Академический Документы

Профессиональный Документы

Культура Документы

Global kons-COns Contract

Загружено:

Sandeep GyawaliАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Global kons-COns Contract

Загружено:

Sandeep GyawaliАвторское право:

Доступные форматы

represents a change of accounting policy and therefore wish to treat the write off as a prior period

adjustment.

(e) A provision for income tax for the year to 31 March 20X1 of $15 million is required.

Required

(a) Prepare the statement of profit or loss of Winger for the year to 31 March 20X1. (9 marks)

(b) Prepare a statement of financial position as at 31 March 20X1 in accordance with International

Accounting Standards as far as the information permits. (11 marks)

(Total = 20 marks)

Note. As you have not yet covered IAS 1 Presentation of Financial Statements, you do not need to comply

with its detailed requirements.

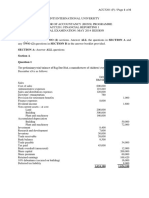

11 Global Konstruckshen

Global Konstrukshen Co is a civil engineering company. It started work on two long-term projects during

the year ended 31 December 20X0. The following figures relate to those projects at the reporting date.

Alpine bypass World Ecology Centre

$'000 $'000

Contract price 9,000 8,000

Costs incurred to date 1,400 2,900

Estimated costs to completion 5,600 5,200

Value of work certified to date 2,800 3,000

Cash received from contractee 2,600 3,400

An old mineshaft has been discovered under the site for the World Ecology Centre and the costs of dealing

with this have been taken into account in the calculation of estimated costs to completion. Global's

lawyers are reasonably confident that the customer will have to bear the additional costs which will be

incurred in stabilising the land. If negotiations are successful then the contract price will increase to $10m.

Global recognises turnover and profits on long-term (construction) contracts on the basis of work certified

to date.

Required

(a) Calculate the figures which would appear in Global Konstrukshen's financial statements in respect

of these two projects.

(b) It has been suggested that profit on construction contracts should not be recognised until the

contract is completed. Briefly explain whether you believe that this suggestion would improve the

quality of financial reporting for long-term contracts.

12 Provisions 45 mins

IAS 37 Provisions, contingent liabilities and contingent assets was issued in 1998. Prior to its publication,

there was no International Accounting Standard that dealt with the general subject of accounting for

provisions.

Extract prepares its financial statements to 31 December each year. During the years ended 31 December

20X0 and 31 December 20X1, the following event occurred.

Extract is involved in extracting minerals in a number of different countries. The process typically involves

some contamination of the site from which the minerals are extracted. Extract makes good this

contamination only where legally required to do so by legislation passed in the relevant country.

The company has been extracting minerals in Copperland since January 20W8 and expects its site to

produce output until 31 December 20X5. On 23 December 20X0, it came to the attention of the directors

of Extract that the government of Copperland was virtually certain to pass legislation requiring the making

good of mineral extraction sites. The legislation was duly passed on 15 March 20X1. The directors of

488 Exam question bank

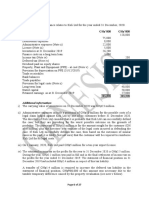

11 Global Konstrukshen

Tutor's hint. Calculate profit or loss on the contract and cost of sales comes out as a balancing figure. You

can then work out the accrued cost of sales and accrued future losses.

(a) Alpine bypass World Ecology centre

$'000 $'000

Turnover 2,800 3,000

Profit/(loss) (W) 622 (100)

Cost of sales 2,178 3,100

Current assets

Amount recoverable on contract (2,800 – 2,600) 200 –

Current liabilities

Payment on account (3,400 – 3,000) – (400)

Accrued cost of sales (2,178 – 1,400) (778) –

Accrued future losses (3,100 – 2,900) – (200)

2,800

(W) Alpine: (9,000 – (1,400 + 5,600) = 622

9,000

World Ecology: 8,000 – (2,900 + 5,200) = 100

(b) Construction contracts are recognised as such when they cover at least two accounting periods. If

they were not to be treated as they are under IAS 11 then the costs incurred during the early years

of the contract would be recognised but with no corresponding turnover. This would lead to several

years of losses then one year of high profits regardless of how profitable the contract really was.

The advantage of this approach however would be that there would be no need to use estimates

and forecasts.

The current treatment matches an element of the turnover to the costs incurred. There is an

attempt to maintain prudence by ensuring that any foreseeable losses are accounted for

immediately. This gives a fairer representation of the underlying financial substance of the

transaction and makes it easier for the user of the accounts to assess the financial position of the

company.

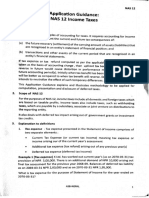

12 Provisions

Tutor's hint. A good knowledge of IAS 37 is needed in this question. Do not disregard the discounting

aspects, these calculations are quite straightforward as you are given the formulae in the exam.

(a) Why there was a need for an accounting standard dealing with provisions

IAS 37 Provisions, contingent liabilities and contingent assets was issued to prevent entities from

using provisions for creative accounting. It was common for entities to recognise material

provisions for items such as future losses, restructuring costs or even expected future expenditure

on repairs and maintenance of assets. These could be combined in one large provision (sometimes

known as the 'big bath'). Although these provisions reduced profits in the period in which they

were recognised (and were often separately disclosed on grounds of materiality), they were then

released to enhance profits in subsequent periods. To make matters worse, provisions were often

recognised where there was no firm commitment to incur expenditure. For example, an entity

might set up a provision for restructuring costs and then withdraw from the plan, leaving the

provision available for profit smoothing.

526 Exam answer bank

Вам также может понравиться

- 11 Global Konstrukshen: Alpine Bypass World Ecology CentreДокумент1 страница11 Global Konstrukshen: Alpine Bypass World Ecology CentreJohn WickОценок пока нет

- (' in Crores) Less: Total Contract Price: © The Institute of Chartered Accountants of IndiaДокумент12 страниц(' in Crores) Less: Total Contract Price: © The Institute of Chartered Accountants of IndiaYashОценок пока нет

- 73264bos59105 Inter P1aДокумент12 страниц73264bos59105 Inter P1aRaish QURESHIОценок пока нет

- CA IPCC Accounting Guideline Answers May 2015Документ24 страницыCA IPCC Accounting Guideline Answers May 2015Prashant PandeyОценок пока нет

- Entity Y: Problem 4: Activity 2Документ11 страницEntity Y: Problem 4: Activity 2Christine Eunice RaymondeОценок пока нет

- Ias11 Ie 1-12Документ5 страницIas11 Ie 1-12rachelОценок пока нет

- ACC3201Документ6 страницACC3201natlyhОценок пока нет

- As GR 1 Ipcc Compiler 2015-18Документ24 страницыAs GR 1 Ipcc Compiler 2015-18KRISHNA MANDLOIОценок пока нет

- QUESTION 6 Financial Reporting May 2021 KOLIДокумент6 страницQUESTION 6 Financial Reporting May 2021 KOLILaud ListowellОценок пока нет

- 6200 (Fin Act & Rept), Exam Session, March-April, 2022Документ10 страниц6200 (Fin Act & Rept), Exam Session, March-April, 2022Monira afrozОценок пока нет

- ACG211E Test 1 Suggested SolutionДокумент5 страницACG211E Test 1 Suggested Solutionsphesihlemkhize1204Оценок пока нет

- MTP 12 14 Answers 1696416138Документ13 страницMTP 12 14 Answers 1696416138harshallahotОценок пока нет

- Nanyang Business School AB1201 Financial Management Tutorial 8: The Basics of Capital Budgeting (Common Questions)Документ4 страницыNanyang Business School AB1201 Financial Management Tutorial 8: The Basics of Capital Budgeting (Common Questions)asdsadsaОценок пока нет

- Day 3 - Lecture Examples - Chapter 6Документ5 страницDay 3 - Lecture Examples - Chapter 6NikolaNikoloskiОценок пока нет

- Akm 3 Weeks 3Документ3 страницыAkm 3 Weeks 3RohmadОценок пока нет

- Cuac208 Tests and AssignmentsДокумент8 страницCuac208 Tests and AssignmentsInnocent GwangwaraОценок пока нет

- Step 1: Identify The Contract With The Customer: AcctranДокумент8 страницStep 1: Identify The Contract With The Customer: AcctranPrecy Joy TrimidalОценок пока нет

- Indian Institute of Management Ahmedabad: Financial Reporting and Analysis End ExaminationДокумент4 страницыIndian Institute of Management Ahmedabad: Financial Reporting and Analysis End ExaminationPulkit SethiaОценок пока нет

- Practice QuestionsДокумент19 страницPractice QuestionsAbdul Qayyum Qayyum0% (2)

- Chapter 7 - Teacher's Manual - Afar Part 1Документ24 страницыChapter 7 - Teacher's Manual - Afar Part 1Angelic100% (3)

- Pembahasan: A. Membuat Analisis Kontrak Dan Estimasi Gross Profit Setiap Tahun 2018 2019Документ64 страницыPembahasan: A. Membuat Analisis Kontrak Dan Estimasi Gross Profit Setiap Tahun 2018 201917HARISA SETYA HANDINIОценок пока нет

- Construction Contracts: 1. False 6. True 2. False 7. True 3. False 8. False 4. True 9. False 5. True 10. TRUEДокумент25 страницConstruction Contracts: 1. False 6. True 2. False 7. True 3. False 8. False 4. True 9. False 5. True 10. TRUEjuennaguecoОценок пока нет

- Long-Term Construction ContractsДокумент9 страницLong-Term Construction ContractsRoi Martin A. De VeyraОценок пока нет

- Chapter 7 Construction ContractsДокумент10 страницChapter 7 Construction Contractsleshz zynОценок пока нет

- Quiz ConstructionДокумент1 страницаQuiz ConstructionErjohn PapaОценок пока нет

- Compilation Pyq - Far570Документ109 страницCompilation Pyq - Far570Nur SyafiqahОценок пока нет

- LTCC Work BookДокумент49 страницLTCC Work BookHannah NolongОценок пока нет

- Answer On AccountingДокумент6 страницAnswer On AccountingShahid MahmudОценок пока нет

- IA Quiz ImadeДокумент4 страницыIA Quiz ImadeKuro ZetsuОценок пока нет

- Nov-Dec 2012Документ11 страницNov-Dec 2012Usuf JabedОценок пока нет

- F5 Bafs 1 AnsДокумент6 страницF5 Bafs 1 Ansouo So方Оценок пока нет

- Long-Term Construction Contracts & FranchiseДокумент6 страницLong-Term Construction Contracts & FranchiseBryan ReyesОценок пока нет

- MMPC-004 Accounting For ManagersДокумент4 страницыMMPC-004 Accounting For Managersbhavan pОценок пока нет

- 8Документ85 страниц8Alex liao100% (2)

- Construction Contracts: International Accounting Standard 11Документ5 страницConstruction Contracts: International Accounting Standard 11Babu babuОценок пока нет

- Practice Midterm Questions JAN 2022 Second With SOLUTIONS v7Документ17 страницPractice Midterm Questions JAN 2022 Second With SOLUTIONS v7Aryan JainОценок пока нет

- Solution - (Ust-Jpia) Ca51016 Ia3 Mock Preliminary Examination ReviewerДокумент11 страницSolution - (Ust-Jpia) Ca51016 Ia3 Mock Preliminary Examination Reviewerhpp academicmaterialsОценок пока нет

- 69796bos55750 p1Документ34 страницы69796bos55750 p1Dj babuОценок пока нет

- Economic Aspects On Condensate To Gasoline Invesment ProjectДокумент23 страницыEconomic Aspects On Condensate To Gasoline Invesment Projectsbjtcms98Оценок пока нет

- Accounting - AnswerДокумент13 страницAccounting - AnswerINTER SMARTIANSОценок пока нет

- Chapter 21 - QB - Q1 - SolutionДокумент4 страницыChapter 21 - QB - Q1 - SolutionRichard SibekoОценок пока нет

- Acctg For Special Transaction - 3rd Lesson PDFДокумент9 страницAcctg For Special Transaction - 3rd Lesson PDFDebbie Grace Latiban LinazaОценок пока нет

- 2816 Solution To Long Term Construction ContractsДокумент47 страниц2816 Solution To Long Term Construction ContractsPhoeza Espinosa Villanueva100% (1)

- Management Information May-Jun 2016Документ2 страницыManagement Information May-Jun 2016SomeoneОценок пока нет

- 7001 Assignment #1Документ6 страниц7001 Assignment #1南玖Оценок пока нет

- Discussion Questions Risks and Audit ProceduresДокумент16 страницDiscussion Questions Risks and Audit ProceduresLoo Bee YeokОценок пока нет

- Mock Answers Far-1 Autumn 2022Документ13 страницMock Answers Far-1 Autumn 2022rana m harisОценок пока нет

- Jul22 Osa Supp Accounting and Financial Management Question PaperДокумент9 страницJul22 Osa Supp Accounting and Financial Management Question PaperMelokuhle MhlongoОценок пока нет

- AFAR Self Test - 9002Документ7 страницAFAR Self Test - 9002Jennifer RueloОценок пока нет

- LiabilitiesДокумент2 страницыLiabilitiesFrederick AbellaОценок пока нет

- FAC3761 - Exam Prep - Mock Question Paper - Suggested SolutionДокумент9 страницFAC3761 - Exam Prep - Mock Question Paper - Suggested SolutionRene EngelbrechtОценок пока нет

- Long Quiz:: Construction Contracts Name: Date: Professor: Section: ScoreДокумент12 страницLong Quiz:: Construction Contracts Name: Date: Professor: Section: ScoreNahwi Kimpa100% (1)

- 921 Financial Accounting Reporting Sep Oct 2022Документ4 страницы921 Financial Accounting Reporting Sep Oct 2022supritha724Оценок пока нет

- Solution To Example 1:: Property, Plant and Equipment - Part 3 - Solutions To ExamplesДокумент11 страницSolution To Example 1:: Property, Plant and Equipment - Part 3 - Solutions To ExamplesLayОценок пока нет

- ACC1100 S1 2018 Exam SolutionДокумент15 страницACC1100 S1 2018 Exam SolutionFarah PatelОценок пока нет

- Income Statement and Foreign Currency TransactionsДокумент19 страницIncome Statement and Foreign Currency TransactionsPaula LazărОценок пока нет

- © The Institute of Chartered Accountants of IndiaДокумент12 страниц© The Institute of Chartered Accountants of IndiaMiku JainОценок пока нет

- 12 CasДокумент7 страниц12 CasLakshay SharmaОценок пока нет

- LTCC Quiz W AnsДокумент4 страницыLTCC Quiz W AnsalyОценок пока нет

- Equity Valuation: Models from Leading Investment BanksОт EverandEquity Valuation: Models from Leading Investment BanksJan ViebigОценок пока нет

- Nepal Accounting Standard 34: Interim Financial ReportingДокумент12 страницNepal Accounting Standard 34: Interim Financial ReportingSandeep GyawaliОценок пока нет

- Nepal Accounting Standard 24: Related Party DisclosuresДокумент9 страницNepal Accounting Standard 24: Related Party DisclosuresSandeep GyawaliОценок пока нет

- Deferred Tax-DT GroupДокумент4 страницыDeferred Tax-DT GroupSandeep GyawaliОценок пока нет

- QN1. Consolidated FS-HeverДокумент6 страницQN1. Consolidated FS-HeverSandeep Gyawali100% (1)

- Preface To NFRS PDFДокумент4 страницыPreface To NFRS PDFSandeep GyawaliОценок пока нет

- NAS 19 Employees Benefits PDFДокумент128 страницNAS 19 Employees Benefits PDFSandeep GyawaliОценок пока нет

- Bonus Regulation NepДокумент9 страницBonus Regulation NepBijay JoshiОценок пока нет

- NAS 12 Income TaxesДокумент33 страницыNAS 12 Income TaxesSandeep GyawaliОценок пока нет

- This Is A Dummy FileДокумент1 страницаThis Is A Dummy FileSandeep GyawaliОценок пока нет

- Bonus Act-Eng - 20110904110710Документ12 страницBonus Act-Eng - 20110904110710Vijay AgrahariОценок пока нет

- Class NotesДокумент1 страницаClass NotesSandeep GyawaliОценок пока нет

- Only FileДокумент1 страницаOnly FileSandeep GyawaliОценок пока нет

- Fake Not ImpДокумент1 страницаFake Not ImpSandeep GyawaliОценок пока нет

- Not ImpДокумент1 страницаNot ImpSandeep GyawaliОценок пока нет

- Infinity EndgameeДокумент1 страницаInfinity EndgameeSandeep GyawaliОценок пока нет

- NothingДокумент1 страницаNothingSandeep GyawaliОценок пока нет

- Just FileДокумент1 страницаJust FileSandeep GyawaliОценок пока нет

- My FileДокумент1 страницаMy FileSandeep GyawaliОценок пока нет

- American Life Insurance CompanyДокумент13 страницAmerican Life Insurance CompanyPatrick NokrekОценок пока нет

- Retail Costing-F&tДокумент31 страницаRetail Costing-F&tKaushal YadavОценок пока нет

- Talk About ImbalancesДокумент1 страницаTalk About ImbalancesforbesadminОценок пока нет

- Z June 2018 Module 2.06 (Suggested Solutions)Документ20 страницZ June 2018 Module 2.06 (Suggested Solutions)M Nasir ArifОценок пока нет

- A Literature Study On The Capital Asset Pricing MoДокумент5 страницA Literature Study On The Capital Asset Pricing Momarcel XОценок пока нет

- Chapter - Capital BudgetingДокумент33 страницыChapter - Capital BudgetingSakshi SharmaОценок пока нет

- Breaking Events: Building MaterialsДокумент5 страницBreaking Events: Building Materialsapi-26443191Оценок пока нет

- Chapter 2 Ca AnswersДокумент9 страницChapter 2 Ca Answersfaaltu accountОценок пока нет

- Standard & Poors Outlook On GreeceДокумент10 страницStandard & Poors Outlook On GreeceEuronews Digital PlatformsОценок пока нет

- PNB Vs AmoresДокумент3 страницыPNB Vs AmoresLea AndreleiОценок пока нет

- Repurchase Agreements and Money Market FundsДокумент3 страницыRepurchase Agreements and Money Market FundssdfasdfahgadsОценок пока нет

- Bank StatementДокумент2 страницыBank StatementhanhОценок пока нет

- Vanik Education PVT LTD: GSTIN - 21AAFCV2531H1ZQДокумент1 страницаVanik Education PVT LTD: GSTIN - 21AAFCV2531H1ZQNRUSINGHA PATRAОценок пока нет

- Act512 - Assignment Chapter - 06Документ9 страницAct512 - Assignment Chapter - 06Rafin MahmudОценок пока нет

- Philippine Stock ExchangeДокумент11 страницPhilippine Stock ExchangeJyasmine Aura V. AgustinОценок пока нет

- Indas 2Документ28 страницIndas 2Ranjan DasguptaОценок пока нет

- Profile PartnersДокумент20 страницProfile PartnersSunita AgarwalОценок пока нет

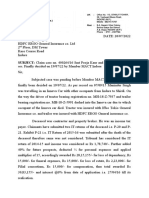

- SUBJECT: Claim Case No. 400264/16 SMT Pooja Kaur and Ors. Vs Ashok andДокумент4 страницыSUBJECT: Claim Case No. 400264/16 SMT Pooja Kaur and Ors. Vs Ashok andkunal jainОценок пока нет

- midChapterTest 1-1 1-4Документ1 страницаmidChapterTest 1-1 1-4VIPОценок пока нет

- FN 200 - Financial Forecasting Seminar QuestionsДокумент7 страницFN 200 - Financial Forecasting Seminar QuestionskelvinizimburaОценок пока нет

- Audit Observation TemplateДокумент10 страницAudit Observation TemplateJoseph SalidoОценок пока нет

- Soneri Bank: Internship Report OnДокумент37 страницSoneri Bank: Internship Report OnAnoshKhanОценок пока нет

- FAQ - Maxicare SME Online Payment FacilityДокумент7 страницFAQ - Maxicare SME Online Payment FacilityJohn Dexter SunegaОценок пока нет

- United States Securities and Exchange Commission Washington, D.C. 20549 Form 1-Z Exit Report Under Regulation A General InstructionsДокумент2 страницыUnited States Securities and Exchange Commission Washington, D.C. 20549 Form 1-Z Exit Report Under Regulation A General InstructionsAnthony ANTONIO TONY LABRON ADAMSОценок пока нет

- Acc101 - 4Документ14 страницAcc101 - 4Nguyen Thi My Ngan (K17CT)Оценок пока нет

- Accounts Receivable-Related Party TransactionДокумент2 страницыAccounts Receivable-Related Party Transactionwarsidi100% (1)

- Capital Budgeting Cash Flows1Документ37 страницCapital Budgeting Cash Flows1Mofdy MinaОценок пока нет

- Kims RLCO Trading System DescriptionДокумент21 страницаKims RLCO Trading System DescriptionAmol b100% (2)

- Act std4Документ3 страницыAct std4Helen B. EvansОценок пока нет

- Ithrees's Whole Ion Finalyzed To PrintДокумент82 страницыIthrees's Whole Ion Finalyzed To PrintMohamed FayasОценок пока нет