Академический Документы

Профессиональный Документы

Культура Документы

Ganapati TDS Chalan

Загружено:

Pruthiv RajОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Ganapati TDS Chalan

Загружено:

Pruthiv RajАвторское право:

Доступные форматы

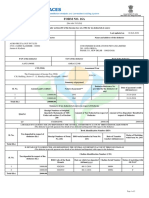

*Important : Please see notes overleaf T.D.S.

/TCS TAX CHALLAN single copy (to be sent to the ZAO)

before filling up the Challan

CHALLAN NO./ Tax Applicable(Tick One)*

ITNS Assessment Year

TAX DEDUCTED/COLLECTED AT SOURCE FROM

281

(0020) Company (0021) Non-Company 2020 - 21

Deductees Deductees

Tax Deduction Account No.(T.A.N.)

BBNG01805G

Full Name

GANAPATI COAL TRANSPORT SERVICE

Complete Address with City & State

1, HENSMUL ANGUL DERA, ODISHA

Tel. No. 06760 - 9437047170 PIN 759103

Type of Payment Code * 94C - Contractors / Sub Contractors

(Tick One) (Please see overleaf)

TDS/TCS Payable by Taxpayer (200)

TDS/TCS Regular Assessment (Raised by I.T. Deptt.) (400)

DETAILS OF PAYMENT Amount (in Rs only) FOR USE IN RECEIVING BANK

Debit to A/c / Cheque credited on

Income Tax 120141.00

Fee under sec. 234E 0.00

Surcharge 0.00 -

D D M M Y Y

Education Cess 0.00

Interest 0.00

SPACE FOR BANK SEAL

Penalty 0.00

Total 120141.00

Total (in words) One Lakhs Twenty Thousand One Hundred Forty One

only.

CRORES LACS THOUSANDS HUNDREDS TEN UNITS

1 20 1 4 1

Paid in Cash/Debit to A/c /Cheque No. Dated 18/02/2020

Drawn on ICICI BANK

(Name of the Bank and Branch)

Date :

Signature of person making payment

Taxpayers Counterfoil(To be filled by the taxpayer)

Rs.

TAN BBNG01805G

Received From GANAPATI COAL TRANSPORT SERVICE SPACE FOR BANK SEAL

(Name)

Cash/Debit to A/c / Cheque No. For Rs. 120141.00

Rs. (in words) One Lakhs Twenty Thousand One Hundred Forty One only.

Drawn on ICICI BANK

(Name of the Bank and Branch)

Company/Non-Company Deductees

on account of Tax Deducted at Source(TDS)/Tax Collected at Source(TCS)

94C - Contractors / Sub Contractors

from____________________________________ (Fill up Code)

(Strike out whichever is not applicable)

For the Assessment Year 2020-21 Rs.

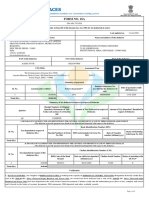

*NOTES

1. Please note that quoting false TAN may attract a penalty of Rs. 10,000/ - as per section 272BB of I.T. Act, 1961.

2. Use a Separate Challan for each Nature(Type) of Payment. The relevant codes are:

Section Nature of Payment Code

192 Payment to Govt. Employees other than Union Government Employees 9 2 A

192 Payment of Employees other than Govt. Employee 9 2 B

193 Interest on Securities 1 9 3

194 Dividend 1 9 4

194A Interest other than interest on securities 9 4 A

194B Winnings from lotteries and crossword puzzles 9 4 B

194BB Winnings from horse race 4 B B

194C Payment of contractors and sub-contractors 9 4 C

194D Insurance Commission 9 4 D

194E Payments to non-resident Sportsmen/Sport Associations 9 4 E

194EE Payments in respect of Deposits under National Savings Schemes 4 E E

194F Payments on account of Re-purchase of Units by Mutual Funds or UTI 9 4 F

194G Commission, prize etc., on sale of Lottery tickets 9 4 G

194H Commission or Brokerage 9 4 H

194I Rent 9 4 I

194J Fees for Professional or Technical Services 9 4 J

194K Income payable to a resident assessee in respect of Units of a specified Mutual Fund or of the units of the UTI 9 4 K

194LA Payment of Compensation on acquisition of certain immovable property 4 L A

194LB Income by way of Interest from Infrastructure Debt fund 4 L B

194LC Income by way of interest from Indian company engaged i n certain business. 4 L C

195 Other sums payable to a non-resident 1 9 5

196A Income in respect of units of Non-Residents 9 6 A

196B Payments in respect of Units to an Offshore Fund 9 6 B

196C Income from foreign Currency Bonds or shares of Indian Company payable to Non -Resident 9 6 C

196D Income of foreign institutional investors from securities 9 6 D

206C Collection at source from Alcoholic Liquor for Human Consumpt ion 6 C A

206C Collection at source from timber obtained under Forest Lease 6 C B

206C Collection at source from Timber obtained by any Mode other than a Forest Lease 6 C C

206C Collection at source from any other Forest Produce (not being Tendu Leaves) 6 C D

206C Collection at source from Scrap 6 C E

206C Collection at source from contractors or licensee or lease relating to Parking lots 6 C F

206C Collection at source from contractors or licensee or lease relating to toll plaza 6 C G

206C Collection at source from contractors or licensee or lease relating to mine or quarry 6 C H

206C Collection at source from tendu leaves 6 C I

206C Collection at source from on sale of certain Minerals 6 C J

206C Collection at source on cash case of Bullion and Jewellery 6 C K

Вам также может понравиться

- Premium ReceiptДокумент1 страницаPremium ReceiptVivekanand Gupta0% (2)

- Business Opportunity Assignment ENT300Документ15 страницBusiness Opportunity Assignment ENT300SyahirahОценок пока нет

- BillДокумент8 страницBillSterenco Rita0% (1)

- Bailiff Manual RedactedДокумент226 страницBailiff Manual RedactedSandor GOMBOSОценок пока нет

- T.D.S. / T.C.S. Tax Challan: To Any Person or Web Site For Publication or For Commercial or Any Other UseДокумент10 страницT.D.S. / T.C.S. Tax Challan: To Any Person or Web Site For Publication or For Commercial or Any Other UseHARDEEPTHAPARОценок пока нет

- Tds ChallanДокумент2 страницыTds Challannilesh vithalaniОценок пока нет

- Important: Please See Notes Overleaf Before Filling UpДокумент3 страницыImportant: Please See Notes Overleaf Before Filling UpgalorebayОценок пока нет

- Ganraj ConstructionДокумент2 страницыGanraj ConstructionSUNIL GAIKWADОценок пока нет

- Tds Challan 281 Excel FormatДокумент459 страницTds Challan 281 Excel FormatSaravana Kumar0% (1)

- Itns-281 TDS ChallanДокумент1 страницаItns-281 TDS Challanvirendra36999100% (2)

- T.D.S./Tcs Tax ChallanДокумент3 страницыT.D.S./Tcs Tax ChallanSURABHI PATRAОценок пока нет

- GST FormatДокумент3 страницыGST FormatAnmol GoyalОценок пока нет

- T.D.S./Tcs Tax ChallanДокумент3 страницыT.D.S./Tcs Tax ChallanRukmani GuptaОценок пока нет

- Tax Deducted at SourceДокумент3 страницыTax Deducted at SourceShivam SharmaОценок пока нет

- TCS TenduДокумент1 страницаTCS TenduSwetha KarthickОценок пока нет

- Form No. 16A: From ToДокумент3 страницыForm No. 16A: From ToVijaya KumariОценок пока нет

- Ashima Kalra 194 CДокумент1 страницаAshima Kalra 194 CSudhanshu JaiswalОценок пока нет

- Income Tax Challan - 280Документ1 страницаIncome Tax Challan - 280Subrata SarkarОценок пока нет

- T.D.S. / Tcs Tax Challan: Zero Zero One Two Seven OneДокумент5 страницT.D.S. / Tcs Tax Challan: Zero Zero One Two Seven OneSachin KumarОценок пока нет

- Tax Deposit-Challan 281-Excel FormatДокумент5 страницTax Deposit-Challan 281-Excel FormatpreetОценок пока нет

- T.D.S./Tcs Tax Challan: Tax Deducted/Collected at Source From (0020) COMPANY (0021) NON-COMPANY Deductees DeducteesДокумент2 страницыT.D.S./Tcs Tax Challan: Tax Deducted/Collected at Source From (0020) COMPANY (0021) NON-COMPANY Deductees DeducteesSURABHI PATRAОценок пока нет

- Challan - 281Документ1 страницаChallan - 281Kelly WilliamsОценок пока нет

- Challan PDFДокумент1 страницаChallan PDFShilesh GargОценок пока нет

- ChallanДокумент1 страницаChallanShilesh GargОценок пока нет

- Challan 280Документ2 страницыChallan 280Rahul SinglaОценок пока нет

- For Payment From July 2005 OnwardsДокумент1 страницаFor Payment From July 2005 Onwardsvijay123*75% (4)

- 23120500288895UTIB ChallanReceiptДокумент1 страница23120500288895UTIB ChallanReceiptbinitashah11573Оценок пока нет

- Challan No./ Itns 280: Details of Payments For Use in Receiving BankДокумент3 страницыChallan No./ Itns 280: Details of Payments For Use in Receiving BankSatish BatchaОценок пока нет

- ITNS 280: Challan No. Challan No. ITNS 281Документ1 страницаITNS 280: Challan No. Challan No. ITNS 281Sar-Im Teron AcousticОценок пока нет

- Direct Tax Challan Report: Save PrintДокумент2 страницыDirect Tax Challan Report: Save PrintRavi JujjavarapuОценок пока нет

- Tds/Tcs Tax Challan: AADP12345KДокумент3 страницыTds/Tcs Tax Challan: AADP12345KC.A. Ankit JainОценок пока нет

- (0021) Non Company Deductees BPLJ01048F: T.D.S./T.C.S. Tax Challan Challan No./ ITNS 281 2021-22 BPLJ01048FДокумент1 страница(0021) Non Company Deductees BPLJ01048F: T.D.S./T.C.S. Tax Challan Challan No./ ITNS 281 2021-22 BPLJ01048FAngad MundraОценок пока нет

- 24040600201802UTIB ChallanReceiptДокумент1 страница24040600201802UTIB ChallanReceiptabdulbeg1986Оценок пока нет

- TDS ChallanДокумент1 страницаTDS ChallanJainsanjaykumarОценок пока нет

- Challan No. ITNS 280Документ2 страницыChallan No. ITNS 280RAHUL AGARWALОценок пока нет

- Form 281 Candeur Constructions - 92bДокумент1 страницаForm 281 Candeur Constructions - 92bReddeppa Reddy BisaigariОценок пока нет

- Challan No. ITNS 281Документ1 страницаChallan No. ITNS 281jagdish412301Оценок пока нет

- Income Tax - Bank Remittance CHALLANДокумент1 страницаIncome Tax - Bank Remittance CHALLANvivek anandanОценок пока нет

- Screenshot 2023-12-07 at 5.27.16 PMДокумент1 страницаScreenshot 2023-12-07 at 5.27.16 PMdrsadhu2001Оценок пока нет

- 24040900011525HDFC ChallanReceiptДокумент1 страница24040900011525HDFC ChallanReceiptkunal3152Оценок пока нет

- 15-Mar-2019 CL PDFДокумент3 страницы15-Mar-2019 CL PDFDarshanОценок пока нет

- 24020900091148HDFC ChallanReceiptДокумент1 страница24020900091148HDFC ChallanReceiptArun ShindeОценок пока нет

- 23060100062942RBIS ChallanReceiptДокумент2 страницы23060100062942RBIS ChallanReceiptAnuj BeniwalОценок пока нет

- 24030701423838SBIN ChallanReceiptДокумент1 страница24030701423838SBIN ChallanReceiptFiroz AliОценок пока нет

- 23080300051201HDFC ChallanReceiptДокумент2 страницы23080300051201HDFC ChallanReceiptmahesh rahejaОценок пока нет

- 24040800030981HDFC ChallanReceiptДокумент1 страница24040800030981HDFC ChallanReceiptkunal3152Оценок пока нет

- Direct Tax Challan ReportДокумент2 страницыDirect Tax Challan ReportVivek MurtadakОценок пока нет

- Self Assessment Tax Challan NiДокумент1 страницаSelf Assessment Tax Challan NiNitin KarwaОценок пока нет

- Challan Advance TaxДокумент1 страницаChallan Advance Taxamit22505Оценок пока нет

- Agrpc4052h 2021Документ4 страницыAgrpc4052h 2021lraj344Оценок пока нет

- Aaqca3567p 2023Документ5 страницAaqca3567p 2023logeshwaranvОценок пока нет

- 23092400074562SBIN ChallanReceiptДокумент1 страница23092400074562SBIN ChallanReceiptSundararajan GopalakrishnanОценок пока нет

- Form No. 16A: From ToДокумент2 страницыForm No. 16A: From ToEr Sumit SiwatchОценок пока нет

- DSLSBillДокумент1 страницаDSLSBillrocky1996kumar2023Оценок пока нет

- Draft Challan IchhaДокумент1 страницаDraft Challan IchhaSneha SharmaОценок пока нет

- Form No. 16A: From ToДокумент2 страницыForm No. 16A: From ToDevasyrucОценок пока нет

- Cetp ChargesДокумент1 страницаCetp ChargesBharat SharmaОценок пока нет

- Form No 16A of Vivekananda AcharyaДокумент2 страницыForm No 16A of Vivekananda AcharyaVivekananda AcharyaОценок пока нет

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Документ4 страницыForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961bhavdeepsinhОценок пока нет

- Fixedline and Broadband Services: Your Account Summary This Month'S ChargesДокумент4 страницыFixedline and Broadband Services: Your Account Summary This Month'S Chargespursani56Оценок пока нет

- Challan Salary 192 PDFДокумент1 страницаChallan Salary 192 PDFVipin Kumar ChandelОценок пока нет

- SBI Card Statement - 6880 - 01-01-2024Документ7 страницSBI Card Statement - 6880 - 01-01-2024Jagadish LoganathanОценок пока нет

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineОт EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineОценок пока нет

- Payment Receipt: Receipt For Payment of Bill. This Receipt Is Generated From Odisha Online PortalДокумент1 страницаPayment Receipt: Receipt For Payment of Bill. This Receipt Is Generated From Odisha Online PortalPruthiv Raj100% (1)

- Application For Moratorium of InstallmentДокумент1 страницаApplication For Moratorium of InstallmentPruthiv RajОценок пока нет

- GST FormДокумент16 страницGST FormPruthiv RajОценок пока нет

- Form - CHG-1 - SYNCLUS MAHINDRA-signed-19-03-2020 PDFДокумент1 страницаForm - CHG-1 - SYNCLUS MAHINDRA-signed-19-03-2020 PDFPruthiv RajОценок пока нет

- MAA AUTOMOTIVES - 2019-20GSTR 1 Data Summary YearlyДокумент3 страницыMAA AUTOMOTIVES - 2019-20GSTR 1 Data Summary YearlyPruthiv RajОценок пока нет

- Balance Sheet MST 2018-19Документ12 страницBalance Sheet MST 2018-19Pruthiv Raj100% (1)

- Orissa Vat Receipt 2 EA2 EC19 BBДокумент1 страницаOrissa Vat Receipt 2 EA2 EC19 BBPruthiv RajОценок пока нет

- FIN AL: Form GSTR-1Документ5 страницFIN AL: Form GSTR-1Pruthiv RajОценок пока нет

- 8130 0 0 50 0 8180 SGST (0006)Документ2 страницы8130 0 0 50 0 8180 SGST (0006)Pruthiv RajОценок пока нет

- FIN AL: Form GSTR-3BДокумент3 страницыFIN AL: Form GSTR-3BAkshita PorwalОценок пока нет

- 0 0 0 15000 0 15000 SGST (0006)Документ2 страницы0 0 0 15000 0 15000 SGST (0006)Pruthiv RajОценок пока нет

- 0 0 0 10000 0 10000 SGST (0006)Документ2 страницы0 0 0 10000 0 10000 SGST (0006)Pruthiv RajОценок пока нет

- 0 0 0 15000 0 15000 SGST (0006)Документ2 страницы0 0 0 15000 0 15000 SGST (0006)Pruthiv RajОценок пока нет

- Attachment PDFДокумент88 страницAttachment PDFissa fernandesОценок пока нет

- Economics (Macroeconomics)Документ105 страницEconomics (Macroeconomics)Pruthiv RajОценок пока нет

- Uses of National Income DataДокумент4 страницыUses of National Income DataPruthiv RajОценок пока нет

- Esenbok City Estate EpeДокумент3 страницыEsenbok City Estate EpeClifford PaОценок пока нет

- UnlockedДокумент5 страницUnlockedKush SharmaОценок пока нет

- FNB Payment NotificationДокумент1 страницаFNB Payment Notificationsamuelzuriel001Оценок пока нет

- Quasi-Contracts: By: Val F. PiedadДокумент33 страницыQuasi-Contracts: By: Val F. PiedadMingОценок пока нет

- Alex Jones Court Records Show Restraining Order Against HimДокумент7 страницAlex Jones Court Records Show Restraining Order Against HimPeter T. Santilli100% (1)

- Card Account Number: Statement Date: 5342 7312 3017 6006 Payment Due Date: Minimum Amount Due: Credit Limit: Available LimitДокумент1 страницаCard Account Number: Statement Date: 5342 7312 3017 6006 Payment Due Date: Minimum Amount Due: Credit Limit: Available LimitNuruzzaman BiplobОценок пока нет

- Lim V PeopleДокумент6 страницLim V PeopleNikkiAndradeОценок пока нет

- VAT ModuleДокумент50 страницVAT ModuleRovi Anne IgoyОценок пока нет

- Quotation For Army Pharma Ltd.Документ7 страницQuotation For Army Pharma Ltd.US BD TechnologyОценок пока нет

- 8 CIR Vs Engineering EquipmentДокумент11 страниц8 CIR Vs Engineering EquipmentbusinessmanОценок пока нет

- Government AccountingДокумент22 страницыGovernment Accountingkris4aleya4domingo4sОценок пока нет

- Cash Management NotesДокумент28 страницCash Management Notesabhishek khodОценок пока нет

- Oblicon Chap 4 Extinguishment of ObligationДокумент42 страницыOblicon Chap 4 Extinguishment of ObligationJanzel SantillanОценок пока нет

- C.P. - 816 - 2009 SC Pak Decision Rate of IntererestДокумент14 страницC.P. - 816 - 2009 SC Pak Decision Rate of IntererestOsmanRafaeeОценок пока нет

- Guidelines To Fill Application Form of Executive PGDM ProgramДокумент9 страницGuidelines To Fill Application Form of Executive PGDM ProgramJaydeepdasforeverОценок пока нет

- Master of Management in EU Funds DMWДокумент12 страницMaster of Management in EU Funds DMWAzoska Saint SimeoneОценок пока нет

- 2000-DST Jan 2018 FinalДокумент3 страницы2000-DST Jan 2018 FinalClark GuilasОценок пока нет

- 16 SOBC Booklet Excluding FED ENG 081221 2Документ61 страница16 SOBC Booklet Excluding FED ENG 081221 2Faizan WahidОценок пока нет

- Introduction To TdsДокумент28 страницIntroduction To TdsGavendra BhartiОценок пока нет

- QuickBooks For RestaurantsДокумент15 страницQuickBooks For RestaurantsepinedamОценок пока нет

- Quotation of MDB & SDBДокумент6 страницQuotation of MDB & SDBArif TalukderОценок пока нет

- Compromise Agreement - AguinaldoДокумент6 страницCompromise Agreement - AguinaldoPatrice Noelle RamirezОценок пока нет

- NFL Standard Representation AgreementДокумент6 страницNFL Standard Representation AgreementTrey CephusОценок пока нет

- OjcmДокумент217 страницOjcmaki014Оценок пока нет

- Proposal FormДокумент9 страницProposal FormrohitОценок пока нет

- Invoice PDFДокумент1 страницаInvoice PDFAtharva S SakhareОценок пока нет

- MF Wedding ContractДокумент2 страницыMF Wedding ContractmountainfarmОценок пока нет