Академический Документы

Профессиональный Документы

Культура Документы

Toys and Games in The United Arab Emirates

Загружено:

Laveena NairОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Toys and Games in The United Arab Emirates

Загружено:

Laveena NairАвторское право:

Доступные форматы

TOYS AND GAMES IN THE UNITED ARAB EMIRATES - ANALYSIS

Country Report | Jun 2019

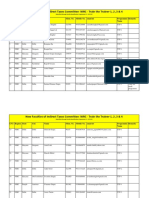

EXECUTIVE SUMMARY Market Sizes

Toys and games sees slow growth Sales of Toys and Games

Retail Value RSP - AED million - Current - 2004-2023

Although toys and games continued to see growth in current value terms in 2018, this

was slower than in all other years of the review period. This was due to the challenges

faced by the economy, which remained uncertain, and lower consumer confidence, 3,391 Forecast

which was hampered by the introduction of VAT. Traditional toys and games saw a 5,000

second year of current value decline, with spending declining in many categories; most

significantly within plush. On the other hand, video games continued to see growth, as

demand for static consoles and online games continued to increase. 4,000

Technology drives demand

3,000

It is clear that technology drives demand within toys and games. Amongst the

categories within traditional toys and games, those related to technology in some way

recorded growth in 2018, such as remote control toys. The share of electronic toys 2,000

within traditional toys and games also continued to increase. In addition, technological

advances in video games kept the category alive and growing, with digital video games

software seeing particularly strong growth. 1,000

Mattel maintains its lead

0

Mattel maintained its lead in toys and games in the United Arab Emirates in 2018. It 2004 2018 2023

held the lead in traditional toys and games with well-known global brands such as

Fisher-Price, Barbie and Matchbox, amongst others. Sony Corp, which maintained

second place in overall toys and games in 2018, led video games with its popular Sales Performance of Toys and Games

PlayStation 4 brand. Nevertheless, both companies saw declines in their value shares in % Y-O-Y Retail Value RSP Growth 2004-2023

2018, due to rising competition from smaller players.

Internet retailing and hypermarkets see distribution share growth

1.4% Forecast

25%

Within traditional toys and games in the United Arab Emirates, the major distribution

channels in 2018 were traditional toys and games stores and hypermarkets, whilst in

video games, the leading channels were electronics and appliance specialist retailers, 20%

hypermarkets and internet retailing. Hypermarkets is an extremely popular channel for

toys and games, as these outlets offer a large assortment of products all under one roof

– often at heavily discounted prices. So far, store-based retailers has not been 15%

negatively impacted by internet retailing. This is because the country is highly

dependent on bricks-and-mortar stores, and continued to see the expansion of store

numbers across channels to cater to its growing population. Stores are conveniently 10%

and strategically located in shopping centres across the country, maintaining the

dominance of store-based retailers.

5%

Toys and games is set to get back on track over the forecast period

As the population of the United Arab Emirates continues to increase, due to the influx 0%

2004 2018 2023

of expatriates into the country, the demand for toys and games is expected to stabilise

and return to better growth in current value terms in the forecast period. This will also

be supported by economic stabilisation due to EXPO 2020 and returning consumer

confidence as the VAT increase is absorbed and accepted. Therefore, demand is set to

increase over the forecast period, with most categories within toys and games growing

Sales of Toys and Games by Category

Retail Value RSP - AED million - Current - 2018 Growth Performance

once again. However, plush will require much stronger innovations to revive its

performance.

Traditional Toys and Games

1,423.3

SOURCES Video Games

1,967.4

Sources used during the research included the following: -10% 0% 15%

Summary 1 Research Sources TOYS AND GAMES 3,390.7 CURRENT % CAGR % CAGR

YEAR % 2013-2018 2018-2023

GROWTH

Trade Associations International Council of Toy Industries

Toy Indus try As s ocia tion

Two Four 54

Trade Press Abs olute Geeks

Africa Bus ines s

Al Ara biya

Al Ba wa ba

© Euromonitor Interna onal 2020 Page 1 of 2

Trade Associations International Council of Toy Industries Competitive Landscape

Ara bia n Bus ines s

Ara bia n Ga zette Company Shares of Toys and Games

Ba ra joun % Share (NBO) - Retail Value RSP - 2018

Bus ines s Intelligence Middle Ea s t

Mattel Inc 10.4%

Cha nnel EMEA

Sony Corp 9.8%

Cinema Blend

Nintendo Co Ltd 9.0%

Globa l Licens e

Globa l Toy News Hasbro Inc 7.8%

Gulf Buis nes s Electronic Arts Inc 6.7%

Gulf Bus ines s Activision Blizzard Inc 5.8%

Gulf News LEGO Group 4.4%

Ips os Ara bNet Riot Games Inc 3.6%

itp.net

Microsoft Corp 3.5%

Kha leej Times

Valve Corp 2.9%

MCV The Ma rket for Computer & Video Ga mes

Epic Games Inc 1.7%

TechRa da r

The Na tiona l VTech Holdings Ltd 1.5%

TimeOut Duba i LeapFrog Enterprises Inc 1.2%

Toy Store Ubisoft Entertainment SA 1.2%

Two Four54 Warner Bros Entertainmen... 1.0%

Za wya

Ravensburger Ltd 0.9%

Source: Euromonitor Interna tiona l Walt Disney Co, The 0.8%

Sony Computer Entertainm... 0.7%

PUBG Corp 0.7%

Others 26.4%

Brand Shares of Toys and Games

% Share (LBN) - Retail Value RSP - 2018

PlayStation 4 7.8%

Fifa 3.8%

League of Legends 3.6%

Lego 3.5%

Nintendo Switch 2.8%

DOTA 2.8%

Call of Duty 2.5%

Fisher-Price 2.5%

Xbox One 2.3%

World of Warcraft 2.2%

Barbie 1.9%

Fortnite 1.7%

VTech 1.5%

Battlefield 1.4%

LeapFrog 1.2%

Uncharted 1.2%

Monopoly 1.1%

Cluedo 1.1%

Nintendo 2DS 1.0%

Others 54.1%

Increasing share Decreasing share No change

© Euromonitor Interna onal 2020 Page 2 of 2

Вам также может понравиться

- Toys and Games in Canada - Analysis: Country Report - Jun 2019Документ2 страницыToys and Games in Canada - Analysis: Country Report - Jun 2019Martin Elias Prasca GutierrezОценок пока нет

- 132-Article Text-896-1-10-20210809Документ8 страниц132-Article Text-896-1-10-20210809Farhat SultanОценок пока нет

- News 1651670859653Документ15 страницNews 1651670859653Kalpesh PatelОценок пока нет

- SuperData 2019 Year in Review PDFДокумент23 страницыSuperData 2019 Year in Review PDFAna Valeria RodriguezОценок пока нет

- Turkey's Mobile Game Market ReviewДокумент2 страницыTurkey's Mobile Game Market ReviewHüseyin TeklerОценок пока нет

- Case 2 Data Sheet GamingДокумент4 страницыCase 2 Data Sheet GamingpriyaОценок пока нет

- Video Games in RomaniaДокумент18 страницVideo Games in RomaniaCioc Daniel AlexandruОценок пока нет

- Larson17-50327-2023-02-19 04-44-00-pmДокумент4 страницыLarson17-50327-2023-02-19 04-44-00-pmapi-737825735Оценок пока нет

- Indian Toy IndustryДокумент13 страницIndian Toy IndustryVaibhav DoijadОценок пока нет

- Industry Analysis Project - Week 4Документ13 страницIndustry Analysis Project - Week 4Catherine WilliamsОценок пока нет

- Hobby & Toy Stores in The US Industry ReportДокумент37 страницHobby & Toy Stores in The US Industry ReportOozax OozaxОценок пока нет

- Global Toys Market Trends and Opportunities 2013 2018Документ10 страницGlobal Toys Market Trends and Opportunities 2013 2018Jad FarranОценок пока нет

- Gaming Industry Final DissertationДокумент50 страницGaming Industry Final DissertationJayadtiya Singh jasolОценок пока нет

- Gaming in IndiaДокумент10 страницGaming in IndiaKanad Kumar GhoshОценок пока нет

- Success Story (Revised) Final28tДокумент18 страницSuccess Story (Revised) Final28tRamkumarArumugapandiОценок пока нет

- Study Id40455 Ecommerce Report Toys Hobby and DiyДокумент27 страницStudy Id40455 Ecommerce Report Toys Hobby and DiyRitika SinghalОценок пока нет

- MKT 338 Marketing PlanДокумент20 страницMKT 338 Marketing Planapi-436079503Оценок пока нет

- Smart Toys Do Toys Dream of Digital LivesДокумент6 страницSmart Toys Do Toys Dream of Digital Livesmadil81Оценок пока нет

- Z Marketer - Relevation M ProposalДокумент19 страницZ Marketer - Relevation M ProposalPhương Anh NguyễnОценок пока нет

- Report Riding The Digital Wave PDFДокумент54 страницыReport Riding The Digital Wave PDFJean. PОценок пока нет

- Company:-: Zeta Inc. (IP Based Game Operator and Publisher in China)Документ2 страницыCompany:-: Zeta Inc. (IP Based Game Operator and Publisher in China)Shilpi KumariОценок пока нет

- Gaming Industry Analysis: Company: Nazara Technologie S LTDДокумент4 страницыGaming Industry Analysis: Company: Nazara Technologie S LTDT M Nikhil SaiОценок пока нет

- Zeta Information PackДокумент3 страницыZeta Information Packrashmi shreeОценок пока нет

- Indian Gaming IndustryДокумент16 страницIndian Gaming IndustryArsh SinghaniaОценок пока нет

- Study - Id40455 - Ecommerce Report Toys Hobby and DiyДокумент29 страницStudy - Id40455 - Ecommerce Report Toys Hobby and DiyAbhishek100% (2)

- DMCC Gaming ReportДокумент31 страницаDMCC Gaming ReportJose Antonio Mejia GranadosОценок пока нет

- Market GamessДокумент8 страницMarket Gamessengr najeebОценок пока нет

- Ar GamesДокумент7 страницAr Gamesapi-332279034Оценок пока нет

- Ym0706-01 3000Документ10 страницYm0706-01 3000Frankline MachukaОценок пока нет

- Individual Assignment: Marketing ManagementДокумент6 страницIndividual Assignment: Marketing ManagementThasne RaviОценок пока нет

- Global Toys Market: Trends and Opportunities (2013-2018)Документ10 страницGlobal Toys Market: Trends and Opportunities (2013-2018)Daedal ResearchОценок пока нет

- North West Creative and Media Industries PLC 2009: The Videogames & Animation Industry October 2009Документ11 страницNorth West Creative and Media Industries PLC 2009: The Videogames & Animation Industry October 2009Nam VoОценок пока нет

- 2016 Gaming Industry ReportДокумент11 страниц2016 Gaming Industry ReportNan Ilie-IonutОценок пока нет

- ReportДокумент6 страницReportMmОценок пока нет

- SuperData 2020 Year in ReviewДокумент23 страницыSuperData 2020 Year in ReviewezequielvilaОценок пока нет

- Assignment On Toys and Games Retail Industry in IndiaДокумент7 страницAssignment On Toys and Games Retail Industry in IndiaAsif WasimОценок пока нет

- WCP Video Game Report 20151104Документ47 страницWCP Video Game Report 20151104MeenalОценок пока нет

- Plagiarism Scan Report: Plagiarised UniqueДокумент2 страницыPlagiarism Scan Report: Plagiarised UniqueDivya KoppikarОценок пока нет

- Nazara Technologies Initiating Coverage Indian Online Gaming IndustryДокумент77 страницNazara Technologies Initiating Coverage Indian Online Gaming IndustryG Vishwanath ReddyОценок пока нет

- Gaming Industry in IndiaДокумент64 страницыGaming Industry in IndiaViraj Wadkar67% (3)

- Toy Market Research StudyДокумент7 страницToy Market Research StudyAtul KumarОценок пока нет

- Nazara TechnologiesДокумент15 страницNazara TechnologiesBorn StarОценок пока нет

- Future of Virtual Reality MarketДокумент14 страницFuture of Virtual Reality MarketMohseen KhanОценок пока нет

- GamingДокумент45 страницGamingMichaelMaungTintKhineОценок пока нет

- 2020 Global Mobile Games Advertising and Monetization ReportДокумент103 страницы2020 Global Mobile Games Advertising and Monetization ReportPolina ChtchelockОценок пока нет

- Nutaku Media Kit 2019Документ20 страницNutaku Media Kit 2019Denny WijayaОценок пока нет

- Audience Insights On Mobile GamersДокумент27 страницAudience Insights On Mobile Gamerssoren bhatnagarОценок пока нет

- Module 13 The Video Games Industryand Data Analytics January 2023 V 13Документ82 страницыModule 13 The Video Games Industryand Data Analytics January 2023 V 13Hemang ChopraОценок пока нет

- 2016 대한민국 게임백서 영문요약본Документ32 страницы2016 대한민국 게임백서 영문요약본Anggy Wira PambudiОценок пока нет

- Netease Games Strategy 2020Документ17 страницNetease Games Strategy 2020Kevin TroyОценок пока нет

- Internship Report Fill EditedДокумент35 страницInternship Report Fill EditedSushil PrajapatОценок пока нет

- Virtual Reality & Augmented Reality in Gaming Market in 2021Документ3 страницыVirtual Reality & Augmented Reality in Gaming Market in 2021MadhavОценок пока нет

- GamingReport 2022Документ24 страницыGamingReport 2022Demon SpiritОценок пока нет

- Video Games in IndiaДокумент12 страницVideo Games in IndiapearlshreyajainОценок пока нет

- 2018 VR AR Survey Digital PDFДокумент21 страница2018 VR AR Survey Digital PDFLucas Carvalho De Almeida MedeirosОценок пока нет

- Mattel FinalДокумент65 страницMattel FinalAnkit Srivastava100% (1)

- GAMES CCNewzooSpringReport PagesДокумент12 страницGAMES CCNewzooSpringReport PagesccvvkkОценок пока нет

- Research - Toys in IndiaДокумент8 страницResearch - Toys in IndiaSherkhane KrishnakanthОценок пока нет

- Games, Toys & Childrens Vehicles World Summary: Market Values & Financials by CountryОт EverandGames, Toys & Childrens Vehicles World Summary: Market Values & Financials by CountryОценок пока нет

- Indian Media and EntertainmentДокумент7 страницIndian Media and Entertainmentvinay_814585077Оценок пока нет

- Prgm-Sminr Faculties Identified Through FIP NIRCДокумент9 страницPrgm-Sminr Faculties Identified Through FIP NIRCDonor CrewОценок пока нет

- Ermita Malate Hotel Motel Operators V City Mayor DigestДокумент1 страницаErmita Malate Hotel Motel Operators V City Mayor Digestpnp bantay100% (2)

- Xi'an City Sports Park Landscape Improvement ProjectДокумент3 страницыXi'an City Sports Park Landscape Improvement ProjectGirija Sankar SahuОценок пока нет

- List - of - Members As On 6 3 18 PDFДокумент8 страницList - of - Members As On 6 3 18 PDFashish jaiswal100% (1)

- CIR vs. Estate of Benigno P. Toda, JRДокумент13 страницCIR vs. Estate of Benigno P. Toda, JRMrln VloriaОценок пока нет

- Marketing Communication I Assignment (Advertisement)Документ13 страницMarketing Communication I Assignment (Advertisement)Serene_98Оценок пока нет

- CJ1W-PRT21 PROFIBUS-DP Slave Unit: Operation ManualДокумент100 страницCJ1W-PRT21 PROFIBUS-DP Slave Unit: Operation ManualSergio Eu CaОценок пока нет

- Bill Vaskis ObitДокумент1 страницаBill Vaskis ObitSarah TorribioОценок пока нет

- (I) (Ii) (Iii) (Iv) : Nahata Professional Academy Q1. Choose The Correct AnswerДокумент5 страниц(I) (Ii) (Iii) (Iv) : Nahata Professional Academy Q1. Choose The Correct AnswerBurhanuddin BohraОценок пока нет

- Clarifications IntraДокумент2 страницыClarifications Intrapm278Оценок пока нет

- Rock Classification Gizmo WorksheetДокумент4 страницыRock Classification Gizmo WorksheetDiamond실비Оценок пока нет

- Knock Knock GamesДокумент1 страницаKnock Knock GamesArsyta AnandaОценок пока нет

- Alternating Voltage and CurrentДокумент41 страницаAlternating Voltage and CurrentKARTHIK LОценок пока нет

- PSCI101 - Prelims ReviewerДокумент3 страницыPSCI101 - Prelims RevieweremmanuelcambaОценок пока нет

- OsteomyelitisДокумент10 страницOsteomyelitismustafaОценок пока нет

- FINAL Parent Handbook AitchisonДокумент68 страницFINAL Parent Handbook AitchisonSaeed AhmedОценок пока нет

- Divorce: in The PhilippinesДокумент4 страницыDivorce: in The PhilippinesKidMonkey2299Оценок пока нет

- 1393Документ7 страниц1393Victor IkeОценок пока нет

- Wp406 DSP Design ProductivityДокумент14 страницWp406 DSP Design ProductivityStar LiОценок пока нет

- Ingles V Eje 1 Week 2Документ5 страницIngles V Eje 1 Week 2Cristhian Javier Torres PenaОценок пока нет

- PWC Taxavvy 18 2020 Mco PDFДокумент12 страницPWC Taxavvy 18 2020 Mco PDFMichael YapОценок пока нет

- 10 Ideas For ConversationДокумент116 страниц10 Ideas For ConversationGreenLake36100% (1)

- Pineapple Working PaperДокумент57 страницPineapple Working PaperAnonymous EAineTiz100% (7)

- Xeljanz Initiation ChecklistДокумент8 страницXeljanz Initiation ChecklistRawan ZayedОценок пока нет

- Soal Dan Pembahasan Grammar Lat TOEP 1Документ6 страницSoal Dan Pembahasan Grammar Lat TOEP 1Abdur100% (2)

- Loneliness in Carson Mcculler's The Heart Is A Lonely HunterДокумент3 страницыLoneliness in Carson Mcculler's The Heart Is A Lonely HunterRahul SharmaОценок пока нет

- Security Operating Procedures and StandardsДокумент5 страницSecurity Operating Procedures and StandardsQuy Tranxuan100% (2)

- Anna May de Leon Galono, A089 528 341 (BIA Sept. 29, 2015)Документ7 страницAnna May de Leon Galono, A089 528 341 (BIA Sept. 29, 2015)Immigrant & Refugee Appellate Center, LLCОценок пока нет

- ECAT STD 2 Sample Question PaperДокумент7 страницECAT STD 2 Sample Question PaperVinay Jindal0% (1)

- 6.marketing ManagementДокумент11 страниц6.marketing ManagementadararaОценок пока нет