Академический Документы

Профессиональный Документы

Культура Документы

Scheduled Commercial Banks - Business in India: Reserve Bank of India Bulletin

Загружено:

arun_saini01Исходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Scheduled Commercial Banks - Business in India: Reserve Bank of India Bulletin

Загружено:

arun_saini01Авторское право:

Доступные форматы

3.

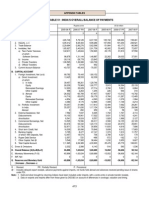

Scheduled Commercial Banks - Business in India (` crore)

Outstanding Variation over

Item as on Financial year so far Year-on-year

Oct. 22 # Fortnight

2010 2009-2010 2010-2011 2009 2010

1 2 3 4 5 6 7

Liabilities to the Banking System

Demand and Time Deposits from Banks 63,853 1,066 2,844 –1,078 6,901 12,153

Borrowings from Banks(1) 25,047 2,048 –12,075 –7,310 –18,978 7,635

Other Demand and Time Liabilities (2) 7,873 888 –15,958 1,895 –34,987 2,058

Liabilities to Others

Aggregate Deposits 48,75,254 86,945 3,21,296 3,82,429 6,66,279 7,19,849

(1.8) (8.4) (8.5) (19.1) (17.3)

Demand 6,66,122 50,699 12,247 20,512 71,195 1,30,790

Time 42,09,132 36,246 3,09,048 3,61,916 5,95,084 5,89,059

Borrowings (3) 1,14,575 –4,761 –13,200 10,297 –13,195 13,839

Other Demand and Time Liabilities 3,76,224 52,554 2,672 46,803 6,829 66,032

Borrowings from Reserve Bank 4,094 1,559 –11,728 4,052 –685 4,094

Cash in Hand and Balances with Reserve Bank 3,05,174 1,771 –23,217 –1,794 1,655 69,916

Cash in Hand 30,438 2,593 6,006 4,860 2,607 4,152

Balances with Reserve Bank 2,74,736 –823 –29,223 –6,654 –952 65,764

Assets with the Banking System

Balance with Other Banks(4) 46,796 426 –6,597 –15,624 7,924 484

Money at Call and Short Notice 15,698 2,790 –7,592 –1,970 –12,788 8,252

Advances to Banks 4,599 –773 –978 –5,293 –1,900 2,674

Other Assets 53,531 2,996 –27,869 9,067 –37,030 29,679

Investments (5) 15,02,032 26,335 1,88,990 1,17,279 2,99,802 1,46,631

(1.8) (16.2) (8.5) (28.4) (10.8)

Government Securities 14,96,671 26,441 1,91,874 1,18,277 3,04,543 1,49,012

Other Approved Securities 5,360 –106 –2,884 –997 –4,742 –2,381

Bank Credit 34,76,133 7,134 92,716 2,31,345 2,52,285 6,07,868

(0.2) (3.3) (7.1) (9.6) (21.2)

Food Credit 47,215 –2,540 –10,198 –1,275 –12,242 11,202

Non-Food credit 34,28,918 9,674 1,02,914 2,32,619 2,64,527 5,96,665

Loans, Cash-credit and Overdrafts 33,55,262 13,485 91,857 2,33,104 2,55,344 5,87,729

Inland Bills- Purchased 10,192 –274 –1,801 –1,821 –3,419 279

Discounted (6) 63,759 –4,703 6,884 1,541 7,717 13,718

Foreign Bills- Purchased 16,814 –95 –2,538 681 –2,403 829

Discounted 30,105 –1,279 –1,687 –2,160 –4,954 5,313

Cash-Deposit Ratio 6.26

Investment-Deposit Ratio 30.81

Credit-Deposit Ratio 71.30

(1) Excluding borrowings of Regional Rural Banks from their sponsor banks. (2) Wherever it has not been possible to identify a liability to the banking system, it has been

included in the corresponding items under 'liabilities to others'. (3) Other than from Reserve Bank of India, NABARD and EXIM Bank. (4) In current account and in other

account. (5) Investments set out in this Table are for the purpose of SLR and do not include other investments which are given separately in Table No. 5. (6) Excludes bills

rediscounted with the Reserve Bank of India.

Figures in brackets denote percentage variation in the relevant period.

Note: Includes the impact of mergers since May 3, 2002.

4. Cash Reserve Ratio and Interest Rates (per cent per annum)

2009 2010

Item/Week Ended

Oct. 23 Sep. 17 Sep. 24 Oct. 1 Oct. 8 Oct. 15 Oct. 22

1 2 3 4 5 6 7 8

Cash Reserve Ratio (per cent)(1) 5.00 6.00 6.00 6.00 6.00 6.00 6.00

Bank Rate 6.00 6.00 6.00 6.00 6.00 6.00 6.00

I.D.B.I.(2) 10.25 10.25 10.25 10.25 10.25 10.25 10.25

Base Rate(3) 11.00-12.00 7.50-8.00 7.50-8.00 7.50-8.50 7.50-8.50 7.50-8.50 7.50-8.50

Deposit Rate(4) 6.25-7.50 6.75-7.75 6.75-7.75 7.00-8.00 7.00-8.00 7.00-8.00 7.00-8.00

Call Money Rate (Low/High)(5)

- Borrowings 1.50/4.10 3.20/6.25 4.00/6.40 4.00/7.40 3.25/6.60 3.25/6.75 3.50/7.15

- Lendings 1.50/4.10 3.20/6.25 4.00/6.40 4.00/7.40 3.25/6.60 3.25/6.75 3.50/7.15

(1) Cash Reser ve R atio relates to Scheduled Commercial Banks (e xcluding Regional Rural Banks). (2) Minimum Term L ending R ate (MTLR).

(3) Base Rate relates to five major banks since July 1, 2010. Earlier figures relate to Benchmark Prime Lending Rate (BPLR). (4) Deposit Rate relates to major banks

for term deposits of more than one year maturity. (5) Data cover 90-95 per cent of total transactions reported by participants.

RESERVE BANK OF INDIA BULLETIN

2 WEEKLY STATISTICAL SUPPLEMENT November 5, 2010

Вам также может понравиться

- 5T A165c3afДокумент1 страница5T A165c3afSumit GargОценок пока нет

- 5T A165c3af PDFДокумент1 страница5T A165c3af PDFSumit GargОценок пока нет

- 4 MIS - March 2013Документ129 страниц4 MIS - March 2013kr__santoshОценок пока нет

- MS08092022Документ3 страницыMS08092022Hoàng Minh ChuОценок пока нет

- FinposДокумент1 страницаFinposmahfuz699Оценок пока нет

- Financial Statement Analysis of Masan Company Masan GroupДокумент25 страницFinancial Statement Analysis of Masan Company Masan GroupVũ Minh HoàngОценок пока нет

- Bop PDFДокумент1 страницаBop PDFLoknadh ReddyОценок пока нет

- Trade and PaymentsДокумент17 страницTrade and PaymentsmazamniaziОценок пока нет

- Beta Exhibit 03 - 91 Day Tresury BillДокумент1 страницаBeta Exhibit 03 - 91 Day Tresury BillAnonymous tvA58EWlRgОценок пока нет

- Rev6 - LK BKP Per Mar 2021 Per Table (ENG)Документ14 страницRev6 - LK BKP Per Mar 2021 Per Table (ENG)IPutuAdi SaputraОценок пока нет

- Accounting ProjectДокумент16 страницAccounting Projectnawal jamshaidОценок пока нет

- Macro For The Market and Funding Liquidity Stress TestsДокумент40 страницMacro For The Market and Funding Liquidity Stress Testsbing mirandaОценок пока нет

- Vap & Associates: Company SecretariesДокумент5 страницVap & Associates: Company Secretariesvivek singhОценок пока нет

- Item Amount 1 2: Private Sector Banks 2008Документ8 страницItem Amount 1 2: Private Sector Banks 2008vjayvjay87Оценок пока нет

- Ceres Gardening Company Submission TemplateДокумент5 страницCeres Gardening Company Submission TemplateShubham MishraОценок пока нет

- 4.analisisdeestadosfinancieros, CocaCola (Rodriguez Aleman 2022040)Документ4 страницы4.analisisdeestadosfinancieros, CocaCola (Rodriguez Aleman 2022040)Jose Arturo Rodriguez AlemanОценок пока нет

- ALM Bank: Balance Sheet - Assets (Thousand USD) 31/12/2017 31/12/2016 31/12/2015 31/12/2014Документ7 страницALM Bank: Balance Sheet - Assets (Thousand USD) 31/12/2017 31/12/2016 31/12/2015 31/12/2014Ali TahtahОценок пока нет

- TABLE 5.1 Components of Monetary AssetsДокумент9 страницTABLE 5.1 Components of Monetary AssetsfaysalОценок пока нет

- Love Verma Ceres Gardening SubmissionДокумент8 страницLove Verma Ceres Gardening Submissionlove vermaОценок пока нет

- UntitledДокумент2 страницыUntitledJivitteshОценок пока нет

- Table 10 Financial Access Survey, 2006 - 2018Документ1 страницаTable 10 Financial Access Survey, 2006 - 2018Ahmed MunawarОценок пока нет

- Banco Central Do Brasil FS 2017-p67Документ69 страницBanco Central Do Brasil FS 2017-p67Qorxmaz AydınlıОценок пока нет

- EquityДокумент3 страницыEquityyasrab abbasОценок пока нет

- Financial Statements-Ceres Gardening CompanyДокумент5 страницFinancial Statements-Ceres Gardening CompanyVishesh0% (2)

- Mutual Fund Holding Report - Feb23 - 13032023 - IDBIДокумент54 страницыMutual Fund Holding Report - Feb23 - 13032023 - IDBIAnkit PandeОценок пока нет

- Vi.5. Posisi Pinjaman Luar Negeri Swasta (Juta USD) : 2007 2008 2009 2010 2011 Bank Kelompok BankДокумент2 страницыVi.5. Posisi Pinjaman Luar Negeri Swasta (Juta USD) : 2007 2008 2009 2010 2011 Bank Kelompok BankIzzuddin AbdurrahmanОценок пока нет

- 80028Документ2 страницы80028jeetОценок пока нет

- Krishan AccountДокумент6 страницKrishan Accountkrishan jindalОценок пока нет

- Balancepayment BPM6Документ2 страницыBalancepayment BPM6Aliza IshraОценок пока нет

- Chapter 2Документ32 страницыChapter 2AhmedОценок пока нет

- Dec 2023 Financials UpdatedДокумент102 страницыDec 2023 Financials Updatedpraveenramesh058Оценок пока нет

- Swedish Match 9 212 017Документ6 страницSwedish Match 9 212 017Karan AggarwalОценок пока нет

- Schwab Jan2023 SMART SupplementДокумент1 страницаSchwab Jan2023 SMART SupplementManish SinghОценок пока нет

- Financial Statements-Ceres Gardening CompanyДокумент9 страницFinancial Statements-Ceres Gardening CompanyHarshit MalviyaОценок пока нет

- Statements of Financial Position PT Bank Rakyat Indonesia (Persero) TBK As of June 30, 2021 and December 31, 2020 (In Million Rupiah)Документ14 страницStatements of Financial Position PT Bank Rakyat Indonesia (Persero) TBK As of June 30, 2021 and December 31, 2020 (In Million Rupiah)vivian rainsaniОценок пока нет

- Estimación - Taller - Del WACC - PVC BДокумент4 страницыEstimación - Taller - Del WACC - PVC BSergio Andres Cortes ContrerasОценок пока нет

- Exihibit 1: Key Financial and Market Value Data, 2002-2011 (In Millions of Dollars Except For Ratios)Документ22 страницыExihibit 1: Key Financial and Market Value Data, 2002-2011 (In Millions of Dollars Except For Ratios)JuanОценок пока нет

- Bank of Tanzania: TZS '000 TZS '000Документ1 страницаBank of Tanzania: TZS '000 TZS '000MKUTA PTBLDОценок пока нет

- Ceres Gardening CalculationsДокумент9 страницCeres Gardening CalculationsJuliana Marques0% (2)

- Internal Variance Analysis For Media Times LimitedДокумент4 страницыInternal Variance Analysis For Media Times LimitedHarri2011Оценок пока нет

- Super Gloves 2Документ6 страницSuper Gloves 2anon_149445490Оценок пока нет

- PPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPДокумент21 страницаPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPKashif GondalОценок пока нет

- Bank - Model Commerzbank 1Документ10 страницBank - Model Commerzbank 1Khryss Anne Miñon MendezОценок пока нет

- Pakistan Balance of PaymentsДокумент94 страницыPakistan Balance of PaymentsHamzaОценок пока нет

- Published Mar 2023Документ17 страницPublished Mar 2023sei jrОценок пока нет

- Financial Statements-Ceres Gardening CompanyДокумент8 страницFinancial Statements-Ceres Gardening Companypallavikotha84Оценок пока нет

- Interim Consolidated Statements of Financial Position: Samsung Electronics Co., Ltd. and Its SubsidiariesДокумент3 страницыInterim Consolidated Statements of Financial Position: Samsung Electronics Co., Ltd. and Its SubsidiariesAbigail LapuzОценок пока нет

- Reports SampleДокумент20 страницReports SampleChristian Jade Lumasag NavaОценок пока нет

- PR1649ST10012024 RMДокумент1 страницаPR1649ST10012024 RMkushal srivastavaОценок пока нет

- Ceres Gardening Company - Spreadsheet For StudentsДокумент1 страницаCeres Gardening Company - Spreadsheet For Studentsandres felipe restrepo arango0% (1)

- Toyota Balance SheetДокумент3 страницыToyota Balance SheetqwertuipbkjhggfgfddОценок пока нет

- Rastriya Banijya Bank Limited Singhdurbar Plaza, Kathmandu Unaudited Financial Results (Quarterly) As at 1St Quarter of Fiscal Year 2008-09Документ1 страницаRastriya Banijya Bank Limited Singhdurbar Plaza, Kathmandu Unaudited Financial Results (Quarterly) As at 1St Quarter of Fiscal Year 2008-09gonenp1Оценок пока нет

- Caso Ceres en ClaseДокумент4 страницыCaso Ceres en ClaseAdrian PeranОценок пока нет

- BOP SummaryДокумент1 страницаBOP SummarysamirnajeebОценок пока нет

- 4019 XLS EngДокумент4 страницы4019 XLS EngAnonymous 1997Оценок пока нет

- Paramount Student SpreadsheetДокумент12 страницParamount Student Spreadsheetanshu sinhaОценок пока нет

- Weekly Statement of Position of All Scheduled Banks As at Close of Business On September 25, 2020Документ1 страницаWeekly Statement of Position of All Scheduled Banks As at Close of Business On September 25, 2020sm_1234567Оценок пока нет

- 02 EnglishДокумент7 страниц02 EnglishMalaz.A.S MohamedОценок пока нет

- Taiwan Semiconductor Manufacturing Company Limited and Subsidiaries Consolidated Condensed Balance SheetДокумент4 страницыTaiwan Semiconductor Manufacturing Company Limited and Subsidiaries Consolidated Condensed Balance SheetHarry KilОценок пока нет

- Red Flag Overview. November, 2010Документ43 страницыRed Flag Overview. November, 2010Lee MichaelОценок пока нет

- XStxoo 7 AE1 JJYZ5 IДокумент2 страницыXStxoo 7 AE1 JJYZ5 Inani santhuОценок пока нет

- Partnership Formation ExerciseДокумент2 страницыPartnership Formation ExerciseArlene Diane OrozcoОценок пока нет

- Unit 5 Asset-Liability Management Techniques: 5.1. General Principles of Bank ManagementДокумент8 страницUnit 5 Asset-Liability Management Techniques: 5.1. General Principles of Bank Managementመስቀል ኃይላችን ነውОценок пока нет

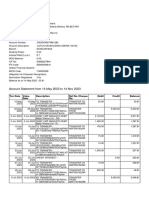

- Your Statement: 14 January To 13 February 2022Документ8 страницYour Statement: 14 January To 13 February 2022Toni MirosanuОценок пока нет

- List of Conditions Effective From 01-04-2017Документ13 страницList of Conditions Effective From 01-04-2017omidreza tabrizianОценок пока нет

- Structure of Financial SystemДокумент14 страницStructure of Financial SystemRegina LintuaОценок пока нет

- Basel III and Its Implications On Banking SectorДокумент56 страницBasel III and Its Implications On Banking Sectoradityavikram009Оценок пока нет

- Position of The Bank - Rene, YifredewДокумент11 страницPosition of The Bank - Rene, YifredewYifredew AdamuОценок пока нет

- Indian Banking System and Its Emerging Trends - 2020Документ36 страницIndian Banking System and Its Emerging Trends - 2020RAJ PATELОценок пока нет

- Legal DocumentДокумент28 страницLegal DocumentgauravОценок пока нет

- Cash and Cash EquivalentsДокумент3 страницыCash and Cash EquivalentsShiela Mae SangidОценок пока нет

- Teachers Attendance SheetДокумент32 страницыTeachers Attendance Sheetpankaj sainiОценок пока нет

- Nigeria Atm Card FraudДокумент3 страницыNigeria Atm Card FraudPrimelift Safety Resources LimitedОценок пока нет

- Metro-Score PPI: Customer Credit ReportДокумент5 страницMetro-Score PPI: Customer Credit ReportPastor Roy Onyancha CyberОценок пока нет

- UK Visa Process - Student Visa AugustДокумент8 страницUK Visa Process - Student Visa AugustNancyОценок пока нет

- Bdo Service Slip Final 1Документ1 страницаBdo Service Slip Final 1Ivy Maril De Guzman-ViernesОценок пока нет

- Term Deposits PDFДокумент312 страницTerm Deposits PDFAdeel Ahmed MinhasОценок пока нет

- ch18 PDFДокумент34 страницыch18 PDFLê Chấn PhongОценок пока нет

- Approved Money Transfer - Western UnionДокумент2 страницыApproved Money Transfer - Western Unionhoquangdanh100% (2)

- SBI01 MAR 2022 To 21 NOV 2022Документ12 страницSBI01 MAR 2022 To 21 NOV 2022Fascino WhiteОценок пока нет

- University of Mumbai: Bachelor of Management Studies (Finance) Semester VIДокумент73 страницыUniversity of Mumbai: Bachelor of Management Studies (Finance) Semester VIPranay ShettyОценок пока нет

- Capri Global Capital LTD.: Loan Application Form Occupation Details Applicant PhotographДокумент3 страницыCapri Global Capital LTD.: Loan Application Form Occupation Details Applicant PhotographAbhishek Bhalla100% (1)

- ch09Документ44 страницыch09Balach MalikОценок пока нет

- PH 9 HK 2 y 3 GGu 4 ZWLNДокумент6 страницPH 9 HK 2 y 3 GGu 4 ZWLNRanjit BeheraОценок пока нет

- Wak ContohДокумент5 страницWak ContohDanial MustafaОценок пока нет

- Net Present Value (NPV)Документ28 страницNet Present Value (NPV)KAORU AmaneОценок пока нет

- Lynn Szymoniac 3rd Amended PDFДокумент214 страницLynn Szymoniac 3rd Amended PDFGreg Wilder100% (3)

- Maths Worksheet - LoansДокумент3 страницыMaths Worksheet - LoansCape Town After-School TutorialsОценок пока нет

- Jaysasuman ResumeДокумент5 страницJaysasuman ResumeJay SasumanОценок пока нет