMENTmuyi kunleОценок пока нет

- Macro Cheat SheetДокумент3 страницыMacro Cheat SheetMei SongОценок пока нет

- Time Value of Money - Concepts and Practice Problems - No SolutionsДокумент17 страницTime Value of Money - Concepts and Practice Problems - No Solutionsamit meelОценок пока нет

- Chapter 8 Corporate FinanceДокумент34 страницыChapter 8 Corporate FinancediaОценок пока нет

- Econ1102 Macroeconomics 1 Sample Exam QuestionsДокумент2 страницыEcon1102 Macroeconomics 1 Sample Exam Questionschristine_liu0110100% (2)

- Econometrics ProjectДокумент10 страницEconometrics ProjectCarlos Ferreira100% (1)

- FM Textbook Solutions Chapter 3 Second Edition PDFДокумент15 страницFM Textbook Solutions Chapter 3 Second Edition PDFlibredescarga0% (1)

- FN3105 Formula Spreadsheet Mid TermДокумент1 страницаFN3105 Formula Spreadsheet Mid TermGD GamingОценок пока нет

- Corporate Finance FormulasДокумент3 страницыCorporate Finance FormulasMustafa Yavuzcan83% (12)

- Calculating Present and Future Values of Cash FlowsДокумент3 страницыCalculating Present and Future Values of Cash FlowsjainswapnilОценок пока нет

- Calculate fair share price using dividend discount modelДокумент9 страницCalculate fair share price using dividend discount modelTannao100% (1)

- Cong ThucДокумент12 страницCong ThucGiang Thái HươngОценок пока нет

- Economy of PakistanДокумент31 страницаEconomy of PakistanBilal HussainОценок пока нет

- 2 Textbook - Evaluation Amended - 14 7 2010 PDFДокумент22 страницы2 Textbook - Evaluation Amended - 14 7 2010 PDFKhalid de CancОценок пока нет

- Poverty in Pakistan Issues Causes and Institutional ResponsesДокумент87 страницPoverty in Pakistan Issues Causes and Institutional ResponsesIftikhar JavedОценок пока нет

- Political Instability: A Case Study of PakistanДокумент13 страницPolitical Instability: A Case Study of PakistanimranОценок пока нет

- Pakistan Energy Crisis An OverviewДокумент14 страницPakistan Energy Crisis An OverviewikramОценок пока нет