Академический Документы

Профессиональный Документы

Культура Документы

Harrison FA IFRS 11e CH06 SM

Загружено:

Jingjing ZhuОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Harrison FA IFRS 11e CH06 SM

Загружено:

Jingjing ZhuАвторское право:

Доступные форматы

Chapter 6

Inventory and Merchandising Operations

Short Exercises

(10 min.) S 6-1

$ Millions

Inventory………………………… 3.6

Cash…………………………... 3.6

Accounts Receivable…………. 19.5

Sales Revenue………………. 19.5

Cost of Goods Sold…………… 4.8

Inventory……………………... 4.8

Cash……………………………… 19.1

Accounts Receivable………. 19.1

424 Financial Accounting: IFRS 11/e Solutions Manual

(10-15 min.) S 6-2

1. (Journal entries)

Inventory………………………………….. 150,000

Accounts Payable……………………. 150,000

Amounts Receivable…………………… 180,000

Sales Revenue………………………... 180,000

Cost of Goods Sold…………………….. 112,500

Inventory ($150,000 × .75)………….. 112,500

Cash ($180,000 × .40)…………………... 72,000

Accounts Receivable………………... 72,000

2. (Financial statements)

BALANCE SHEET

Current assets:

Inventory ($150,000 − $112,500)………… $ 37,500

INCOME STATEMENT

Sales revenue……………………………… $180,000

Cost of goods sold…………………………

112,500

Gross profit………………………………… $67,500

Chapter 6 Inventory and Merchandising Operations 425

(15-20 min.) S 6-3

a b c

Average Cost FIFO LIFO

Cost of goods sold:

Average (26 × $4,871.18

$187.35)

FIFO $1,620 + (17 $4,850

× $190)

LIFO $4,750 + (1 × $4,930

$180)

Ending inventory:

Average (8 × $ 1,237.68

$154.71)

FIFO (8 × $160) $1,280

LIFO (8 × $140) $1,120

Computations:

Units sold = (9 + 25 – 8) = 26

Units in ending inventory = 8

Average cost per unit = ($1,620 + $4,750) ÷ (9 + 25) = $187.35

Cost per unit:

First purchase = $180 ($1,620 ÷ 9 = $180)

Second purchase = $190 ($4,750 ÷ 25 = $190)

426 Financial Accounting: IFRS 11/e Solutions Manual

(10-15 min.) S 6-4

Jackson’s Copy Center

Income Statement

Year Ended December 31, 20X6

Average FIFO LIFO

Sales revenue (580 × $22.50) $13,050 $13,050 $13,050

Cost of goods sold (580 × $10.17*) 5,898

(92 × $9.20) + (488 × $10.30) 5,873

(580 × $10.30) 5,974

Gross profit 7,152 7,177 7,076

Operating expenses 3,570 3,570 3,570

Net income $ 3,582 $3,607 $ 3,506

_____

*

Average cost per unit:

Beginning inventory (92 @ $9.20)…………….. $ 846.40

Purchases (680 @ $10.30)…………………………

7,004.00

Goods available…………………….……………… $7,850.40

Average cost per unit $7,850.40 / 772 units…… $ 10.17

Chapter 6 Inventory and Merchandising Operations 427

(10-15 min.) S 6-5

Jackson Copy Center

Income Statement

Year Ended December 31, 20X6

Average FIFO LIFO

Sales revenue (580 × $22.50) $13,050 $13,050 $13,050

Cost of goods sold (580 × $10.17*) 5,898

(92 × $9.20) + (488 × $10.30) 5,873

(580 × $10.30) ______ ______ 5,974

Gross profit 7,152 7,177 7,076

Operating expenses 3,570 3,570 3,570

Income before income tax $3,582 $ 3,607 $ 3,506

Income tax expense (35%) $ 1,254 $ 1,262 $ 1,227

*From S 6-4 Method to Method to

maximize minimize

reported income tax

income expense.

(before

tax).

428 Financial Accounting: IFRS 11/e Solutions Manual

(5 min.) S 6-6

Managers at Macrodata.com can purchase lots of inventory

before year end. Under LIFO, these high inventory costs go

directly to cost of goods sold in the current year. As a result,

the current year’s net income drops and that saves on income

tax. Saving on taxes is one reason companies want to decrease

their income.

Student responses may vary.

(5-10 min.) S 6-7

BALANCE SHEET

Current assets:

Inventories, at market (which is lower than cost)……. $ 48,000

INCOME STATEMENT

Cost of goods sold [$470,000 + ($54,000 − $48,000)]…… $476,000

Chapter 6 Inventory and Merchandising Operations 429

(15-20 min.) S 6-8

DATE: _____________

TO: Jason Stone, President of Stone Saxophone

Company

FROM: [Student Name]

SUBJECT: Proposal for Increasing Net Income

We can increase net income by not buying our normal

quantities of inventory as we make sales. Inventory costs are

rising, and the company uses the LIFO inventory method.

Under LIFO, the high cost of our inventory purchases goes

straight into cost of goods sold. By slowing our purchases of

inventory, we can keep those high costs out of cost of goods

sold this year. That will keep net income from going lower and

will help net income be as high as possible. Also, our inventory

quantities are above normal, so we don’t need to buy a lot of

inventory before year end.

Student responses will vary.

430 Financial Accounting: IFRS 11/e Solutions Manual

(10-15 min.) S 6-9

LIFO 1. Matches the most current cost of goods sold

against sales revenue.

LIFO 2. Results in an old measure of the cost of ending

inventory.

LCM 3. Writes inventory down when replacement cost

drops below historical cost.

LIFO 4. Enables a company to buy high-cost inventory at

year end and thereby to decrease reported

income and income tax.

FIFO 5. Enables a company to keep reported income

from dropping lower by liquidating older layers of

inventory.

LIFO 6. Generally associated with saving income taxes.

FIFO 7. Results in a cost of ending inventory that is close

to the current cost of replacing the inventory.

Specific

unit cost 8. Used to account for automobiles, jewelry, and art

objects.

Average 9. Provides a middle-ground measure of ending

inventory and cost of goods sold.

FIFO 10. Maximizes reported income.

Chapter 6 Inventory and Merchandising Operations 431

(5-10 min.) S 6-10

Dollars in Millions

$38,542 − $16,543

Gross profit percentage = = 0.571

$38,542

$16,543

Inventory turnover = = 9.4 times

($1,461 + $2,045) / 2

(5-10 min.) S 6-11

Beginning inventory……………………………... $ 254,000

+ Purchases……………………………………….… 1,580,000

= Goods available…………………………………... 1,834,000

− Cost of goods sold:

Sales revenue………………………. $4,200,000

Less estimated gross profit (60%) (2,520,000)

Estimated cost of goods sold………………. (1,680,000)

= Estimated cost of ending inventory…………... $ 154,000

432 Financial Accounting: IFRS 11/e Solutions Manual

(5 min.) S 6-12

Correct

Amount

(Thousands)

a. Net sales (unchanged)………………………………. $2,100

b. Inventory ($480 − $14)……………………………….. $ 466

c. Cost of goods sold ($1,150 + $14)………………… $1,164

d. Gross profit ($2,100 − $1,164)……………………… $ 936

(5 min.) S 6-13

1. Last year’s reported gross profit was understated.

Correct gross profit last year was $5.1 million ($3.2 + $1.9).

2. This year’s gross profit is overstated.

Correct gross profit for this year is $3.7 million ($5.6 − $1.9).

Chapter 6 Inventory and Merchandising Operations 433

(5-10 min.) S 6-14

1. Ethical. There is nothing wrong with buying inventory

whenever a company wishes.

2. Unethical. The company falsified its ending inventory in

order to cheat the government (and the people) out of taxes.

3. Unethical. The company falsified its purchases, cost of

goods sold, and net income in order to cheat the government

(and the people) out of income tax.

4. Unethical. The company falsified its ending inventory and net

income.

5. Ethical. Same analysis as 1.

434 Financial Accounting: IFRS 11/e Solutions Manual

Exercises

Group A

(15-20 min.) E 6-15A

Req. 1

Perpetual System

1. Purchases:

Inventory…………………….……….… 48,000

Accounts Payable…………………. 48,000

2. Sales:

Cash ($77,000 × .21)…….………… 16,170

Accounts Receivable ($77,000 × .79). 60,830

Sales Revenue…………….………. 77,000

Cost of Goods Sold………………….. 41,000

Inventory………………….……….... 41,000

Req. 2

BALANCE SHEET

Current assets:

Inventory………………………………. $ 16,000

INCOME STATEMENT

Sales revenue……………………………. $77,000

Cost of goods sold……………………… 41,000

Gross profit………………………………. $36,000

Chapter 6 Inventory and Merchandising Operations 435

(15-25 min.) E 6-16A

Journal

DATE ACCOUNT TITLES AND EXPLANATION DEBIT CREDIT

1 Inventory ($660 + $2,160)…………….. 2,820

Accounts Payable…………………... 2,820

2 Accounts Receivable (12 × $520)….. 6,240

Sales Revenue………………………. 6,240

Cost of Goods Sold……………………. 2,000*

Inventory……………………………… 2,000

_____

*(5 × $160) + (4 × $165) + (3 × $180) = $2,000

Req. 3

Sales revenue…………………………... $6,240

Cost of goods sold…………………….. 2,000

Gross profit……………………………... $4,240

Ending inventory

($800 + $660 + $2,160 − $2,000)…... $1,620**

**Or, (9 × $180) = $1,620

436 Financial Accounting: IFRS 11/e Solutions Manual

(10-15 min.) E 6-17A

1.

Inventory

Begin. Bal. (5 units × $160) 800

Purchases

Dec. 15 (4 units × $165) 660 Cost of goods sold

26 (12 units × $180) 2,160 (12 units × $?) ?

Ending bal. (9 units × $?) ?

Cost of Goods Sold Ending Inventory

(a) Specific

unit cost (2 × $160) + (4 × $165) + = $2,060 (3 × $160) + (6 × $180) = $1,560

(6 × $180)

(b) Average

cost 12 × $172* = $2,064 9 × $172* = $1,548

_____

($800 + $660 + $2,160)

*Average cost per unit = = $172

(5 + 4 + 12)

(c) FIFO (5 × $160) + (4 × $165) + = $2,000 (9 × $180) = $1,620

(3 × $180)

(d) LIFO (12 × $180) = $2,160 (5 × $160) + (4 × $165) = $1,460

2. LIFO produces the highest cost of goods sold, $2,160.

FIFO produces the lowest cost of goods sold, $2,000.

The increase in inventory cost from $160 to $180 per unit

causes the difference in cost of goods sold.

Chapter 6 Inventory and Merchandising Operations 437

(10 min.) E 6-18A

Cost of goods sold:

LIFO ($2,160) − FIFO ($2,000)…………………… $160

× Income tax rate…………………………………… .35

LIFO advantage in tax savings……………………… $ 56

(15 min.) E 6-19A

1.

a. FIFO

Cost of goods sold:

(18 × $34)… ……………............... $612

Ending inventory:

(3 × $34) + (6 × $65)……………... $ 492

b. LIFO

Cost of goods sold:

(6 × $65) + (9 × $34)…................. $696

Ending inventory:

(9 × $34)……………...................... $ 306

Req. 2

MusicSheet.net

Income Statement

Month Ended April 30, 20XX

Sales revenue (18 × $122) ………………………….. $2,196

Cost of goods sold……………………………………. 612

Gross profit…………………………………………….. 1,584

Operating expenses…………………………………... 280

Income before income tax…………………………… 1,304

Income tax expense (32%)…………………………… 417

Net income……………………………………………… $ 887

438 Financial Accounting: IFRS 11/e Solutions Manual

(15 min.) E 6-20A

Millions

1. Gross profit: FIFO LIFO

Sales revenue…………………………… $5.2 $5.2

Cost of goods sold

FIFO: 600,000 × $5………………….. 3.0

LIFO: (500,000 × $3) + (100,000 × $4)…

1.9

Gross profit……………………………… $2.2 $3.2

2. Gross profit under FIFO and LIFO differ because inventory

costs decreased during the period.

3. Valuing the ending inventory at $5.00 per unit will, result in

an ending inventory valued at $4,500,000 (900,000 @ $5)

while the FIFO inventory was valued at $3,300,000 (500,000 @

$3) + (200,000 @ $4) + (200,000 @ $5). This would amount to

changing the method of accounting for inventories from FIFO

to LIFO. The difference of $1,200,000 between the ending

inventories would reduce cost of goods sold by $1,200,000

and increase net income by the same amount. While

accounting changes like this are permissible under GAAP,

they must be for a business purpose, and not merely to

increase the manager’s bonus. The company’s auditors will

likely view the change unfavorably. In addition, such a

change will likely increase the company’s tax bill, so it is

unlikely that the owners of the company will go along with it

either.

Chapter 6 Inventory and Merchandising Operations 439

(5-10 min.) E 6-21A

Lush Garden Supply

Income Statement (partial)

Year Ended July 31, 20X6

Sales revenue ……………………………………………… $161,000

Cost of goods sold [$76,000 + ($18,000 − $14,800)]… 79,200

Gross profit………………………………………………… $ 81,800

Note: Cost is used for beginning inventory because cost is

lower than market. Market (replacement cost) is used for

ending inventory because market is lower than cost at

year end.

440 Financial Accounting: IFRS 11/e Solutions Manual

(15-20 min.) E 6-22A

(Amounts in thousands)

a. $ 67 $21 + $65 − $19 = $67

b. $ 58 $125 − $67 = $58

c. Must first solve for d

d. $ 94 $138 − $44= $94

c. $ 95 $26 + c − $94 = $27; c = $95

e. $ 98 $60 + $38 = $98

f. $ 27 f + $65 − $32 = $60; f = $27

g. $ 5 $11 + $32 − g = $38; g = $5

h. $ 56 $94 − $38 = $56

Chris Company

Income Statement

Year Ended December 31, 20X6

(Thousands)

Net sales $ 125

Cost of goods sold

Beginning inventory $ 21

Net purchases 65

Goods available 86

Ending inventory (19)

Cost of goods sold 67

Gross profit 58

Operating and other expenses 42

Net income (Net loss) $16

Chapter 6 Inventory and Merchandising Operations 441

(20-30 min.) E 6-23A

Gross Profit

Company Percentage Inventory Turnover

$58 $67

Chris = 0.464 = 3.4 times

$125 ($21 + $19) / 2

$44 $94

Ford = 0.319 = 3.5 times

$138 ($26 + $27) / 2

$38 $60

Arthur = 0.388 = 2.0 times

$98 ($27 + $32) / 2

$56 $38

Michaels = 0.596 = 4.8 times

$94 ($11 + $5) / 2

Michaels has the highest gross profit percentage, 59.6%.

Michaels has the highest rate of inventory turnover, 4.8 times.

Based on these data, Michaels looks the most profitable

because Michaels gross profit percentage is approximately

1½ times the other companies’ gross profit percentage. And

Michaels’ inventory turnover is about 25% higher than Chris’

turnover.

442 Financial Accounting: IFRS 11/e Solutions Manual

(15 min.) E 6-24A

Req. 1 and 2

1 2

FIFO LIFO

$148,000 − $82,500 $148,000 − $98,200

Gross profit percentage =

$148,000 $148,000

= 0.443 = 0.336

$82,500 $98,200

Inventory turnover =

($22,000 + $24,000) / 2 ($10,000 + $16,000) / 2

= 3.6 times = 7.6 times

Req. 3

FIFO makes the company look better on the gross profit

percentage.

Req. 4

LIFO makes the company look better on the rate of inventory

turnover.

Chapter 6 Inventory and Merchandising Operations 443

(10-15 min.) E 6-25A

Year ended January 31, 20X5 Millions

Budgeted cost of goods sold ($6,700 × 1.10)……….. $7,370

Budgeted ending inventory…………………………….. 2,500

Budgeted goods available………….…………………… 9,870

Actual beginning inventory…………………………….. (2,200)

Budgeted purchases…………………………………….. $7,670

(10-15 min.) E 6-26A

Beginning inventory……………………… $ 48,500

Net purchases……………………………… 32,900

Goods available……….…………………... 81,400

Estimated cost of goods sold:

Net sales revenue……………………… $ 64,000

Less estimated gross profit of 35%… (22,400)

Estimated cost of goods sold………... 41,600

Estimated cost of inventory destroyed.. $ 39,800

Another reason managers use the gross profit method to

estimate ending inventory is to test the reasonableness of

ending inventory.

444 Financial Accounting: IFRS 11/e Solutions Manual

10-15 min.) E 6-27A

Mighty Sea Marine Supply

Income Statement (Corrected)

Years Ended September 30, 20X6 and 20X5

20X6 20X5

Sales revenue $143,000 $120,000

Cost of goods sold:

Beginning inventory $22,000* $ 9,000

Net purchases 74,000 67,000

Goods available 96,000 76,000

Ending inventory (19,000) (22,000)*

Cost of goods sold 77,000 54,000

Gross profit 66,000 66,000

Operating expenses 28,000 24,000

Net income $ 38,000 $ 42,000

*$14,500 + $7,500 = $22,000

Mighty Sea actually performed poorly in 20X6, compared to

20X5, with net income down from $42,000 to $38,000, despite

the increase in sales revenue.

Chapter 6 Inventory and Merchandising Operations 445

Exercises

Group B

(15-20 min.) E 6-28B

Req. 1

Perpetual System

1. Purchases:

Inventory…………………….……….… 45,000

Accounts Payable…………………. 45,000

2. Sales:

Cash (€72,000 × .24)…….………… 17,280

Accounts Receivable (€72,000 × .76). 54,720

Sales Revenue…………….………. 72,000

Cost of Goods Sold………………….. 40,000

Inventory………………….……….... 40,000

Req. 2

BALANCE SHEET

Current assets:

Inventory………………………………. € 19,000

INCOME STATEMENT

Sales revenue……………………………. € 72,000

Cost of goods sold……………………… 40,000

Gross profit………………………………. € 32,000

446 Financial Accounting: IFRS 11/e Solutions Manual

(15-25 min.) E 6-29B

Journal

DATE ACCOUNT TITLES AND EXPLANATION DEBIT CREDIT

1 Inventory ($960 + $1,870)…………….. 2,830

Accounts Payable…………………... 2,830

2 Accounts Receivable (16 × $640)….. 10,240

Sales Revenue………………………. 10,240

Cost of Goods Sold……………………. 2,430*

Inventory……………………………… 2,430

_____

*(13 × $150) + (3 × $160) = $2,430

Req. 3

Sales revenue…………………………... $10,240

Cost of goods sold…………………….. 2,430

Gross profit……………………………... $7,810

Ending inventory

($1,200 + $750 + $2,080 − $2,430)…. $1,600**

**Or, (10 × $160) = $1,600

Chapter 6 Inventory and Merchandising Operations 447

(10-15 min.) E 6-30B

1.

Inventory

Begin. Bal. (8 units × €150) 1,200

Purchases

May 15 (5 units × €150) 750 Cost of goods sold

26 (13 units × €160) 2,080 (16 units × €?) ?

Ending bal. (10 units × €?) ?

Cost of Goods Sold Ending Inventory

(a) Specific

unit cost (9 × €150) + (7 × €160) = €2,470 (4 × €150) + (6 × €160) = €1,560

(b) Average

cost 16 × €155* = €2,480 10 × €155* = €1,550

_____

(€1,200 + €750 + €2,080)

*Average cost per unit = = €155

(8 + 5 + 13)

(c) FIFO (13 × $150) + (3 × €160) = €2,430 (10 × €160) = €1,600

(d) LIFO (13 × $160) + (3 × €150) = €2,530 (10 × €150) = €1,500

2. LIFO produces the highest cost of goods sold, €2,530.

FIFO produces the lowest cost of goods sold, €2,430.

The increase in inventory cost from €150 to €160 per unit

causes the difference in cost of goods sold.

448 Financial Accounting: IFRS 11/e Solutions Manual

(10 min.) E 6-31B

Cost of goods sold:

LIFO (€2,530) − FIFO (€2,430)………………………… €100

× Income tax rate……………………………………….. .38

LIFO advantage in tax savings………………………….. € 38

(15 min.) E 6-32B

1.

a. FIFO

Cost of goods sold:

(14 × €38) ……………................... €532

Ending inventory:

(3 × €38) + (5 × €68)…………….. €454

b. LIFO

Cost of goods sold:

(5 × €68) + (9 × €38)…………….. €682

Ending inventory:

(8 × €38) ……………..................... €304

2.

MusicLife.net

Income Statement

Month Ended April 30, 20X6

Sales revenue (9 × €106) + (5 × €92)……………. €1,414

Cost of goods sold……………………………………. 532

Gross profit…………………………………………….. 882

Operating expenses…………………………………... 430

Income before income tax…………………………… 452

Income tax expense (30%)…………………………… 136

Net income……………………………………………… € 316

Chapter 6 Inventory and Merchandising Operations 449

(15 min.) E 6-33B

Millions

1. Gross profit: FIFO LIFO

Sales revenue……………………………. €14.1 €14.1

Cost of goods sold

FIFO: 1,300,000 × €9……………… 11.7

LIFO: (600,000 × €7) + (100,000 × €8)

+ (600,000 × €9) 10.4

Gross profit……………………………………… €2.4 €3.7

2. Gross profit under FIFO and LIFO differ because inventory

costs decreased during the period.

3. Valuing the ending inventory at €9.00 per unit will result in an

ending inventory valued at €8,100,000 (900,000 × €9) while the

FIFO inventory was valued at €6,800,000 (200,000 × €9) +

(100,000 × €8) + (600,000 × €7). The difference of €1,300,000

between the ending inventories would reduce cost of goods

sold by €1,300,000 and increase net income by the same

amount. While accounting changes like this are permissible

under GAAP, they must be for a business purpose, and not

merely to increase the manager’s bonus. The company’s

auditors will likely view the change unfavorably. In addition,

such a change will likely increase the company’s tax bill, so it

is unlikely that the owners of the company will go along with

it either.

450 Financial Accounting: IFRS 11/e Solutions Manual

(5-10 min.) E 6-34B

Secret Garden Supply

Income Statement (partial)

Year Ended May 31, 20X6

Sales revenue ……………………………………………… €152,000

Cost of goods sold [€63,000 + (€15,300 − €13,400)]… 64,900

Gross profit………………………………………………… € 87,100

Note: Cost is used for beginning inventory because cost is

lower than market. Market (replacement cost) is used for

ending inventory because market is lower than cost at

year end.

Chapter 6 Inventory and Merchandising Operations 451

(15-20 min.) E 6-35B

(Amounts in thousands)

a. € 65 €18 + €64 − €17 = €65

b. € 56 €121 − €65 = €56

c. Must first solve for d

d. € 87 €135 − €48 = €87

c. € 89 €26 + c − €87 = €28; c = €89

e. € 93 €61 + €32 = €93

f. € 27 f + €56 − €22 = €61; f = €27

g. € 5 €8 + €33 − g = €36; g = €5

h. € 53 €89 − €36 = €53

Frank Company

Income Statement

Year Ended December 31, 20X6

(Thousands)

Net sales € 121

Cost of goods sold

Beginning inventory € 18

Net purchases 64

Goods available 82

Ending inventory (17)

Cost of goods sold 65

Gross profit 56

Operating and other expenses 48

Net income (Net loss) €8

452 Financial Accounting: IFRS 11/e Solutions Manual

(20-30 min.) E 6-36B

Gross Profit

Company Percentage Inventory Turnover

€56 €65

Frank = 0.463 = 3.7 times

€121 (€18 + €17) / 2

€48 €87

Hill = 0.356 = 3.5 times

€135 (€27 + €22) / 2

€32 €61

Fort = 0.344 = 2.5 times

€93 (€29 + €20) / 2

€53 €36

Orville = 0.596 = 5.5 times

€89 (€8 + €5) / 2

Orville has the highest gross profit percentage, 59.6%.

Orville also has the highest rate of inventory turnover, 5.5

times.

Based on these data, Orville looks the most profitable because

Ogden’s gross profit percentage is greater than 1 ½ times the

other companies’ gross profit percentage. And Orville’s

inventory turnover is about 30% more than the other

companies’ turnover.

Chapter 6 Inventory and Merchandising Operations 453

(15 min.) E 6-37B

Req. 1 and 2

1 2

FIFO LIFO

€145,000 − €87,500 €145,000 − €95,200

Gross profit percentage =

€145,000 €145,000

= 0.397 = 0.343

€87,500 €95,200

Inventory turnover =

(€19,000 + €22,000) / 2 (€16,000 + €23,000) / 2

= 4.3 times = 4.9 times

Req. 3

FIFO makes the company look better on the gross profit

percentage.

Req. 4

LIFO makes the company look better on the rate of inventory

turnover.

454 Financial Accounting: IFRS 11/e Solutions Manual

(10-15 min.) E 6-38B

Year ended January 31, 20X6: Millions

Budgeted cost of goods sold (€6,400 × 1.10)… €7,040

Budgeted ending inventory……………………… 2,200

Budgeted goods available………….……………… 9,240

Actual beginning inventory………………………… (1,900)

Budgeted purchases…………………………………….. €7,340

Chapter 6 Inventory and Merchandising Operations 455

(10-15 min.) E 6-39B

Beginning inventory……………………… € 45,700

Net purchases……………………………… 39,100

Goods available……….…………………... 84,800

Estimated cost of goods sold:

Net sales revenue……………………… €68,400

Less estimated gross profit of 40%… (27,360)

Estimated cost of goods sold………... 41,040

Estimated cost of inventory destroyed.. € 43,760

Another reason managers use the gross profit method to

estimate ending inventory is to test the reasonableness of

ending inventory.

456 Financial Accounting: IFRS 11/e Solutions Manual

(10-15 min.) E 6-40B

Friendly Harbor Marine Supply

Income Statement (Corrected)

Years Ended September 30, 20X6 and 20X5

20X6 20X5

Sales revenue €139,000 €121,000

Cost of goods sold:

Beginning inventory €19,800* €12,000

Net purchases 74,000 69,000

Goods available 93,800 81,000

Ending inventory (18,500)

(19,800)*

Cost of goods sold 75,300 61,200

Gross profit 63,700 59,800

Operating expenses 26,000 19,000

Net income € 37,700 €40,800

*€13,000 + €6,800 = $19,800

Friendly Harbor actually performed poorly in 20X6, compared to

20X5, with net income down from €40,800 to €37,700, despite

the increase in sales revenue.

Chapter 6 Inventory and Merchandising Operations 457

Challenge Exercises

(5-10 min.) E 6-41

a. Use average cost.

b. Use FIFO.

c. Use FIFO.

d. Use any method. They all produce the same results

because costs are stable.

e. Buy inventory late in the year.

f. Company is using LIFO.

458 Financial Accounting: IFRS 11/e Solutions Manual

(20-30 min.) E 6-42

Sales increased, the gross profit dropped, and net income slid

into a net loss, as shown here:

Dollars in millions 20X6 20X5 20X4

Sales $36.2 $35.8 $34.3

Cost of sales 28.6 27.7 26.8

Gross profit 7.6 8.1 7.5

Net income (net loss) (0.4) 0.2 0.7

Gross profit $7.6 $8.1 $7.5

= = 0.210 = 0.226 = 0.219

percentage $36.2 $35.8 $34.3

Inventory $28.6 $27.7 $26.8

= = 3.5 = 3.7 = 3.8

turnover ($8.9 + $7.3) / 2 ($7.3 + $7.8) / 2 ($7.8 + $6.4) / 2

Both the gross profit percentage and the rate of inventory

turnover dropped during this period. This suggests that L Mart

had to discount its merchandise more and more just to sell the

goods. The end result was a net loss in 20X6.

Selling expenses increased significantly, which suggests that L

Mart had to advertise heavily in order to sell its inventory.

Chapter 6 Inventory and Merchandising Operations 459

Quiz

Q6-43 c ($3,500 + $6,300 − $5,400 = $4,400)

Q6-44 d ($7,600 − $5,400 = $2,200)

Q6-45 a

Q6-46 c (1,100 @ $15.00 + 1,300 @ $15.20 = $36,260)

Q6-47 b (1,300 @ $15.20 + 200 @ $15 = $22,760)

Q6-48 a

Q6-49 a ($154,000 + $213,000 = $367,000)

Q6-50 d

Q6-51 a

Q6-52 c [$632,000 − ($68,000 + $480,000 − $45,000) =

$129,000]

Q6-53 b ($26,000 + X − $14,000 = $103,000; X = $91,000)

Q6-54 c

Q6-55 d [$330,000 ÷ ($29,000 + $34,000) / 2] = 10.5 times

Q6-56 c Net sales = $453,000 ($460,000 − $7,000)

COGS = $57,000 + ($215,000 + $24,000 −

$4,800 − $6,200) − $48,000

= $237,000

GP% = ($453,000 − $237,000) / $453,000

= .477

Q6-57 b $50,000 + $74,000 − $96,000 (1 − .50) = $76,000

Q6-58 a

Q6-59 b

460 Financial Accounting: IFRS 11/e Solutions Manual

Problems

Group A

(20-30 min.) P 6-60A

Req. 1

Inventory……………………………………. 8,107,000

Accounts Payable……………………… 8,107,000

Accounts Payable…………………………. 7,907,000

Cash………………………………………. 7,907,000

Cash…………………………………………. 4,800,000

Accounts Receivable……………………... 9,900,000

Sales Revenue………………………….. 14,700,000

Cost of Goods Sold (150,000 × $55.77*). 8,365,500

Inventory…………………………………. 8,365,500

_____

*($1,150,000 + $8,107,000) ÷ (23,000 + 31,000 + 51,000 + 61,000)

= $55.77

Operating Expenses………………………. 3,550,000

Cash ($3,550,000 × .70)………………... 2,485,000

Accrued Liabilities ($3,550,000 × .30). 1,065,000

Income Tax Expense……………………… 835,350

Income Tax Payable…………………… 835,350

[($14,700,000 − $8,365,500 − $3,550,000)] × .30 = $835,350

Chapter 6 Inventory and Merchandising Operations 461

(continued) P 6-60A

Req. 2

Inventory

Beg. bal. 1,150,000

Purchases 8,107,000 COGS 8,365,500

End. bal. 891,500

Req. 3

Nice Buy

Income Statement

Year Ended February 28, 20X6

Sales revenue ……………………………… $ 14,700,000

Cost of goods sold……………………….. 8,365,500

Gross profit………………………………… 6,334,500

Operating expenses………………………. 3,550,000

Income before tax…………………………. 2,784,500

Income tax expense (30%)………………. 835,350

Net income…………………………………. $ 1,949,150

462 Financial Accounting: IFRS 11/e Solutions Manual

(20-30 min.) P 6-61A

Req. 1

The store uses FIFO.

This is apparent from the flow of costs out of inventory. For

example, the October 11 sale shows unit cost of $35, which

came from the beginning inventory. This is how FIFO, and only

FIFO, works.

Req. 2

Cost of goods sold:

13 × $35 = $ 455

39 × 35 = 1,365

5 × 36 = 180

40 × 36 = 1,440

$3,440

Sales 13 + 39 = 52 units × $70 = $3,640

5 + 40 = 45 units × $71 = 3,195 $6,835

Cost of goods 3,440

sold……………………………………….

Gross $3,395

profit………………………………………………..

Req. 3

Cost of October 31 inventory (39* × $36) + (24 × $2,292

$37).

Chapter 6 Inventory and Merchandising Operations 463

*Goods remaining from Oct 8 purchase: 84 units - 5 - 40 =39

464 Financial Accounting: IFRS 11/e Solutions Manual

(20-30 min.) P 6-62A

Req. 1

Inventory

Begin. bal. (78 units × $19) 1,482

Purchases:

Oct. 4 (99 units × $20) 1,980

19 (155 units × $22) 3,410 Cost of goods sold

25 (48 units × $23) 1,104 (334 units × $?) ?

Ending bal. (46 units × $?) ?

Cost of Goods Sold Ending Inventory

Average cost 334 × $20.9895* = $7,010 46 × $20.9895* = $966

____

*Average cost ($1,482 + $1,980 + $3,410 + $1,104)

= = $20.9895

per unit (78+ 99 + 155 + 48)

FIFO (78 × $19) + (99 × $20)

+ (155 × $22) + (2 × $23) = $ 6,918 (46 × $23) = $1,058

LIFO (48 × $23) + (155 × $22)

+ (99 × $20) + (32 × $19) = $7,102 (46 × $19) = $874

Chapter 6 Inventory and Merchandising Operations 465

(continued) P 6-62A

Req. 2

LIFO results in the highest cost of goods sold because (a) the

company’s prices are rising and (b) LIFO assigns to cost of

goods sold the cost of the latest inventory purchases. When

costs are rising, these latest inventory costs are the highest,

and that makes cost of goods sold the highest under LIFO.

Student responses may vary.

Req. 3

Fatigues Surplus

Income Statement

Month Ended October 31, 20X6

Sales revenue (334 × $52)……………………….. $17,368

Cost of goods sold……………………………….. 7,010

Gross profit………………………………………… 10,358

Operating expenses……………………………… 5,400

Income before income taxes……………………. 4,958

Income tax expense (40%)………………………. 1,983

Net income…………………………………………. $ 2,975

466 Financial Accounting: IFRS 11/e Solutions Manual

(30-40 min.) P 6-63A

Req. 1 (partial income statements)

Byron Aviation

Income Statement

Year Ended December 31, 20X6

AVERAGE FIFO LIFO

Sales revenue $132,447 $132,447 $132,447

Cost of goods sold 73,249 72,685 73,553

Gross profit $ 59,198 $ 59,762 $ 58,894

Computations of cost of goods sold:

Average cost ($6,084 + $2,449 + $67,716 + $4,968)

= = $8.1298

per unit (780 + 310 + 8,360 + 540)

COGS at average cost = 9,010 × $8.1298 = $73,249

FIFO COGS = (780 × $7.80) + (310 × $7.90) + (7,920 × $8.10) = $72,685

LIFO COGS = (540 × $9.20) + (8,360 × $8.10) + (110 × $7.90) = $73,553

Chapter 6 Inventory and Merchandising Operations 467

(continued) P 6-63A

Req. 2

Use the LIFO method to minimize income tax because cost of

goods sold is highest (gross profit is lowest) under LIFO when

inventory costs are rising.

468 Financial Accounting: IFRS 11/e Solutions Manual

(15-30 min.) P 6-64A

Everything Trade Mart should apply the lower-of-cost-or-market

rule to account for inventories. The current replacement cost of

ending inventory is less than Everything’s actual cost, so

Everything Trade Mart must write the inventory down to current

replacement cost, with the following journal entry:

Cost of Goods Sold……………… 78,000

Inventory………………………... 78,000

To write inventory down to NRV.

Everything should report the following amounts in its financial

statements:

BALANCE SHEET

Inventory at market (which is lower than

cost of $210,000)………………………………... $132,000*

INCOME STATEMENT

Cost of goods sold ($750,000 + $78,000)…… $828,000

_____

*$210,000 − $78,000 = $132,000

Reliability qualitative characteristic is the reason to account

for inventory at the lower of cost or NRV. Not revaluing the

inventory to the lower NRV lends biasness to the ending

inventory which violates the reliability requirement.

The Matching principle (from Chapter 3: Accrual Accounting &

Income) requires costs/losses to be recorded in the period in

which they contributed to revenue/gains. Since the impairment

in inventory occurred during this accounting period, not

recording the impairment would mean a misstatement of both

this year’s and the subsequent year’s net income.

Student responses may vary.

Chapter 6 Inventory and Merchandising Operations 469

(20-30 min.) P 6-65A

Req. 1

Coffee Shop

Sprinkle Top, Inc. Corp.

Millions Millions

Gross profit percentage:

Sales……………………. $554 $7,720

Cost of sales…………... 487 3,170

Gross profit……………. $ 67 $4,550

Gross profit $67 $4,550

= 12.1% = 58.9%

percentage: $554 $7,720

Inventory turnover:

Cost of goods sold $487 $3,170

=

Average inventory ($29 + $38) / 2 ($629+ $547) / 2

= 14.5 times = 5.4 times

Req. 2

From these statistics, it’s hard to tell whether Sprinkle Top or

Coffee Shop is more profitable. Coffee Shop has a much higher

gross profit percentage but Sprinkle Top has a much faster

inventory turnover. To adequately evaluate profitability, we will

need to also consider the companies’ selling, general, and

administrative expenses.

470 Financial Accounting: IFRS 11/e Solutions Manual

(25-30 min.) P 6-66A

Req. 1 (estimate of ending inventory by the gross profit

method)

Beginning inventory……………………... $ 57,200

Purchases…………………………………. $490,400

Less: Purchase discounts…………. (11,100)

Purchase returns……………... (70,800)

Net purchases…………………………. 408,500

Goods available………………………….. 465,700

Cost of goods sold:

Sales revenue………………………….. $668,000

Less: Sales returns………………… (11,500)

Net sales…………………………….….. 656,500

Less: Estimated gross profit of 40%. (262,600)

Estimated cost of goods sold………. 393,900

Estimated cost of ending inventory…... $ 71,800

Chapter 6 Inventory and Merchandising Operations 471

(continued) P 6-66A

Req. 2 (income statement through gross profit)

Theon Company

Income Statement (partial)

Month of October, 20X6

Sales revenue………………………………. $668,000

Less: Sales returns…………………….. (11,500)

Net sales revenue………………………. 656,500

Cost of goods sold………………………… 393,900*

Gross profit…………………………….…… $262,600

_____

*Cost of goods sold:

Beginning inventory…………………………... $ 57,200

Purchases………………………. $490,400

Less: Purchases discounts... (11,100)

Purchase returns…….. (70,800)

Net purchases………………………………….. 408,500

Cost of goods available for sale……………. 465,700

Less: Estimated ending inventory…………. (71,800)

Cost of goods sold……………………………. $393,900

472 Financial Accounting: IFRS 11/e Solutions Manual

(20-25 min.) P 6-67A

Req. 1

Cost of sales, budgeted ($720,000 × 1.08)… $ 777,600

+ Ending inventory, budgeted…………………. 78,000

= Cost of goods available………………………. 855,600

− Beginning inventory………………………….. (68,000)

= Purchases, budgeted ………………………… $ 787,600

Req. 2

Grammy’s Convenience Store

Budgeted Income Statement

Year Ended December 31, 20X5

Sales ($957,000 × 1.08)……………………….… $1,033,560

Cost of sales ($720,000 × 1.08)……………… 777,600

Gross profit…………………………………… 255,960

Operating expenses ($114,000 − $16,040)… 97,960

Net income…………………………………….… $158,000

Chapter 6 Inventory and Merchandising Operations 473

(15-20 min.) P 6-68A

Req. 1 (corrected income statements)

R. B. Video Sales

Income Statement (adapted; amounts in millions)

Years Ended 20X6, 20X5, and 20X4

20X6 20X5 20X4

Net sales revenue……………... $43 $40 $37

Cost of goods sold:

Beginning inventory……….. $ 9* $ 8* $ 4

Purchases…………………… 29 27 25

Goods available…………….. 38 35 29

Ending inventory…………… (7) (9)* (8)*

Cost of goods sold………… 31 26 21

Gross profit…………………….. 12 14 16

Operating expenses..…………. 7 7 7

Net income……………………… $ 5 $ 7 $ 9

*Throughout the period from year end 20X4 to year beginning 20X6, inventory was

understated by $3 million.

474 Financial Accounting: IFRS 11/e Solutions Manual

(continued) P 6-68A

Req. 2

The corrections did not change total net income over the three-

year period. But the corrections drastically altered the trend of

net income — from an increasing pattern to a decreasing

pattern.

Req. 3

The shareholders will not be happy with a declining trend of net

income because the company is losing ground with its profits.

Chapter 6 Inventory and Merchandising Operations 475

Problems

Group B

(20-30 min.) P 6-69B

Req. 1

Inventory…………………………………… 9,782,000

Accounts Payable…………………… 9,782,000

Accounts Payable……………………… 9,492,000

Cash……………………………………… 9,492,000

Cash………………………………………… 5,400,000

Accounts Receivable……………………… 10,084,000

Sales Revenue…………………………. 15,484,000

Cost of Goods Sold………………………... 10,191,000*

Inventory……………………………… 10,191,000

*(€990,000 + €9,782,000) ÷ (18,000 + 33,000 + 53,000 + 63,000) =

€64.50

€64.50 x 158,000 = €10,191,000

Operating Expenses…………………… 2,860,000

Cash (€2,860,000 × 0.70)…………… 2,002,000

Accrued Liabilities (€2,860,000 × 0.30). 858,000

Income Tax Expense………………………. 851,550

Income Tax Payable………………… 851,550

[(€15,484,000 − €10,191,000 − €2,860,000) × .35 = €851,550]

476 Financial Accounting: IFRS 11/e Solutions Manual

(continued) P 6-69B

Req. 2

Inventory

Beg. bal. 990,000

Purchases 9,782,000 COGS 10,191,000

End. bal. 581,000

Req. 3

Best Guy

Income Statement

Year Ended February 28, 20X6

Sales revenue …………………………… €15,484,000

Cost of goods sold…………………….. 10,191,000

Gross profit……………………………… 5,293,000

Operating expenses…………………… 2,860,000

Income before tax……………………… 2,433,000

Income tax expense (35%)……………. 851,550

Net income………………………………. € 1,581,450

Chapter 6 Inventory and Merchandising Operations 477

(20-30 min.) P 6-70B

Req. 1

The store uses FIFO.

This is apparent from the flow of costs out of inventory. For

example, the March 11 sale shows a unit cost of $38, which

came from the beginning inventory. This is how FIFO, and only

FIFO, works.

Req. 2

Cost of goods sold:

18 × $38 = $ 684

30 × 38 = 1,140

12 × 39 = 468

37 × 39 = 1,443

$3,735

Sales 18 + 30 = 48 units × $66 = $3,168

12 + 37 = 49 units × $69 = $3,381 $6,549

Cost of goods sold……………………………………. (3,735)

Gross profit……………………………………………... $2,814

Req. 3

Cost of March 31 inventory (28 × $39 + 17 x $40) = $1,772

*Goods remaining from Oct 8 purchase: 77 - 12 - 37 = 28

478 Financial Accounting: IFRS 11/e Solutions Manual

(20-30 min.) P 6-71B

Req. 1

Inventory

Begin. bal. (69 units × €24) 1,656

Purchases:

July 4 (108 units × €26) 2,808

12 (153 units × €28) 4,284 Cost of goods sold

25 (38 units × €29) 1,102 (316 units × €?) ?

Ending bal. (52 units × €?) ?

Cost of Goods Sold Ending Inventory

Average cost 316 × €26.7663* €8,458 52× €26.7663* €1,392

____

*Average cost (€1,656 + €2,808 + €4,284 + €1,102) =

=

per unit (69 + 108 + 153 + 38) €26.7663

FIFO (69 × €24) + (108 × €26) (14 × €28) +

+ ( 139 × €28) = €8,356 (38 × €29) = €1,494

LIFO (38 × €29) + (153 × €28) +

( 108 × €26) + (17 × €24) = €8,602 52 × €24 = €1,248

Chapter 6 Inventory and Merchandising Operations 479

(continued) P 6-71B

Req. 2

LIFO cost of goods sold is highest because (a) prices are rising

and (b) LIFO assigns to cost of goods sold the cost of the latest

inventory purchases. When costs are rising, these latest

inventory costs are the highest, and that makes cost of goods

sold the highest under LIFO.

Student responses may vary.

Req. 3

Swat Team Surplus

Income Statement

Month Ended July 31, 20X6

Sales revenue (316 × €55)…………………….. €17,380

Cost of goods sold……………………………….. 8,458

Gross profit………………………………………… 8,922

Operating expenses……………………………… 3,500

Income before income taxes……………………. 5,422

Income tax expense (32%)………………………. 1,735

Net income…………………………………………. € 3,687

480 Financial Accounting: IFRS 11/e Solutions Manual

(30-40 min.) P 6-72B

Req. 1 (partial income statements

Bryan Aviation

Income Statement

Year Ended December 31, 20X6

AVERAGE FIFO LIFO

Sales revenue €128,226 €128,226 €128,226

Cost of goods sold 73,134 72,603 73,637

Gross profit € 55,092 € 55,623 € 54,589

Computations of cost of goods sold:

Average cost (€5,550 + €2,496 + €67,878 + €4,823)

= = €8.0990

per case (740 + 320 + 8,380 + 530)

COGS at average cost = 9,030 × €8.0990 = €73,134

FIFO COGS = (740 × €7.50) + (320 × €7.80) + (7,970 × €8.10) = €72,603

LIFO COGS = (530 × €9.10) + (8,380 × €8.10) + (120 × €7.80) = €73,637

Chapter 6 Inventory and Merchandising Operations 481

(continued) P 6-72B

Req. 2

Use FIFO to report the highest net income because cost of

goods sold is lowest (gross profit is highest) under FIFO when

inventory costs are rising.

482 Financial Accounting: IFRS 11/e Solutions Manual

(15-20 min.) P 6-73B

Ariel Trade Mart should apply the lower-of-cost-or-market rule

to account for inventories. The current replacement cost of

ending inventory is less than Ariel Trade Mart’s actual cost, so

Ariel Trade Mart must write the inventory down to current

replacement cost, with the following journal entry:

Cost of Goods Sold………… 72,000

Inventory…………………... 72,000

To write inventory down to NRV.

Ariel Trade Mart should report the following in its financial

statements:

BALANCE SHEET

Inventory, at market (which is lower than cost

of €270,000)……………………………………... €198,000*

INCOME STATEMENT

Cost of goods sold (€830,000 + €72,000)……… €902,000

*€270,000 − €72,000 = €198,000

Faithful representation qualitative characteristic is the reason

to account for inventory at the lower of cost or NRV. Not

revaluing the inventory to the lower NRV lends a biasness to

the ending inventory which violates the reliability requirement.

The Matching principle (from Chapter 3: Accrual Accounting &

Income) requires costs to be recorded in the period in which

they contributed to gains. Since the impairment occurred

during this period, not recording it would mean a misstatement

of both this year’s and the subsequent year’s net income.

Student responses may vary.

Chapter 6 Inventory and Merchandising Operations 483

(20-25 min.) P 6-74B

Req. 1

Pastry People, Coffee Grind

Inc. Corp.

Dollars in Millions

Gross profit percentage:

Sales…………………… $558 $7,270

Cost of goods sold…. 486 3,290

Gross profit…………… $ 72 $3,980

Gross profit $72 $3,980

= 12.9% = 54.7%

percentage: $558 $7,270

Inventory turnover:

Cost of goods sold $486 $3,290

=

Average inventory ($18 + $31) / 2 ($632 + $548) / 2

= 19.8 times = 5.6 times

Req. 2

From these statistics, it is hard to tell whether Pastry People or

Coffee Grind is more profitable. Coffee Grind Corp. has a

higher gross profit percentage but Pastry People has a much

faster inventory turnover. To adequately evaluate profitability,

we will need to also consider the companies’ selling, general,

and administrative expenses.

484 Financial Accounting: IFRS 11/e Solutions Manual

(25-30 min.) P 6-75B

Req. 1 (estimate of ending inventory by the gross profit

method)

Beginning inventory……………………… €57,700

Purchases………………………………….. €490,800

Less: Purchase discounts………….. (12,200)

Purchase returns……………… (70,200)

Net purchases…………………………... 408,400

Goods available…………………………… 466,100

Cost of goods sold:

Sales revenue…………………………… €665,000

Less: Sales returns…………………. (16,500)

Net sales…………………………………. 648,500

Less: Estimated gross profit of 45%.. (291,825)

Estimated cost of goods sold………... 356,675

Estimated cost of ending inventory…… €109,425

Chapter 6 Inventory and Merchandising Operations 485

(continued) P 6-75B

Req. 2 (income statement through gross profit)

Joey Company

Income Statement (partial)

For the Period Up to the Fire

Sales revenue………………………….. €665,000

Less: Sales returns………………… (16,500)

Net sales revenue…………………... 648,500

Cost of goods sold……………………. 356,675*

Gross profit…………………………….. €291,825

_____

*Cost of goods sold:

Beginning inventory………………………... €57,700

Purchases……………………... €490,800

Less: Purchases discounts. (12,200)

Purchase returns……. (70,200)

Net purchases……………………………….. 408,400

Goods available……………………………... 466,100

Less: Estimated ending inventory………. (109,425)

Cost of goods sold…………………………. €356,675

486 Financial Accounting: IFRS 11/e Solutions Manual

(20-25 min.) P 6-76B

Req. 1

Cost of sales, budgeted (€722,000 × 1.10).. € 794,200

+ Ending inventory, budgeted………………... 76,000

= Cost of goods available……………………... 870,200

− Beginning inventory…………………………. (65,000)

= Purchases, budgeted ……………………….. € 805,200

Req. 2

Chris’ Convenience Stores

Budgeted Income Statement

Year Ended December 31, 20X6

Sales (€964,000 × 1.10)……………………… €1,060,400

Cost of sales (€722,000 × 1.10)……………. 794,200

Gross profit………………………………….... 266,200

Operating expenses (€110,000 − €4,800)… 105,200

Net income…………………………………….. € 161,000

Chapter 6 Inventory and Merchandising Operations 487

(15-20 min.) P 6-77B

Req. 1 (corrected income statements)

Waterville Video Sales

Income Statement (adapted; amounts in millions)

Years Ended 20X6, 20X5, and 20X4

20X6 20X5 20X4

Net sales revenue……………... €38 €35 €32

Cost of goods sold:

Beginning inventory……….. € 11* € 10* € 7

Purchases…………………… 32 30 28

Goods available…………….. 43 40 35

Ending inventory…………… (10) (11)* (10)*

Cost of goods sold………… 33 29 25

Gross profit…………………….. 5 6 7

Operating expenses…………... 3 3 3

Net income……………………… € 2 € 3 € 4

*Throughout the period from year end 20X4 to year beginning 20X6, inventory was

understated by €2 million.

488 Financial Accounting: IFRS 11/e Solutions Manual

(continued) P 6-77B

Req. 2

The corrections did not change total net income over the three-

year period. But the corrections made the company’s trend of

net income reflect a downward trend — with 20X5 net income

decreasing from that of 20X4 and then continuing the drop in

20X6.

Req. 3

The shareholders will not be happy with the downward trend,

since it appears to be continuing.

Chapter 6 Inventory and Cost of Goods Sold 489

Decision Cases

(50-60 min.) Decision Case 1

Req 1

Duracraft Corporation

Income Statement

FIFO LIFO

Sales revenue $1,200,000 $1,200,000

Cost of goods sold: 585,000* 645,000**

Gross profit 615,000 555,000

Operating expenses 200,000 200,000

Income before income

tax expense 415,000 355,000

Income tax expense

($415,000 × .40) 166,000

($355,000 × .40) 142,000

Net income $ 249,000 $ 213,000

_____

*$100,000 + $485,000 = $585,000

**$160,000 + $485,000 = $645,000

490 Financial Accounting 7/e Solutions Manual

(continued) Decision Case 1

Req. 2

FIFO LIFO

Net income………… $249,000 $213,000

FIFO net income is higher because (1) prices are rising (from

$100 to $121.25 to $160), and (2) FIFO and LIFO assign costs to

expense (cost of goods sold) in opposite patterns.

Student responses may vary.

Chapter 6 Inventory and Cost of Goods Sold 491

(15-25 min.) Decision Case 2

Req. 1

This question provides a rich setting for a class discussion.

There’s no single correct answer to this question. Some

students may favor Company B because it reports higher net

income than Company A. B may be preferred because it

appears more successful than A, and B’s share price may

therefore rise more than A’s share price. Thus it may appear

that Company B would be a better investment than A.

Other students may prefer Company A because it discloses the

inventory method it uses. Company B does not let outsiders

know which method it uses to account for its inventory. These

students may trust Company A more than B because A is more

willing to “bare its soul to the public.”

Professors can point out that A, the LIFO company, may be

better off because of the lower income taxes that A pays by

using the LIFO method. We don’t know whether Company B is

making the most of this cash-flow advantage of LIFO.

Student responses will vary.

Req. 2

Yes, the authors would prefer managers to be conservative in

accounting for inventory — for all the reasons accountants use

conservatism. If any errors occur, we would prefer to be

pleasantly surprised rather than negatively shocked.

492 Financial Accounting 7/e Solutions Manual

Ethical Issue

Req. 1

Changing accounting methods year after year hurts a

company’s credibility, which makes it hard for the company to

borrow or raise money from outside investors. The question

that arises about such a company is: What is the business

trying to hide?

Req. 2

The comparability principle is violated.

Req. 3

Creditors and outside investors could be harmed by

accounting changes year after year. It becomes difficult to tell

which changes in the business are real and which changes

result from the shift in the accounting method. Outsiders find it

difficult to track the company’s operating results and financial

position over time. Ultimately the company suffers because

lenders will not want to lend it money, and outsiders will be

reluctant to invest money in the business. This may deprive the

entity of needed funds and hurt its chances for success or

survival.

Chapter 6 Inventory and Cost of Goods Sold 493

Focus on Financials: Nestlé

(30 min.)

Req. 1

Nestlé measures its inventories at the lower of Cost or Net

Realizable Value. Cost is determined using the FIFO (First in

First Out) method for raw materials and purchased finished

goods, while the Weighted average cost method is used for

work in progress, sundry supplies and manufactured finished

goods.

Req. 2

If Nestlé adopted FIFO with rising inventory prices, profit would

rise due to lower COGS. This is because the older, cheaper

inventory would be sold first.

Req. 3

Cost of goods sold: CHF 44,199 million

Cost of inventory purchased: 8,401 – 8,153 + 44,199 = CHF

44,447 million

Ending Inventory – Beginning Inventory + Cost of goods sold

Req. 4

Gross profit margin @ 2015: 88,785 – 44,730 / 88,785 = 49.62%

Gross profit margin @ 2016: 89,469 – 44,199 / 89,469 =50.60%

Gross profit margin improved over the two years

Req. 5

494 Financial Accounting 7/e Solutions Manual

Inventory Turnover Ratio = COGS / Average Inventory

Inventory Turnover Ratio 2015: 5.16x

Inventory Turnover Ratio 2016: 5.34x

The inventory turnover ratio rose over the two years. This

indicates that the company is better at shifting inventory out to

customers and holding less inventory as a result. To get a

picture, we might also compare how Nestlé’s turnover ratio

compares with peers in the same industry.

Group Project

Student responses will vary.

Chapter 6 Inventory and Cost of Goods Sold 495

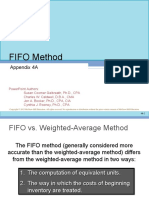

Chapter 6 Appendix

Appendix Short Exercises

(10-15 min.) S6A-1

(Journal entries)

General Journal

1. Purchases 1,270

Accounts Payable 1,270

Purchased inventory on account.

2. Accounts Receivable 3,400

Sales Revenue 3,400

Sold inventory on account.

3. End-of-period entries to update

inventory and record Cost of Goods

sold:

a. Cost of Goods Sold 460

Inventory (beginning balance) 460

Transfer beginning inventory to COGS.

b. Inventory (ending balance) 630

Cost of Goods Sold 630

Set up ending inventory based on physical

count.

c. Cost of Goods Sold 1,270

Purchases 1,270

Transfer purchases to COGS.

496 Financial Accounting 7/e Solutions Manual

(10-15 min.) S6A-2

Req. 1 Posting general journal entries

Inventory

460* 460

630

630

* Beginning inventory was $460

Cost of Goods Sold

460 630

1,270

1,100

Req. 2

Cost-of-Goods-Sold Model

Beginning inventory $ 460

Add: Purchases 1,270

Goods available for sale 1,730

Less: Ending inventory 630

Cost of goods sold $1,100

Req. 3

Paxton Technologies

Income Statement (Partial)

Sales revenue $3,400

Cost of goods sold:

Beginning inventory 460

Purchases 1,270

Goods available 1,730

Ending inventory (630)

Cost of goods sold 1,100

Gross profit $2,300

Chapter 6 Inventory and Cost of Goods Sold 497

Appendix Exercises

(10-15 min.) E6A-3A

Inventory

Begin. Bal. (6 units × $60) 360

Purchases

Jul 1 (3 units × $60) 180 Cost of goods sold

15 (14 units × $70) 980 (18 units × $?) ?

26 (2 units × $80) 160

Ending Bal. (7 units × $?) ?

Cost of

Ending Inventory

Goods Sold

(1) Specific

unit cost (7 × $60) + (9 × $70) + (2 × $60) + (5 × $70) = $470

= $1,210

(2 × $80)

(2) Average

cost (18 × $67.20*) = $1,209.6 (7 × $67.20*) = $470.40

0

_____

($360 + 180 + 980 + 160)

*Average cost per unit = = $67.20

(6 + 3 + 14 + 2)

(3) FIFO

(9 × $60) + (9 × $70) = $1,170 (5 × $70) + (2 × $80) = $510

(4) LIFO (2 × $80) + (14 × $70) +

= $1,260 (7 × $60) = $420

(2 × $60)

498 Financial Accounting 7/e Solutions Manual

(10-15 min.) E6A-4A

Reqs. 1 & 2 (Journal entries)

General Journal

1. Purchases 1,320

Accounts Payable 1,320

Purchased inventory on account.

2. Accounts Receivable 5,066

Sales Revenue 5,066

Sold inventory on account.

3. End-of-period entries to update inventory

and record Cost of Goods Sold:

a. Cost of Goods Sold 360

Inventory (beginning balance) 360

Transfer beginning inventory to COGS.

b. Inventory (ending balance) 420

Cost of Goods Sold 420

Set up ending inventory based on physical

count.

c. Cost of Goods Sold 1,320

Purchases 1,320

Transfer purchases to COGS.

Chapter 6 Inventory and Cost of Goods Sold 499

(continued) E6A-4A

Req.3 Posting general journal entries

Cost of Goods Sold

Beginning Inventory 360 Ending Inventory 420

Purchases 1,320

Cost of goods sold 1,260

Req. 4 Cost-of-Goods-Sold Model

Beginning inventory 360

Add: Purchases 1,320

Goods available 1,680

Less: Ending inventory 420

Cost of goods sold 1,260

500 Financial Accounting 7/e Solutions Manual

(10-15 min.) E6A-5B

Inventory

Begin. Bal. (7 units × $62) 434

Purchases

Dec 8 (5 units × $62) 310 Cost of goods sold

15 (14 units × $72) 1,008

26 ( 3 units × $82) 246 (20 units × $?) ?

Ending Bal. ( 9 units × $?) ?

Cost of Goods Sold Ending Inventory

(1) Specific

unit cost (8 × $62) + (9 × $72) + (4 × $62) + (5 × $72) = $608

= $1,390

(3 × $82)

(2) Average

cost (20 × $68.90*) = $1,378 (9 × $68.90*) = $620

_____

($434 + 310 + 1,008 + 246)

*Average cost per unit = = $68.90

(7 + 5 + 14 + 3)

(3) FIFO

(12 × $62) + (8 × $72) = $1,320 (6 × $72) + (3 × $82) = $678

(4) LIFO (3 × $82) + (14 × $72) + (9 × $62) = $558

= $1,440

(3 × $62)

Chapter 6 Inventory and Cost of Goods Sold 501

(10-15 min.) E6A-6B

Reqs. 1 & 2 (Journal entries)

General Journal

1. Purchases 1,564

Accounts Payable 1,564

Purchased inventory on account

2. Accounts Receivable 6,360

Sales Revenue 6,360

Sold inventory on account

3. End-of-period entries to update inventory

and record Cost of Goods Sold:

a. Cost of Goods Sold 434

Inventory (beginning balance) 434

Transfer beginning inventory to COGS

b. Inventory (ending balance) 558

Cost of Goods Sold 558

Set up ending inventory based on physical

count

c. Cost of Goods Sold 1,564

Purchases 1,564

Transfer purchases to COGS

502 Financial Accounting 7/e Solutions Manual

(continued) E6A-6B

Req.3 Posting general journal entries

Cost of Goods Sold

Beginning Inventory 434 Ending Inventory 558

Purchases 1,564

Cost of goods sold 1,440

Req. 4 Cost-of-Goods-Sold Model

Beginning inventory $ 434

Add: Purchases 1,564

Goods available 1,998

Less: Ending inventory 558

Cost of goods sold $1,440

Chapter 6 Inventory and Cost of Goods Sold 503

Appendix Problems

(20-25 min.) P6A-7A

Req. 1

Inventory

Begin. Bal. (50 units × $18) 900

Purchases

Jul 8 (80 units × $19) 1,520 Cost of goods sold

30 (21 units × $20) 420 (95 units × $?) ?

Ending Bal. (56 units × $?) ?

Cost of Goods Sold Ending Inventory

FIFO

(50 × $18) + (45 × $19) = $1,755 (21 × $20) + (35 × $19) = $1,085

Req. 2

Date Units Sold Selling Price Total Revenue

July 3 18 $70 $1,260

July 11 32 $70 $2,240

July 19 4 $72 $ 288

July 24 36 $72 $2,592

July 30 5 $72 $ 360

Total 95 $6,740

Watercress Outlet

Income Statement (Partial)

Sales revenue $6,740

Cost of goods sold:

Beginning inventory $ 900

Purchases 1,940

Goods available 2,840

Ending inventory (1,085)

Cost of goods sold 1,755

Gross profit $4,985

504 Financial Accounting 7/e Solutions Manual

(20-30 min.) E6A-8A

Req. 1 (Journal entries)

General Journal (Amounts in

Thousands)

1. Purchases $2,240

Accounts Payable 2,240

Purchased inventory on account

2. Accounts Receivable 2,520

Cash 1,080

Sales Revenue 3,600

Sold inventory for cash and on

account

3. End-of-period entries to update

inventory and record Cost of Goods

Sold:

a. Cost of Goods Sold 580

Inventory (beginning balance) 580

Transfer beginning inventory to COGS

b. Inventory (ending balance) 700

Cost of Goods Sold 700

Set up ending inventory based on

physical count

c. Cost of Goods Sold 2,240

Purchases 2,240

Transfer purchases to COGS

Chapter 6 Inventory and Cost of Goods Sold 505

(continued) E6A-8A

Req. 2

Decadent Desserts, Inc.

Income Statement (Partial)

Sales revenue $3,600

Cost of goods sold:

Beginning inventory $580

Purchases 2,240

Goods available 2,820

Ending inventory (700)

Cost of goods sold 2,120

Gross Profit $1,480

Cost-of-Goods-Sold Model

Beginning inventory $580

Add: Purchases 2,240

Goods available 2,820

Less: Ending inventory 700

Cost of goods sold $2,120

506 Financial Accounting 7/e Solutions Manual

(20-25 min.) P6A-9B

Req. 1

Inventory

Begin. Bal. (52 units × $20) 1,040

Purchases

Jan 8 (75 units × $21) 1,575 Cost of goods sold

30 (20 units × $22) 440 (102 units × $?) ?

Ending Bal. (45 units × $?) ?

Cost of Goods Sold Ending Inventory

FIFO (52 × $20) + (50 × $21) = $2,090 (20 × $22) + (25 × $21) = $965

Req. 2

Date Units Sold Selling Price Total Revenue

Jan 3 19 $75 $1,425

Jan 11 33 $75 $2,475

Jan 19 3 $77 $ 231

Jan 24 40 $77 $3,080

Jan 31 7 $77 $ 539

Total 102 $7,750

Trendy Outlet

Income Statement (Partial)

Sales revenue $7,750

Cost of goods sold:

Beginning inventory $1,040

Purchases 2,015

Goods available 3,055

Ending inventory (965)

Cost of goods sold 2,090

Gross profit $5,660

Chapter 6 Inventory and Cost of Goods Sold 507

(20-30 min.) E6A-10B

Req. 1 (Journal entries)

General Journal (thousands)

1. Purchases 2,100

Accounts Payable 2,100

Purchased inventory on account

2. Accounts Receivable 2,800

Cash 1,200

Sales Revenue 4,000

Sold inventory for cash and on account

3. End-of-period entries to update inventory

and record Cost of Goods Sold:

a. Cost of Goods Sold 520

Inventory (beginning balance) 520

Transfer beginning inventory to COGS.

b. Inventory (ending balance) 680

Cost of Goods Sold 680

Set up ending inventory based on physical

count.

c. Cost of Goods Sold 2,100

Purchases 2,100

Transfer purchases to COGS.

508 Financial Accounting 7/e Solutions Manual

(continued) E6A-10B

Req. 2

Sinful Desserts, Inc.

Income Statement (Partial)

Sales revenue $ 4,000

Cost of goods sold:

Beginning inventory $ 520

Purchases 2,100

Goods available 2,620

Ending inventory (680)

Cost of goods sold 1,940

Gross Profit $ 2,060

Cost-of-Goods-Sold Model

Beginning inventory 520

Add: Purchases 2,100

Goods available 2,620

Less: Ending inventory 680

Cost of goods sold 1,940

Chapter 6 Inventory and Cost of Goods Sold 509

Вам также может понравиться

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsОт EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsОценок пока нет

- Harrison FA IFRS 11e CH07 SMДокумент85 страницHarrison FA IFRS 11e CH07 SMJingjing Zhu0% (1)

- Fischer11e Smchap04 FinalДокумент28 страницFischer11e Smchap04 FinalWilliam Omar VelezОценок пока нет

- Chapter 6 Solutions 2241Документ22 страницыChapter 6 Solutions 2241JamesОценок пока нет

- Harrison FA IFRS 11e CH09 SMДокумент106 страницHarrison FA IFRS 11e CH09 SMShako GrdzelidzeОценок пока нет

- Harrison FA IFRS 11e CH10 SMДокумент94 страницыHarrison FA IFRS 11e CH10 SMJingjing ZhuОценок пока нет

- Harrison FA IFRS 11e CH10 SMДокумент93 страницыHarrison FA IFRS 11e CH10 SMShako Grdzelidze100% (1)

- Harrison FA IFRS 11e CH04 SMДокумент46 страницHarrison FA IFRS 11e CH04 SMLi Kin LongОценок пока нет

- Harrison FA IFRS 11e CH05 SM PDFДокумент89 страницHarrison FA IFRS 11e CH05 SM PDFJingjing ZhuОценок пока нет

- Harrison FA IFRS 11e CH12 SM Class PDFДокумент9 страницHarrison FA IFRS 11e CH12 SM Class PDFtest testОценок пока нет

- Ch02 Harrison 8e GE SMДокумент96 страницCh02 Harrison 8e GE SMMuh BilalОценок пока нет

- Harrison FA IFRS 11e CH03 SMДокумент94 страницыHarrison FA IFRS 11e CH03 SMJingjing ZhuОценок пока нет

- Harrison FA IFRS 11e CH01 SMДокумент61 страницаHarrison FA IFRS 11e CH01 SMJingjing Zhu50% (2)

- Hhtfa8e ch01 SMДокумент83 страницыHhtfa8e ch01 SMkbrooks323Оценок пока нет

- Ch08 Harrison 8e GE SM (Revised)Документ102 страницыCh08 Harrison 8e GE SM (Revised)Muh BilalОценок пока нет

- CH 02 Review and Discussion Problems SolutionsДокумент16 страницCH 02 Review and Discussion Problems SolutionsArman Beirami100% (2)

- Final Exam AnsДокумент8 страницFinal Exam AnsTien NguyenОценок пока нет

- Homework 4: Computing Deferred Income Tax (Supplement B)Документ5 страницHomework 4: Computing Deferred Income Tax (Supplement B)Dev SharmaОценок пока нет

- Chapter 14 SolutionДокумент9 страницChapter 14 Solutionbellohales0% (1)

- CH 04 Review and Discussion Problems SolutionsДокумент23 страницыCH 04 Review and Discussion Problems SolutionsArman Beirami67% (3)

- Earn Hart Corporation Has Outstanding 3 000 000 Shares of Common PDFДокумент1 страницаEarn Hart Corporation Has Outstanding 3 000 000 Shares of Common PDFAnbu jaromiaОценок пока нет

- ch03 Part9Документ6 страницch03 Part9Sergio HoffmanОценок пока нет

- Practice of Profitability RatiosДокумент11 страницPractice of Profitability RatiosZarish AzharОценок пока нет

- Slopes Inc Manufactures and Sells Snowboards Slopes Manufacture A SingleДокумент2 страницыSlopes Inc Manufactures and Sells Snowboards Slopes Manufacture A SingleAmit PandeyОценок пока нет

- 12Документ82 страницы12Alex liaoОценок пока нет

- Accounting Chapter 10 Solutions GuideДокумент56 страницAccounting Chapter 10 Solutions GuidemeaningbehindclosedОценок пока нет

- Problem Set 2 SolutionДокумент10 страницProblem Set 2 SolutionLawly GinОценок пока нет

- Intermediate Accounting: Assignment 4: Exercise 4-6: Multiple-Step and Extraordinary ItemsДокумент13 страницIntermediate Accounting: Assignment 4: Exercise 4-6: Multiple-Step and Extraordinary ItemsMuhammad MalikОценок пока нет

- Nikolai, Bazley, and Jones Intermediate Accounting, 11th Edition Solutions Manual Errata SheetДокумент4 страницыNikolai, Bazley, and Jones Intermediate Accounting, 11th Edition Solutions Manual Errata SheetKim PadillaОценок пока нет

- Accounting For Partnerships-4Документ21 страницаAccounting For Partnerships-4DangCongKhoiОценок пока нет

- Chapter 2 - The Accounting CycleДокумент36 страницChapter 2 - The Accounting CycleAlan Lui50% (2)

- Warren SM - Ch.01 - Final PDFДокумент54 страницыWarren SM - Ch.01 - Final PDFyoshe lauraОценок пока нет

- Chapter 11 SolutionsДокумент9 страницChapter 11 Solutionsbellohales0% (2)

- Finanical Accounting 9th Edition Solutions Ch9Документ117 страницFinanical Accounting 9th Edition Solutions Ch9Dev Sharma88% (8)

- Financial Accounting 2012 Exam PaperДокумент28 страницFinancial Accounting 2012 Exam PaperJane Fondue100% (1)

- Libby Financial Accounting Chapter10Документ8 страницLibby Financial Accounting Chapter10Jie Bo TiОценок пока нет

- Cash Flow Statement InterpertationsДокумент6 страницCash Flow Statement InterpertationsMansoor FayyazОценок пока нет

- Level 3 Accounting Update Text 2022Документ105 страницLevel 3 Accounting Update Text 2022KhinMgLwin100% (1)

- Accounting 9th Horngren Chapter 2 SolutionДокумент123 страницыAccounting 9th Horngren Chapter 2 SolutionStenverSuurkütt67% (12)

- Comprehensive Problems Solution Answer Key Mid TermДокумент5 страницComprehensive Problems Solution Answer Key Mid TermGabriel Aaron DionneОценок пока нет

- Principles of Cost Accounting 17Th Edition Edward J Vanderbeck Maria R Mitchell-Test BankДокумент161 страницаPrinciples of Cost Accounting 17Th Edition Edward J Vanderbeck Maria R Mitchell-Test BankAbby Navarro100% (1)

- Code 2007 Accounting Level 2 2010 Series 4Документ15 страницCode 2007 Accounting Level 2 2010 Series 4apple_syih100% (1)

- Ch06 Harrison 8e GE SMДокумент87 страницCh06 Harrison 8e GE SMMuh BilalОценок пока нет

- CHPT 06 InventoryДокумент11 страницCHPT 06 InventoryCharu Chandra SinghОценок пока нет

- Financial Accounting International Financial Reporting Standards Global 9th Edition Horngren Solutions ManualДокумент38 страницFinancial Accounting International Financial Reporting Standards Global 9th Edition Horngren Solutions Manualruchingmezcalwzf2p100% (14)

- Financial Accounting International Financial Reporting Standards Global 9Th Edition Horngren Solutions Manual Full Chapter PDFДокумент67 страницFinancial Accounting International Financial Reporting Standards Global 9Th Edition Horngren Solutions Manual Full Chapter PDFthomasowens1asz100% (10)

- Financial Accounting 10th Edition Harrison Solutions Manual DownloadДокумент79 страницFinancial Accounting 10th Edition Harrison Solutions Manual DownloadSandra Andersen100% (29)

- Welcome To The Presentation On Valuation Section A Group 1Документ37 страницWelcome To The Presentation On Valuation Section A Group 1Nayeem Md SakibОценок пока нет

- Fundamental Managerial Accounting Concepts 9th Edition Edmonds Solutions ManualДокумент16 страницFundamental Managerial Accounting Concepts 9th Edition Edmonds Solutions Manualeffigiesbuffoonmwve9100% (20)

- Alk Laporan Keuangan Proforma 21 Oktober 2020Документ10 страницAlk Laporan Keuangan Proforma 21 Oktober 2020Tia MonikaОценок пока нет

- Ch11 Harrison 8e GE SMДокумент91 страницаCh11 Harrison 8e GE SMYeyОценок пока нет

- Hilton CH 7 Select SolutionsДокумент25 страницHilton CH 7 Select SolutionsParth ParthОценок пока нет

- Practice Exam Chapters 9-12 Solutions: Problem IДокумент5 страницPractice Exam Chapters 9-12 Solutions: Problem IAtif RehmanОценок пока нет

- Strategic Cost Management Practical Applications DagpilanДокумент6 страницStrategic Cost Management Practical Applications Dagpilancarol indanganОценок пока нет

- Chapter 4Документ27 страницChapter 4Manish SadhuОценок пока нет

- Chapter 8HWSolutionsДокумент18 страницChapter 8HWSolutionsAlexis Walton100% (2)

- Financial Analysis CPT 3 2024Документ29 страницFinancial Analysis CPT 3 2024Nazmul HasanОценок пока нет

- Financial Accounting 9Th Edition Harrison Solutions Manual Full Chapter PDFДокумент67 страницFinancial Accounting 9Th Edition Harrison Solutions Manual Full Chapter PDFDawnZimmermanxwcq100% (11)

- Chap 5 Prob 1 3Документ10 страницChap 5 Prob 1 3Nyster Ann RebenitoОценок пока нет

- Manajemen Keuangan: Chapter 6: Making Capital Investment DecisionДокумент9 страницManajemen Keuangan: Chapter 6: Making Capital Investment Decision21. Syafira Indi KhoirunisaОценок пока нет

- The Data of Macroeconomics: AcroeconomicsДокумент54 страницыThe Data of Macroeconomics: AcroeconomicsJingjing ZhuОценок пока нет

- The Open Economy: AcroeconomicsДокумент60 страницThe Open Economy: AcroeconomicsVaibhav AroraОценок пока нет

- National Income: Where It Comes From and Where It Goes: AcroeconomicsДокумент69 страницNational Income: Where It Comes From and Where It Goes: AcroeconomicsVaibhav AroraОценок пока нет

- Chapter 1. Statistics and Data: SolutionsДокумент7 страницChapter 1. Statistics and Data: SolutionsJingjing ZhuОценок пока нет

- Chapter 6 Annex A PDFДокумент17 страницChapter 6 Annex A PDFJingjing ZhuОценок пока нет

- Chapter 03 Test BankДокумент128 страницChapter 03 Test BankJingjing ZhuОценок пока нет

- Chapter 7 Annex A PDFДокумент10 страницChapter 7 Annex A PDFJingjing ZhuОценок пока нет

- Chapter 01 - Managerial Accounting An Overview PDFДокумент40 страницChapter 01 - Managerial Accounting An Overview PDFMona IntarianiОценок пока нет

- International Business (King's College London) International Business (King's College London)Документ5 страницInternational Business (King's College London) International Business (King's College London)Jingjing ZhuОценок пока нет

- Chapter 4 Appenx A PDFДокумент27 страницChapter 4 Appenx A PDFJingjing ZhuОценок пока нет

- Chapter 2 Appendix AДокумент15 страницChapter 2 Appendix AJingjing ZhuОценок пока нет

- Chapter 3 Appendix AДокумент16 страницChapter 3 Appendix AJingjing ZhuОценок пока нет

- Chapter 3 Appendix AДокумент16 страницChapter 3 Appendix AJingjing ZhuОценок пока нет

- Chapter 4 Annex B PDFДокумент35 страницChapter 4 Annex B PDFJingjing ZhuОценок пока нет

- Chapter 2 Appendix AДокумент15 страницChapter 2 Appendix AJingjing ZhuОценок пока нет

- Harrison FA IFRS 11e CH06 SMДокумент86 страницHarrison FA IFRS 11e CH06 SMJingjing ZhuОценок пока нет

- Chapter 5 SolutionsДокумент58 страницChapter 5 SolutionsJingjing ZhuОценок пока нет

- Harrison FA IFRS 11e CH05 SM PDFДокумент89 страницHarrison FA IFRS 11e CH05 SM PDFJingjing ZhuОценок пока нет

- Charley's Family Steak House (B) - 1 PDFДокумент7 страницCharley's Family Steak House (B) - 1 PDFJingjing Zhu0% (1)

- International Business (King's College London) International Business (King's College London)Документ5 страницInternational Business (King's College London) International Business (King's College London)Jingjing ZhuОценок пока нет

- AKMy 6e ch10 SMДокумент78 страницAKMy 6e ch10 SMJingjing ZhuОценок пока нет

- The Social Psychology of Financial Markets (King's College London) The Social Psychology of Financial Markets (King's College London)Документ6 страницThe Social Psychology of Financial Markets (King's College London) The Social Psychology of Financial Markets (King's College London)Jingjing ZhuОценок пока нет

- Harrison FA IFRS 11e CH03 SMДокумент94 страницыHarrison FA IFRS 11e CH03 SMJingjing ZhuОценок пока нет

- Harrison FA IFRS 11e CH01 SMДокумент61 страницаHarrison FA IFRS 11e CH01 SMJingjing Zhu50% (2)

- International Business (King's College London) International Business (King's College London)Документ5 страницInternational Business (King's College London) International Business (King's College London)Jingjing ZhuОценок пока нет

- The Social Psychology of Financial Markets (King's College London) The Social Psychology of Financial Markets (King's College London)Документ6 страницThe Social Psychology of Financial Markets (King's College London) The Social Psychology of Financial Markets (King's College London)Jingjing ZhuОценок пока нет

- Thesis PDFДокумент67 страницThesis PDFJingjing ZhuОценок пока нет

- Welete PPPPPPPPДокумент13 страницWelete PPPPPPPPabebaw ataleleОценок пока нет

- Measurement of Inventory and Inventory Shortage5Документ3 страницыMeasurement of Inventory and Inventory Shortage5CJ alandyОценок пока нет

- Investor Relations With Stock Regulations & Strategy For Stock Volume and Price IncreaseДокумент53 страницыInvestor Relations With Stock Regulations & Strategy For Stock Volume and Price IncreaselulenduОценок пока нет

- Topic 2 Discovering Business Opportunities-EaДокумент14 страницTopic 2 Discovering Business Opportunities-EaNorahОценок пока нет

- Resume QuestionsДокумент13 страницResume Questionsshashank shekharОценок пока нет

- Bill of Supply For Electricity: BSES Rajdhani Power LimitedДокумент2 страницыBill of Supply For Electricity: BSES Rajdhani Power LimitedRamesh RawatОценок пока нет

- Chapter 6 - TQM & Quality Management SystemДокумент6 страницChapter 6 - TQM & Quality Management SystemChristine NarcisoОценок пока нет